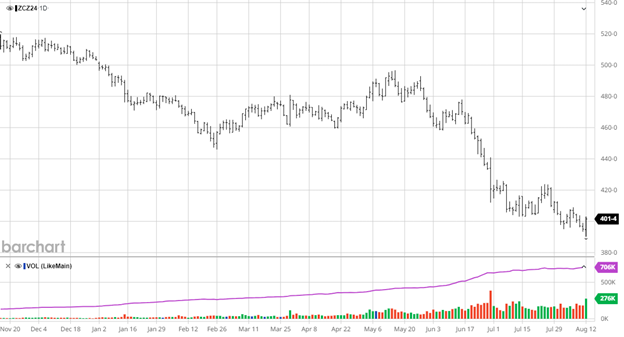

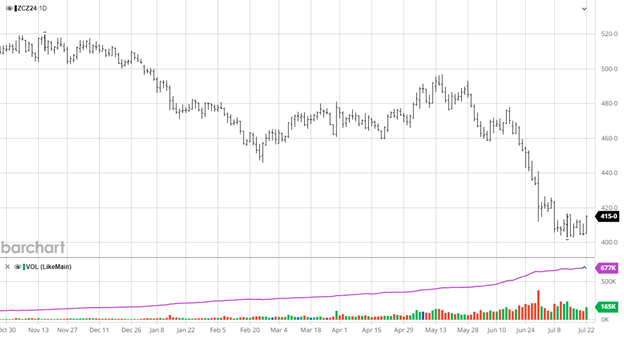

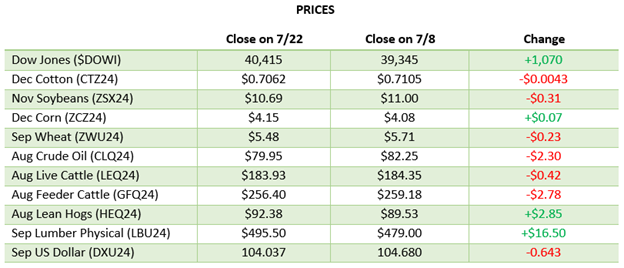

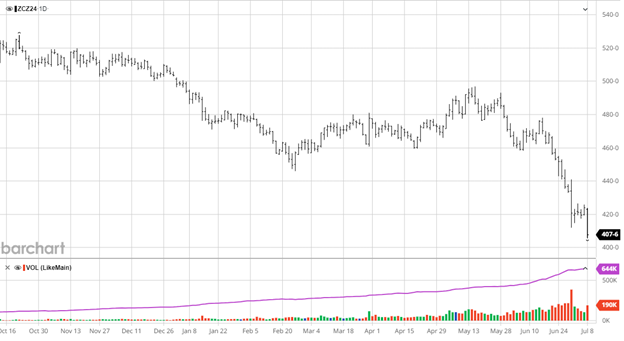

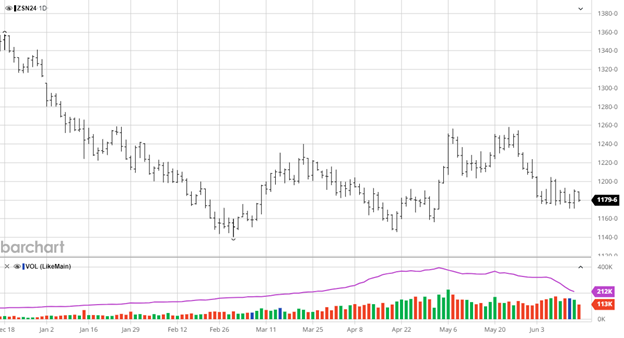

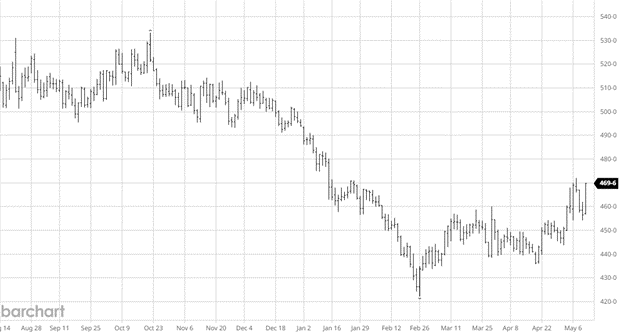

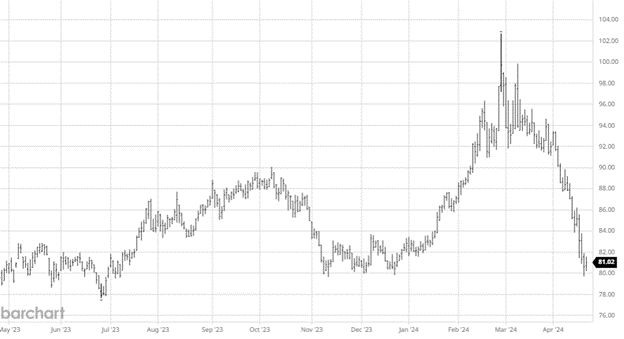

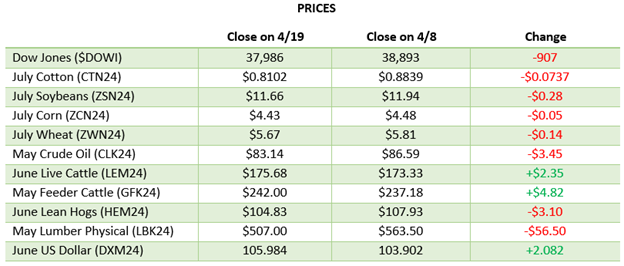

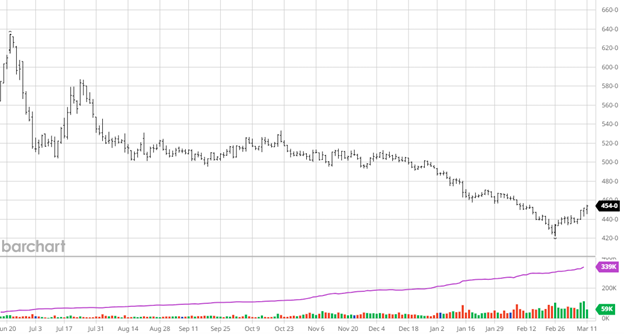

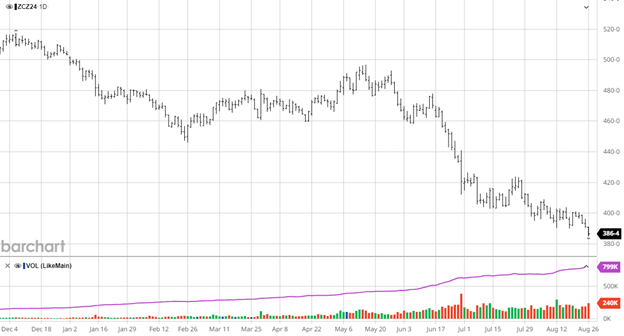

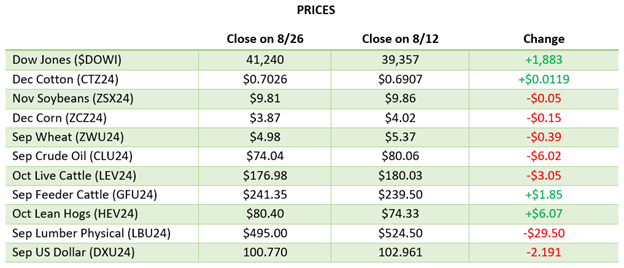

Corn’s continued weakness following the August USDA report. Pro Farmer completed their crop tour last week and see the US yield being 181.1 bu/ac and a total 14.979-billion-bushel production. With another record crop expected this year, the market is continuing lower as plenty of 2023 corn remains in storage needing to be moved before this year’s harvest gets underway. The end of month heat is not expected to do much damage to the corn crop, but this crop is not done yet and still needs some more rain to get to the finish line. While demand is improving in the commodity space with a weaker USD, the large supply is still driving prices lower for the time being. There is not any major news to keep an eye on coming up except export and weather news.

