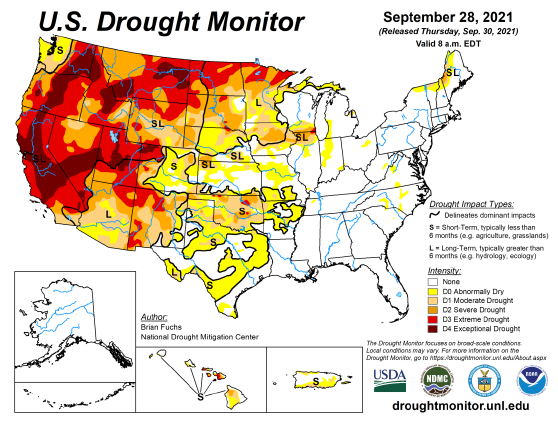

As corn, soybeans, and many other crops begin to enter their harvest season, it is time to think about how the harvest is progressing on the farm. According to agriculture.com, soybean harvest progress is at 16%, and the site reported corn to be at 18%. On top of the progress, it showed that most western and northern states were at a pace above average, and southeastern states were progressing below average.

Last week, RCM Ag Services was fortunate to have a first-hand look at a couple of states within this region. Bert Farrish, Director of Commercial Agriculture, ventured out on an 800-mile crop tour throughout Tennessee and the northern Mississippi Delta from September 21-26. Let’s take a look at his 5-day journey across the south and dive into the industry as Farrish provides his very own commentary for a 2021 crop progress assessment.

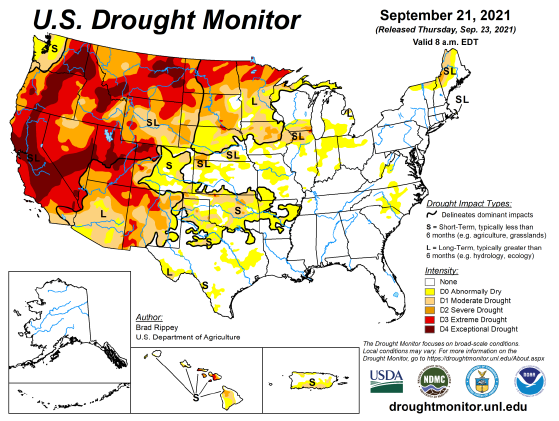

Is Weather Hindering Western Tennessee?

The tour began in Western Tennessee, where turbulent weather was predicted in the forecast, and it wasn’t long before Bert was met with strong thunderstorms between Nashville and Lexington. As he encountered severe weather along the I-40 corridor, he naturally observed little to no harvest work. “The crops looked relatively good; however, Western Tennessee has a long way to go with this year’s harvest,” Farrish stated.

“There is still a lot of corn and soybean in the field, and I predict that harvest, for both corn and beans, will move well into October.” But it wasn’t just corn and beans that needed additional time this year. “Cotton wasn’t near ready for harvest; I am estimating that the harvest won’t begin until mid-October.”

Driving Into The Delta

As Farrish continued his driving tour into the Mississippi Delta, progress wasn’t much further along, and he stated that this area had also received recent rain showers. “I would say corn was 90% complete in the areas I drove through,” which contained routes along I-69, Hwy 61, Hwy 8, and Hwy 6.

“With some exceptions, most crops looked great!” However, Farrish had stated some crops like rice still had a ways to go. “I would say the crop is later than usual, but they will wrap up the bean harvest in the next few weeks with good weather.”

But as we all know, weather this time of year is unpredictable, especially with rain in the forecast this week at a 60% coverage. Over the weekend, there was a steady line of trucks through Cleveland headed to the port of Rosedale, MS. Combines were running everywhere Saturday, September 25, and Sunday, September 26.

The Bolls Are Open — A Preview of the Cotton Counties

With the driving tour coming to an end, the last assessment concludes with cotton. Harvest for cotton still has a long way to go. Farrish predicts that 30-50% of bolls are open. “There were minimal small fields that were ready to pick, but certainly no one is going to open a gin for a few bales.”

But that doesn’t mean all areas in the Delta need work. The cotton in Coahoma and Quitman counties looks as good as ever. Farrish stated, “Some fieldwork has been done in the north Delta, but I am certain harvest for all crops is further along in the south Delta, meaning Hwy 82 and south to near Vicksburg. But I was unable to see this area in this trip.”

Final Trip Takeaways

Overall, Bert concluded his trip feeling optimistic about the crop prospects. Although some areas need improvement, most crops look strong and are on track to have a strong harvest season.

Visit our blog, Here’s What you Need to Know About the Outlook for the First Week of October, for an additional harvest update on the many unknown/under-reported issues early in the year that we may be seeing played out combined with the dry and hot finish.