AG MARKET UPDATE: JULY 14 – 21

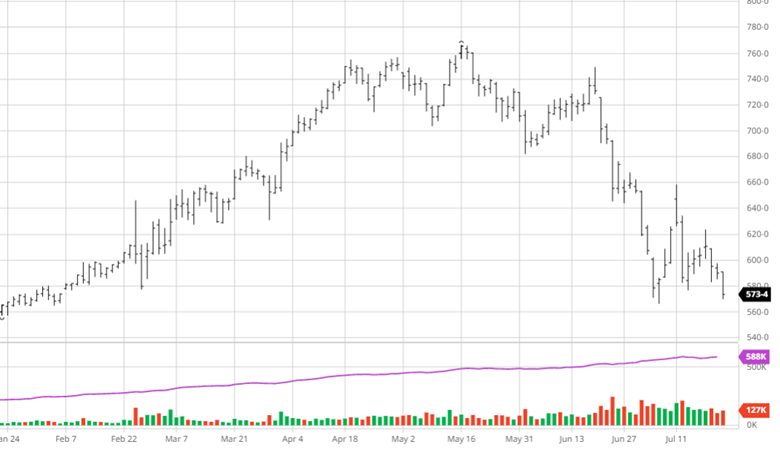

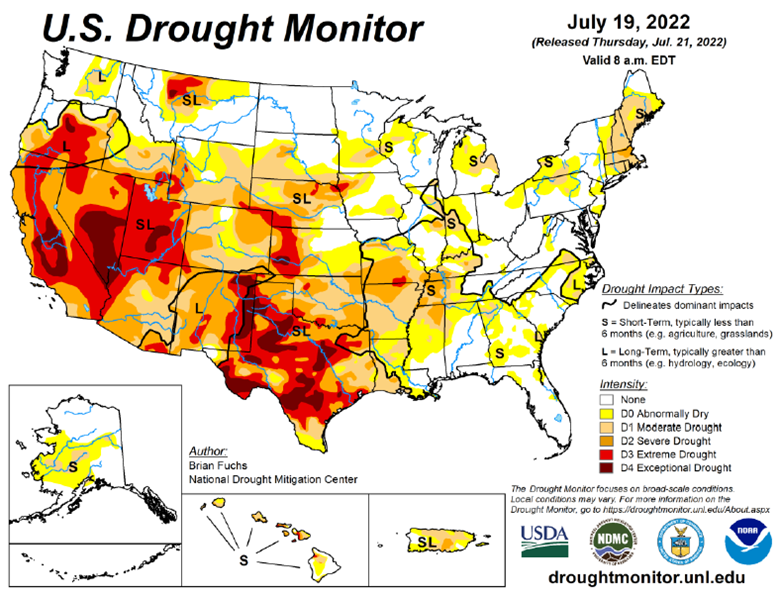

Despite a brutal stretch of hot and dry conditions, Corn prices have continued to struggle, tied in with ever changing forecasts looking at favorable conditions ahead. In total, the trend is clearly down with the cooler forecast for the corn belt and a potential for trade in the Black Sea to resume. Energy prices have also fallen pulling other commodities with it as Russia re-opened the Nord Stream pipeline into Europe (at less than 50% capacity). While prices have retreated to pre-Russia invasion of Ukraine, the potential for a sub trend line corn crop in the US remains. Basis is still strong in many areas showing that there is a disconnect and some areas are very worried about potential yield loss. Weather during the first half of August will be huge for this crop – as forecasts change so will prices. Expect more volatility ahead!

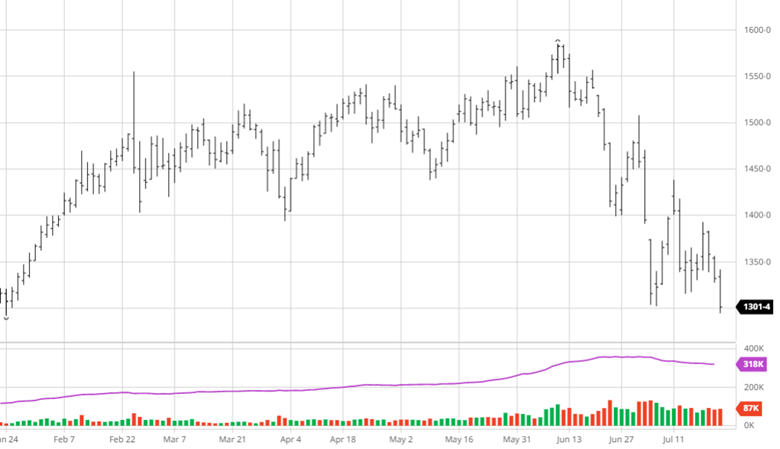

Patterns in Soybeans have been almost identical to Corn – ever changing weather conditions along with uncertainty in global demand are driving prices lower. 26% of soybean production is in areas currently experiencing moderate to severe drought. The weather coming up is important for beans as well; if the cooler forecasts do not come to pass and hot and dry conditions continue beans should see a bump in price. Old crop exports were strong this week while new crop fell in the expected range.

