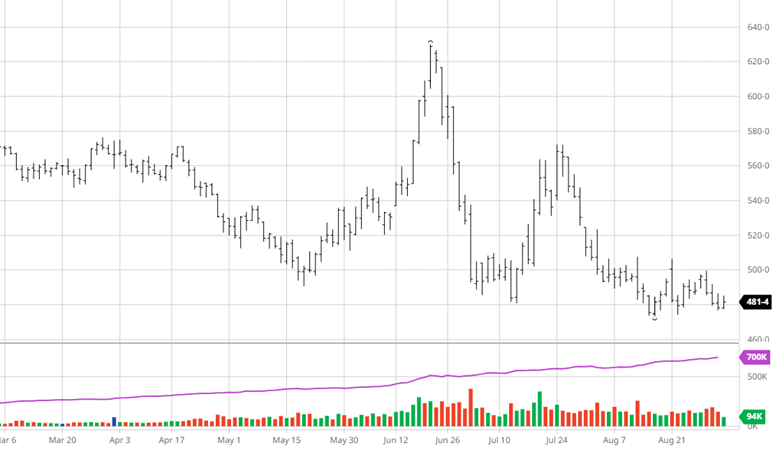

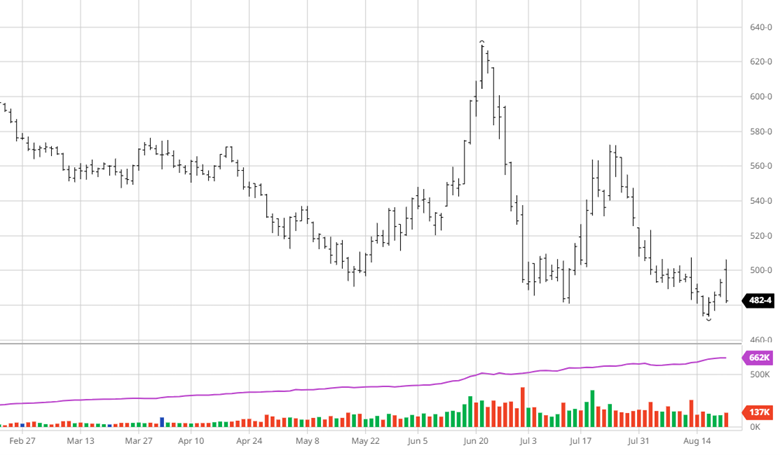

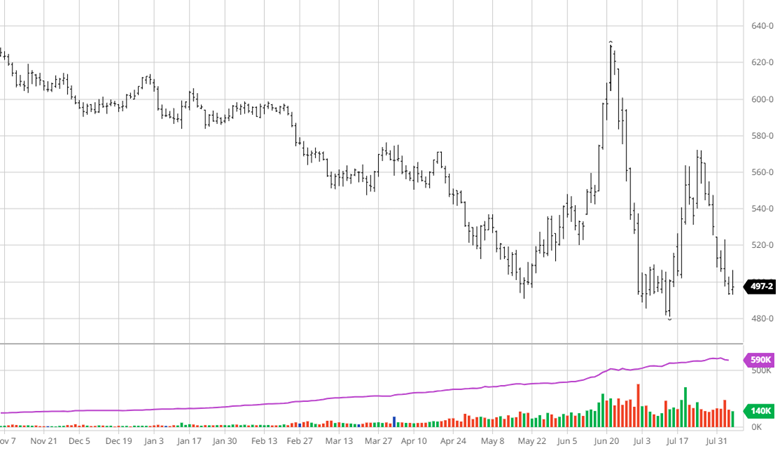

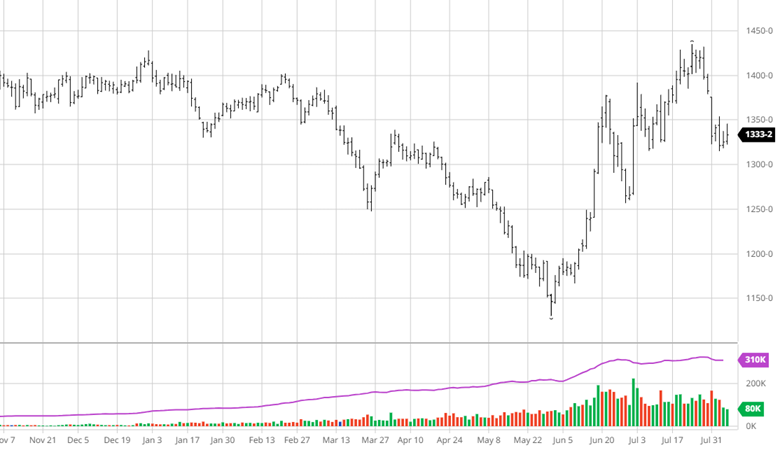

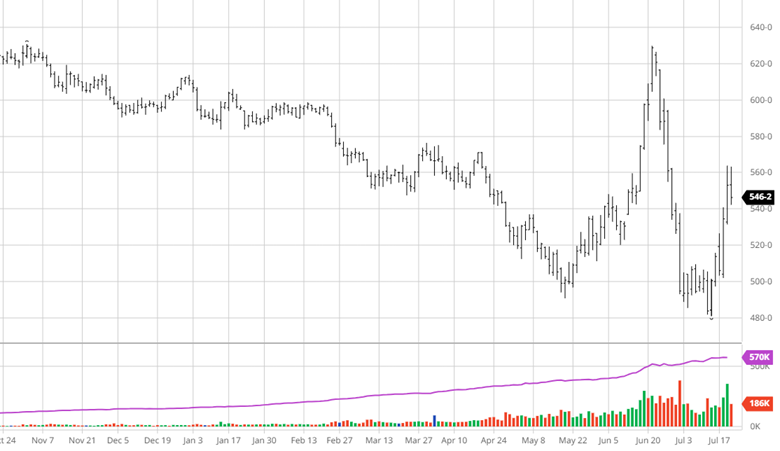

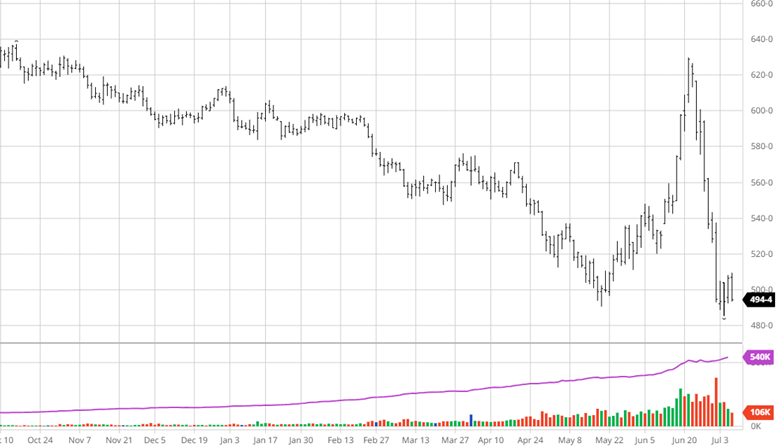

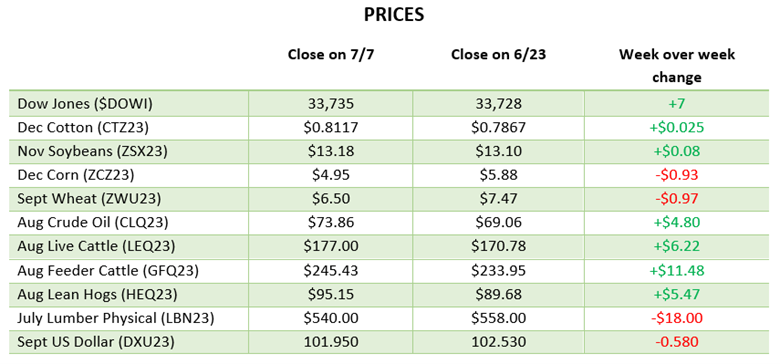

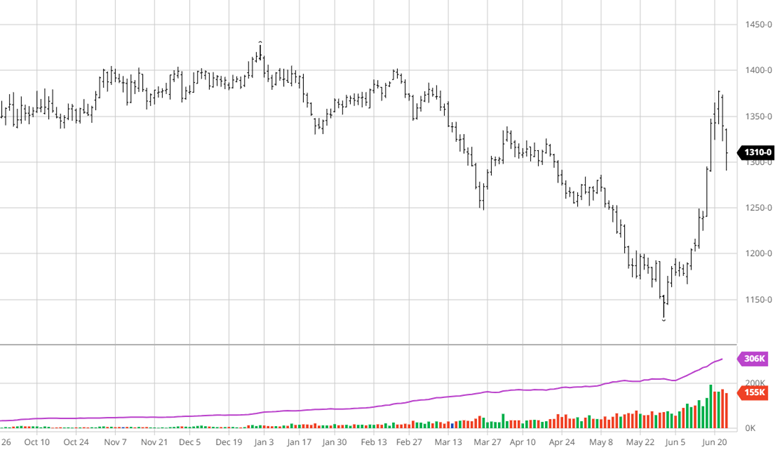

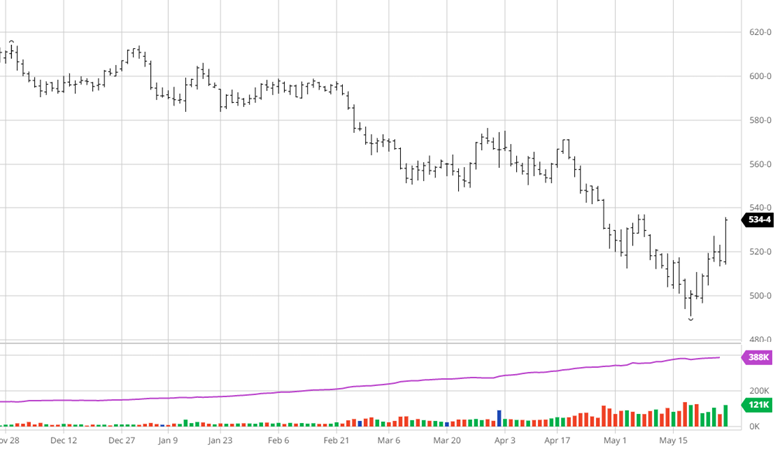

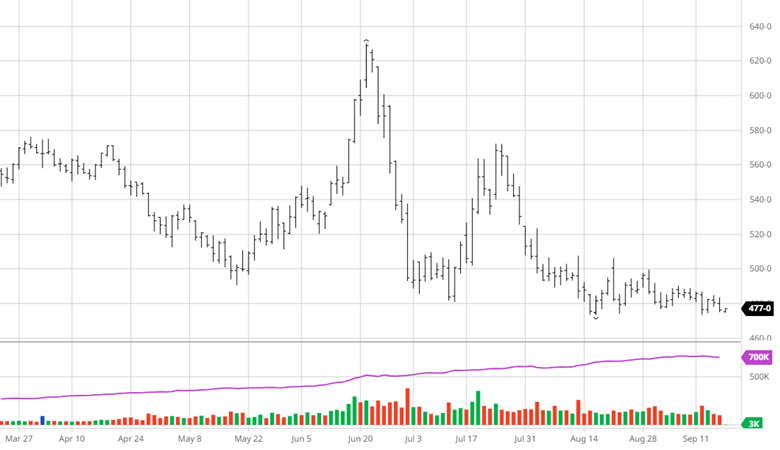

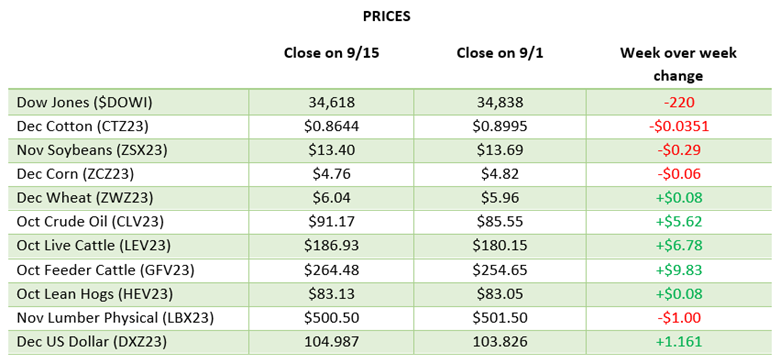

The September USDA Report this week did not give the bulls much to work with, having yield come in above estimates at 175.8 bu/ac and increasing planted acres by 800,000. The increased acreage and yield would still result in a record crop of 15.134 billion bushels despite the drought conditions that bookended this growing season. The largest sale of corn to China since April occurred this week as they made a purchase at the lowest prices in months even with a strong USD. While the markets trade the USDA report, the cash markets in areas are telling a different story with strong seasonal basis and poor crop ratings. Combines will get rolling in the coming weeks and will tell the story of this crop.

