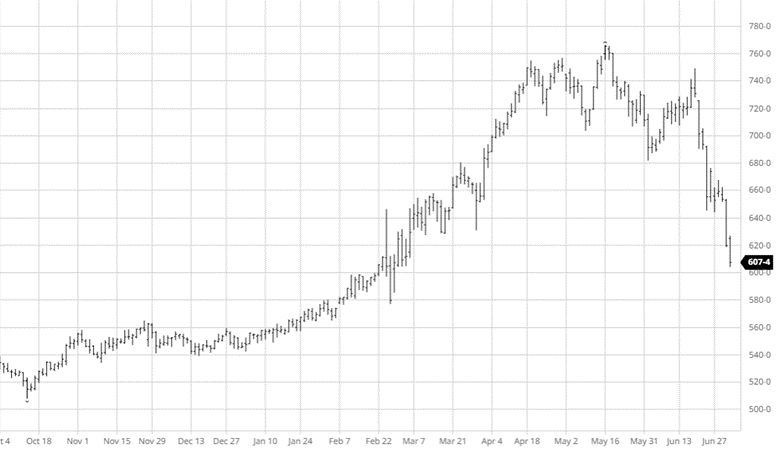

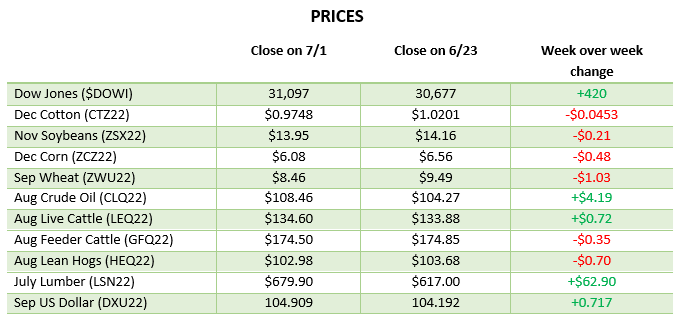

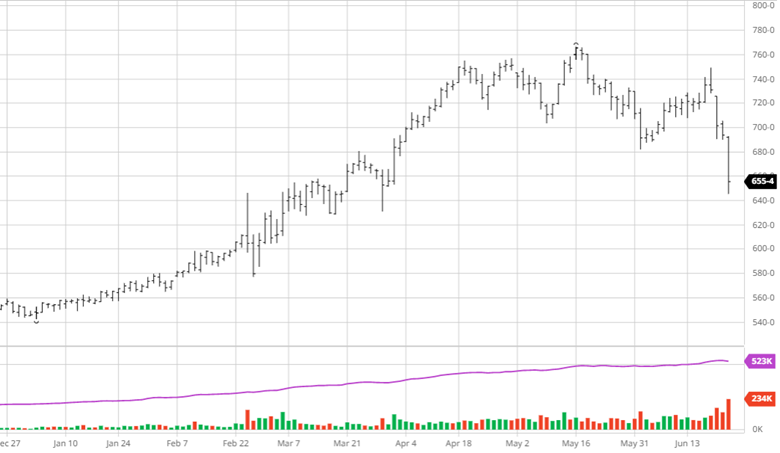

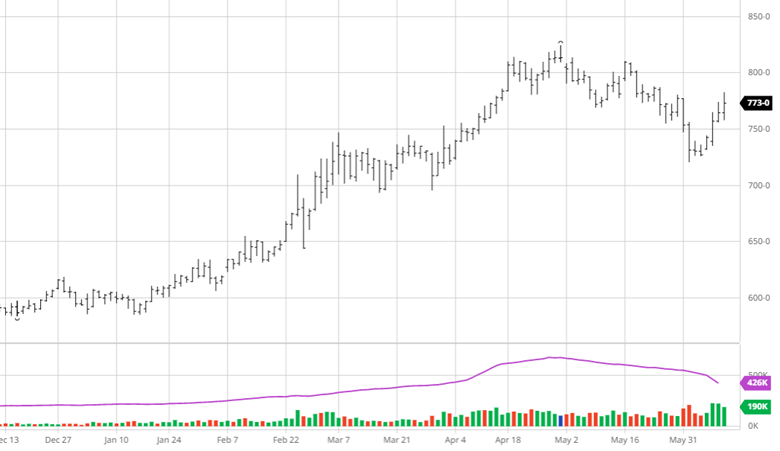

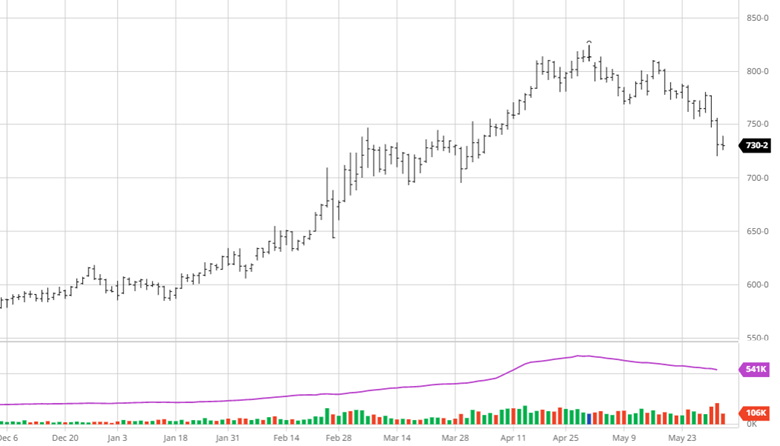

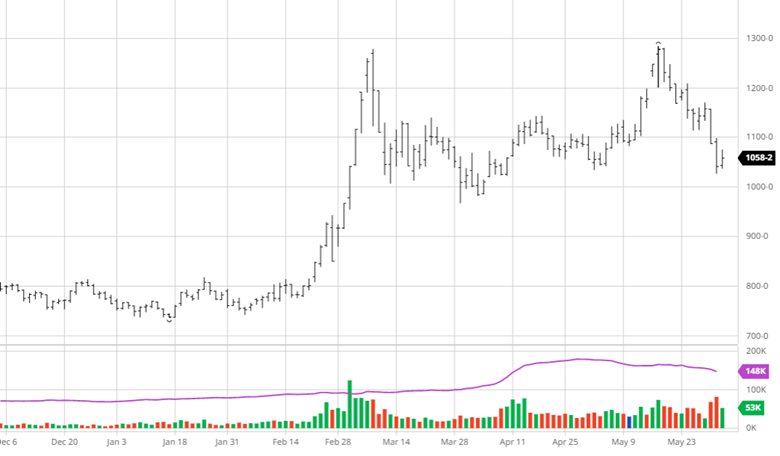

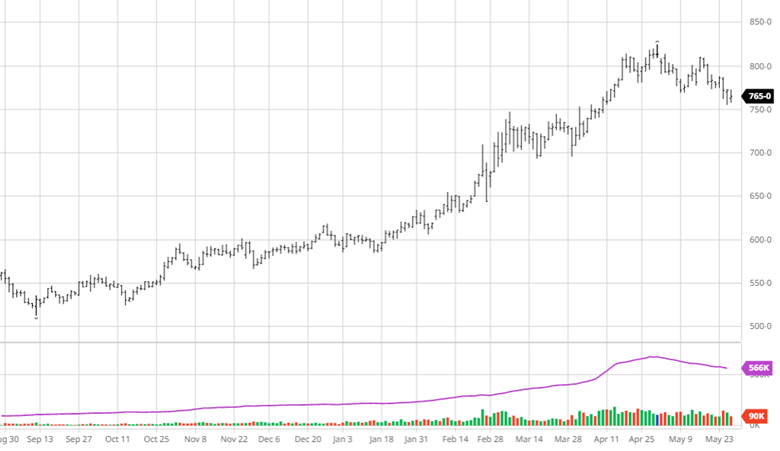

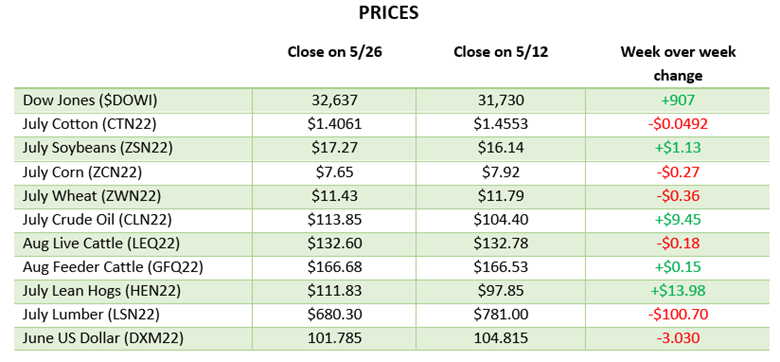

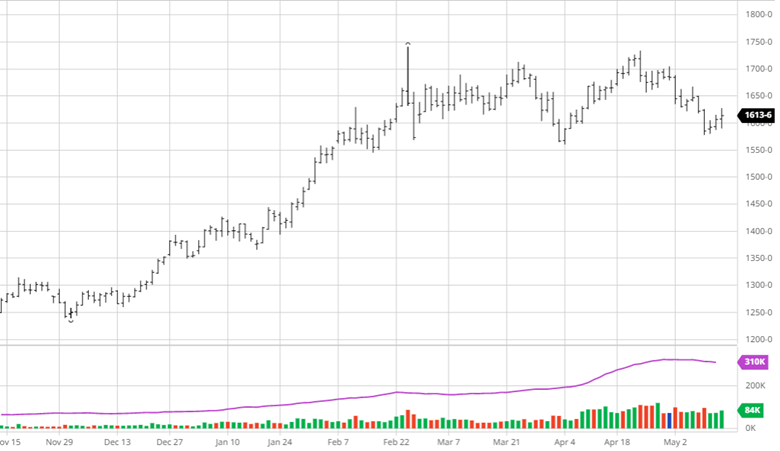

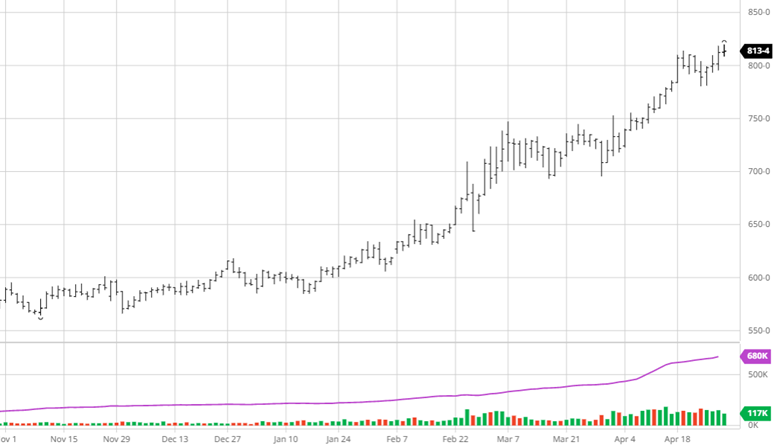

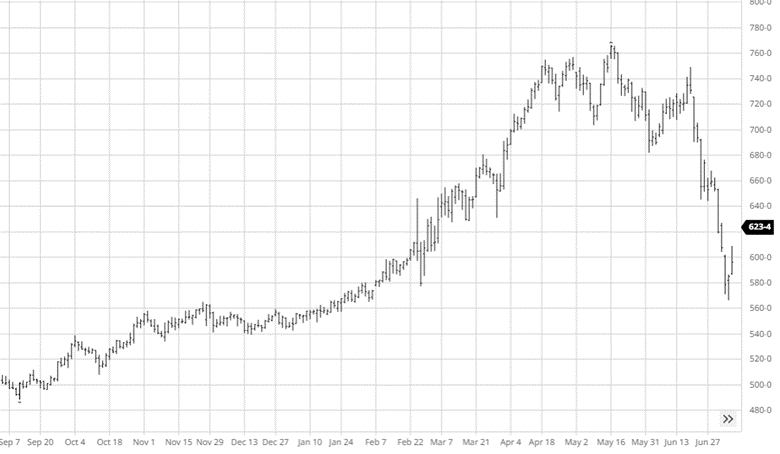

Corn bounced back to end the week after a brutal start. Corn was pressured to start the week with rain this week across large areas and recession fears that would lower demand for fuel and ethanol as energy prices started the week off poorly. Funds over the past couple weeks were unloading some positions as well but that looks to have slowed to end the week with some getting back in. The bounce back to end the week looks to be partly driven by hot and dry weather expecting to get back to the western corn belt next week and slowly continue east. The July USDA report will be released Tuesday July 12th and will be the next major news that could affect the market.

