There comes a time when being proactive and or inactive become the same. That is where this industry is today. A better way to put it is the best offense is a good defense. The daily data bombs send mixed messages. These are messages interpreted differently over the generational chasm. If you are over 40 you are looking for the next shoe to drop in housing. If you are under 40 you are looking for the next opportunity. Neither is right or wrong, just educated differently. Let’s look at the issues.

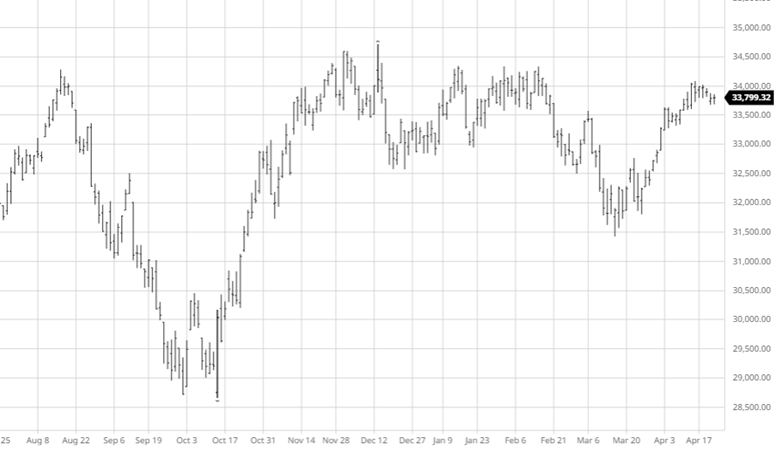

The first focal point that always amazes me is the difference in cycles between multifamily and single-family. In the last 10 years, single-family construction has had 3 downturns while multifamily has yet to see one. Ask a trader in the multifamily space how things are going, and he will say if this is what a recession looks like then he’ll take it. Ask a single-family trader the same question and he will be leaning more on the negative side. The confusing part is the fact that DR Horton had a great quarter, and the home builder stock index is nearing its all-time highs. Things are not that bad so why can’t wood products pull themselves out of this big hole they dug?

