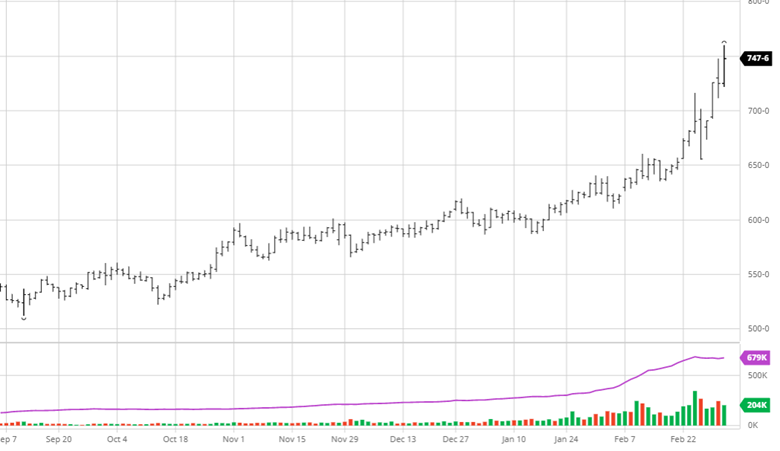

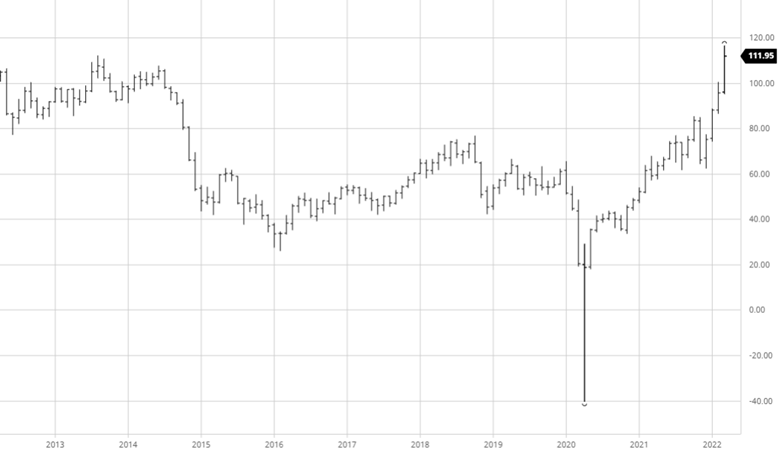

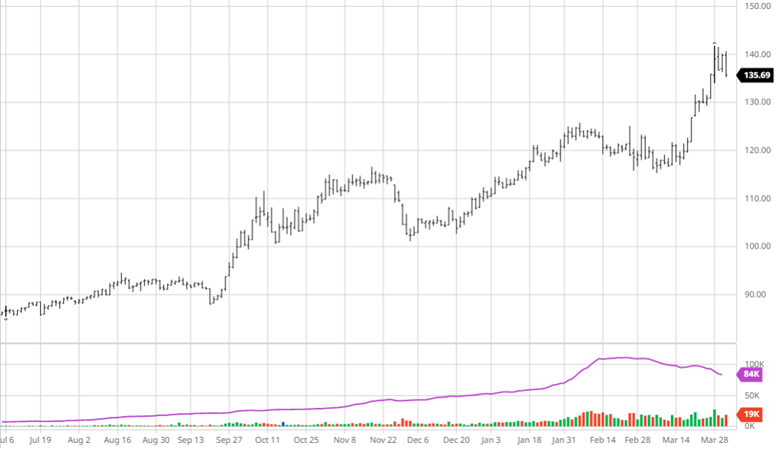

A bullish USDA Prospective Plantings report for corn saw both old and new crop corn getting a boost on Thursday. The USDA sees corn-planted acres for all purposes in 2022 at 89.5 million acres, down 3.87 million from last year and well below the average trade estimate of 92 million. Several factors might have played into this number but going from 92 million acres at the USDA Ag Forum to this number a month later is very interesting. Input prices and supply chain woes likely played a major role in the USDA predicting more bean acres than corn as the cost per acre to raise corn will be very high this year with the risk of not receiving all inputs in time. On top of the fallout of the war in Ukraine, this lower number should see tightening on the world balance sheets even with a record yield this year.

