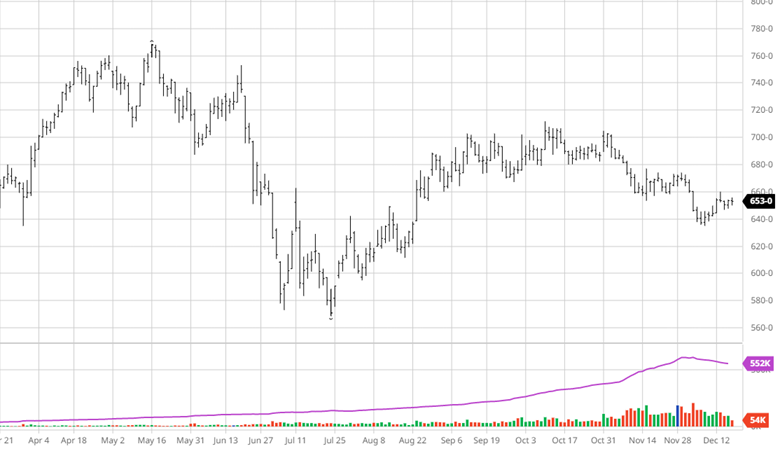

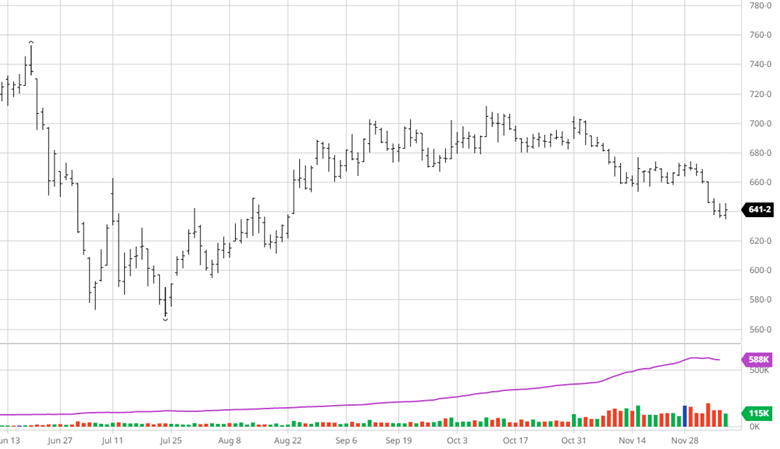

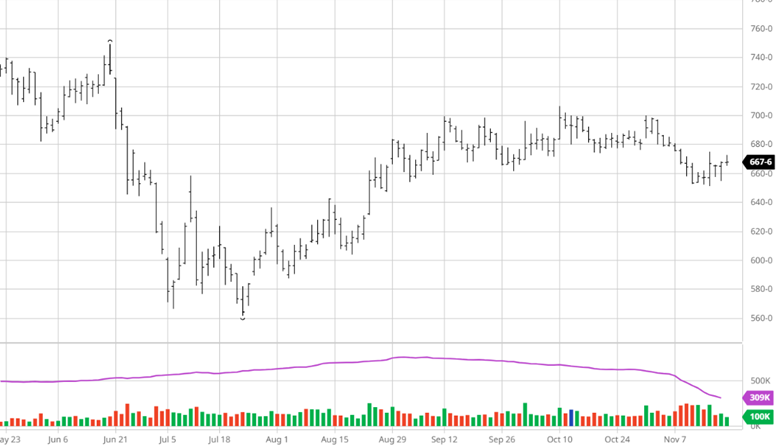

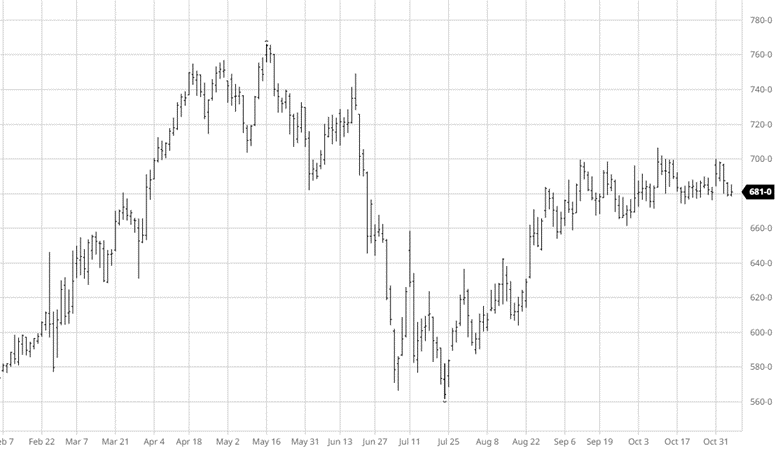

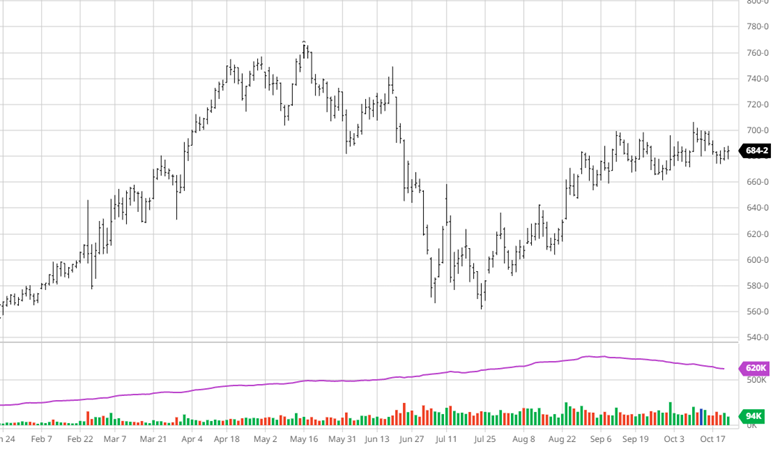

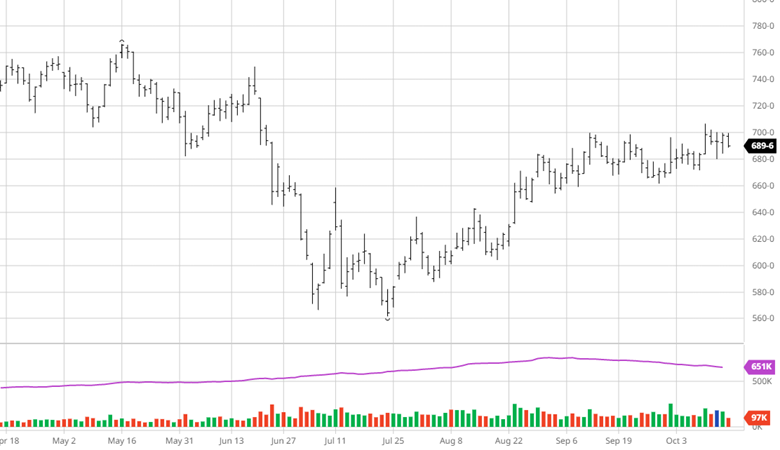

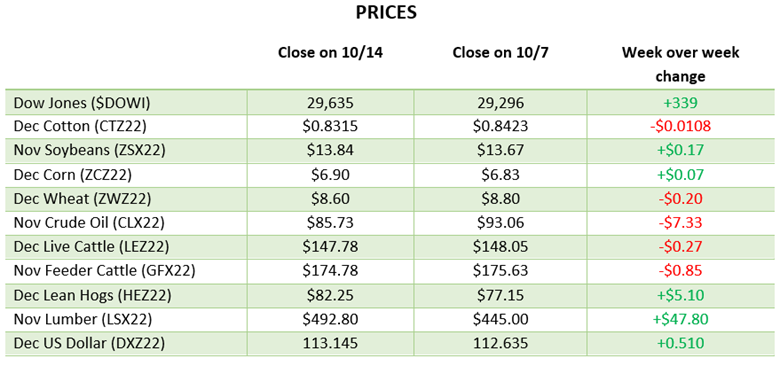

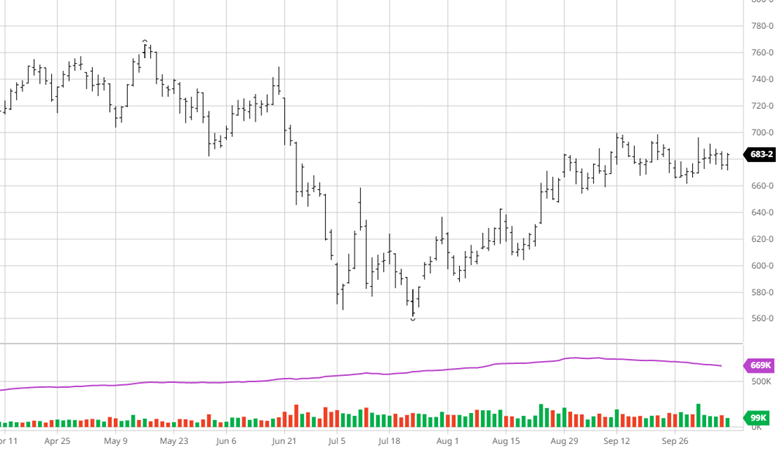

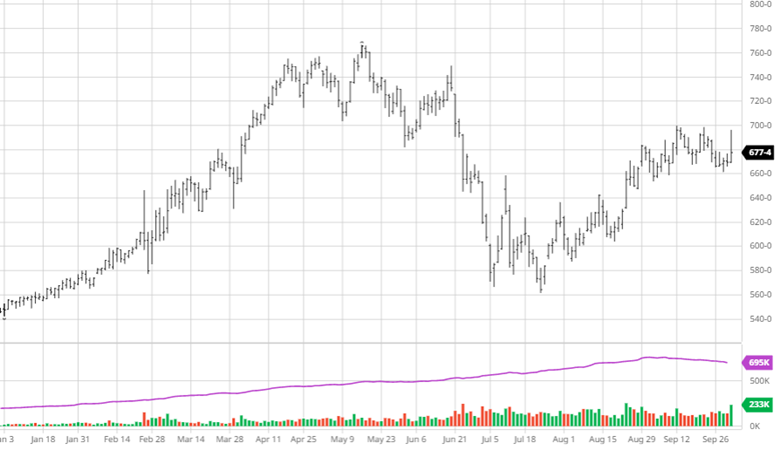

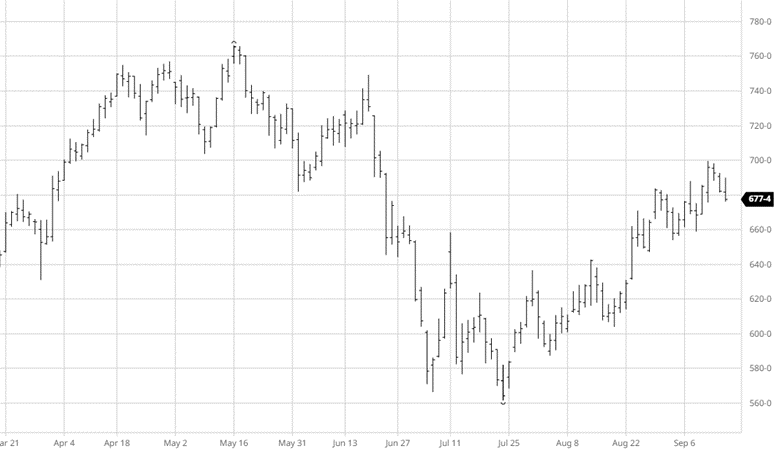

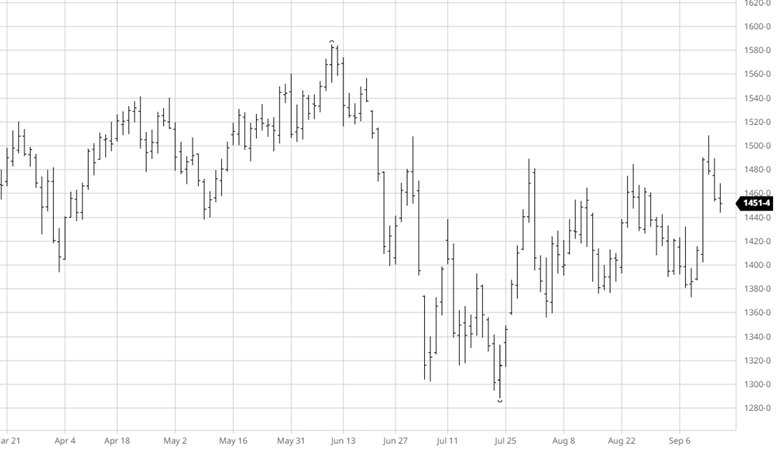

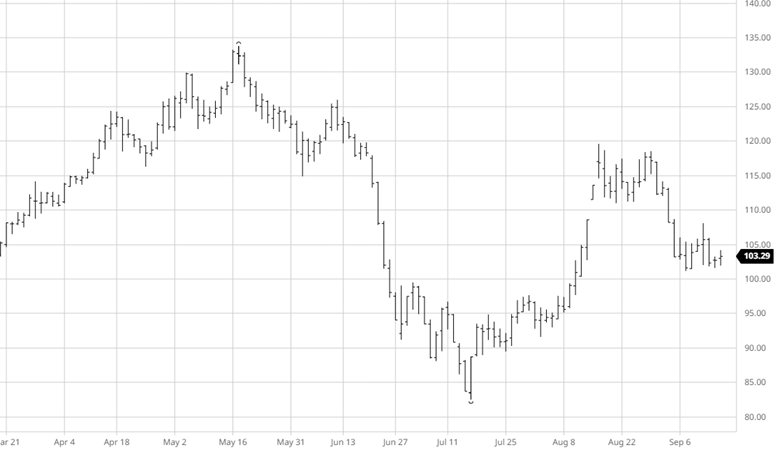

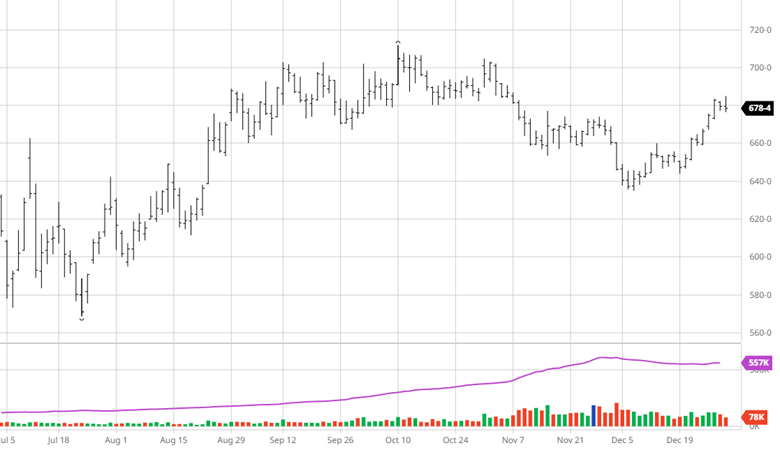

Corn made gains over the last two weeks with the continued escalation of bombing in Ukraine and more dry weather in Argentina. Exports remain uninspiring as the year comes to a close. China announced they will reduce some travel restrictions while covid infections continue to cause problems and continued lockdowns. Brazil’s expected record crops could offset some of Argentina’s losses but what extent will be determined in the next 2 months. The news has been slower as we get to the end of the year but the continuation and escalation of the war along with the other factors can continue.

