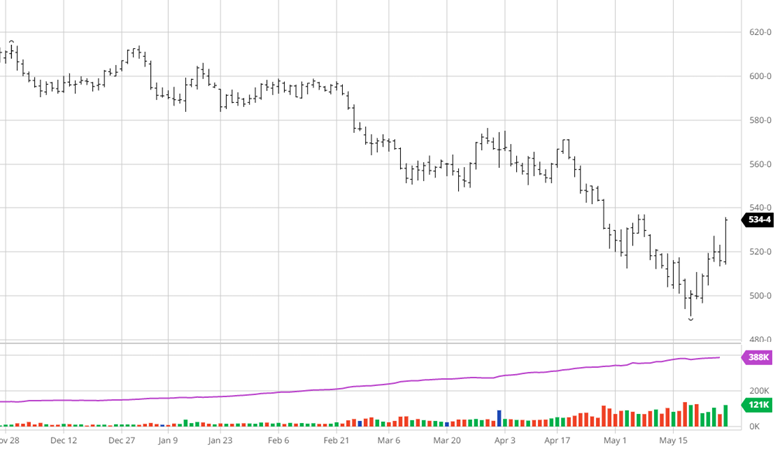

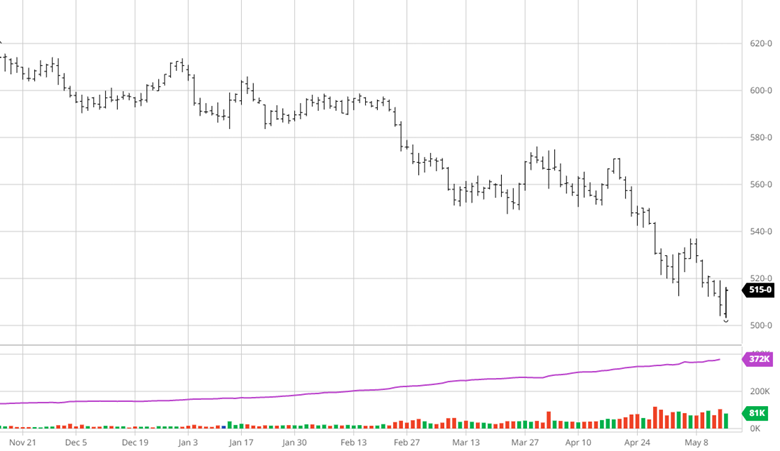

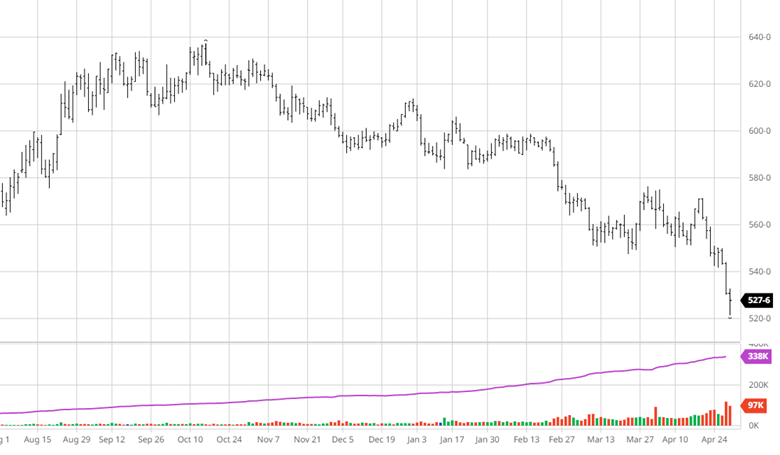

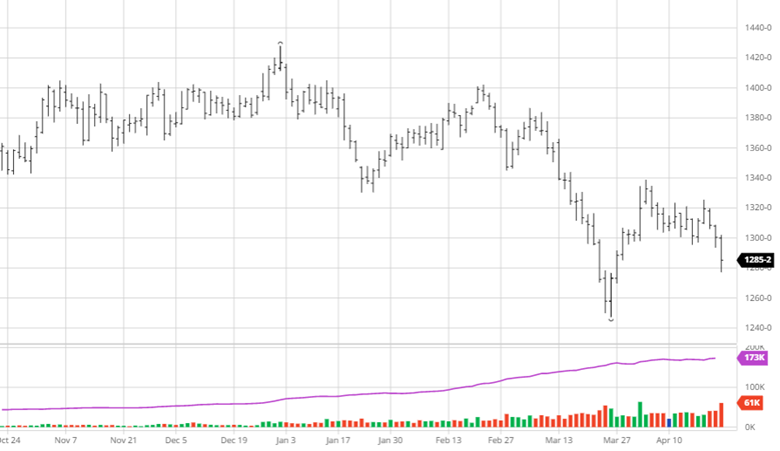

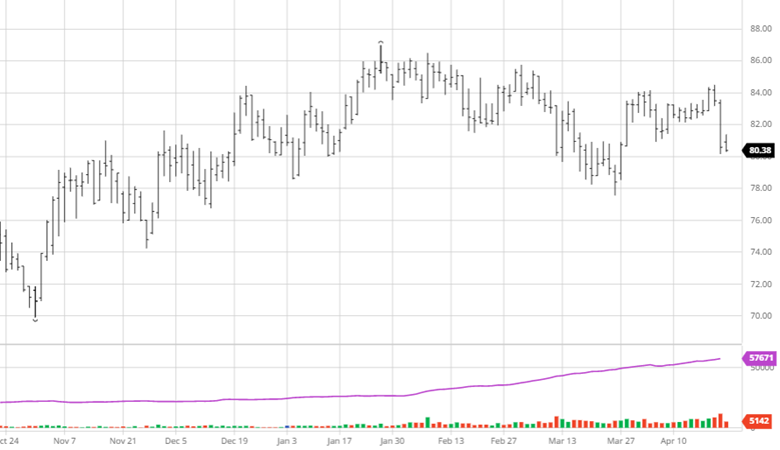

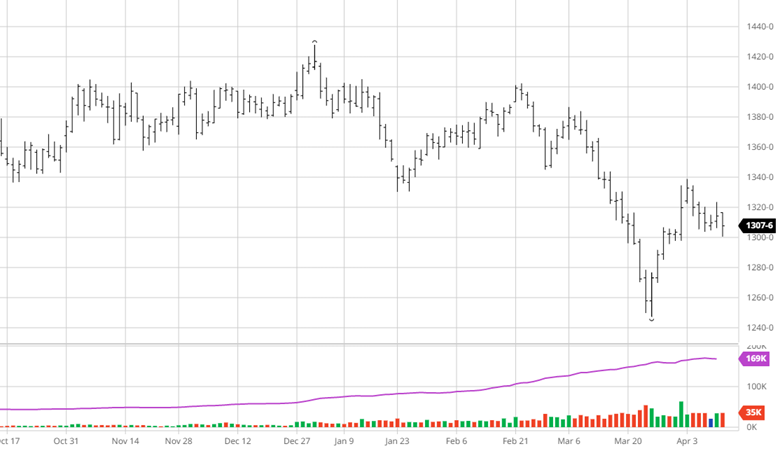

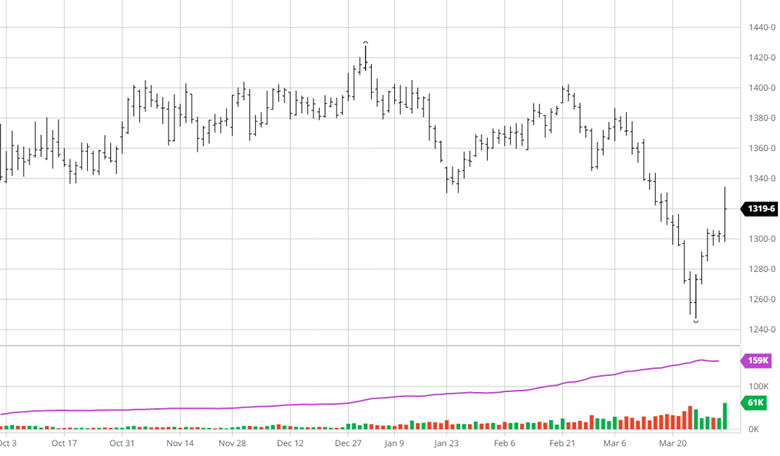

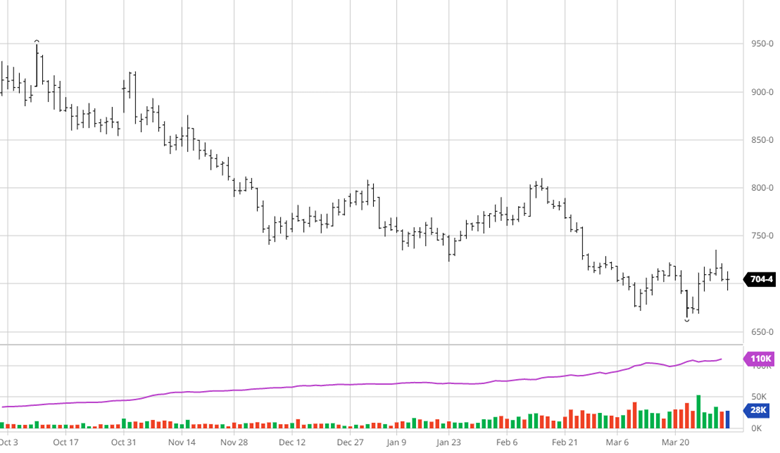

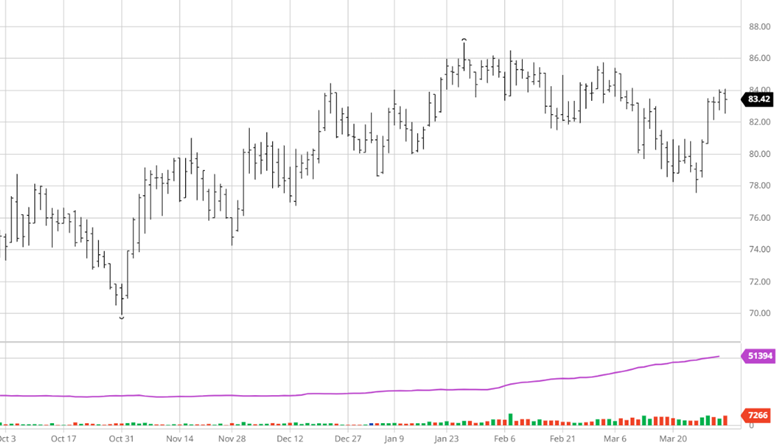

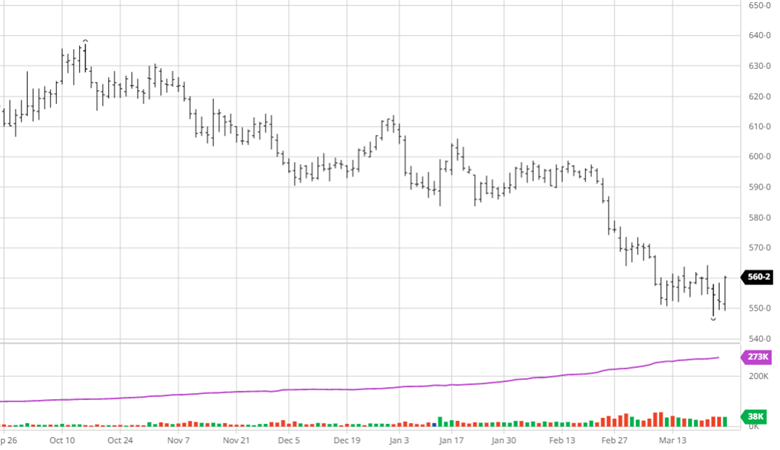

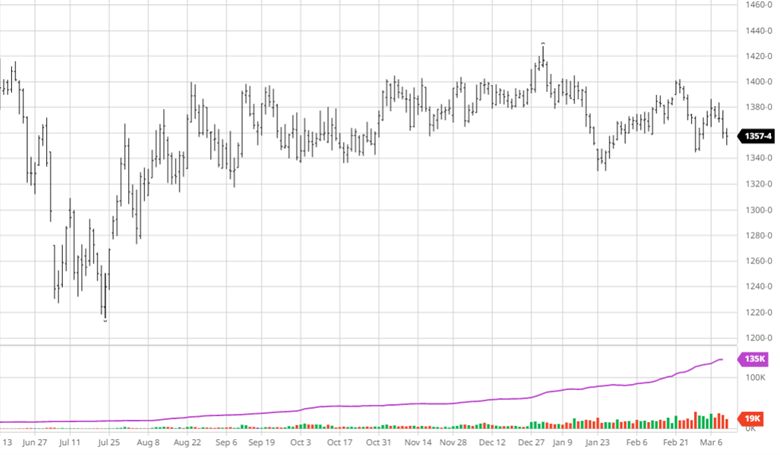

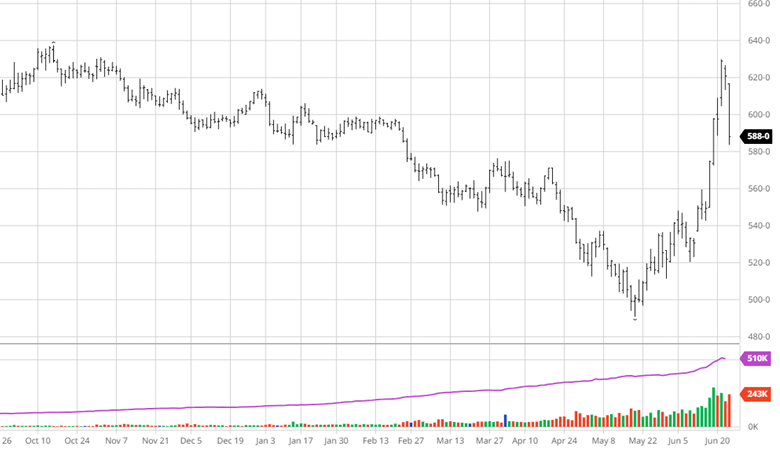

Welcome to the weather market we have been waiting for. The market skyrocketed higher as drought conditions set it across the US as growing is well on the way. The market ended the week with large losses as the chances of rain across a large area is expected over the weekend. While the market was quick to give up 40 cents on chances of rain whether or not that rain comes is still a question mark, let alone the amount needed is unlikely to happen. The US corn crop was rated at 55% good/excellent to start the week, very low for this time of year before we get into the heat of the summer. The actual rainfall amount seen over the weekend will be important, but continued rain in the coming weeks will be needed with minimal subsoil moisture currently helping this crop.