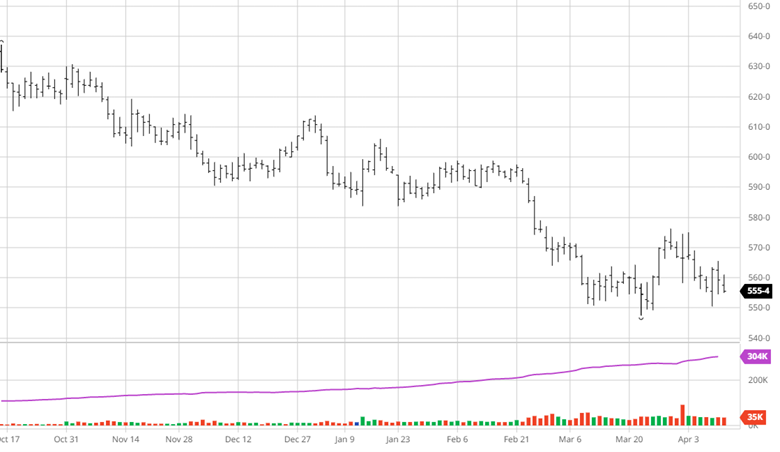

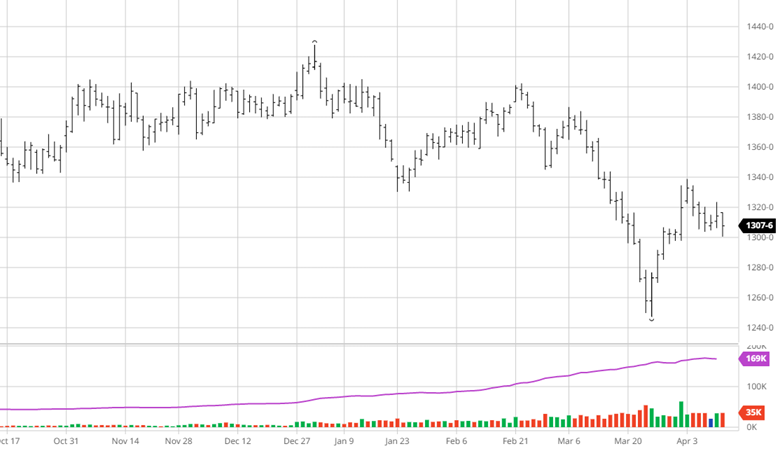

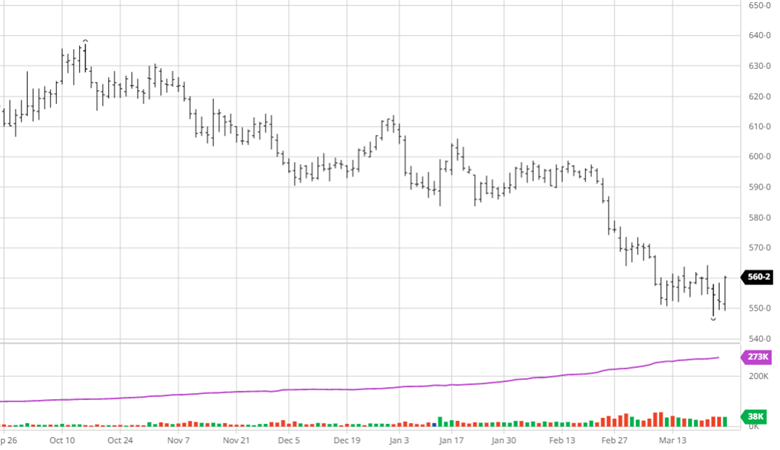

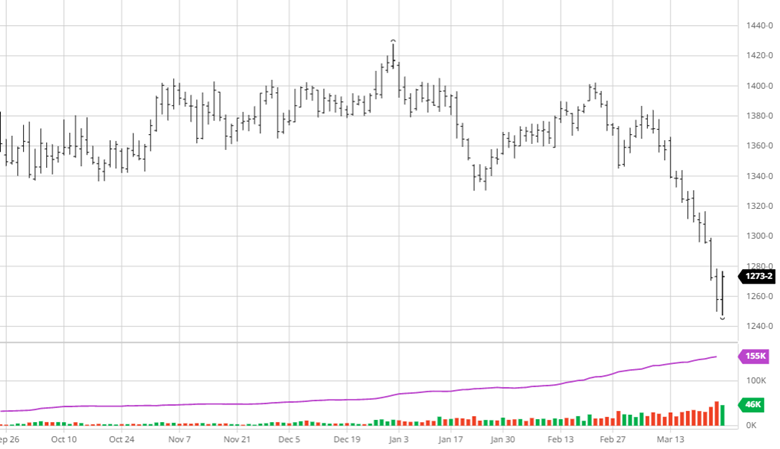

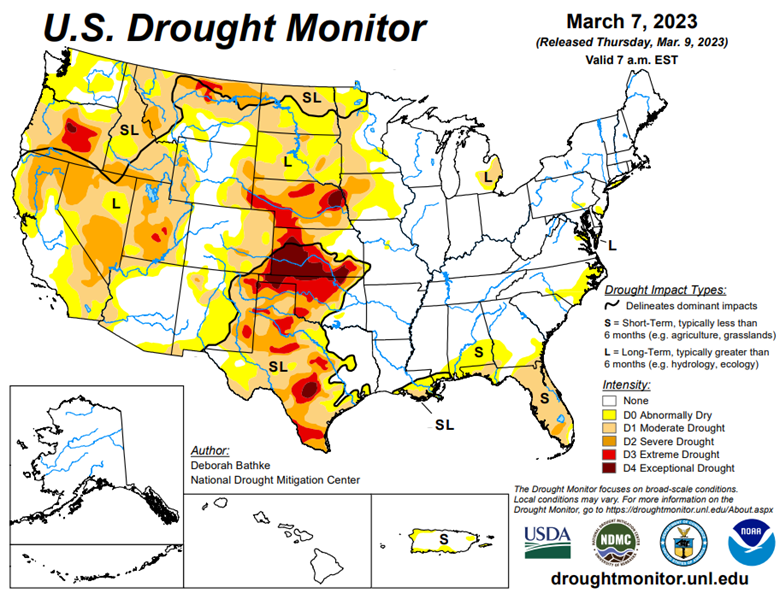

Reports are of almost a record number of multifamily projects going on today. That is why those in that space are enjoying the ride. The confusion is in the single-family sector. Data show that the marketplace is tremendously underbuilt. I think the market is telling us differently. Existing home sales are off sharply. The reason is relatively easy to define. The answer is that a few want to increase their mortgage rate by 200%. This normal supply of homes on the market will not be available for some time. Builders will have to step up to supply the shortfall. Starts are hovering above 2019. That was a year that saw an extreme lack of price volatility. That isn’t my call here. The other focal point is that this market no longer can “lack” volatility. It can remain range bound in the new post covid world but with much wider swings. I think what this market is telling us is that there is still more bottoming work to come.