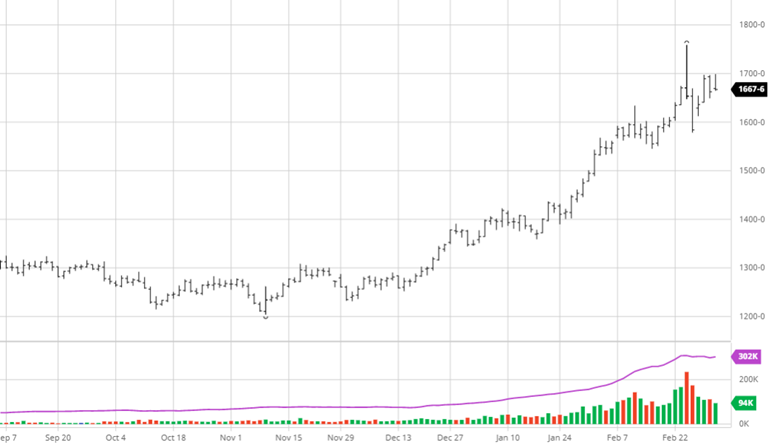

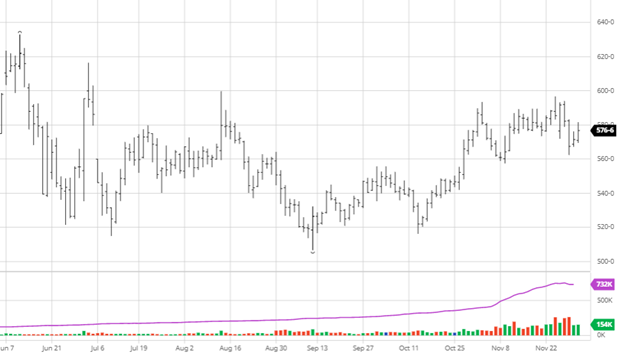

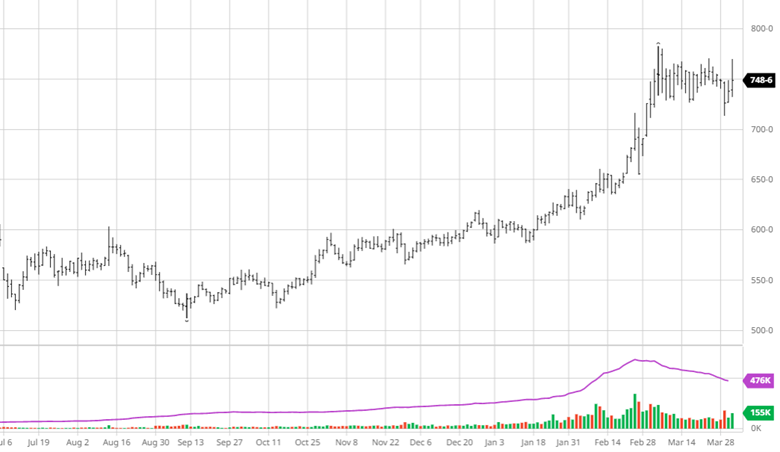

Soybeans had a bearish report as the USDA came out with 91 million planted acres in the US for 2022. This would be a record for planted acres and 4 percent higher than last year, with planted acreage being up or unchanged in 24 of the 29 estimating states. Fewer inputs are needed per acre to grow beans than corn played a major role in the shift in acres year to year. How the market trades in the next few days will be interesting to watch as 91 million is a lot of acres, but the world needs it, so will it actually be enough?

