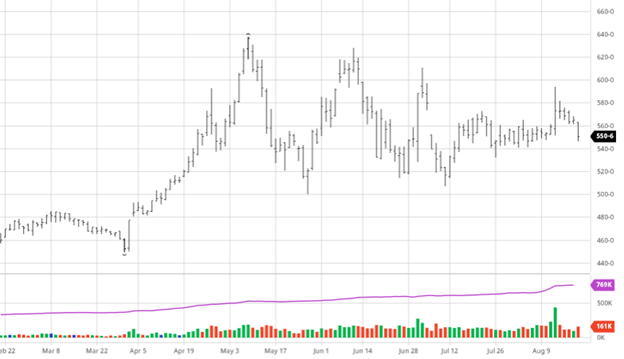

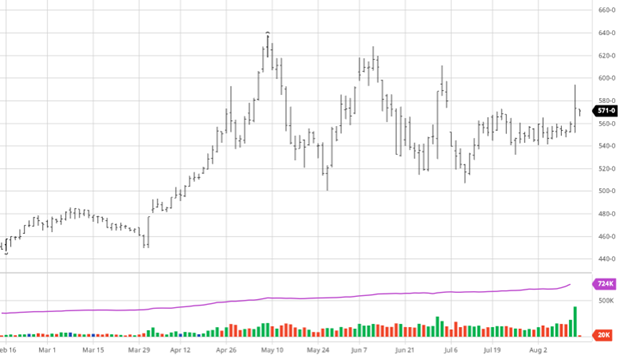

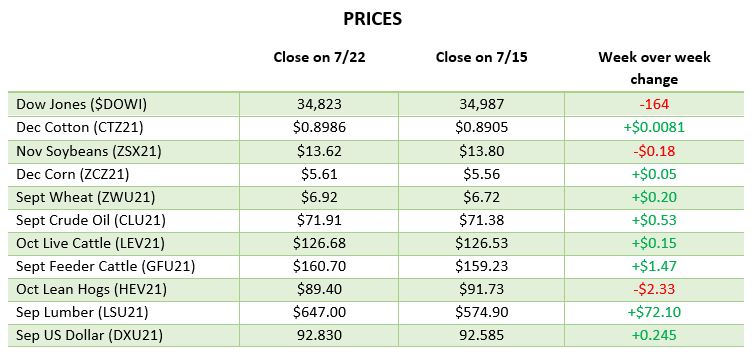

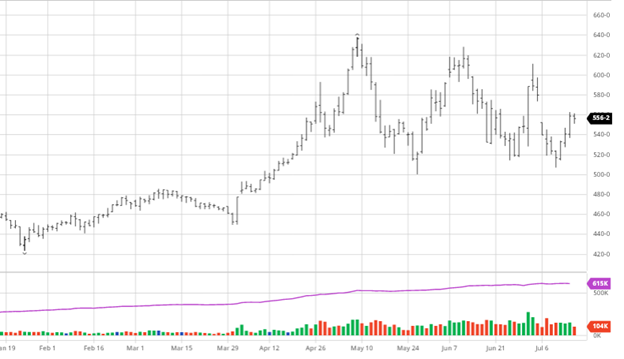

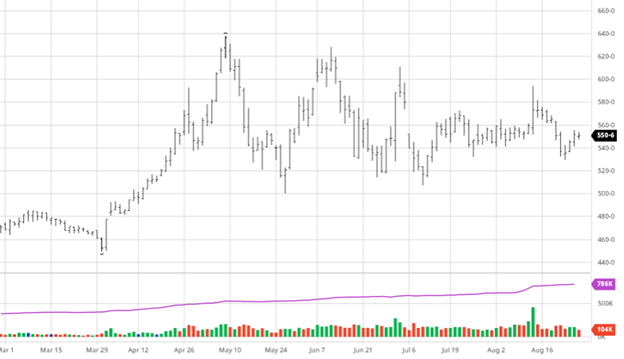

Corn was unchanged on the week as slow news, a lack of major export announcements, and no major rain events crossed the area’s most in need. Additionally, most of the corn belt has seen above average temperatures this week keeping a bid under the market. The late season heat and hot nights are taking their toll on the crop but hopefully the heat will end soon according to some forecasts. This time of year, markets begin to look at multiple yield reports coming in from various independent groups – i.e the Pro Farmer Tour (results HERE). At first glance many in the industry feel the tour results are a bit high, but only time will tell. Any big surprise exports or continued weather problems will be the bulls news while rain and yield reports will be the bears.