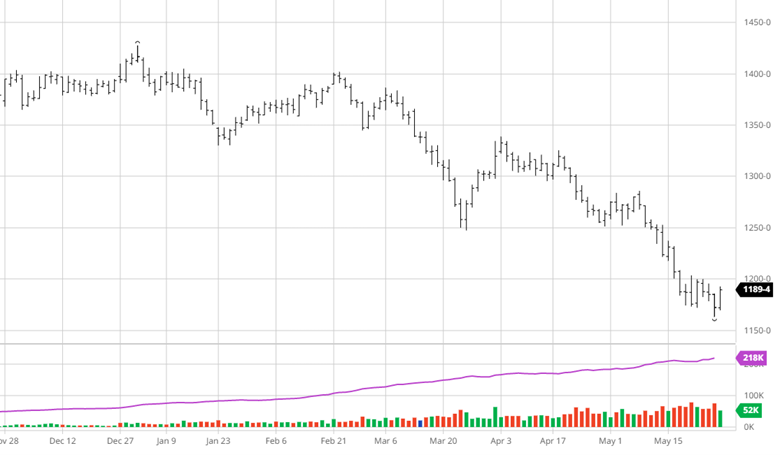

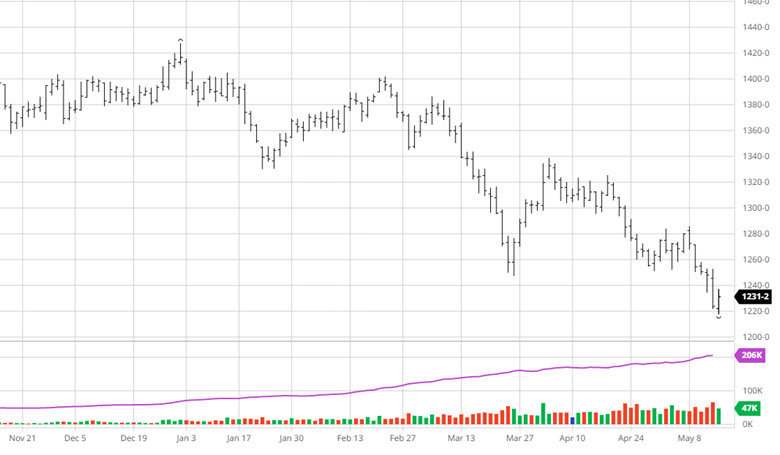

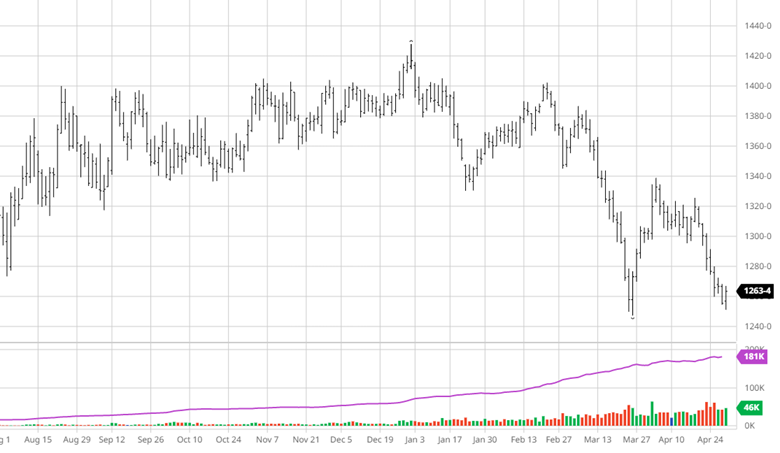

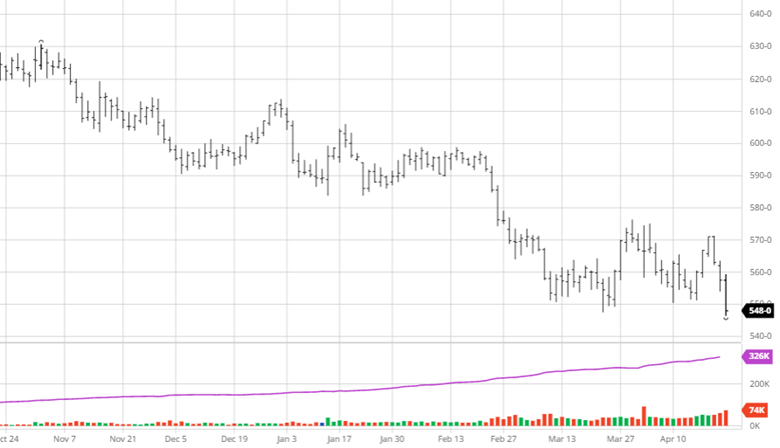

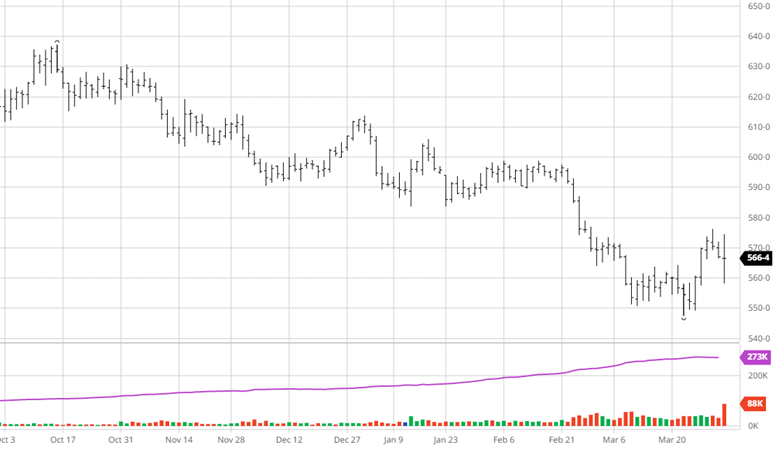

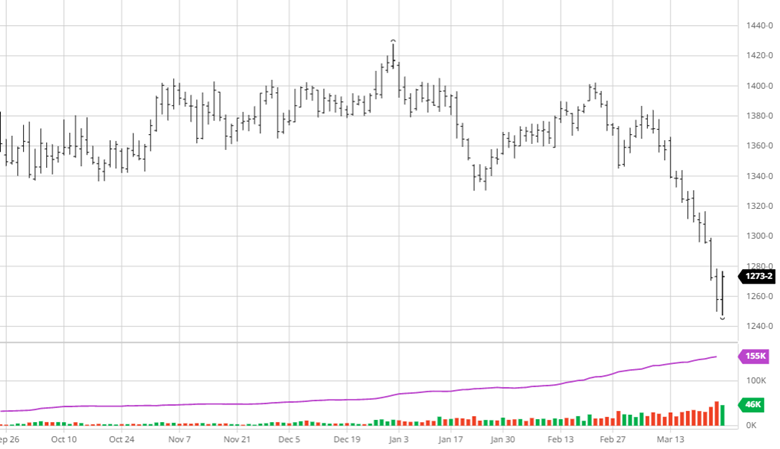

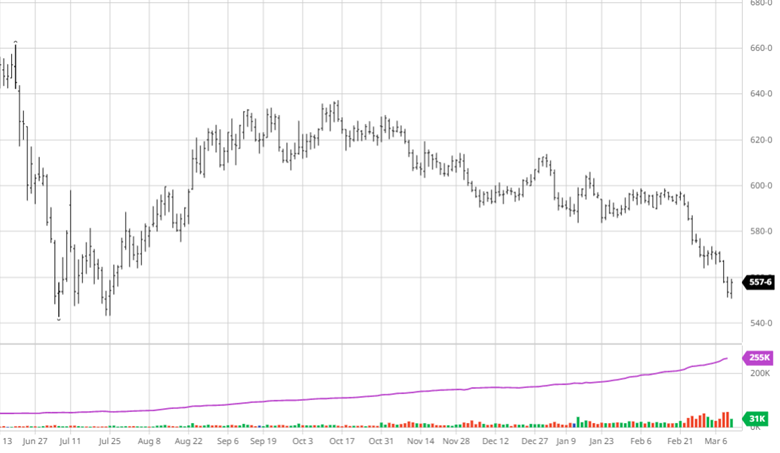

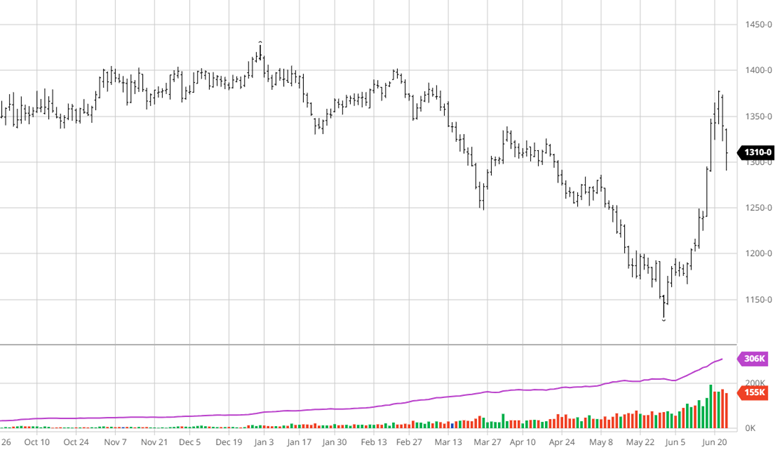

Soybeans saw a similar rally to corn in the last couple weeks with the drought conditions helping the market higher then rain chances pulling them back. The chances of rain this weekend will help soybeans, like corn, but the soybean crop is not in full panic mode yet although it is in some places. The US crop was rated 54% good/excellent to start the holiday shortened week as the weather market is in full effect. One other piece of news this week was the US EPA adjusting the biofuel mandates for 2023-25. While they raised the blending requirements to 22.38 billion gallons by 2025 many were expecting/hoping for higher amounts to give soybeans another catalyst higher. While they increased the 2023 renewable volume obligation by 120 million gallons from the December proposal, they lowered the RVOs by 300+ million gallons for ’24 and ’25.