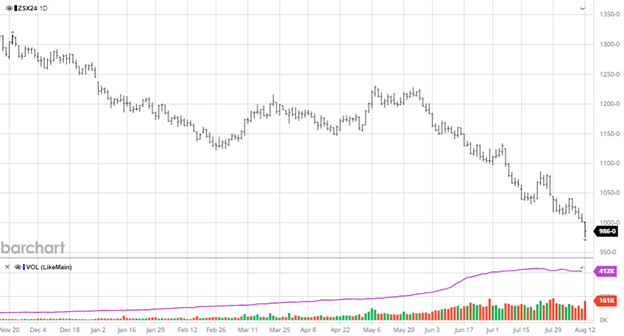

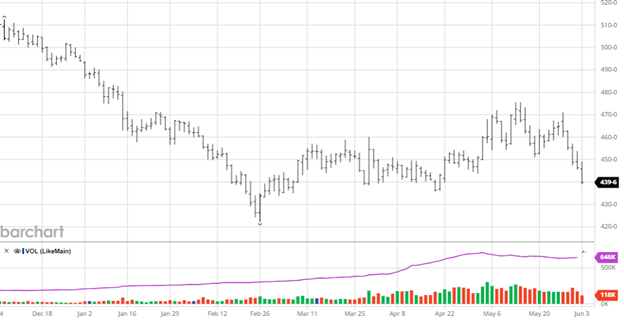

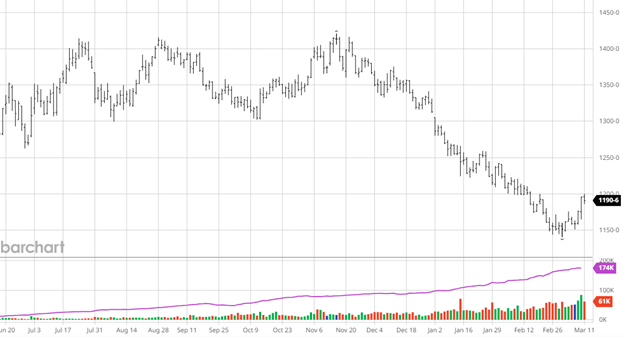

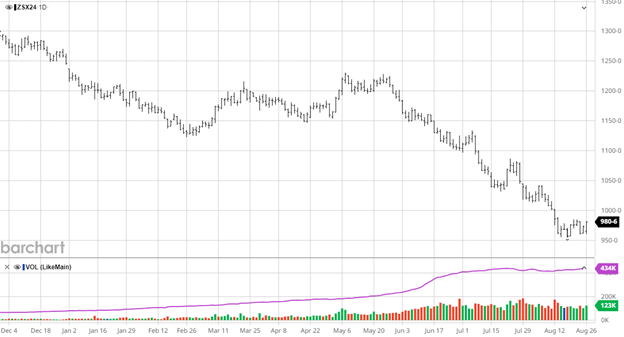

Pro Farmer found a massive crop in their tour last week estimating the 2024 US bean crop at 54.9 bu/ac(!!) and 4.74-billion-bushel total production. This soybean yield would easily be a record and would justify the collapse in bean prices seen this year. The current heat will likely stress the crop a bit, making that big a yield unlikely, however we should still expect to see a record crop, like corn. Soybeans need some good news in the form of demand whether that be from exports or the sustainable fuel market to get this thing turned around without production concerns in South America.

