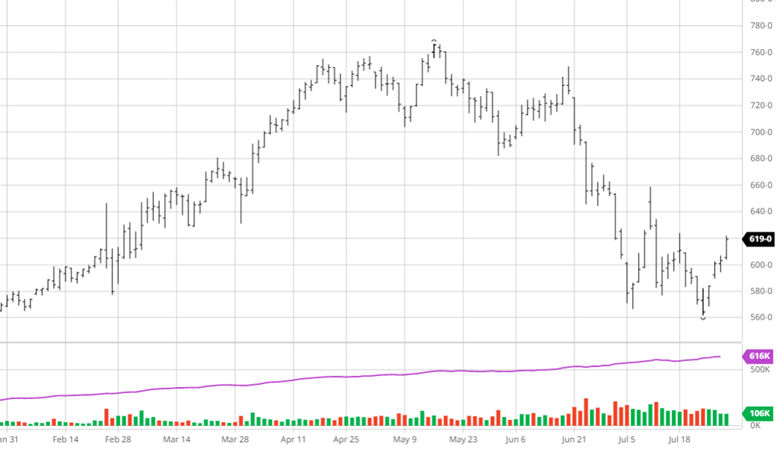

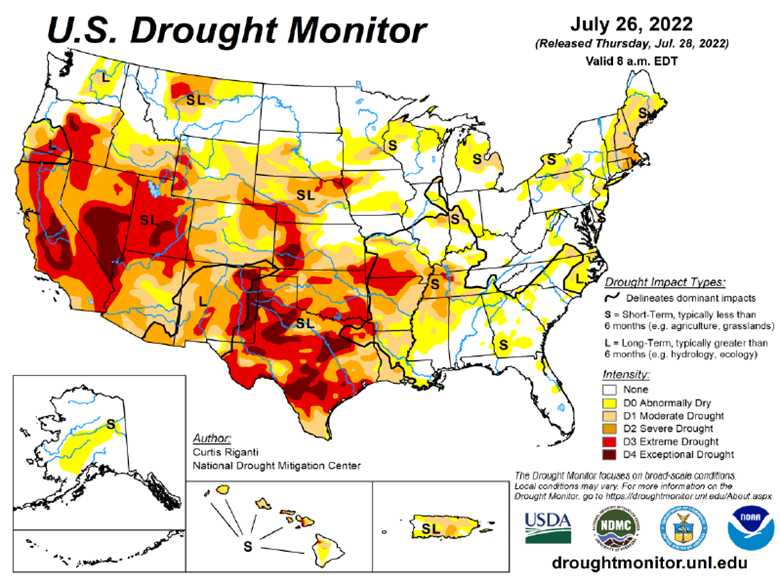

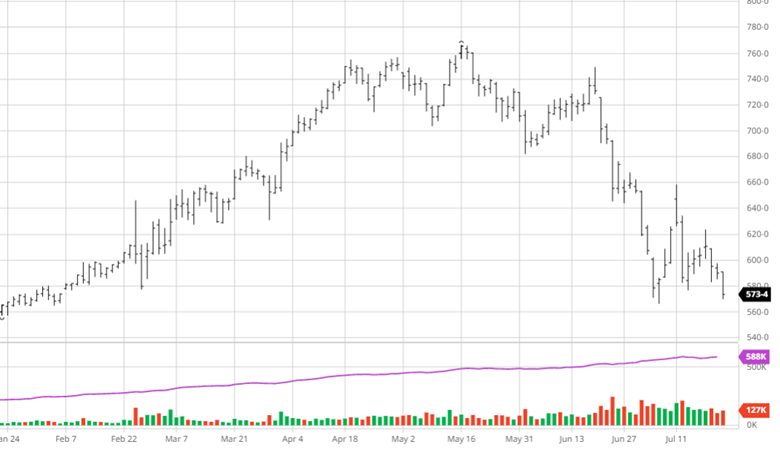

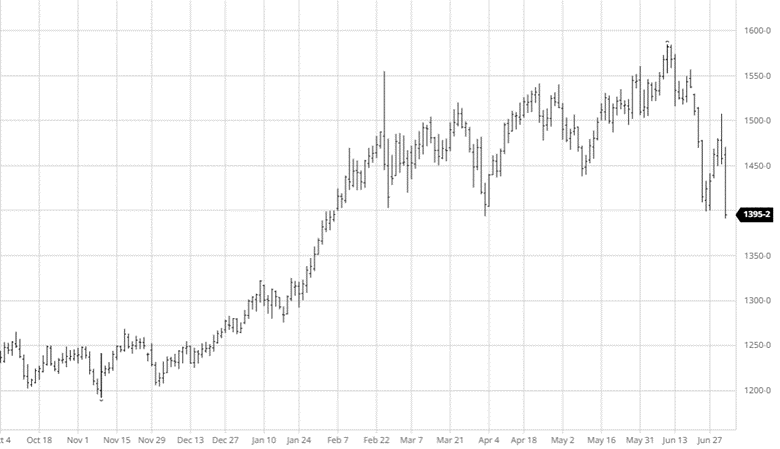

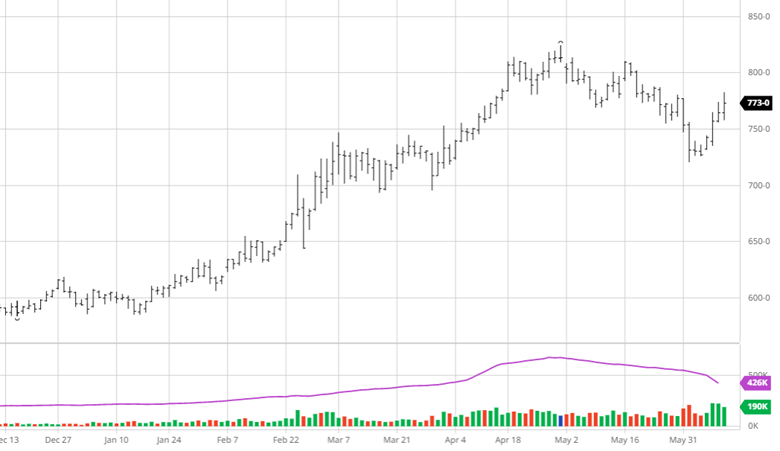

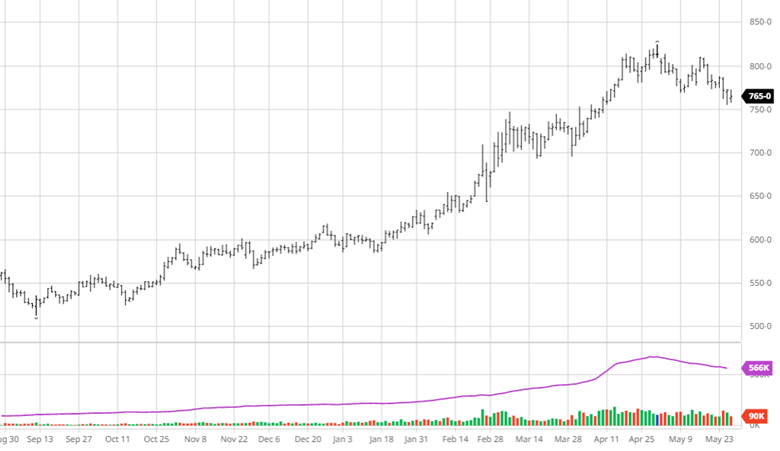

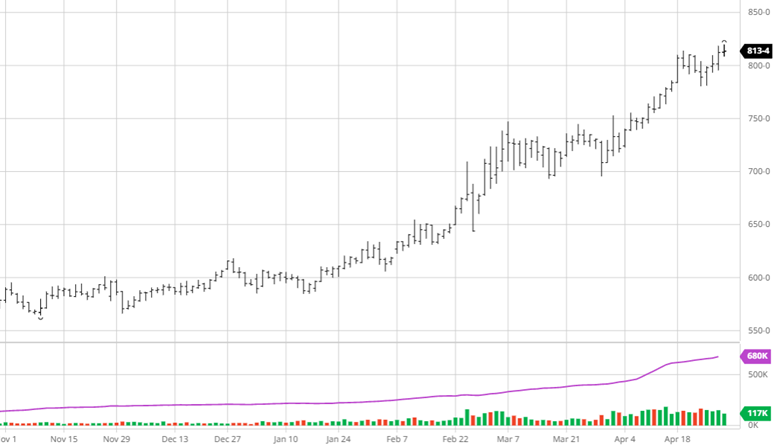

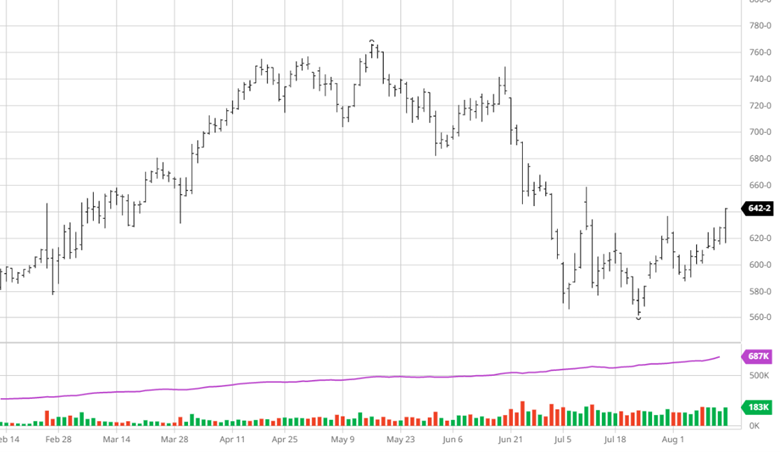

Corn had had a good couple weeks heading into the August USDA report which gave updated ending stocks and yield numbers. The USDA lowered yield to 175.4 bu/acre from 177 in July (average estimate pre-report has 175.9). They raised old crop ending stocks but lowered 22/23 US and world ending stocks. Corn was rated 58% good/excellent this week, dropping 3% nationally from last week to help add bullish news to the corn market. The next month of weather will be important for kernel fill as the weather remains uncertain with some areas expecting hot and dry with others more seasonal weather in the ECB. Seeing world demand pick up would help corn whether it be China, ethanol demand, whatever it is the markets will gladly accept it.