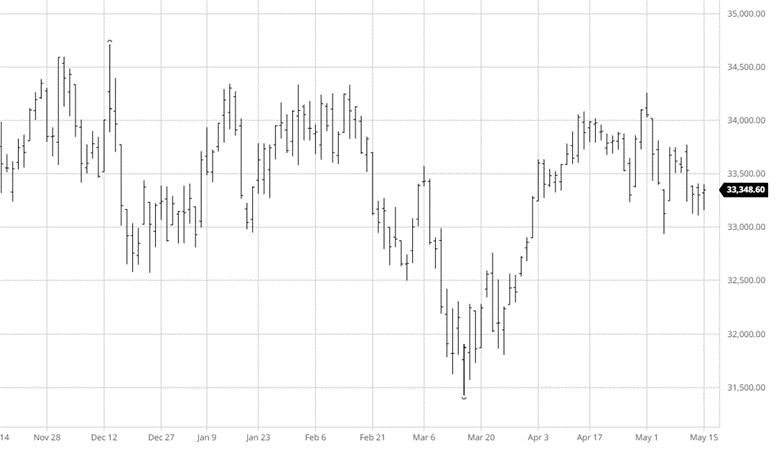

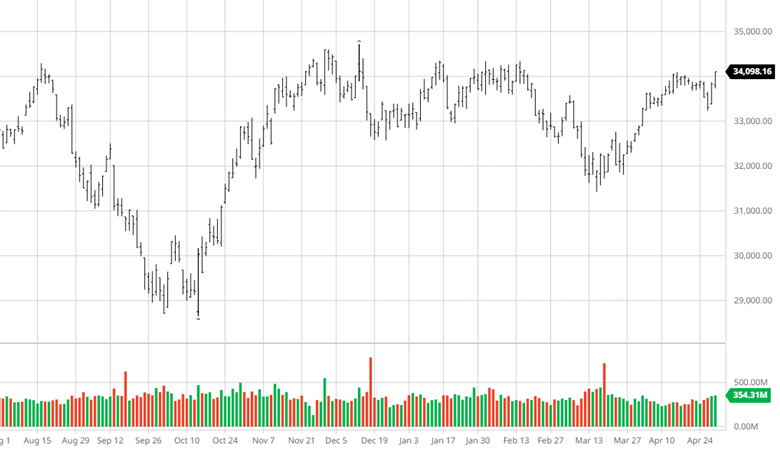

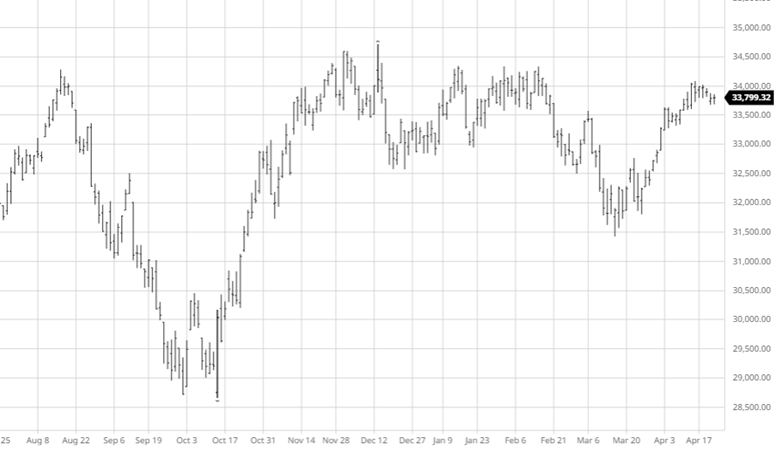

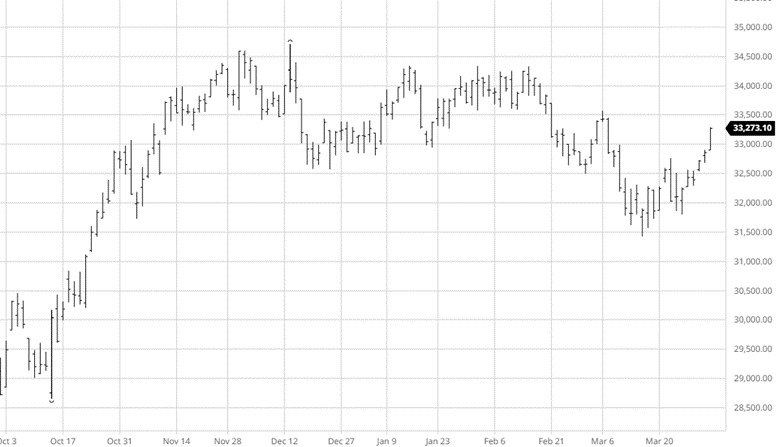

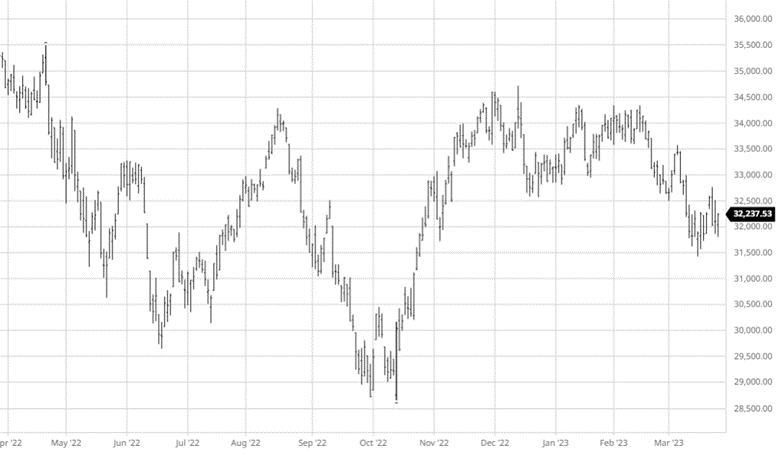

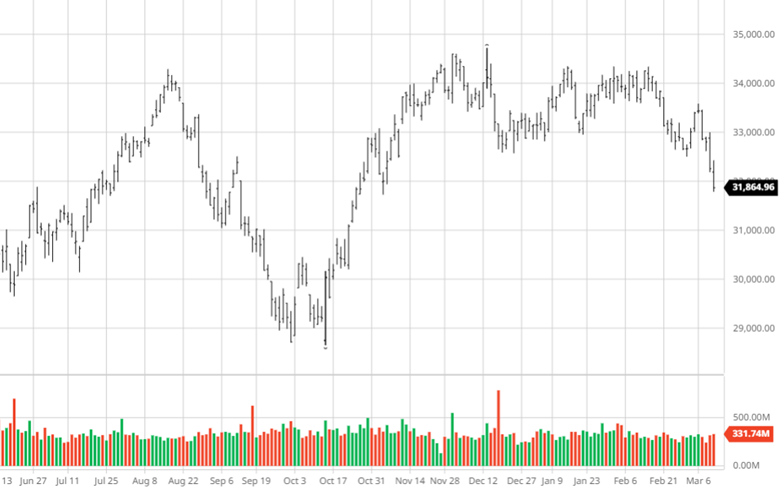

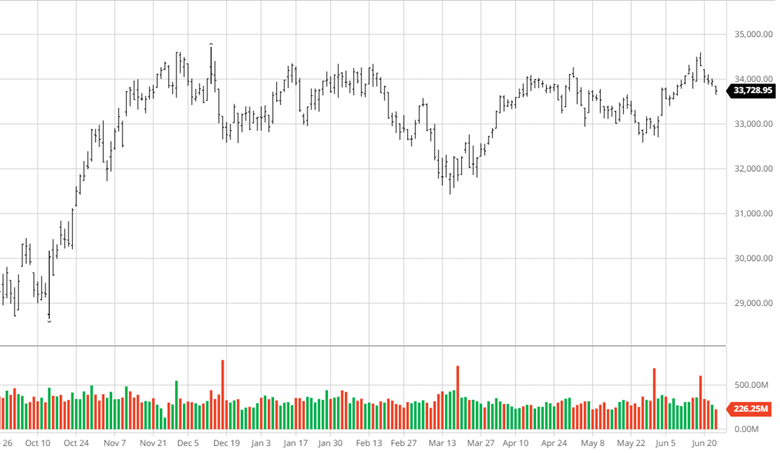

Equity Markets

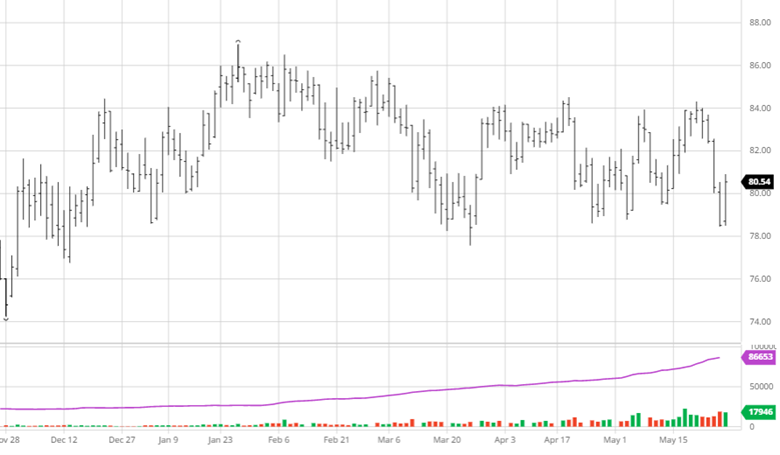

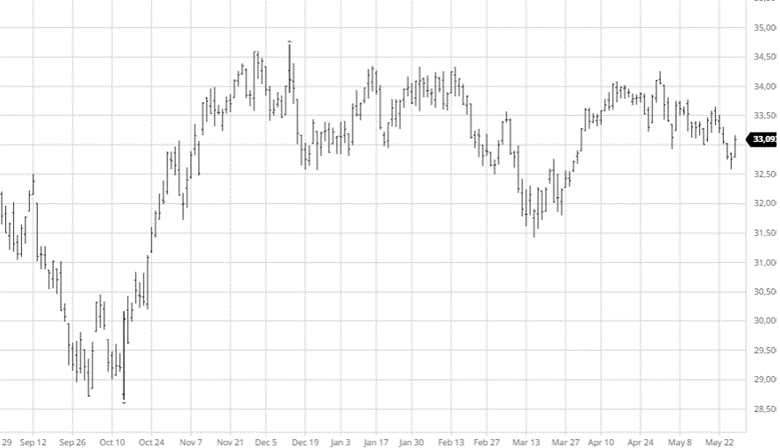

The equity markets saw losses this week after an impressive run over the last couple of months in tech. Recession fears are still widespread in the market as we are not out of the storm yet with inflation still well above the target levels. The Fed did not raise rates in their latest meeting as expected but could still raise them again in the future.

