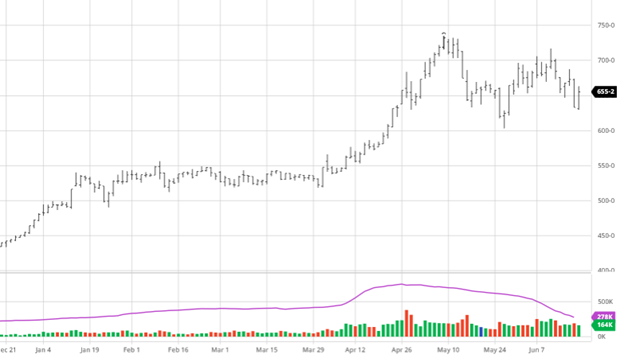

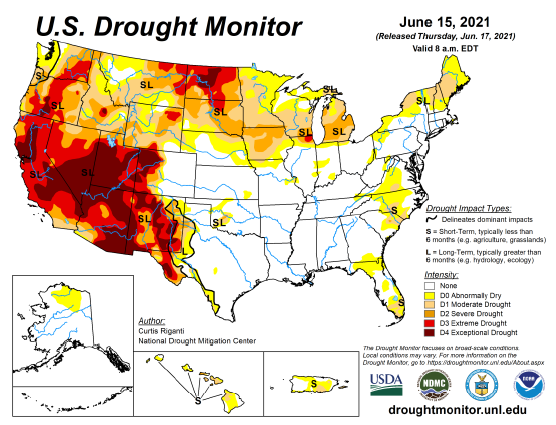

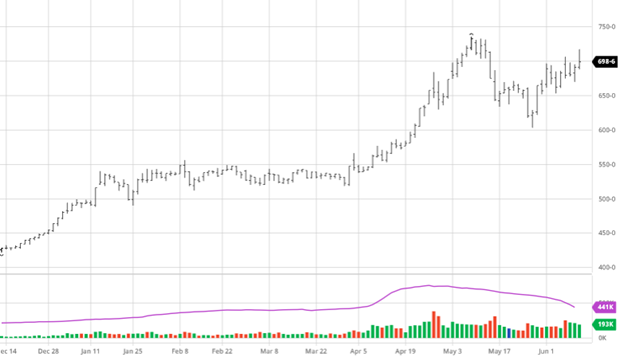

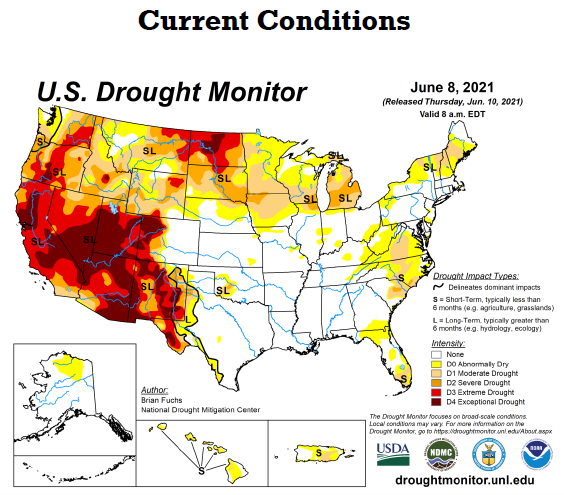

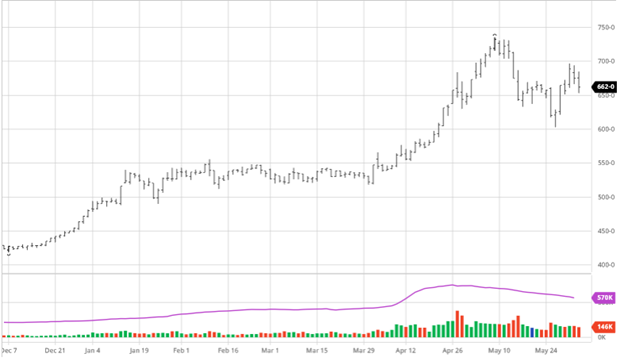

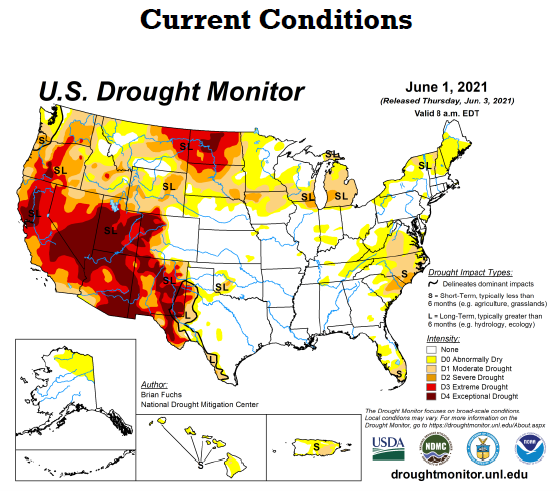

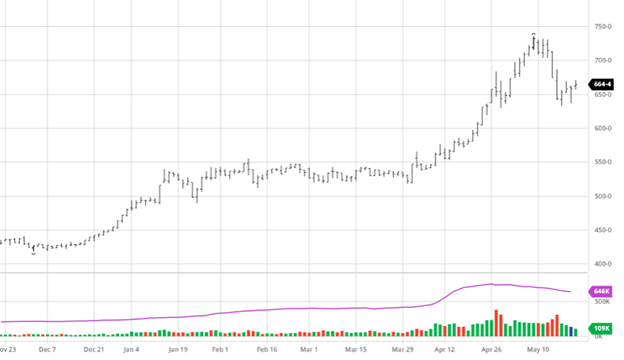

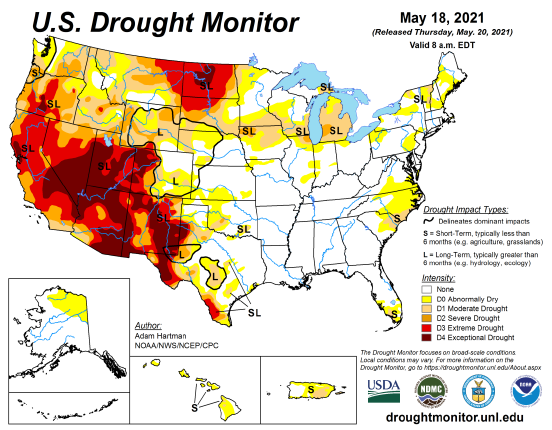

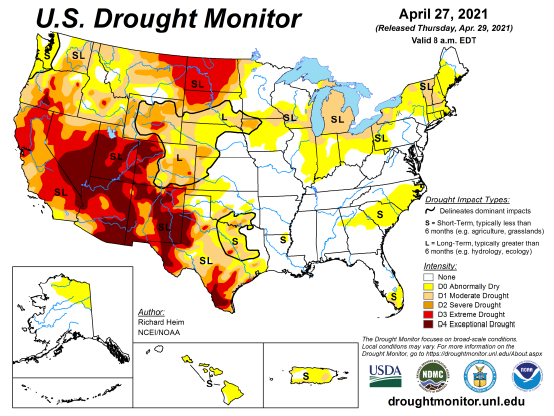

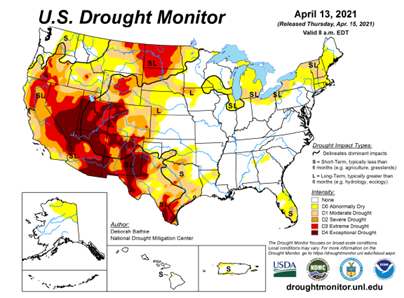

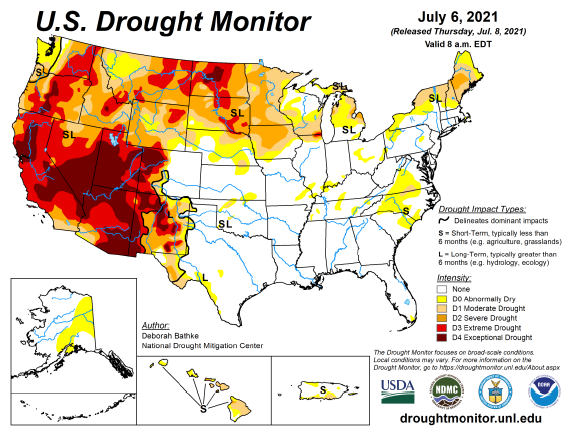

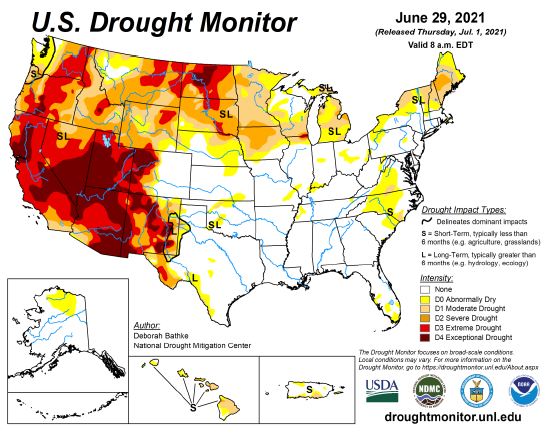

The corn market fell thanks to the rain that was received in the Upper Midwest over the 4th of July weekend. As always when it rains in areas that need it the most, the market freaks out as if it is a crop making/saving rain. The reality is, although the rain was helpful, there are still significant drought conditions across most of the areas that received rain (see in the drought chart at the bottom). With this said, next week is forecasting rain across the western corn belt providing some more relief to those areas before returning to hot and dry after.

CONAB (Brazil’s USDA) updated their yield expectations this morning by cutting their corn crop by 3 million metric tons (120 million bushels). This change came before a freeze event they had recently which could lead to problems and another cut of their expected crop. The USDA will update their estimates of the South American crop next week in the report.

The weekly ethanol report was bullish as production was 2% ahead of pre-Covid 2019 levels. US drivers drove a record amount over the 4th of July weekend with indications that usage for the summer could be a new record. The USDA is expected to increase their estimates for corn used for ethanol coming up as their numbers are lagging the actual pace.