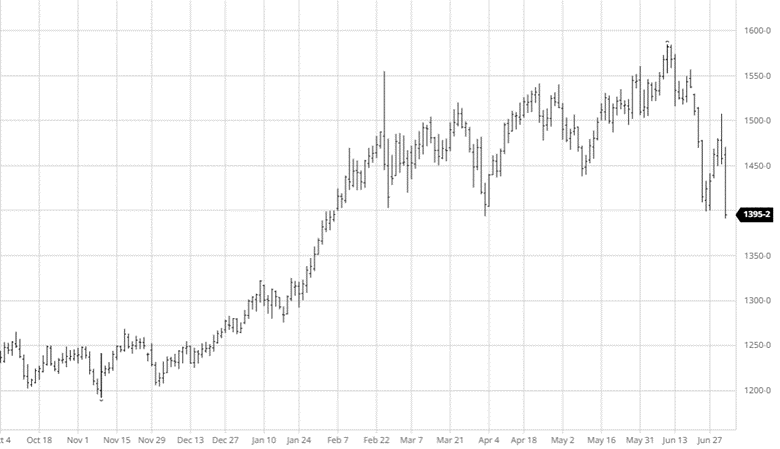

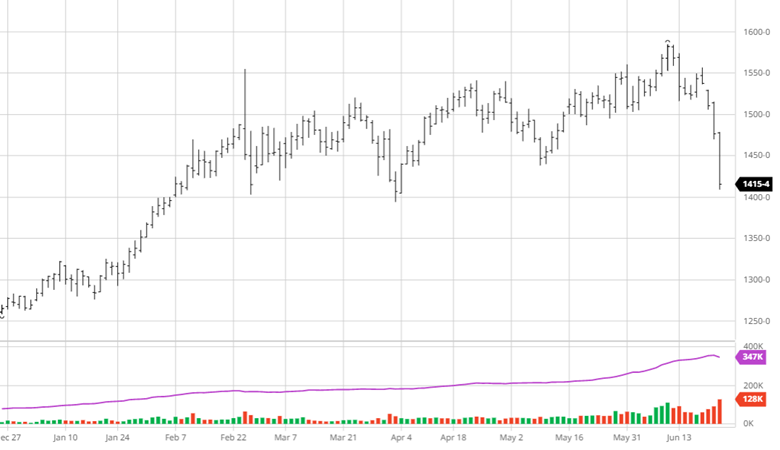

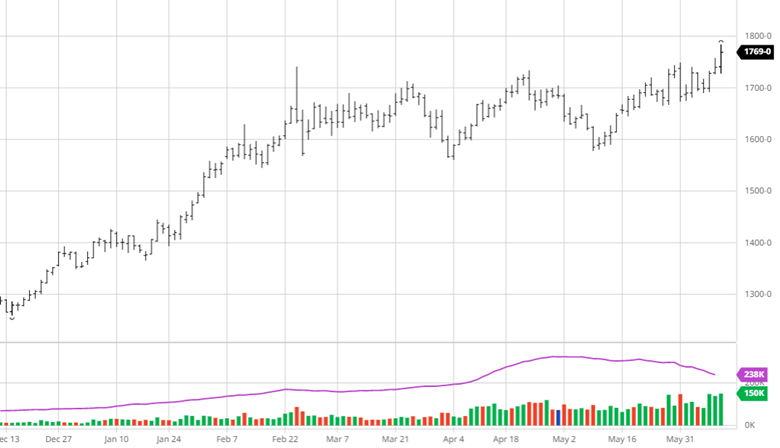

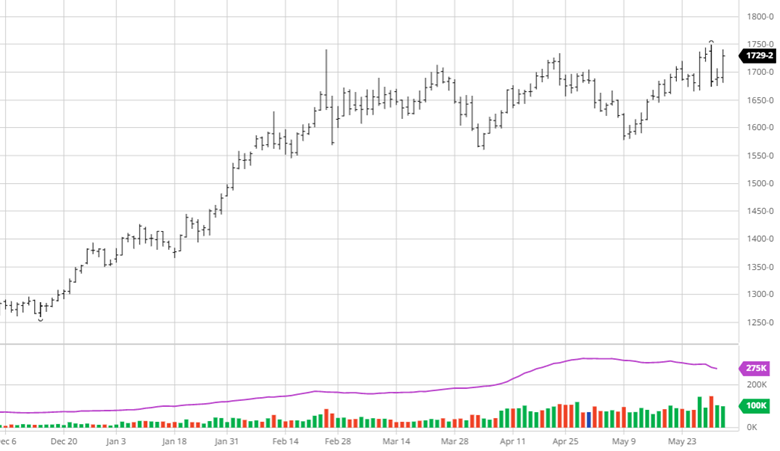

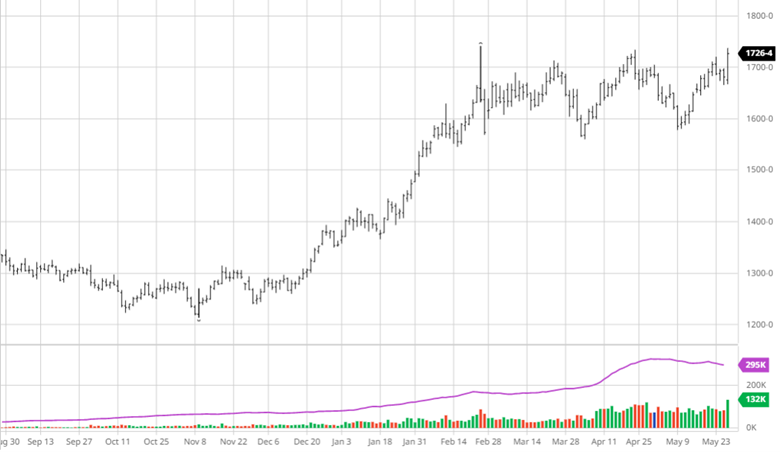

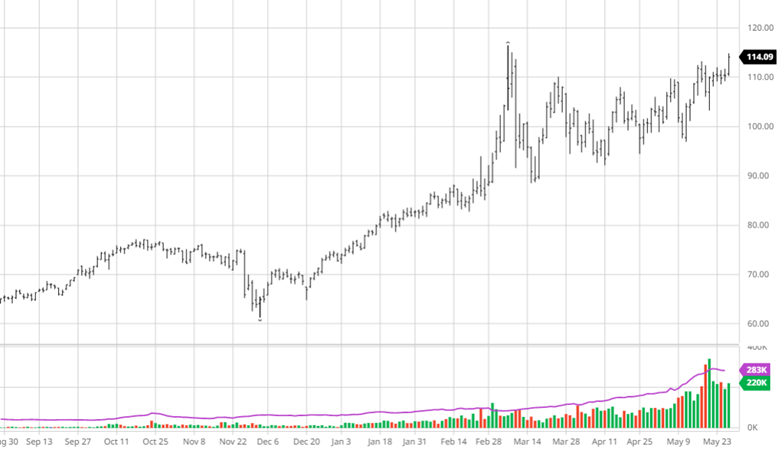

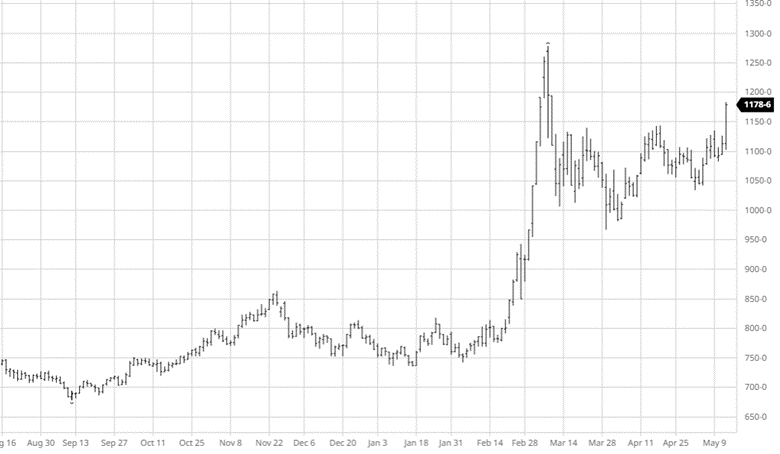

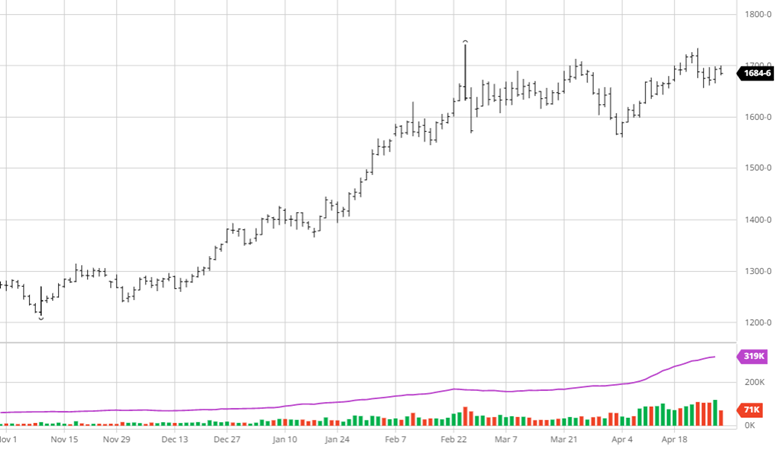

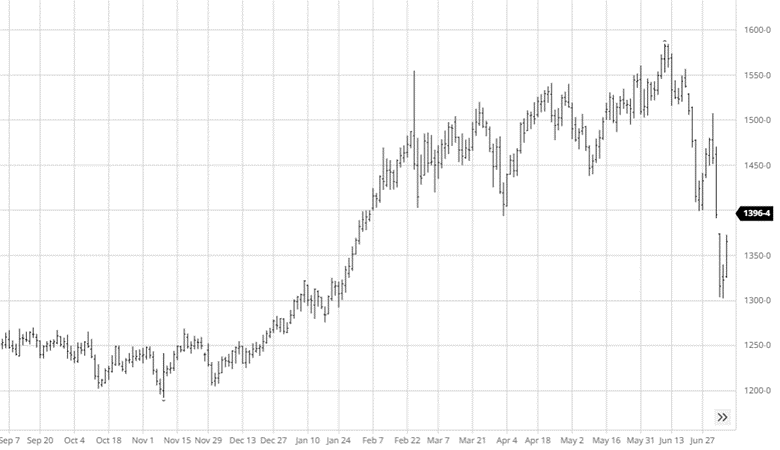

Soybeans have traded like corn and on relatively the same news of weather and fund liquidation. The rain in the Midwest to start the week pressured beans lower while Chinese purchases were rumored to switch to Brazil. The drier outlook over the next couple weeks after this weekend will pressure beans after the last USDA report lowered acres considerably. The move after the last couple weeks following the report that lowered acres by over 2 million did not really match up and left many scratching their heads. Tuesday’s report may shed some light on the direction moving forward and what we need to keep an eye on.