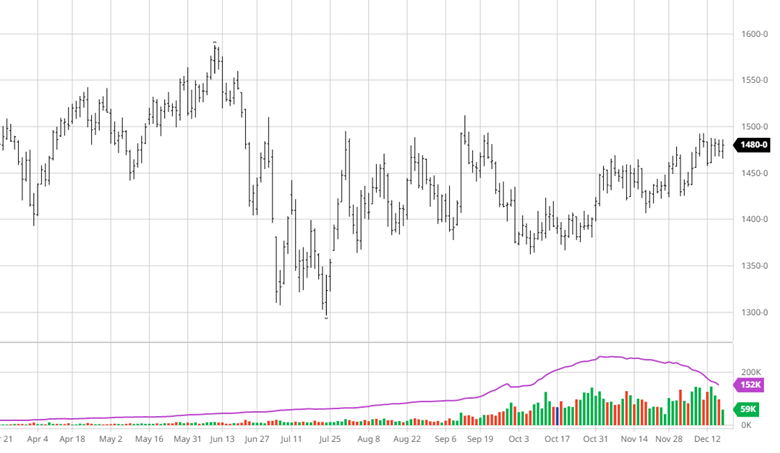

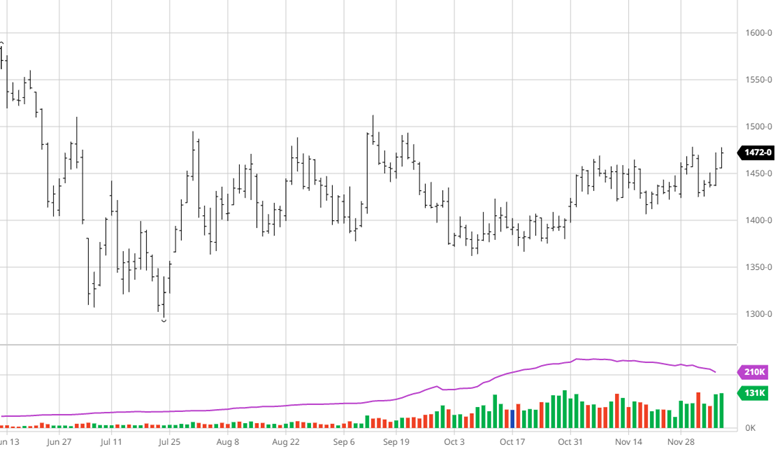

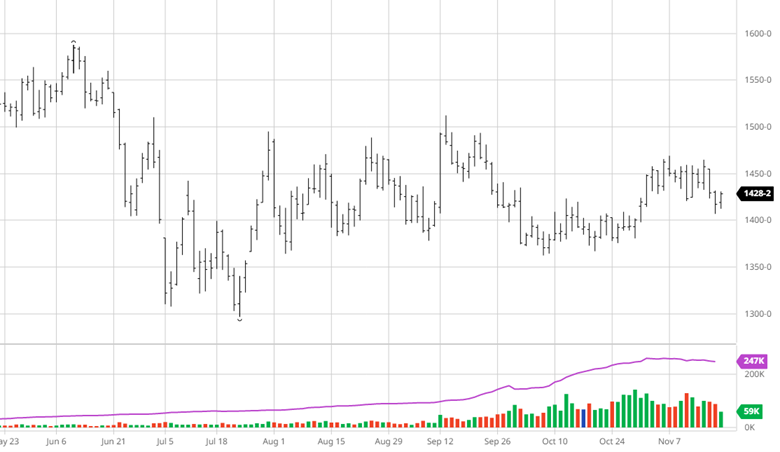

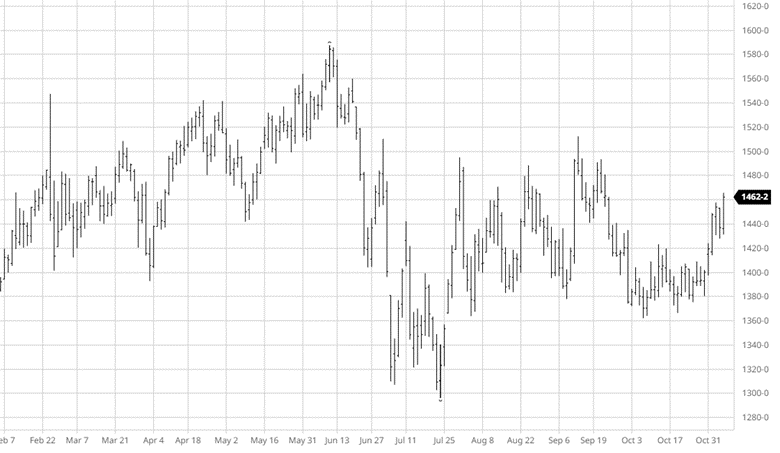

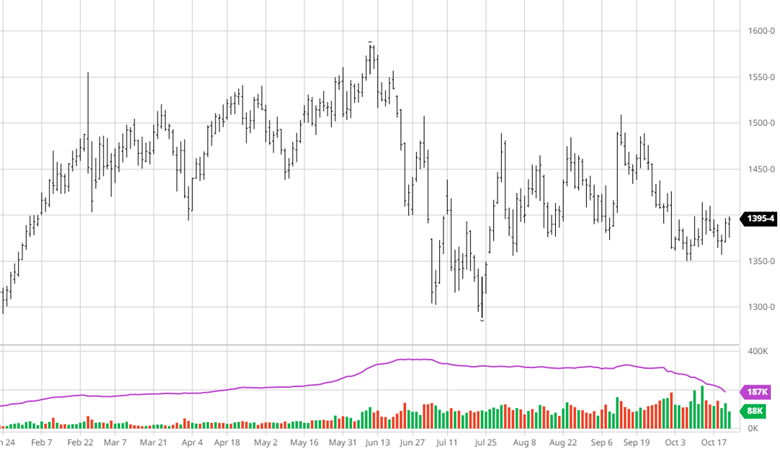

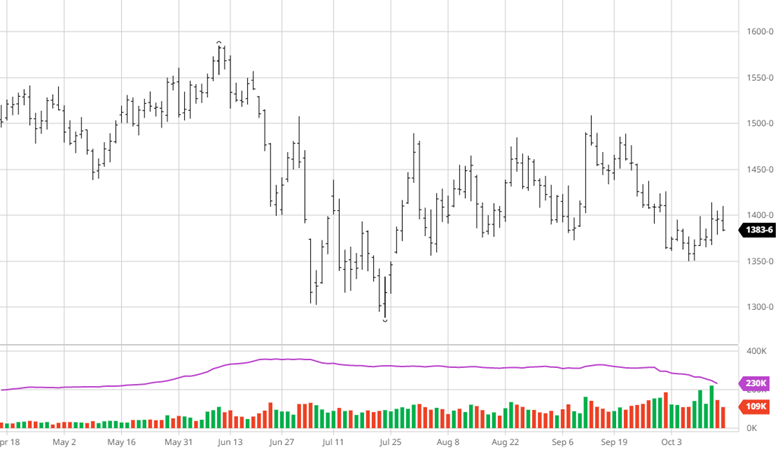

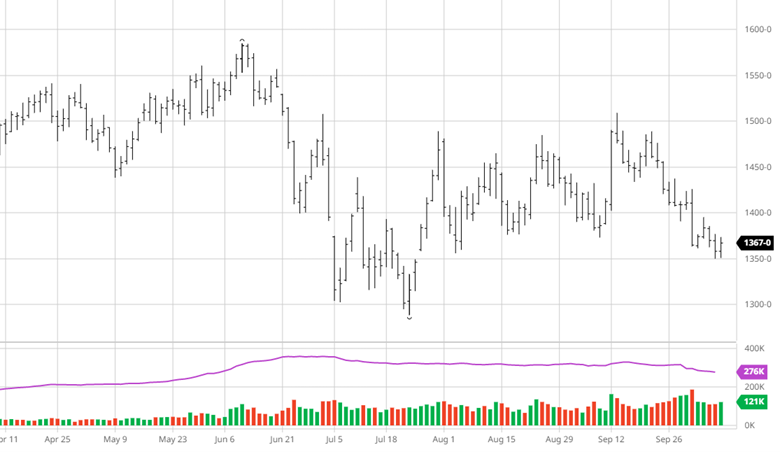

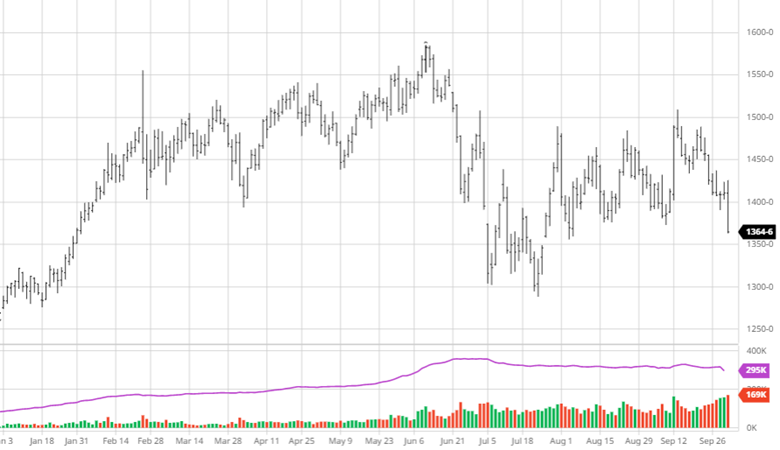

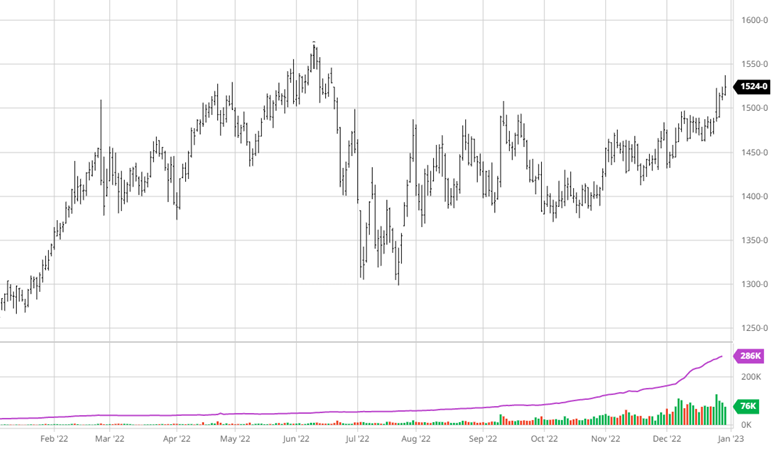

Soybeans participated in the market rally over the last couple weeks making solid gains back over $15. The Argentinian crop is rated as just 10% good to excellent, down from 12% the previous week. Brazil’s weather has been quite favorable to their bean crop which is much larger than Argentina’s. While exports remain lackluster, once Brazil begins to harvest they will become worse. The rally into the end of the year was very welcome and the start of 2023 will set the tone into the spring.

