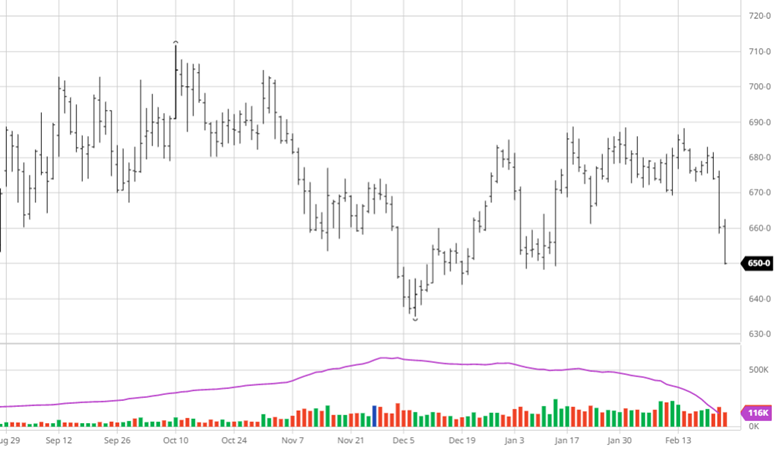

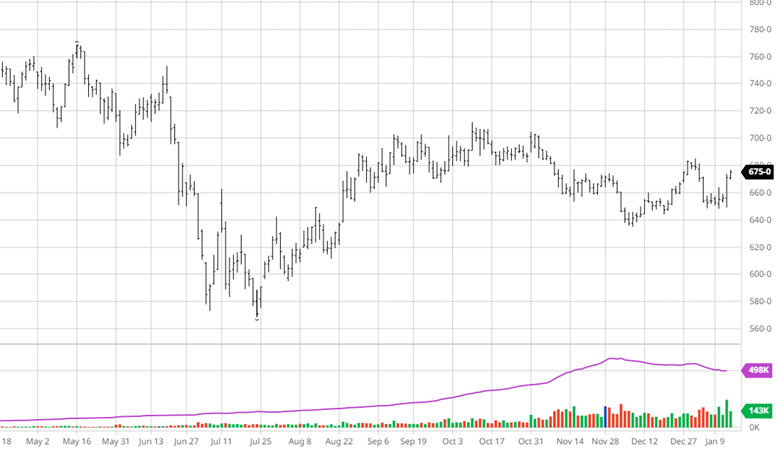

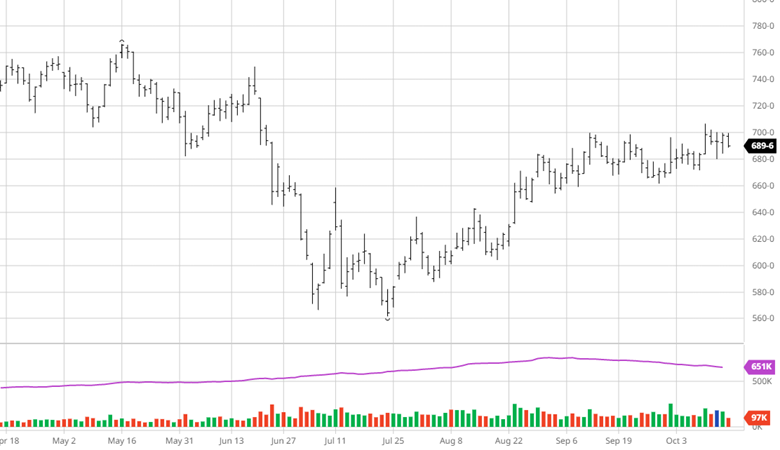

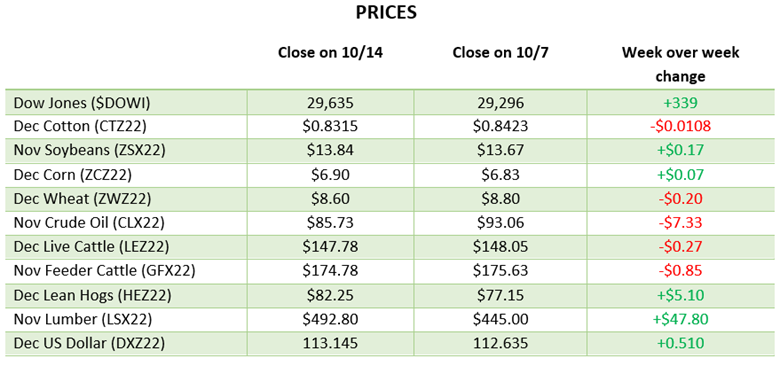

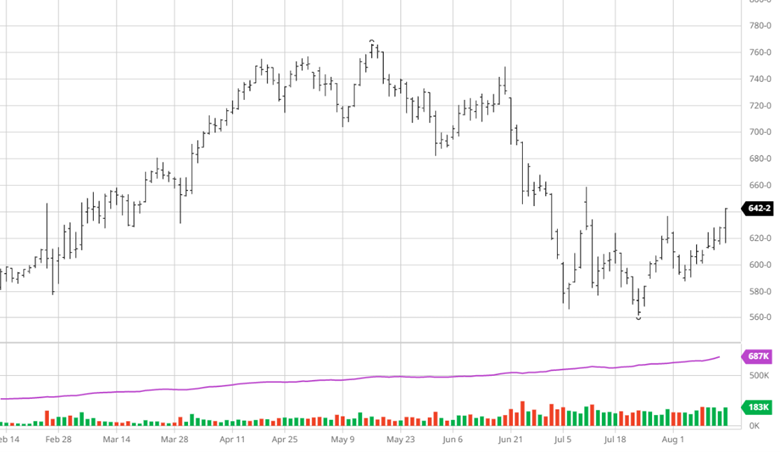

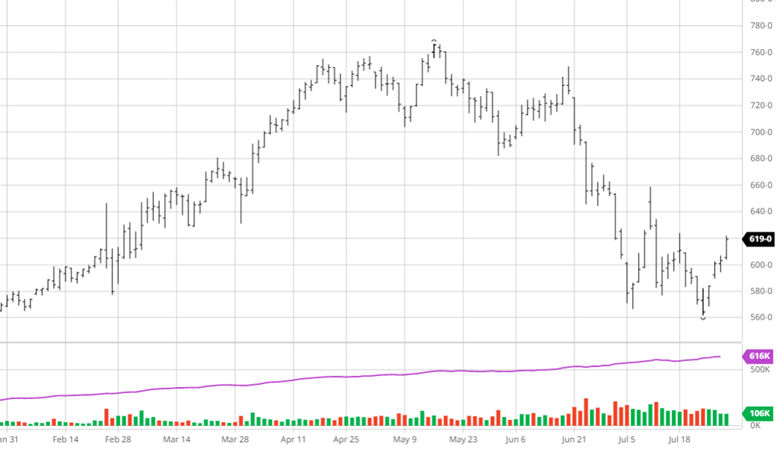

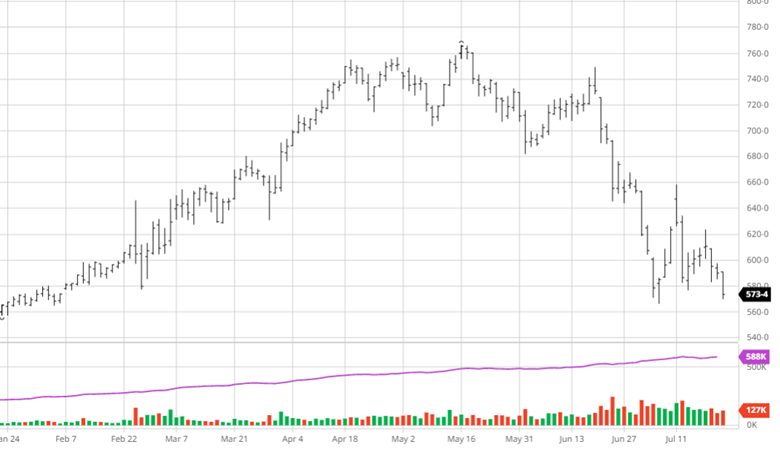

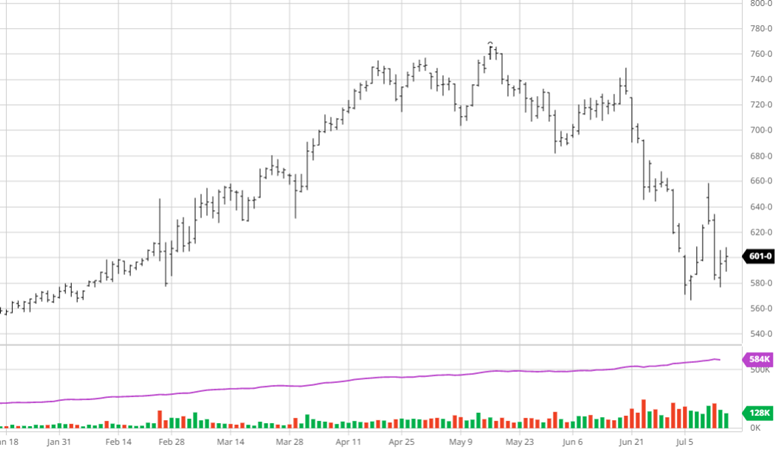

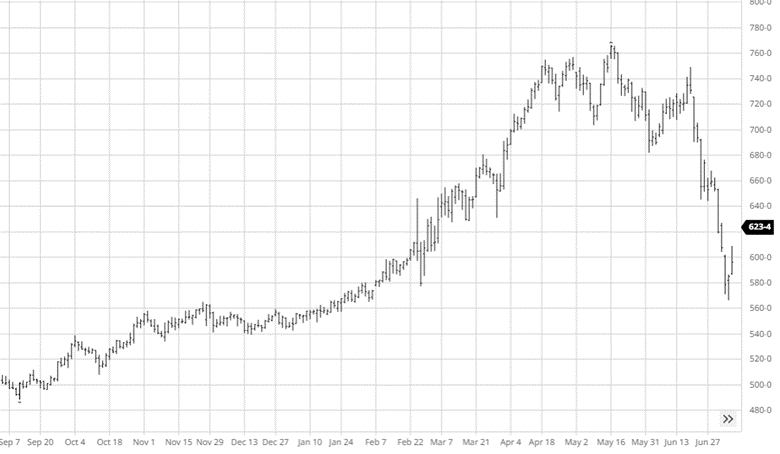

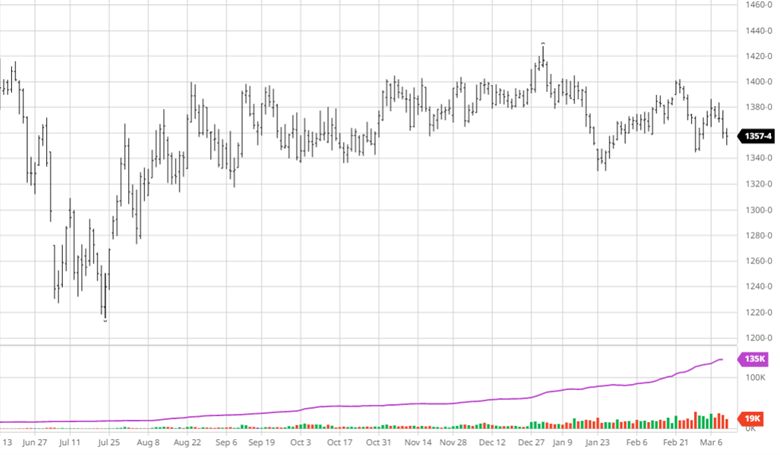

The last 2 weeks have not been friendly to corn despite a neutral to bullish USDA report this week. The USDA lowered Argentina’s production by 40 mmt, but the crop could still be smaller amid a historically poor weather year in Argentina. Corn took a nosedive to end the month of February and has taken another leg lower this week, with the new crop hitting $5.50. After a flat trade for most of February the move lower presents farmers with important decisions regarding what to do for crop insurance. With the Feb average price of $5.91, 40ish cents higher than current levels, farmers should seriously look at the highest level of revenue protection you can get. The premiums will likely be high, but the recent price movement has created an uncertain environment with a long way to go.