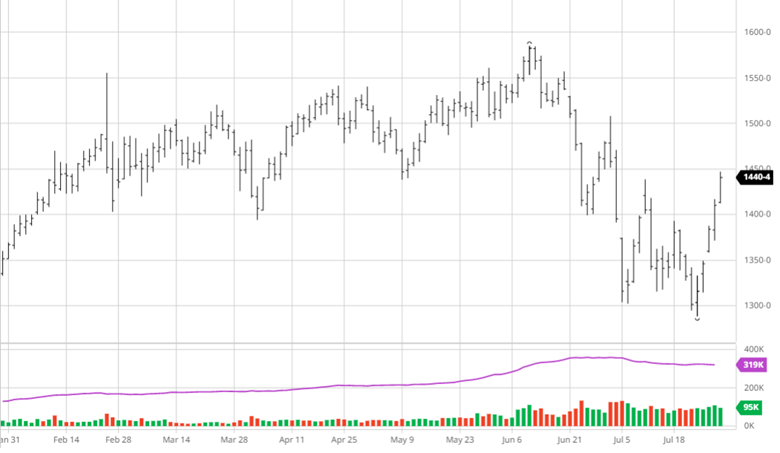

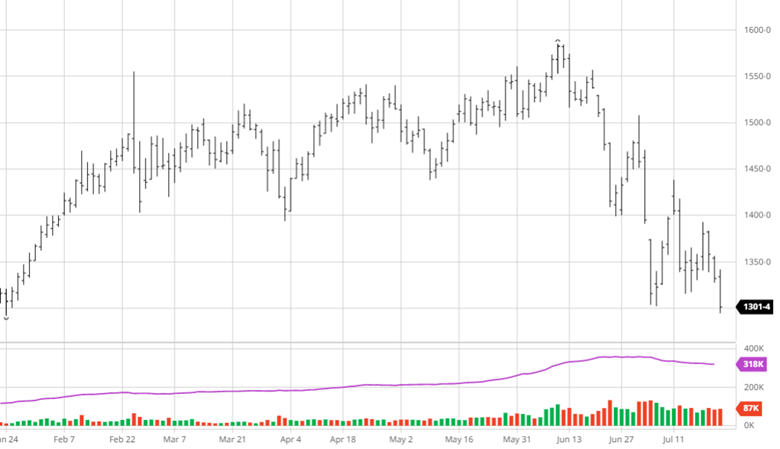

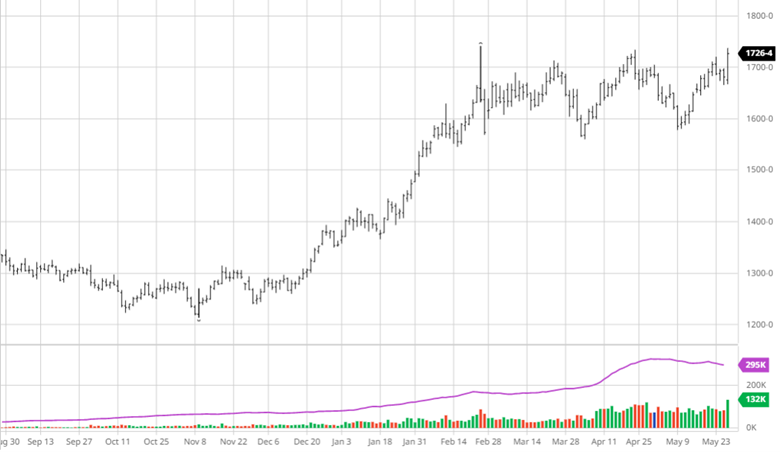

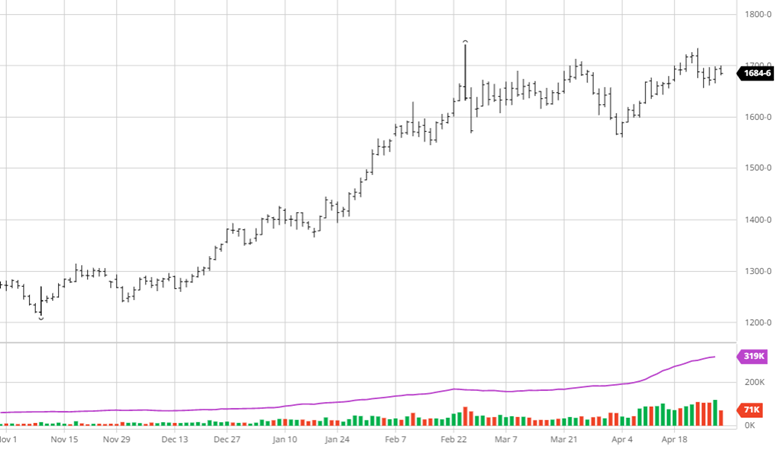

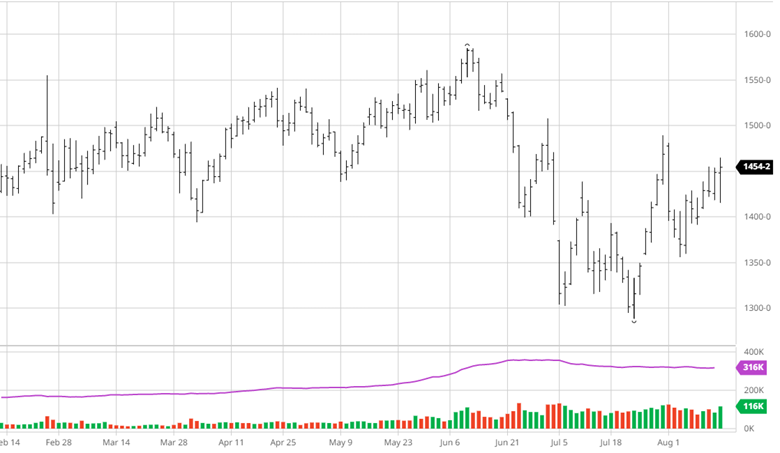

Beans have made small gains over the last 2 weeks and rallied after the report following an initial reaction lower. The initial reaction lower was due to the surprise of a higher yield with the USDA estimating the US crop at 51.9 bu/acre, well above the pre report estimates of 50.4. The slow export pace was also factored into the larger ending stocks but could speed up as beans out of the PNW to Asia are very competitive in the world market. The would be record yield still has ways to go with August and September weather still having mixed expectations.