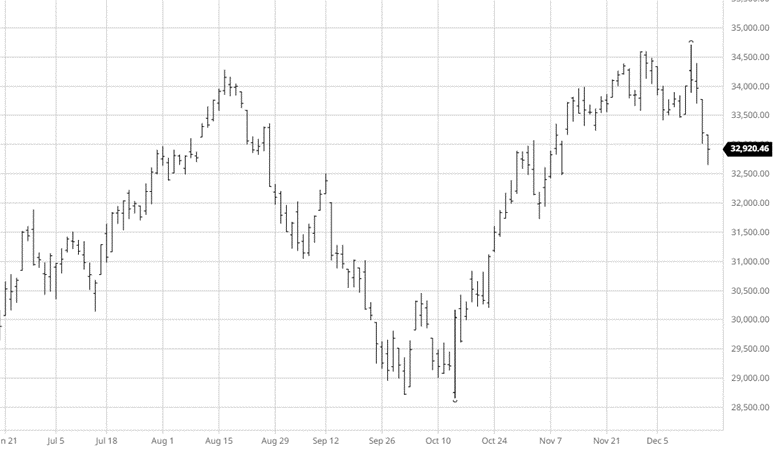

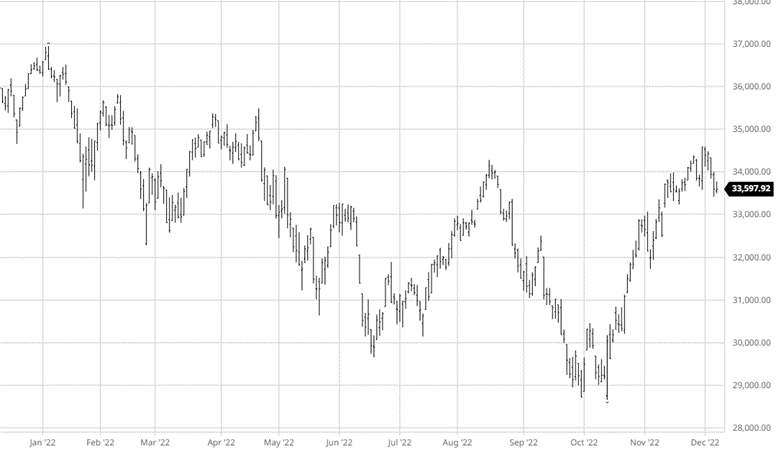

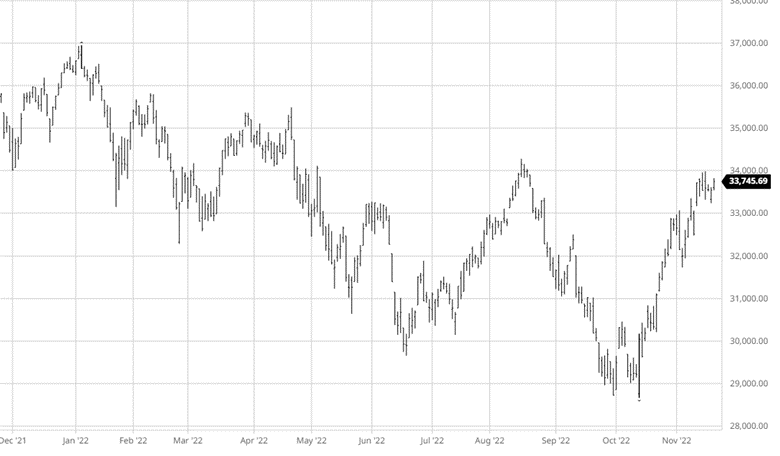

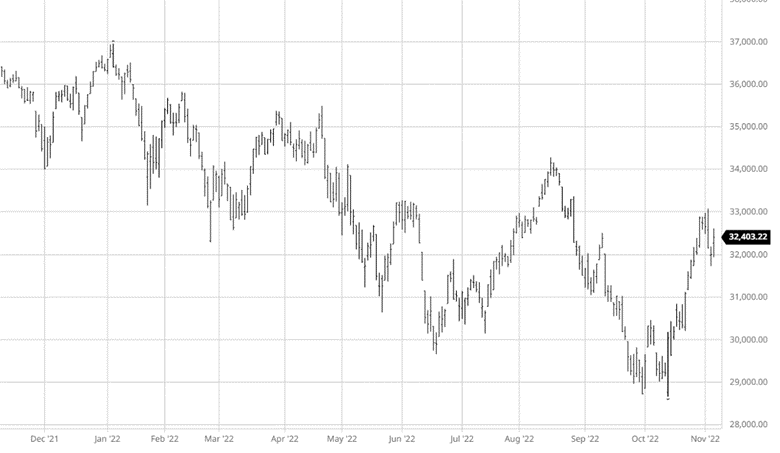

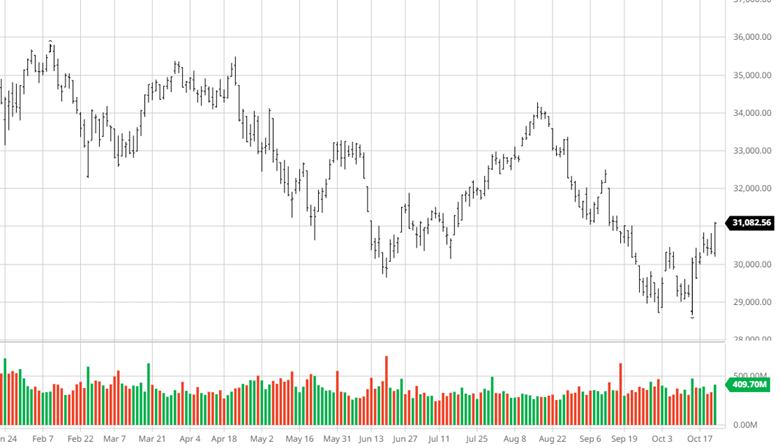

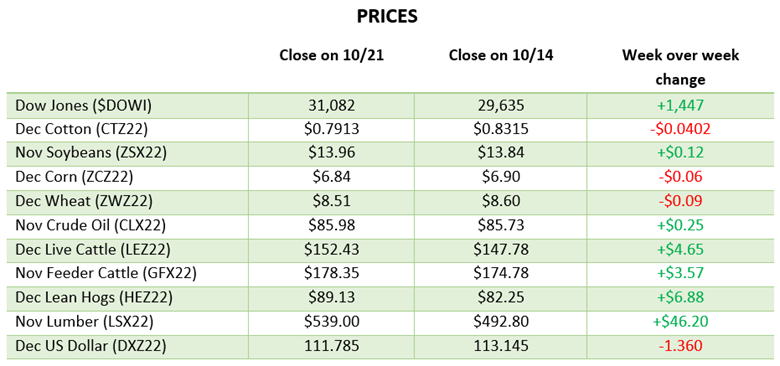

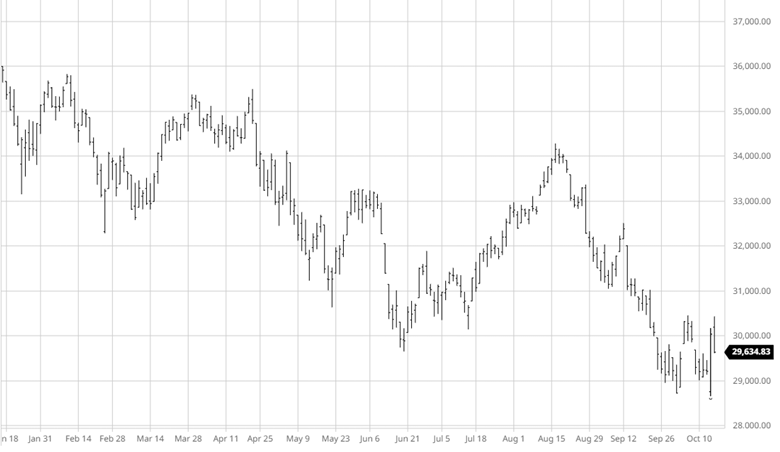

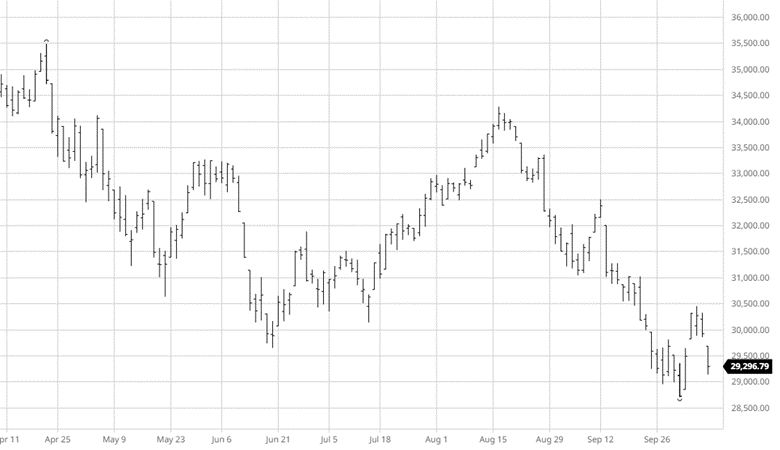

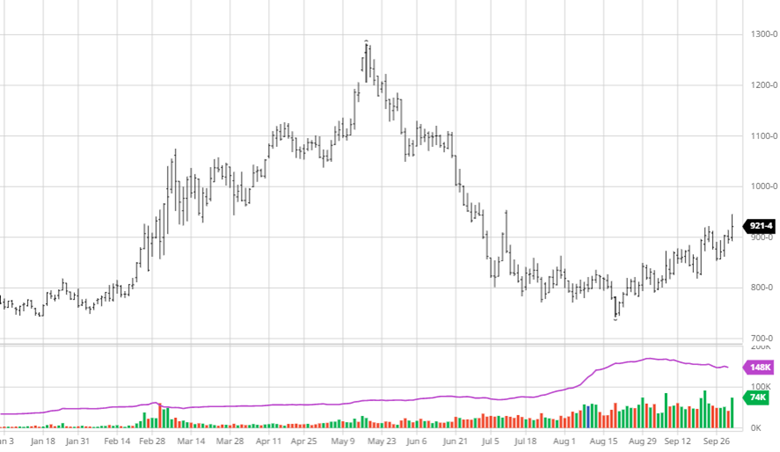

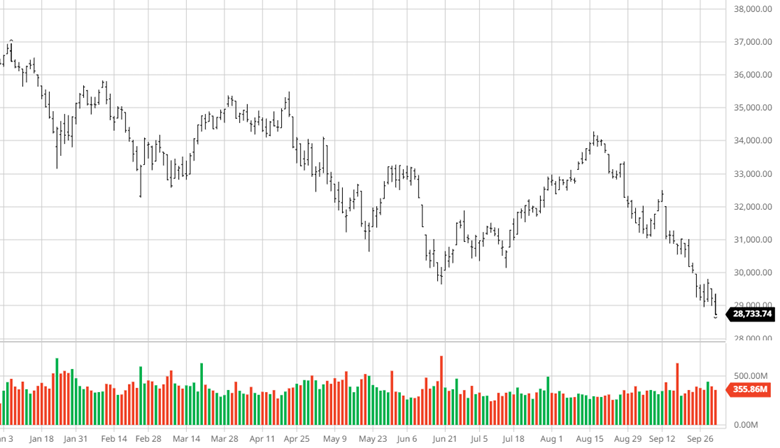

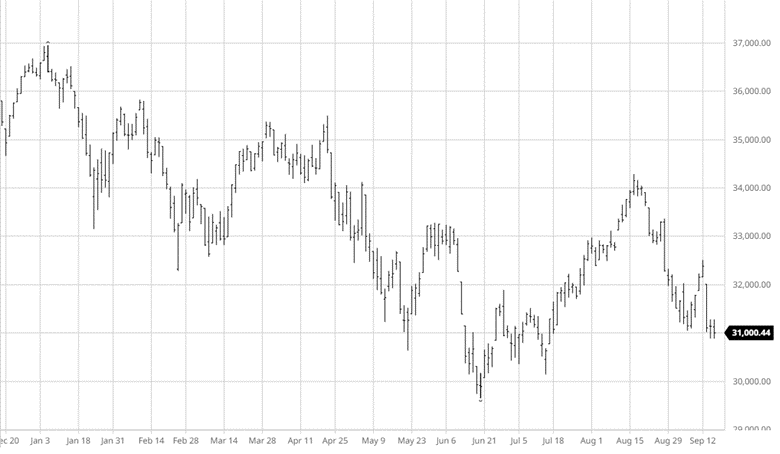

