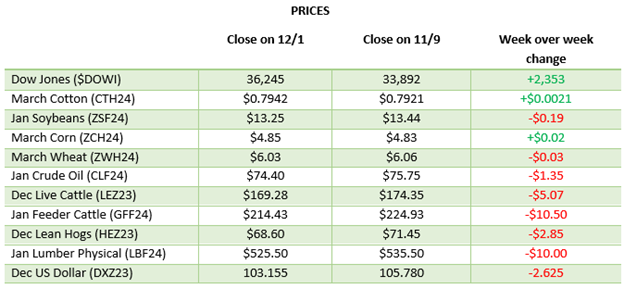

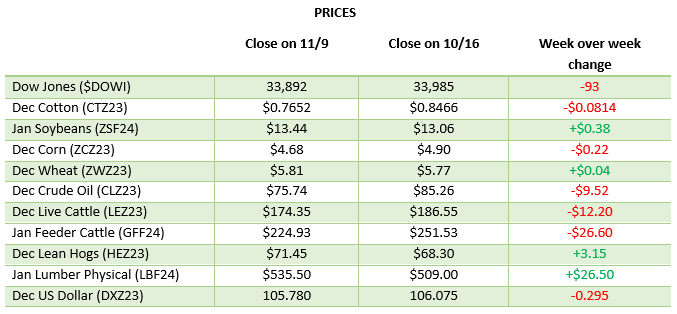

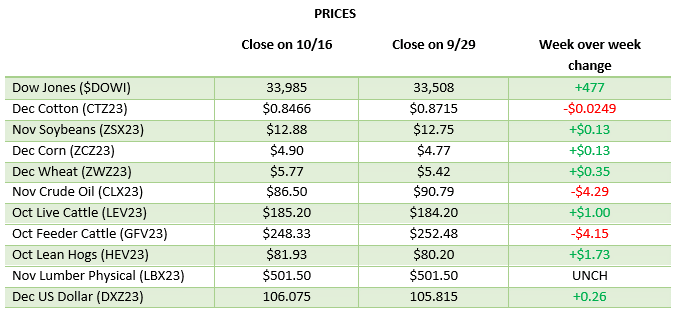

USDA Final 2023 Yield and Stocks

Overview

January 12, 2024

First Glance:

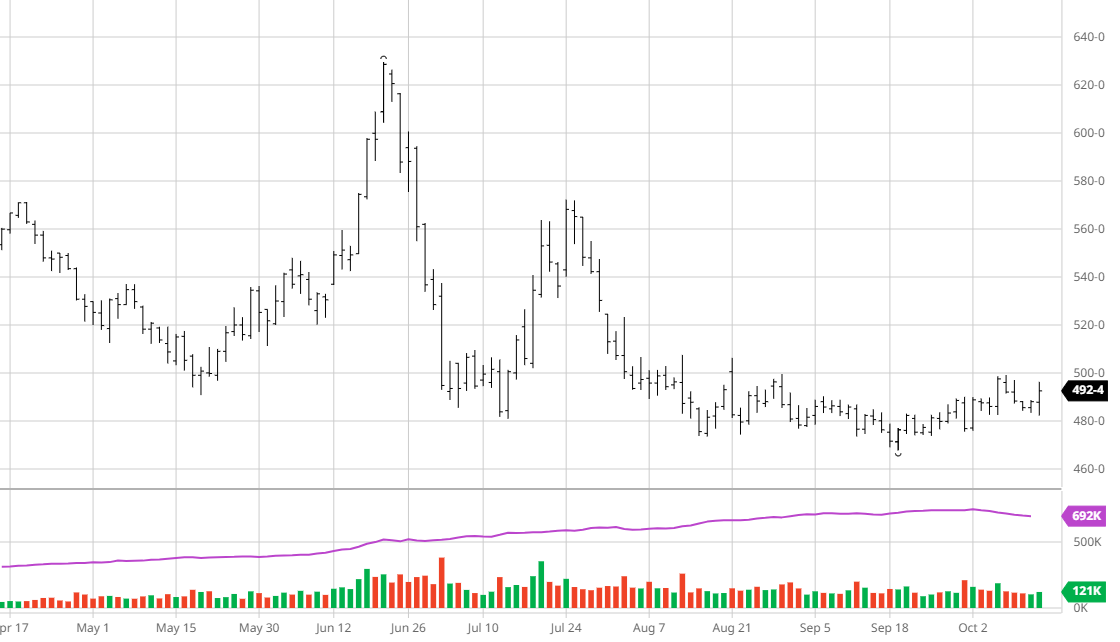

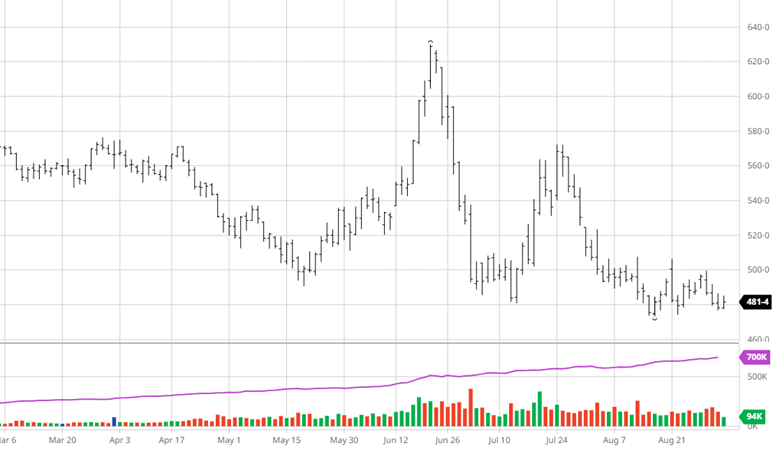

Corn

USDA Yield: 177.3 BPA (174.9 Estimate – 174.9 Nov)

Total Crop: 15.342 BBU (15.226 Estimate – 15.234 Nov)

Harvested Area: 86.513 MA (87.036 Estimate – 87.096 Nov)

23/24 US Ending Stocks: 2.162 BBU (2.111 Estimate – 2.131 Nov)

23/24 World Stocks: 325.2 MMT (312.9 Estimate – 315.2 Nov)

Brazil/ARG Crop: 182 MMT (180 Estimate – 184 Nov)

