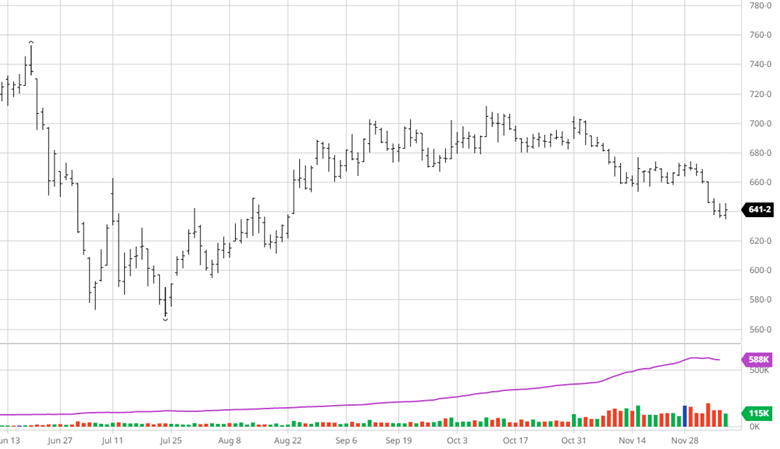

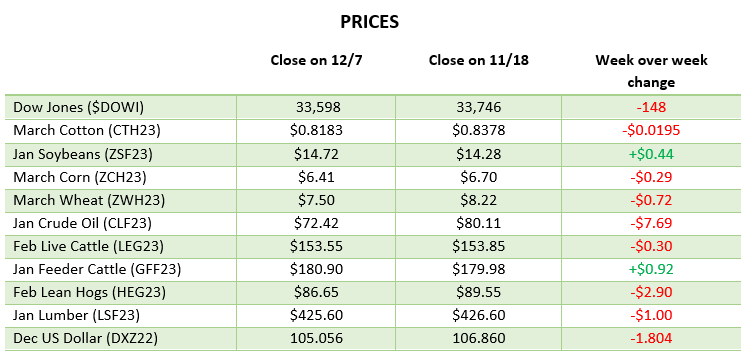

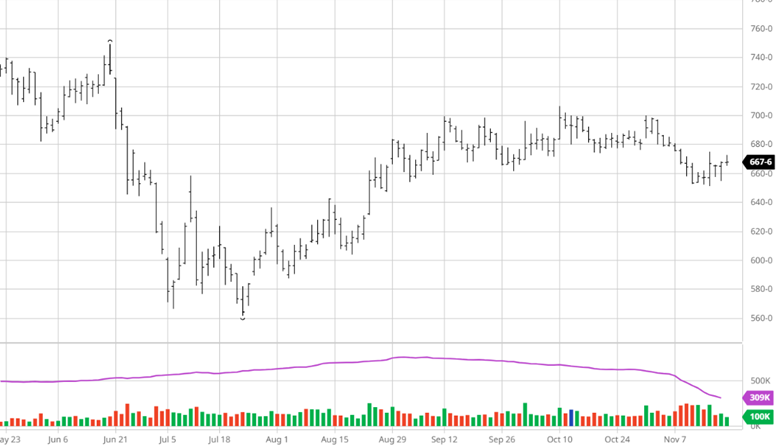

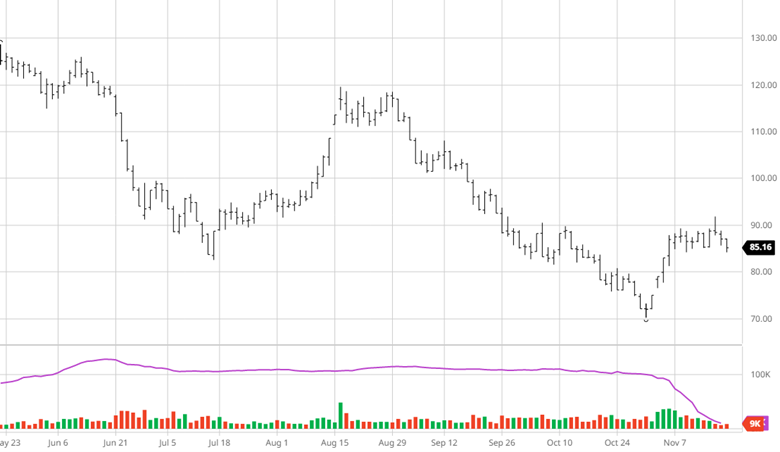

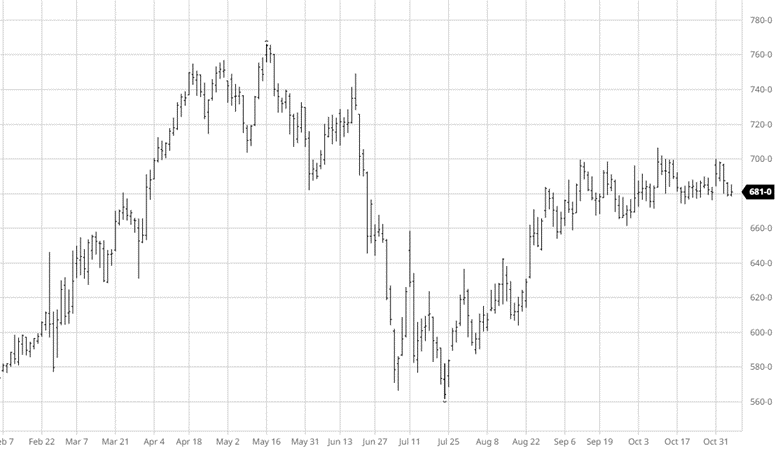

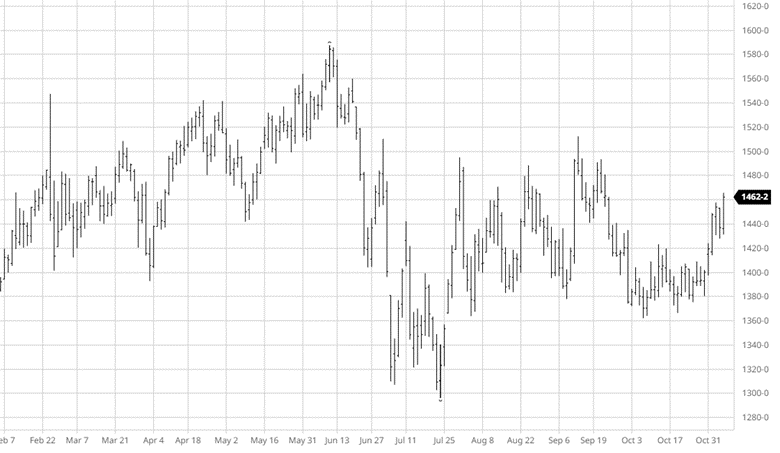

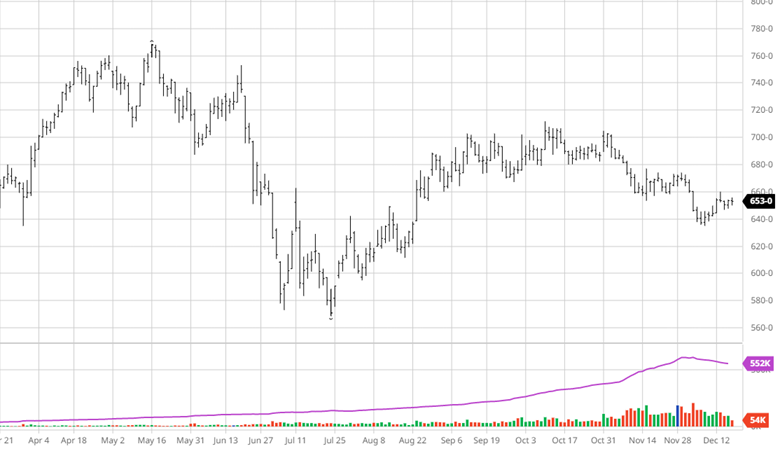

Corn had a good week making gains on mixed news across the world. The war in Ukraine has picked back up with more bombing and aggression from Russia after a “quiet” few weeks. Exports were better this week as we head into the end of the year well behind the expected pace. Weather in Brazil remains good in most areas while Argentina forecast is becoming wetter. Markets will likely remain cooled through the holidays unless there is any unexpected news (flooding rains, further escalation in Ukraine, etc.) that is not already priced in.