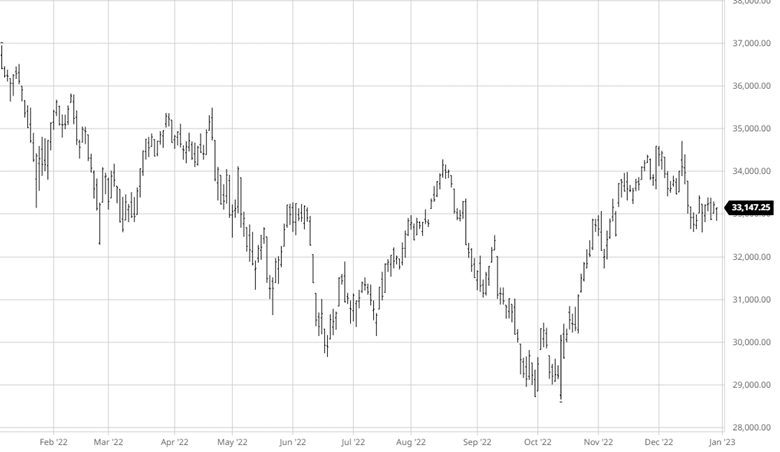

Equity Markets

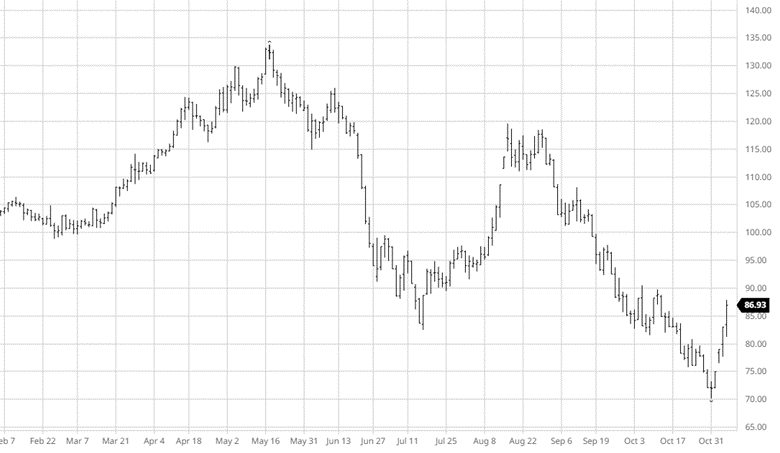

The Dow has been flat the last couple weeks while the NAQDAQ and S&P 500 stocks saw losses. The continued rate hikes into 2023 along with recession fears continue to weigh on the market as investors look for answers along with some tax loss harvesting to end the year. 2022 was not a great year for the markets as a whole and 2023 will sure to hold its own surprises.