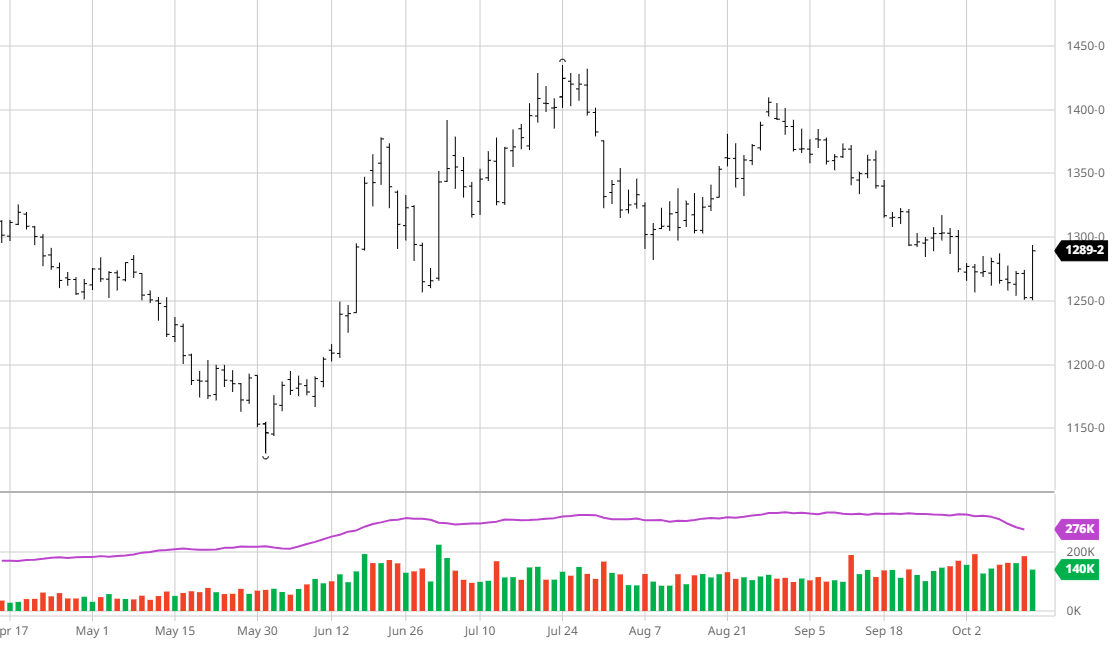

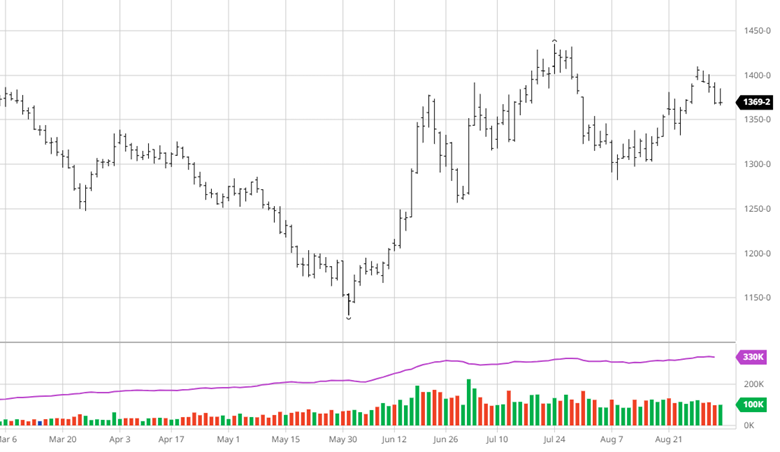

Beans

USDA Yield: 50.6 BPA (49.9 Estimate – 49.9 Nov)

Total Crop: 4.165 BBU (4.134 Estimate – 4.129 Nov)

Harvested Area: 82.356 (82.757 Estimate – 82.791 Nov)

23/24 US Ending Stocks: 280 MBU (245 Estimate – 245 Nov)