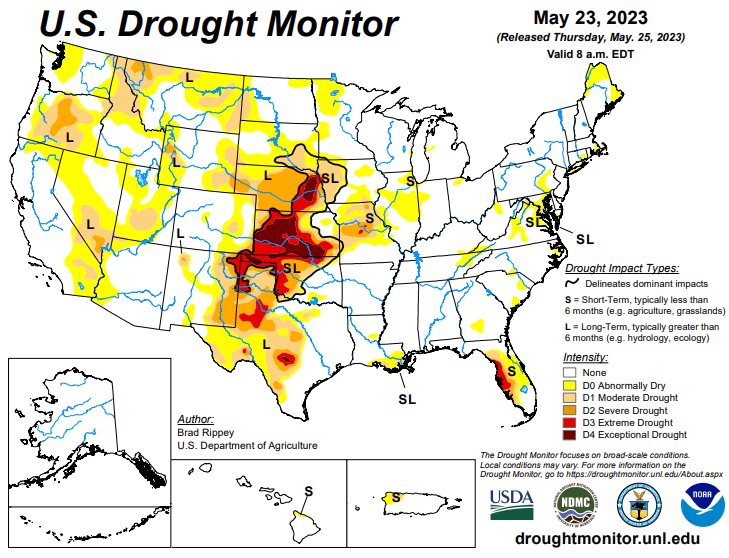

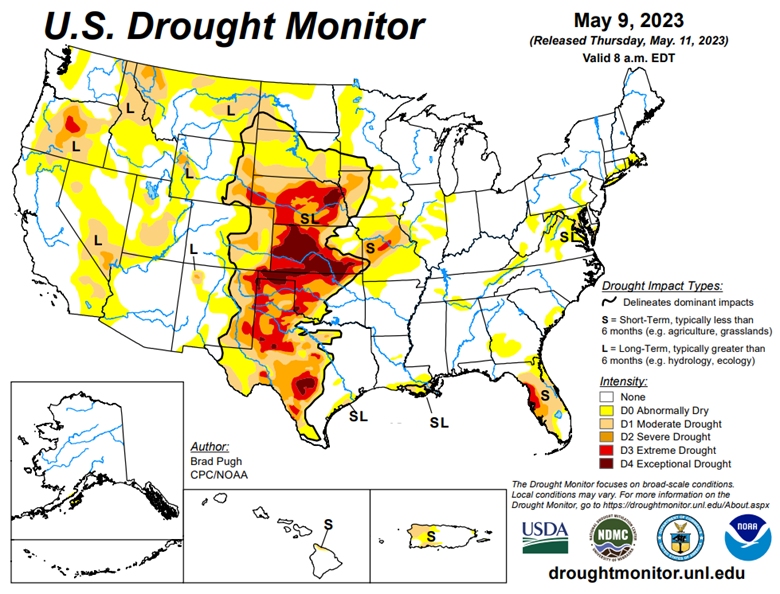

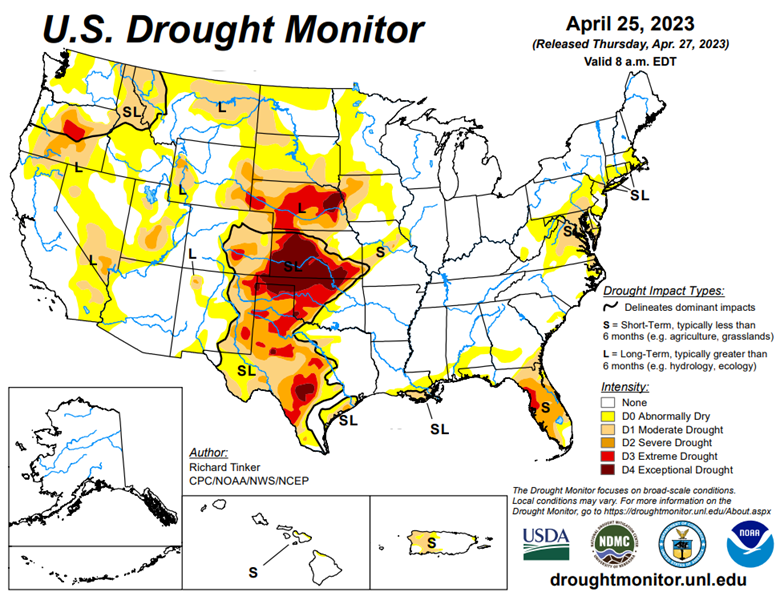

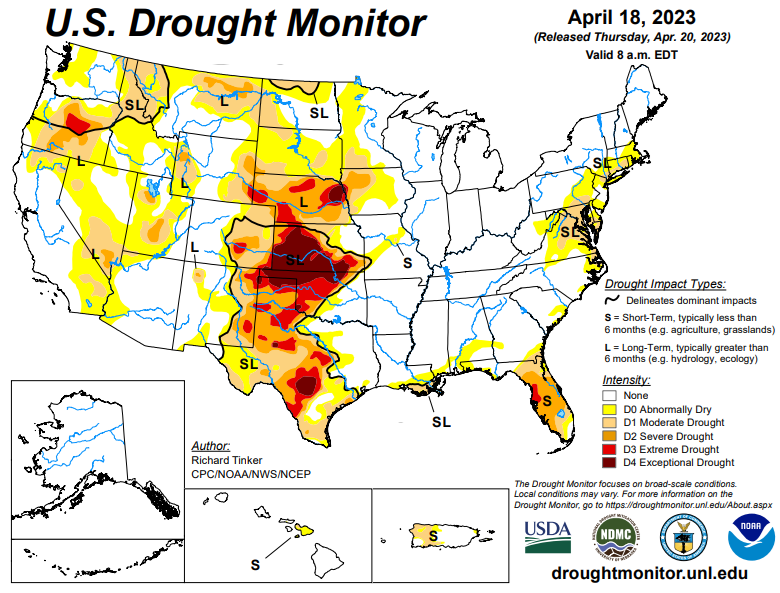

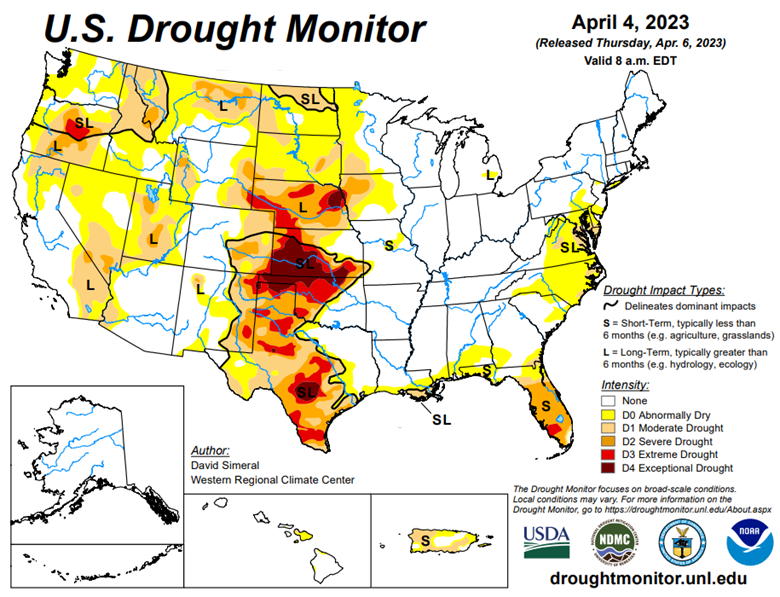

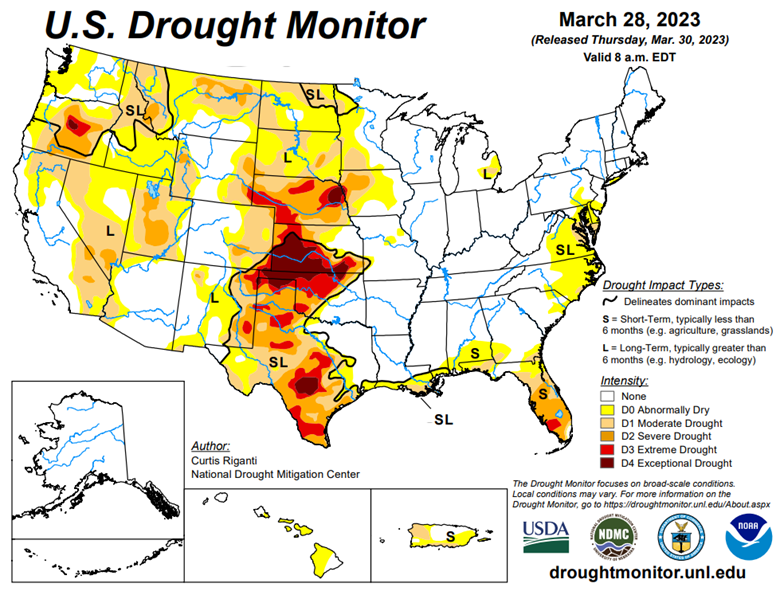

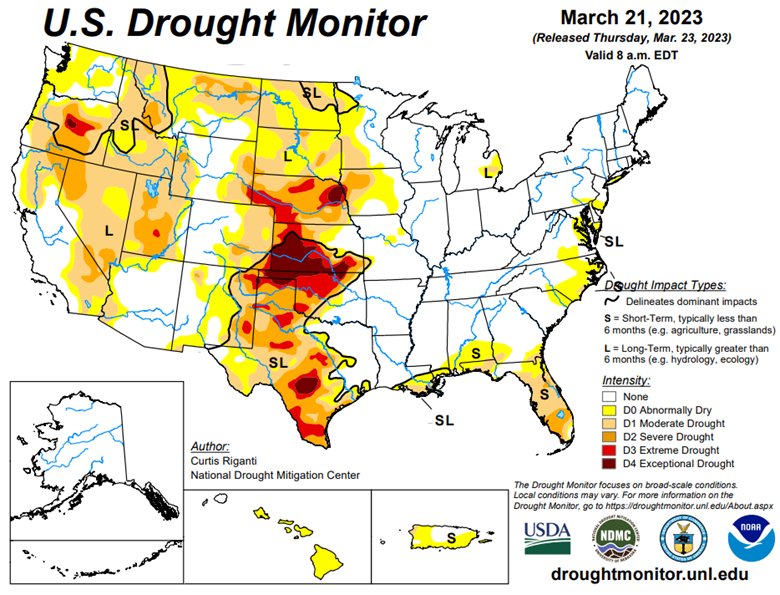