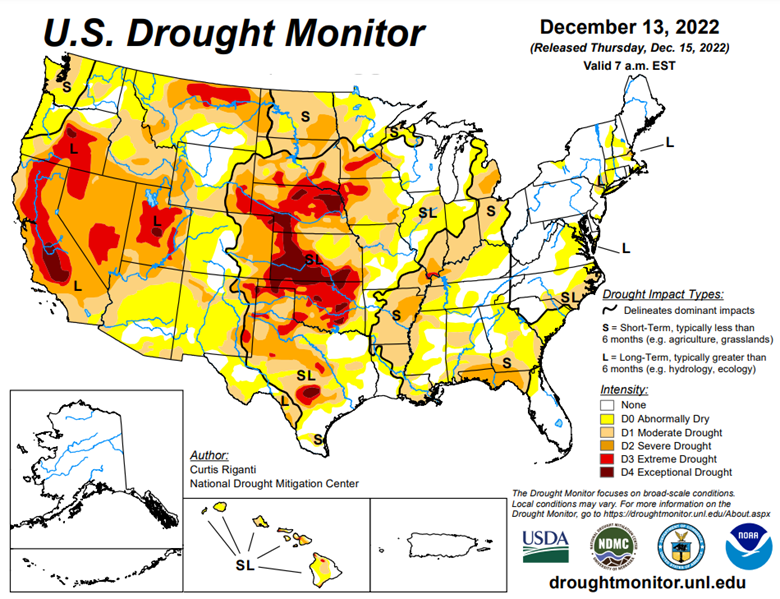

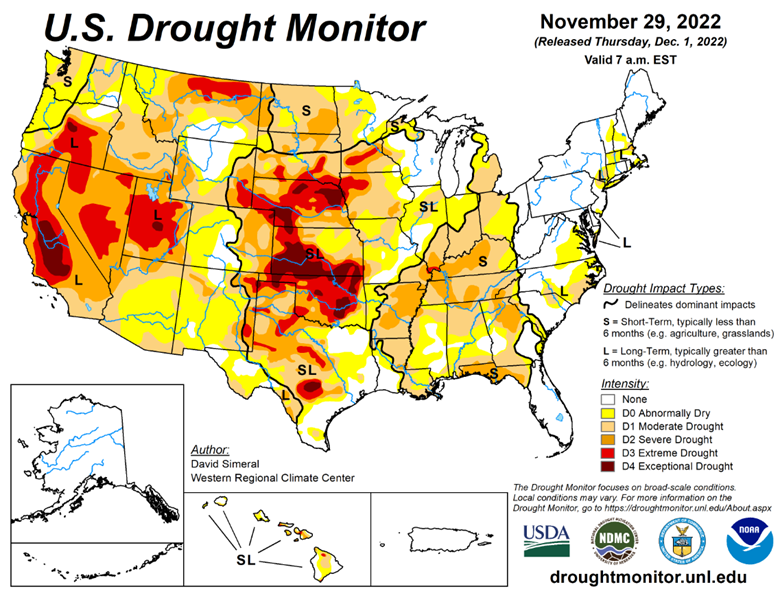

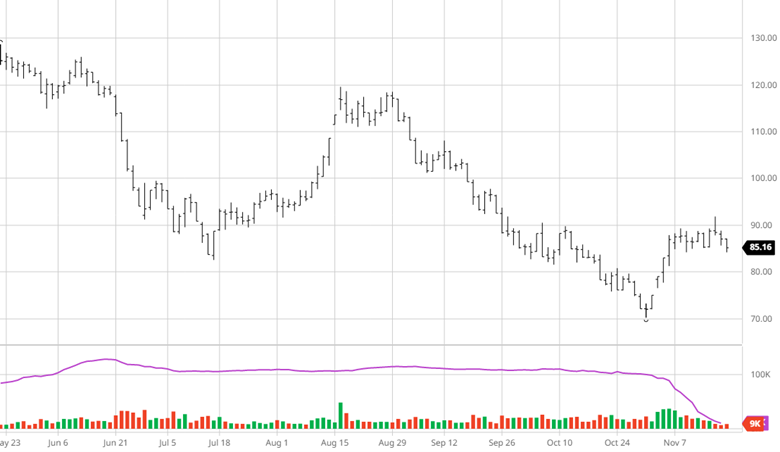

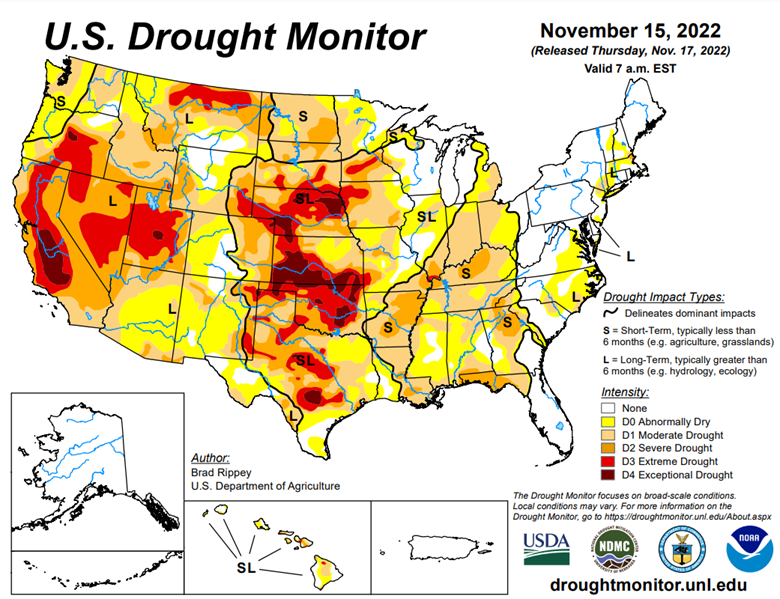

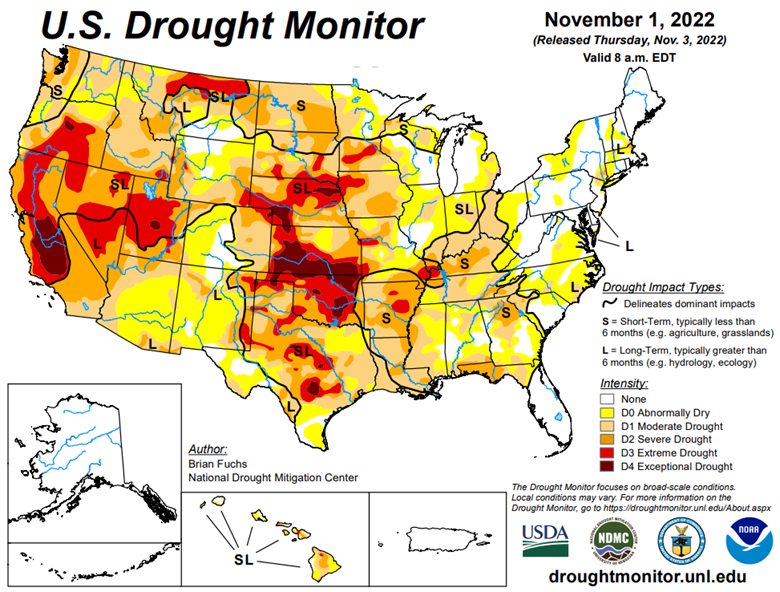

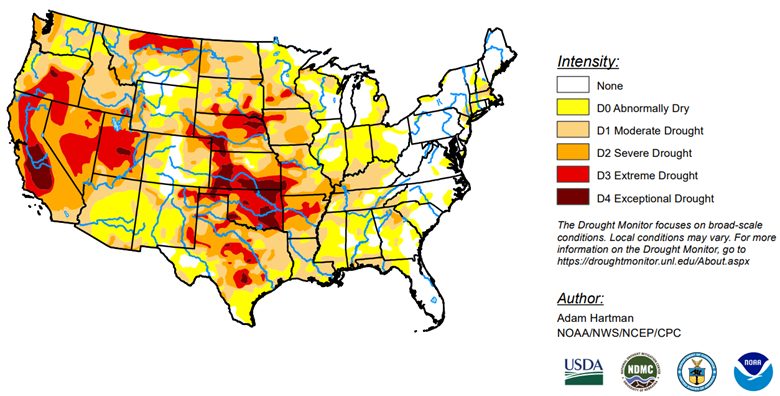

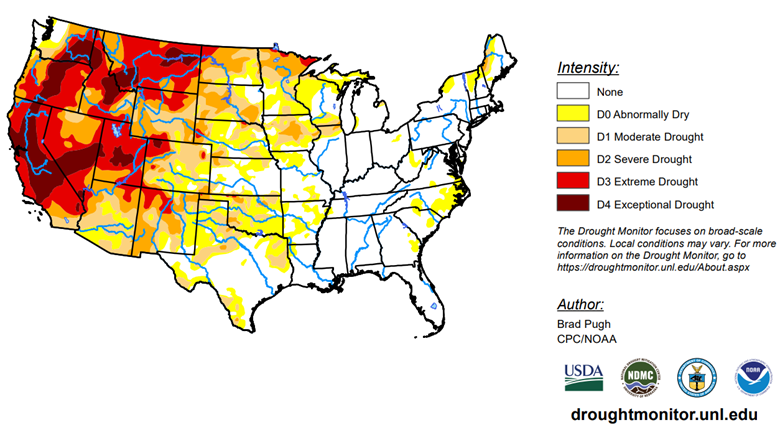

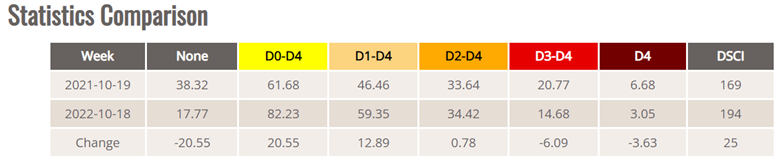

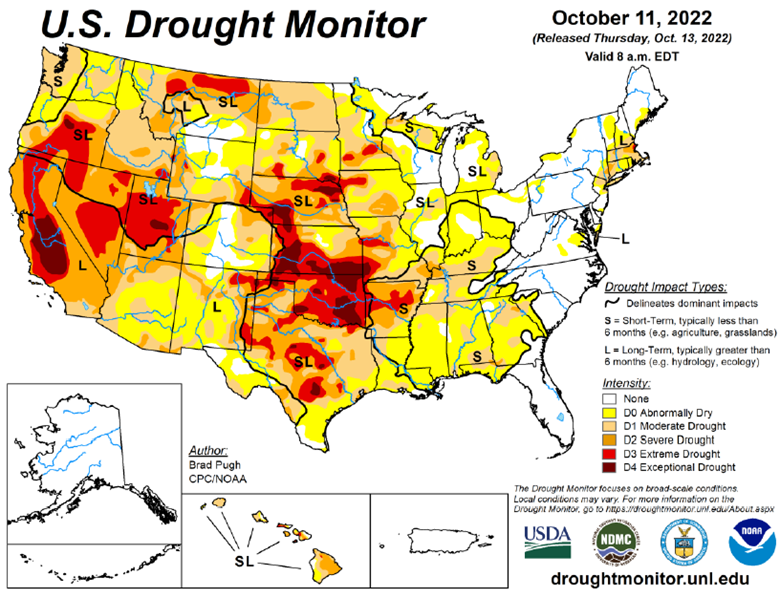

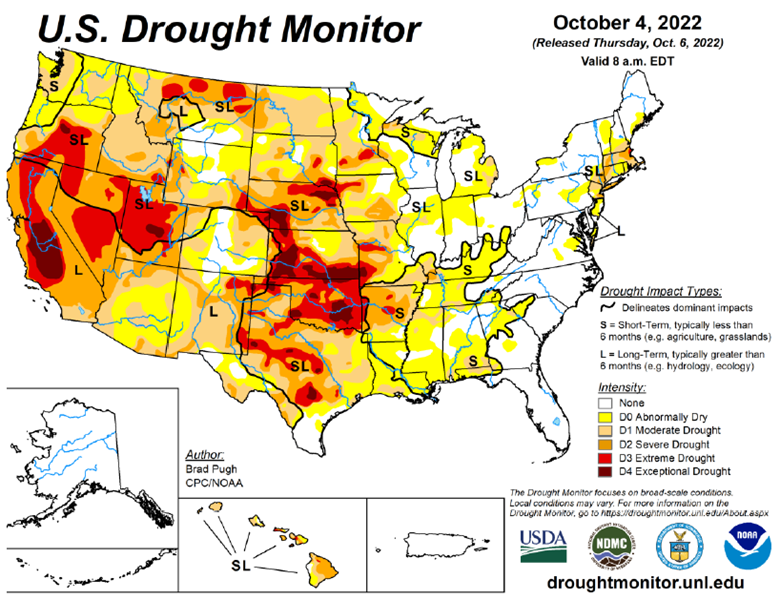

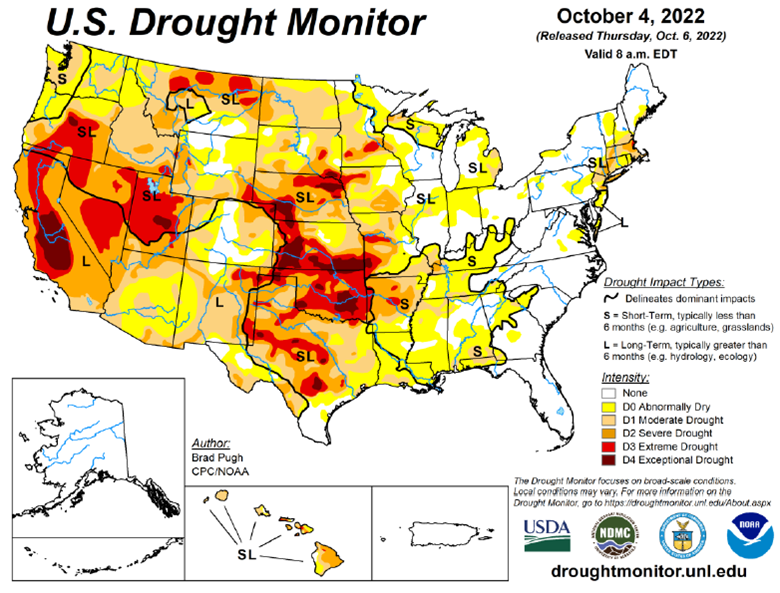