23/24 World Stocks: 114.6 MMT (111.9 Estimate – 114.2 Nov)

Brazil/ARG Crop: 212.0 MMT (204.9 Estimate – 209 Nov)

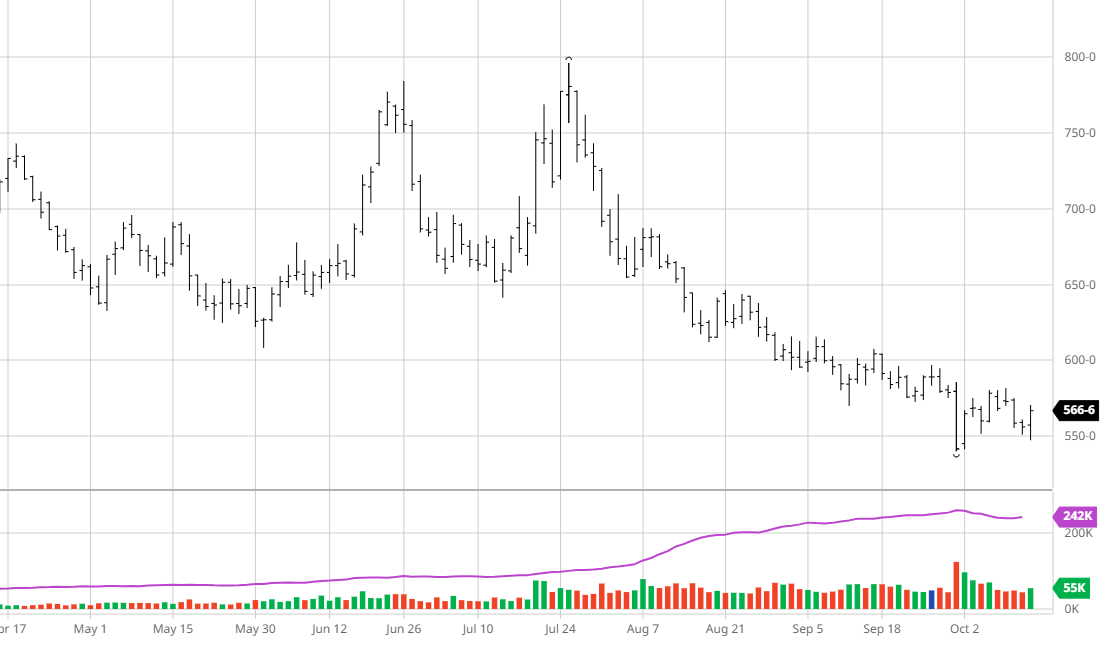

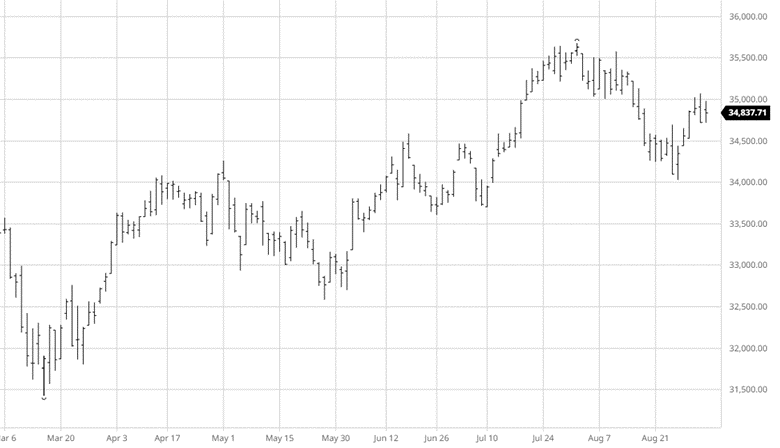

Wheat

23/24 US Ending Stocks: 648 MBU (659 Estimate – 659 Nov)