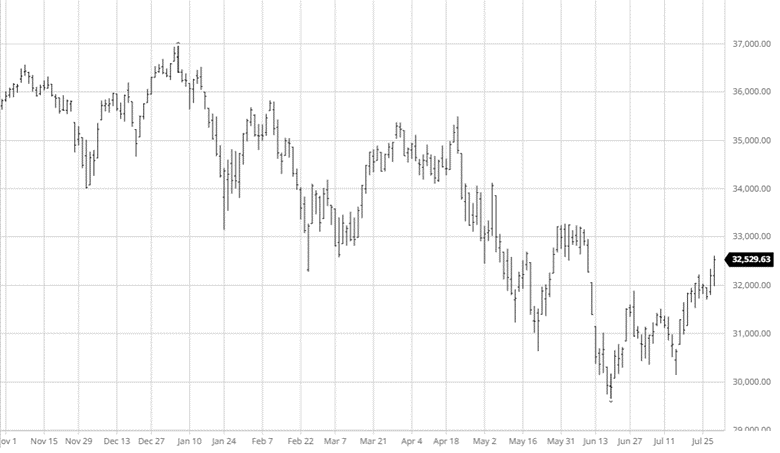

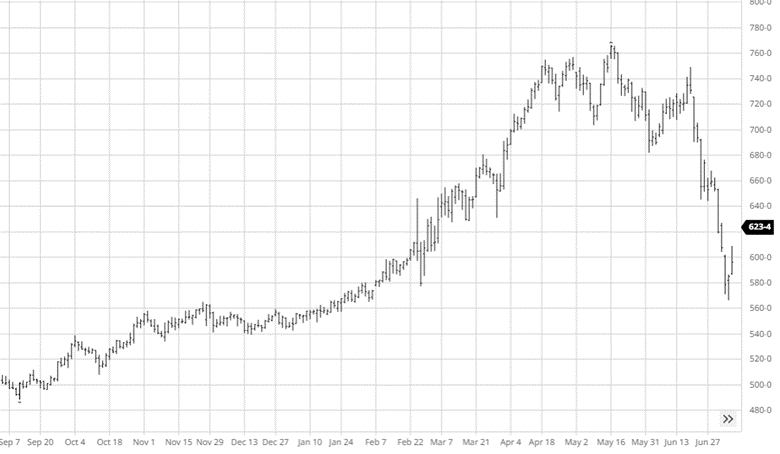

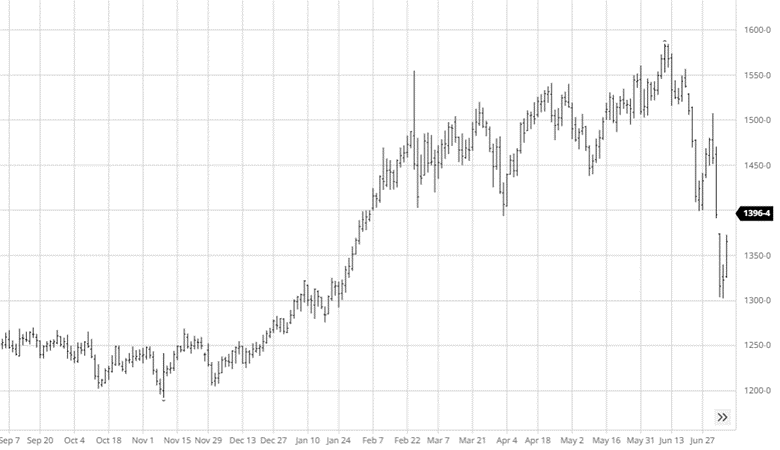

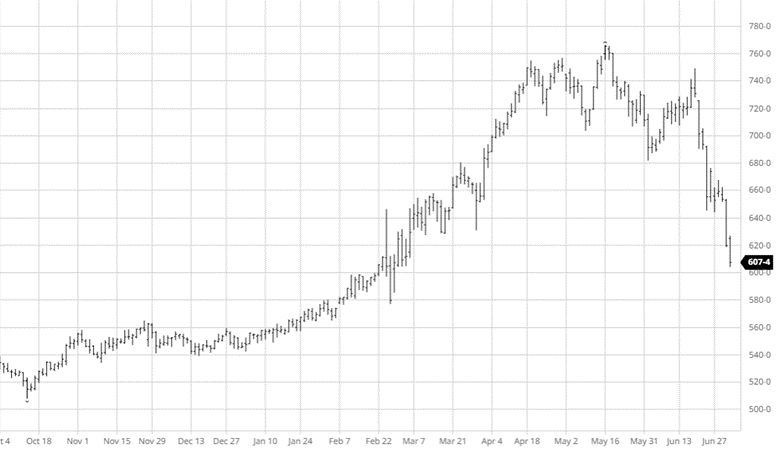

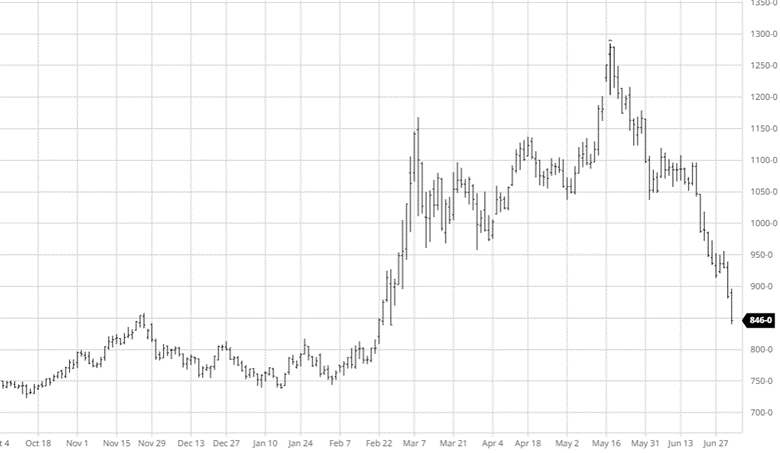

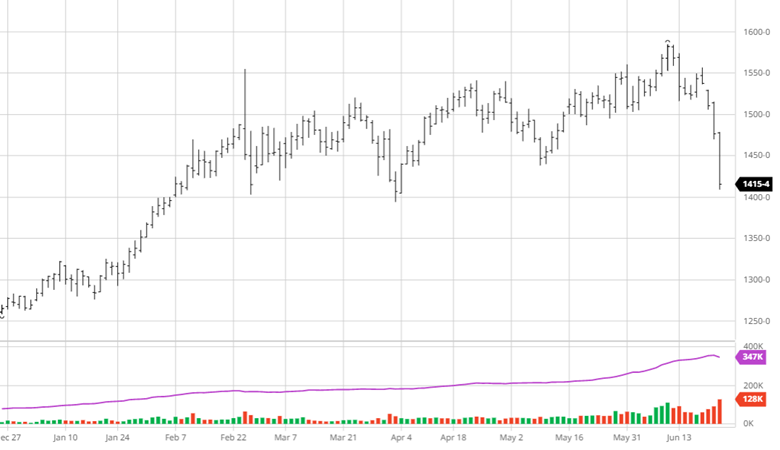

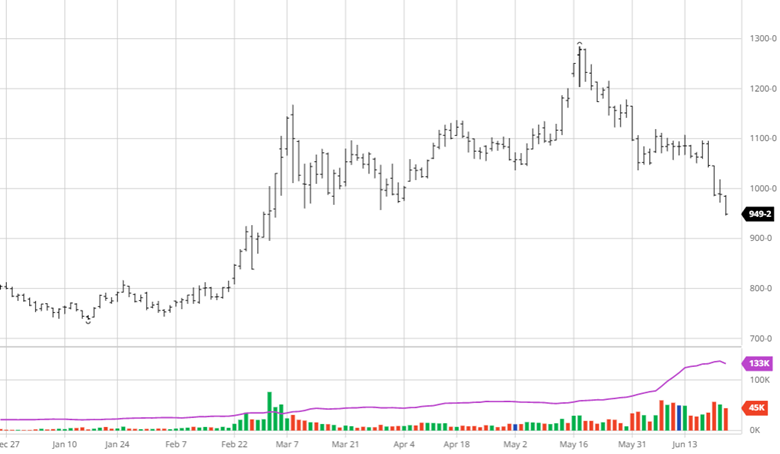

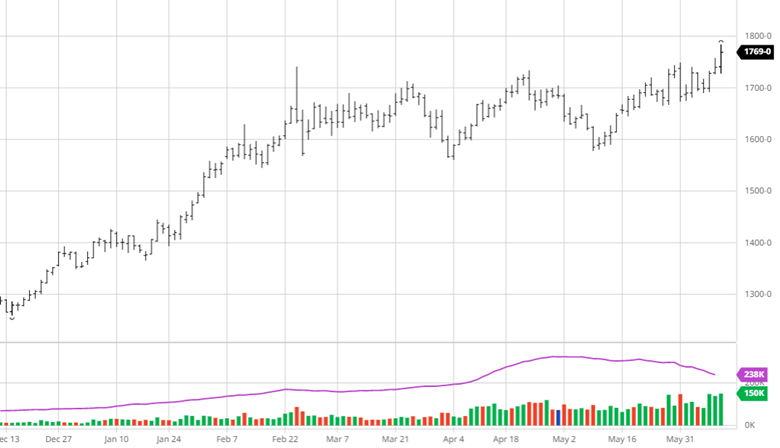

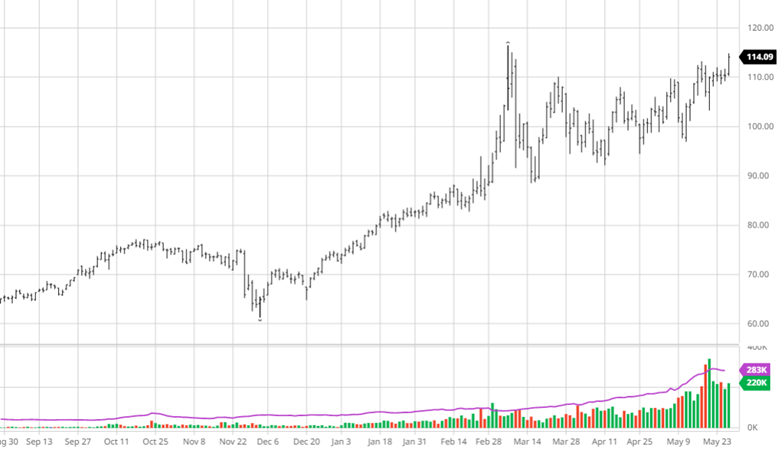

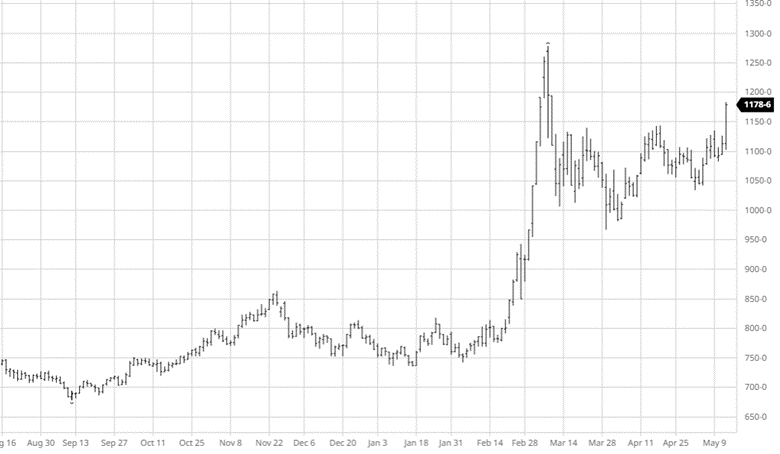

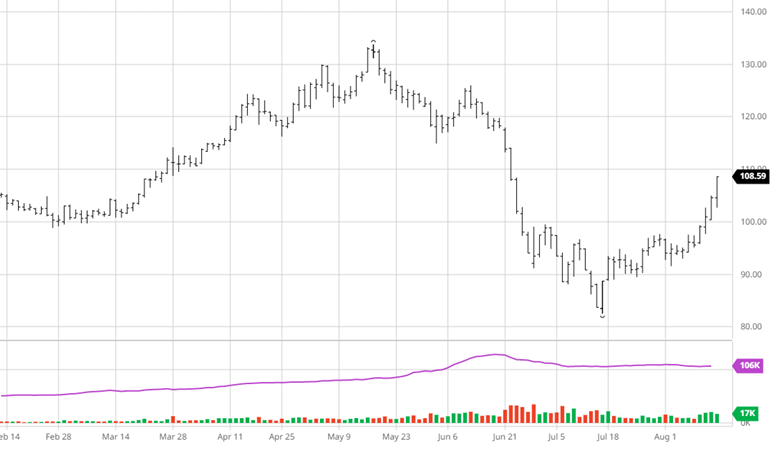

Cotton

Cotton was limit up after several up days following the report as the US’ crop continues to shrink with abandonment expected to continue to grow. 1.8 million bales ending stocks would be one of the lowest on record since 1960 and potentially problematic with world demand if we avoid a worldwide recession.

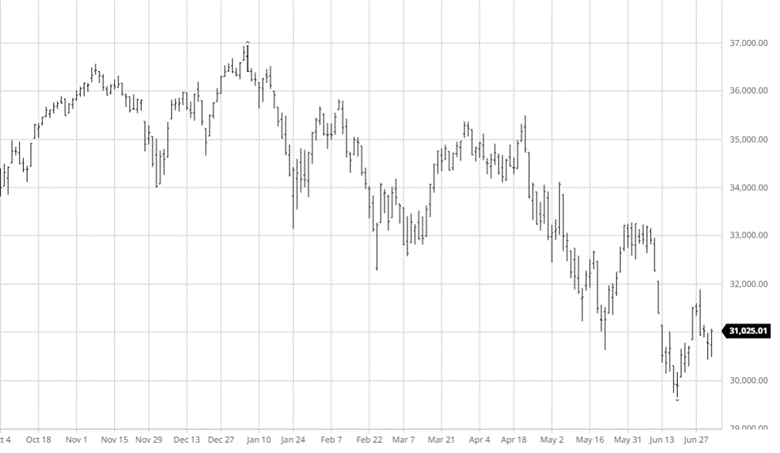

Russia and Ukraine

Vessels carrying grain have left Ukraine but the first cargo was not accepted due to quality concerns at its intended location. While the grain was sitting for a long time this is not surprising as the quality was always going to be a concern. The newest problem is the Zaporzhye nuclear power plant, with the UN Security Council meeting to discuss what needs to be done to make sure there is a not a “catastrophe on a scale much greater than the consequences of the accident at the Chernobyl nuclear power plant”.

