How Financial Institutions and Insurance Companies Play an Essential Role in Feeding the World

The cost of farming has grown over the years, which means financial institutions are amping up their reviewal process for loans and increasing insurance deductibles for protection to reduce their loss risk. What does this mean to supporting food production for the world? Well, as part of our “What It Takes To Feed The World” series, we are diving into critical agriculture sectors and bringing awareness to their roles in the food production cycle.

Financial institutions and insurance companies are the starting point in the process and are essential in providing the necessary funds to farmers on through to commercial entities. For farmers, they help finance EVERYTHING from the seed and chemical to hedge lines for farmers to help manage their price risk and everything in between. For commercial and end user entities, financing includes loans to build and maintain infrastructure and logistics to short term bridge loans to buy directly from farmers on to their own hedge lines of credit to support carrying of positions both pre and post harvest.

What financial and insurance options are available to the agriculture industry, and how are they beneficial to farmers, commercials, and end users? We’ll discuss the answers to these questions and more below.

Farmer Direct Loans

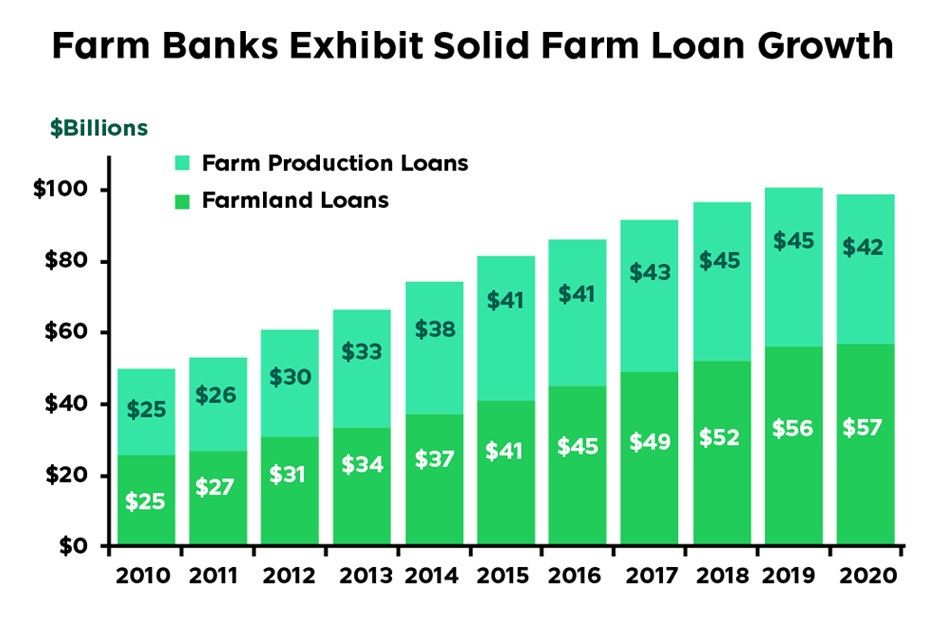

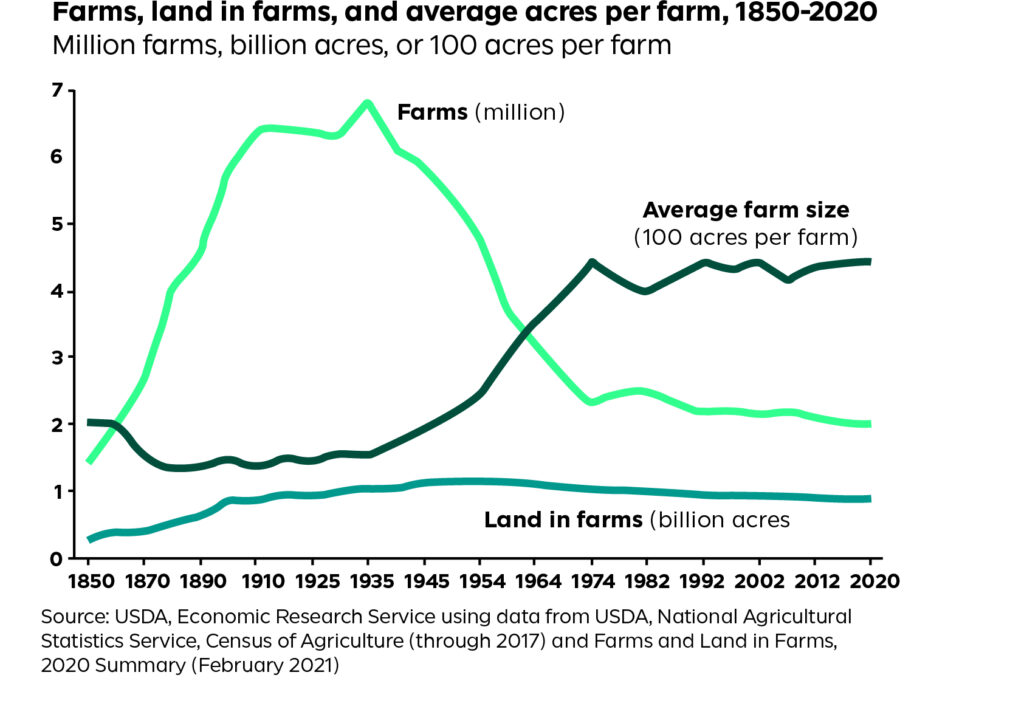

Farm direct loans are loans that the government makes available via the Farm Service Agency, while banks provide similar farmer direct loans. In 2021 the FSA reported loan obligations of $6.67 billion. Meanwhile, in 2020, U.S. farm banks loaned $98.6 billion. The American Bankers Association defines farm banks as banks whose ratio of domestic farm loans to total domestic loans is greater than or equal to the industry average. These amounts show just how much money is needed to produce the U.S. crop each year before farmers even harvest and sell the crop. These loans range from rent payments to fertilizer costs to machinery. But farm banks aren’t just offering loans to the agriculture sector. In 2020 total bank lending reached $174 billion in farm and ranch loans (including the $98.6 billion). These banks play a significant role with billions in small farm loans and even microloans. Small farm loans are less than $500,000, and microloans are less than $100,000. These two categories alone totaled over $55 billion in 2020.