Winter Wheat Seedings: 34.425 MA (35.786 Estimate – 36.699 LY)

23/24 World Stocks: 260.0 MMT (258.3 Estimate – 258.2 Nov)

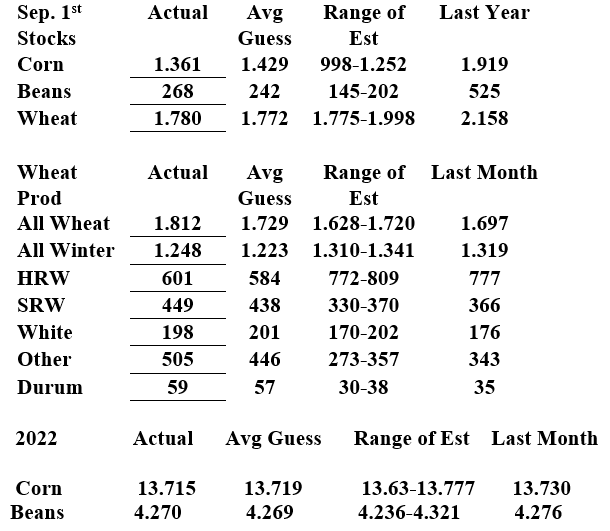

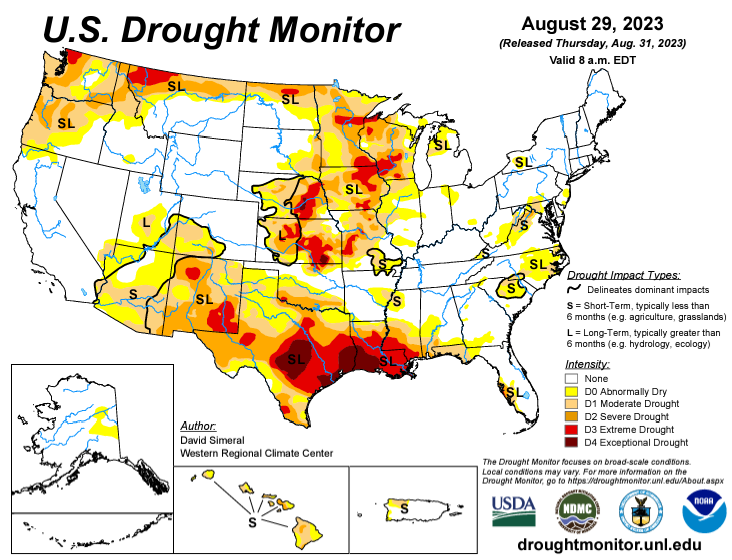

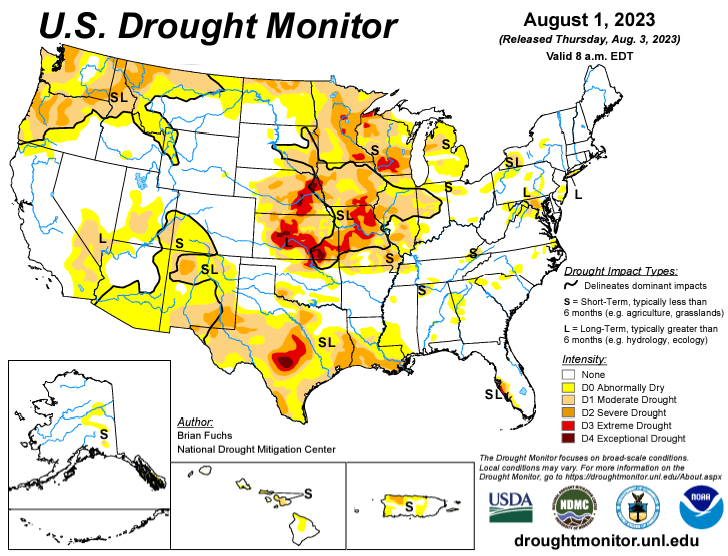

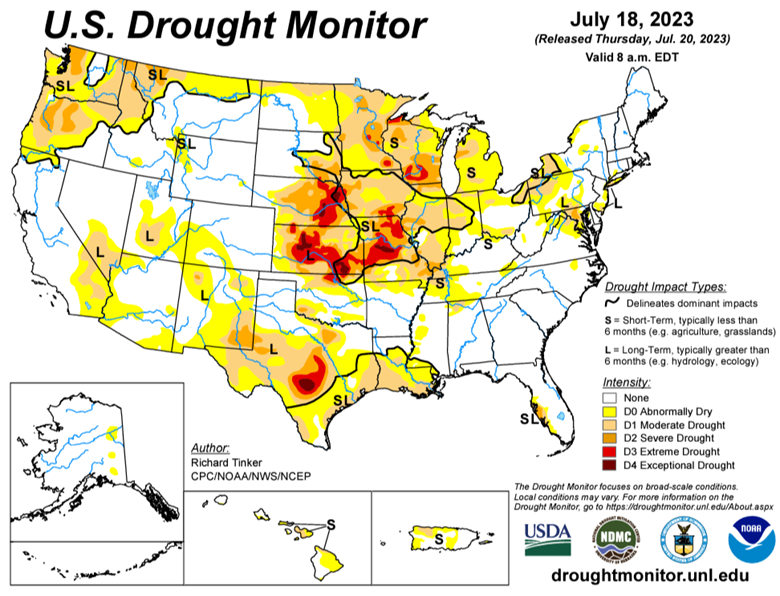

The USDA found larger than expected totals in almost every category, increasing corn yield 2.4 bpa over the November estimate to 177.3 bpa. This is both a record yield and record total crop of 15.342 billion bushels. Bean yield was also raised .7 bpa to 50.6 and a total crop of 4.165 bbu. Both corn and bean harvested acres were slightly trimmed, the only bullish news in the report.

Higher yields were pushed through to higher ending stocks with US corn carryover raised to 2.162 bbu (+31 mbu from Nov) and 803 mbu above last year’s stocks. Beans had a similar fate with stocks set at 280 mbu, up 35 mbu from November but only 16 mbu above last year. Wheat stocks were slightly smaller than expected at 648 mbu but still up 78 mbu from 22/23.

Despite the rough start to Brazil’s growing season in their northern regions, Brazil’s bean and corn crops were not cut as much as expected. The weather has improved hurting the bullish narrative of a bad year for Brazil but the expanded acreage will also help offset any damage done earlier in the year.