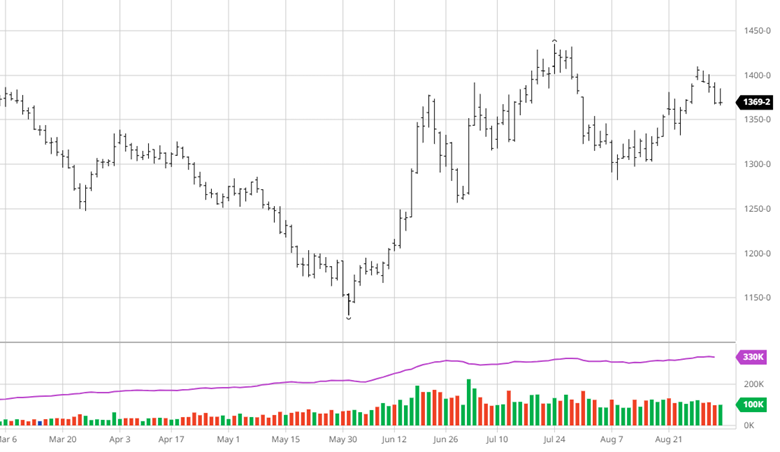

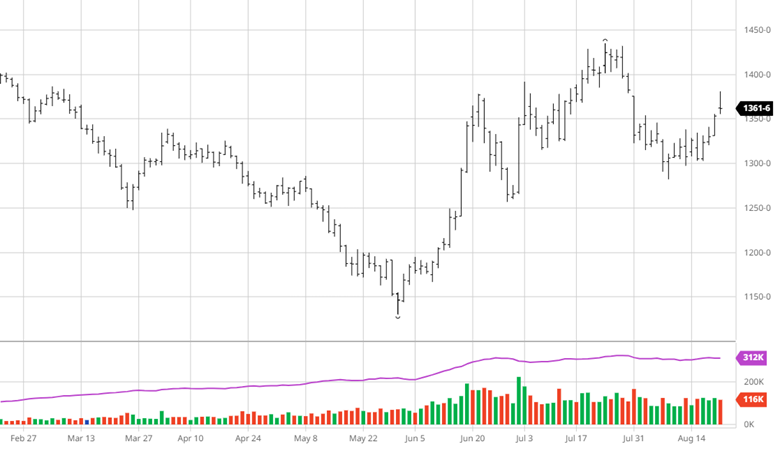

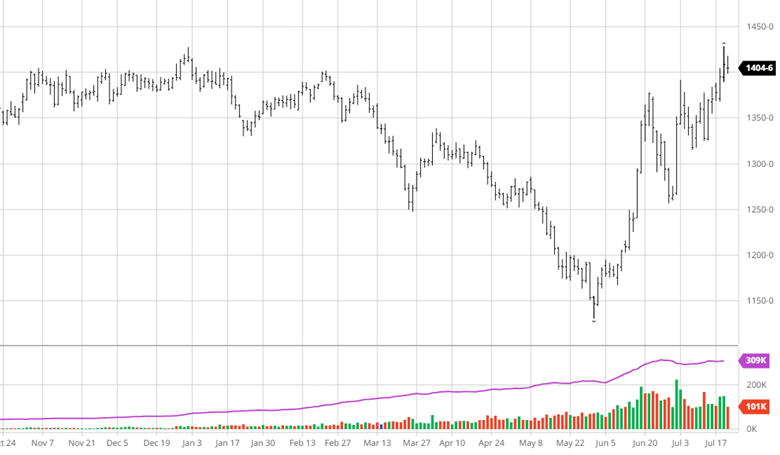

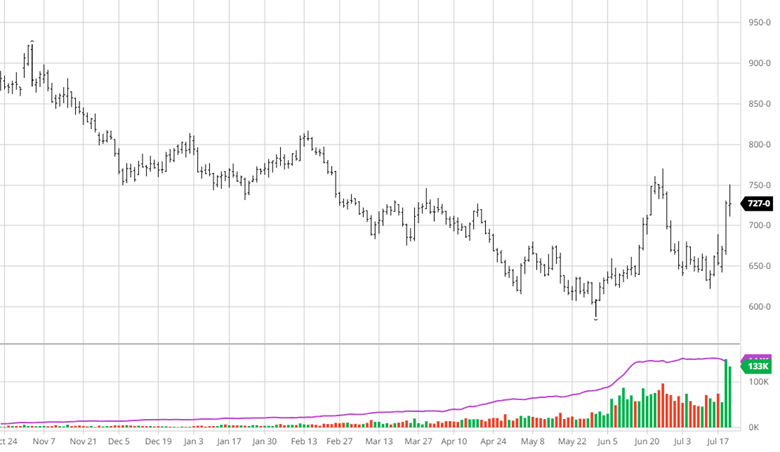

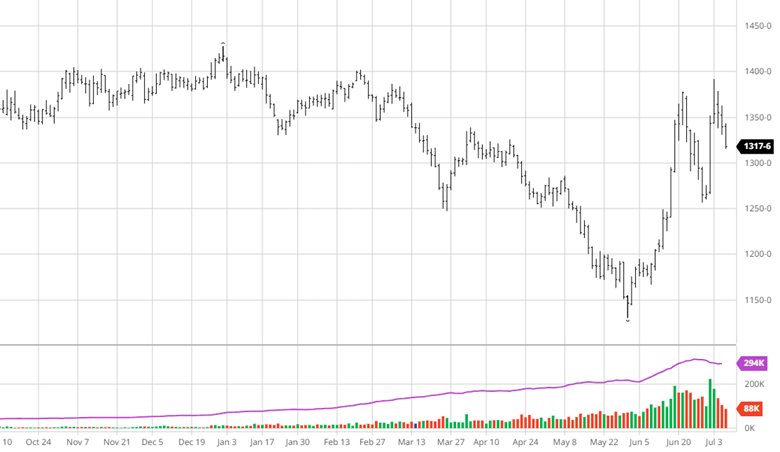

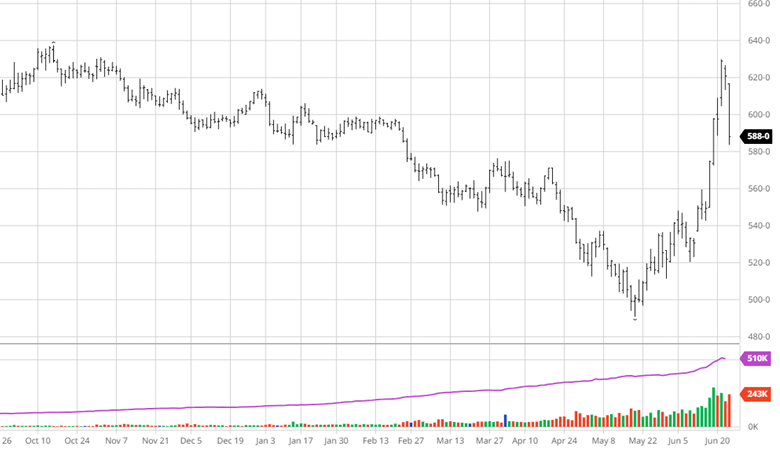

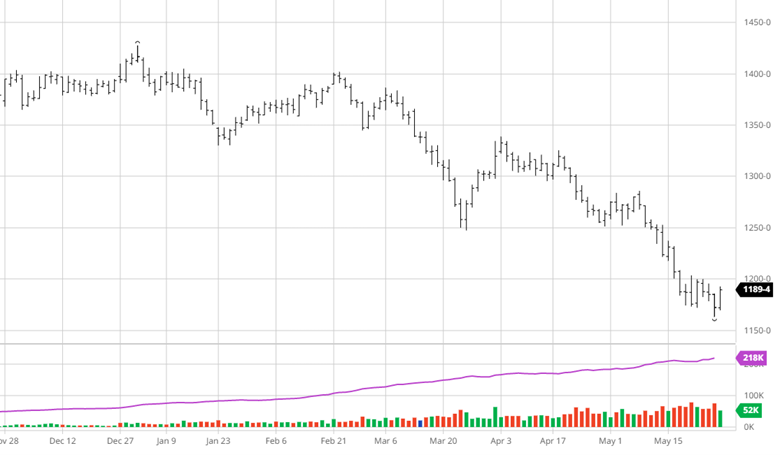

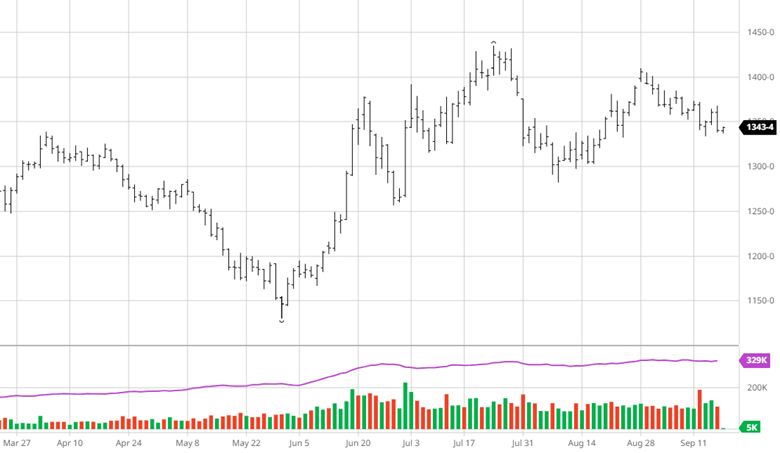

Soybeans fell following the report as well, with the numbers coming in close to expectations but not enough to spark high volumes of buying. The US soybean yield of 50.1 bu/ac following the brutal heat over the end of August and start of September did damage to this crop, but to what extent is hard to tell. The soybean balance sheets are tight for ending stocks and any lower yield from here would eat further into it. The soybean crush numbers were disappointing to end the week, but the stocks were low hinting at the lack of soybeans out in the market currently.