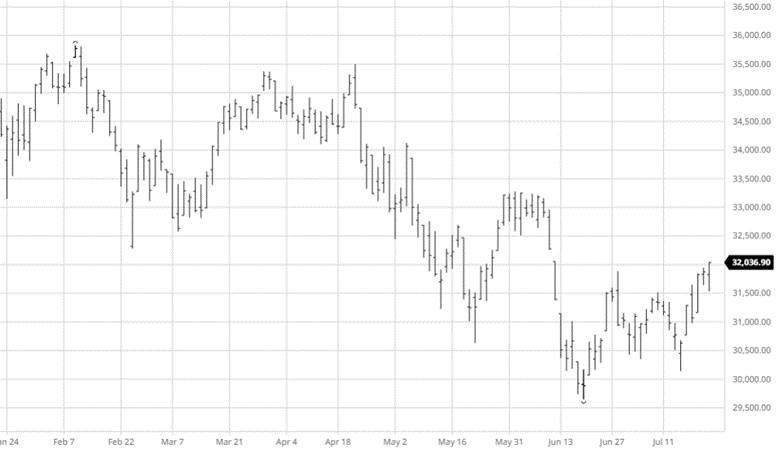

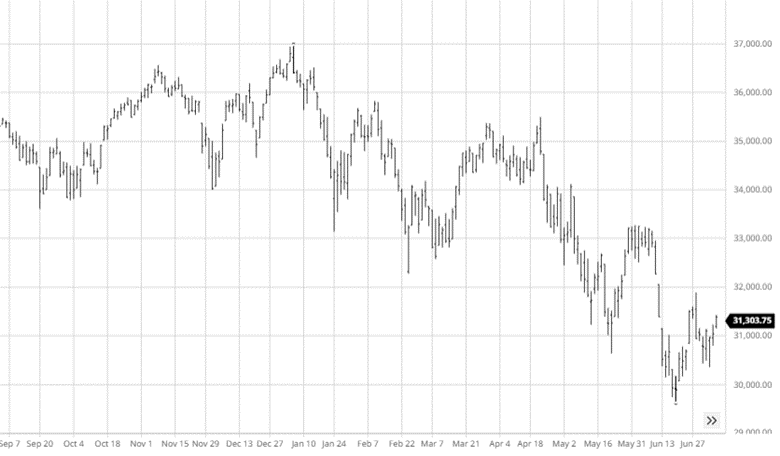

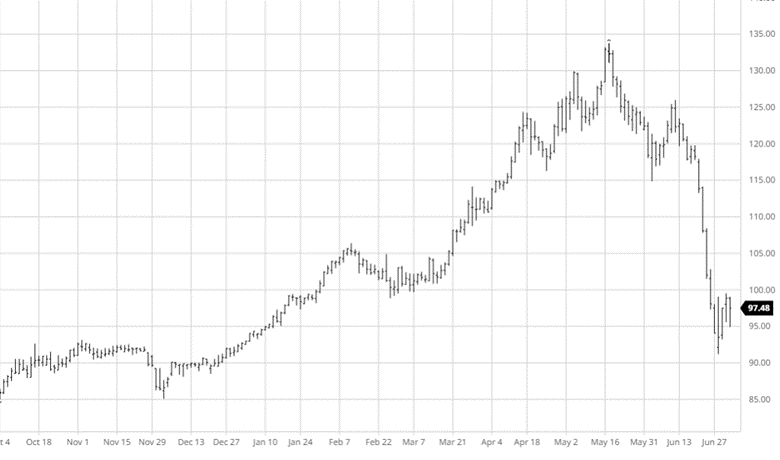

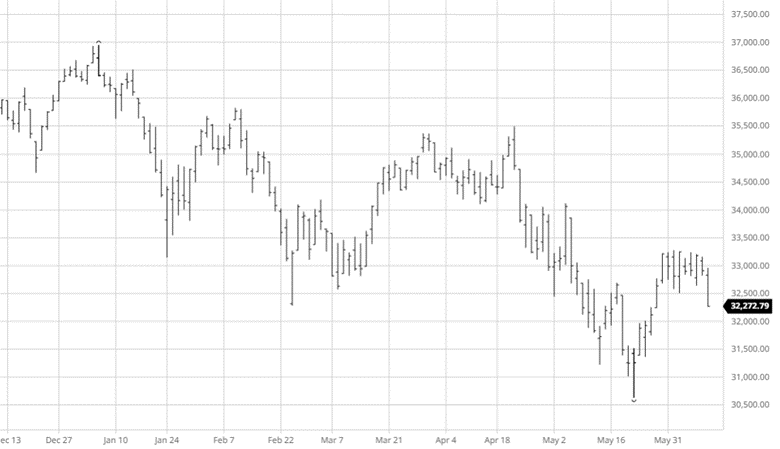

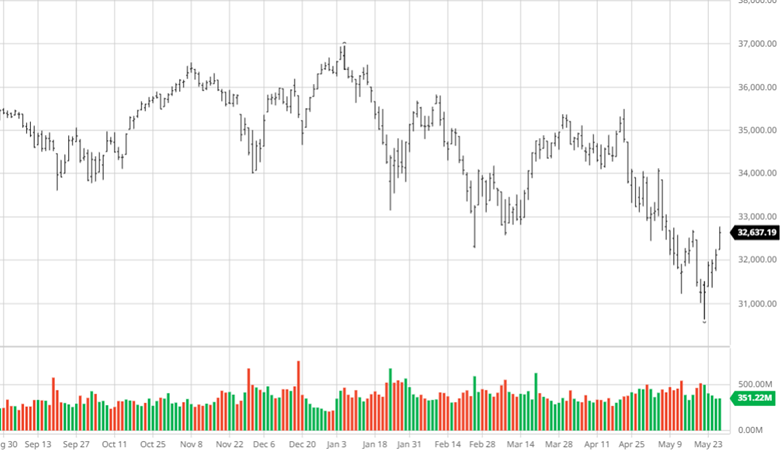

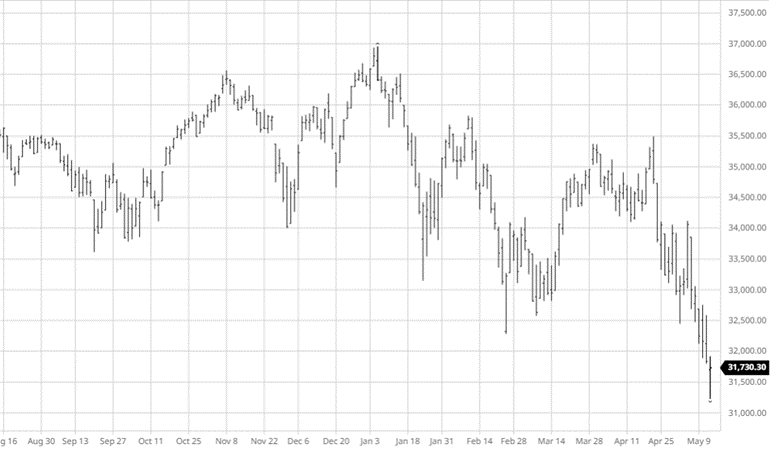

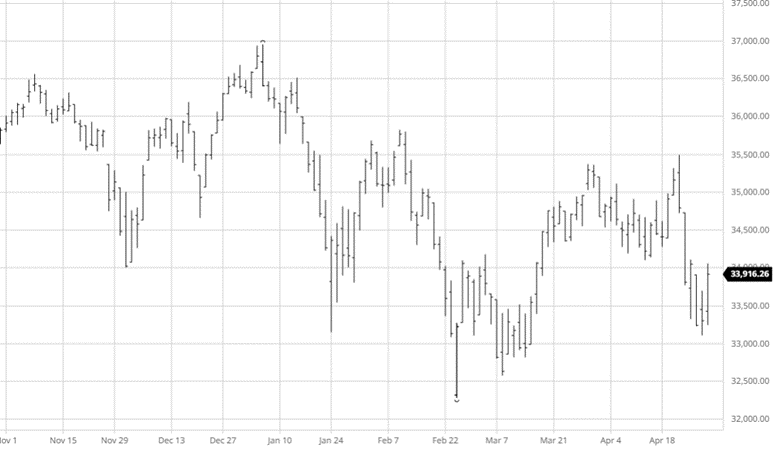

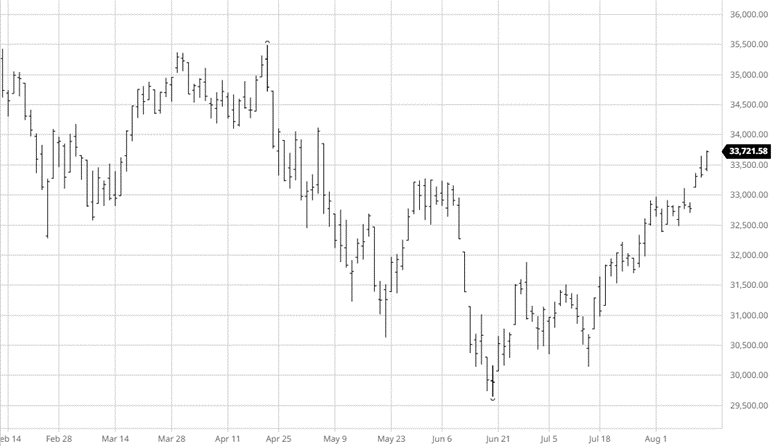

Equity Markets

The equity markets have seen a strong and steady rally higher with consumer sentiment rising. CPI came in at 8.5% again this month so the positive is it did not go up from last month, the negative is it is still at 8.5% YOY so this number will need to start going down before there is too much confidence we have peaked with the Fed still raising rates. Production at several offshore drilling sights were paused for a short period this week while a problem was fixed causing some volatility in the energy sector.

