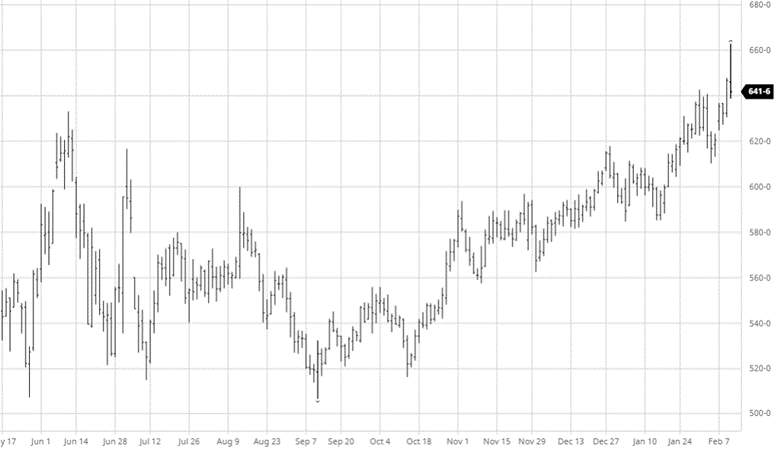

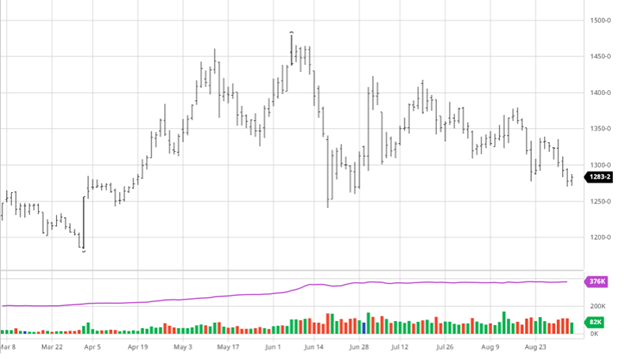

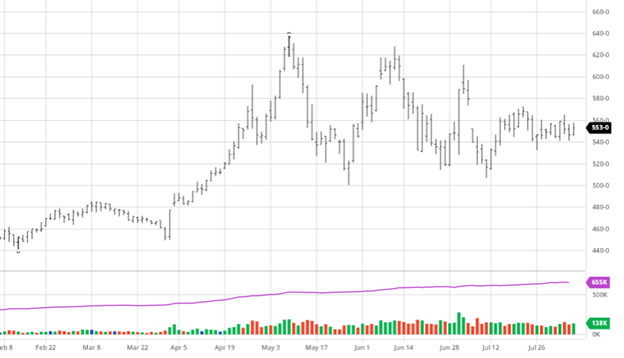

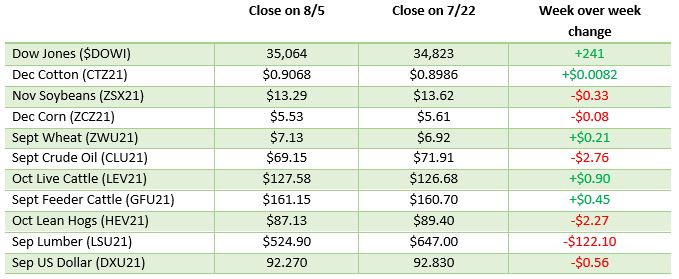

Corn was up a lot this week for similar reasons as wheat, with the Russian invasion of Ukraine pushing commodities higher. The conditions have improved in South America, but the length of trouble still caused large amounts of damage to the crop that we still do not know the depth of. The USDA Ag Outlook Forum came out with 92 million acres for corn, with some acres going to soybeans along with a 181 yield. A 181 yield would be a record crop, but with the supply chain issues, fertilizer prices, and availability of chemicals, many factors could affect yield if farmers can’t get all the inputs. Ukraine and Russia will be the market-moving news for now until we get a better idea of the long-term consequences. The February insurance price for corn is $5.89 ½. Friday’s early selloff will test the bulls for all markets.

