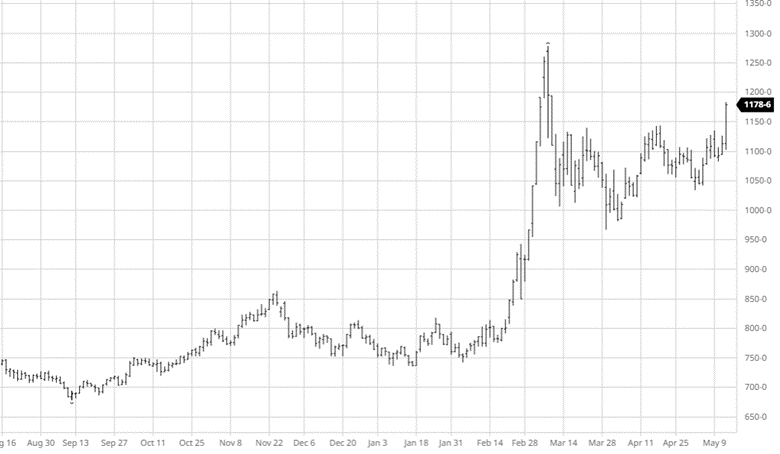

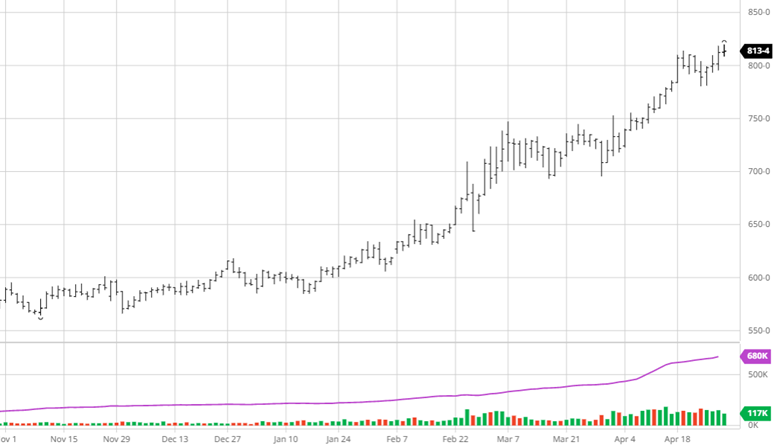

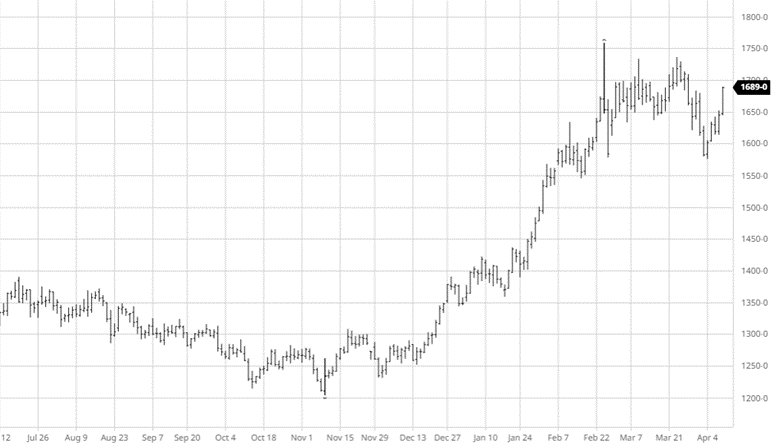

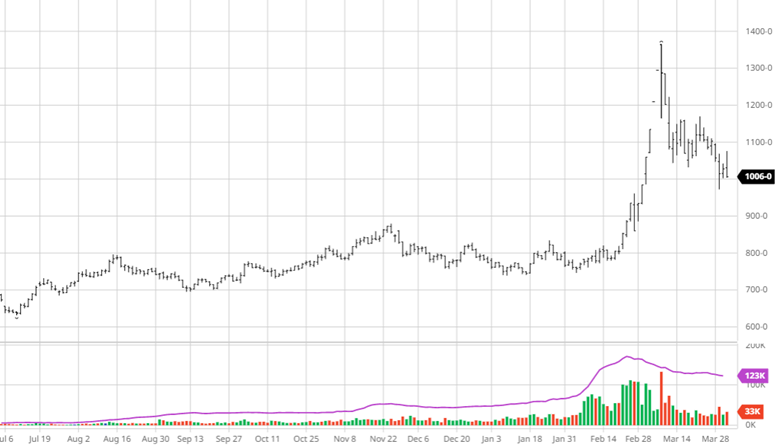

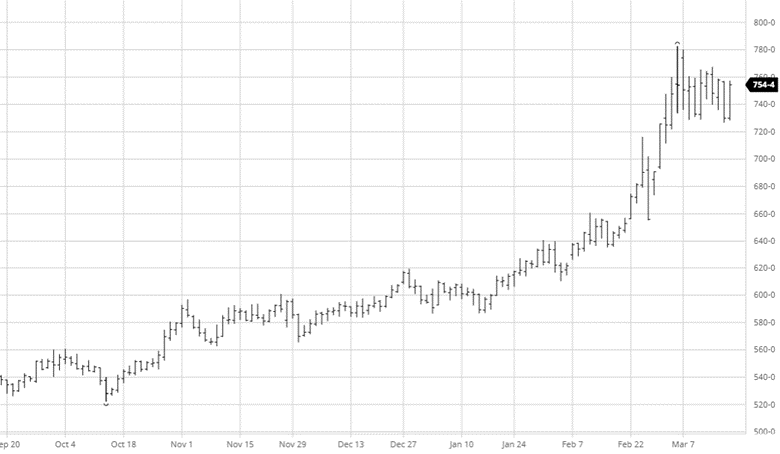

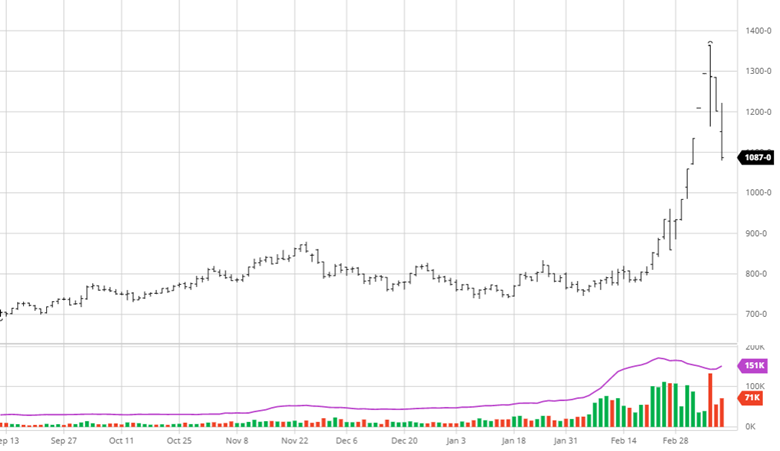

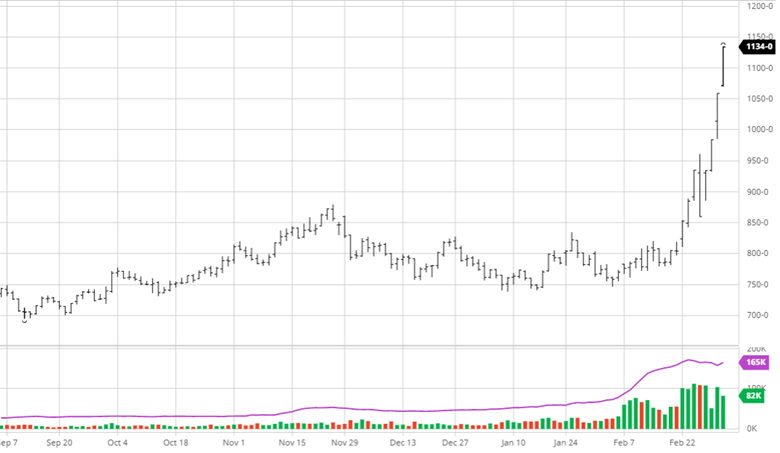

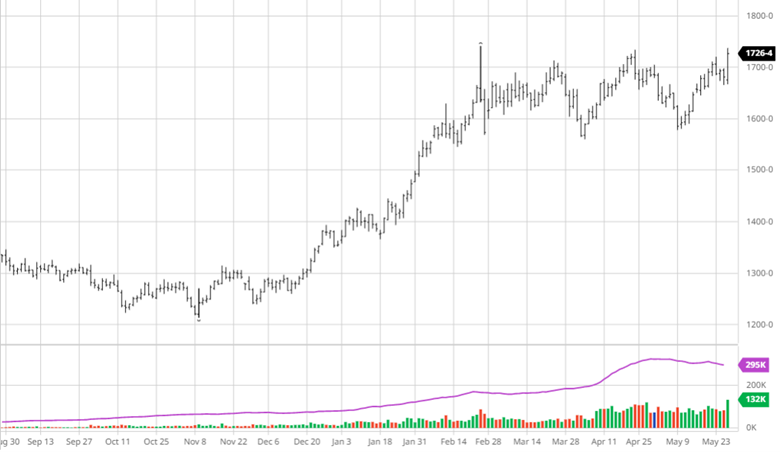

Corn has traded lower over the past couple of weeks as planting progress has sped up following a slow start to the planting season. While we knew the corn would get planted, the early delay was worrisome and continues to have the potential to lead to harvest yield loss. Despite the gains in many states, ND and MN are still wet and cool with no warmer weather in the forecast to help pull these areas into any form of normal pattern.

With the country wide and regional delays to planting, the latest USDA yield estimate of 177 bpa seems realistic vs the initial 181 bpa. That said, more progress will be made over the 3-day weekend as catch up is played leaving traders only guessing how the lates progress data will be reported come Tuesday. 3-day weekends tend to be unpredictable as the markets do not open until Monday night, so any weather event over the weekend followed by a shortened trading week will likely lead to continued volatility.