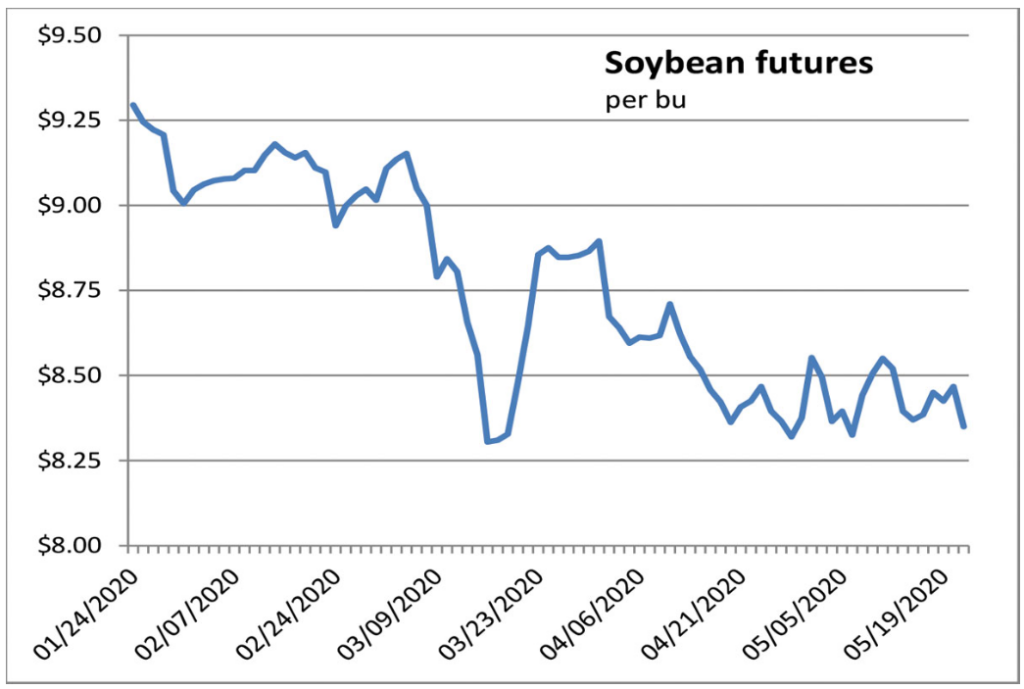

Hedge Margin Lines

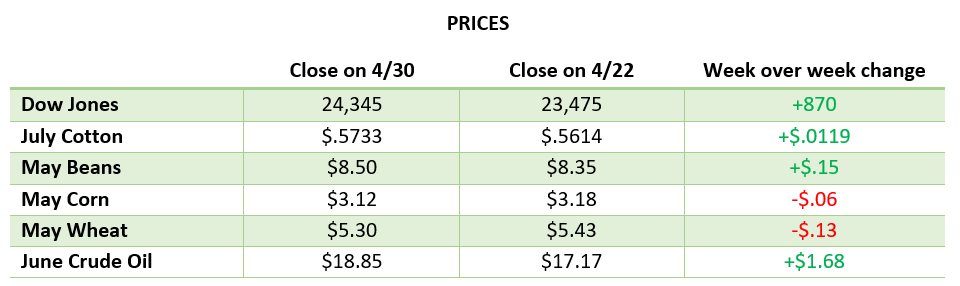

Banks also help finance hedge margin lines to help farmers manage their price risk. By financing the hedge lines, banks allow farmers to place hedge positions in a brokerage account, protecting against adverse price movements that could lessen the value of their crop. When banks loan out money, they expect to be paid back; hedge credit lines are a tool banks use to help support the farmer being able to do so. If your bank is NOT willing to extend a hedge line – please give us call!

By financing hedge margin lines, banks support the farmer and themselves. With loans comes default risk and hedging is one tool to help mitigate the price risk that ultimately will be how the farmer pays back the loan.

Banks and the Rest of the Sector