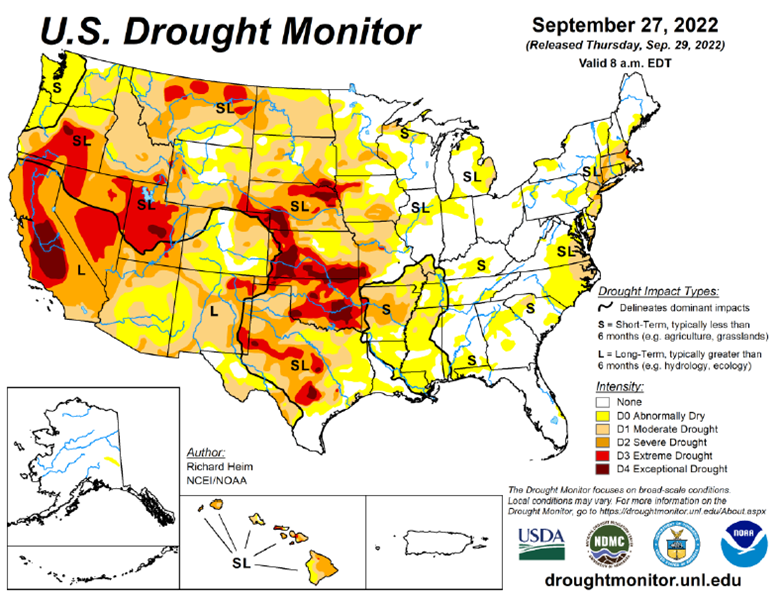

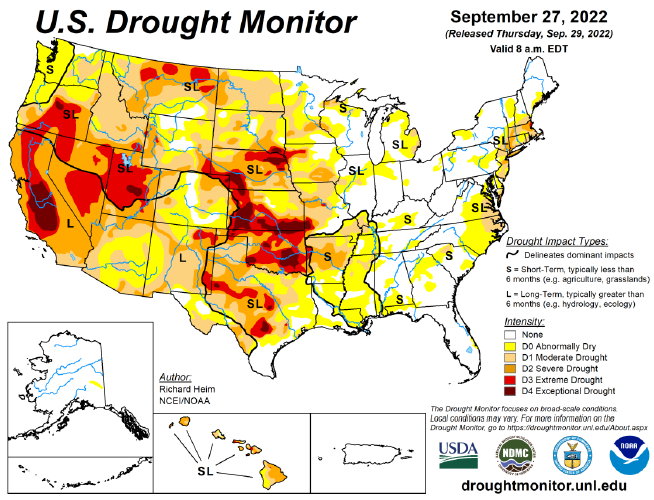

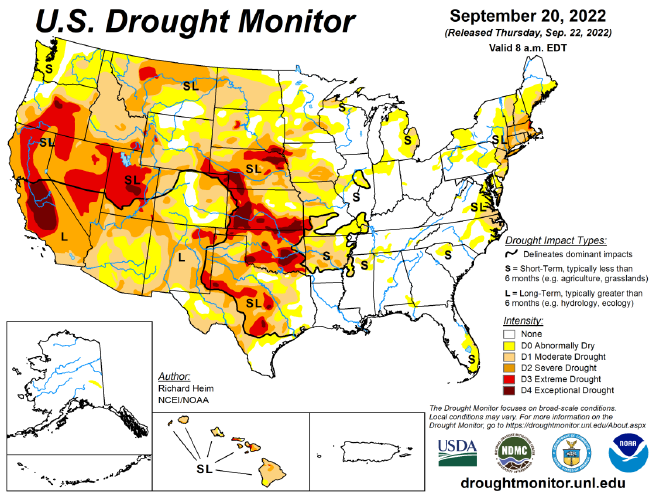

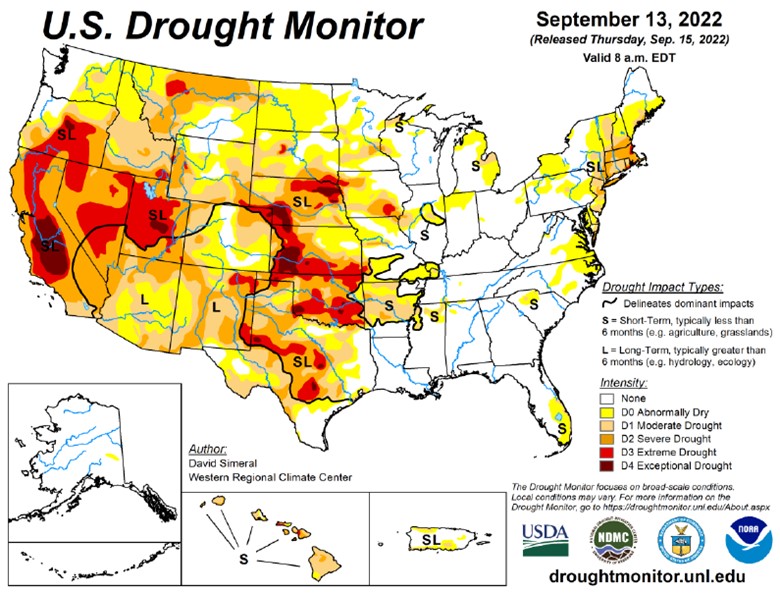

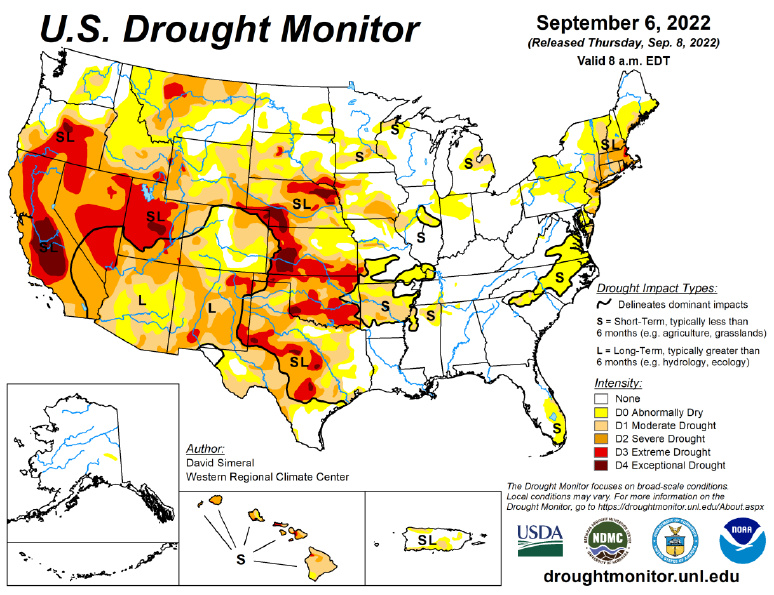

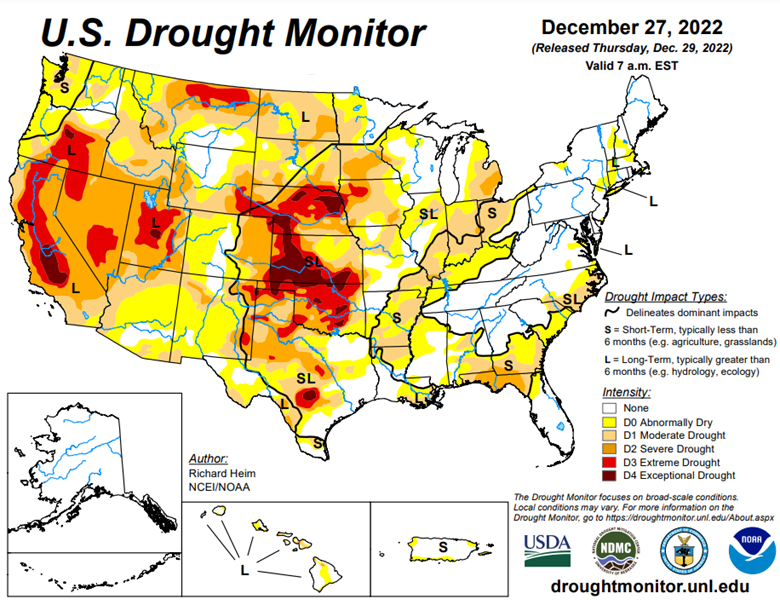

Drought Monitor

Podcast

The Hedged Edge is back online with a guest who could be this podcast’s most important guest of all time. At a time when inflation is running rampant through the world economy, drought conditions are drying up