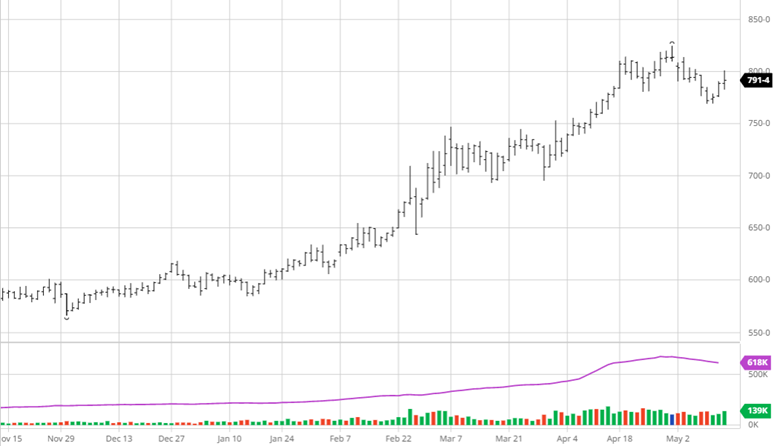

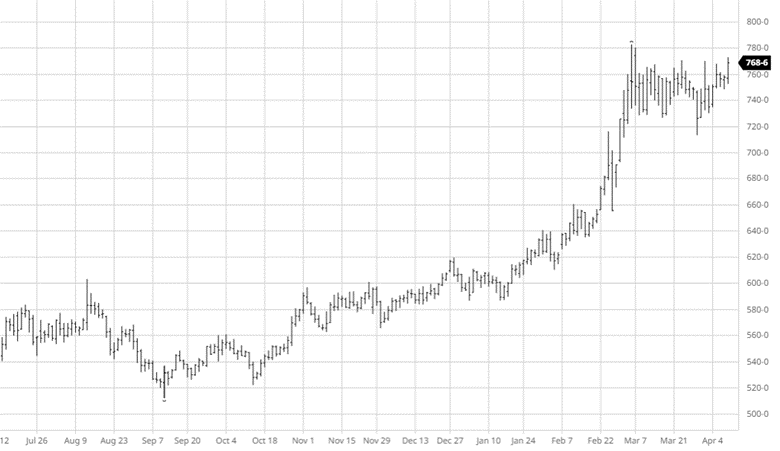

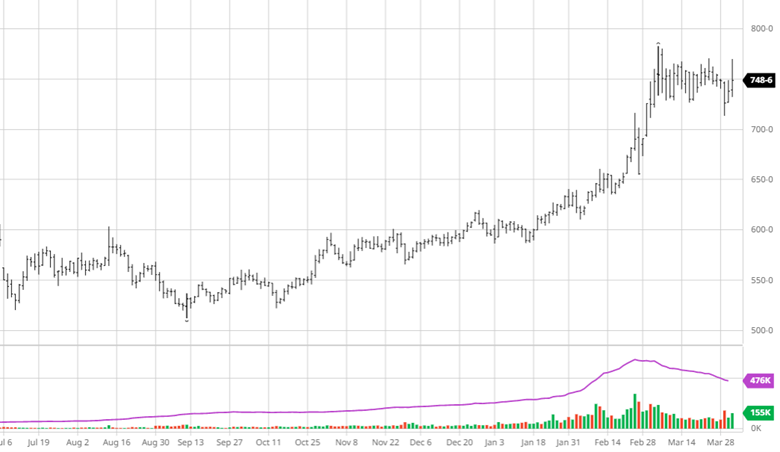

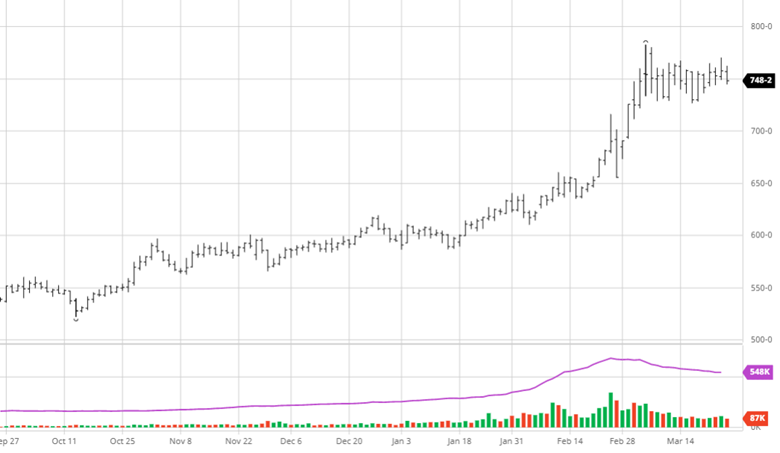

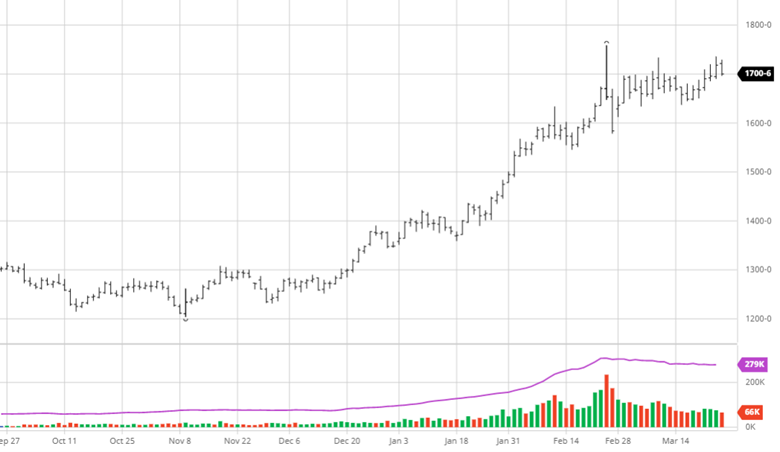

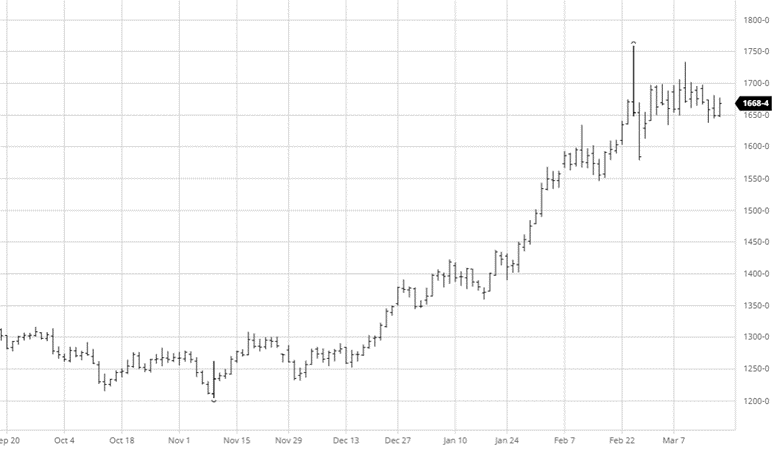

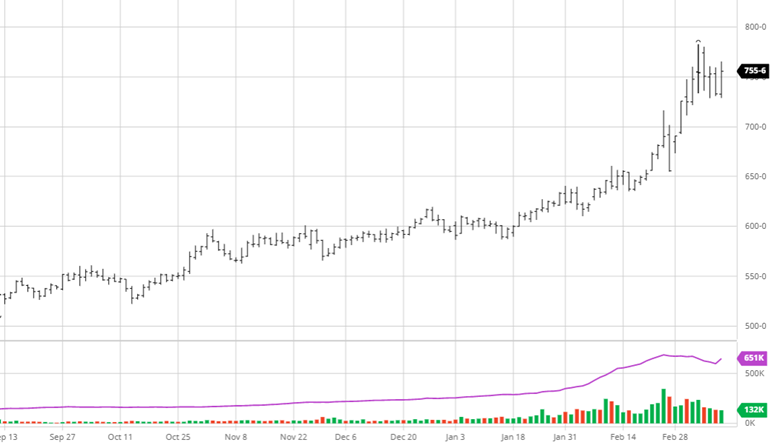

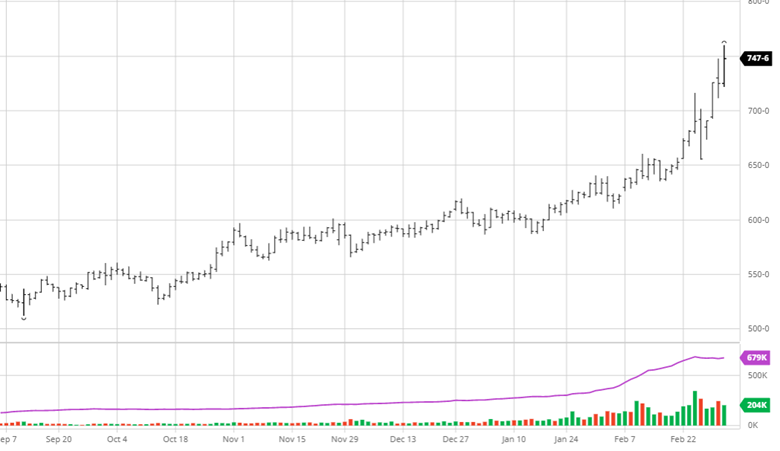

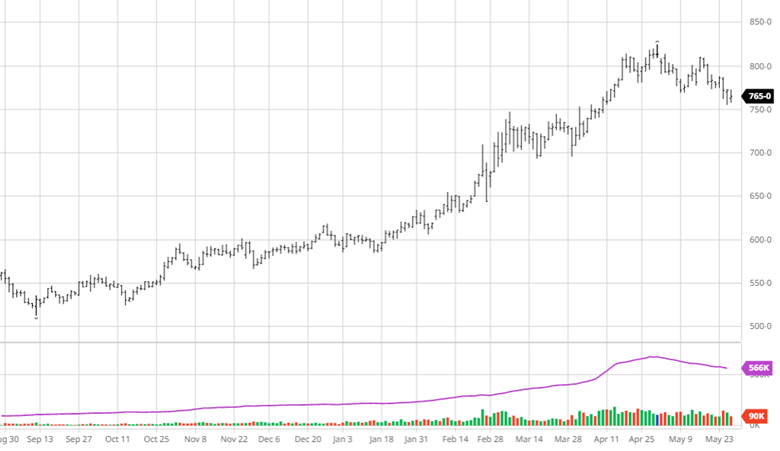

Soybeans have bounced back the past couple of weeks as they have traded up and down since making contract highs in February. Diesel’s rally has helped beans as it increases the need for more vegetable oil in renewable diesels. Chinese demand has been quiet and their new deal with Brazil for corn could lead to friendlier trade elsewhere as well. Planting is slow but we are not late enough into the year yet to worry about yield loss, like we are with corn. More progress will be made over the long weekend and could see a volatile open Monday night as well.