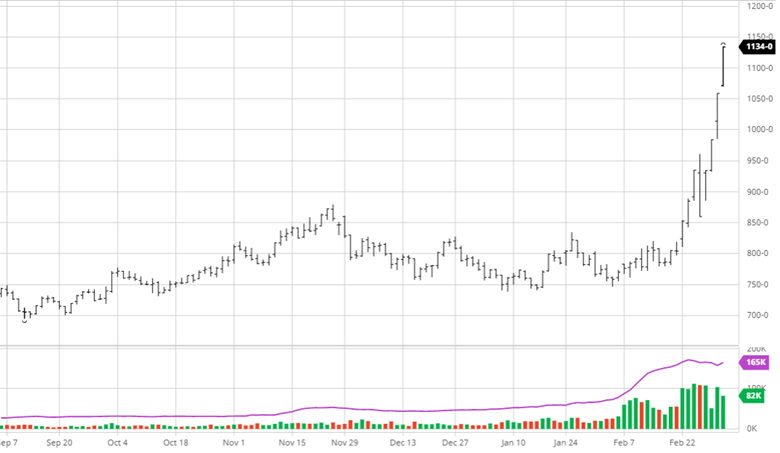

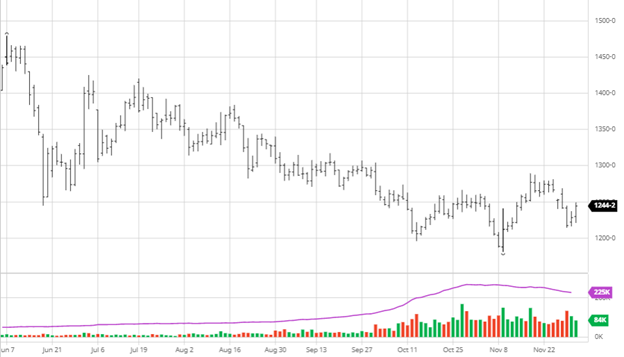

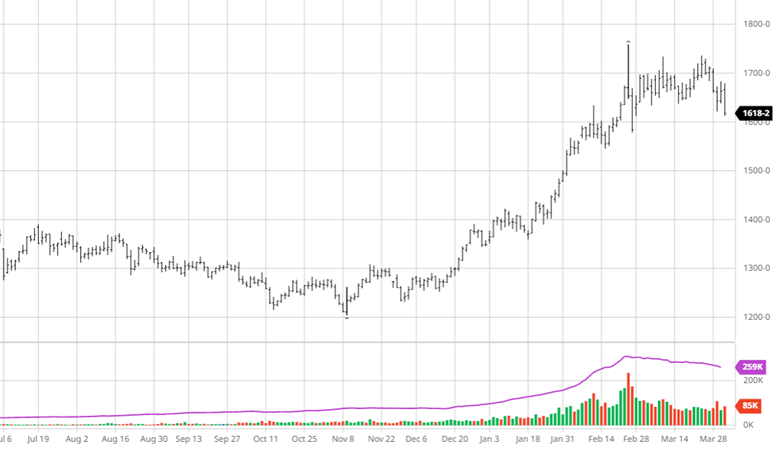

Wheat remains vulnerable to Ukraine and Russia news while also figuring out its value in the world market. Wheat acres came in at 47.351 million, lower than the pre-report estimates — 2022 winter wheat planted area at 34.2 million acres and (23.7 million HRW, 6.89 million SRW, 3.62 WW) 11.2 million acres of spring wheat. China’s poor crop and the issues with the U.S. crop seem to be priced into the market possible, but for the time being, Russia’s war in Ukraine will be the market moving news.