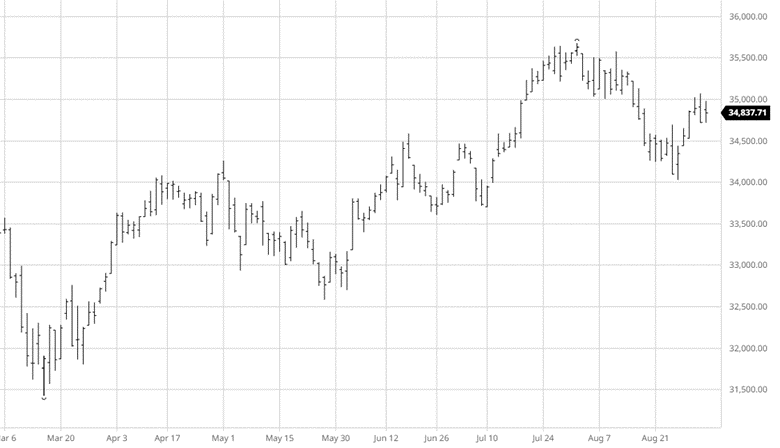

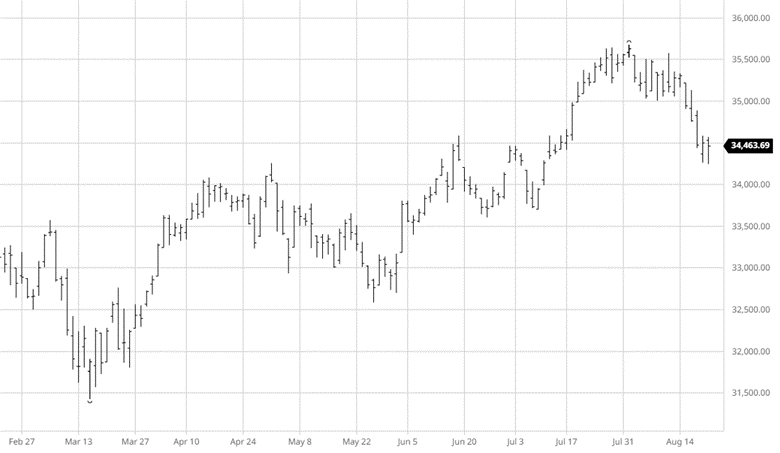

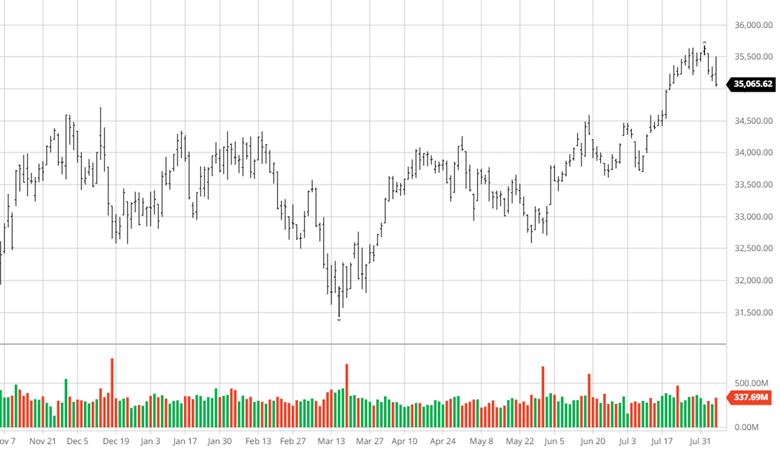

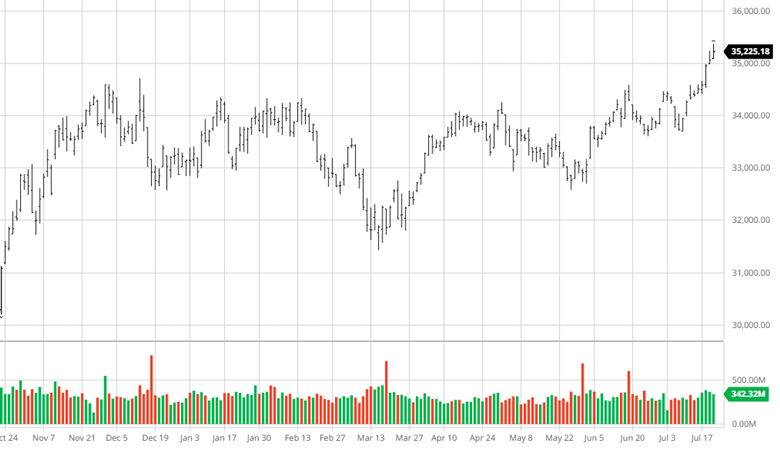

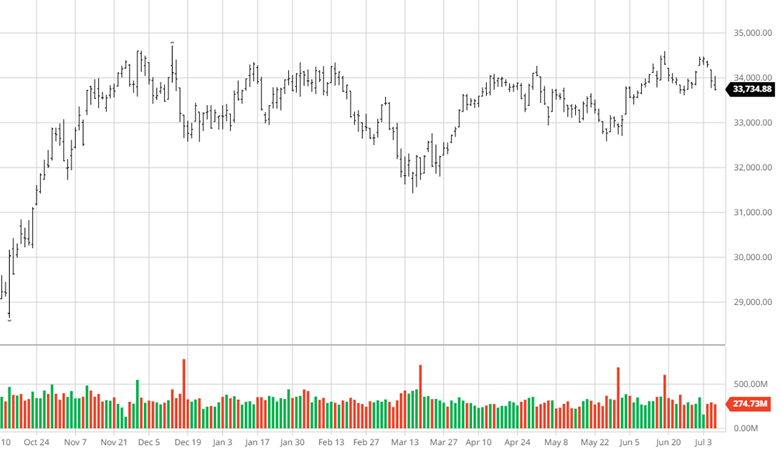

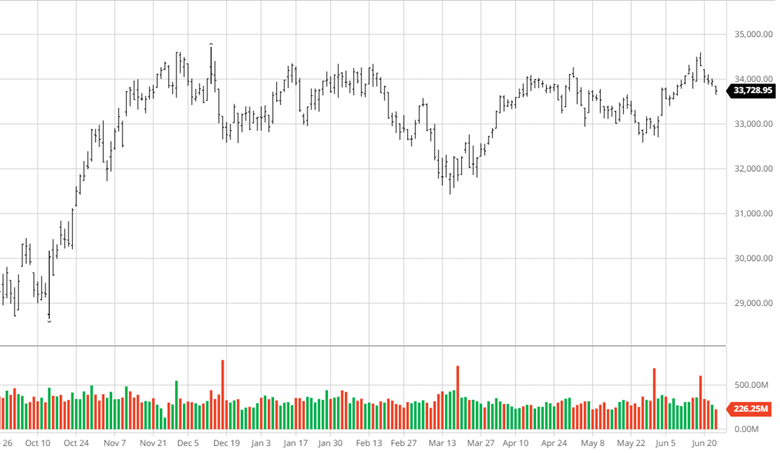

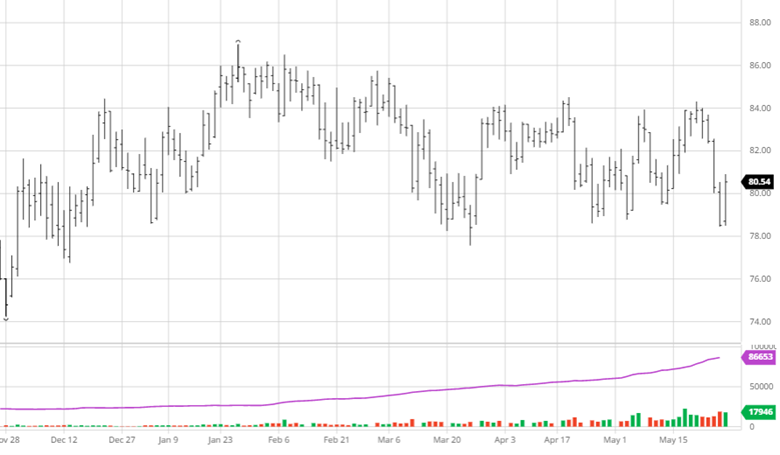

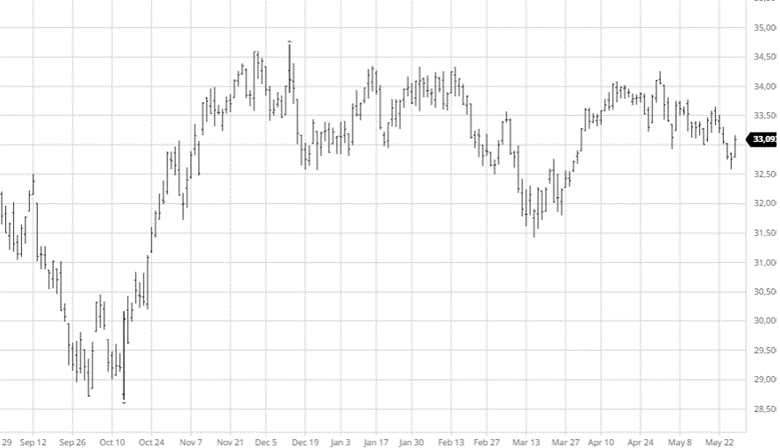

Equity Markets

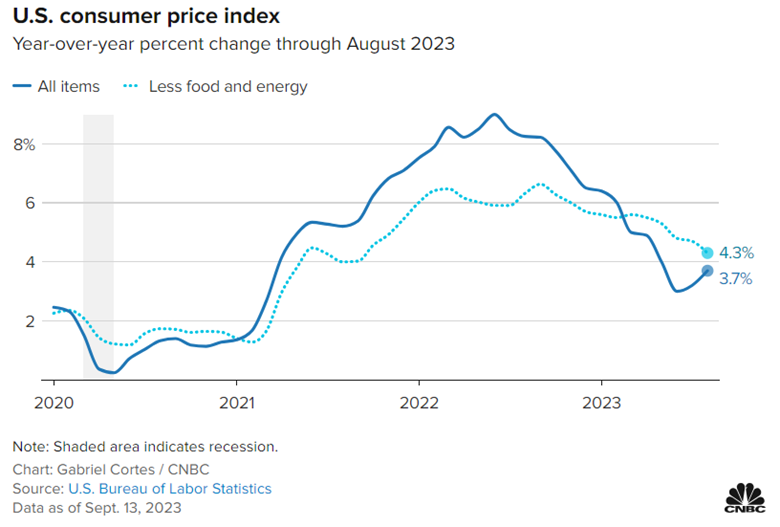

The equity markets have been mixed the past couple weeks with various economic data coming in including CPI of 3.7%, slightly hotter than expected, for the month of August. The markets will continue to process data now that earnings are mostly done with, and the Fed is unlikely to raise rates again. The soft landing is still in play, but any economic surprises could derail that.