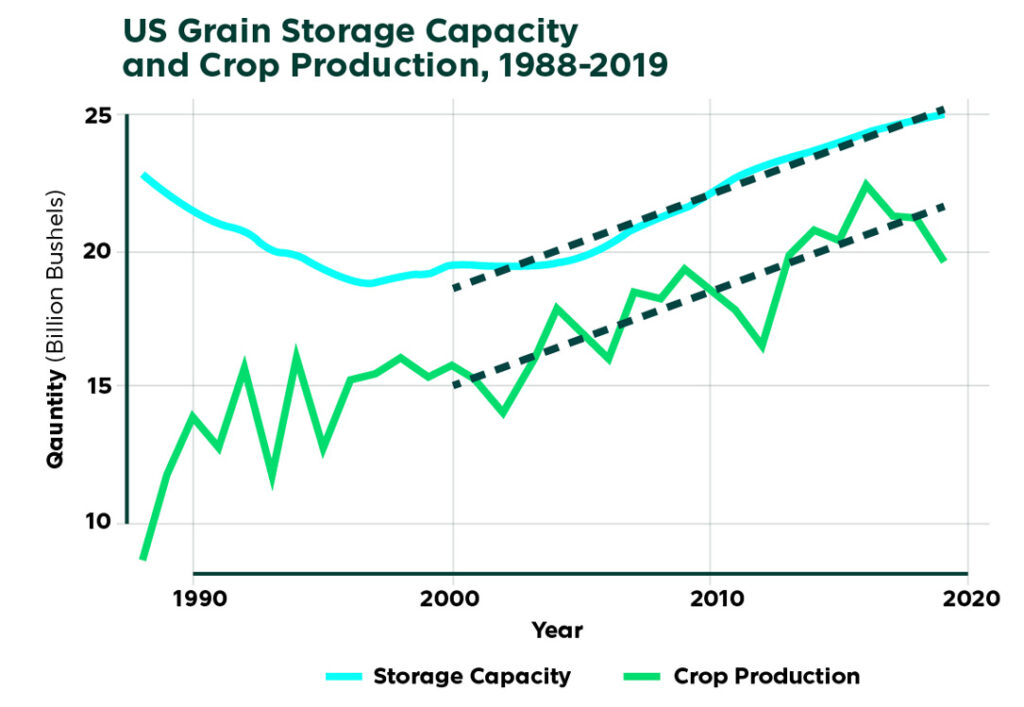

There’s no question that banks are involved in the food production supply chain. When you think about it, commercials, end-users, and other units that touch grain utilize bank loans to enhance their businesses. Like feed yards and elevators, end-users use banks to improve their infrastructure by adding more storage or drying systems, using short-term loans to purchase grain and make other improvements to their business. These improvements ultimately improve the efficiency of the entire system and potentially lead to reduced costs of the final product, which helps the end consumer, people. Just like improvements to city and towns infrastructure are necessary, through the support of bank financing, these improvements are necessary to the health of the agriculture industry’s infrastructure.

