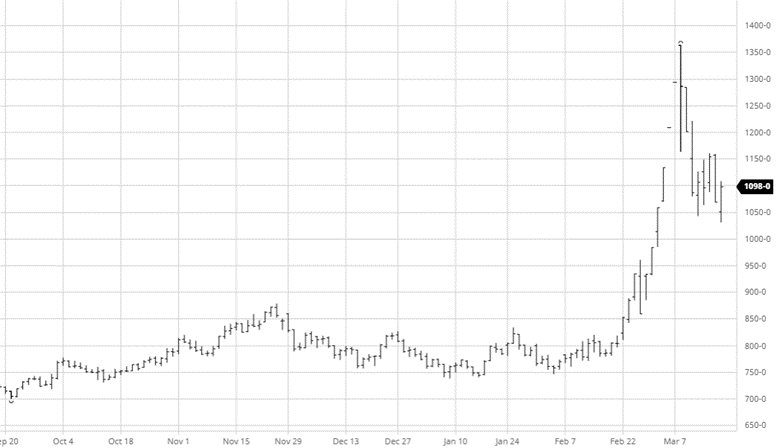

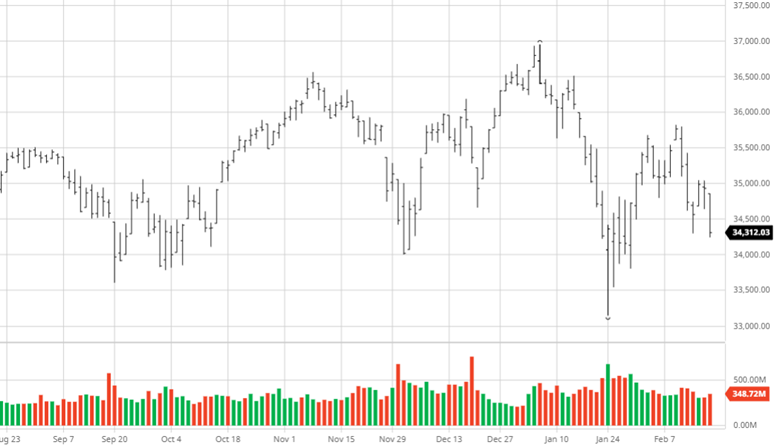

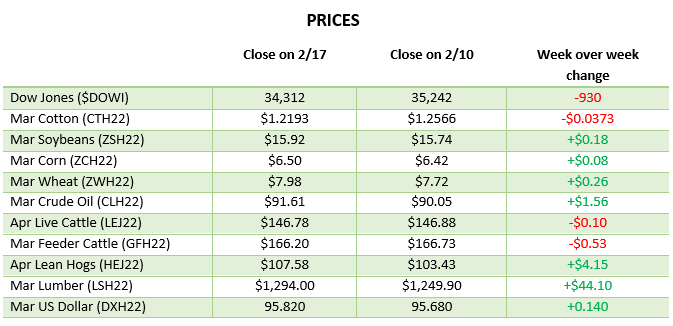

One of the smartest guys in the industry always reminded me that once the NCAA brackets came out, the industry went quiet. That couldn’t be more true today. The market has been quiet for over two weeks. Futures were off $175 last week, and even print was down. Putting basketball to the side, this usually is a slow period as construction ramps up. Add to the many storm clouds overhead, and you get an inactive market. That said, the dynamics are still very strong. Let’s look at some pros and cons of the market today.

Pros:

- New business keeps piling in. While the focus has been on logistics issues and supply chain constraints, business keeps flowing in and is at higher cost levels. One forward sales guy compared it to “taking a drink out of a firehose.”

- Supplies of new and existing homes are still near historic lows.

Cons:

- Mortgage rates are nearing 5% and moving higher. That will affect the buyers.