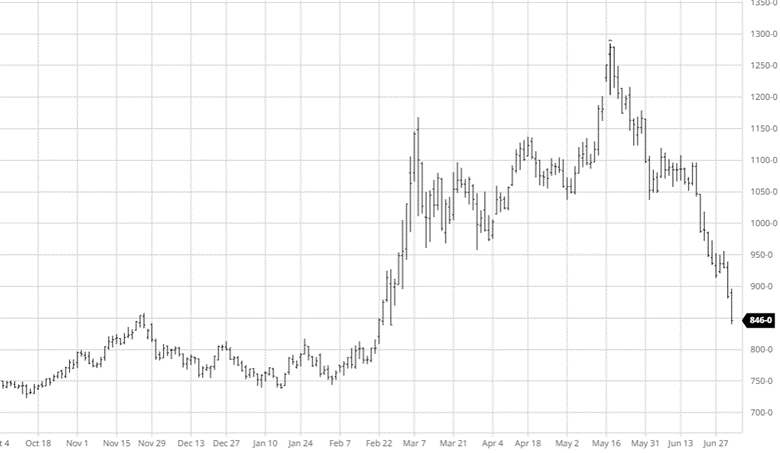

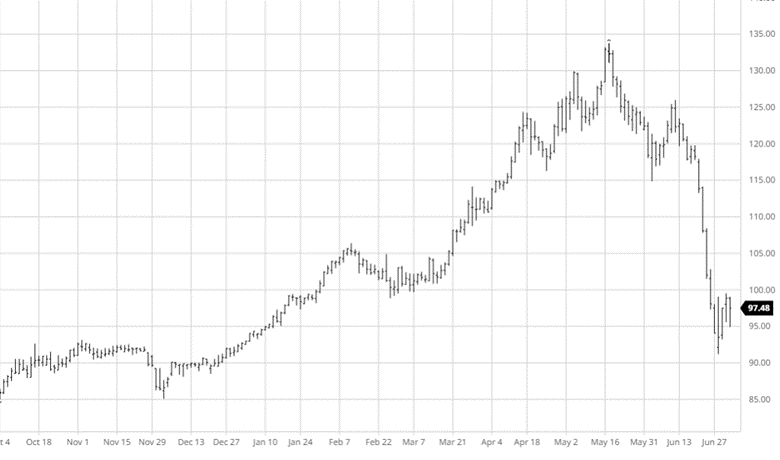

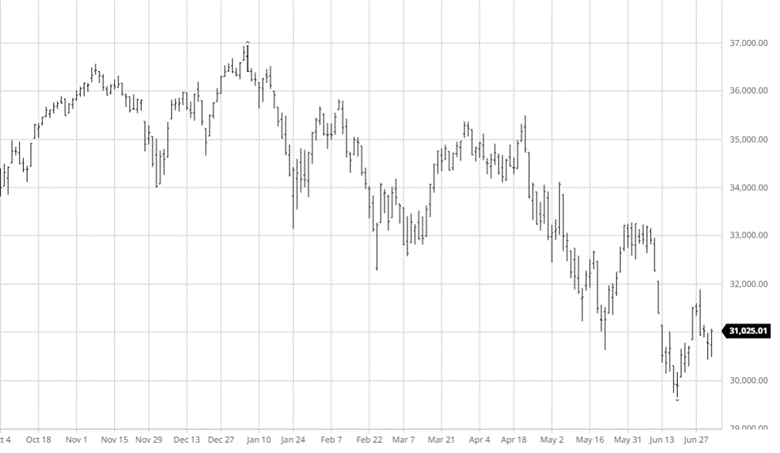

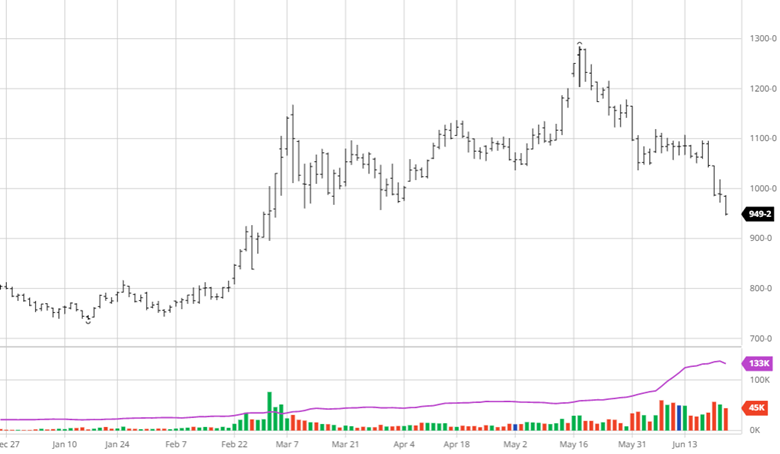

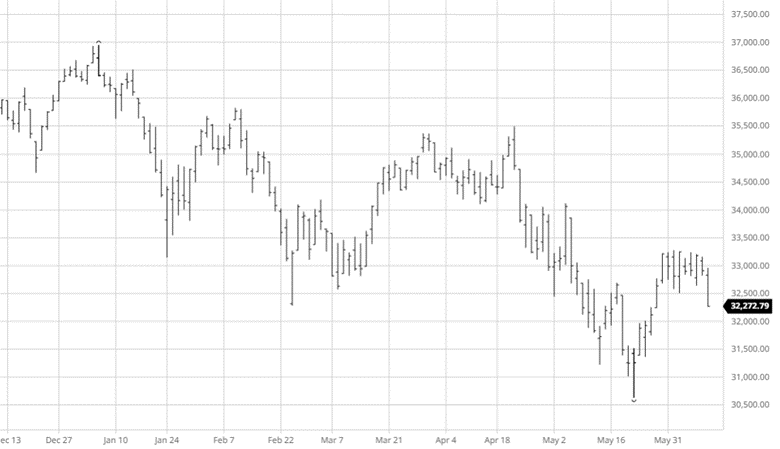

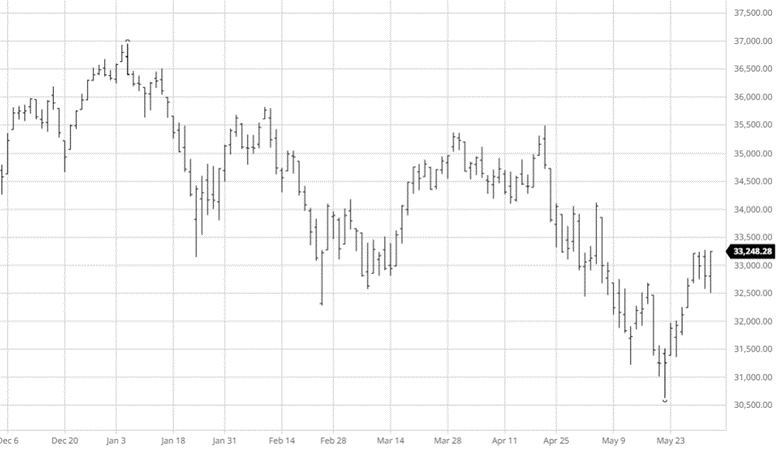

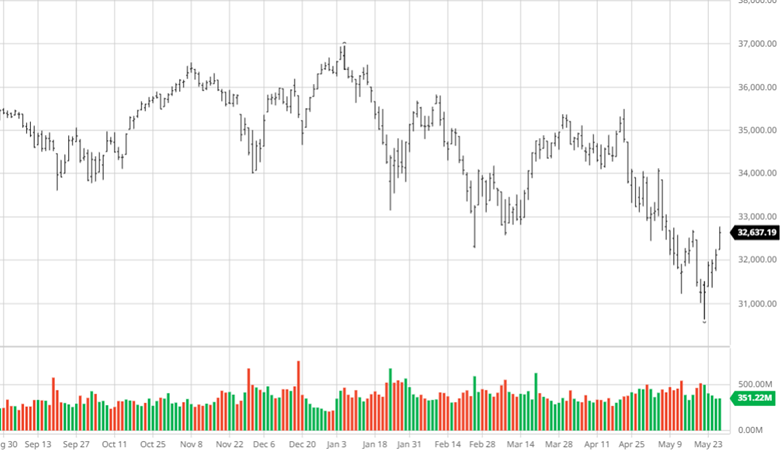

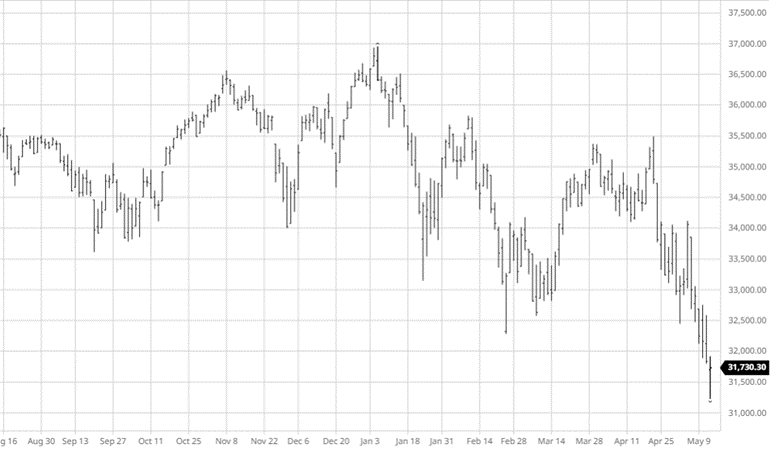

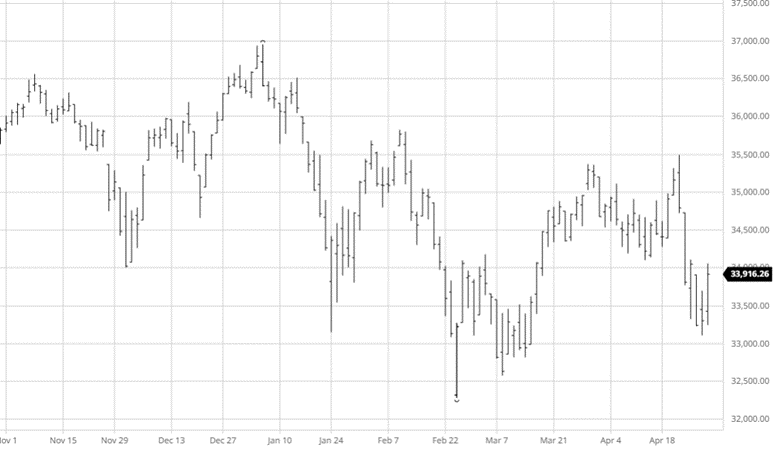