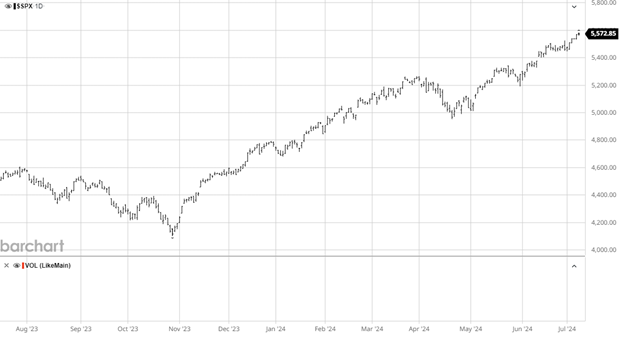

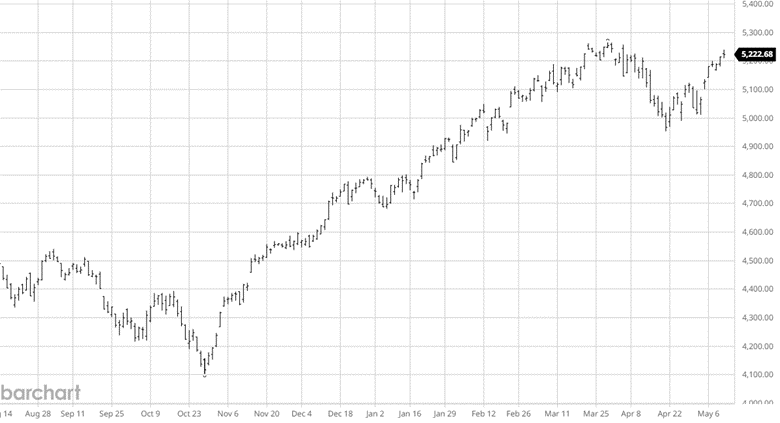

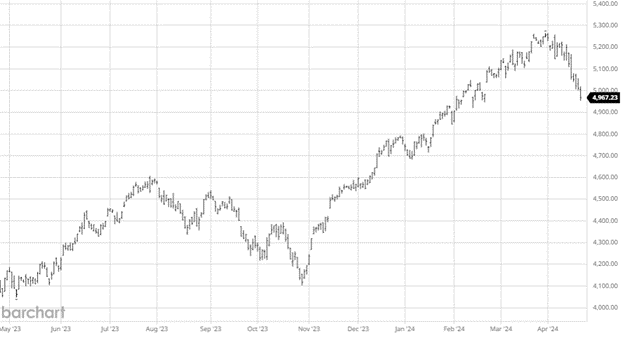

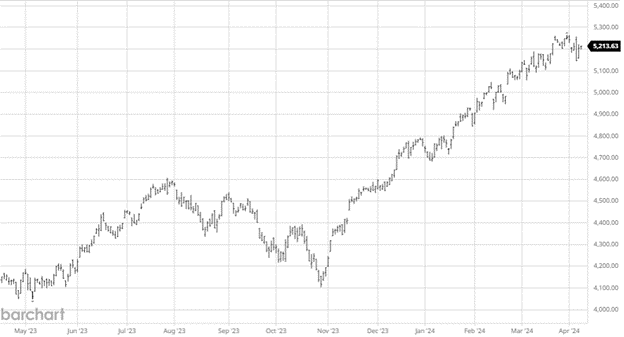

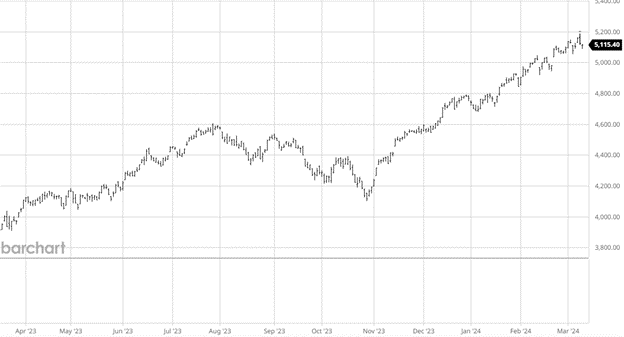

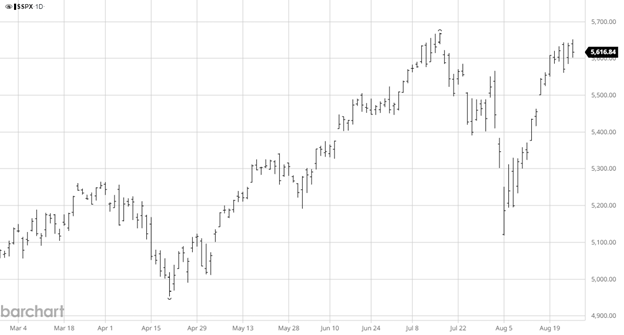

Equity Markets

The equity markets have rallied back to recent highs after a small correction with the Yen carry unwind and some market broadening out of tech. With earnings season coming to an end markets will trade on economic data and any election surprises after Nvidia this week.