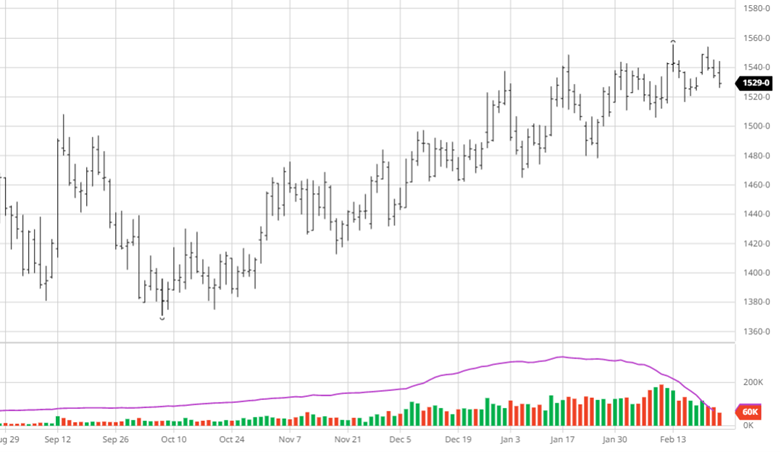

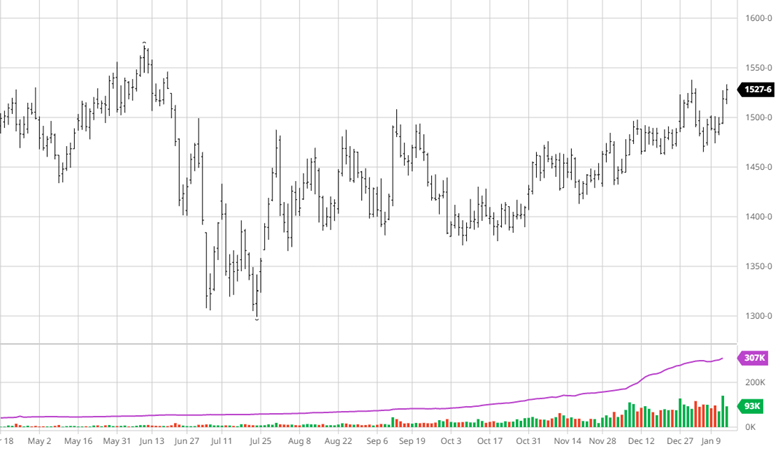

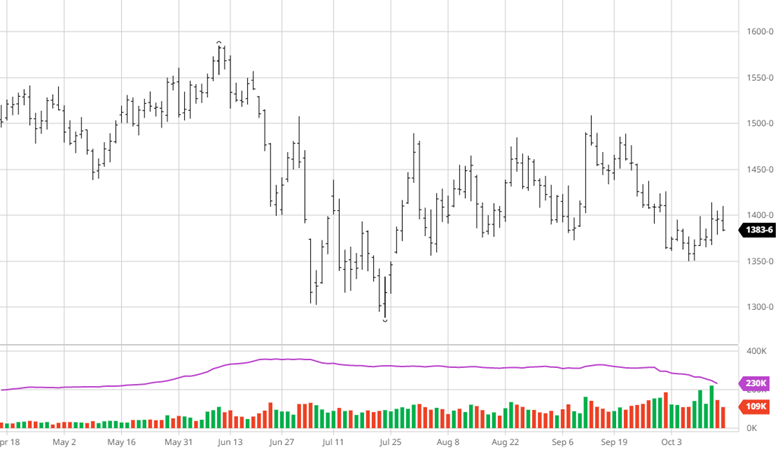

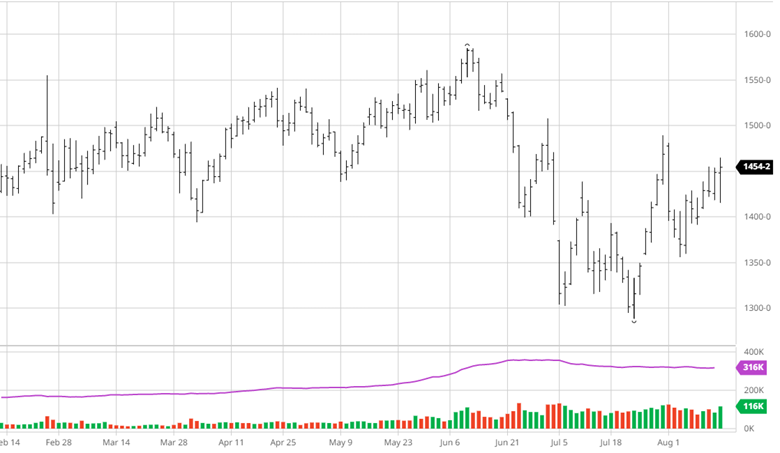

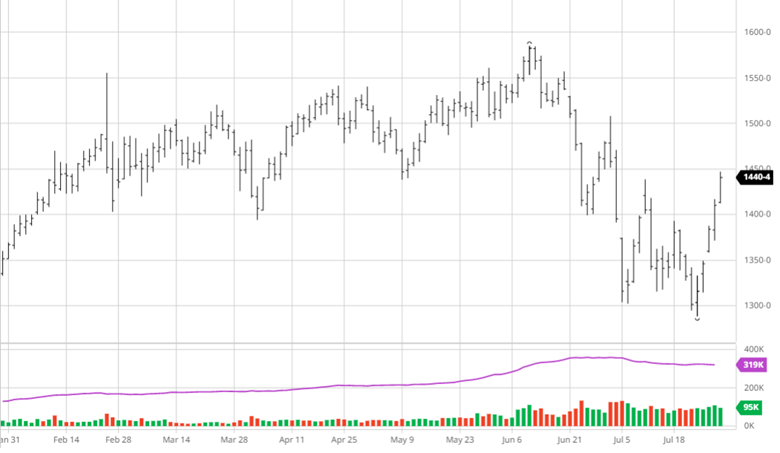

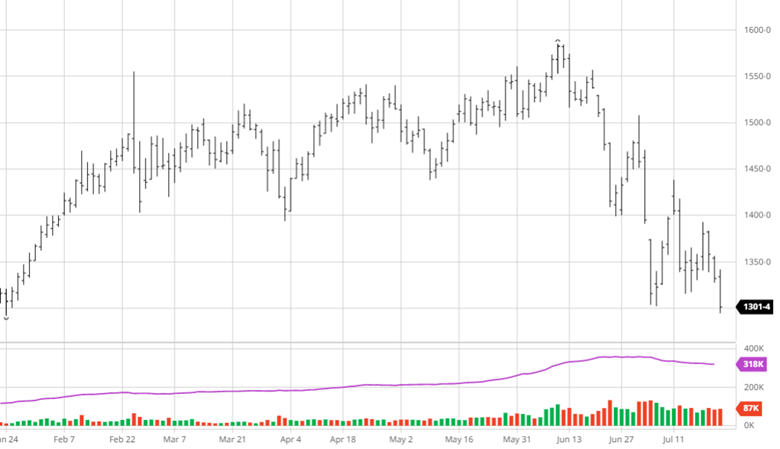

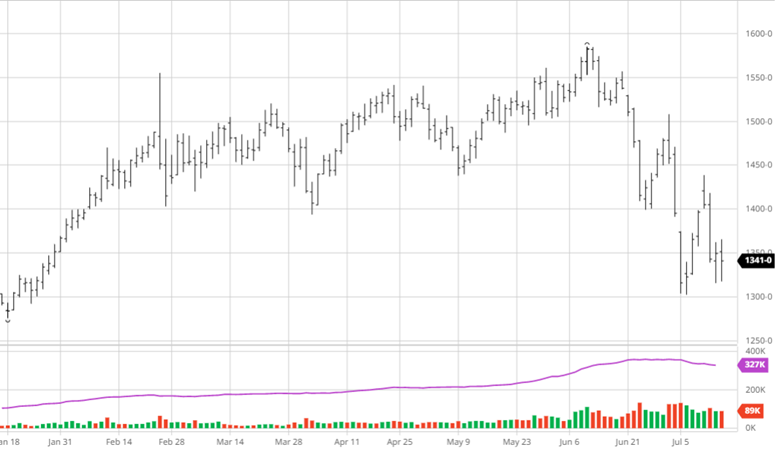

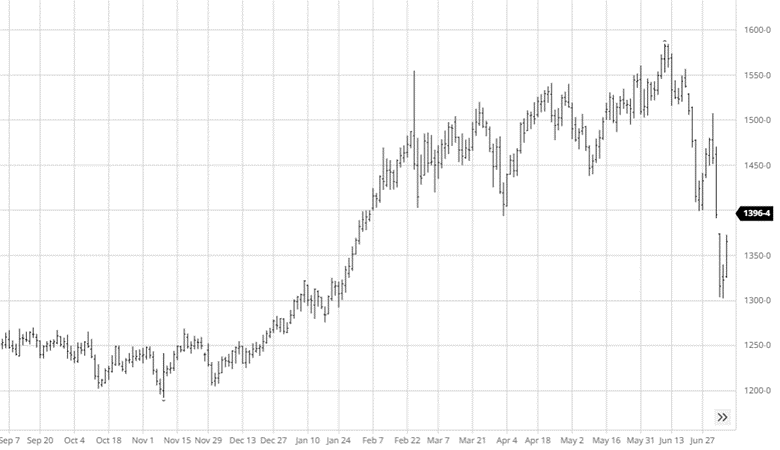

Soybeans moved lower again this week after rebounding last week as soybeans have held together better than corn. Bean stocks were tighter than the trade expected while exports were up 25 mbu but crush down 10 mbu. Global oilseed supply and demand forecasts include lower production, crush and stocks. Like for corn, the USDA lowered Argentina’s production below the average trade estimate. While the news out of the report was mildly bullish, the negativity around corn and wheat bled into beans to end the week.