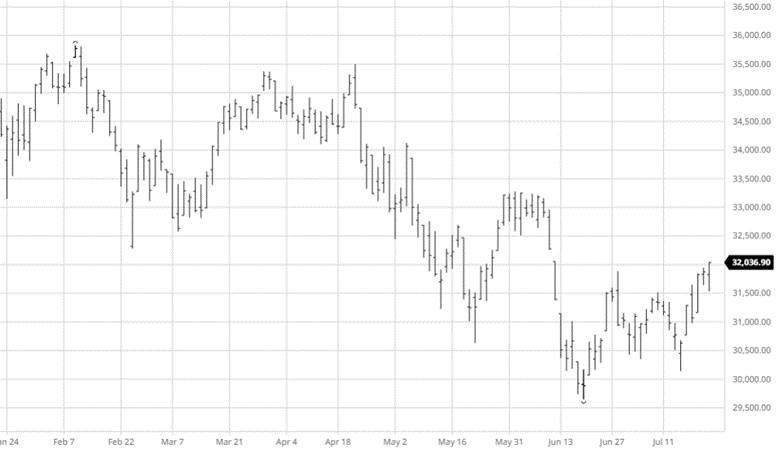

Equity Markets

The equity markets rallied this week stringing together several positive days despite all the concerns of recession and inflation remaining in the market. This appears to be an area that is tradable as many equities are off their lows on the year but still well below the highs. Q2 Earnings have also given some guidance as companies have taken inflation and other rising costs into account for what to expect ahead. Tech stocks have also gotten a big boost this week along with crypto.

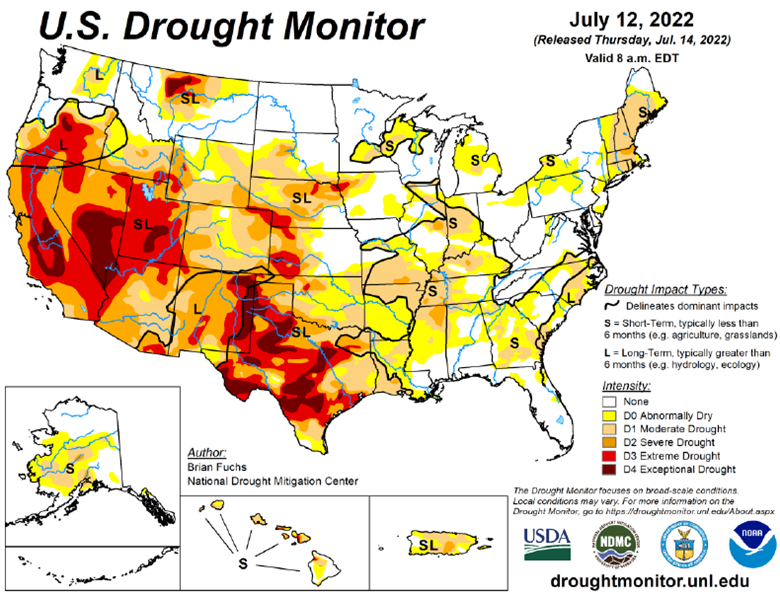

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

Are the Fed’s hikes starting to dampen inflation? Oil, grains, and metals have all fallen from their highs. But the rarely spoken of Cotton market was one of the first to crack…falling from 1.58/lb to 0.95/lb in just a few short days. We’re digging into this sharp drop and just why and how Cotton is involved in seemingly everything with RCM’s very own cotton king, LOGIC advisors Ron Lawson.

In this episode, Ron is giving us the low down on how and why he believes it’s not Dr. Copper which acts as the global economic barometer, but how Cotton is the real Canary and leading indicator on global demand. In between those talks, we’re covering all things Cotton including crop insurance, irrigated vs dry land, the scam that was Pima and Egyptian Cotton, the process of cotton – which countries have it, which want it, ginning it, spinning it, dyeing it, global commodity merchant co’s pushing it around, and even micro-plastics, climate change, and how Cotton always flows to the cheapest labor source. Finally, we’re walking in some high Cotton putting Ron in the hot seat. Will we ever get the growth back? Tune in to get these critical hot takes — SEND IT!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].