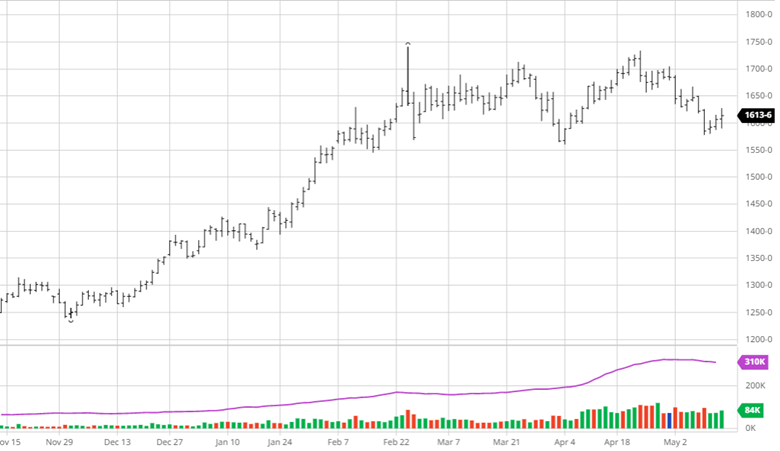

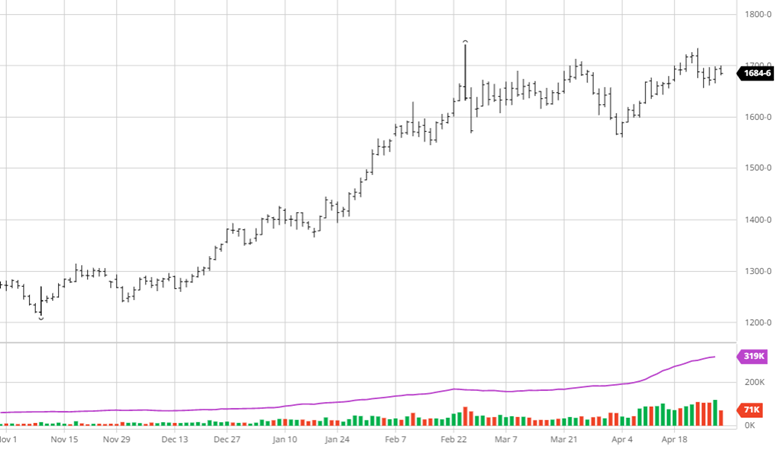

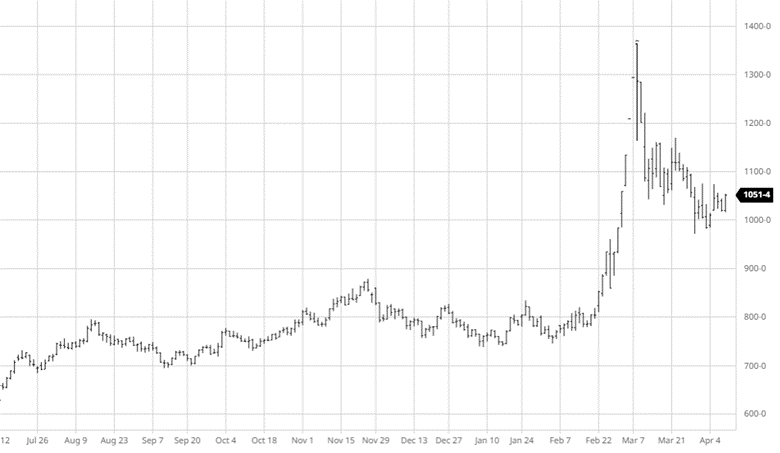

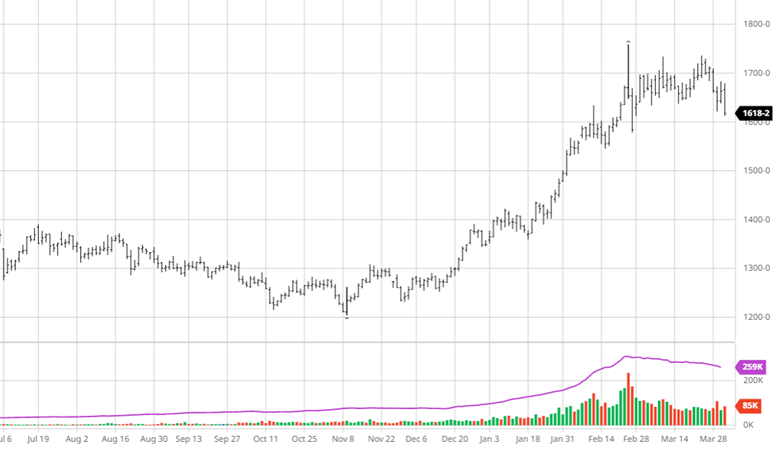

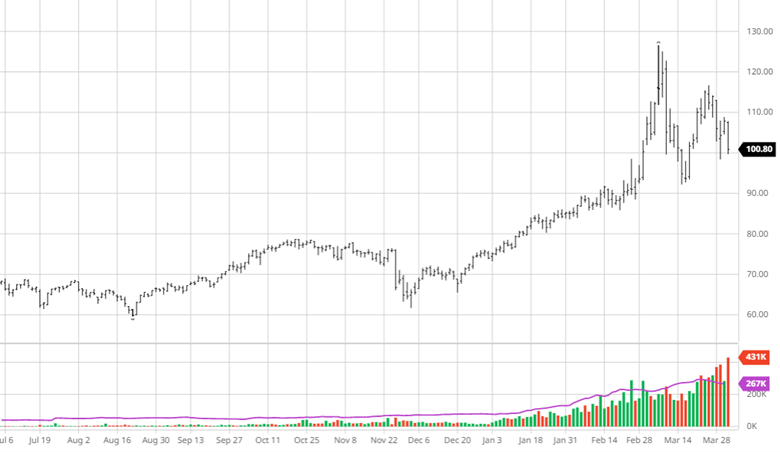

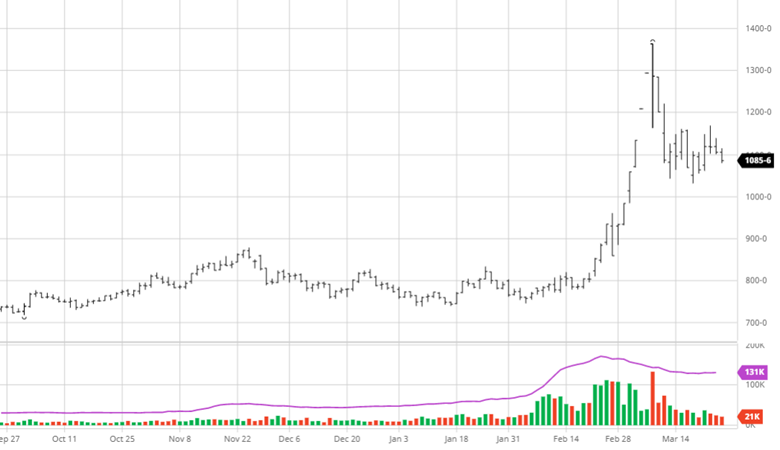

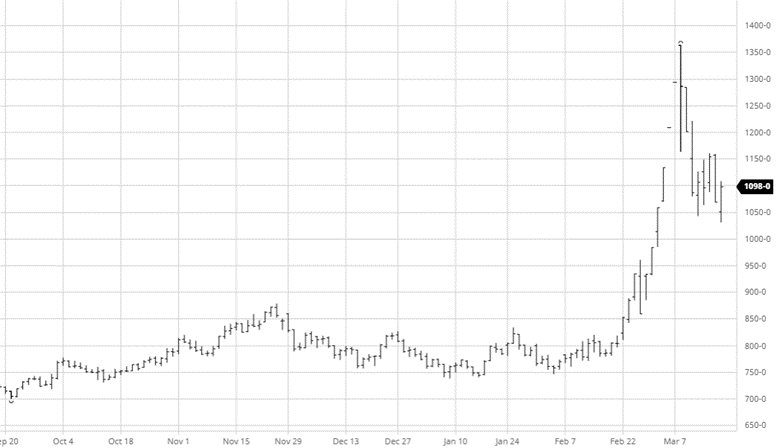

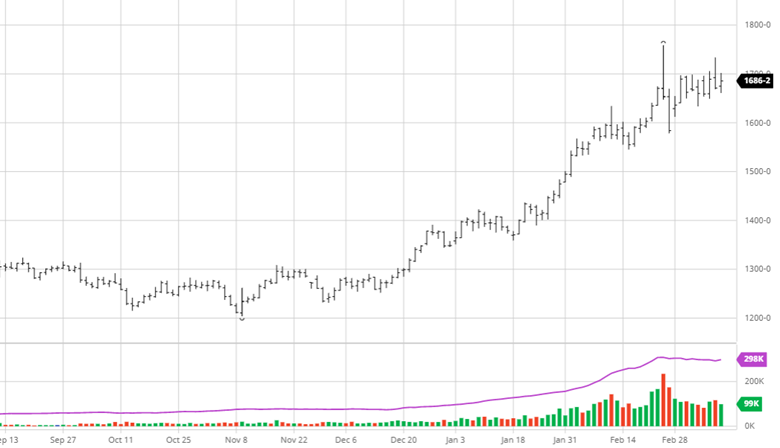

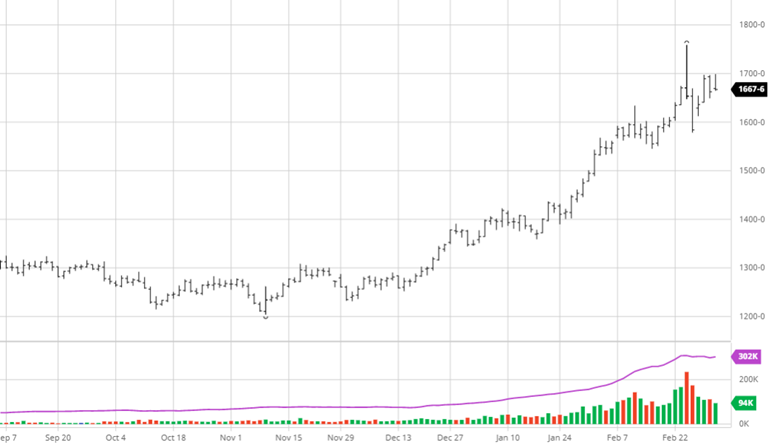