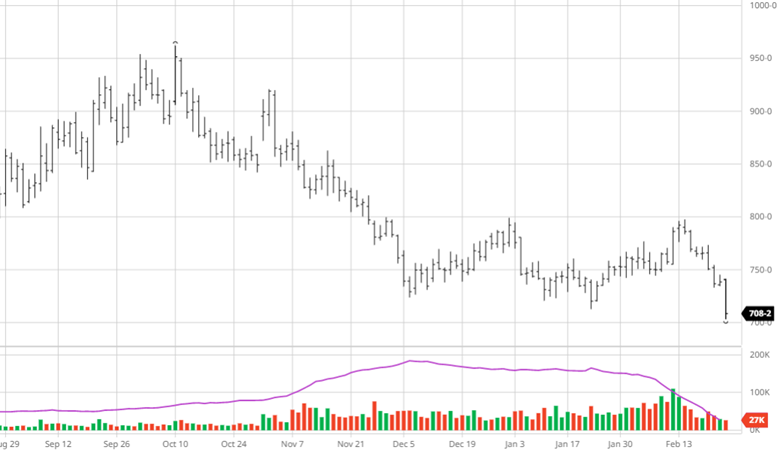

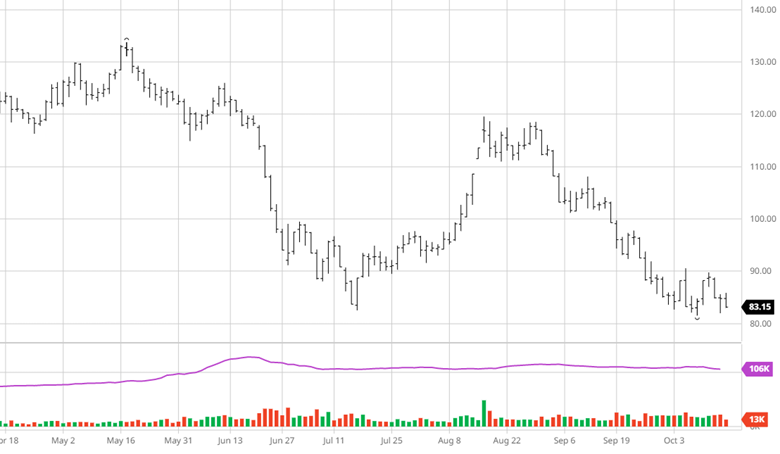

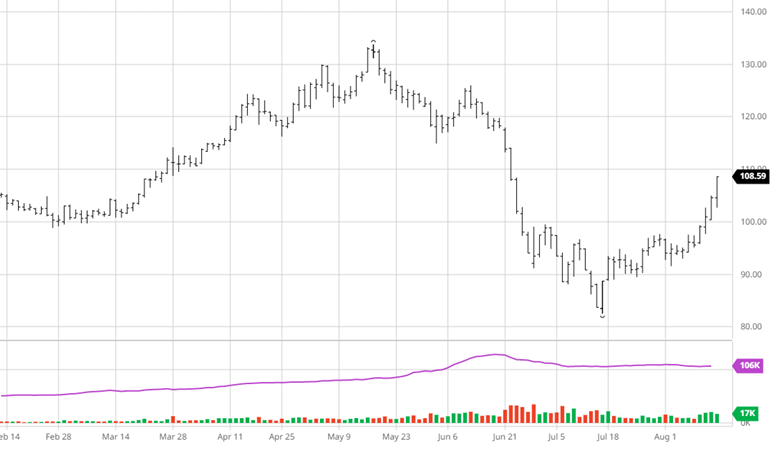

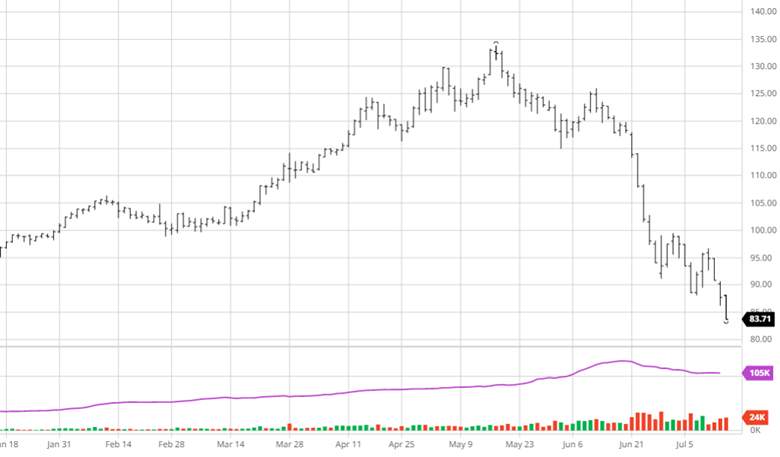

Cotton was punched in the mouth on Friday after trading lower this week. The USDA did not make any significant changes to the supply and demand report. The lack of demand is the main problem as the global 22/23 forecasts this month include lower consumption and trade with higher production and stocks. The world economic outlook is questionable for the coming year and a global recession would hurt cotton more than other areas.

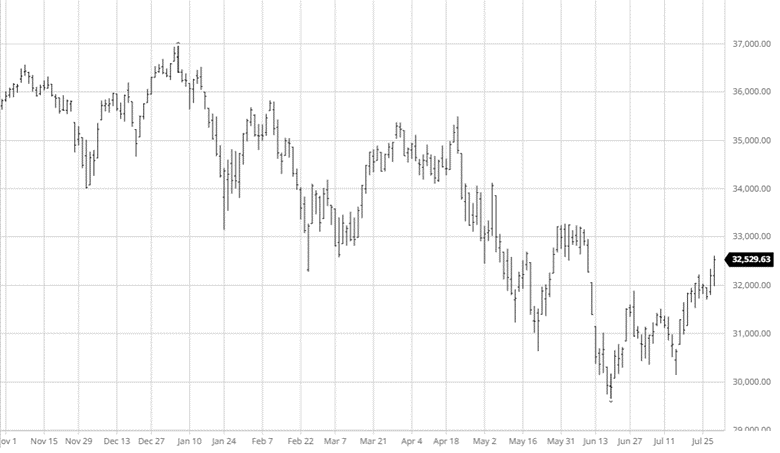

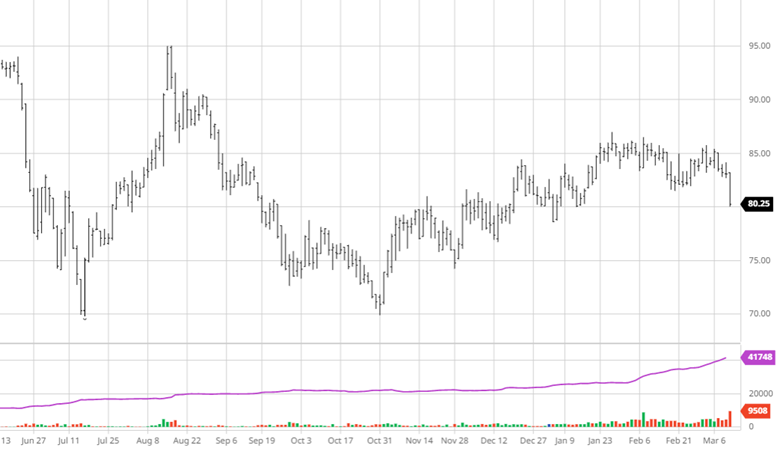

Wheat

The story for wheat has not changed as markets continue to get crushed. The report made no major changes to forecasts and balance sheets and there has not been any major changes in Ukraine as Russia continues their assault. Russian officials are expected to meet with UN officials in Geneva on March 13 to discuss the grain deal renewal and trade sanctions.

