Agricultural Risk: The Role of Intermediaries

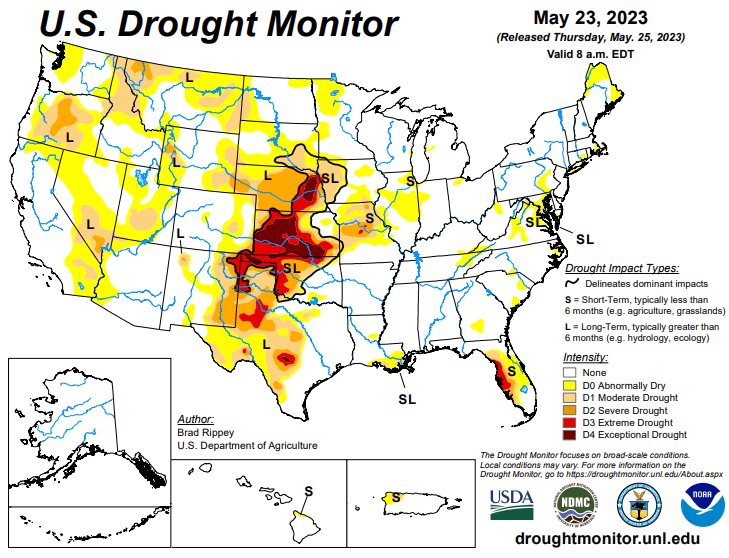

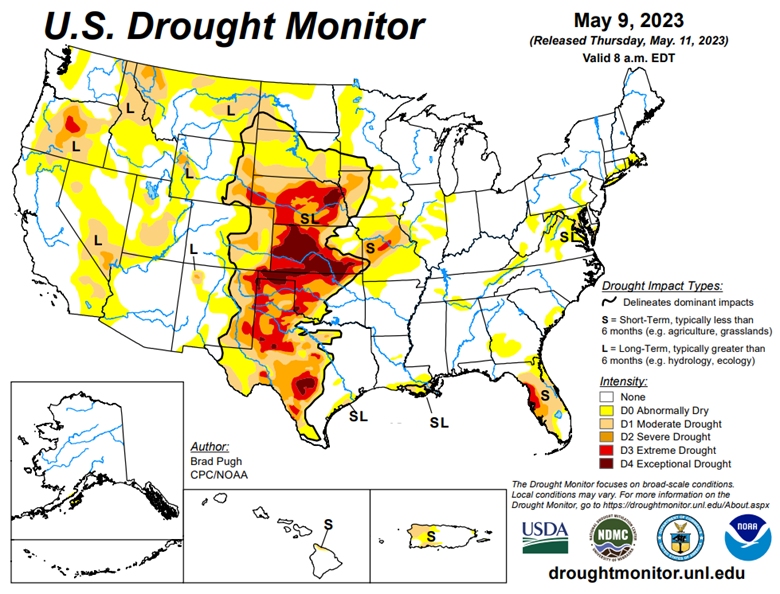

Agriculture is an inherently risky business. Growers and farmers face a wide range of risks, including weather-related events, changes in commodity prices, and supply chain disruptions. These risks not only affect the farmers but also impact every actor along the supply chain, from processors and distributors to retailers and consumers. This blog will discuss the importance of intermediaries in managing agricultural risk.

