Introduction

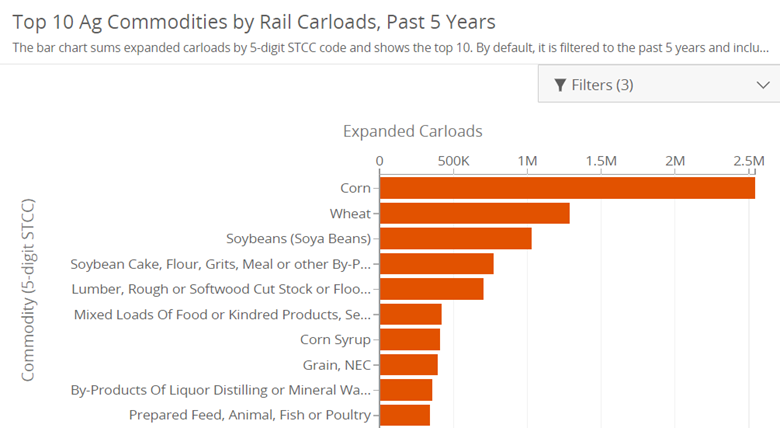

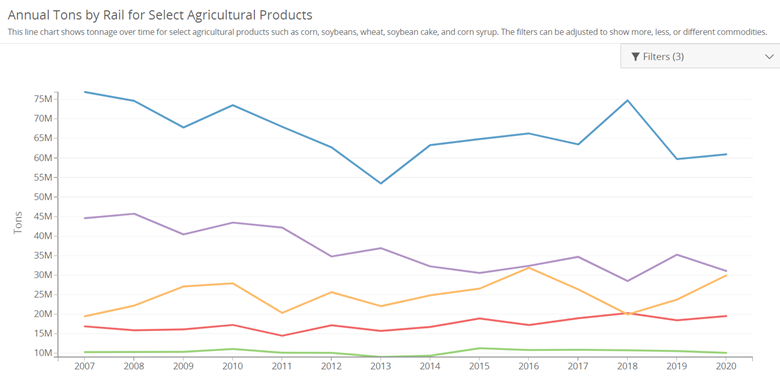

The penultimate step of the process for grain is reaching a commercial elevator before going to an end-user to be converted to a final product. These elevators range in size from your local country elevator with little storage capacity to large elevators with millions of bushels capacity. While some producers deliver straight to the end user in areas where that is an option, commercial elevators handle millions and millions of bushels a year of almost every commodity grown in the US. Once the elevators receive the grain, they ship it to the end-user by rail, barge, or other means.

Commercials and How They Fit In

While commercial elevators come towards the end of the process, they have made selling grain as a farmer easier with convenient locations and increased capacity. Railroads played the largest role in the growth and expansion of the United States in the West, which directly led to the growth in farming in the late 1800s. While all elevators are not along railroads or major waterways, you will find the larger ones here as these locations allow for more volume.

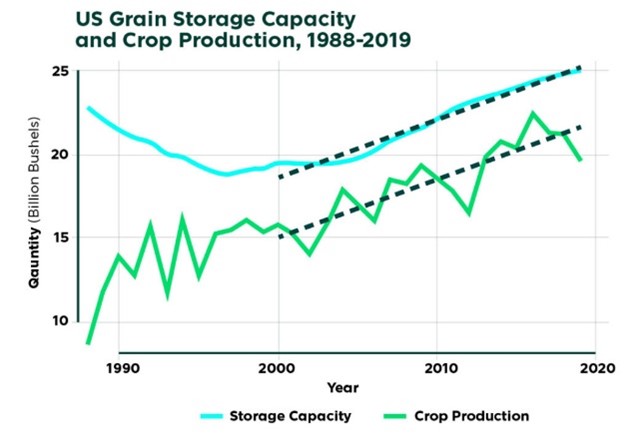

On-farm and off-farm storage (elevators) for grains have grown over the years as the US produces more and more while the world consumes it. For the last 20 years, storage capacities have grown close to even with the increase in production and will continue to grow as the world population grows and more supply is needed.