Other News

- Fed chairman Powell spoke in Jackson Hole last week and set up for the Fed to begin cutting rates next month.

- The Canadian rail strike started and seemingly ended quickly with the government stepping in and saying that arbitration will decide negotiations.

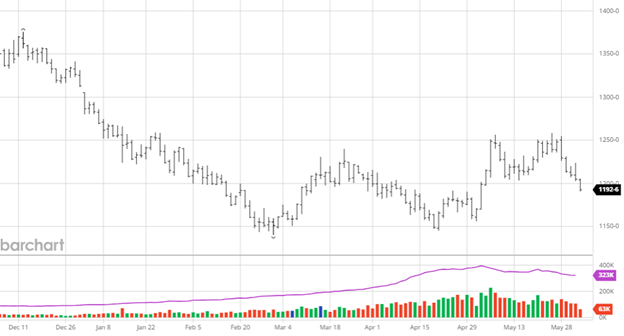

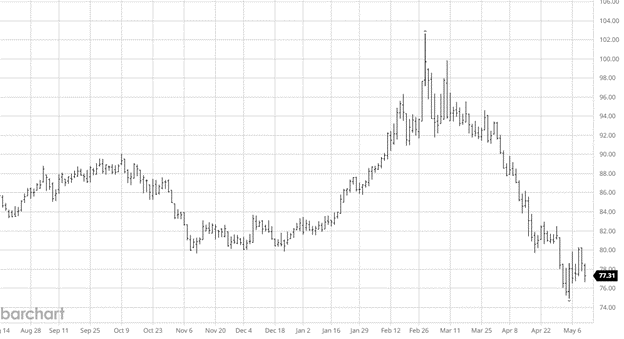

- Wheat’s summer trend lower from the $7.59 high looks to continue as it is not getting any help from other commodities to pull it up.