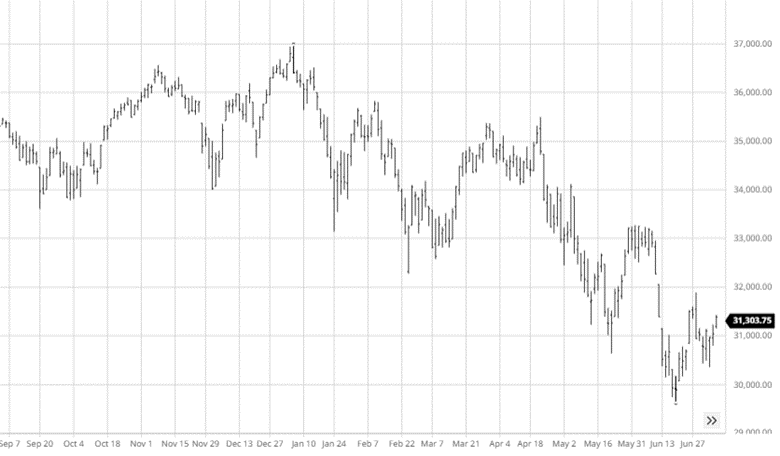

Equity Markets

The equity markets had a fairly level week with some up and down days. The Fed minutes were close to a nonevent as the markets didn’t react. The Fed will probably raise rates by 75 points again in July but their guidance on what will happen after will be important to help recession and inflation fears.