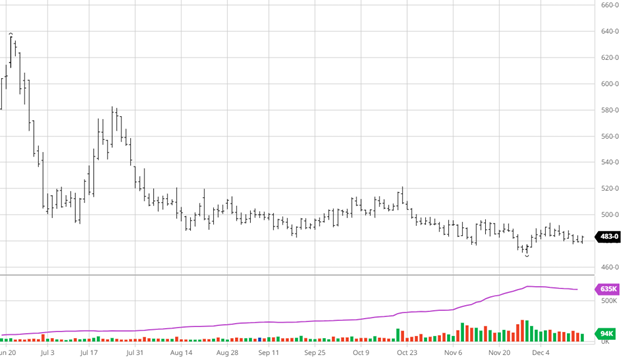

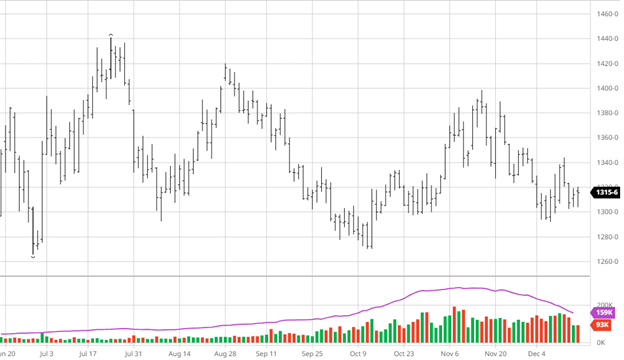

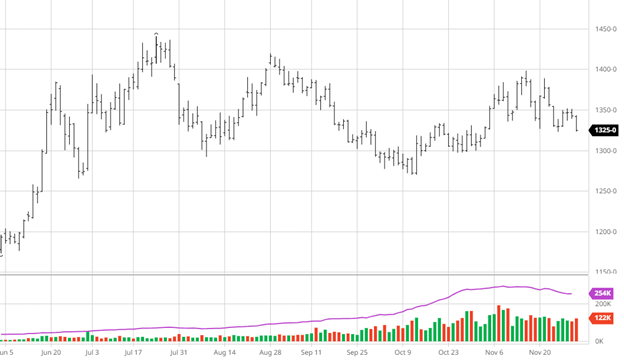

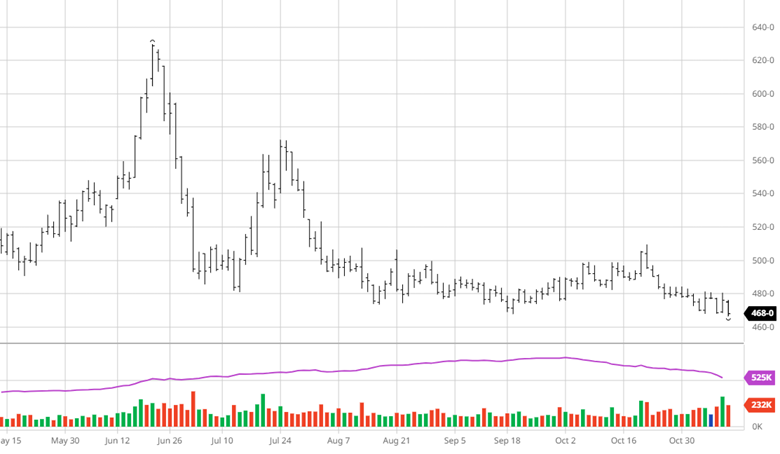

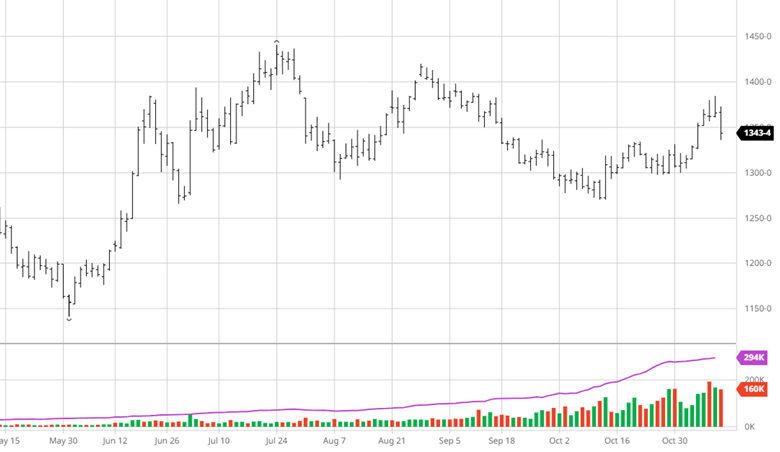

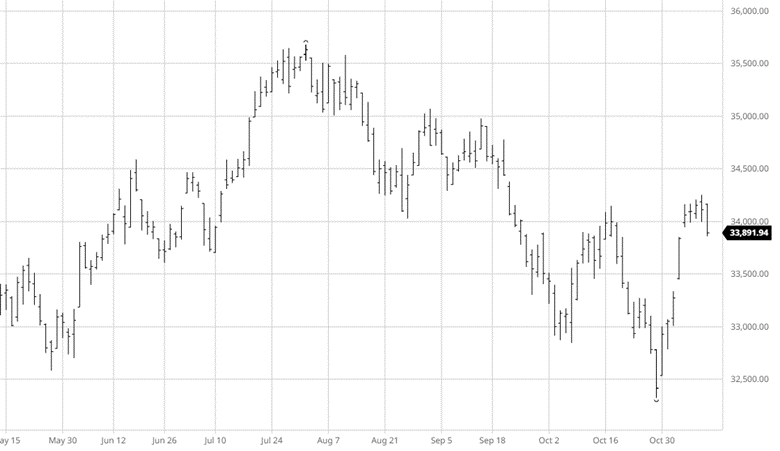