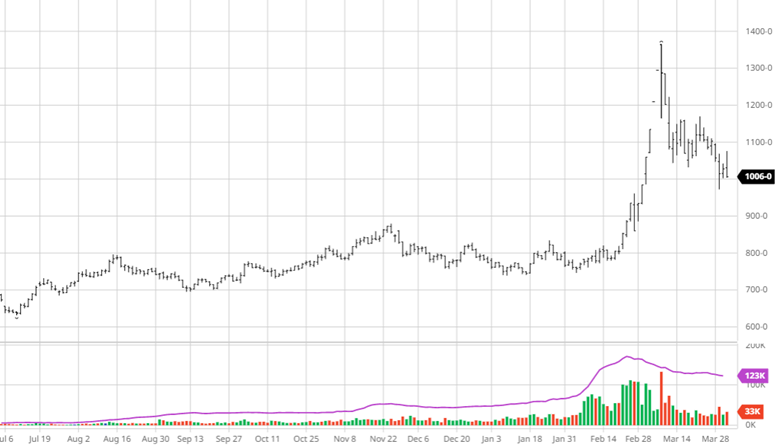

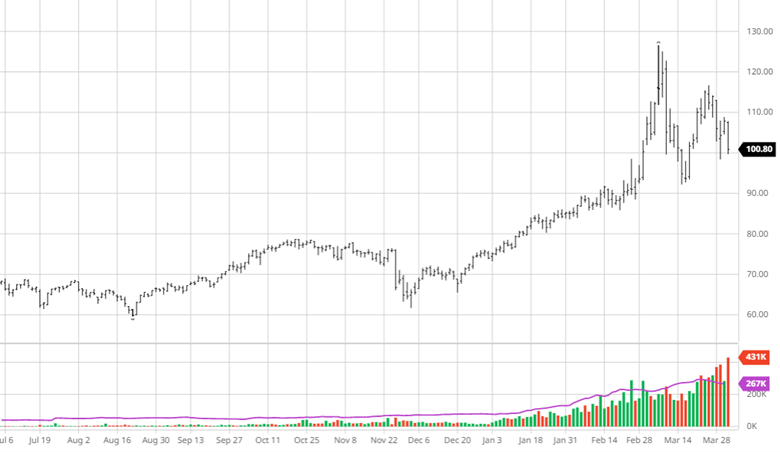

Cotton made another jump higher this week before falling following the report. Cotton acres came in at 12.2 million acres, up 9% from last year. Many growing areas have been dry this winter and could use a spring rain to help improve planting conditions. World demand is still present, so the US will have buyers if they can produce a crop. The old and new crops have been over $1 for several weeks now, making it easier to plant than when it was in the 50 cent range a couple of years ago.

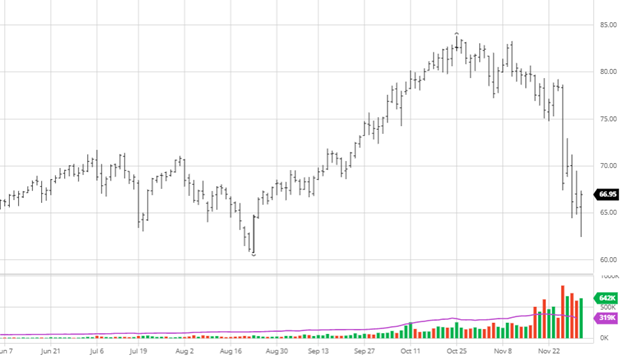

Crude continued its move lower this week with a couple of large intraday ranges. The Biden administration announced that it would release 1 million barrels of oil a day from the Strategic Petroleum Reserves to help fight higher gas prices. The big dip came from rumors of progress in peace talks in Ukraine that seemed incorrect as the conflict continued. The Biden administration also wants to make companies with leases on federal land “use em or lose em” but that would take months to years to go from 0 production levels. When Democrats want to shift to EVs and other “green” energy, it is hard to see why companies invest capital when that party wants to get rid of their dependency as fast as possible.