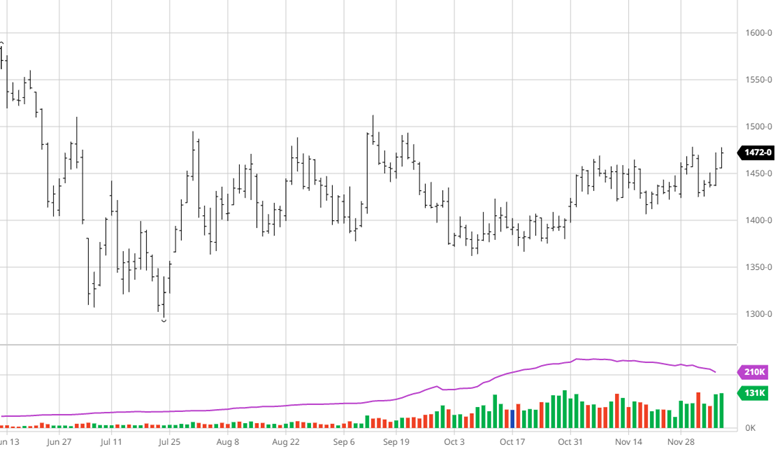

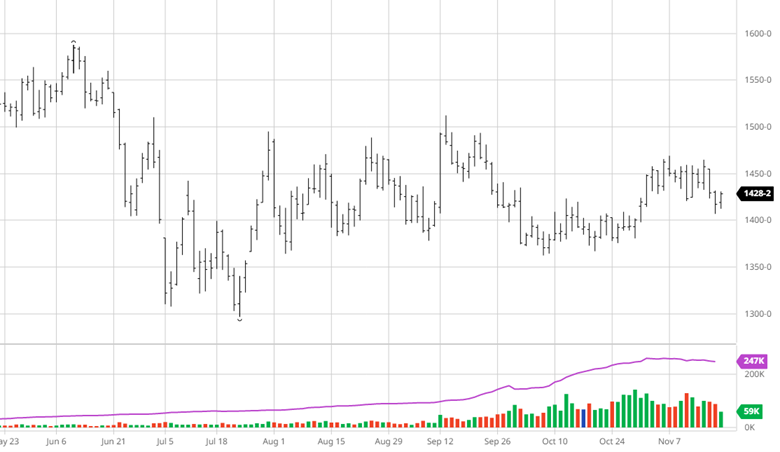

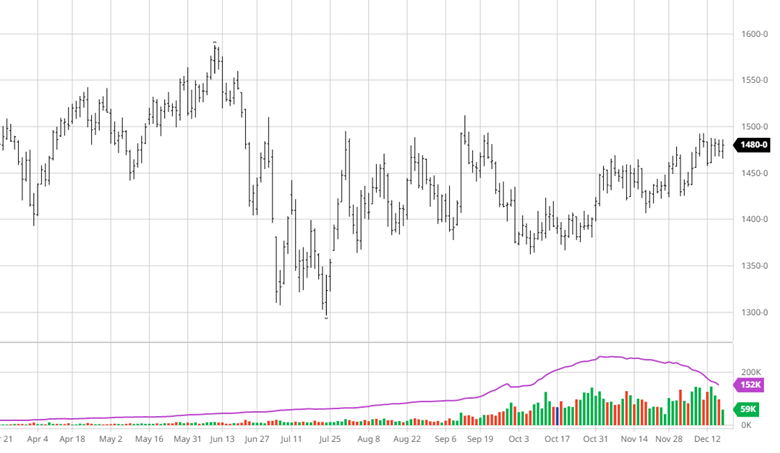

Soybeans were relatively flat this week with a mix of up and down days. We are back up trading at the top of the range we have seen since July. Whether it fails at this level again or can move higher may require some surprise news to the market as exports were good, but the market seemed to shrug off. With South America expected to produce a record crop and those beans hitting the world market in a little over a month, finding buyers for US beans could become challenging. Like corn, news may be quiet heading into the end of the year and holidays.