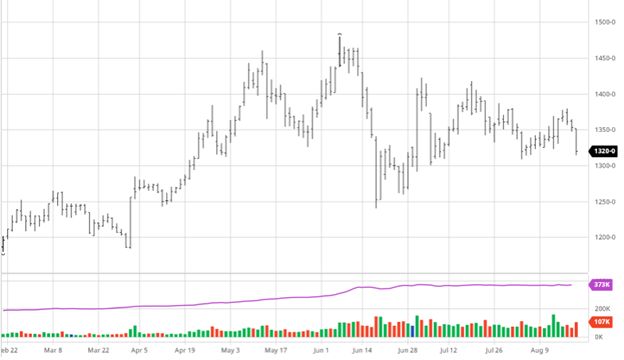

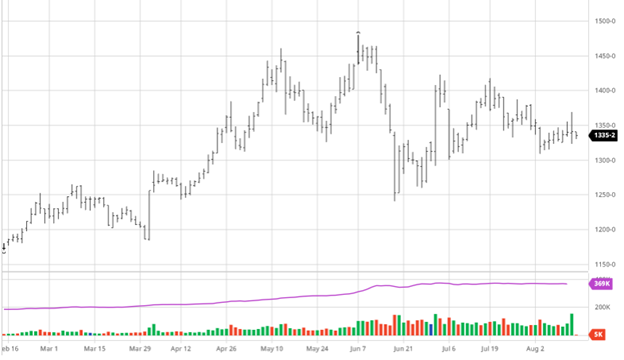

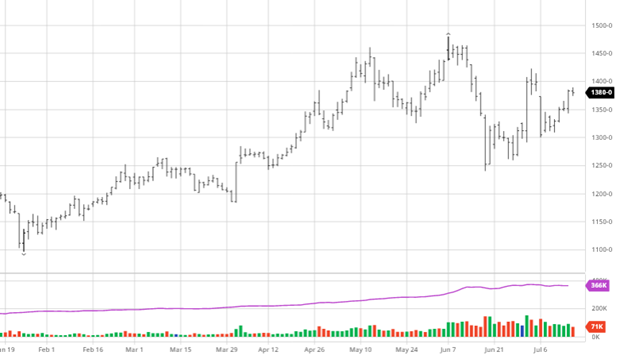

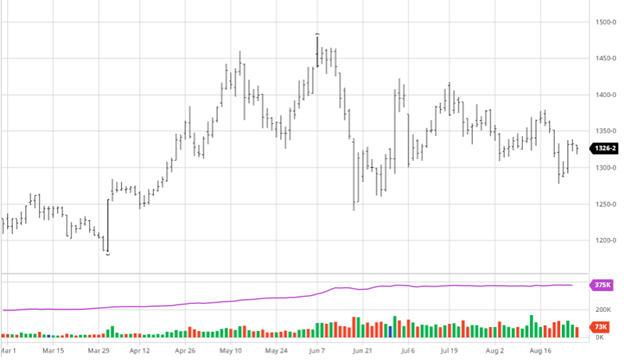

Soybeans made small gains on the week as the same news moved beans that moved corn. China continues to be a buyer going on 2 weeks now which is supportive after their long silence. The market is reacting to these purchases as if they were expected and normal purchases. Regular and consistent purchases will need to continue for the market to remain supportive. Any abrupt could see another slide heading into harvest before we have a better idea on yield. The rains that some think will help corn will also help beans as we head into September.