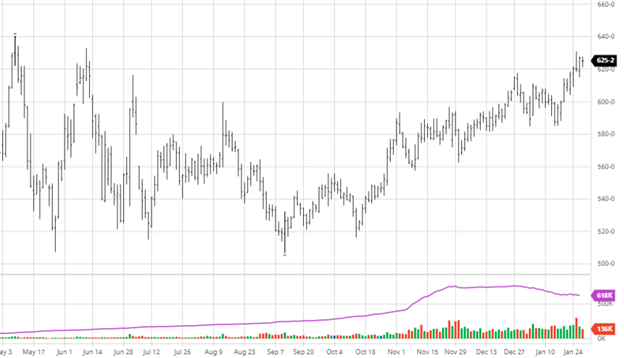

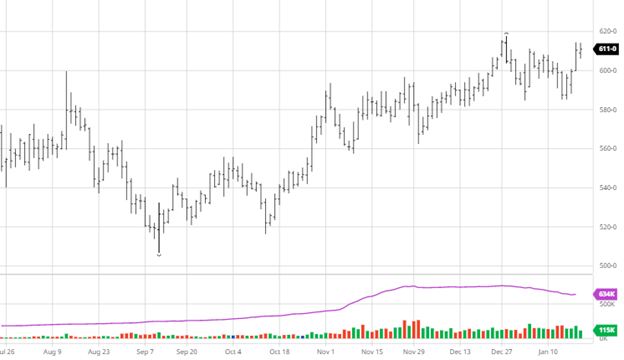

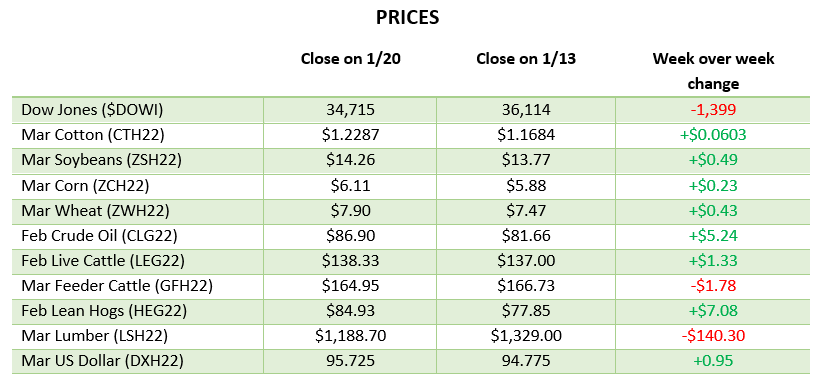

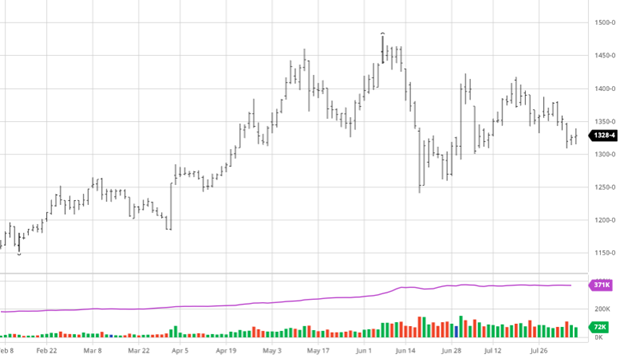

Soybeans gained on the week as the Russia and Ukraine news dominated headlines. Outside of this news, the weather outlook improved for South America that would have been bearish for bean prices if the eastern European turmoil was not going on. The USDA Ag Forum came out with an estimated 88 million acres with a 51.5 bu/acre yield for beans this year in the U.S., which is a bearish number but not surprising at these current price ranges. The November bean price had a more visceral reaction as it fell quickly Thursday off the highs having over a $1 trading range for the day, ultimately falling 36 cents to $14.51 ½. The February insurance price for beans is $14.33 ½.

Soybeans gained on the week as the Russia and Ukraine news dominated headlines. Outside of this news, the weather outlook improved for South America that would have been bearish for bean prices if the eastern European turmoil was not going on. The USDA Ag Forum came out with an estimated 88 million acres with a 51.5 bu/acre yield for beans this year in the U.S., which is a bearish number but not surprising at these current price ranges. The November bean price had a more visceral reaction as it fell quickly Thursday off the highs having over a $1 trading range for the day, ultimately falling 36 cents to $14.51 ½. The February insurance price for beans is $14.33 ½.

