AG MARKET UPDATE: JUNE 23 – JULY 7

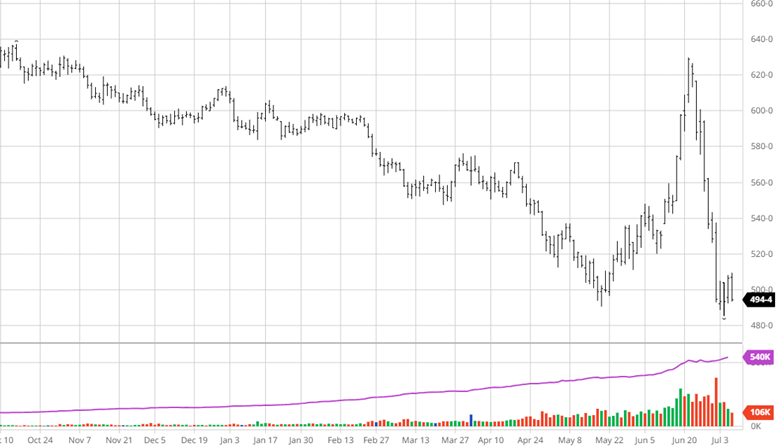

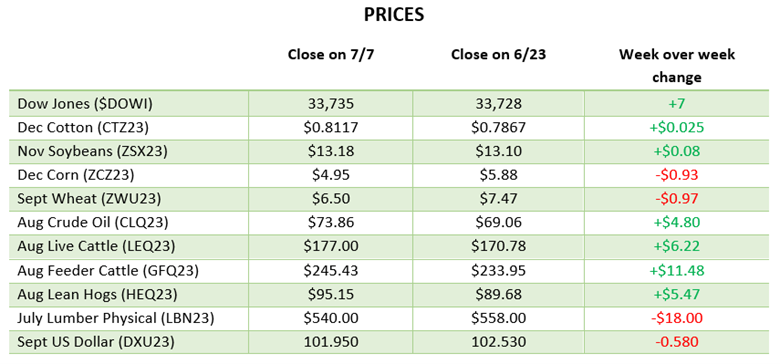

Corn fell over the last couple weeks following the USDA coming out with 94 million planted acres, well above the March prospective plantings report. On top of the report there were widespread rains across the US over the end of June and start of July. While the drought conditions remain in most areas this rain was able to provide relief in much needed areas to buy it some time for another good rain. With La Nina setting in the potential for more rain and cooler temperatures could be what we see moving forward but how much damage was caused in May and June will be hard for the market to see. The export market has not provided any help with the slow pace continuing during the summer. If the dryness continues and the rain did not provide enough relief, we could see prices move back up after we get the USDA projected yield update on Wednesday.

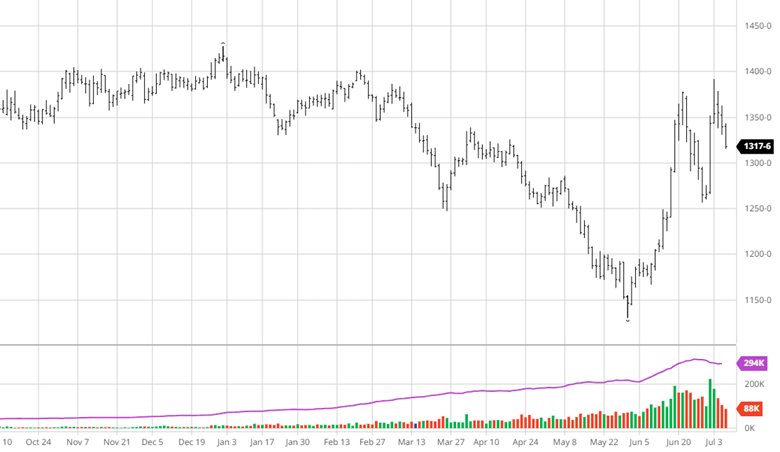

Soybeans had the surprise of lower acres in the report with the USDA coming in at 83.5 million acres, a 4-million-acre shift from the March report. Soybeans got a big pop on this news after falling, like corn, when the chance of rain was added to the forecast for most areas. The pullback this week came as the rains helped this crop that was not in as needy a spot as corn was. The soybean acreage number will help raise the floor of where this crop could have gone with strong yields, but the low number will be the focus as balance sheets tighten. Weather will be the driver moving forward after the USDA report on Wednesday.

The report last week for wheat was boring compared to corn and soybeans with little changes made. All wheat acres were reported at 49.628 million, down only 227,000 from the prospective plantings report. While the numbers did not seem bearish overall the USDA trimmed abandonment from 32.6% to 30.5%. Stocks remain tight but the lack of demand with Russia dominating the world markets leaves the US exporters in a tough spot. The lack of US demand does not seem to be changing anytime soon so paying to store wheat, hoping to profit from any bullish change, could cost you more when you include interest you need to pay back on operating loans. If you are looking to profit in this scenario using cheap options to own back on paper would make more sense.