our rivers, and the global supply of grain is scarce. We are tasked with the question, “what the hell is going on in logistics, and is there any relief in sight?”

To help address these questions and more, I am joined today by a man that needs no introduction to most in the physical commodity sector – Woodson Dunavant with the Dunavant Logistics company based in Memphis, TN.

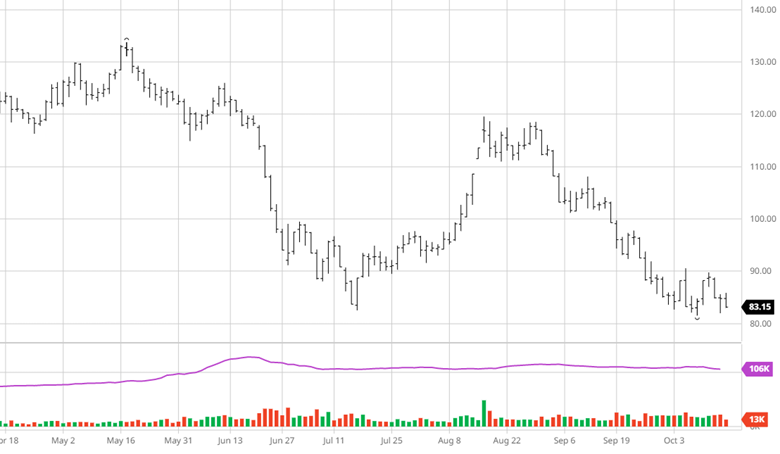

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.