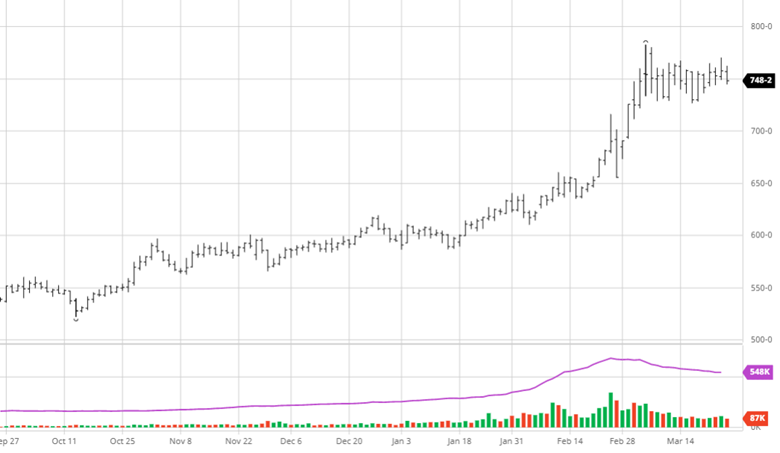

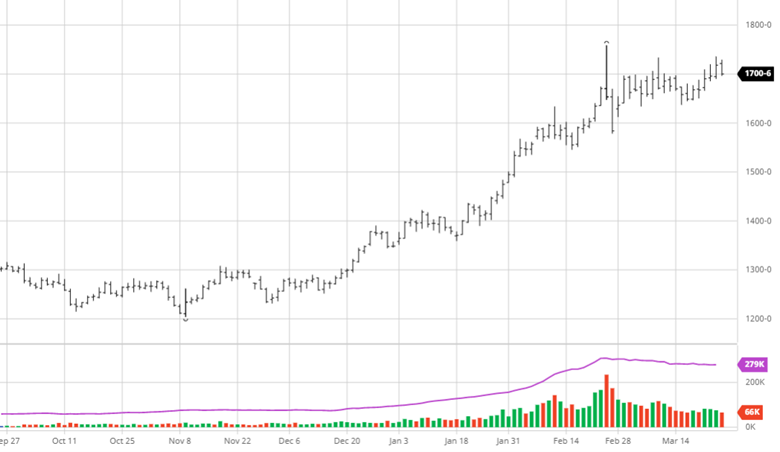

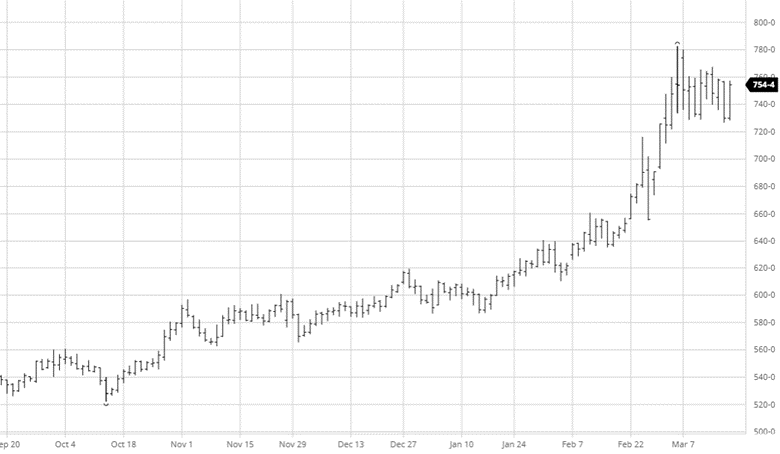

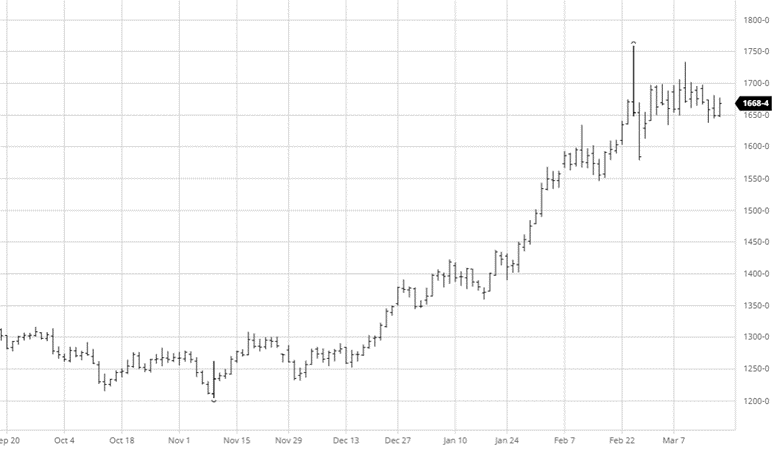

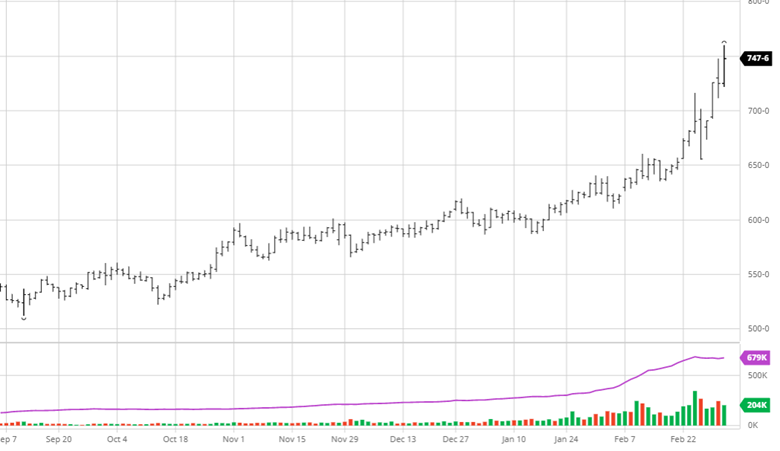