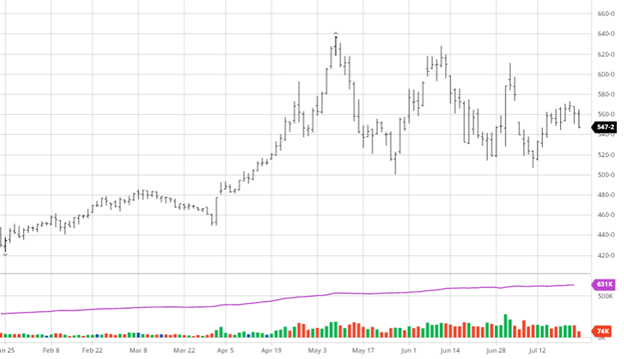

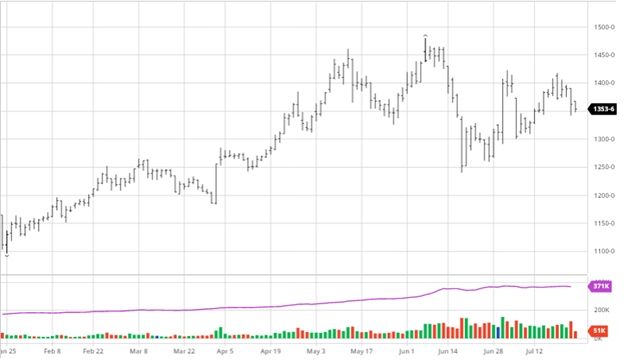

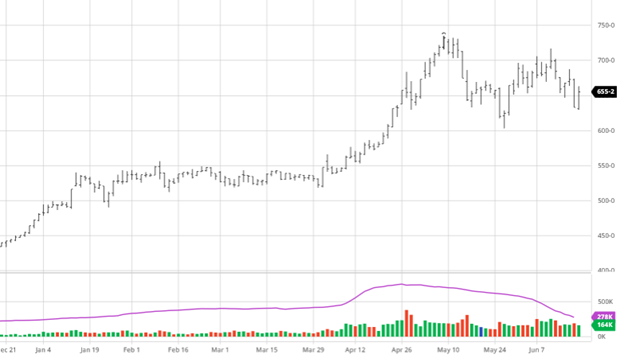

Dow Jones

The Dow gained on the week as what seemed to be investor weariness last week turned into buying opportunities. The events in Afghanistan weighed on the market Thursday with uncertainty about the US foreign relations going forward. As of this morning, Friday 8/27/2021, the S&P and Nasdaq are making fresh all-time highs following the latest comments from the Federal Reserve where NO NEW policy changes were announced and supportive monetary measures will remain in place.

Afghanistan

The suicide bombing by an ISIS-K member Thursday in Kabul, that claimed the lives of dozens of Afghan citizens, along with a dozen US Service members, while injuring countless others, shook the world. The swiftness of the fall of Afghanistan’s army and government to the Taliban has put the US at the center of one of the biggest international situations in recent memory. Going forward the countries around Afghanistan will be important to keep an eye on for exporters to the middle east.

Podcast

Check out our recent podcast where we’ve brought on one of our real-life firefighters from RCM Ag – Jody Lawrence along with Tim Andriesen from the CME Group to provide us with some inside baseball knowledge of the current state of the agriculture markets and to discuss the real-world application of the use of short-dated options to potentially fight the current blaze of volatility surrounding agriculture markets.