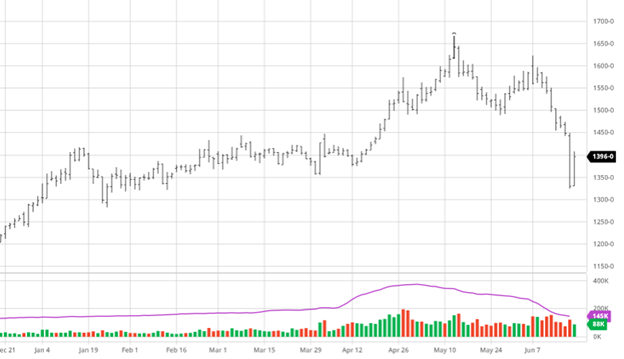

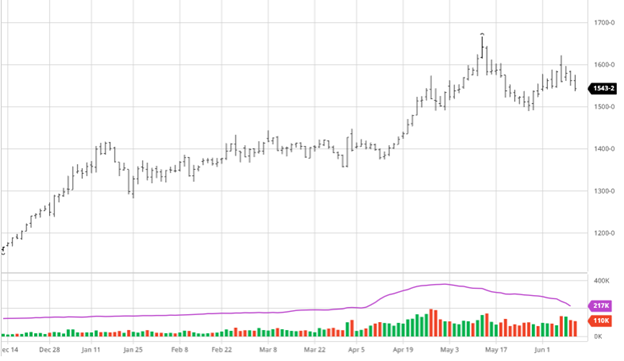

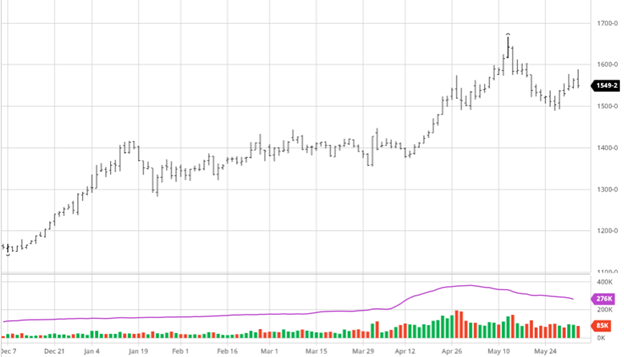

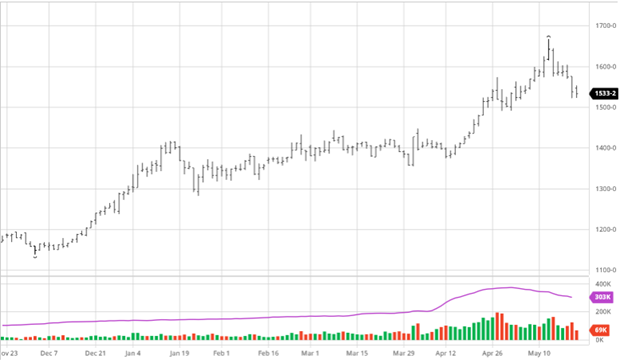

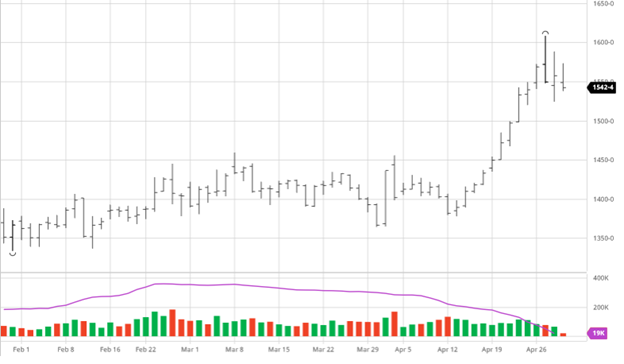

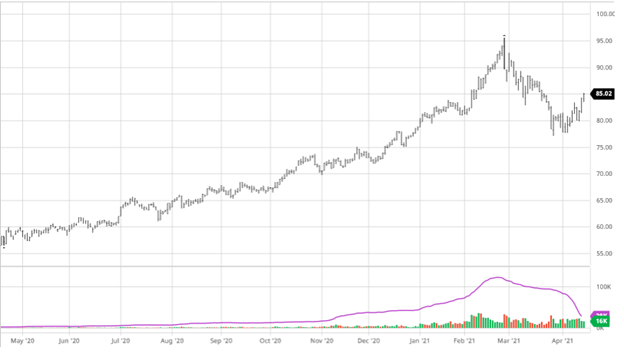

Via Barchart  Soybeans, like corn, fell following the holiday weekend with huge losses on Tuesday to start the week. Weather remains the main focus of the markets as rains in the next week will help but forecasts have it followed by heat and dryness. Bean crop conditions this week were down 1% to 59% g/e. The soybean balance sheet does not have as much room for error as corn so any adverse soybean news will be bullish for the market. The long term up trend broke about 3 weeks ago but prices are still at a great level compared to what we were seeing this time last year. The report on Monday will help tell us what other news should be moving the market other than weather but headlines love to say it rained.

Soybeans, like corn, fell following the holiday weekend with huge losses on Tuesday to start the week. Weather remains the main focus of the markets as rains in the next week will help but forecasts have it followed by heat and dryness. Bean crop conditions this week were down 1% to 59% g/e. The soybean balance sheet does not have as much room for error as corn so any adverse soybean news will be bullish for the market. The long term up trend broke about 3 weeks ago but prices are still at a great level compared to what we were seeing this time last year. The report on Monday will help tell us what other news should be moving the market other than weather but headlines love to say it rained.