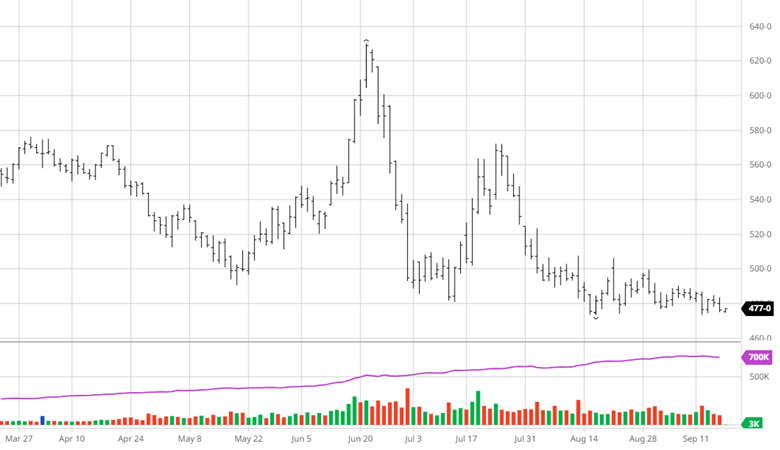

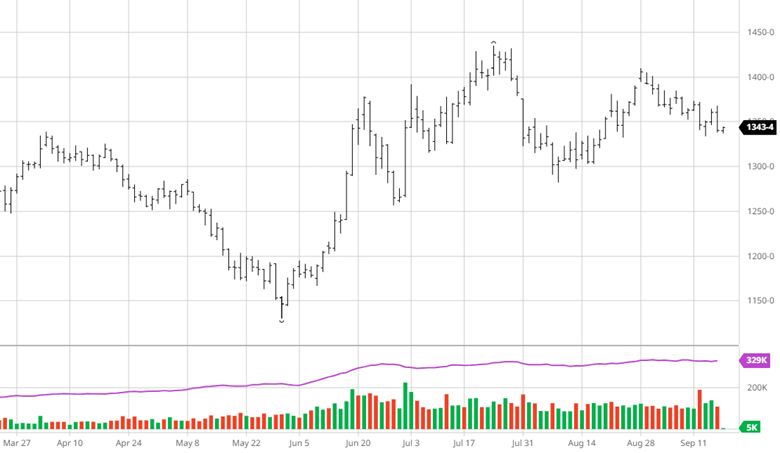

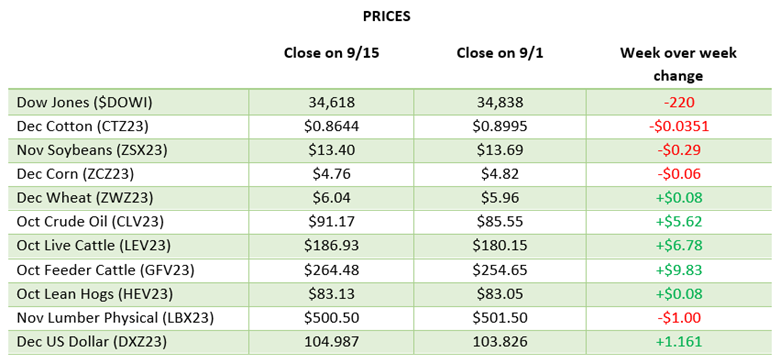

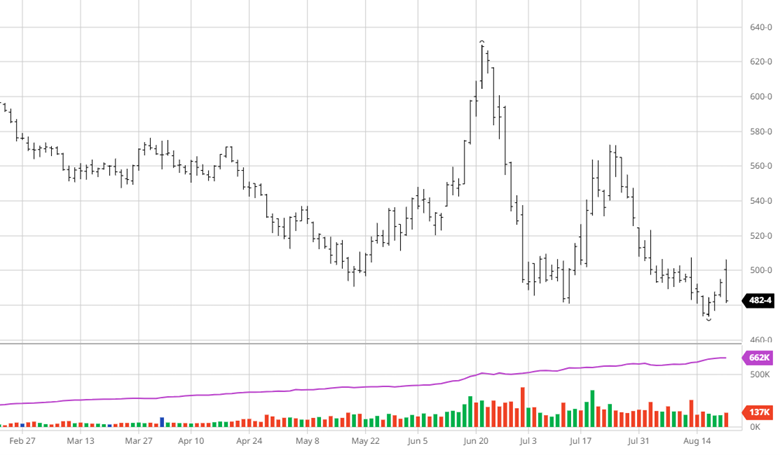

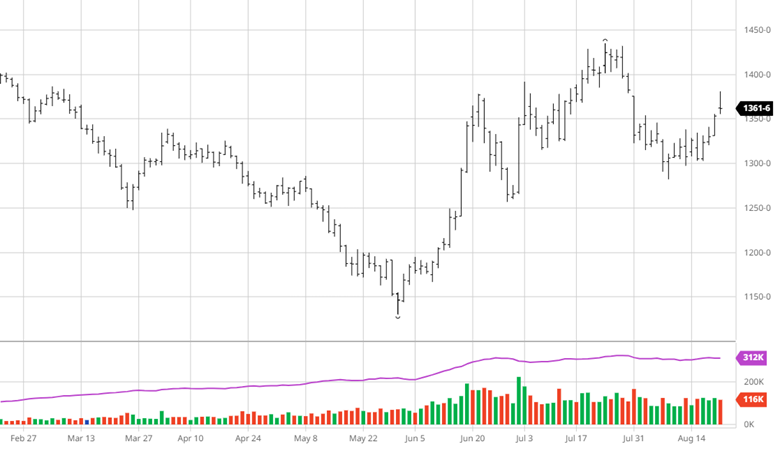

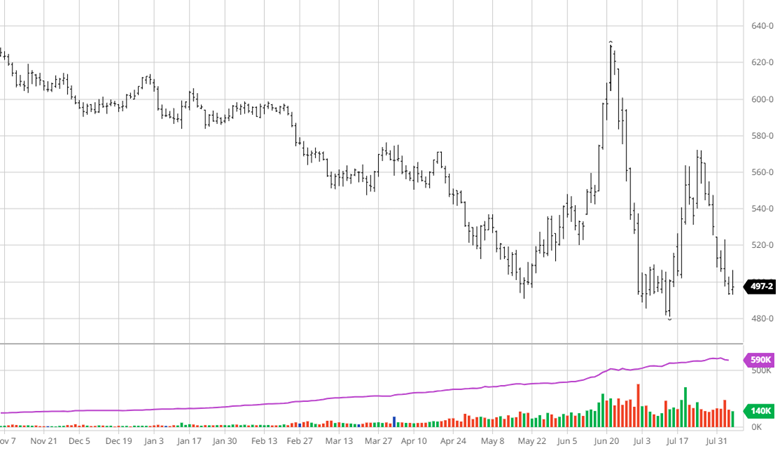

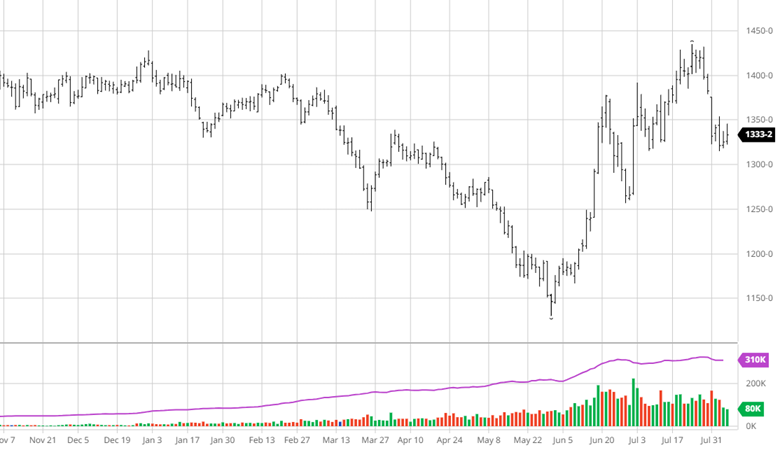