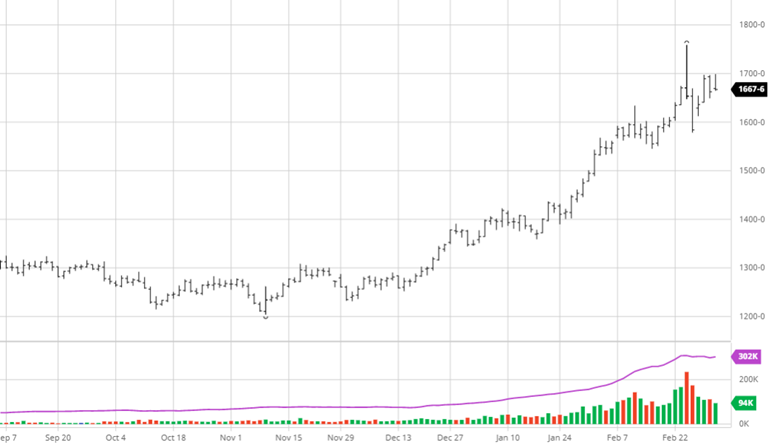

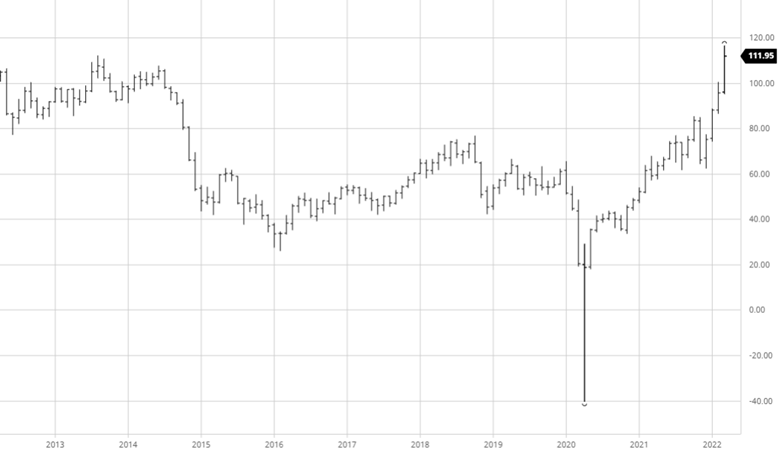

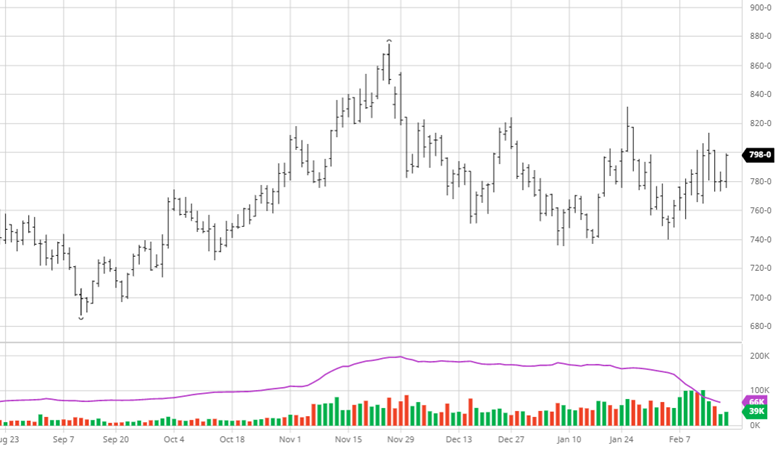

- The mills stay at $1,400 while the industry sits at $600. That