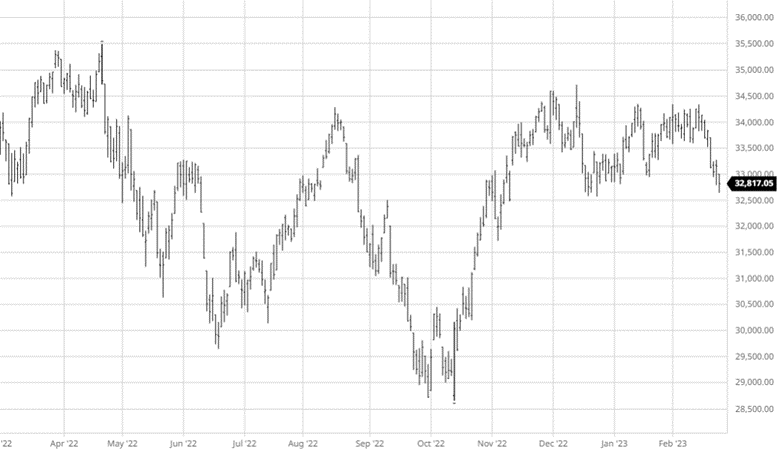

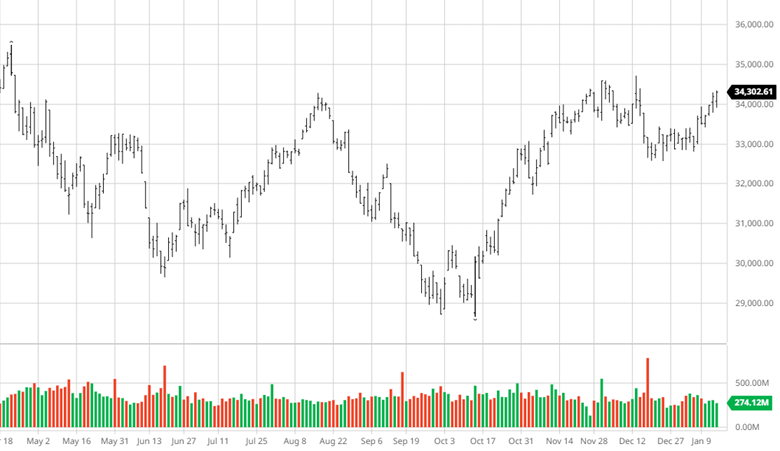

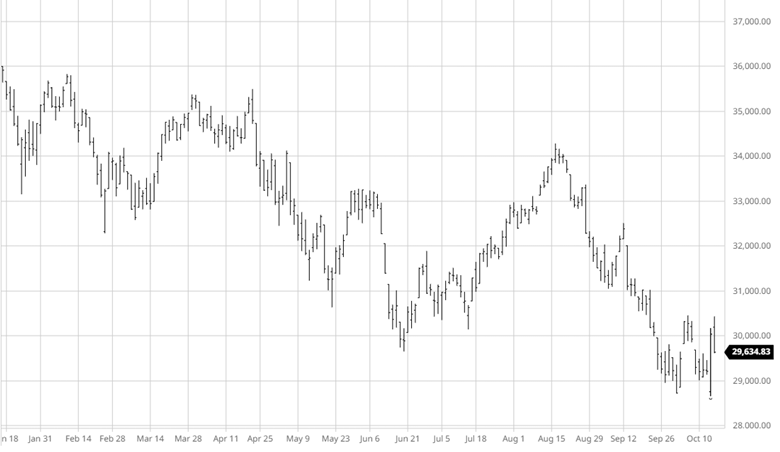

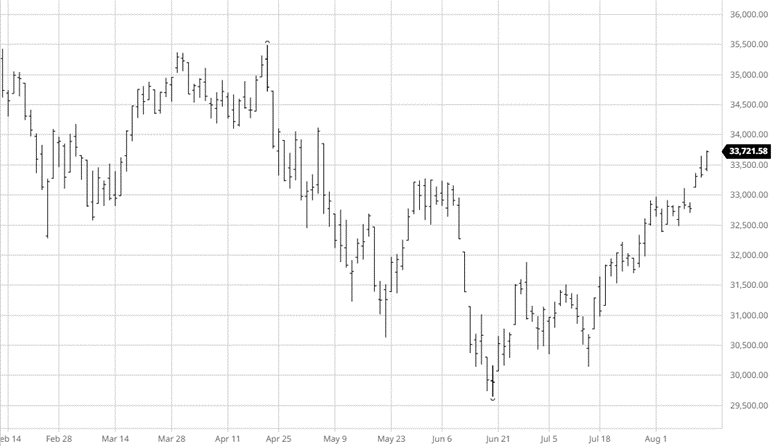

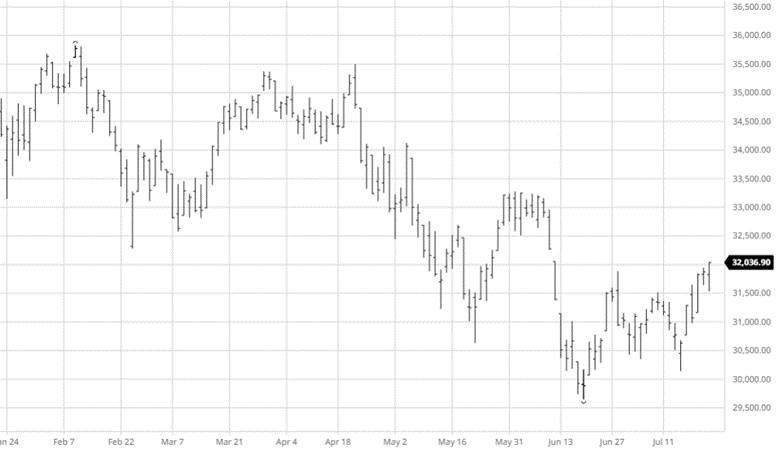

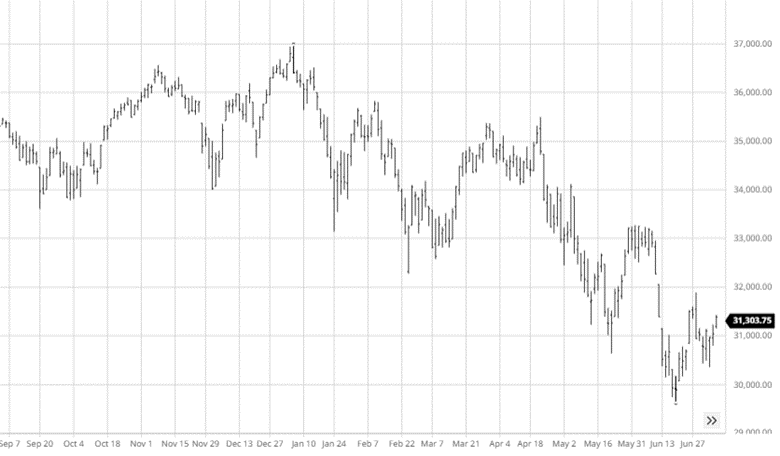

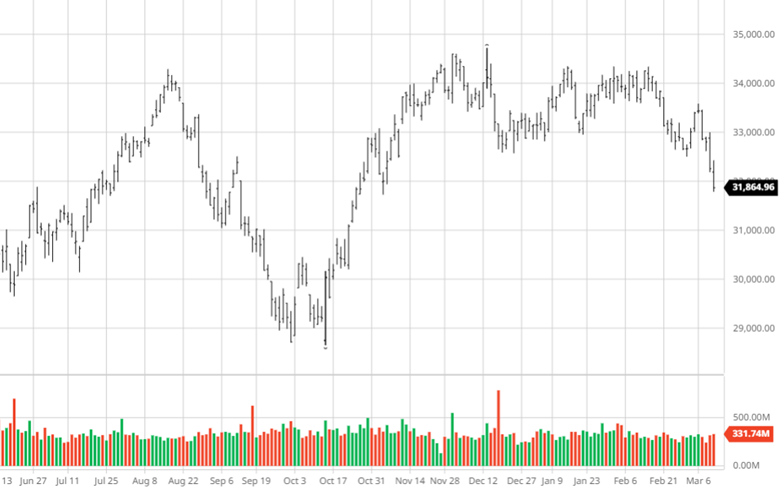

Equity Markets

Equity Markets moved lower this week on overall market weakness and the Silicon Valley Bank news. While one day doesn’t make a trend, the trend lower since the start of February looks to have room to move lower with another big jobs added number keeping the Fed rate hikes as a question mark.