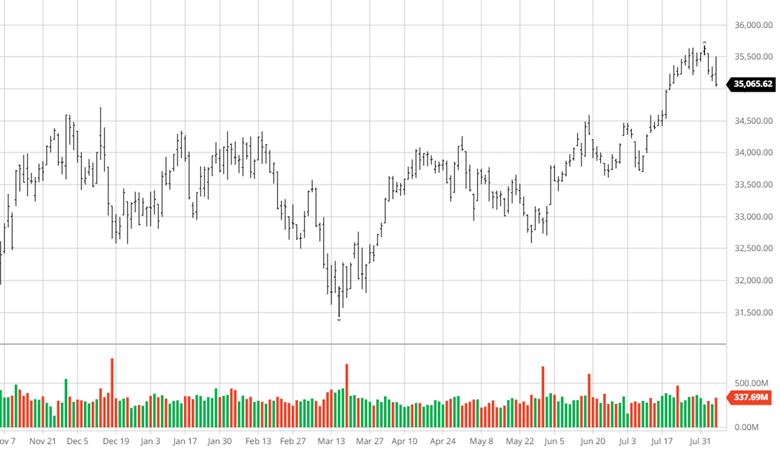

There has not been any good news lately and prices reflect that. In June there was concern over the US crop with corn a $6.25 and beans at $14, now today has made new contract and multi-year lows in corn, soybeans and wheat.