AG MARKET UPDATE: FEBRUARY 24 – MARCH 3

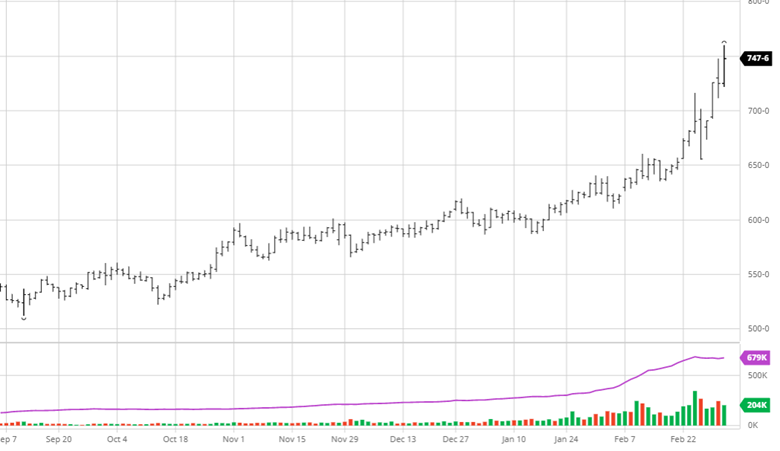

Corn made large gains this week following wheat, but not with the same panic. While Ukraine is a major corn exporter, it is not on the same level of wheat. Corn’s moves will be similar to wheat as the news from eastern Europe, and war will be problematic for the world balance sheets. While it has not moved with the same vigor as wheat, the $1 gain in the last eight trading days shows the potential fallout from this spooks the market. It is hard to tell how many acres will be lost this spring, but it is estimated that only 60% of corn seed is on farms. How likely is it the rest will make it to the farms? We cannot be sure, but it certainly won’t be much more if the conflict drags out. We are still in an inflationary environment, and fund money is very much in these markets, so when they decide to take profits, we will see the same volatility we have of late.

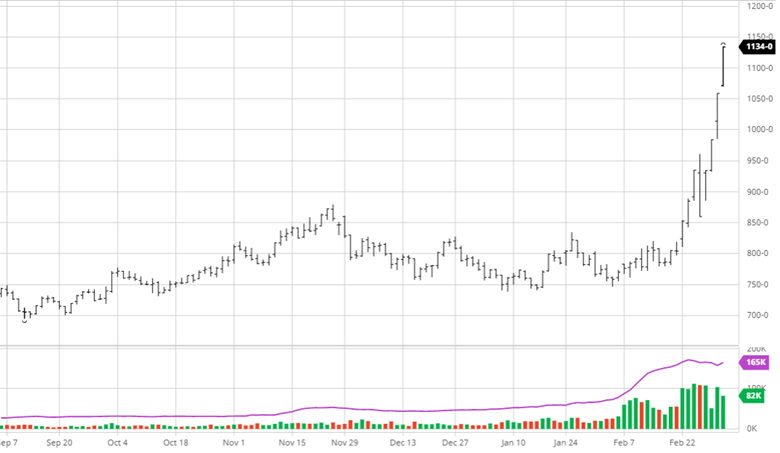

Soybeans gained on the week but barely when compared to corn and wheat’s gains. Corn and wheat are major exports for Ukraine and Russia out of the black sea area where beans are not, so they are not immediately affected. South America’s weather outlook has improved but will not turn around the crop too much after its rough start. Soybeans will benefit from the corn and wheat stories, but they also have their own story to follow in South America.