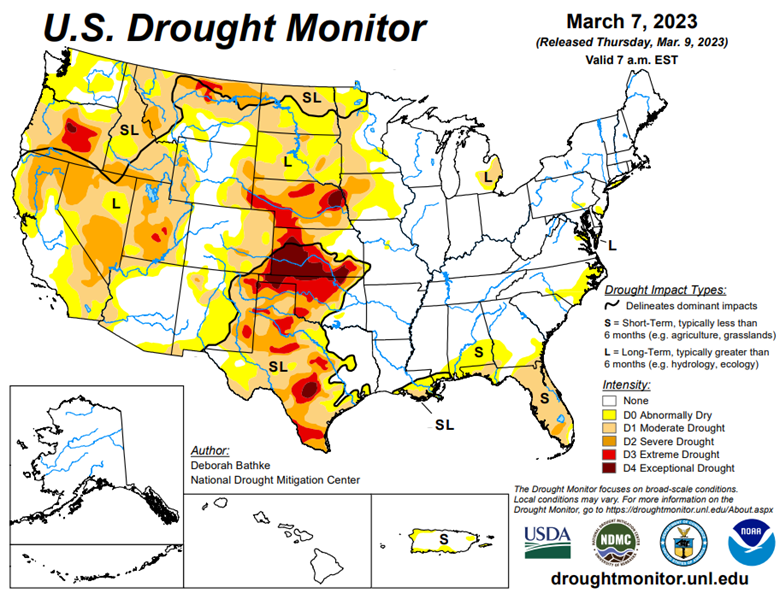

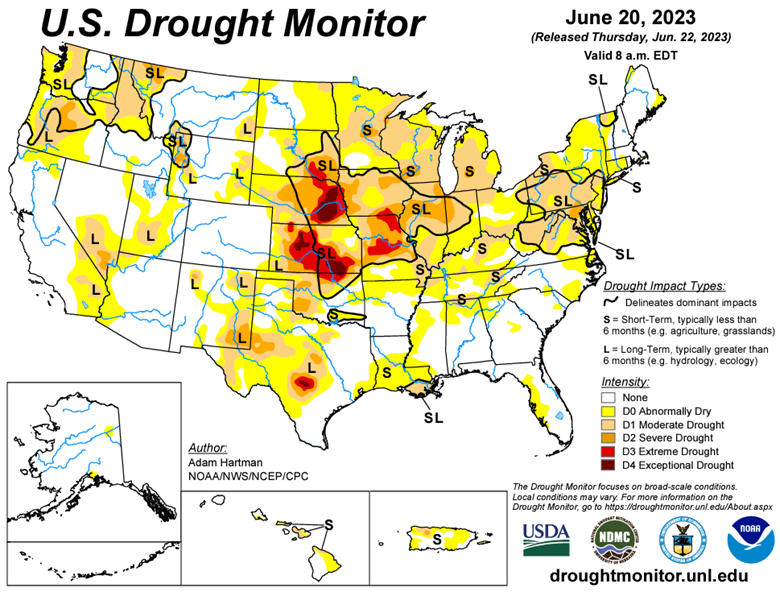

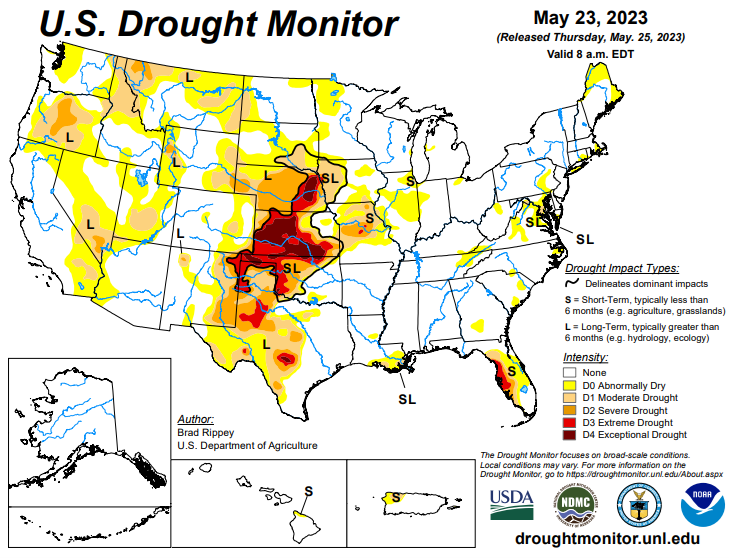

Drought Monitor

The drought monitors below show the change in drought conditions over the last 2 weeks.

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