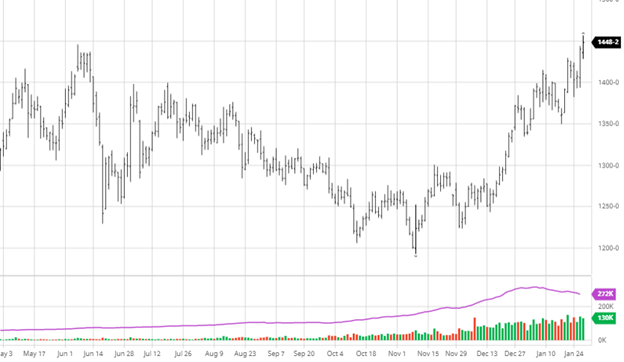

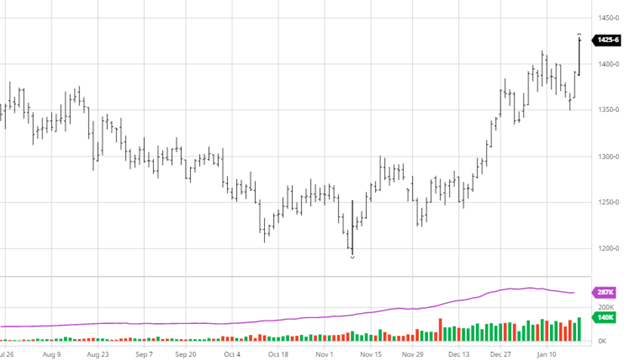

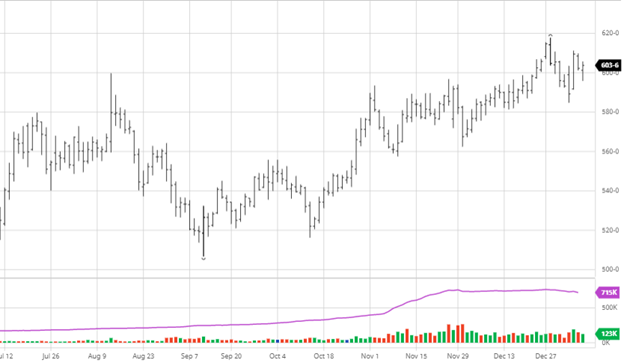

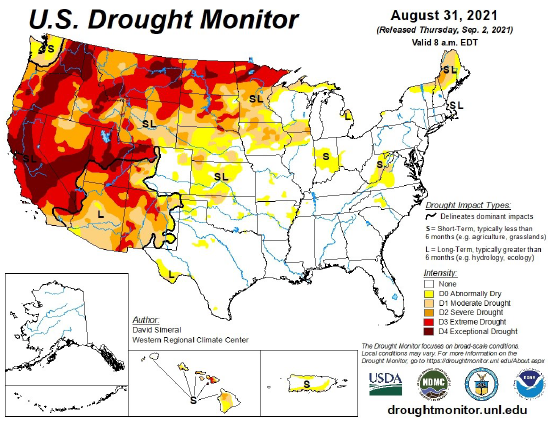

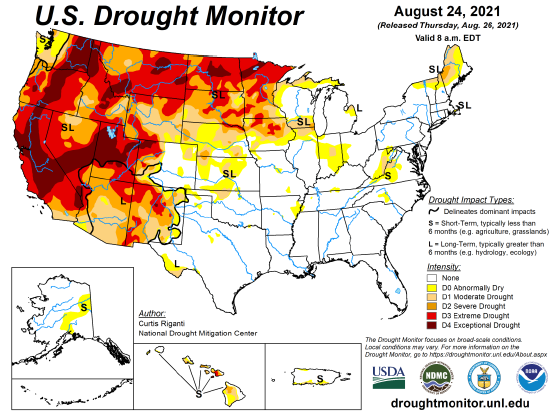

After days of large gains earlier in the week, wheat was limit up on Thursday after Russia invaded Ukraine. Ukraine is a major exporter of wheat and other agricultural goods as it is the 5th largest wheat exporter in the world, with Russia being #1. Not only is the world wheat supply threatened, but all trade in the Black Sea area will be affected, potentially only for a short period but disrupted, nonetheless. Russia accounts for more than 18% of the world’s wheat export and is a large oil and natural gas exporter, so any sanctions that hit their export economy could see ripple effects. This is only the beginning of this conflict, and wheat will be along for the whole ride, so you should expect volatility.