https://rcmagservices.com/the-hedged-edge/

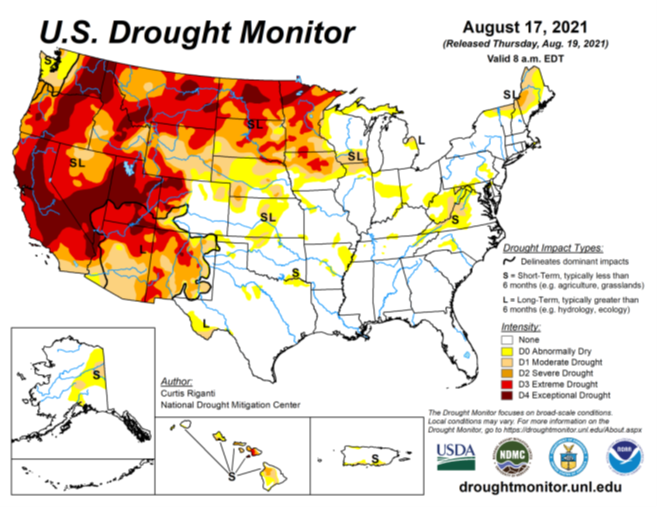

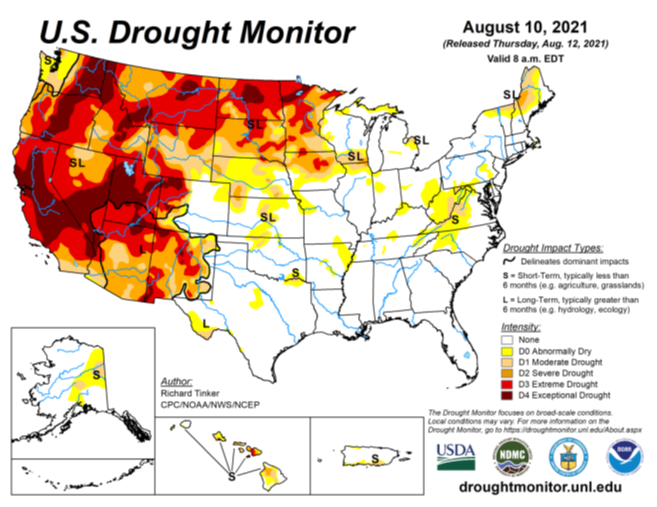

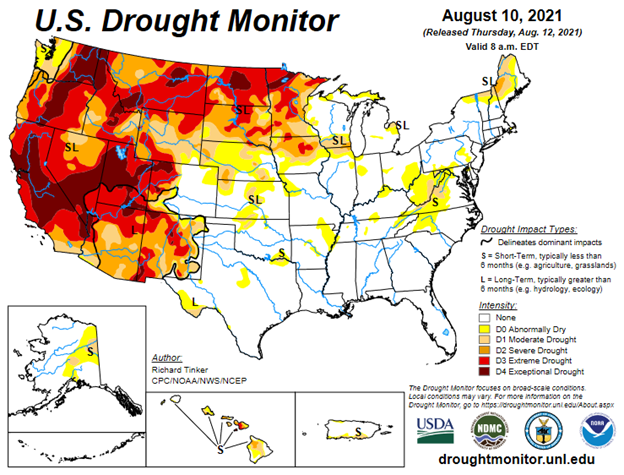

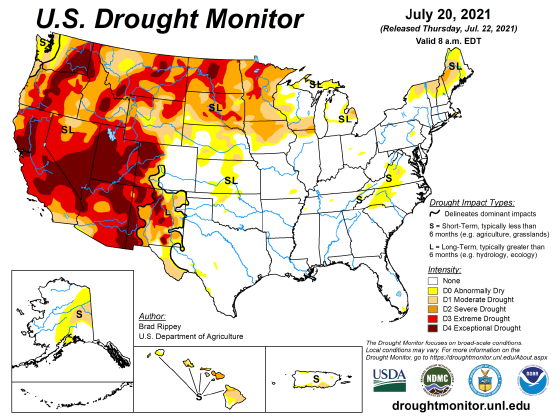

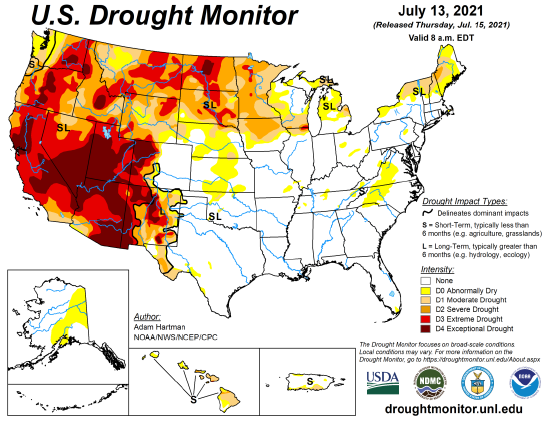

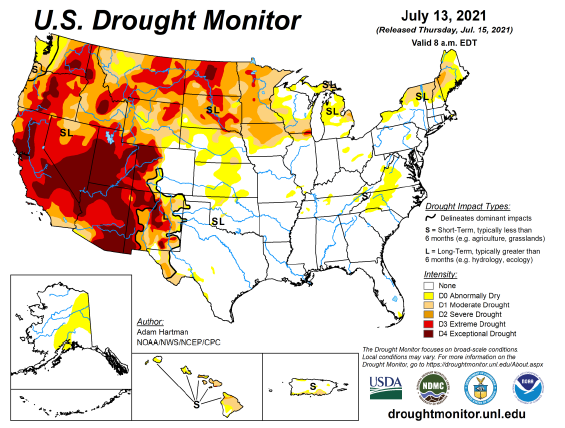