Farming is not getting any cheaper, and more capital is required to produce excellent crops year after year. Banks’ loaning capacities play a major role already, but if we are going to keep up with growing demand in a growing world, their role will be even more critical going forward.

Crop Insurance

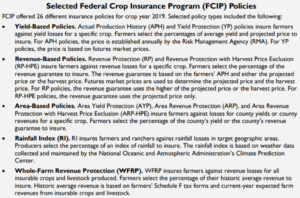

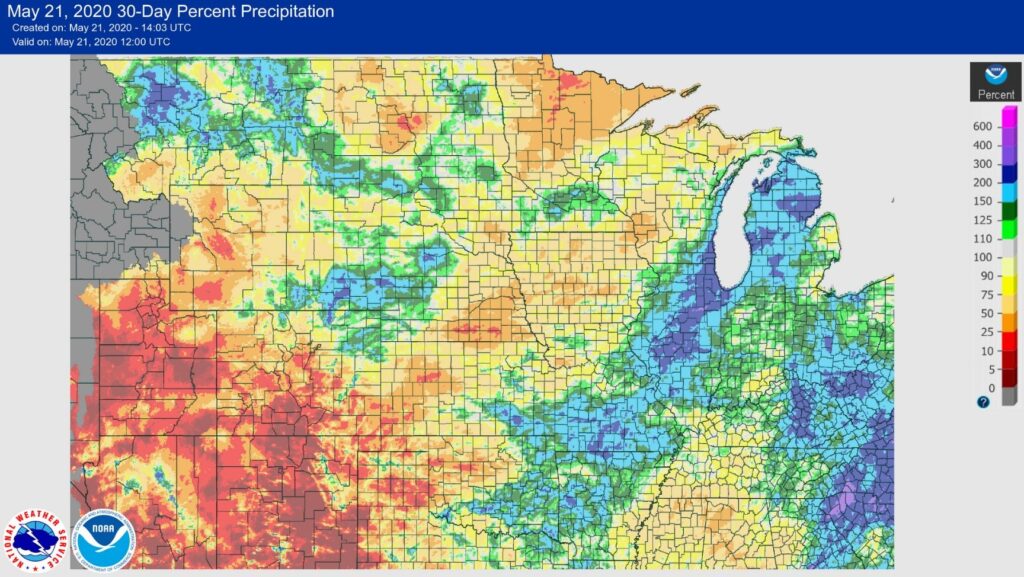

Crop insurance brings continuity to the industry year-over-year as the ups and downs of weather and prices can cost farmers millions of dollars if unprotected. There are two types of insurance for major field crops: yield-based, which pays an indemnity (covers losses) for low yields, and revenue that ensures a level of crop income based on yields and prices.

Insurance offerings and prices vary on where you are located and your land, but like other forms of insurance in your life, it is better to have it and not need it than need it and not have it. While the listed above are the main types of insurance, others can be purchased, like drought insurance for pastureland and hail insurance if your crop gets damaged by an ice storm. These are more specific to your geographic location but play an essential role.

Like banks, insurance companies help with the continuity of the agriculture sector. These companies along with government subsidy programs, provide the opportunity to continue farming when disaster strikes and threatens the financial stability of a farm.

How RCM Ag Services Partners Financial Institutions & Insurance Companies

For our Farmer Direct customers, RCM Ag Services partners with banks and insurance companies to provide our mutual customers daily expert market knowledge and advice. We are firm believers that the long term health and growth of our local farming communities requires a team approach that starts with the farmers and their banking and insurance teams.

For our commercial and end user customers, we are focused on evaluating profit margins and the cost of capital for managing the current and futures market risks. Our Ag Services team is working directly with lenders, 3rd party credit suppliers, as well as USDA government programs to support the long-term financial health of the commercial business sector.

Along with market knowledge, our brokerage services allow us to establish hedge accounts that banks can fund with a credit line, as discussed above. Our brokers have over 150 years of combined experience in the market that helps them provide hedge advice that is customized to each operation, not cookie-cutter advice. Take advantage of these benefits and call one of our knowledgeable ag specialists today at 888-875-2110 or email [email protected]