Equity Markets

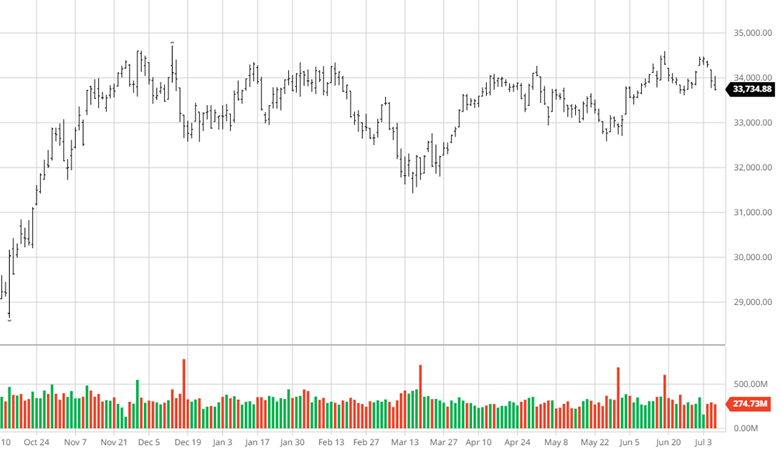

The equity markets have traded close to flat over the last two weeks trading higher then back lower. The jobs report came in hotter than expected again this week. The markets give the Fed almost a 90% chance of raising rates at the next meeting. The markets have been lead higher by several stocks as we get to the halfway point, the question moving forward will be will they continue to lead and is there a recession on the horizon.

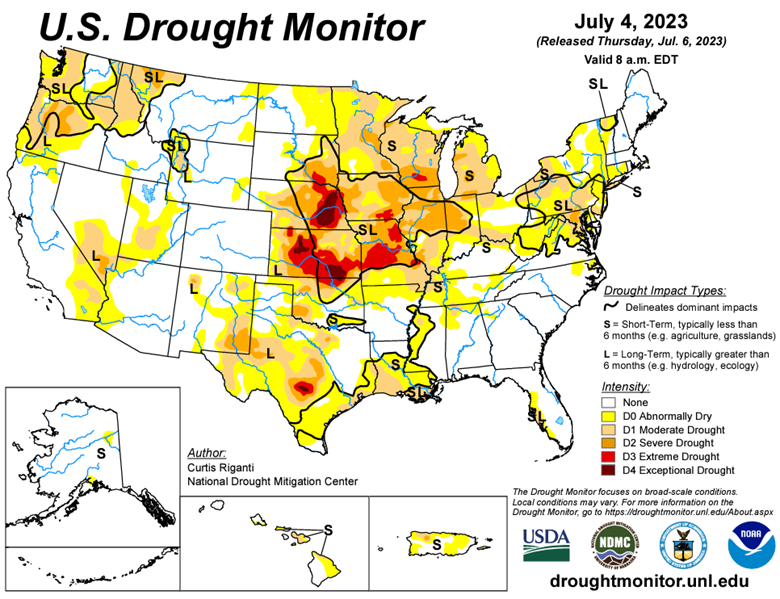

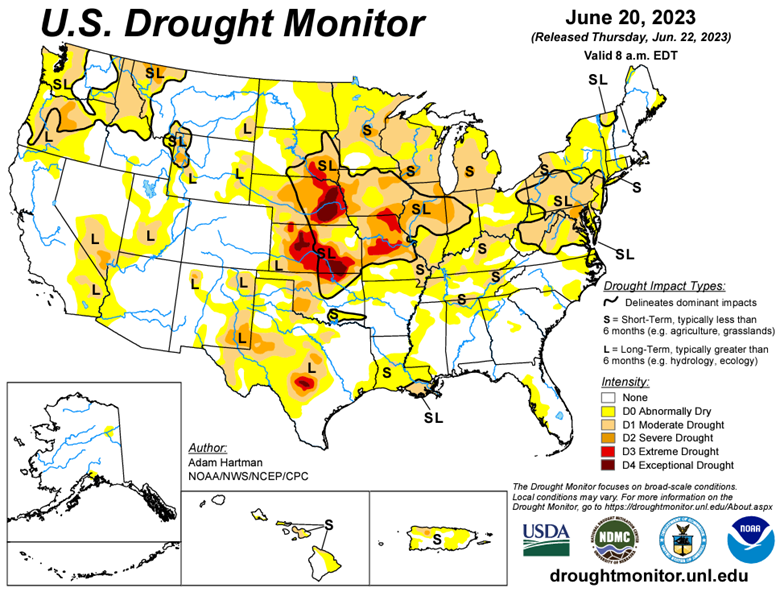

Drought Monitor

The drought monitors below show the change in drought conditions over the last 2 weeks.

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].