After days of large gains earlier in the week, wheat was limit up on Thursday after Russia invaded Ukraine. Ukraine is a major exporter of wheat and other agricultural goods as it is the 5th largest wheat exporter in the world, with Russia being #1. Not only is the world wheat supply threatened, but all trade in the Black Sea area will be affected, potentially only for a short period but disrupted, nonetheless. Russia accounts for more than 18% of the world’s wheat export and is a large oil and natural gas exporter, so any sanctions that hit their export economy could see ripple effects. This is only the beginning of this conflict, and wheat will be along for the whole ride, so you should expect volatility.

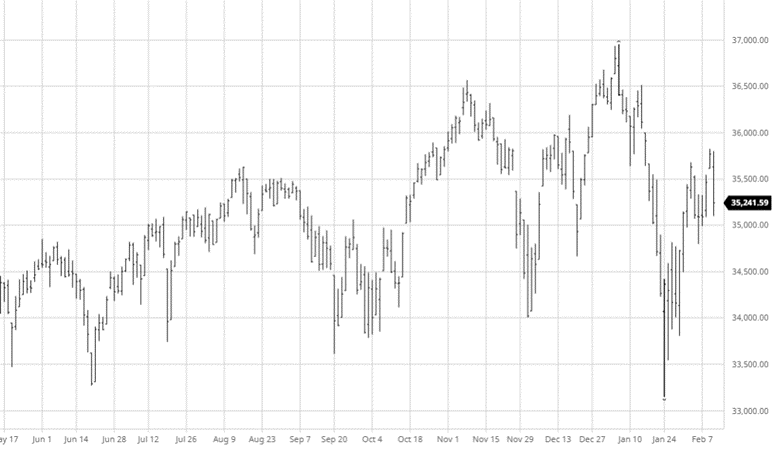

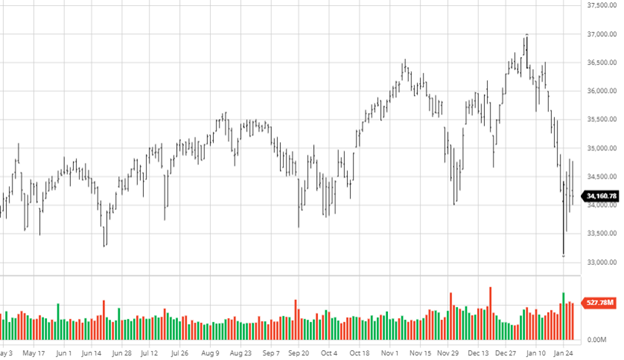

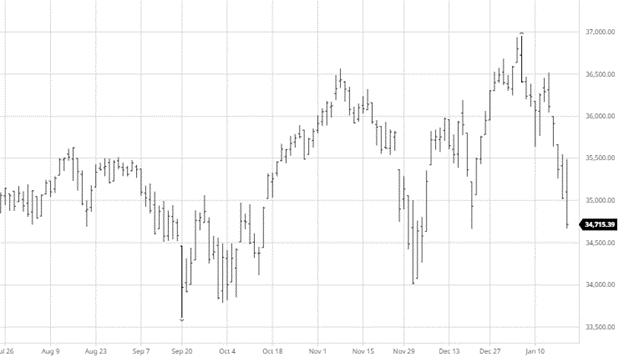

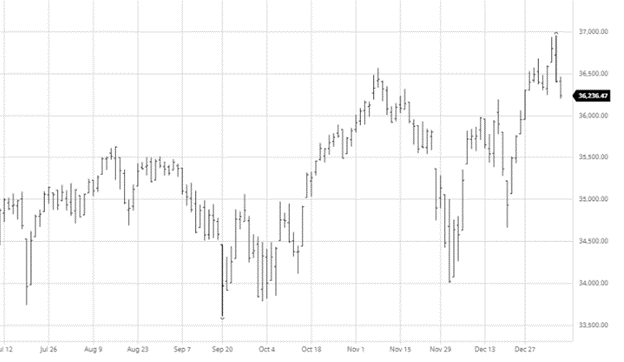

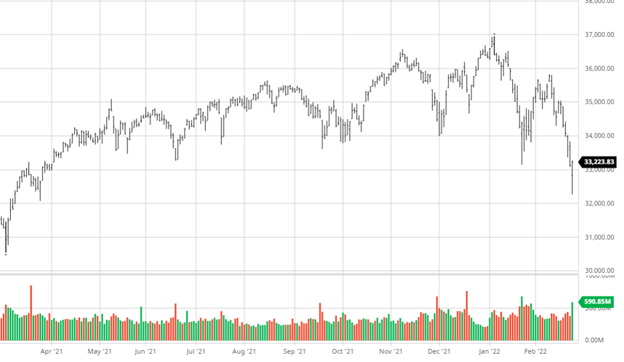

Dow Jones

The equity markets continue to get crushed as, along with the struggles since November, we now have a war between Russia and Ukraine. This will make the Fed hesitant to raise interest rates, but as the bond rates have already risen, we are heading that way, whether