is an $800 spread! That just is not seen in any other commodity.

All this will lead to a lower bottom, followed by another bottleneck.

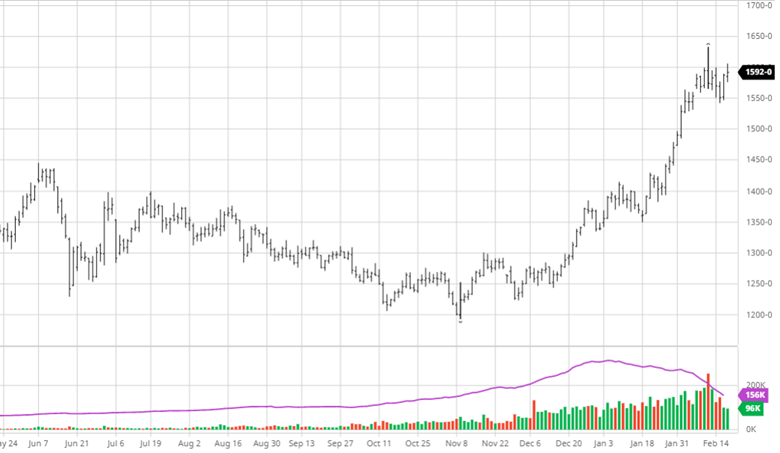

Let’s Get Technical:

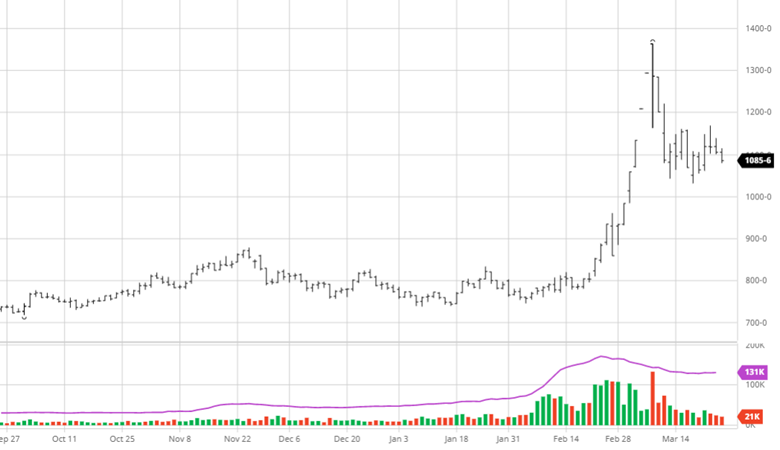

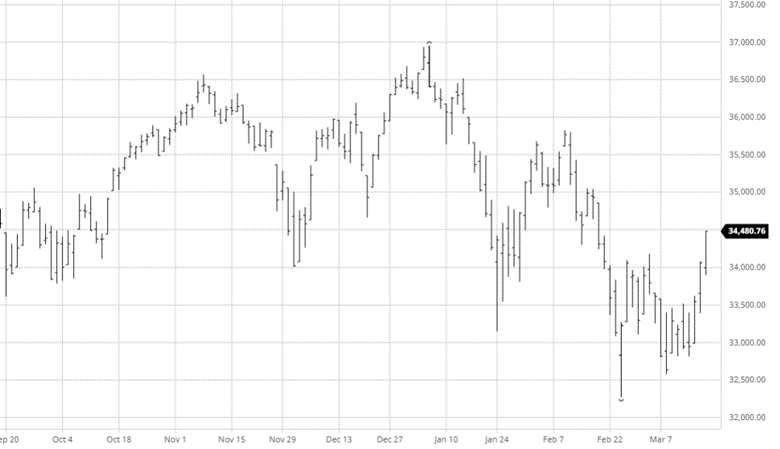

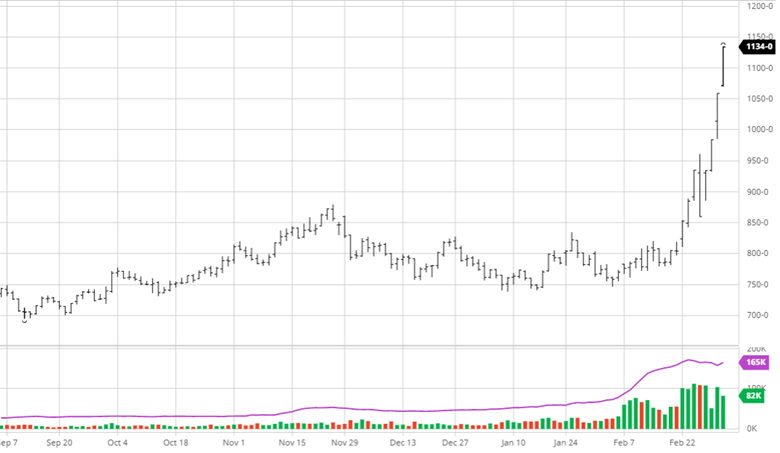

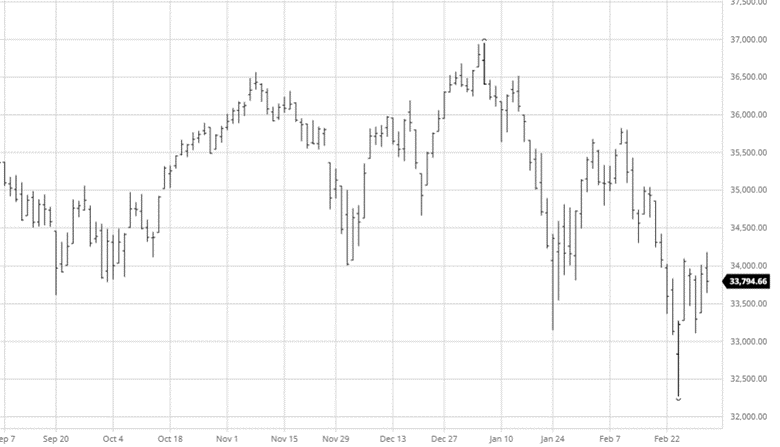

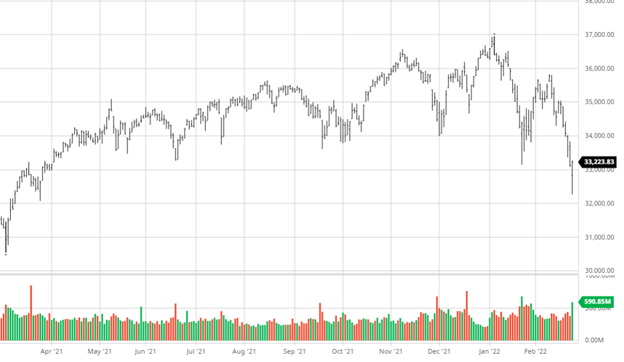

Both the daily and weekly are sitting on support lines. At times, the chart patterns have been looking for a bottom but never turning up. May futures needs to hold the $1,000 mark or could be sitting at $920 in a hurry. Please notice the continuous call for areas to hold, and the key focus for the week is $964. That is the 50% retracement of the whole move starting back at $448.