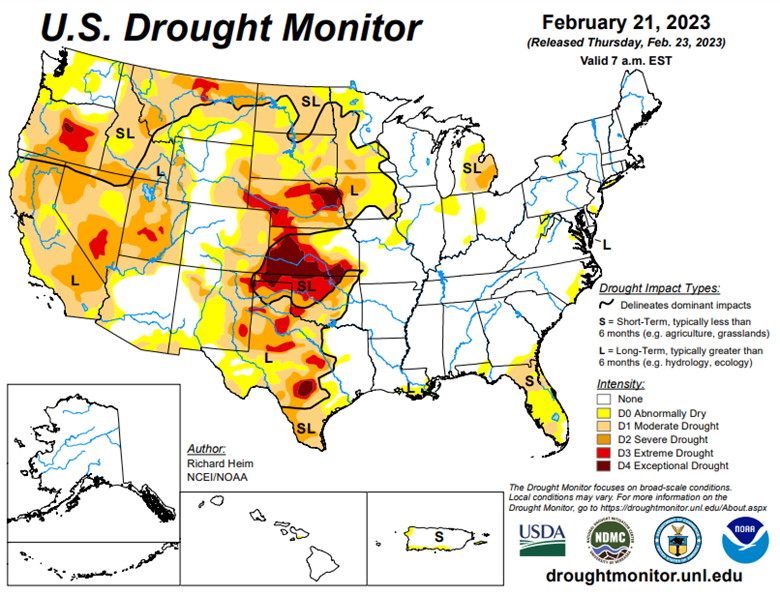

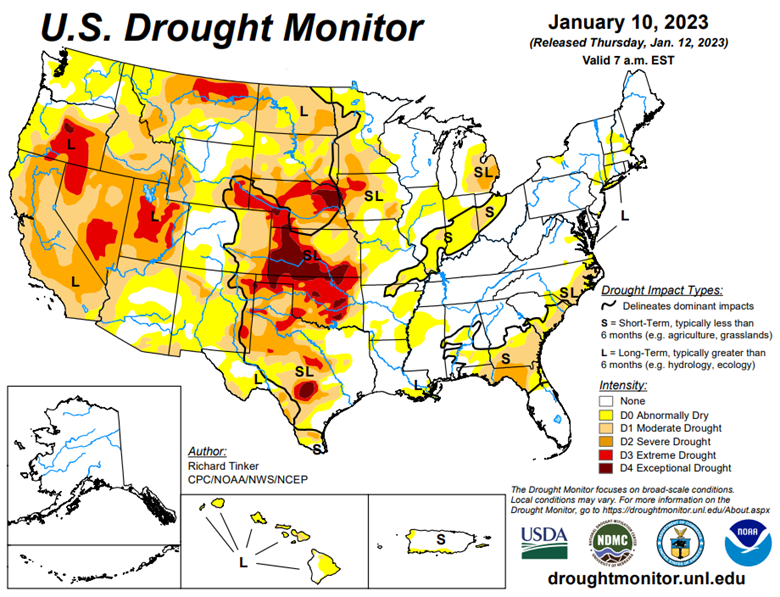

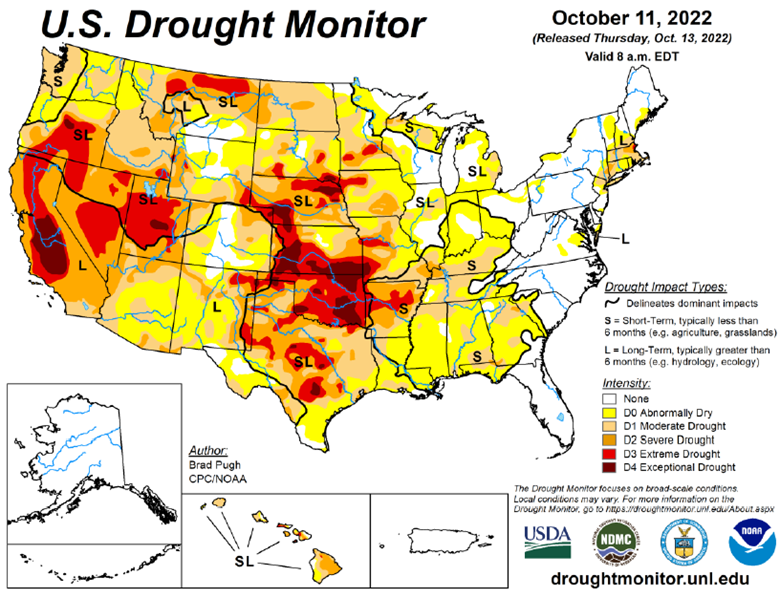

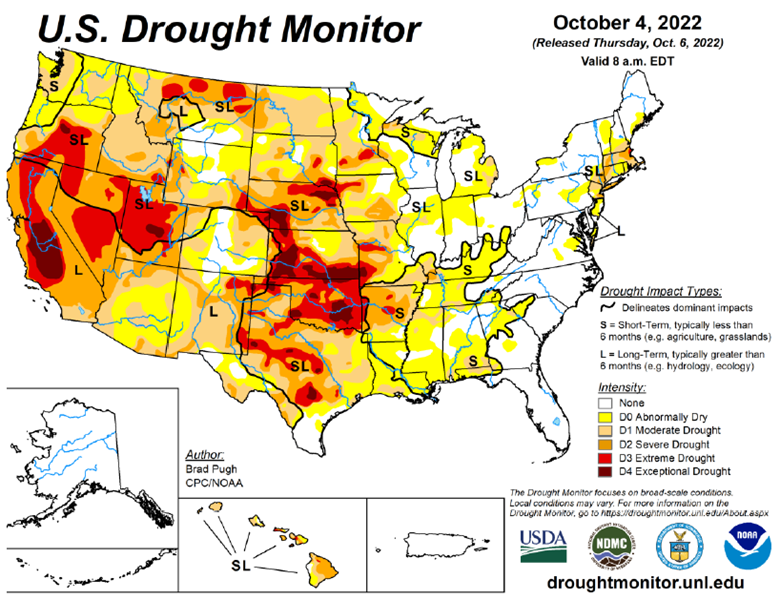

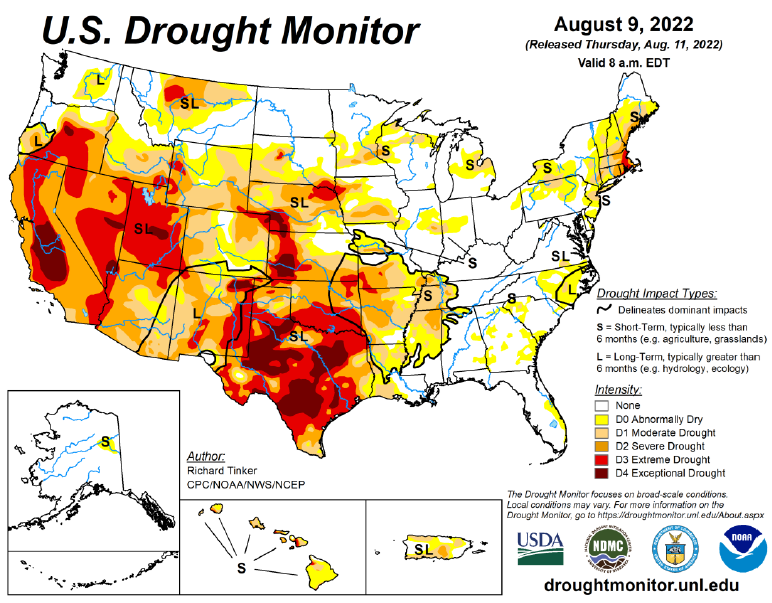

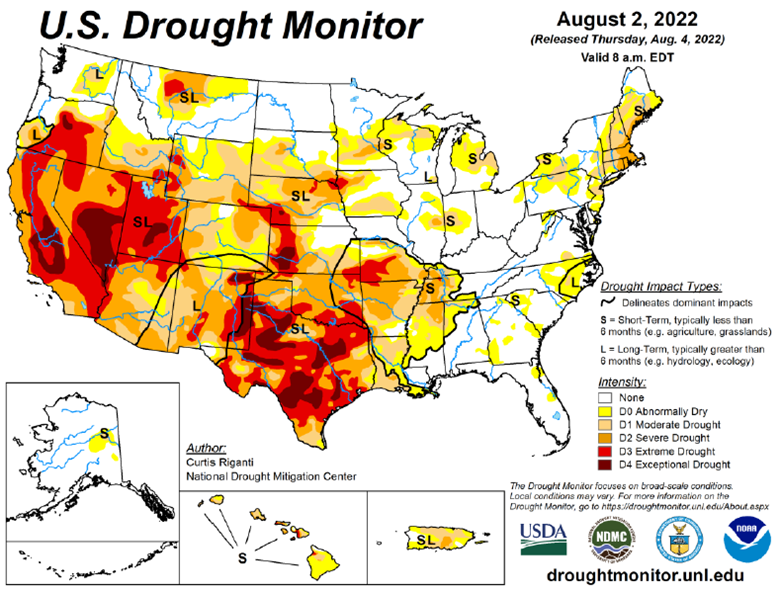

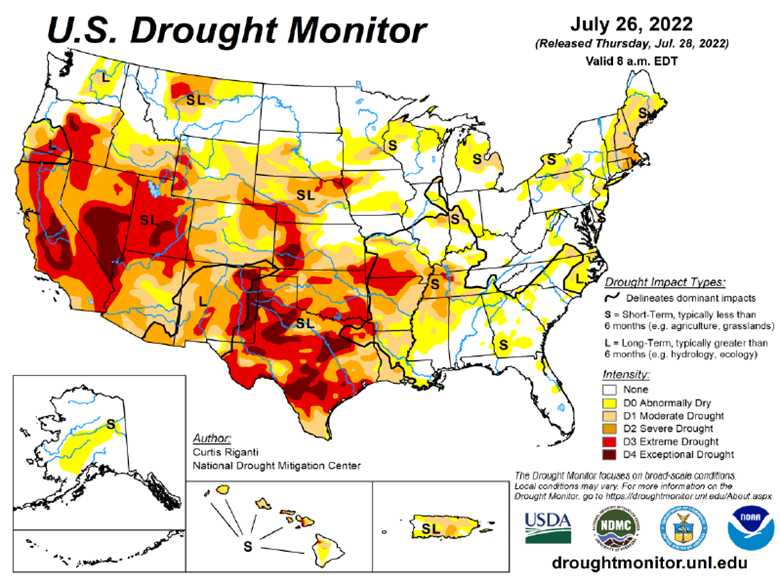