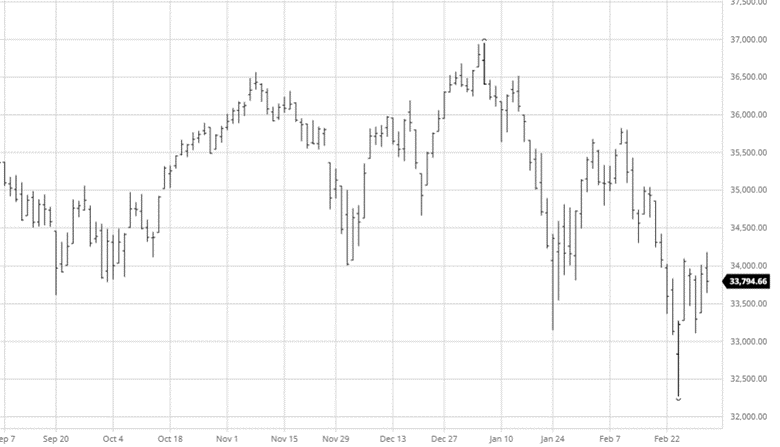

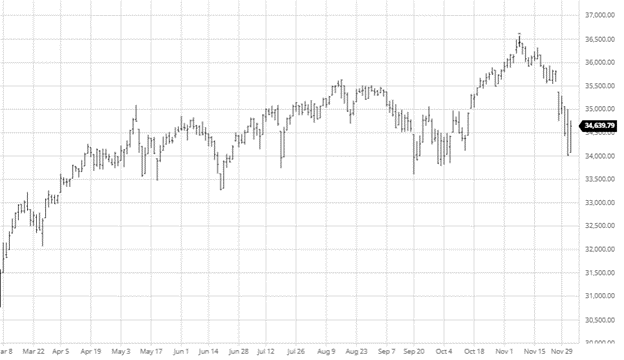

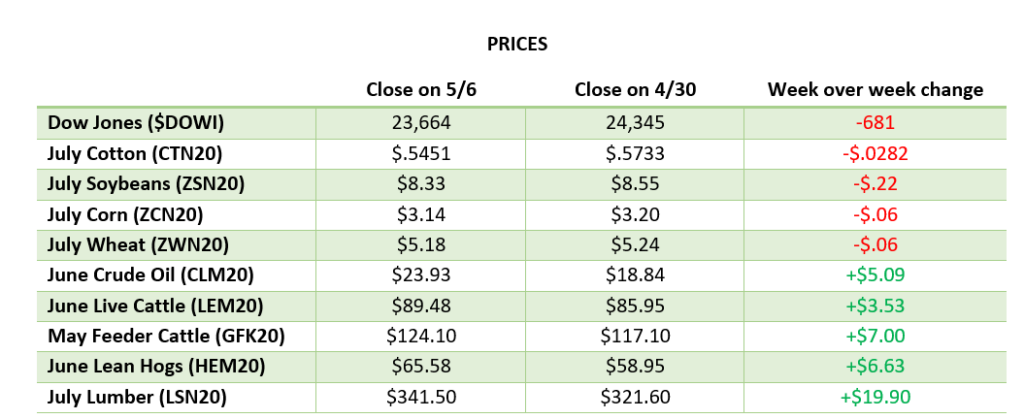

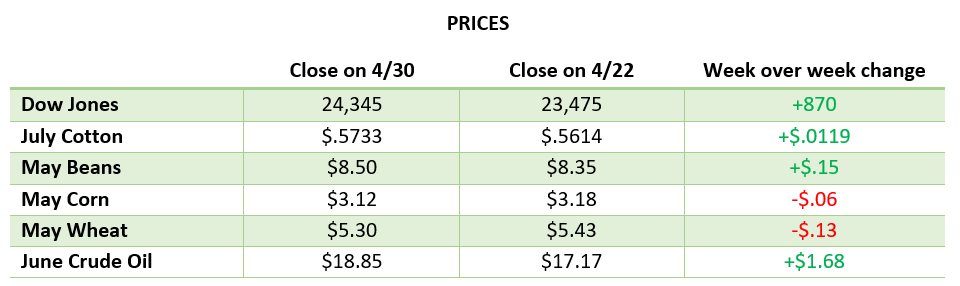

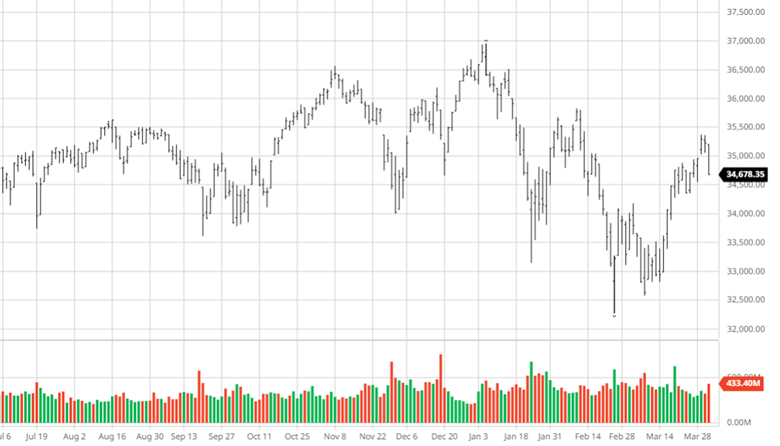

Dow Jones

The equity markets fell slightly during the week due to Thursday’s fall into the close of trading. The 2/10 yr treasury yield inversion has been the main talking point this week as it could be a signal of a recession. While it does not always mean there will be a recession, we have not had a recession without that happening, even though it is usually over a year later. Q1 ended this week after a few months of losses, volatility, confusion, and inflation, and it is hard to see it calming down anytime soon.

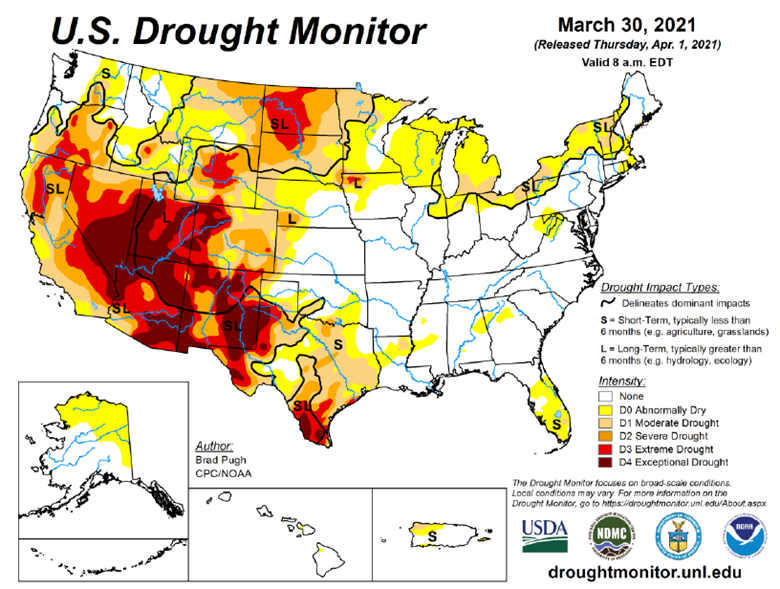

Drought Monitor

The drought monitor below shows where we stand heading into April compares to last year.

Podcast

RCM Ag Services put a unique spin on National Agriculture Day by going international. That’s right, we jumped right into international waters with Maria Dorsett from USDA’s Foreign Agriculture Services for an interesting discussion about linking U.S. agriculture to the rest of the world.

Each year, March 22 represents a special day to increase public awareness of the U.S.’s agricultural role in society, so why not take it one step further by bringing in a global component? As the world population soars, there’s an even greater demand for producing food, fiber, and renewable resources. That’s why we’re taking a deeper dive into the USDA’s trade finance programs, like the GSM-102, which supports sales of U.S. agricultural products in overseas markets and supports export growth in areas of the world that are seeing some of the fastest population growth.

So, jump aboard (no passport needed), as Maria discusses how U.S. companies use GSM-102, what the program features, and the benefits that it offers!