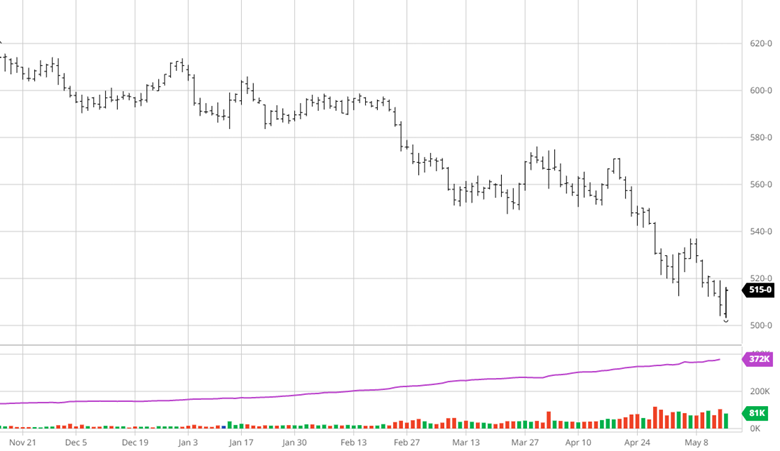

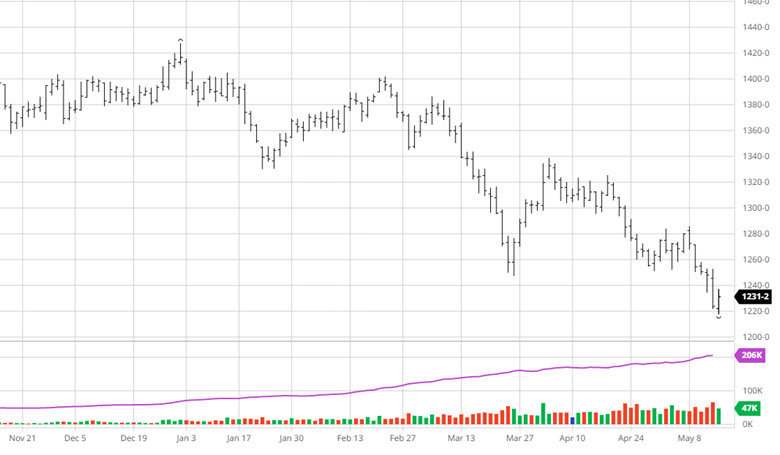

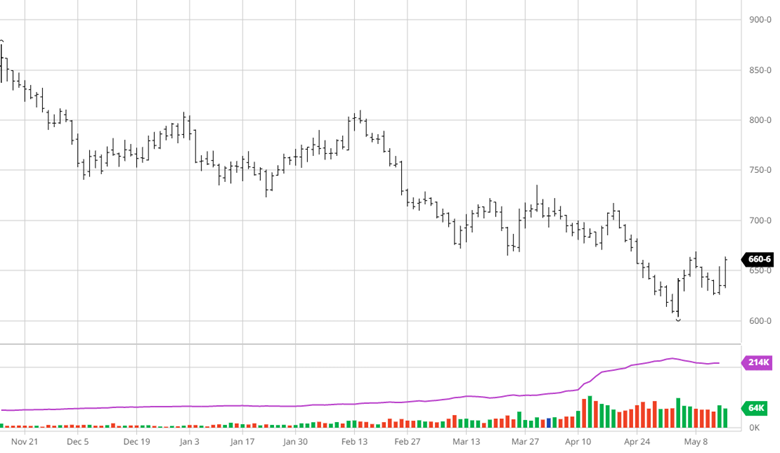

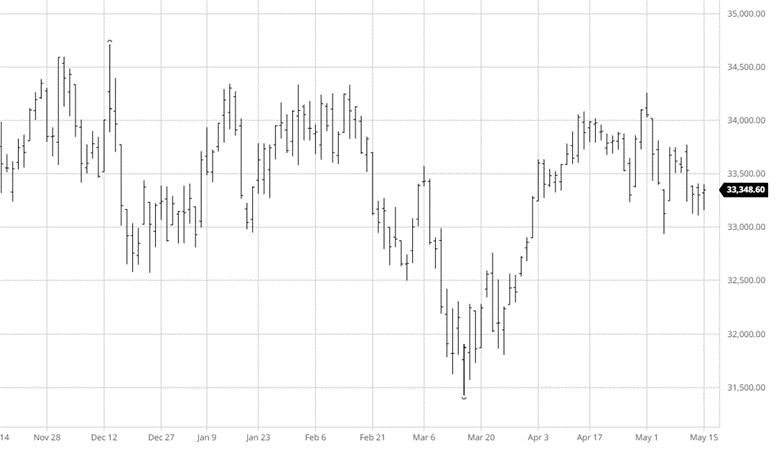

Several types of intermediaries play a crucial role in managing agricultural risk. Futures commission merchants (FCMs) are one such intermediary. They provide access to commodity futures markets, where farmers can manage price risk by buying or selling futures contracts. Exchanges, such as the Chicago Board of Trade, also play a critical role in managing risk by providing a platform for price discovery and risk management.

Types of Intermediaries:

Futures Commission Merchants (FCMs):

FCMs are regulated entities that act as intermediaries between buyers and sellers in commodity futures markets. They facilitate trades, provide margin financing, and manage the risk exposure of market participants.

Exchanges:

Commodity exchanges are marketplaces where buyers and sellers can trade standardized commodity contracts, such as futures and options. Examples of exchanges include the Chicago Board of Trade (CBOT), the Chicago Mercantile Exchange (CME), and the Intercontinental Exchange (ICE).

Brokers/Farm Advisors:

Brokers and farm advisors provide hedging services and market knowledge to help growers and other market participants manage price risks. They can help with market analysis, risk assessments, and hedging strategies.

Originators/Merchandisers:

Originators and merchandisers are intermediaries who connect buyers and sellers of agricultural commodities. They can help farmers and growers find markets for their products and help buyers source the commodities they need.

Co-ops:

Co-ops are farmer-owned organizations that provide services such as grain storage, handling, and marketing. In some cases, they function as elevators, buying grain from farmers and selling it to end-users.

University Extension Offices:

University extension offices provide research, education, and outreach services to the agricultural community. They can help farmers and growers stay informed about new technologies, best practices, and market trends.

Importance in the Big Picture:

Intermediaries are essential to the smooth functioning of agricultural markets. They help manage risk exposure along the supply chain and facilitate the movement of commodities from producers to end-users. Farmers and growers would face more price volatility and uncertainty without intermediaries, and end-users would face supply shortages and price spikes.

RCM Ag Services: Your Trusted Partner for Agricultural Intermediary Services

At RCM Ag Services, we provide a range of intermediary services to the agricultural community. We offer futures and options brokerage, cash grain marketing, risk management consulting, and crop insurance services. Our team of experienced professionals can help farmers and growers manage price risks and navigate the complex world of agricultural markets.