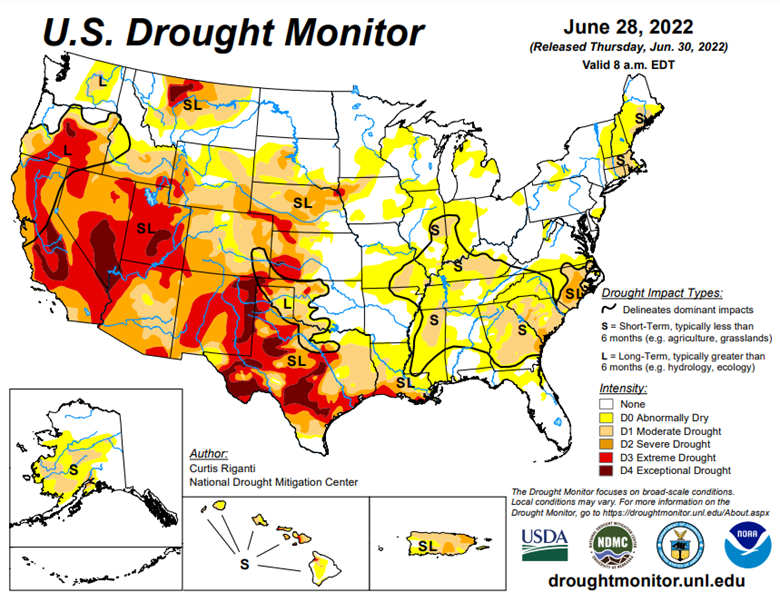

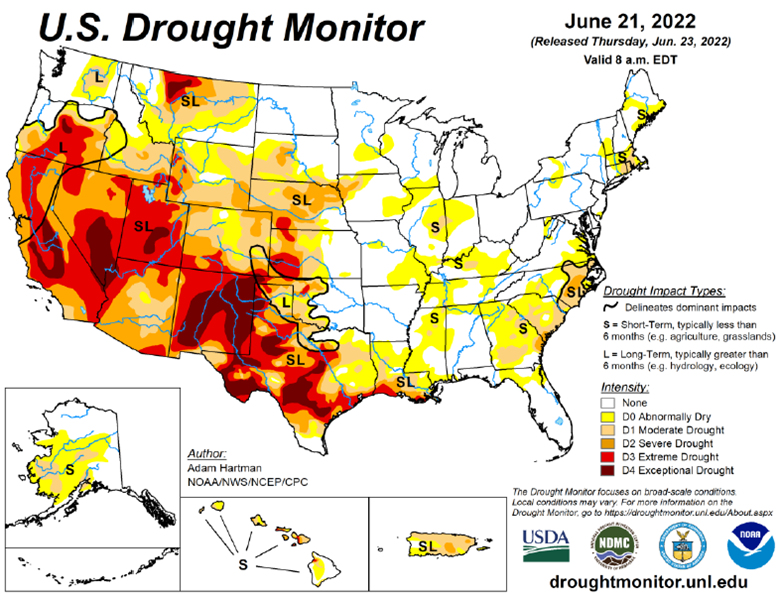

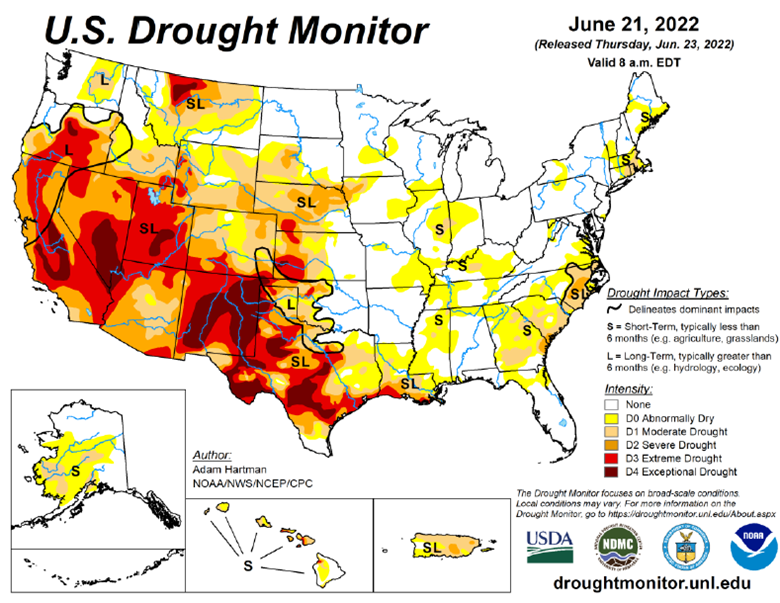

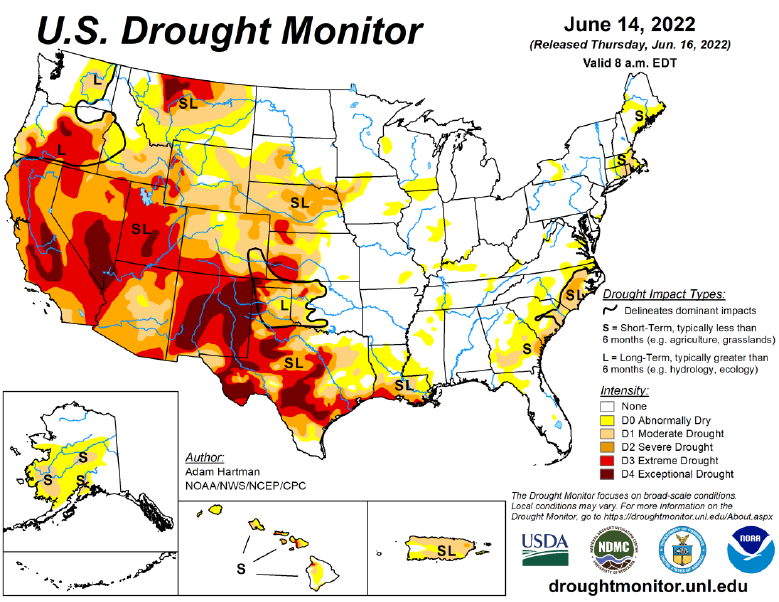

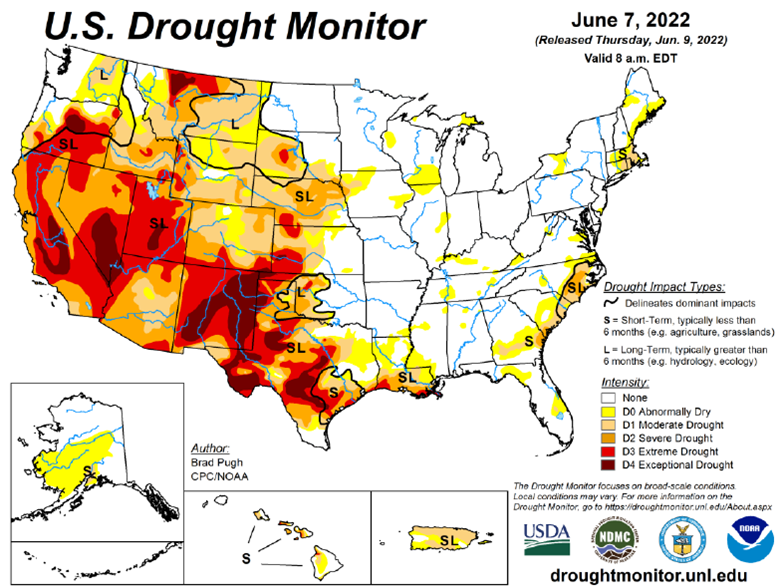

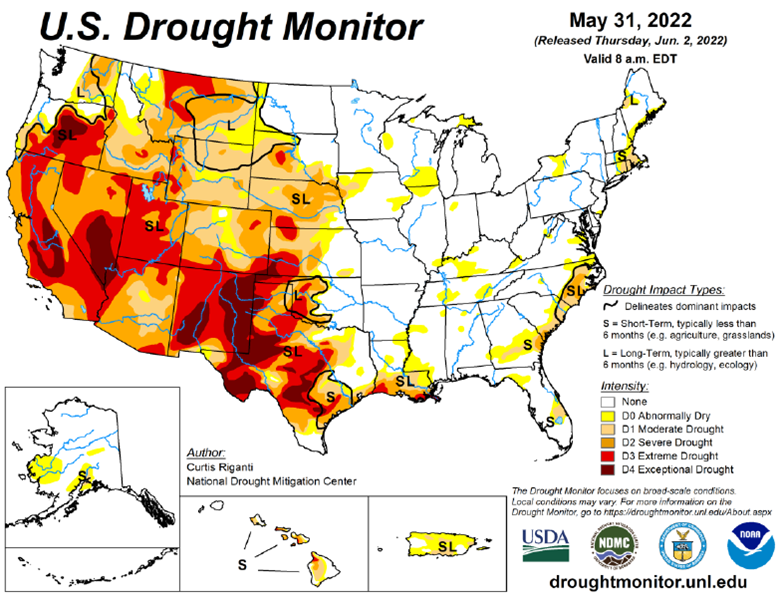

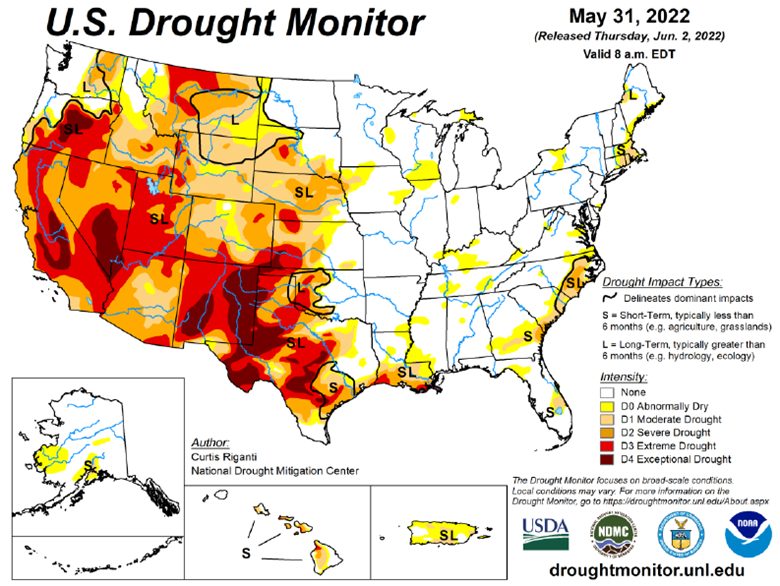

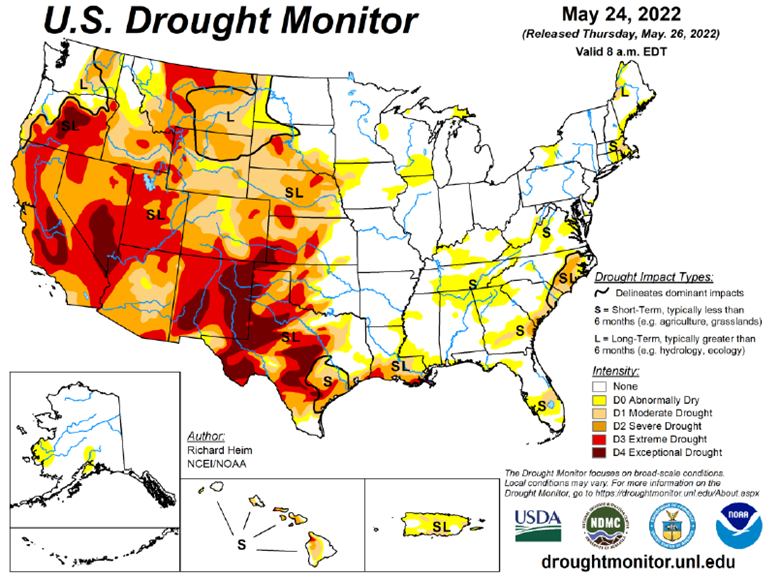

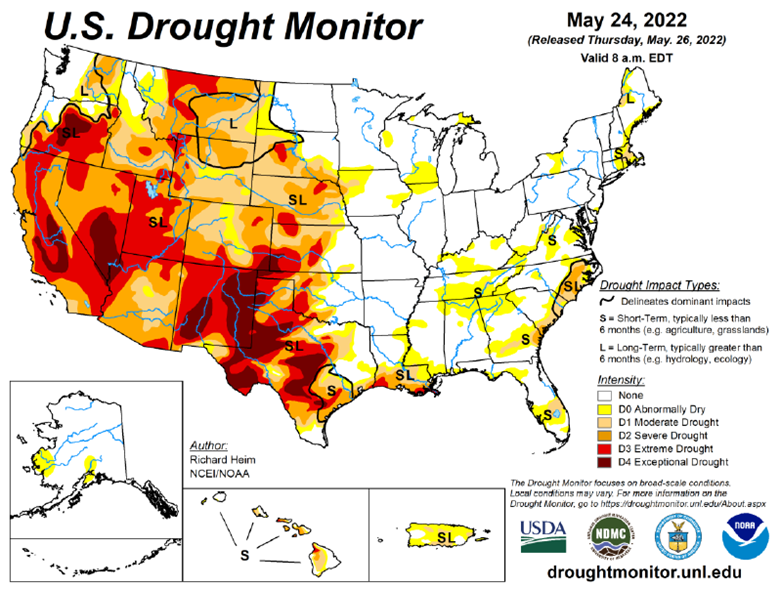

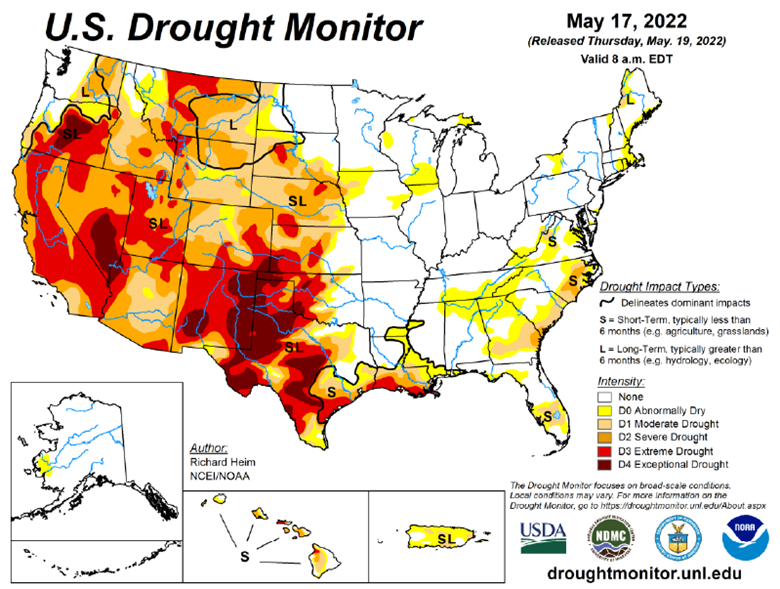

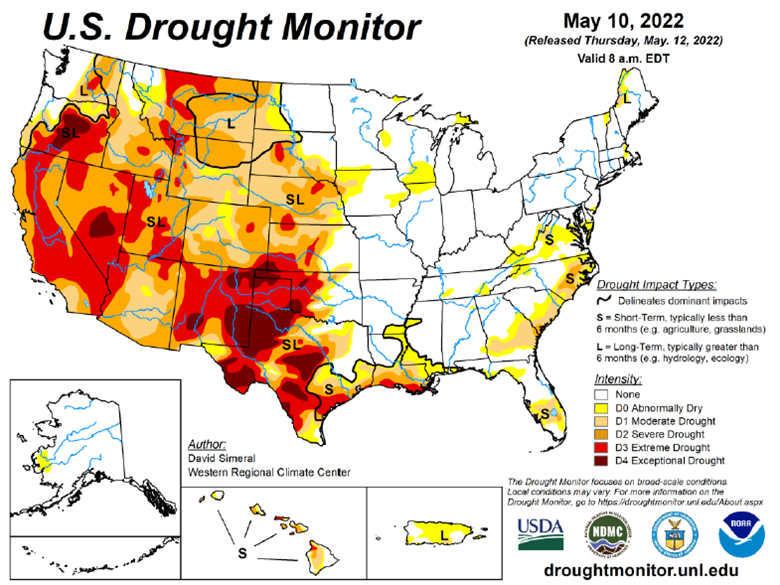

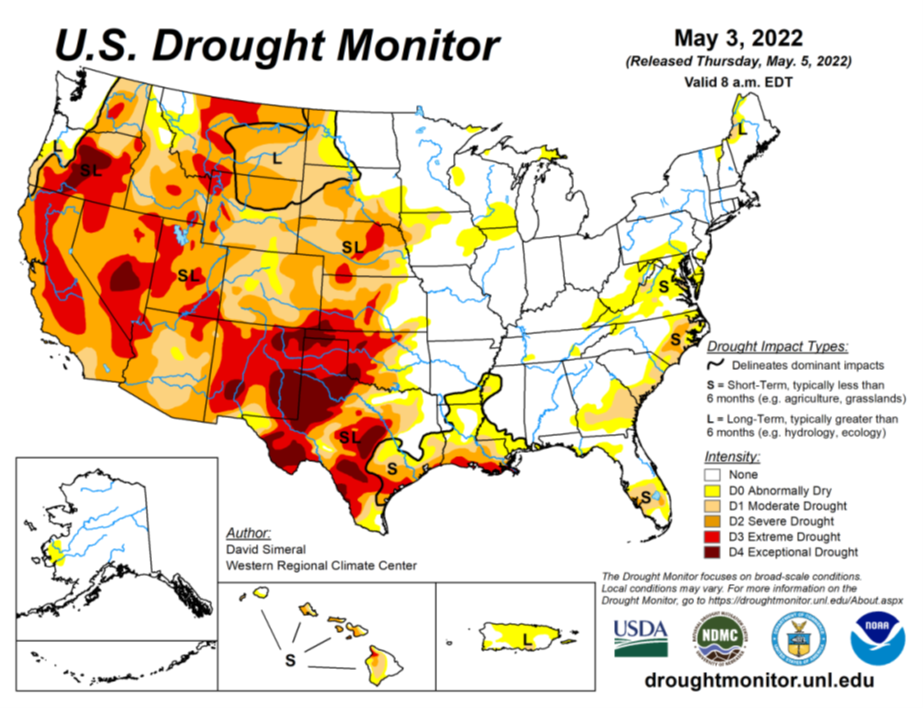

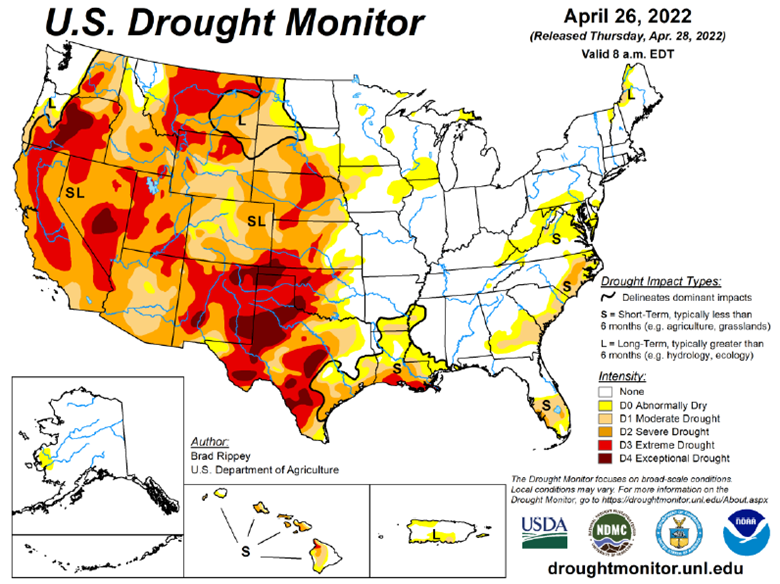

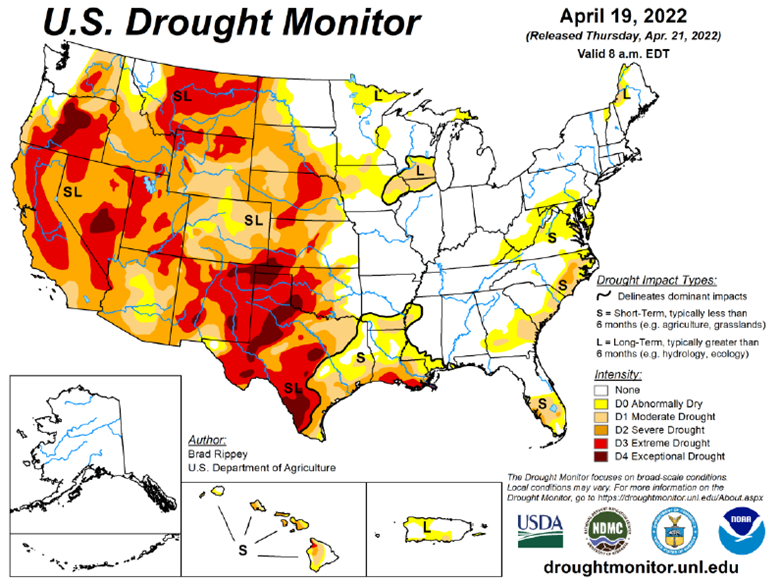