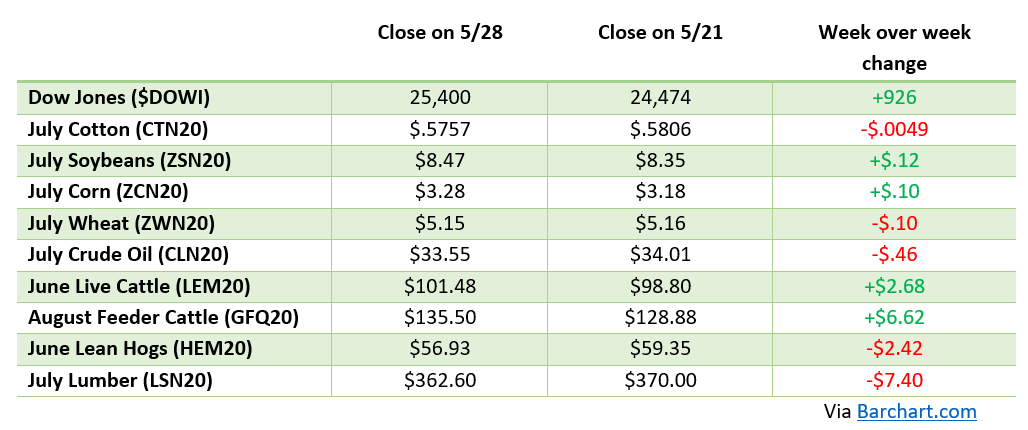

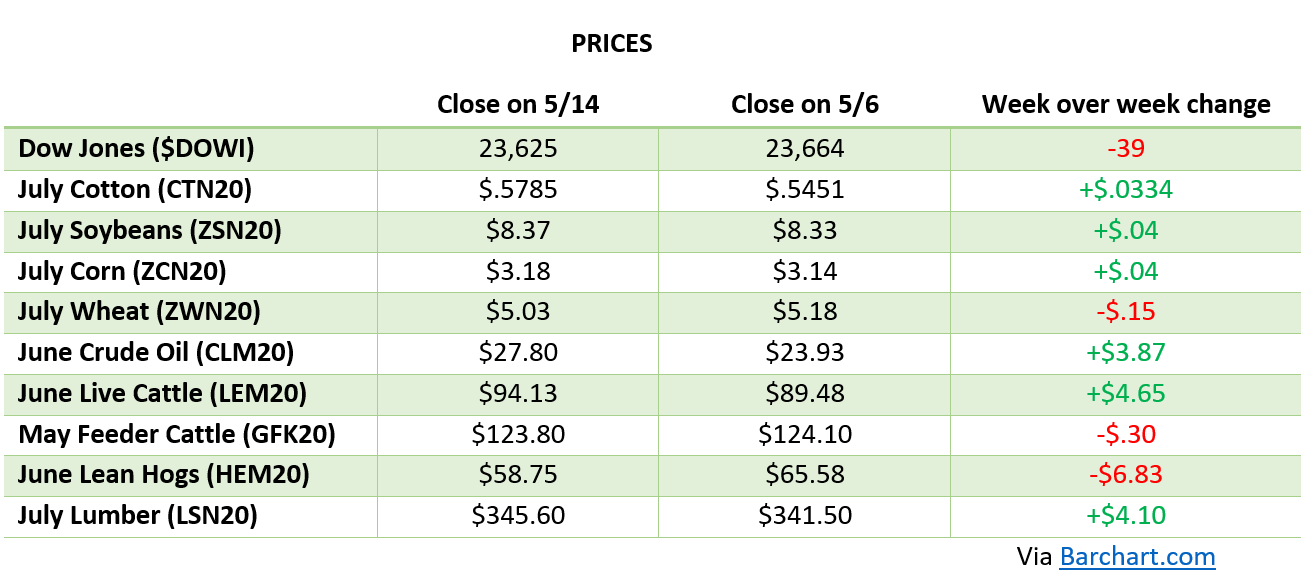

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].