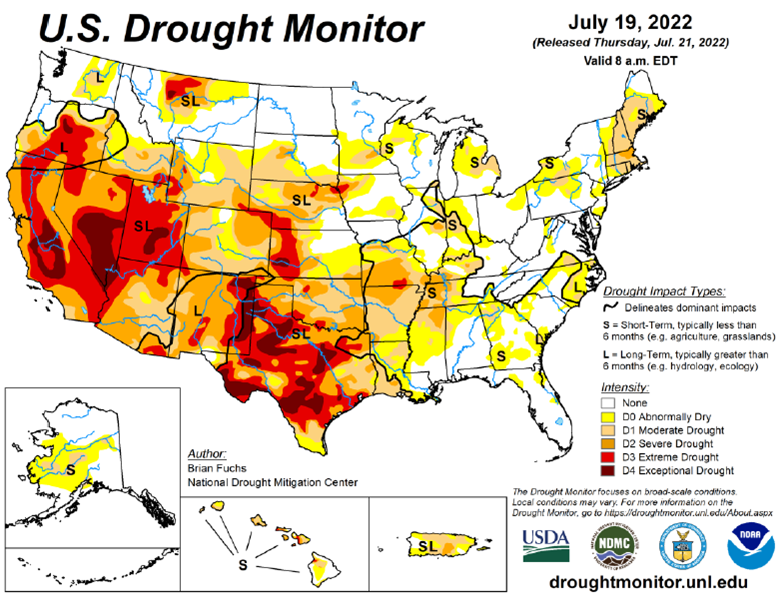

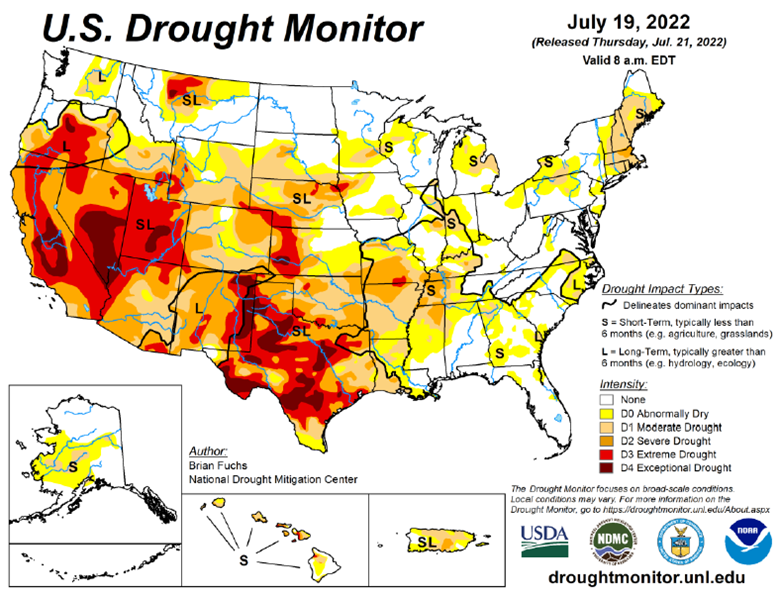

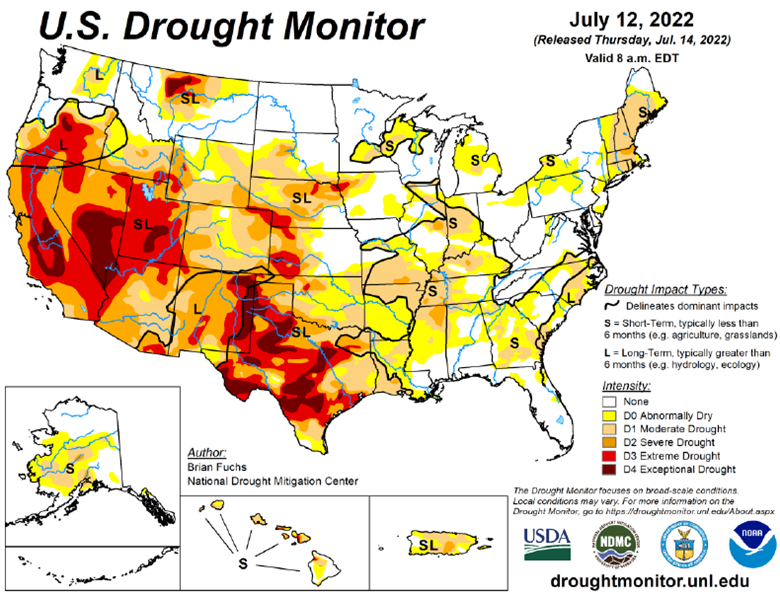

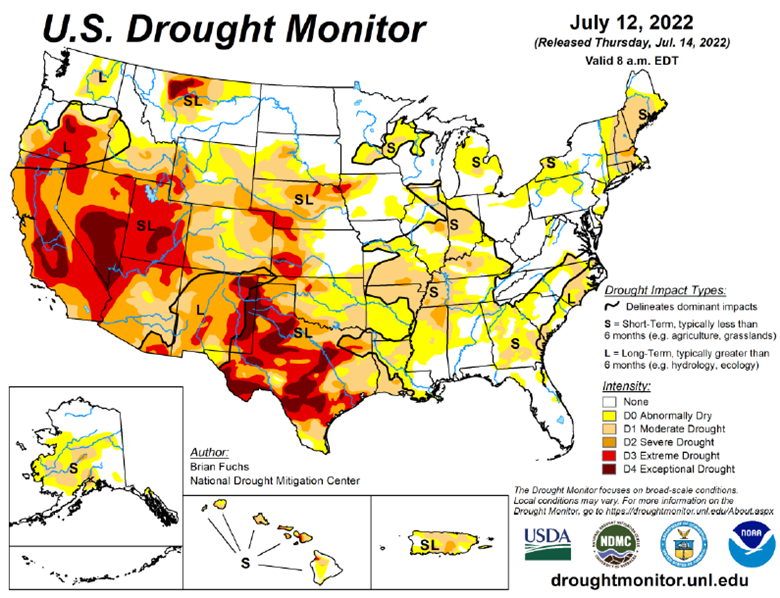

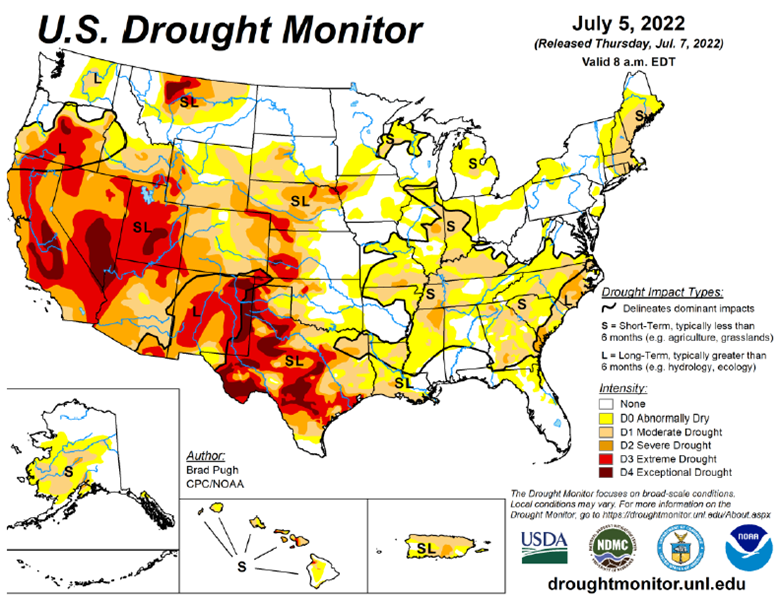

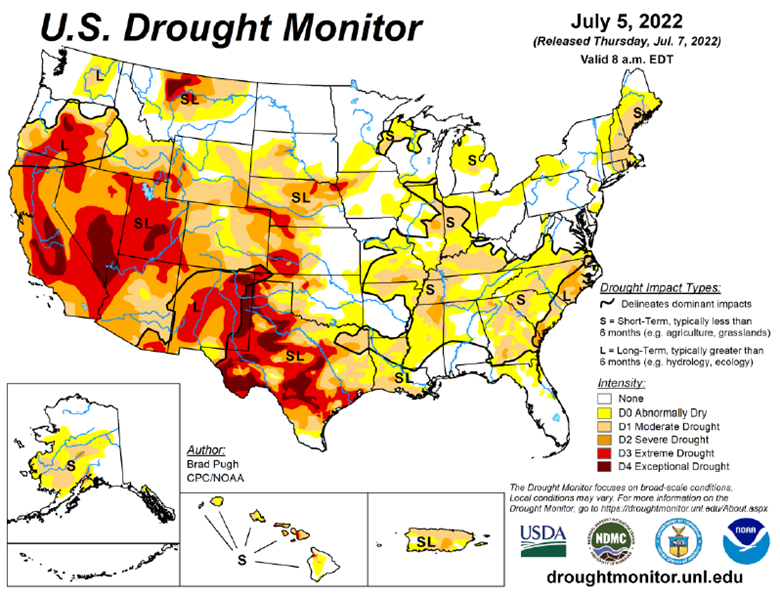