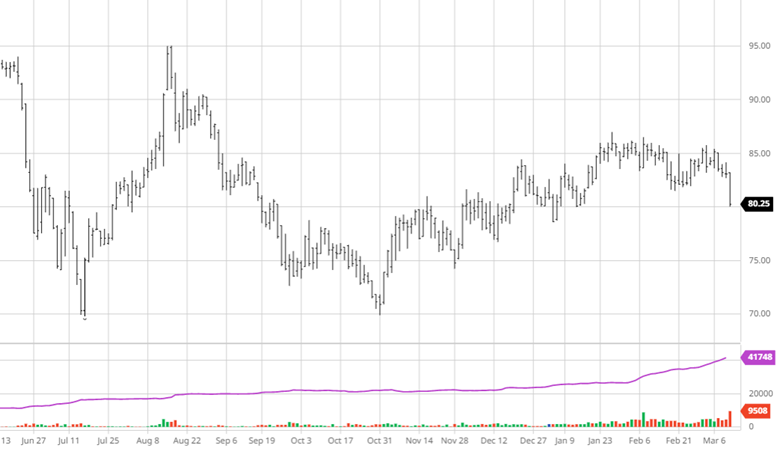

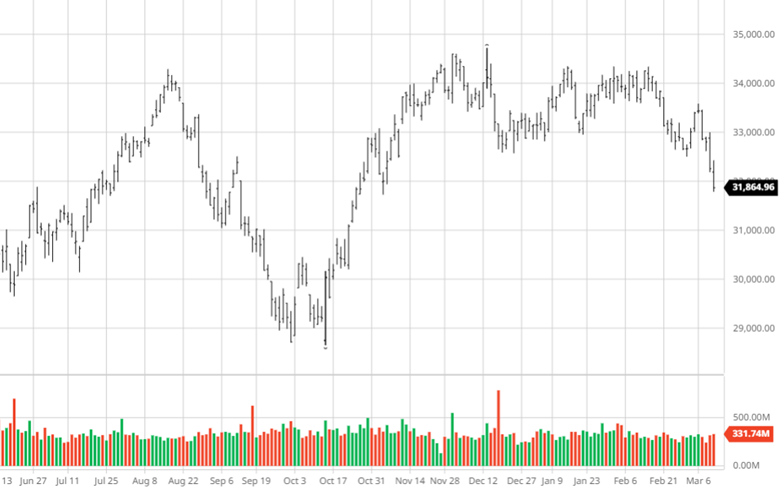

This coming week I expect to see wide swings caused by position evening in May. There aren’t many who want to carry a position into a no-limit May. That covering will add more pressure down than up. What is marketable is the July contract. It is a few dollars away from being a good hedge buy and also a few dollars away from a good basis trade. The basis traders are cleaning up. July is in the zone.