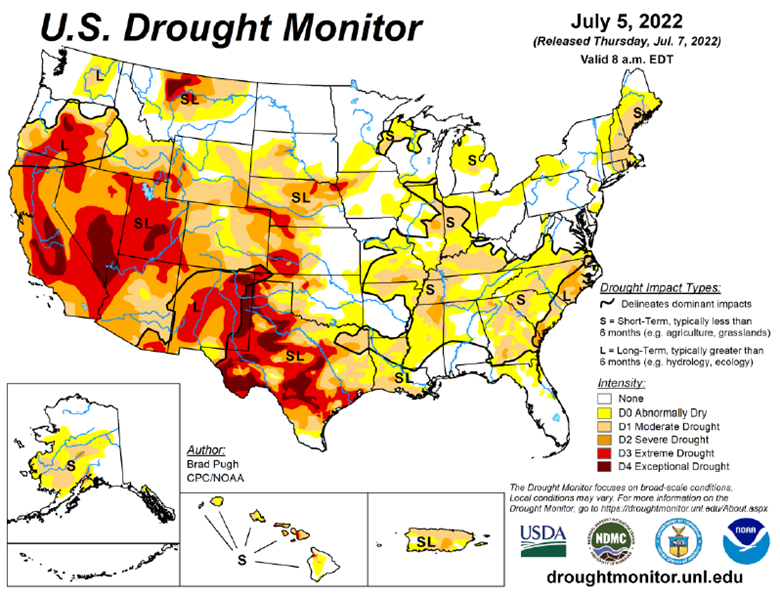

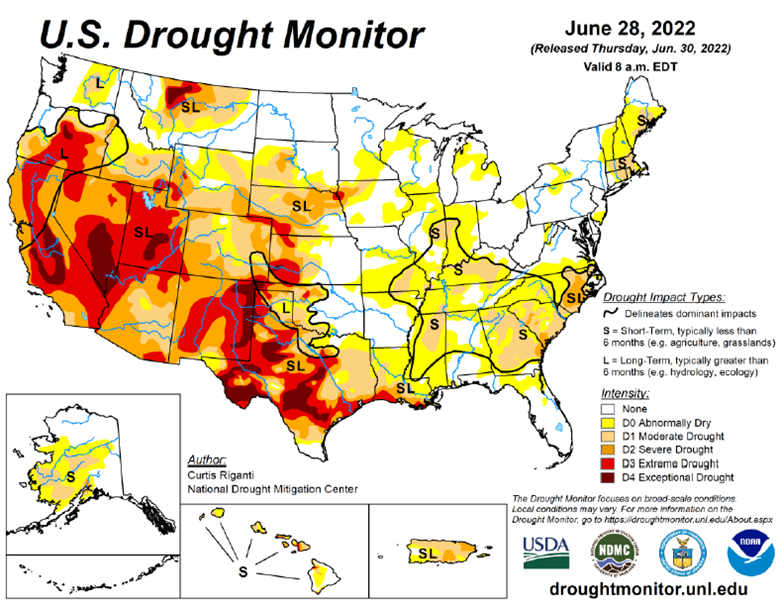

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

There is an agriculture tug of war happening across the nation, impacting America’s farmland. Fertilizer prices are continuously fluctuating, and it has us taking a page the “The Clash” should we stay, or should we go?! And we aren’t the only ones. Many farmers are asking their agronomist and chemical salespeople, “what will fertilizer cost me the rest of the season, and what are my options if I don’t want to go all-in on my typical fertilizer treatment plan?”