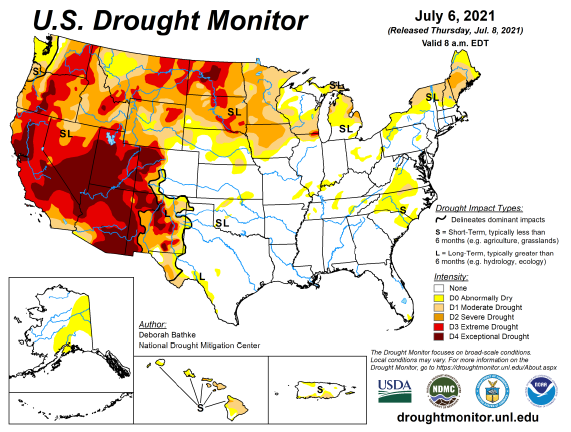

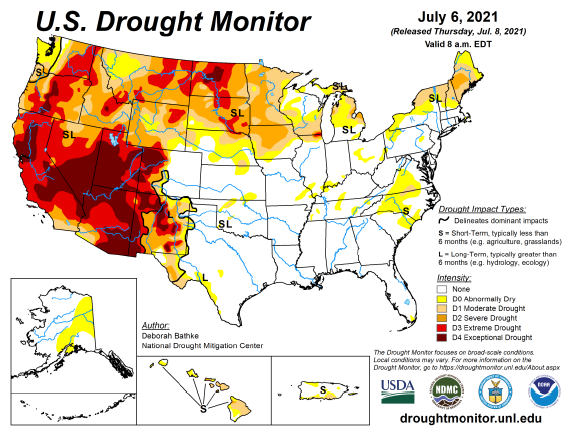

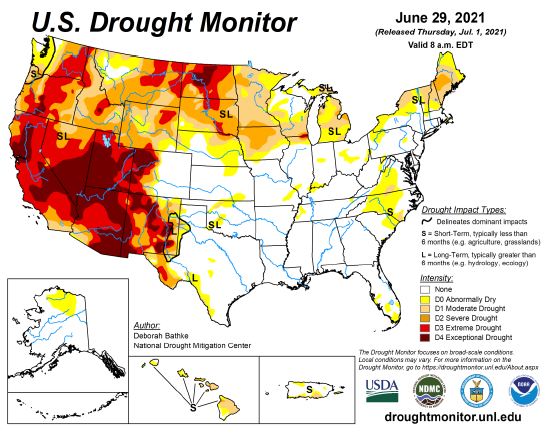

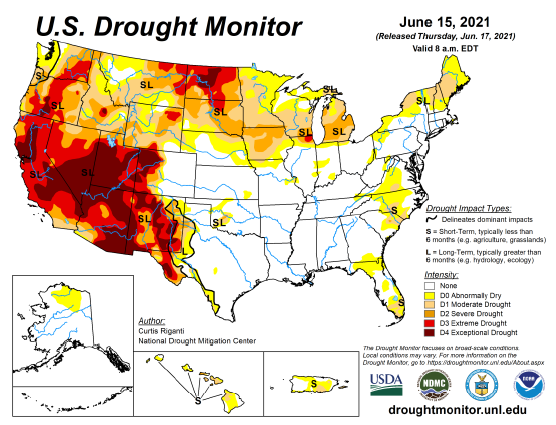

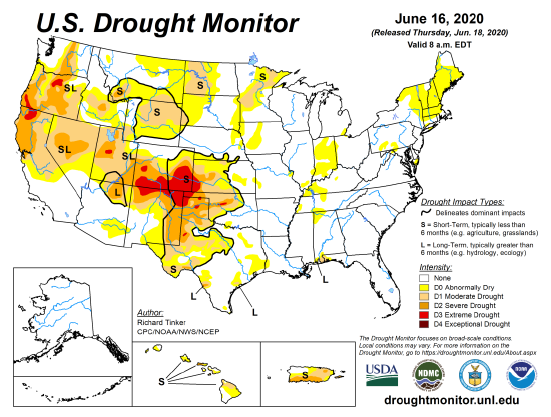

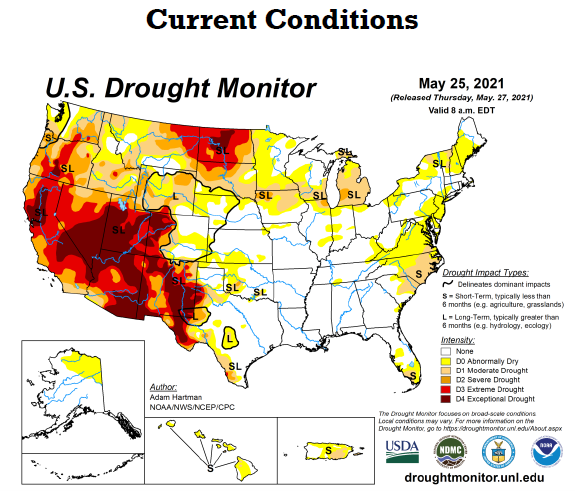

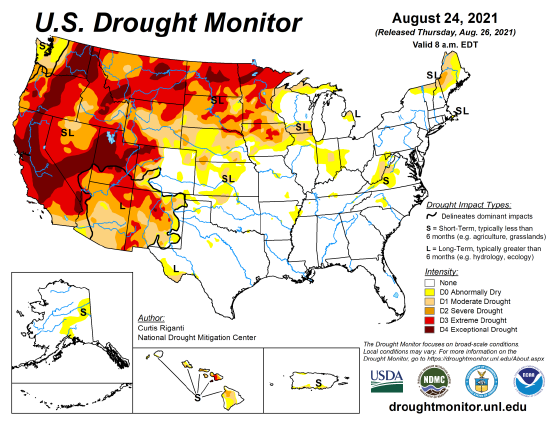