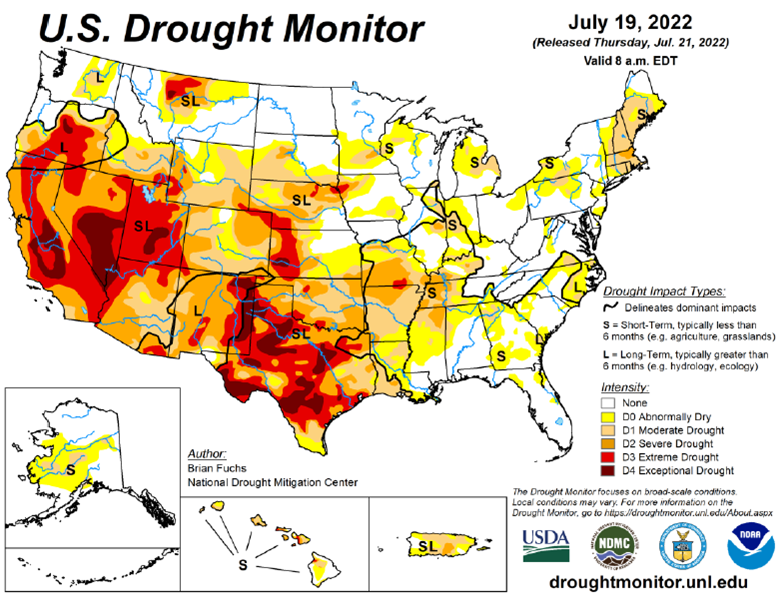

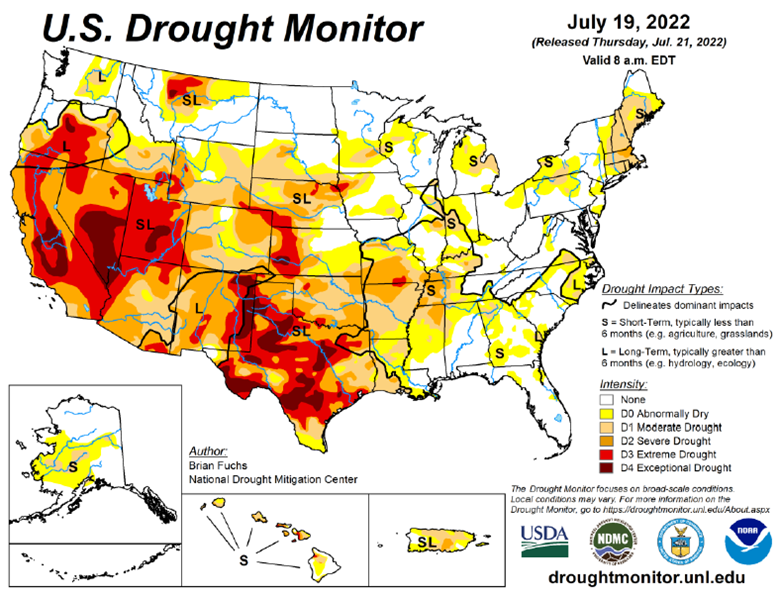

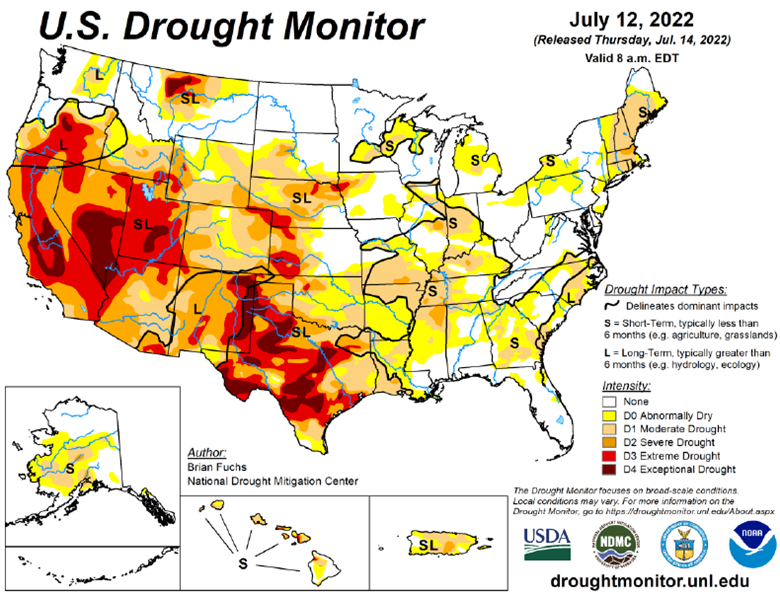

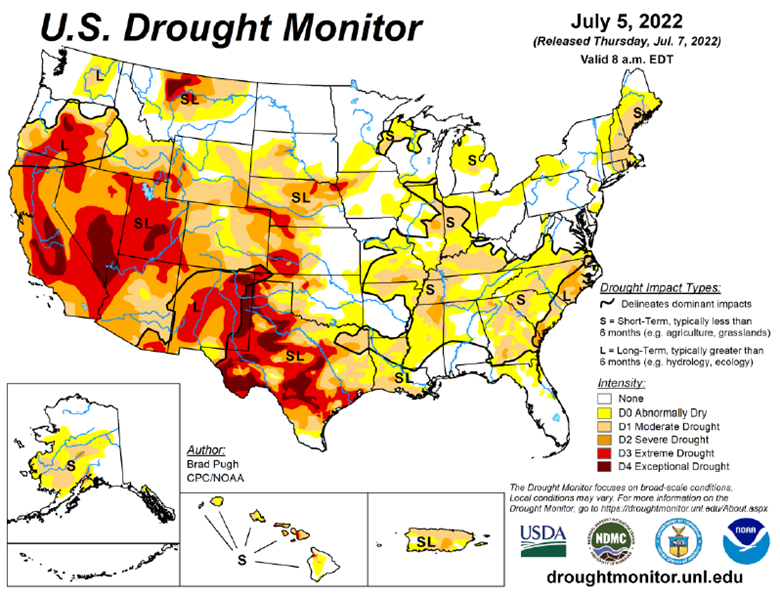

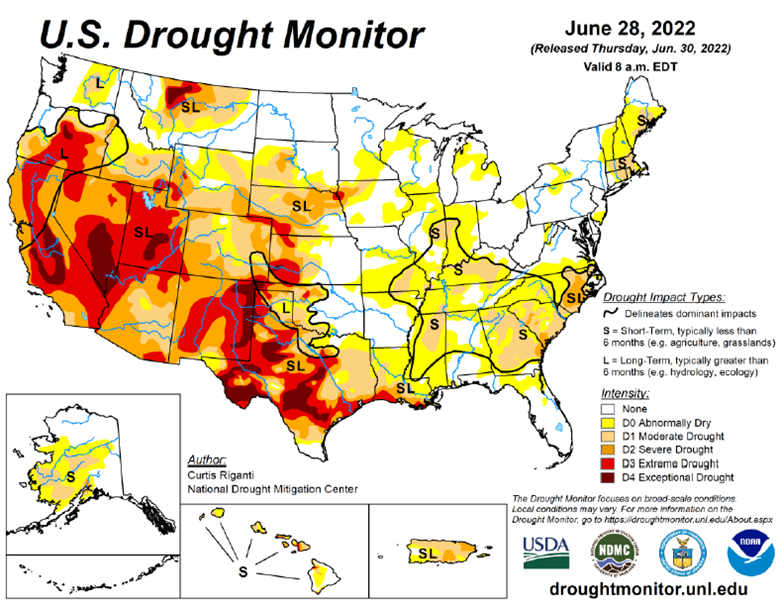

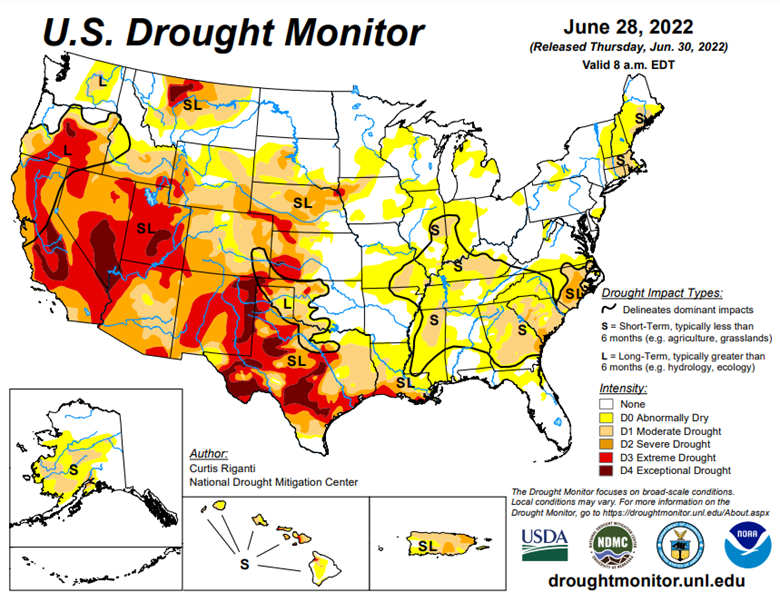

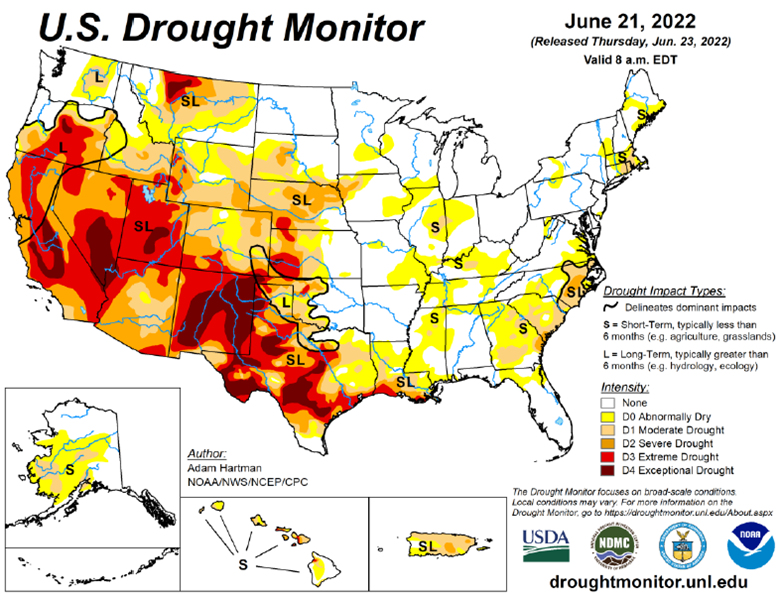

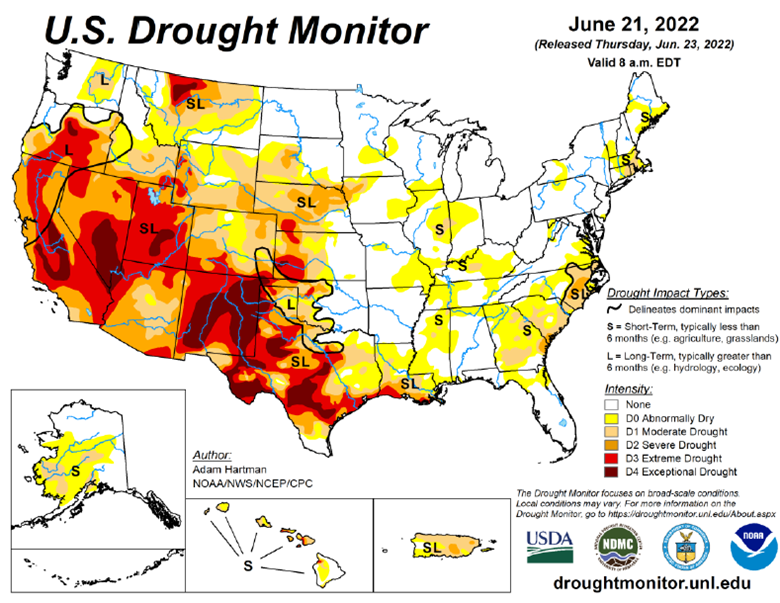

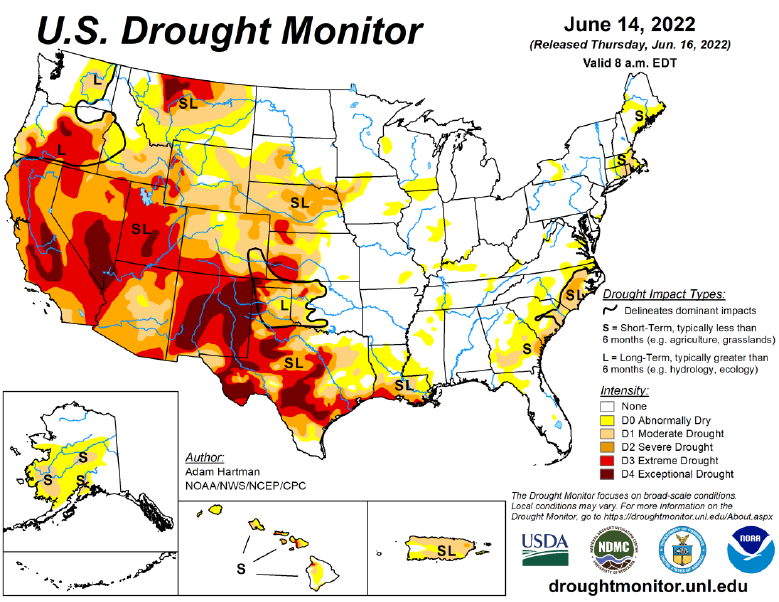

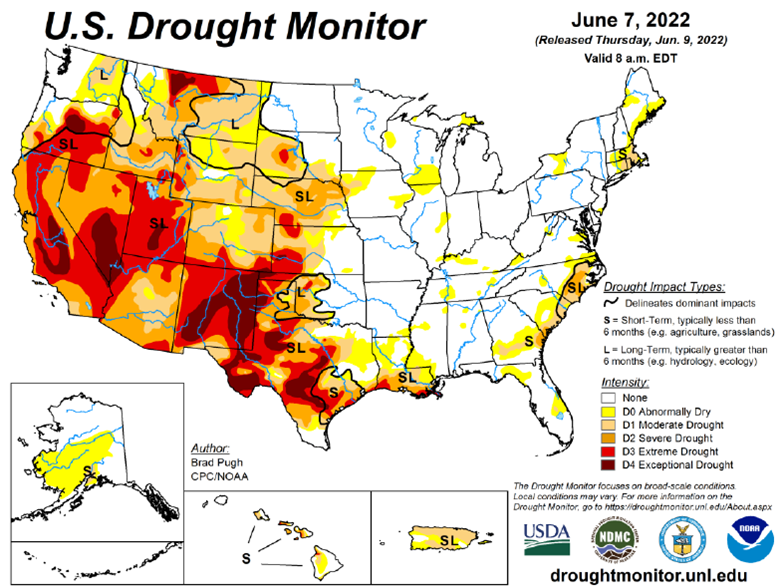

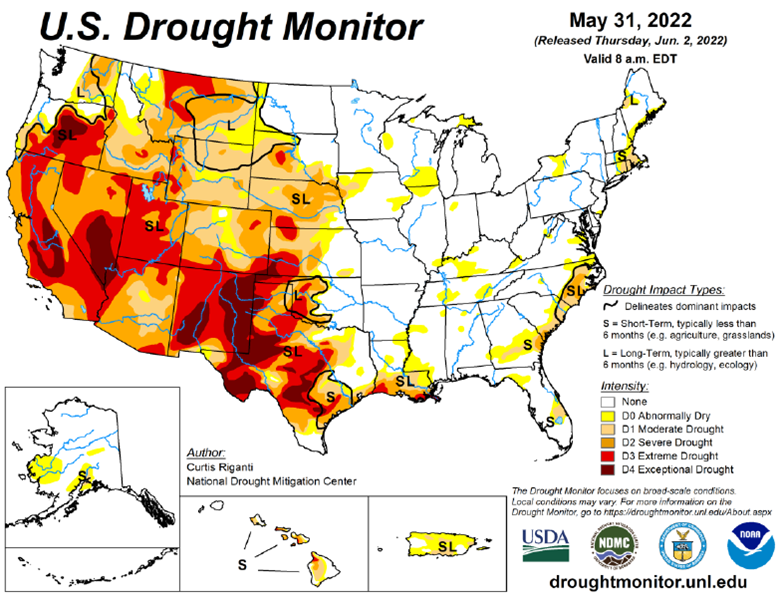

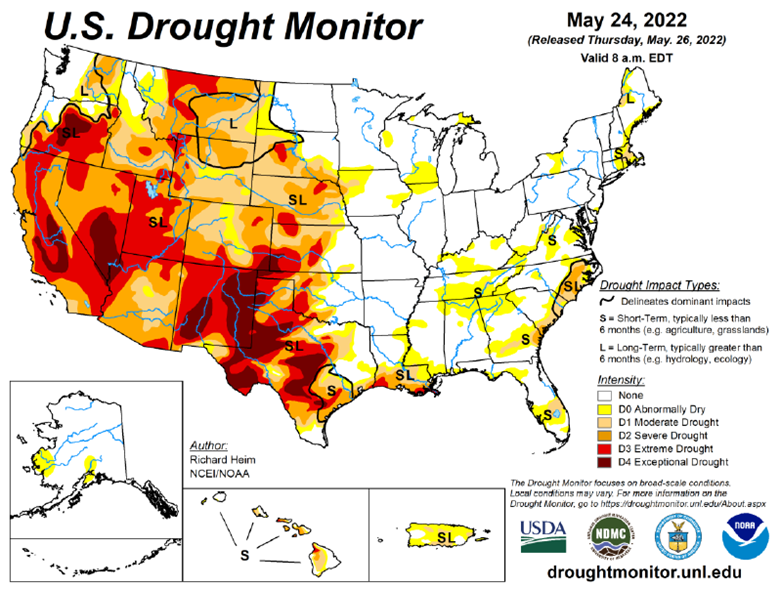

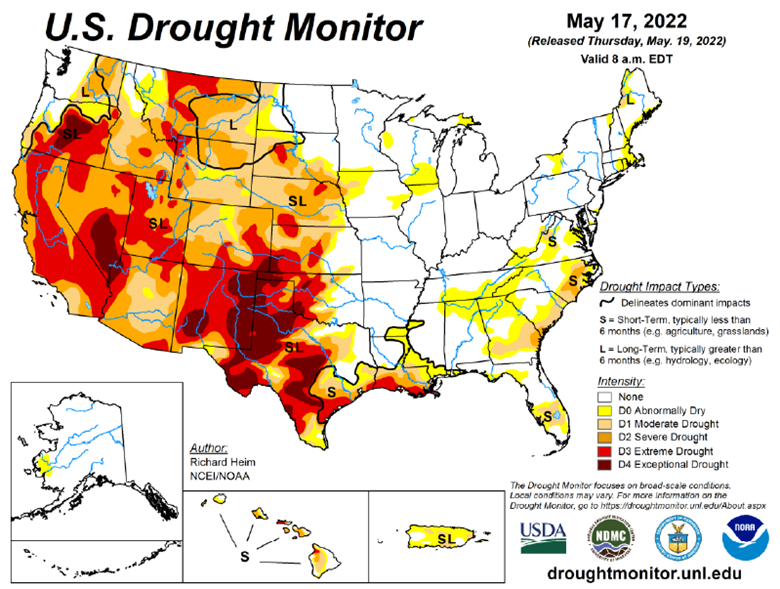