In this episode of the Hedged Edge, we are joined by a special guest who needs no introduction in his local circle, Dick Stiltz. Dick is a 50-year veteran of the fertilizer and chemical industry and is the current Agronomy Marketing Manager of Procurement fertilizer and crop protection at Prairieland FS, Inc in Jacksonville, IL. He is at the pulse of the current struggle and here to discuss the topic at hand.

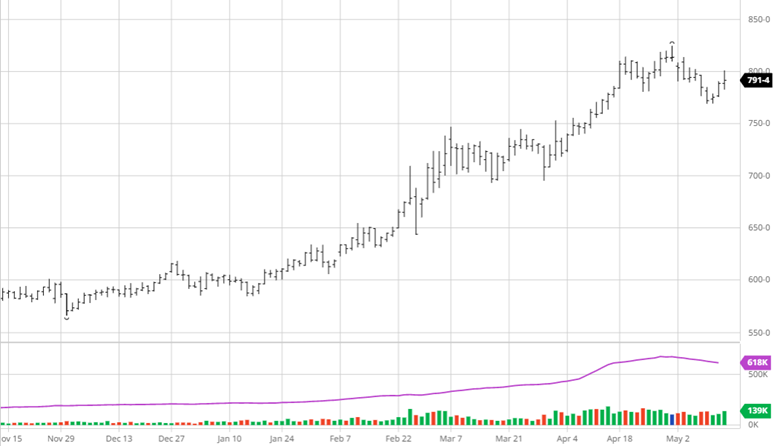

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].