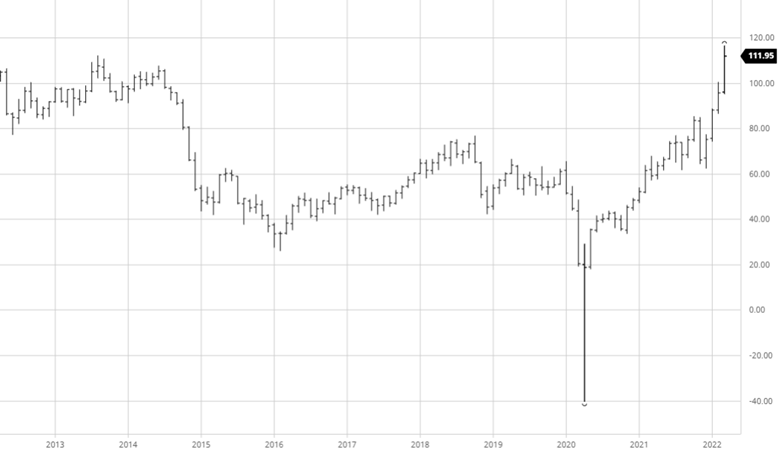

Crude Oil

Crude is back trading near its post invasion highs of the mid $110s while natural gas continues higher. The world energy market continues to trade higher while countries try to explore ways to ease the burden on their citizens. This problem will not be fixed anytime soon so we should expect higher prices in to the summer.