Another example of a commercial facility would be a crush facility. The growth of soybean crush capacity has expanded in the last several years and looks to continue as the demand for soybean oil used in renewable diesel continues to grow. The growth in renewable diesel over the last few years and years to come have made crush facilities a major commercial player now and will only get bigger in the future. Crush facilities close to the growers allow easier access to the beans and competitive prices increase demand.

While it will take time, we will see a shift from soybean meal to soybean oil as the main product coming from these crush facilities. Clean Fuels Alliance America projected renewable diesel production could hit 5.5 billion gallons but 2026 if expansions and new facilities continue. This increase would raise demand for more soy oil, changing the commercial structure that the US has seen in the last 20 years.

End Users and Their Role

End users consume the commodity in all sorts of ways. From feed yards to crush facilities (who then sell the oil and meal) to food production companies, end users cover a wide range of groups. These users face risk on several sides, with the cost of inputs going up and the value of their finished product going down due to other factors. End users face basic economic factors such as recessions and inflation that will affect their revenue, making them adjust their plans of inputs.

While the easy way to think about end users is who makes your cereal, it is crucial to remember how large the commodity space is and that it touches almost every industry. Homebuilders are end users and have seen an increase in their inputs, with lumber moving higher in 2021 before moving lower. If these types of companies cannot effectively manage their risk, it can cost consumers hundreds, if not thousands, of dollars each year.

Proactive and Disciplined Risk Management

Along with the enormous capacity, commercials, and end users also carry a tremendous amount of price/volatility risk requiring a proactive and disciplined risk management approach to maximize the margins of their operation and keep the system moving forward.

Today’s volatile markets have brought unprecedented levels of risk and reward, highlighting the significance of adapting to this environment. With its interdependent supply chain, the agriculture sector is particularly susceptible to the ripple effects of market fluctuations. This is especially true in the current inflation landscape, soaring prices, energy scarcity, and labor shortages.

How RCM Ag Services works with Commercials

RCM Ag Services utilizes our independent standing, national producer reach, and tech partnerships to bring our commercial agriculture customers best-in-class tools and resources to improve efficiency, increase revenues, and generate more customer volume. With our suite of tools and products, your operation can share in markup on products, improve risk management, achieve better FCM clearing rates, and produce more bushels.

Our market commentary allows commercial elevators to keep up with what is going on all over the country and other parts of the world in an easy-to-read and follow format. This allows you to focus on your operation and make it run to its best ability.

For more information on how RCM Ag Services can support your team, follow the link below. https://rcmagservices.com/commercial-agriculture/