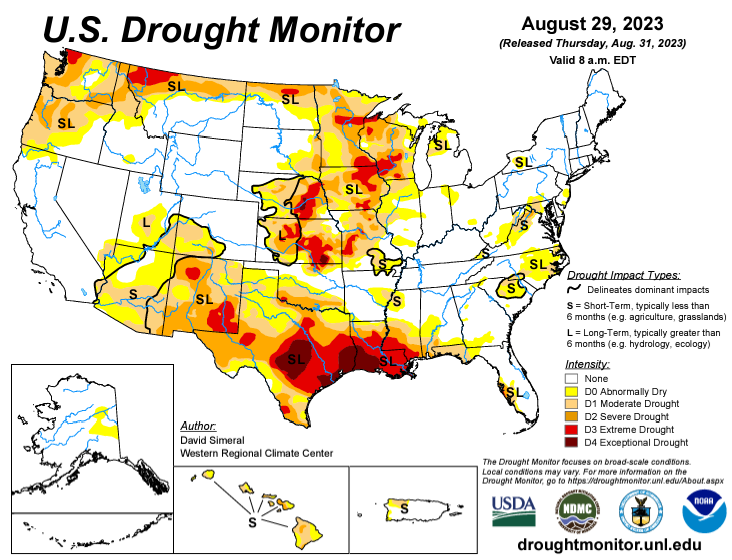

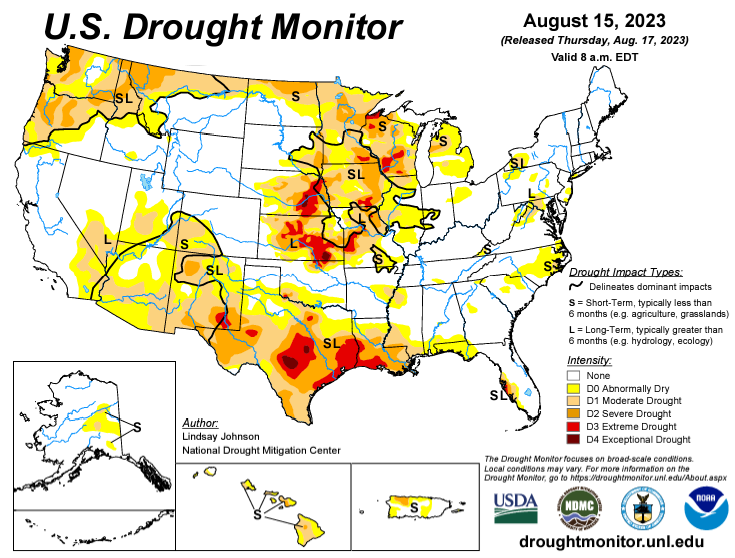

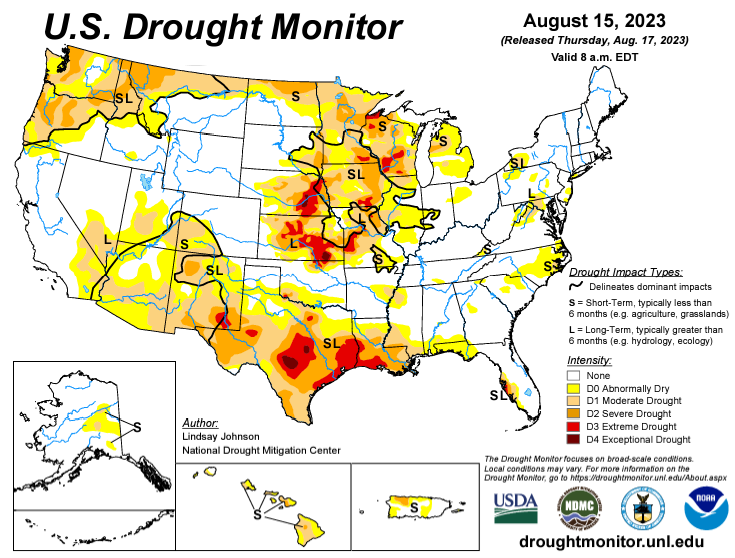

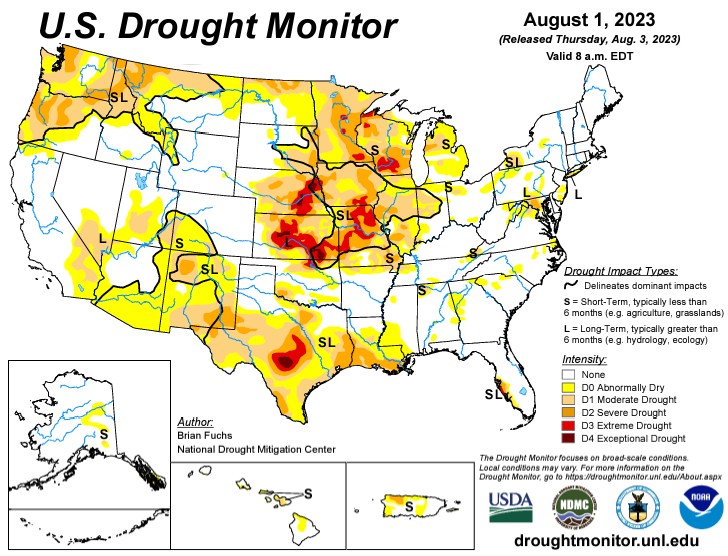

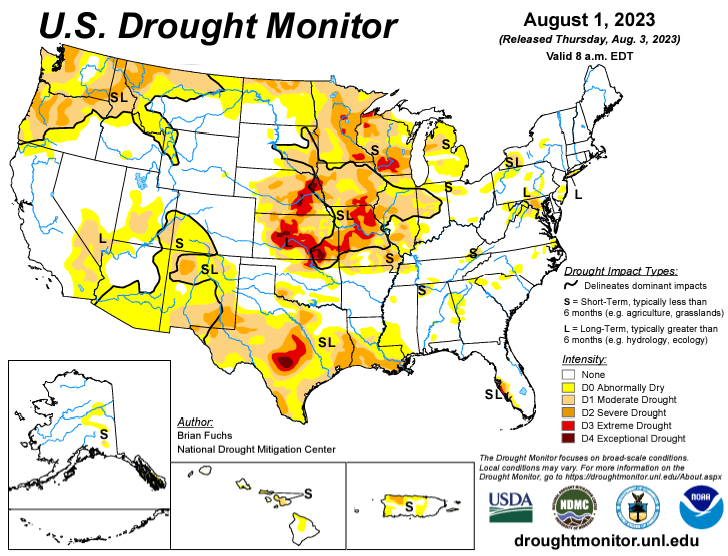

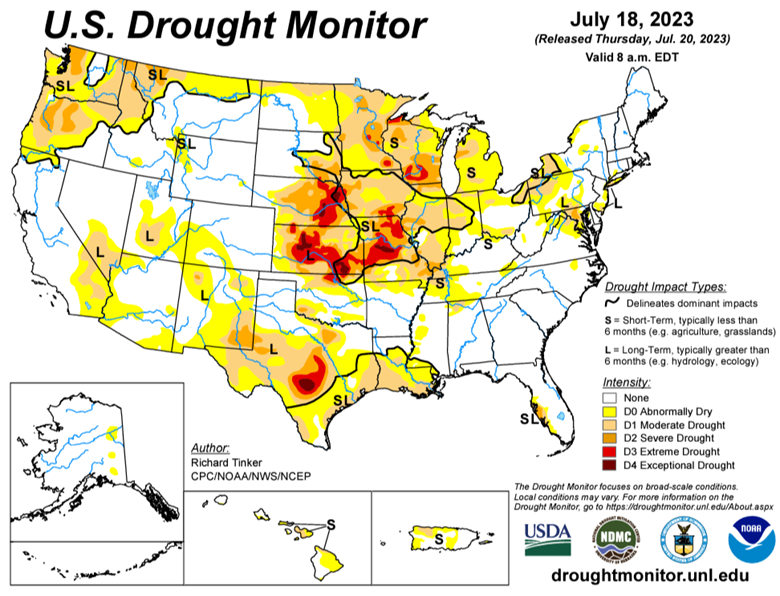