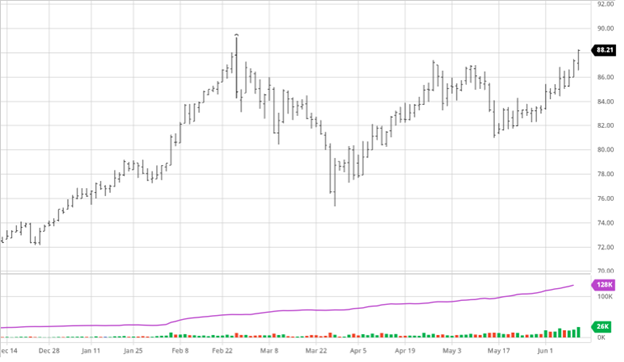

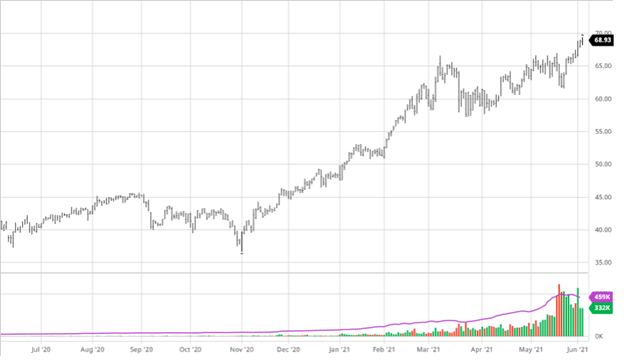

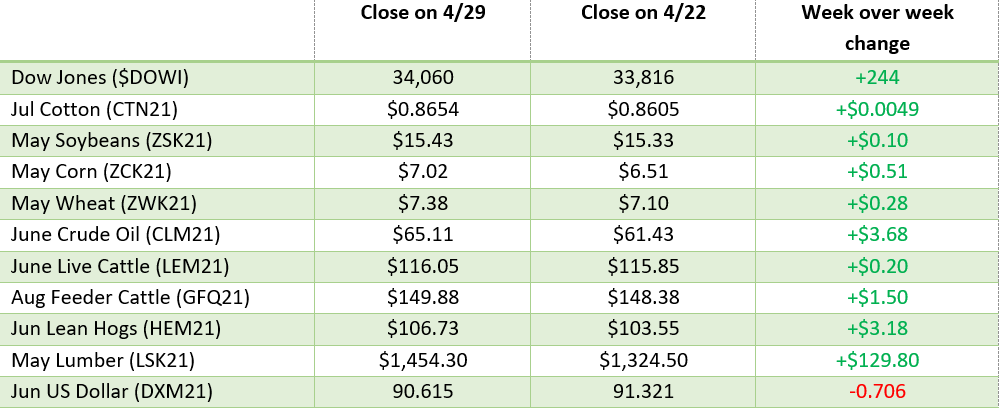

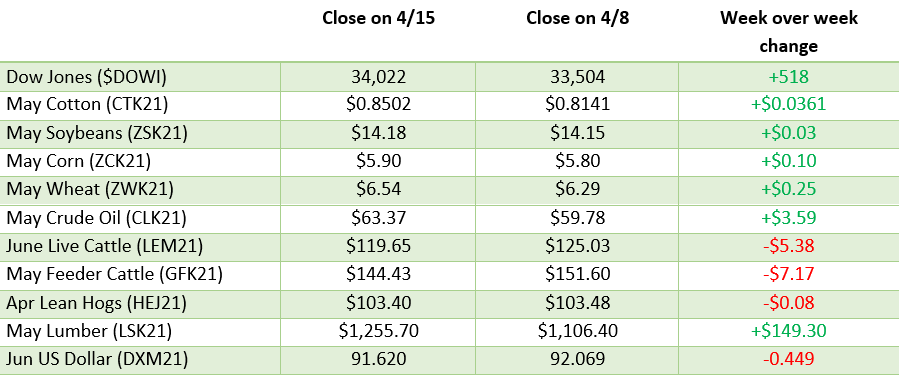

Dow Jones

The Dow lost on the week after a tough Thursday in the markets. The market bounced back well off its lows on Thursday into the close however to keep some momentum. The markets have been volatile, but the big picture is important as we have traded in the range above 34,000 for most of the last 2 months. The delta variant has had many people worried and keeping an eye on the market for any indicator of how bad it could end up being for continued reopening around the world.