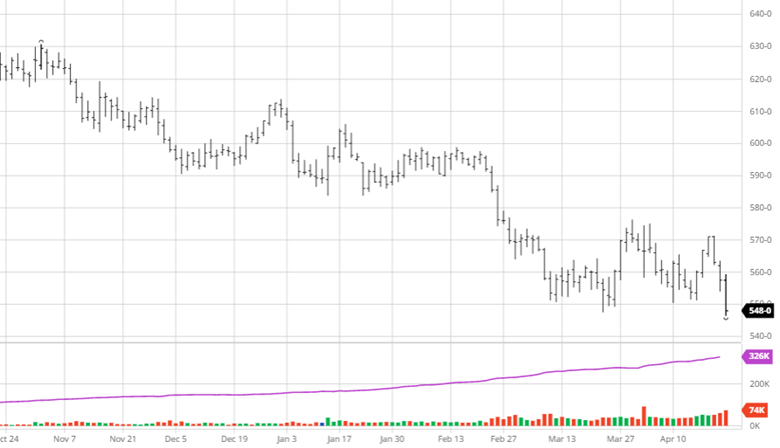

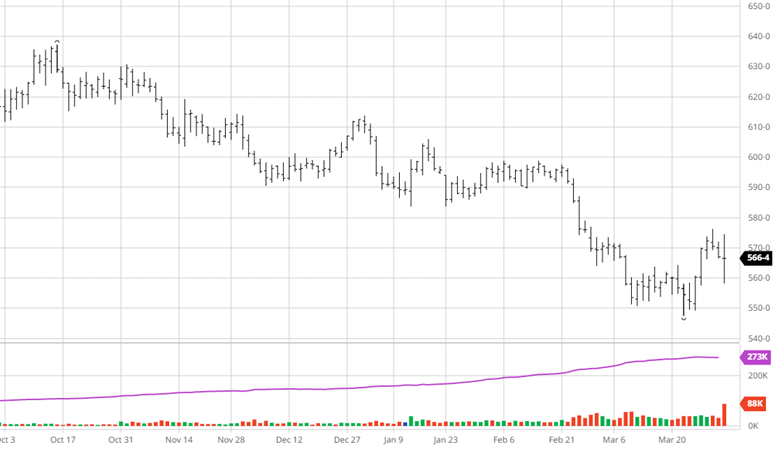

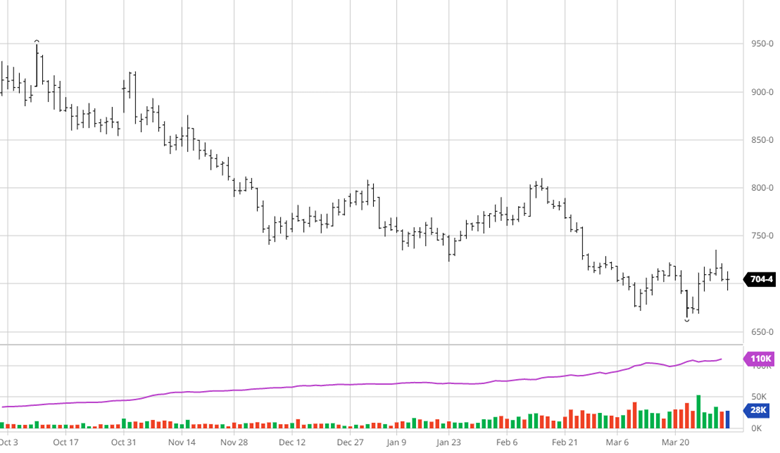

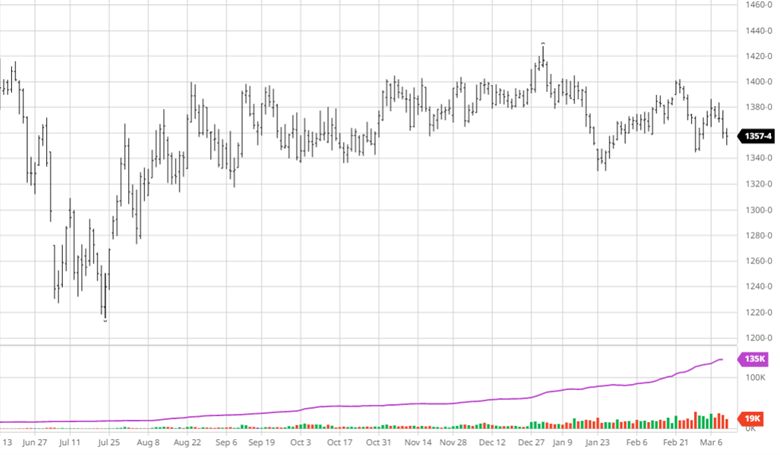

Lumber Futures Volume & Open Interest

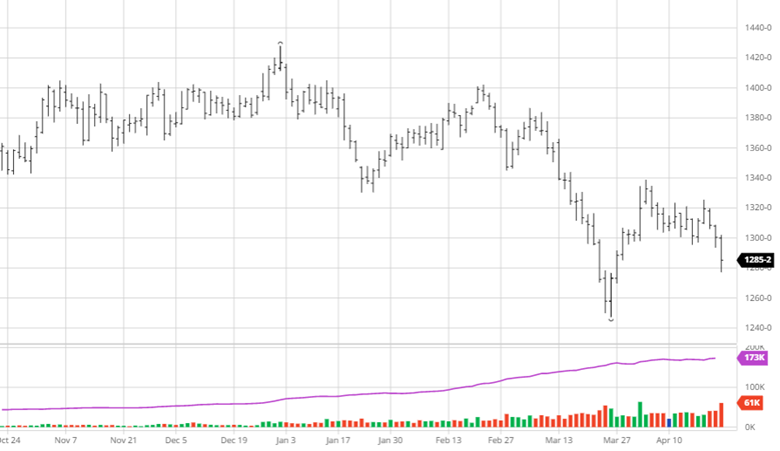

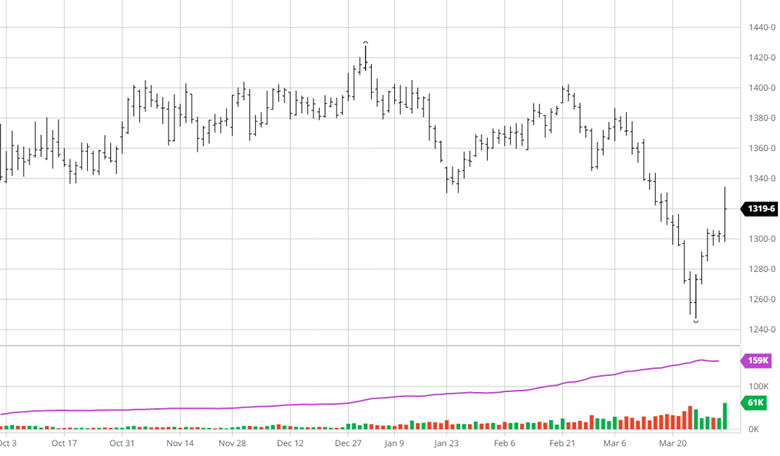