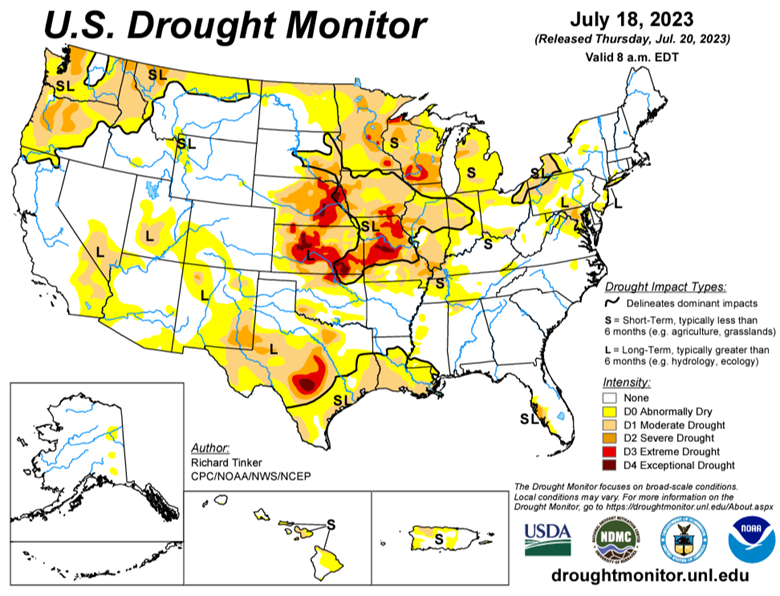

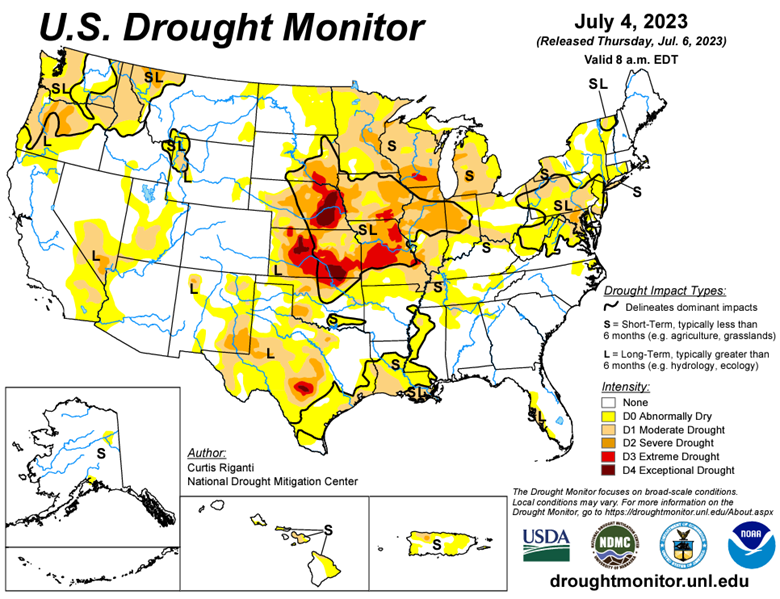

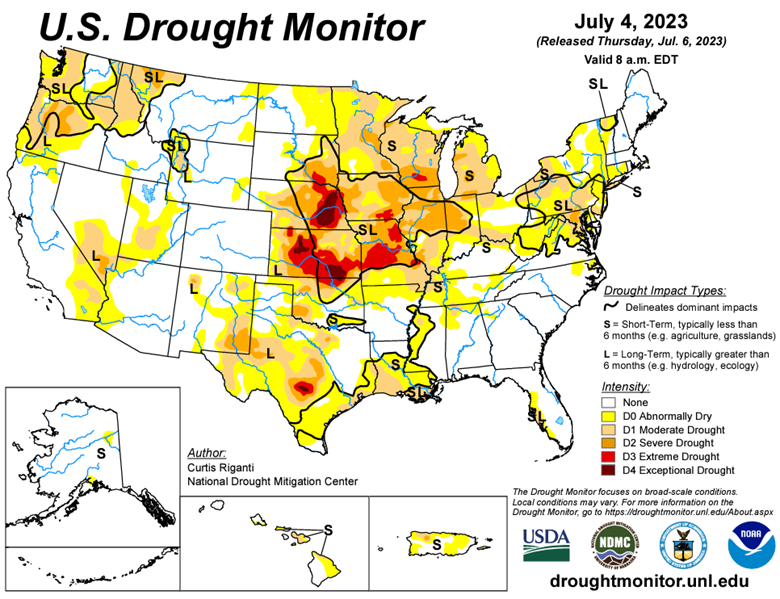

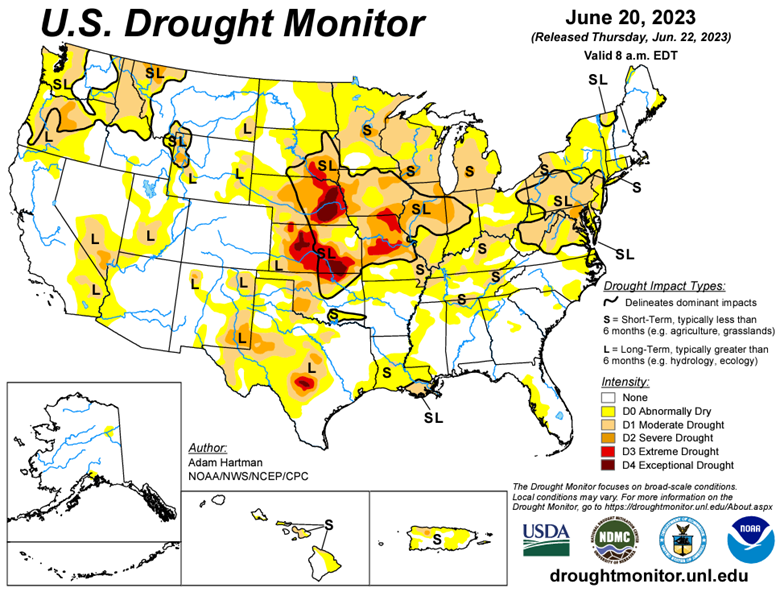

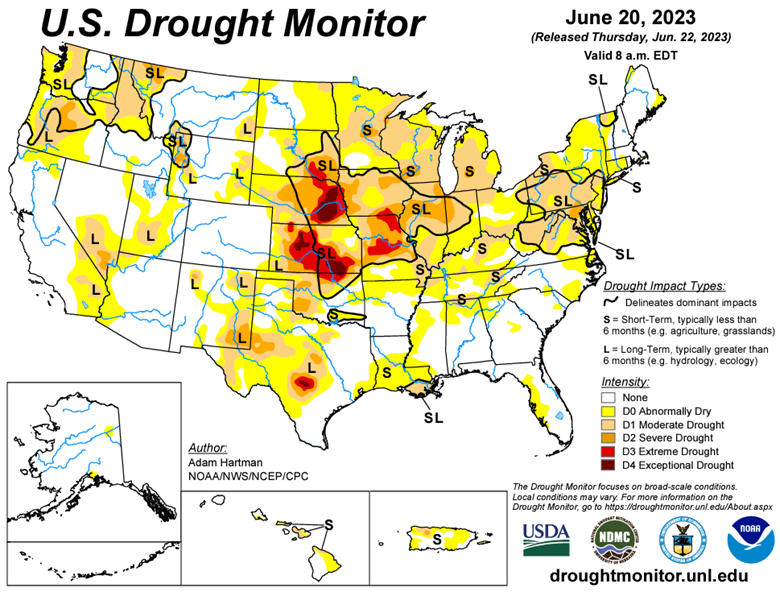

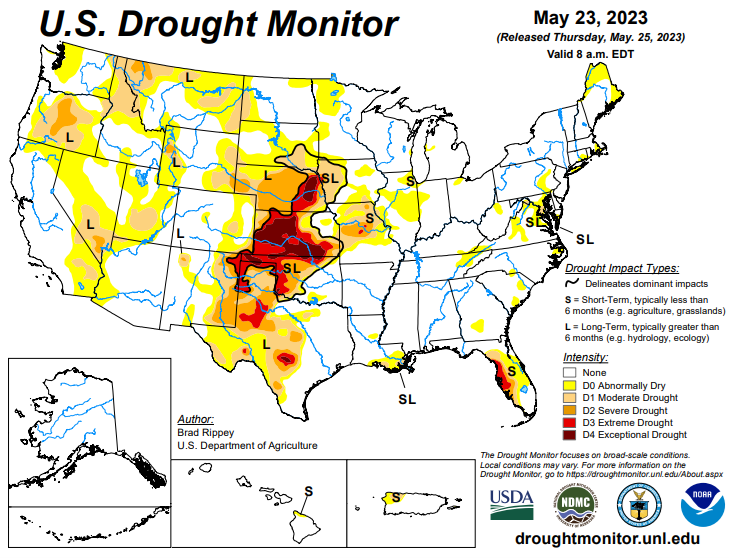

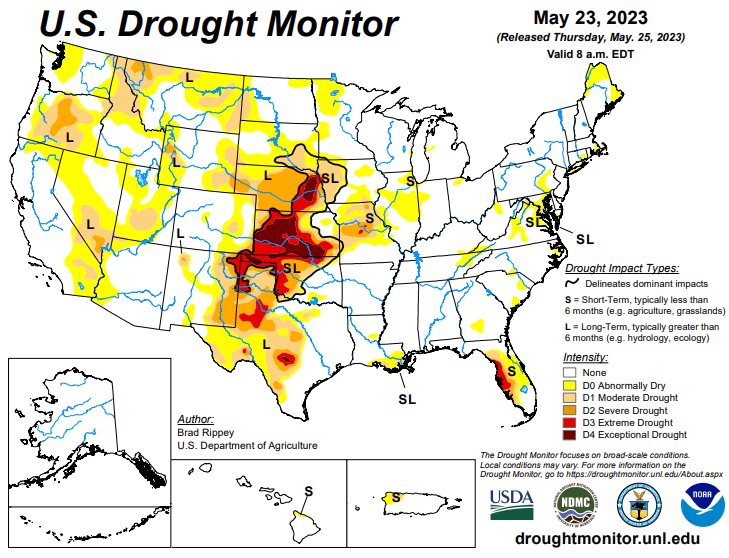