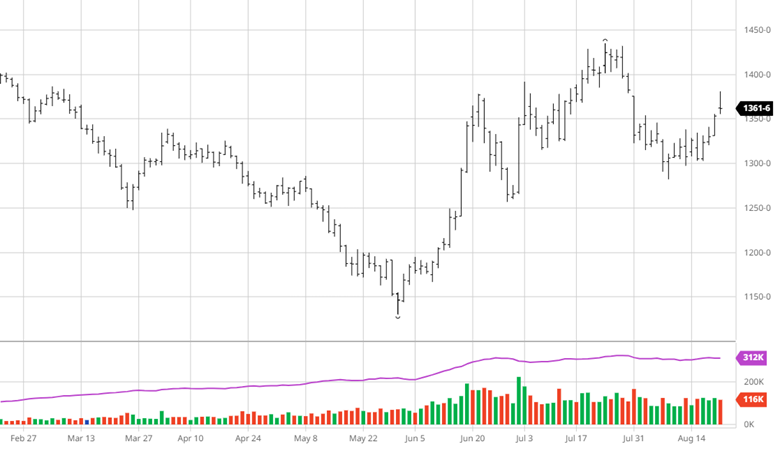

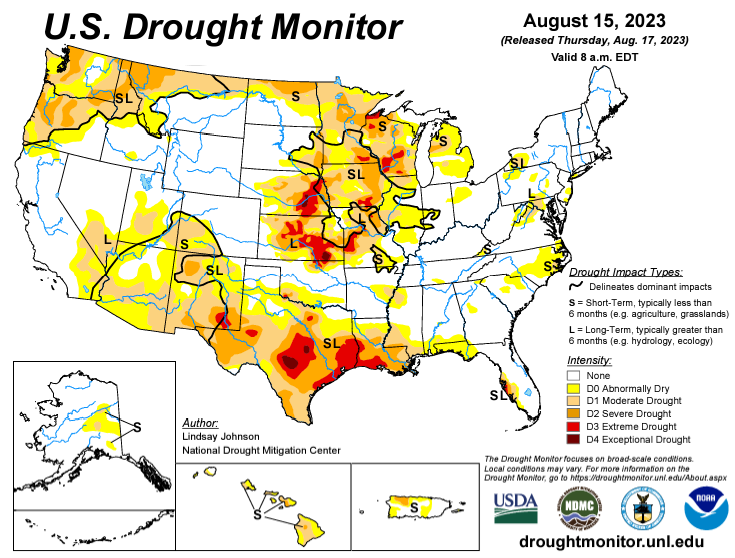

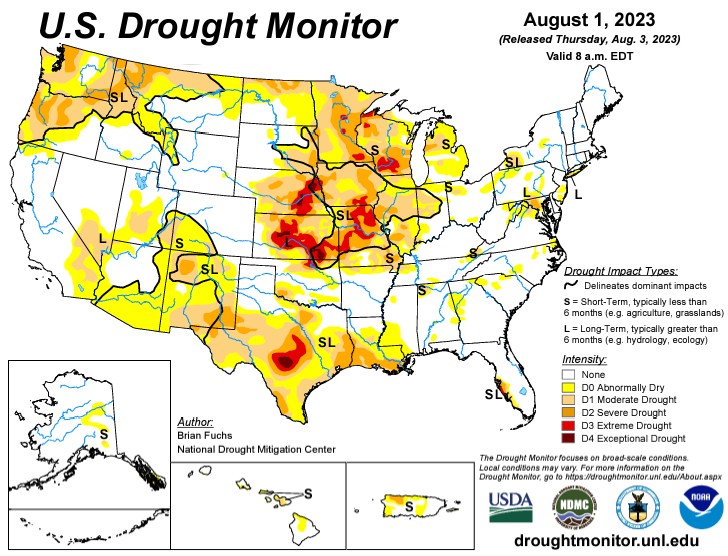

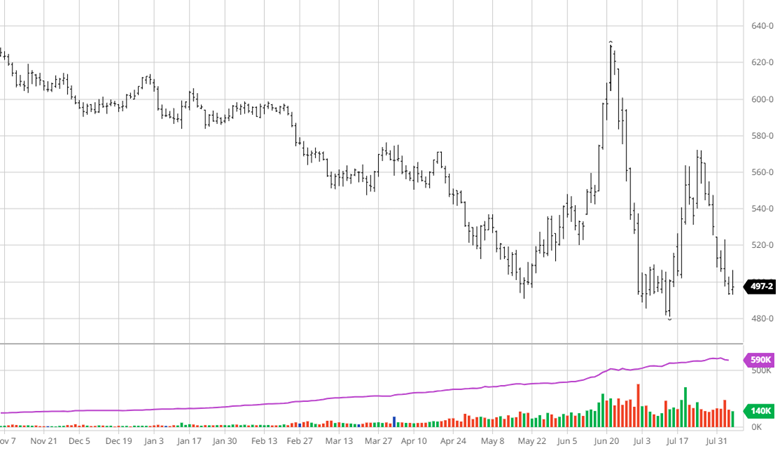

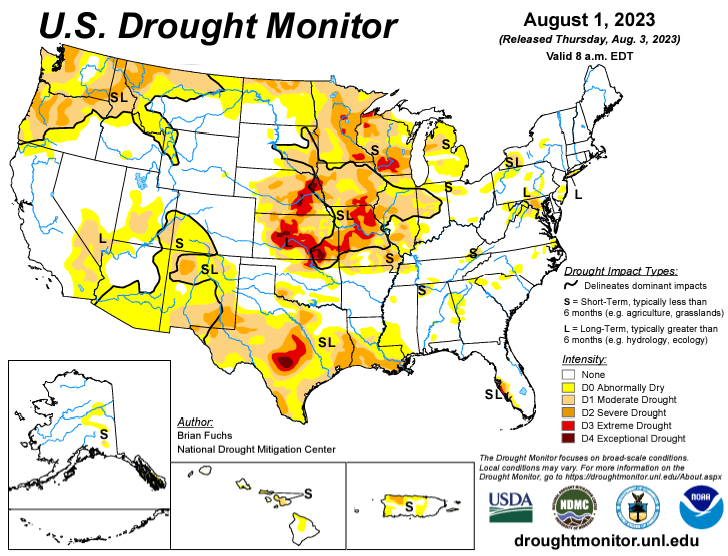

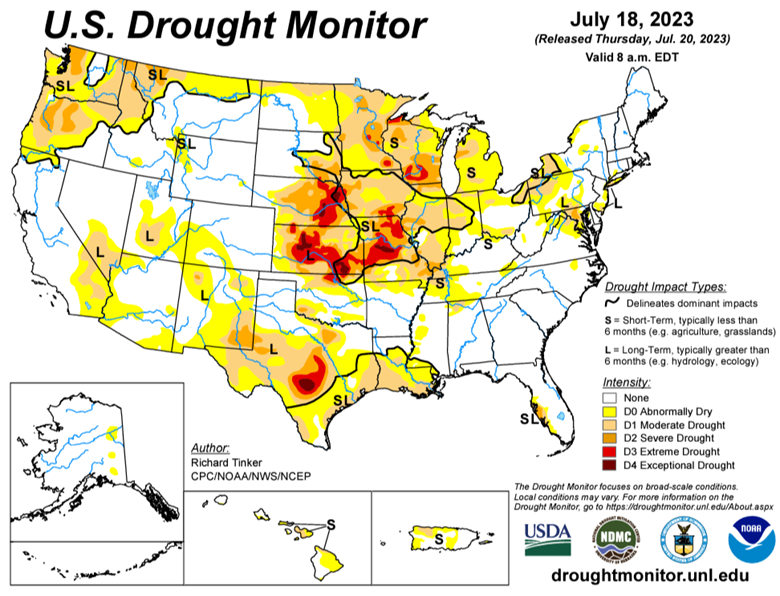

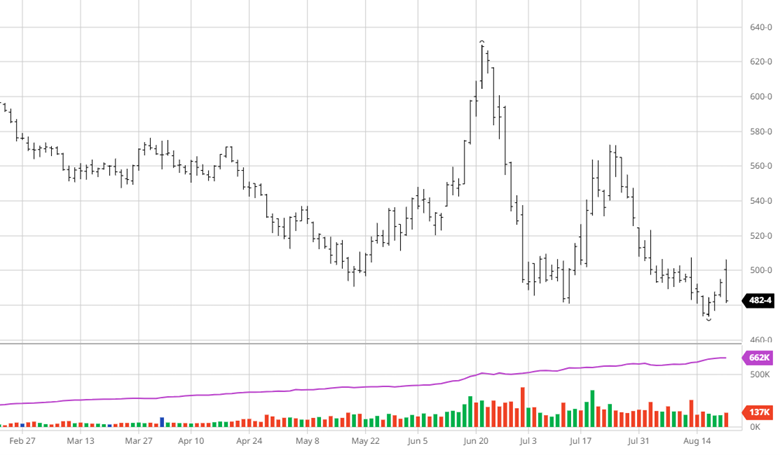

Soybeans have held together well over the last couple of months with the low acreage number supporting it. The weather was not great for beans early on, but like corn, the last couple of weeks have been very beneficial and the heat over the next 10 days can cause some issues. The USDA updated their yield estimates to 50.9 bu/acre, below the trade estimates and previous report but also a reasonable number with how the growing season has gone so far. Bean demand appears to be increasing and if this continues into harvest, momentum behind beans could give it another push that corn seems to be missing. The ProFarmer crop tour will be the news this week along with the hot dry weather, an adjustment to acres down the road is a variable that can change the look of this crop.

Soybeans have held together well over the last couple of months with the low acreage number supporting it. The weather was not great for beans early on, but like corn, the last couple of weeks have been very beneficial and the heat over the next 10 days can cause some issues. The USDA updated their yield estimates to 50.9 bu/acre, below the trade estimates and previous report but also a reasonable number with how the growing season has gone so far. Bean demand appears to be increasing and if this continues into harvest, momentum behind beans could give it another push that corn seems to be missing. The ProFarmer crop tour will be the news this week along with the hot dry weather, an adjustment to acres down the road is a variable that can change the look of this crop.