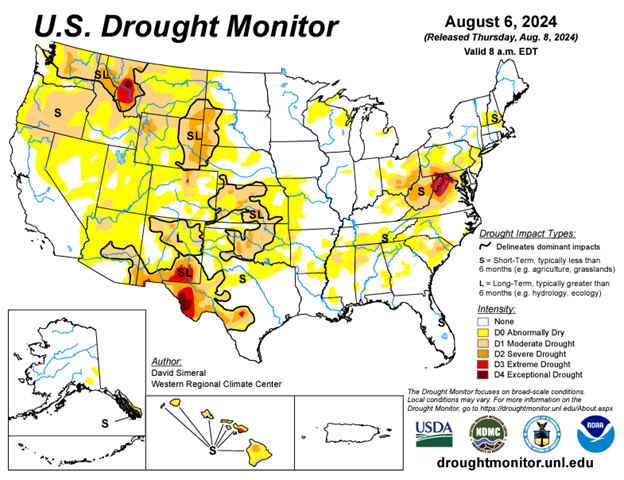

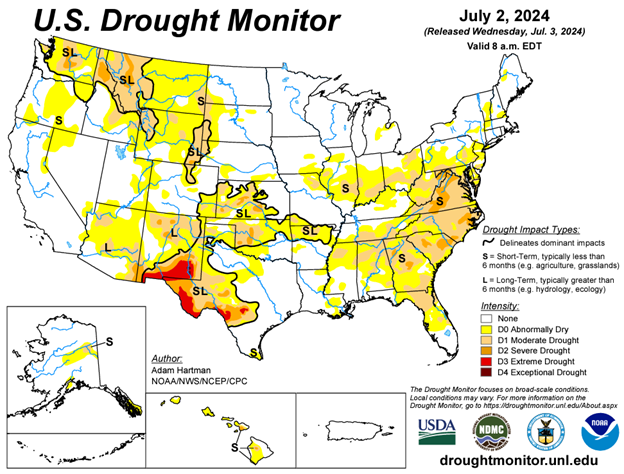

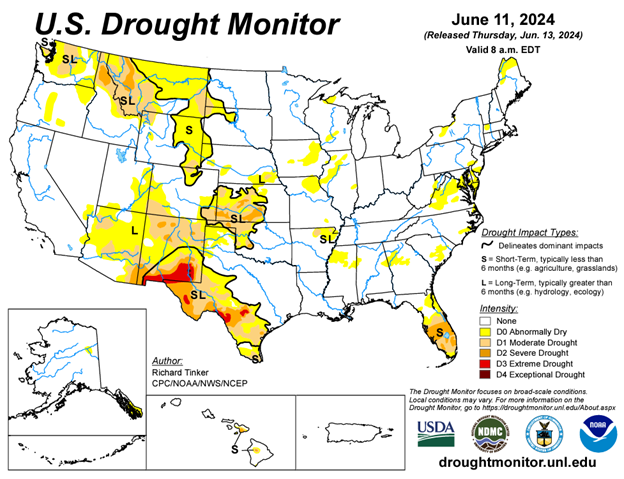

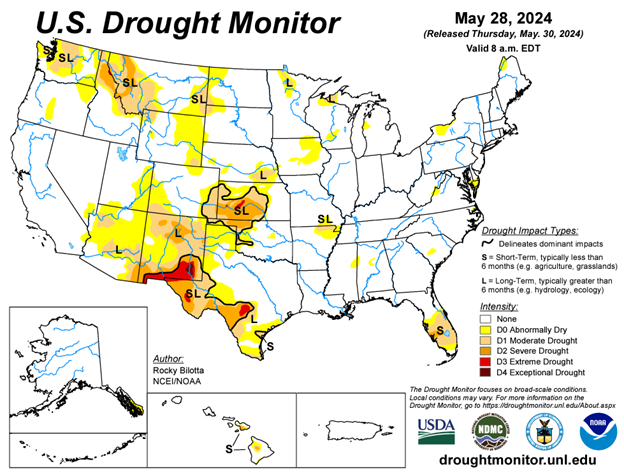

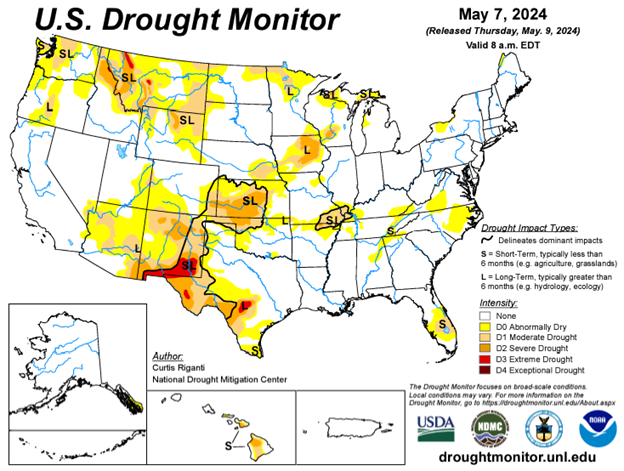