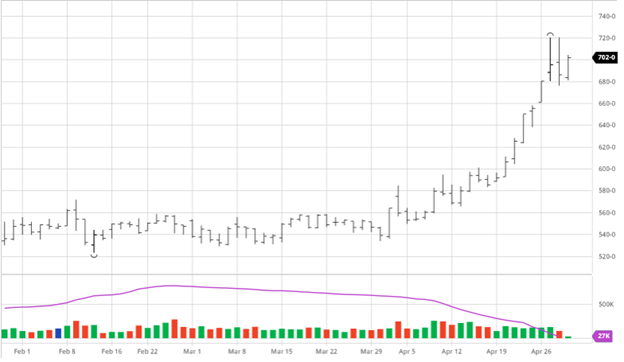

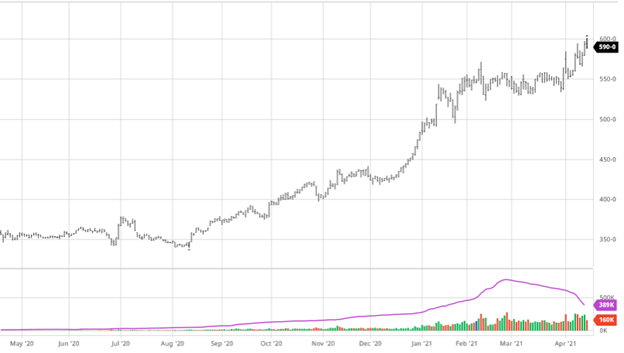

Lumber

Lumber prices have flattened out the last couple weeks after losing over half its value from the peak. Markets are hinting at this being the beginning of a rebalancing as the producers and suppliers feel out the supply and demand story.

Podcast

Check out our recent podcast with Dr. Greg Willoughby: We’re talking with Greg in the new episode about being a “plant doctor”, weather patterns, GMO & organic produce, crop history, technical advances, level 201 education on agronomy, the agronomy equation, Helena Agri, soil biology, American v European agriculture, Greg’s early background in livestock, and the advancement of native plants to modern produce.

https://rcmagservices.com/the-hedged-edge/

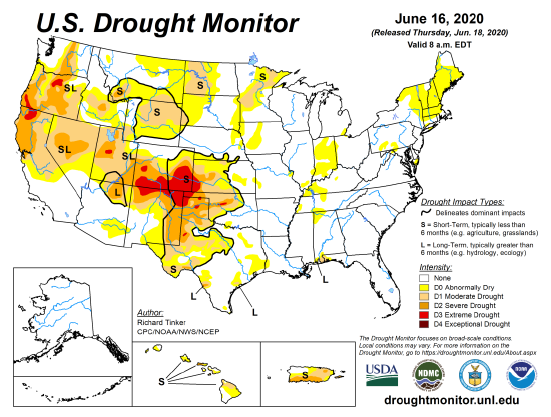

US Drought Monitor

The maps below show the current US drought conditions this week vs last week. As you can see the rain that freaked out some in the markets did not exactly fix the drought problems. The rain was helpful but will need more consistent sustained rain to help the crop in the coming months.

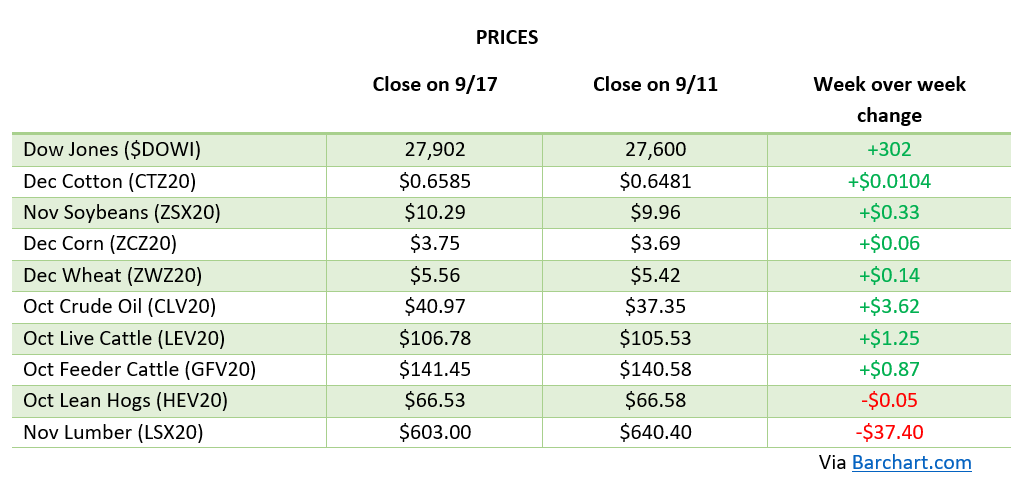

Via Barchart.com