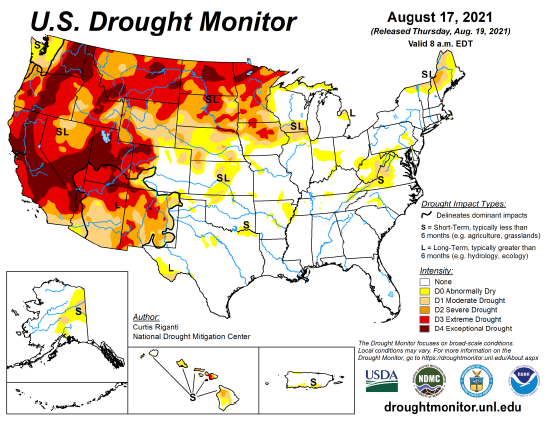

US Drought Monitor

The maps below show there was not much change over the week despite weekend rains in some areas that needed it and some drying in Indiana.

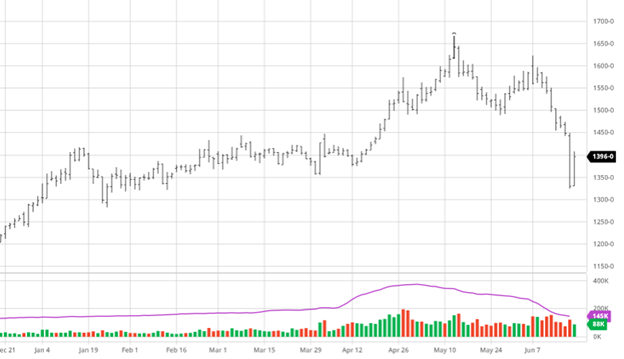

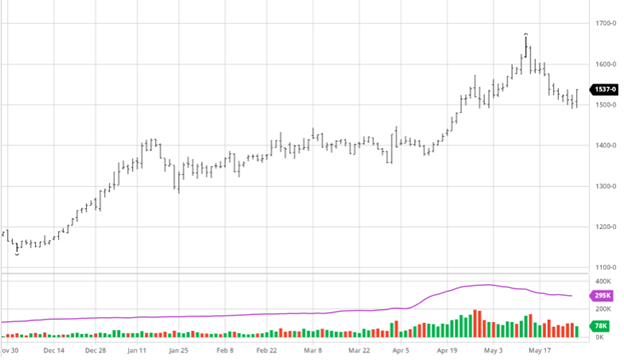

Via Barchart.com