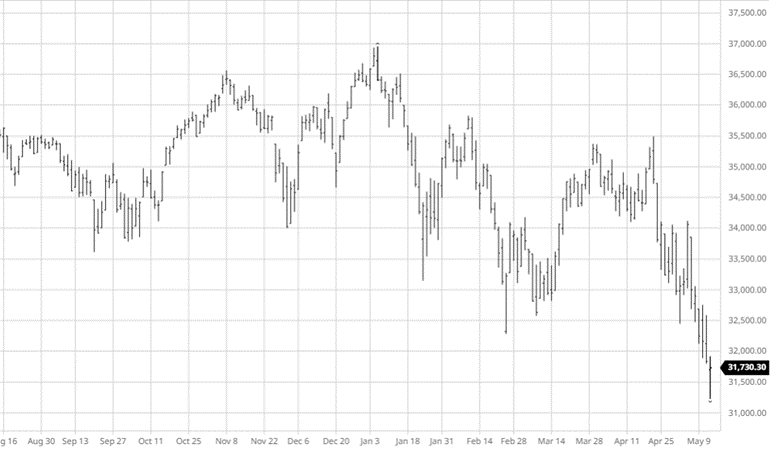

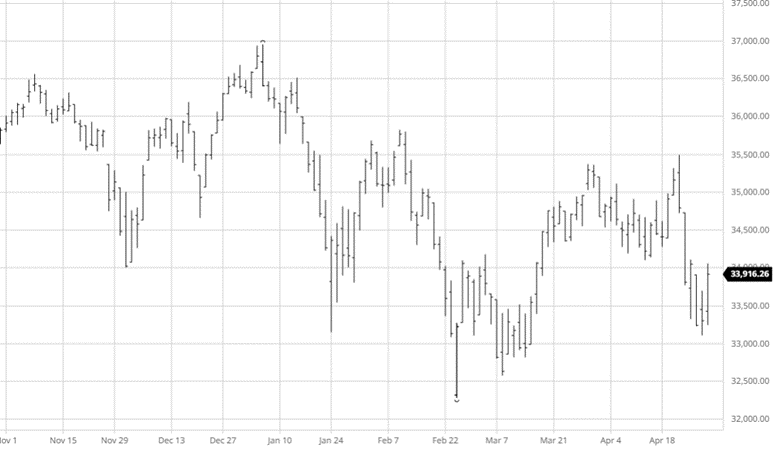

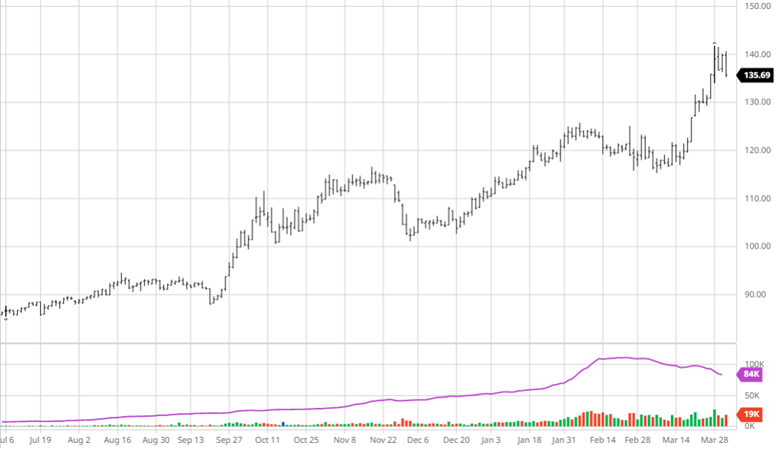

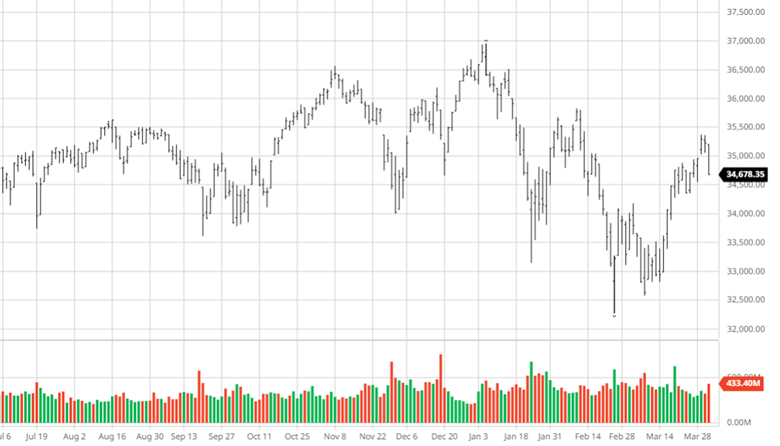

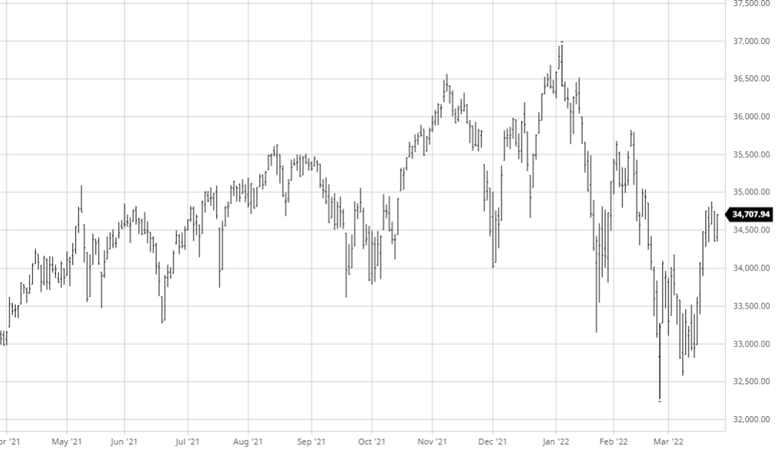

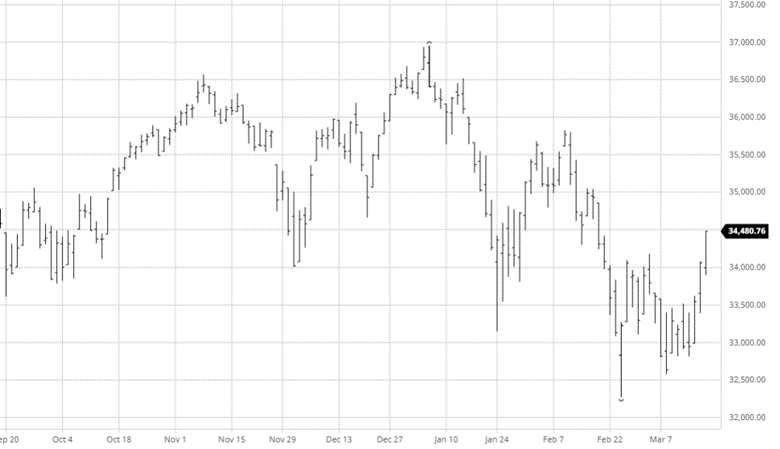

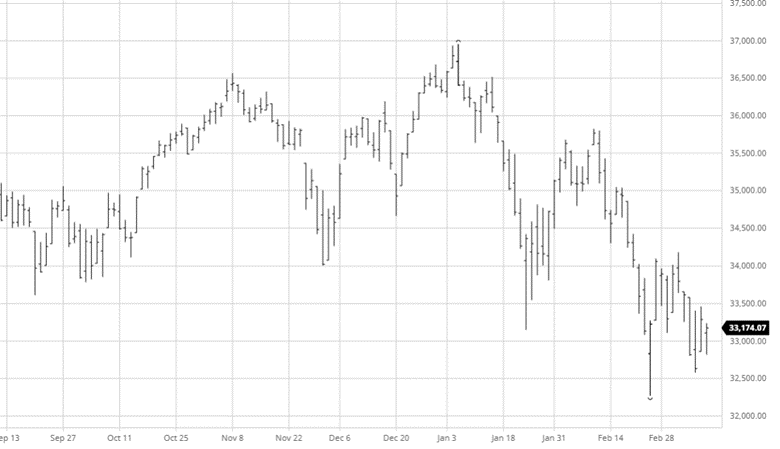

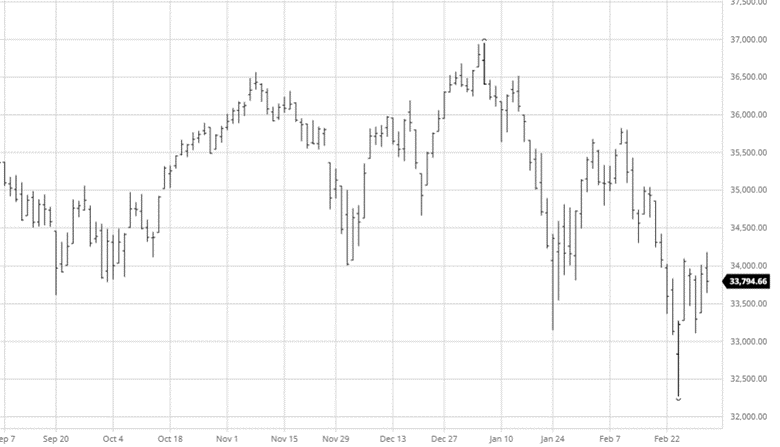

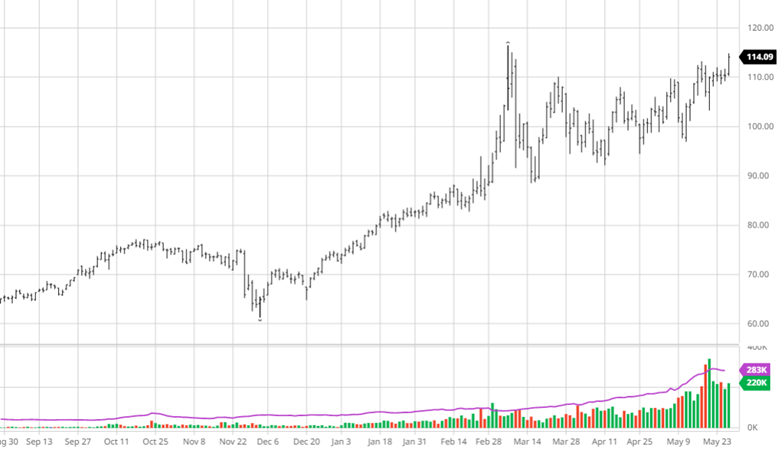

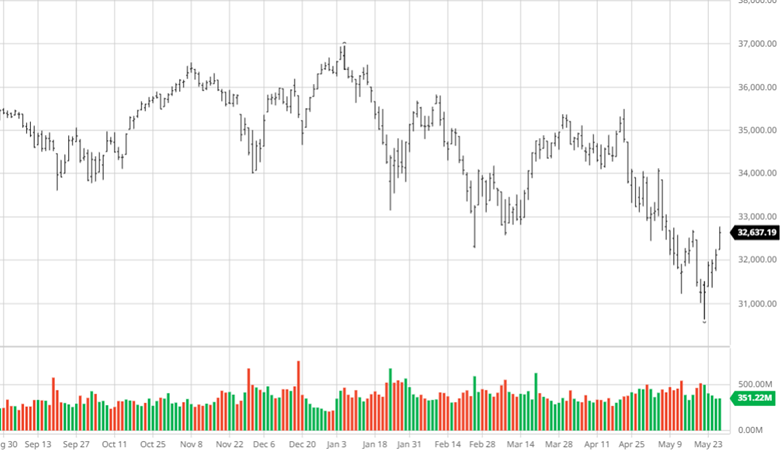

Equity Markets

The equity markets saw a welcome rally this week amidst the continued bear market of the last few months. While this may just be a temporary bounce before the Fed reduces its balance sheet, it is nice to see some positive days in a row. Mixed earnings, interest rates, and the war in the Ukraine continue to dominate the story lines. Keep an eye on the big names as they will continue to decide which way the market goes.