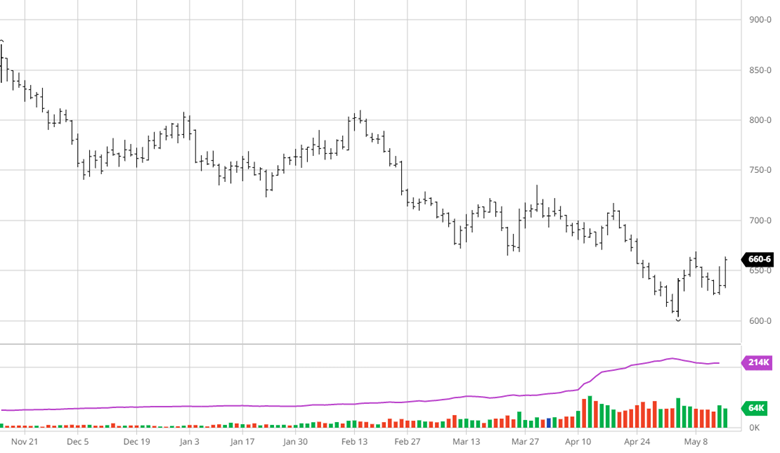

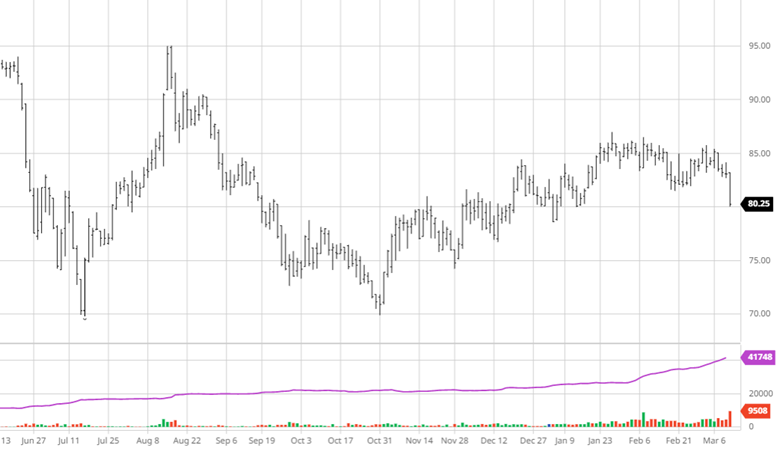

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].

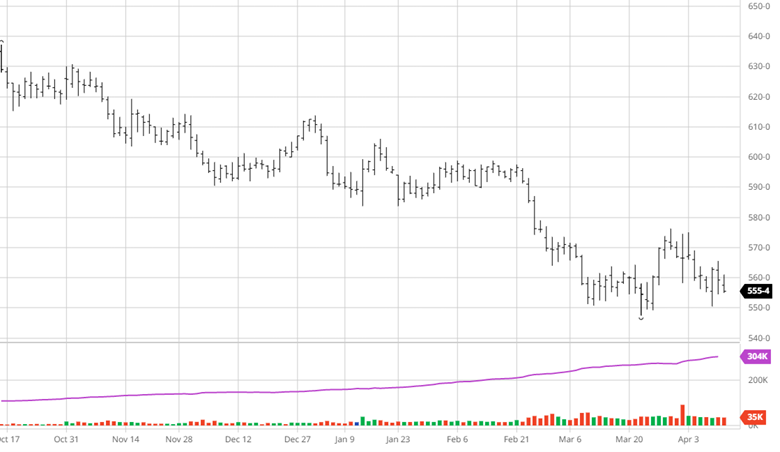

22/23 US Wheat Stocks: 598 MBU (606 MBU Est)

22/23 US Wheat Stocks: 598 MBU (606 MBU Est)