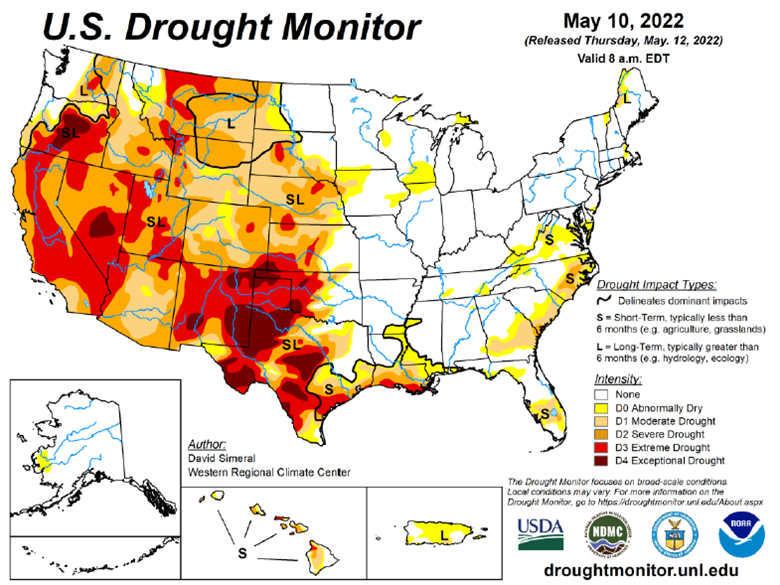

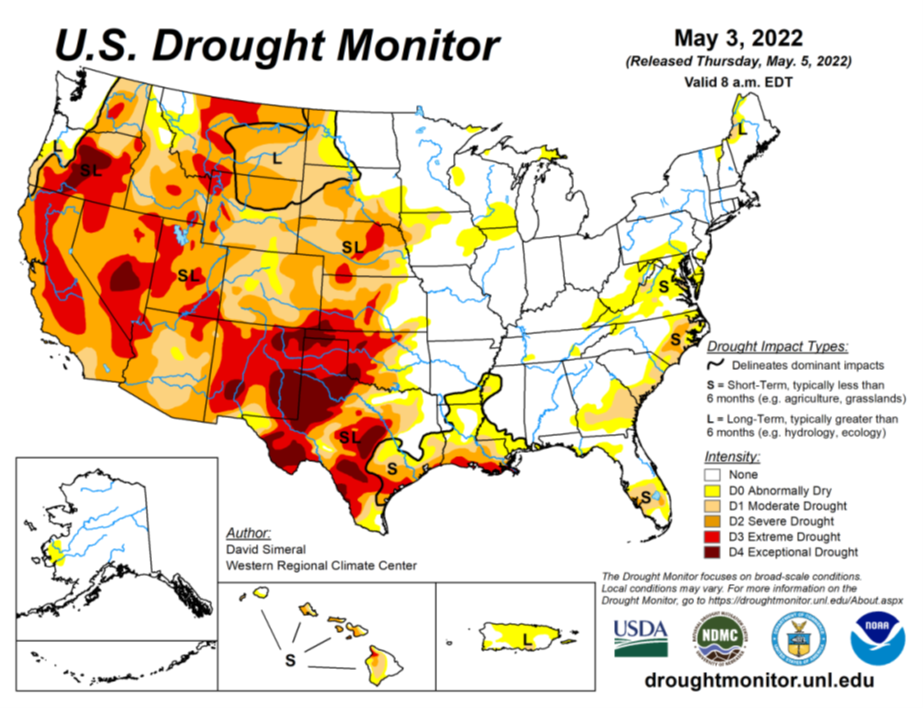

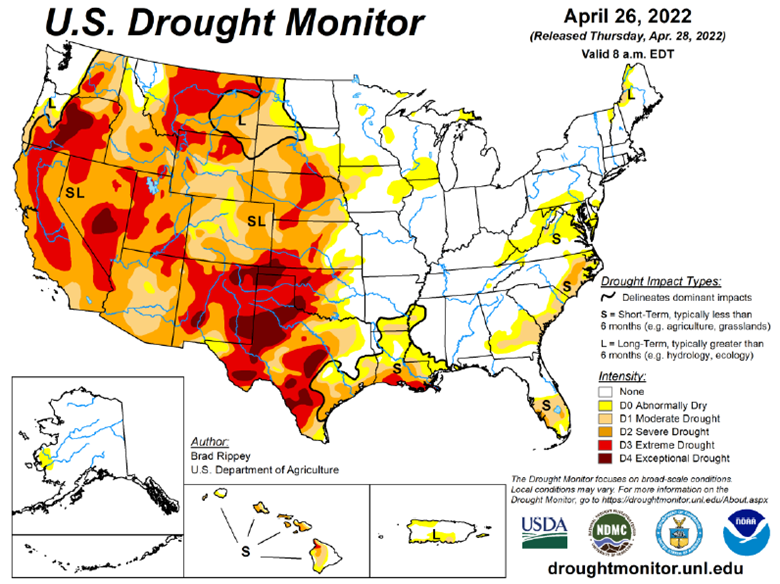

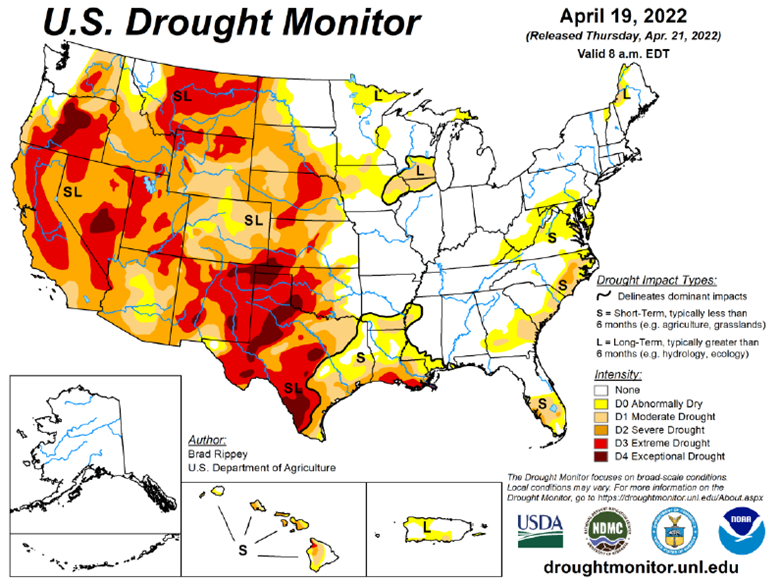

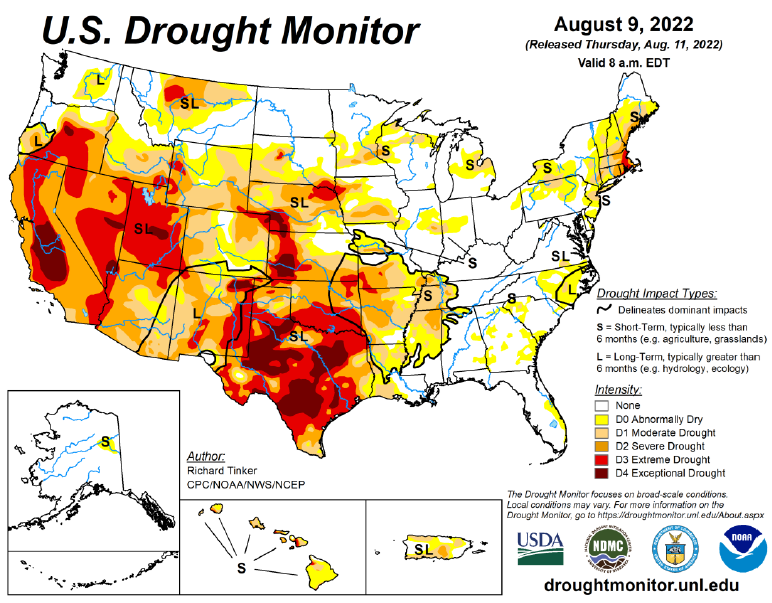

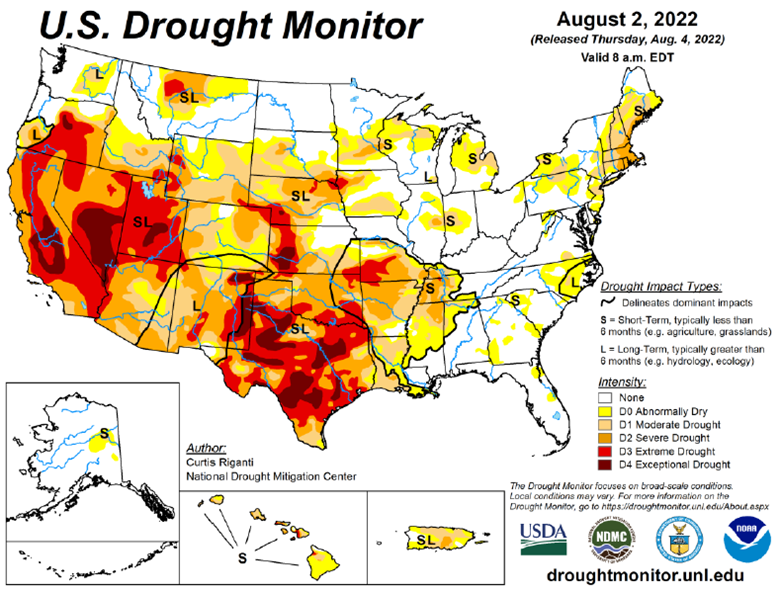

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

Are the Fed’s hikes starting to dampen inflation? Oil, grains, and metals have all fallen from their highs. But the rarely spoken of Cotton market was one of the first to crack…falling from 1.58/lb to 0.95/lb in just a few short days. We’re digging