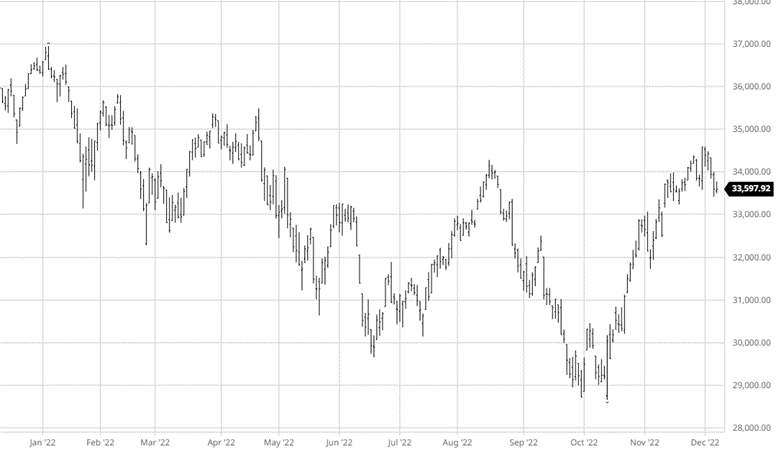

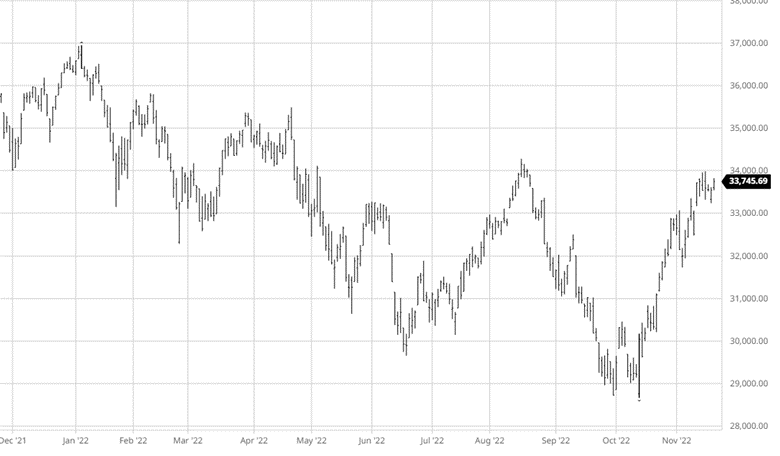

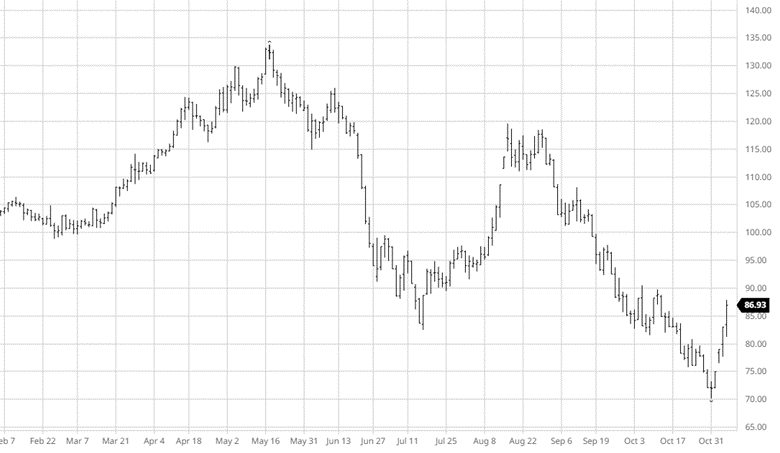

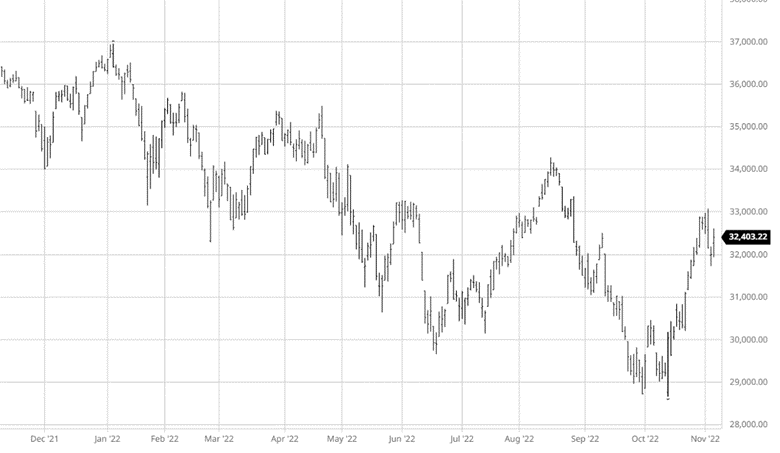

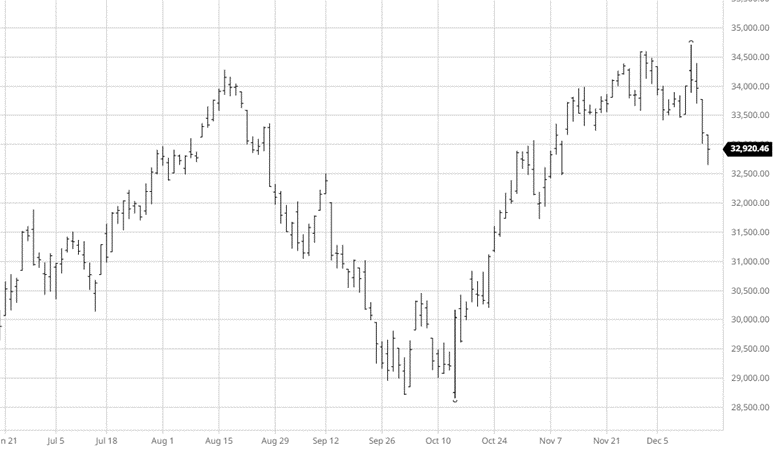

Equity Markets

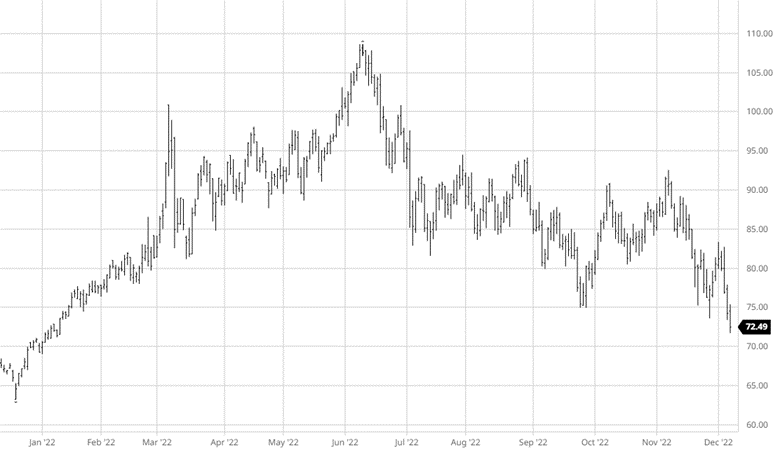

The markets were down this week following a good amount of volatility following the Fed’s announcement of a 50-point hike in rates with comments indicating there will be more raises in the future and could be held higher for longer. CPI came in better than expected but still hot at 7.1%. While we are 2% lower than the highs, we still have a long way to go to hit the target of 2-3% which the Fed will continue to work towards.