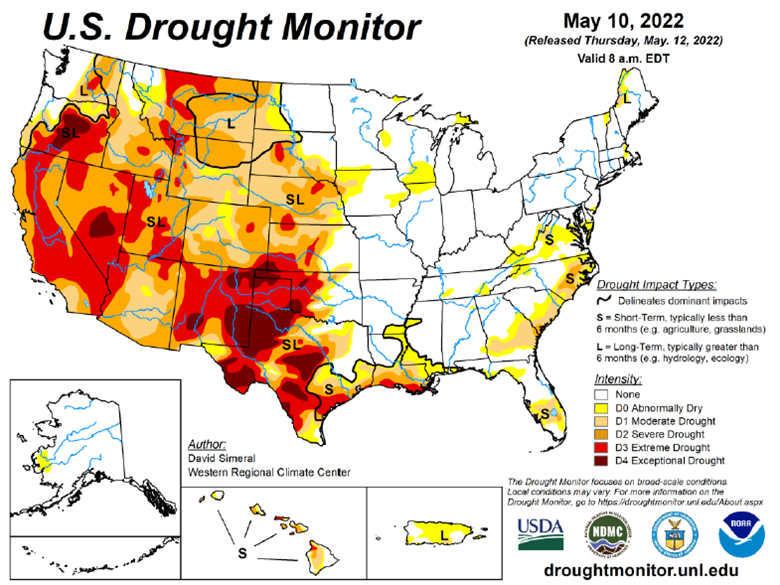

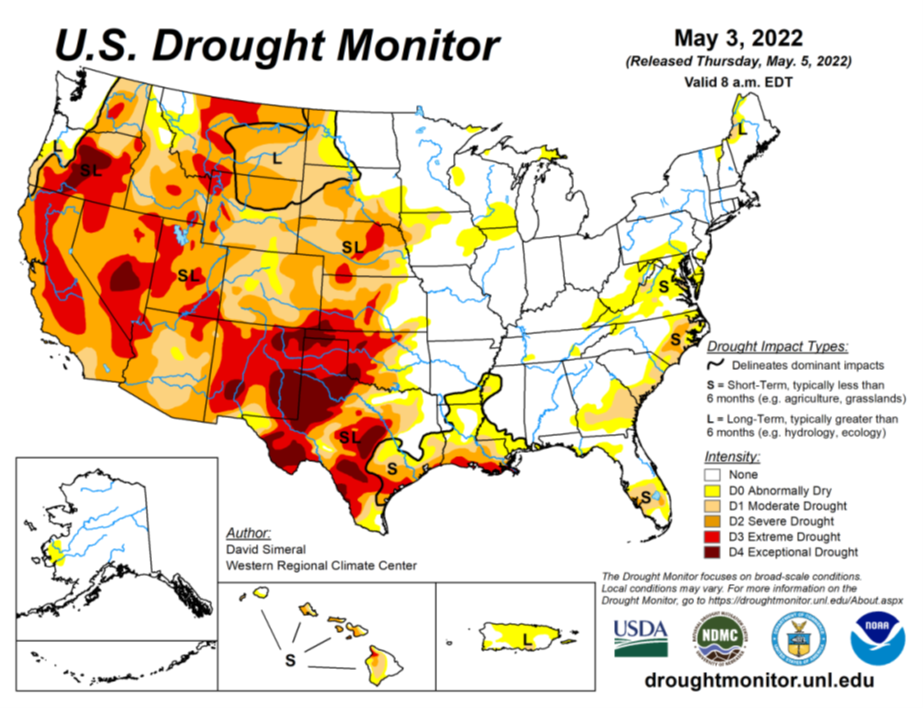

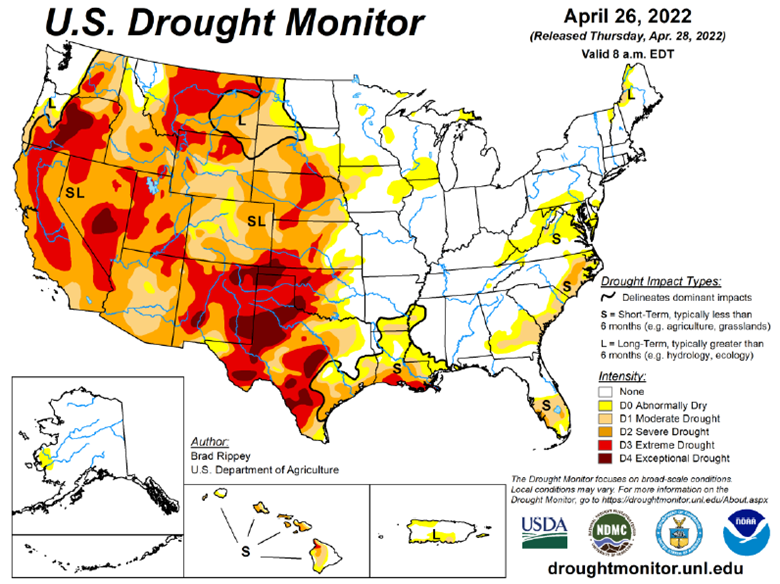

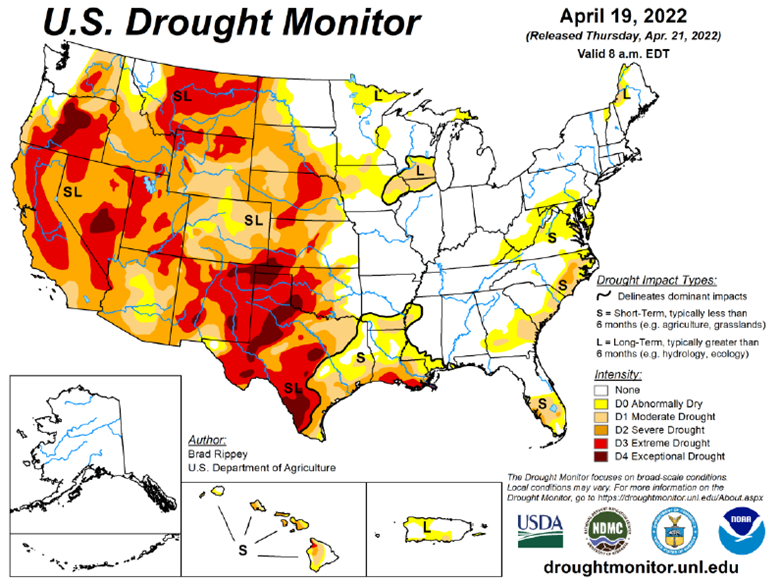

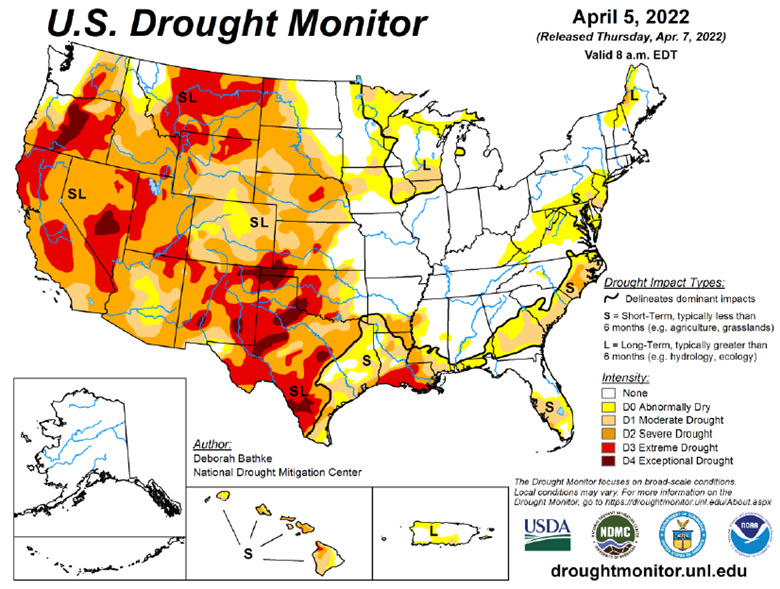

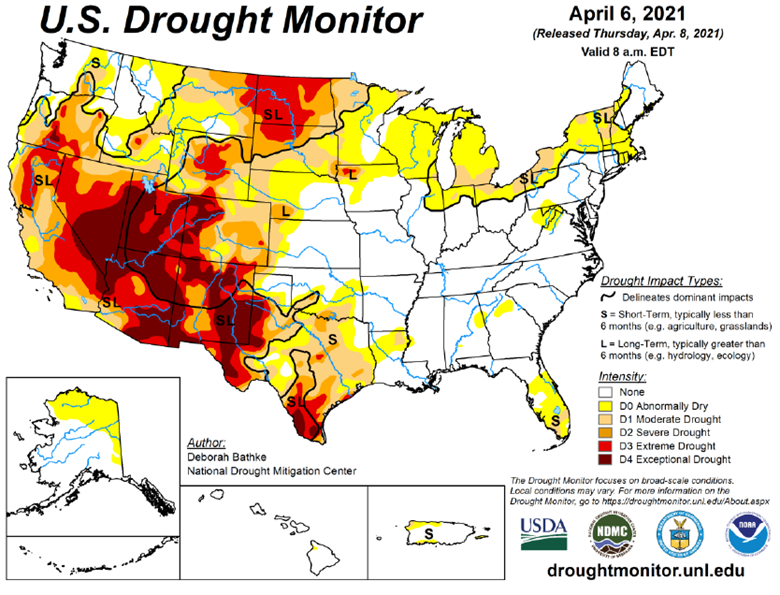

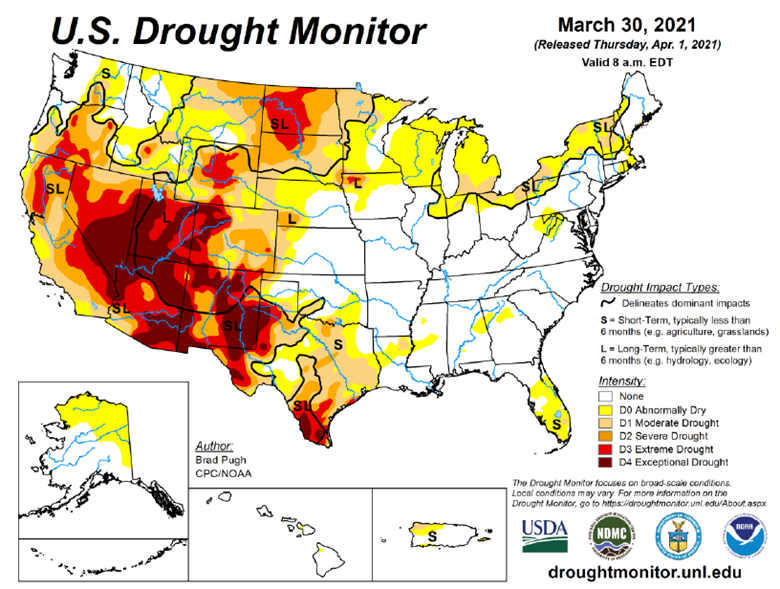

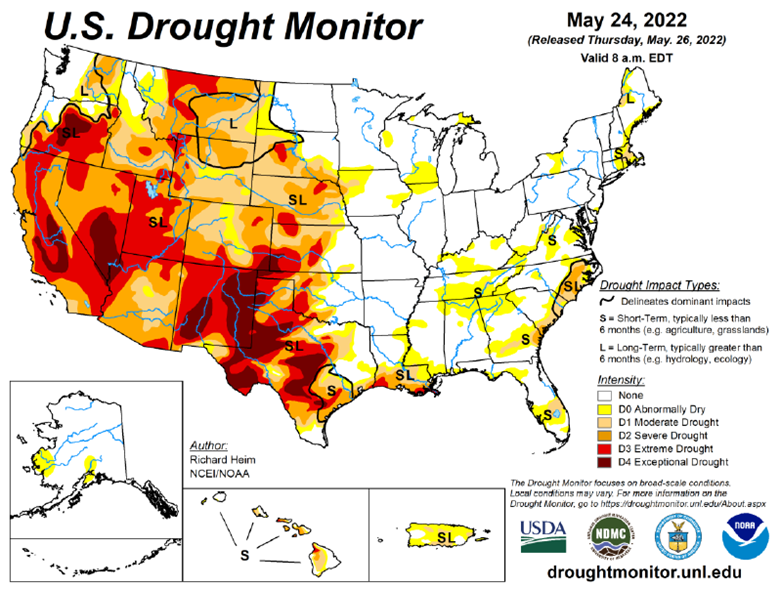

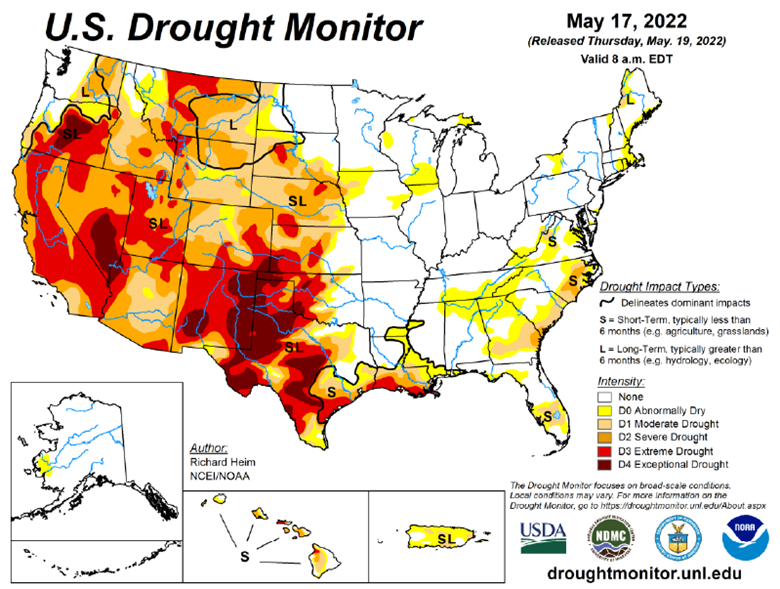

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

There is an agriculture tug of war happening across the nation, impacting America’s farmland. Fertilizer prices are continuously fluctuating, and it has us taking a page the “The Clash” should we stay, or should we go?! And we aren’t the only ones. Many farmers are asking their agronomist and chemical salespeople, “what will fertilizer cost me the rest of the season, and what are my options if I don’t want to go all-in on my typical fertilizer treatment plan?”

In this episode of the Hedged Edge, we are joined by a special guest who needs no introduction in his local circle, Dick Stiltz. Dick is a 50-year veteran of the fertilizer and chemical industry and is the current Agronomy Marketing Manager of Procurement fertilizer and crop protection at Prairieland FS, Inc in Jacksonville, IL. He is at the pulse of the current struggle and here to discuss the topic at hand.

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.