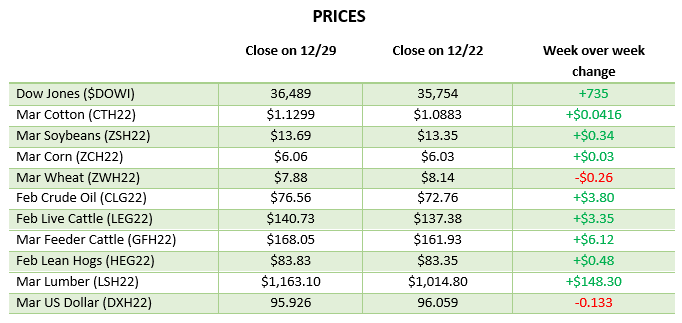

AG MARKET UPDATE: DECEMBER 22 – 29

Corn continued its rally until it faced some selling on Tuesday. The dip on Tuesday should be expected when a market starts running this hot and people like to take their profits. The South American weather has not changed and remains hot and dry in southern Brazil and Argentina. Northern Brazil may have the opposite problem as they are expected to see heavy rains that could lead to flooding delaying the start of harvest in the region. The weekly ethanol grind was good again this week as we are 17 mbu above the weekly pace needed to meet the USDA’s corn used for ethanol projection. As Americans continue to travel despite the new wave of Omicron, we can expect an increase in corn use in the January USDA update. The air has not been let out of the market, despite what “the sky is falling” people said after Tuesday’s dip, as there is still a lot that can happen in the coming weeks and months.

Soybeans saw a big boost the first trading day after Christmas as the weekend weather did nothing the alleviate the concerns for South America’s production. Beans saw the same profit-taking on Tuesday but are still seeing its best levels since August. The same factors affecting corn in South America have the same effect on soybeans. With inflation looking to continue into 2022, we could see higher values in many commodities along with grains. Rising world vegetable oil prices have helped beans during their run along with wide crush margins. As we said last week, corn and beans seem to be on the same boat for now unless something significant happens. Any unexpected rain to help the crop would probably result in a panic selloff as usual.

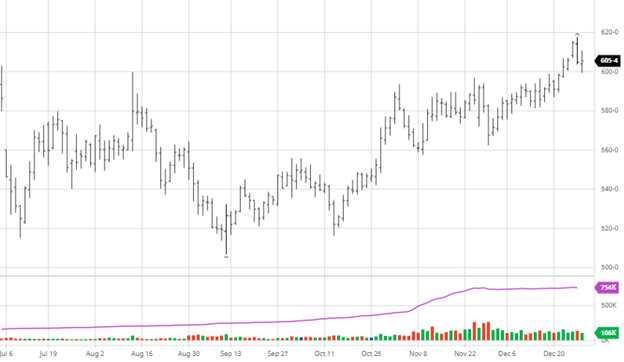

Dow Jones

The Dow had a good week as we have seen a good rally around Christmas and into the New Year’s holiday. The Omicron variant continues to rip through the U.S. and the world as events are canceled, and restrictions are placed back. With the rate of this new wave spreading, it will be interesting to see how long the rules stay if the virus runs its course faster than usual. The CDC changing the quarantine requirement from 10 to 5 days is also welcome news to the market as it appears we may be getting closer to fewer restrictions across the board and workers getting back quicker. At the close on Wednesday, the Dow is up over 19% for the year (wow!).

Podcast

The 2021 U.S. grain crop has the potential to be one of the largest on record. Where did all the yield come from, what areas were the hardest hit, and why on God’s green earth are grain prices still so high?

Today, we are joined by several RCM Ag Services grain markets experts from around the country to catch up on a post-harvest update and share an outlook for production and marketing in each of their respective regions for the remainder of the 2021 marketing season and the upcoming 22 crops.

Via Barchart.com