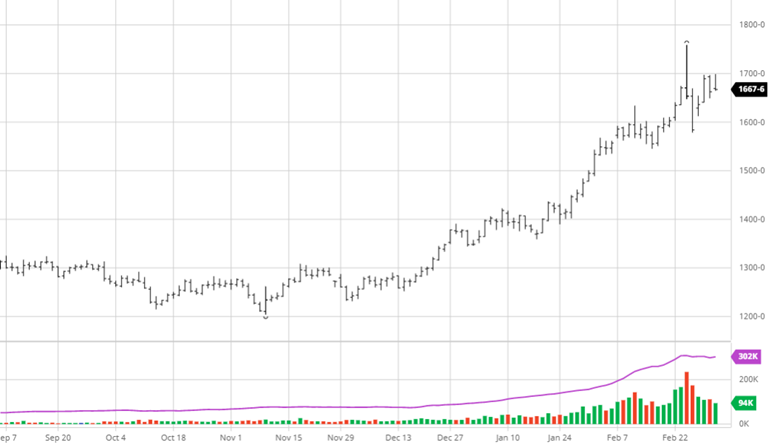

The soft red winter “Chicago” wheat is in full-on panic mode, as you can see from the limit move days in the chart below. The war in Ukraine does not seem to be ending soon, and the sanctions on Russia will last and hurt their economy. Eventually, the market will figure out what fair value wheat is, but for now, with the potential for Ukraine to not do their regular care of the crop, it is on a ride. If Ukrainian farmers cannot apply the fertilizer they usually do, the crop will shrink by several metric tons and could be double digits. Ukraine is the 5th largest exporter of wheat globally; Russia is number 1; this conflict will have major ramifications in the wheat market for the foreseeable future.

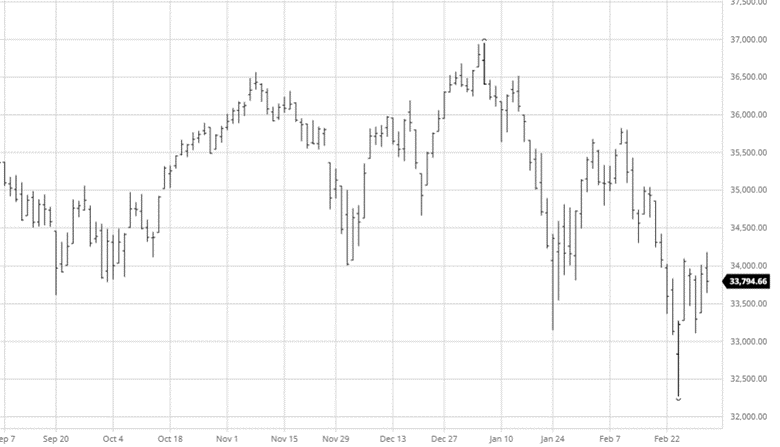

Dow Jones

This week, the equity market made decent gains as they have had a mixed trade the last few days. Jerome Powell said this week that it is all but a certainty that rates will be raised 25 basis points in the March meeting, lower than the 50 thought a few weeks ago before the war with Russia and Ukraine. Inflation has been bad the last year and will not improve soon with higher commodity prices across the board and Russian sanctions presenting a problem for some trade. Look for investors to focus on U.S. equities for the time being, as Europe and emerging market countries use Russia for a lot of their energy and could see issues with production and energy crunches.

Crude Oil

Crude moved higher this week as sanctions against Russia have made the future of Russian oil exports cloudy. The U.S. purchases roughly 600,000 barrels of crude from Russia a day, which does not help our already high gas prices. Crude still has room to go higher as ramping up production to make up for any lost oil takes months to do. If this conflict drags out, we will see elevated fuel prices through the summer and be a larger expense on the farm than the last few years going back to 2014. The 10-year chart below shows the current levels to 2014 to help you budget if you did not hedge your fuel prices.

Podcast

Tune in as biotech guru Dr. Channa S. Prakash discusses everything from Alabama football, genetics as one of the most extensive agricultural advancements, the most significant risk factors to feeding the world over the next 30-50 years, plus everything in between.

Why producing crop plants with a much gentler footprint on the natural resources will help feed the growing population. How 75% of the world’s patents in agriculture gene editing are coming from China. Understanding that trying to impose restrictions on our ability to grow food can be a considerable risk to agriculture. Listen to hear about these topics and more!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].