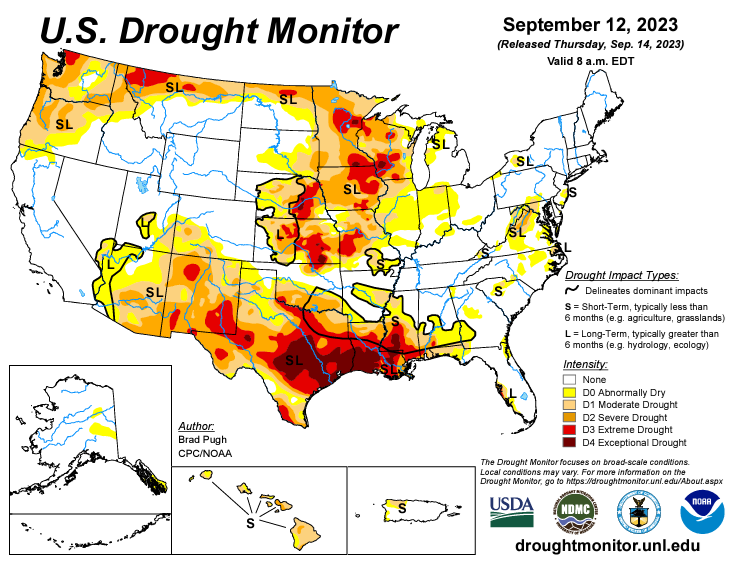

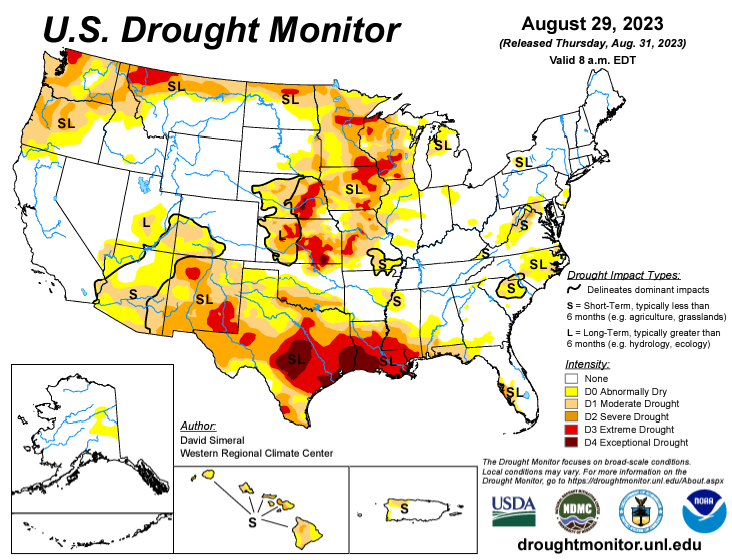

Drought Monitor

The drought monitors below show the change in drought conditions over the last 2 weeks.

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].