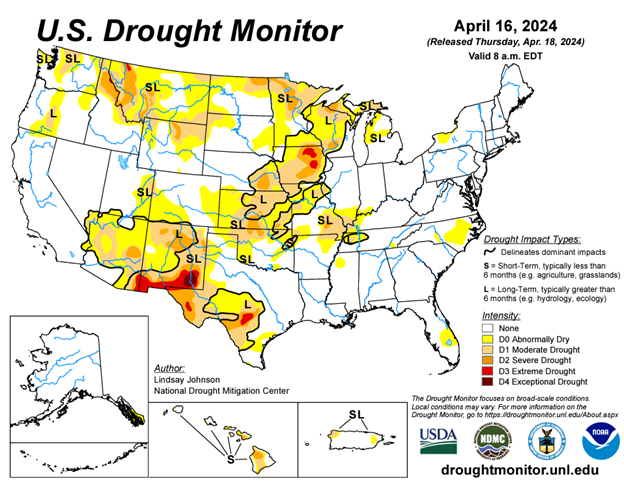

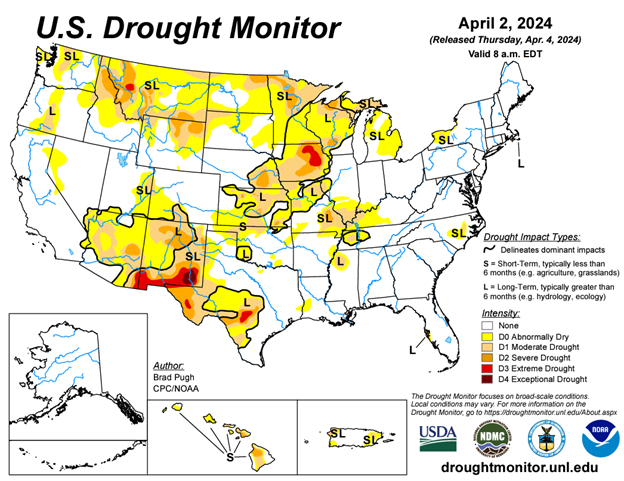

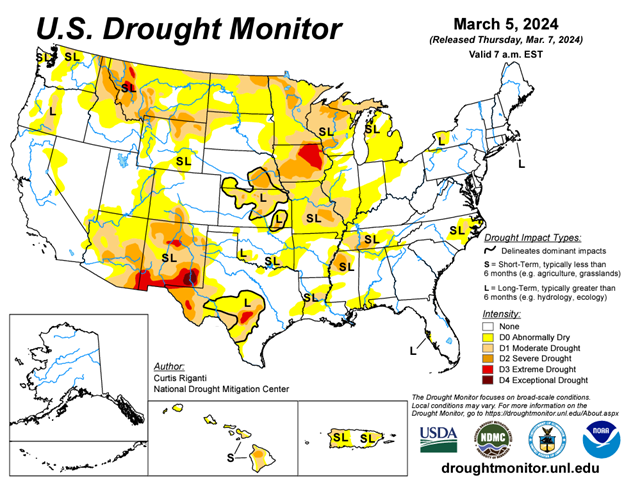

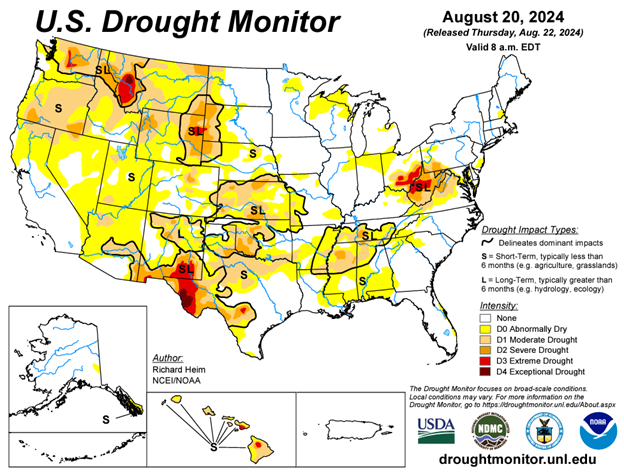

Drought Monitor

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.