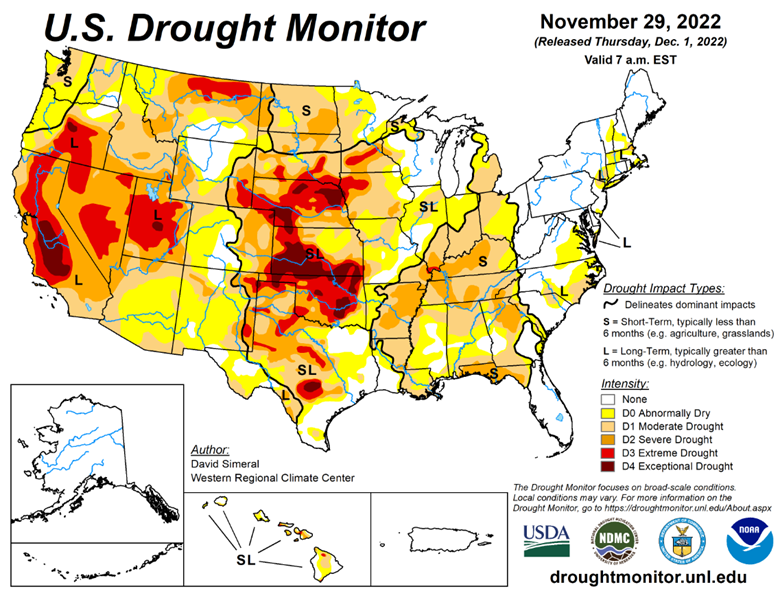

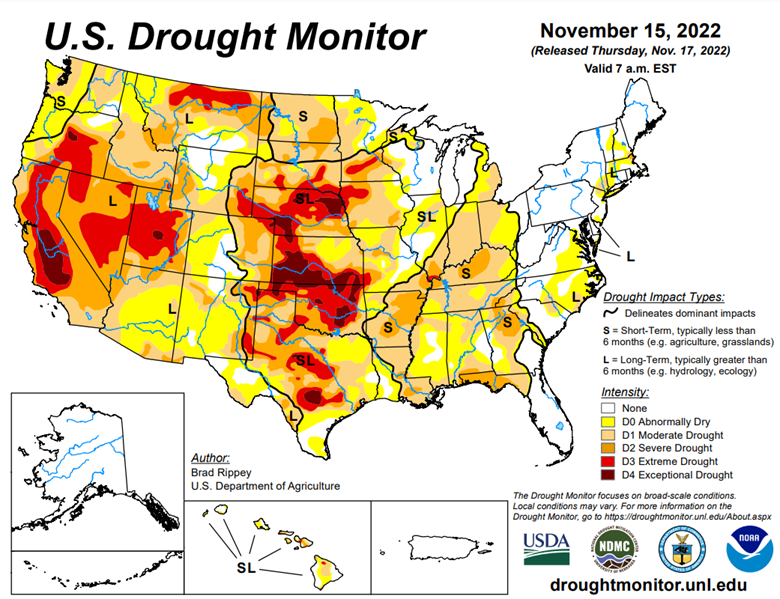

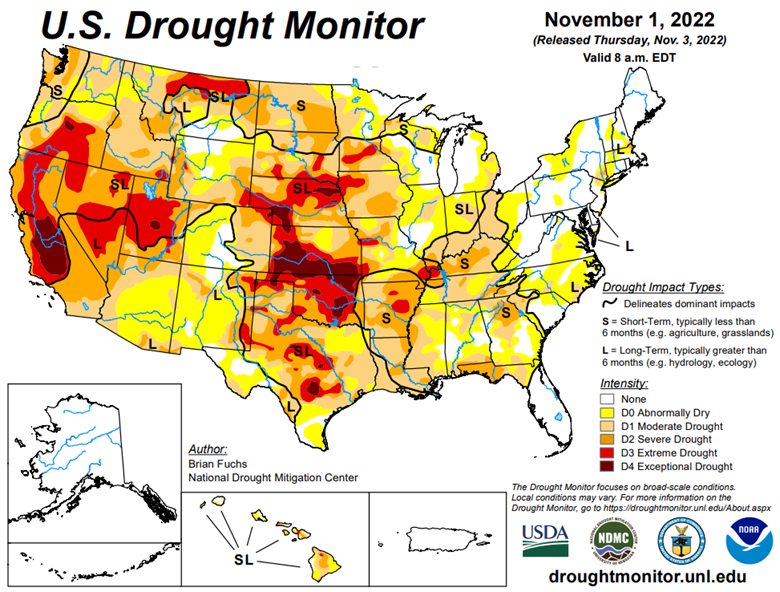

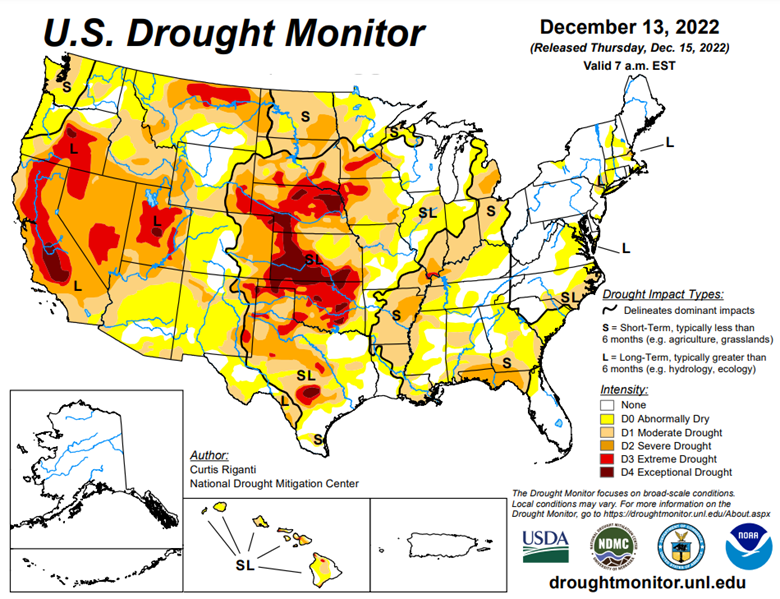

Drought Monitor

Podcast

The Hedged Edge is back online with a guest who could be this podcast’s most important guest of all time. At a time when inflation is running rampant through the world economy, drought conditions are drying up our rivers, and the global supply of grain is scarce. We are tasked with the question, “what the hell is going on in logistics, and is there any relief in sight?”

To help address these questions and more, I am joined today by a man that needs no introduction to most in the physical commodity sector – Woodson Dunavant with the Dunavant Logistics company based in Memphis, TN.

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].