it is a 25-point or 50-point bump. Tech stocks (NASDAQ) hit a 20% decline since November highs on Thursday before bouncing off the lows. Volatility will remain in the market as Russia remains a threat and China is a large unknown moving forward. Commodity prices have risen even more with oil nearing $100, so the inflationary pressure on the markets will not disappear any time soon.

Podcast

Tune in as biotech guru Dr. Channa S. Prakash discusses everything from Alabama football, genetics as one of the most extensive agricultural advancements, the most significant risk factors to feeding the world over the next 30-50 years, plus everything in between.

Why producing crop plants with a much gentler footprint on the natural resources will help feed the growing population. How 75% of the world’s patents in agriculture gene editing are coming from China. Understanding that trying to impose restrictions on our ability to grow food can be a considerable risk to agriculture. Listen to hear about these topics and more!

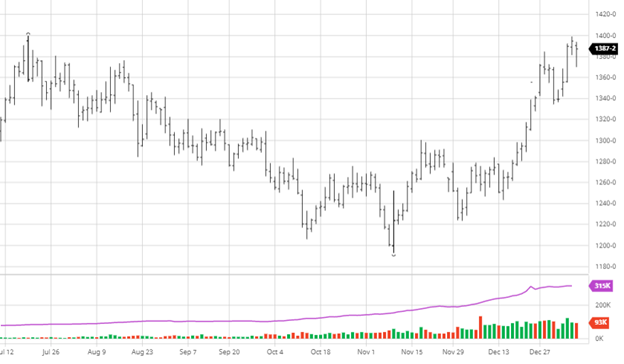

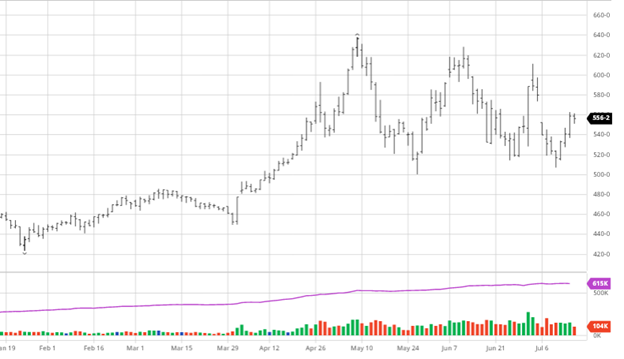

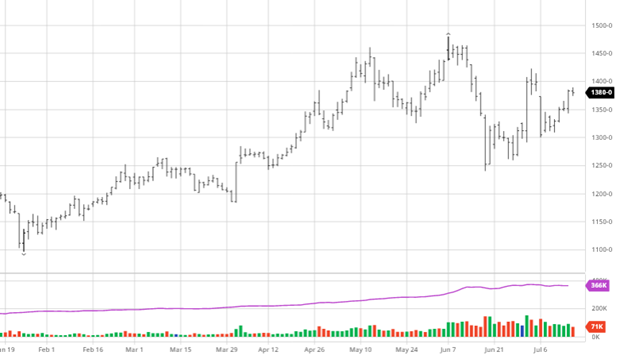

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.