into this sharp drop and just why and how Cotton is involved in seemingly everything with RCM’s very own cotton king, LOGIC advisors Ron Lawson.

In this episode, Ron is giving us the low down on how and why he believes it’s not Dr. Copper which acts as the global economic barometer, but how Cotton is the real Canary and leading indicator on global demand. In between those talks, we’re covering all things Cotton including crop insurance, irrigated vs dry land, the scam that was Pima and Egyptian Cotton, the process of cotton – which countries have it, which want it, ginning it, spinning it, dyeing it, global commodity merchant co’s pushing it around, and even micro-plastics, climate change, and how Cotton always flows to the cheapest labor source. Finally, we’re walking in some high Cotton putting Ron in the hot seat. Will we ever get the growth back? Tune in to get these critical hot takes — SEND IT!

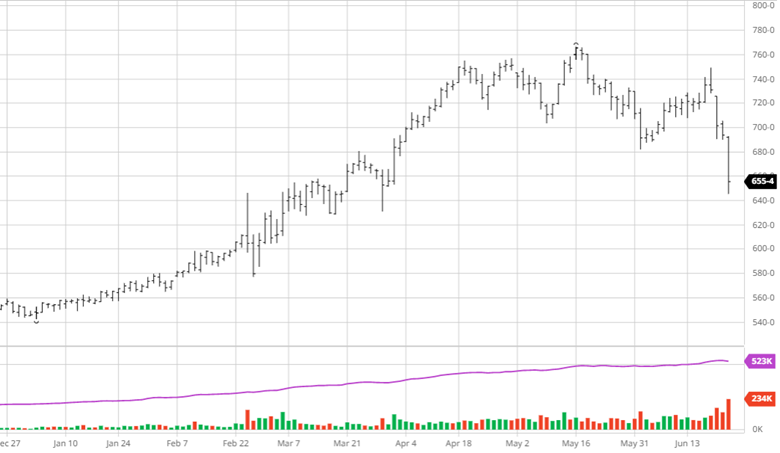

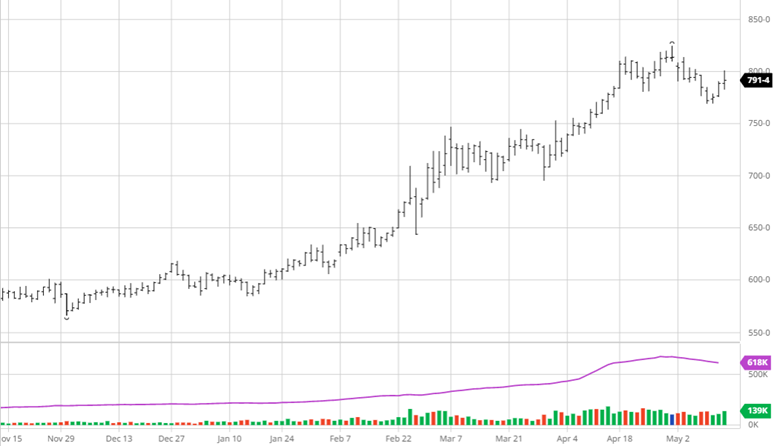

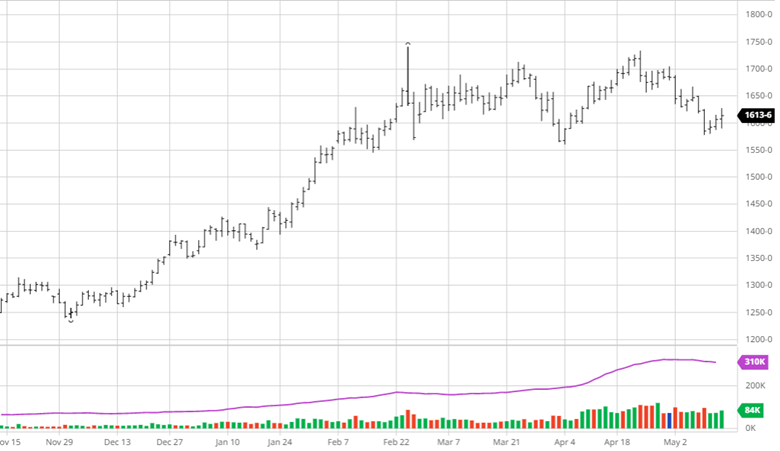

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].