Weekly Round-Up:

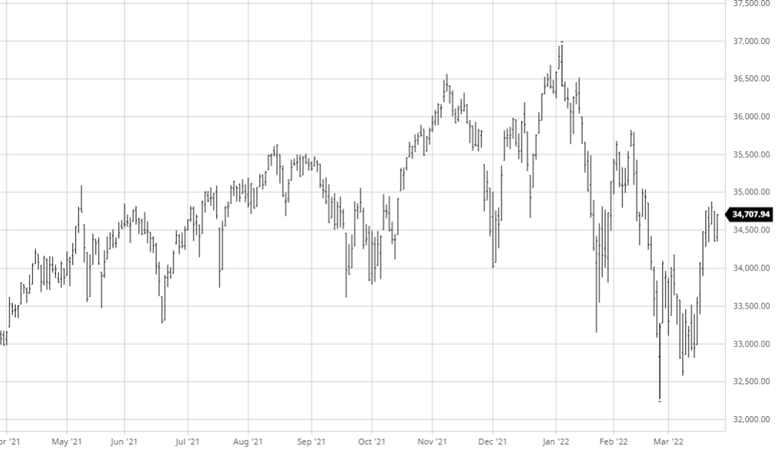

For the last few months and again back last spring, the market reacted to one thing and one thing only: if there was a car available or not. Today there are cars available, and they either have to get cheap enough or show a risk of going away again. That is when enough buying comes in to chase away the algo. It would not be surprising if the week was a slugfest.

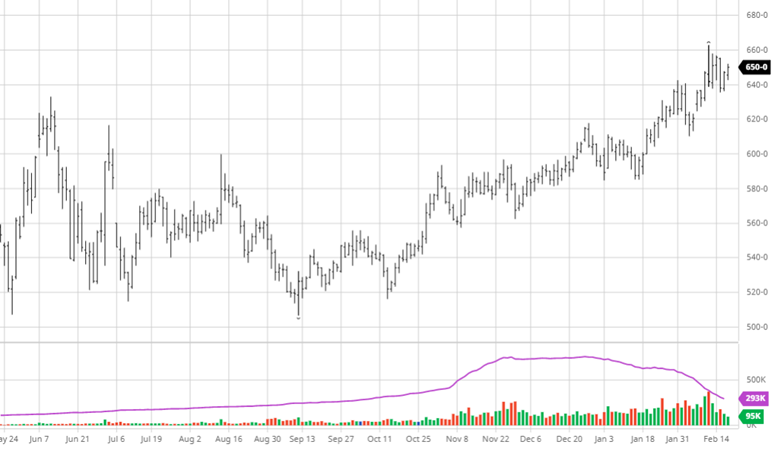

Open Interest and Commitment of Traders:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

https://www.cftc.gov/dea/futures/other_lf.htm

About The Leonard Report

The Leonard Lumber Report is a new column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Before You Go…

RCM Ag Services put a unique spin on National Agriculture Day by going international. That’s right, we jumped right into international waters with Maria Dorsett from USDA’s Foreign Agriculture Services for an interesting discussion about linking U.S. agriculture to the rest of the world.

Each year, March 22 represents a special day to increase public awareness of the U.S.’s agricultural role in society, so why not take it one step further by bringing in a global component? As the world population soars, there’s an even greater demand for producing food, fiber, and renewable resources. That’s why we’re taking a deeper dive into the USDA’s trade finance programs, like the GSM-102, which supports sales of U.S. agricultural products in overseas markets and supports export growth in areas of the world that are seeing some of the fastest population growth.

So, jump aboard (no passport needed), as Maria discusses how U.S. companies use GSM-102, what the program features, and the benefits that it offers!