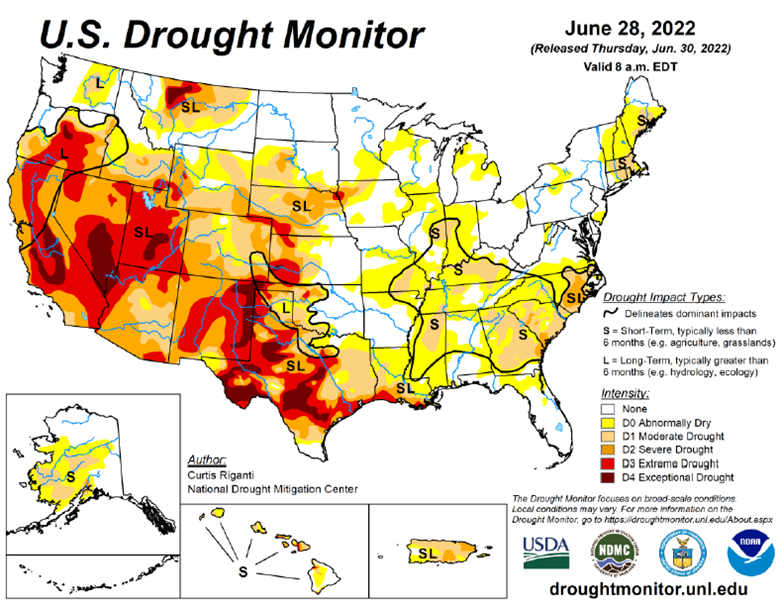

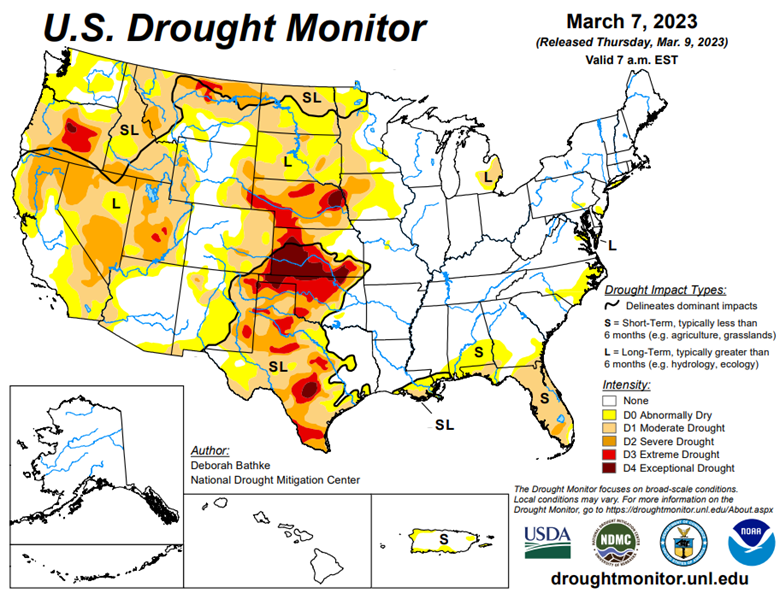

Drought Monitor

The eastern corn belt has gotten plenty of moisture so far this winter with the western corn belt needing more heading into the spring.

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.