CFTC Commitments of Traders Long Report

https://www.cftc.gov/dea/futures/other_lf.htm

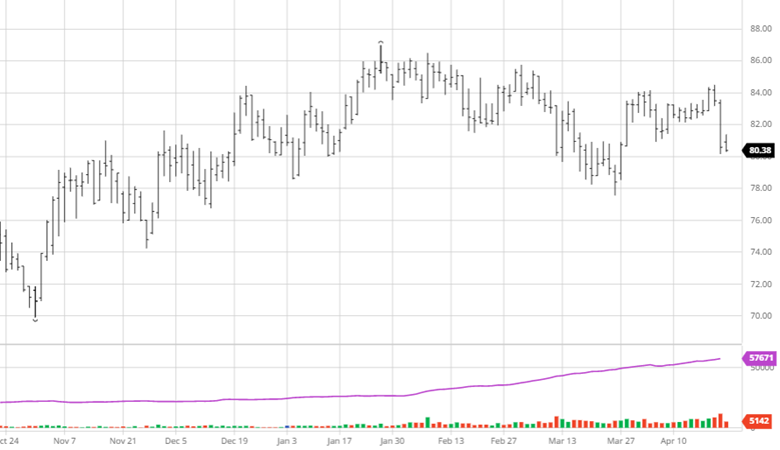

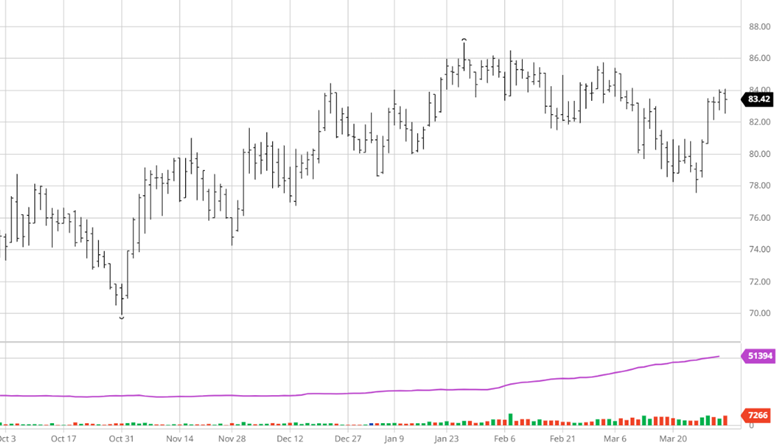

Lumber & Wood Pulp Options

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636