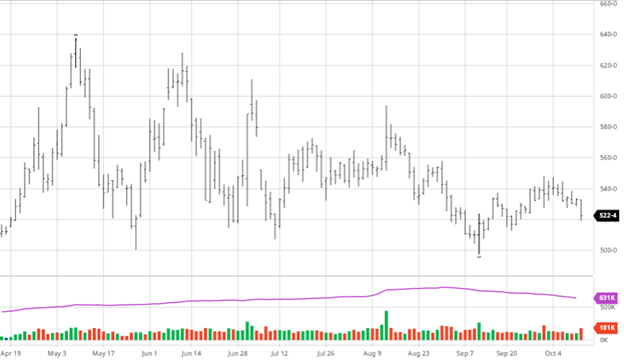

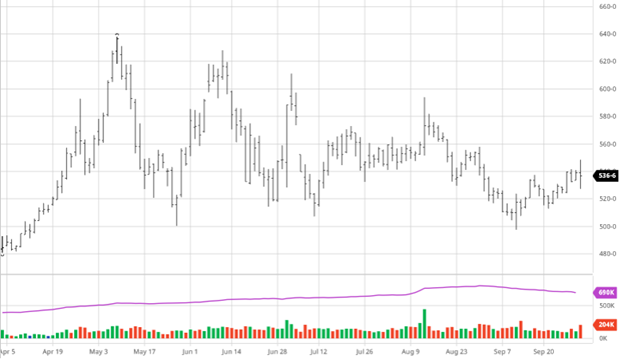

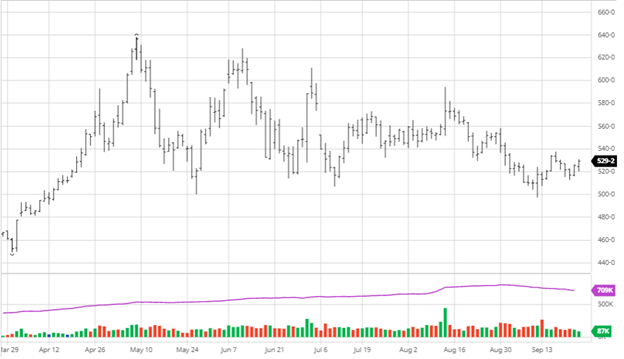

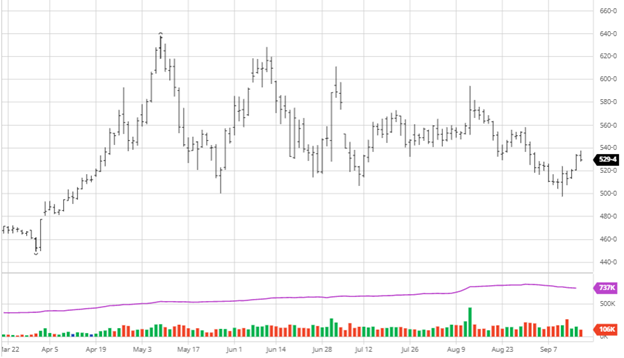

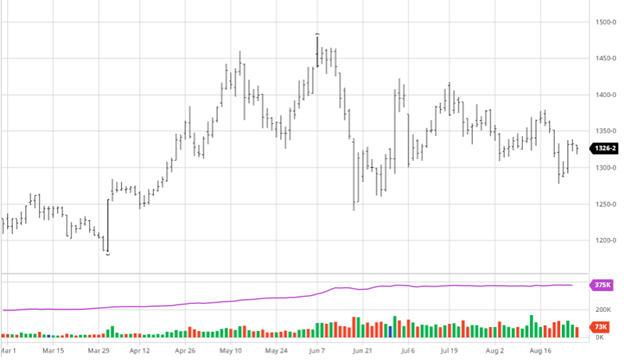

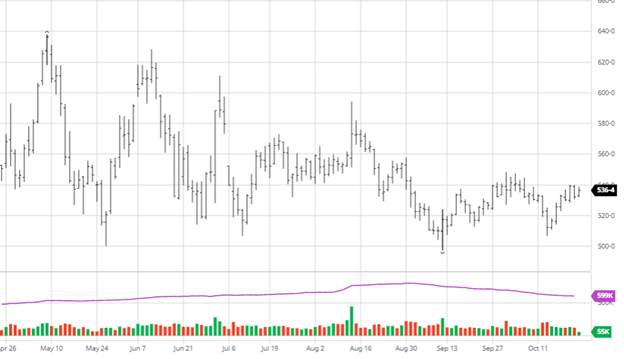

Corn has seen a good rally since the lows that came after the report. Due to the world energy values falling, corn is still well above where it was last week, despite the pullback on Thursday. Rain in the eastern corn belt that was expected to slow harvest coming up has turned a little drier but still present. The rains this week will further deteriorate the already poor-quality plants. The yields were coming in better than expected in some areas the first half of harvest, but we should expect them to be lower in the second half.. NOAA on Thursday released its outlook for a warmer winter in the U.S., which hit energy prices and could see them trend lower, which would not help corn, among other things. It is vital this time of year to start paying attention to South American weather, and right now, Argentina is off to a dry start. Ethanol production continues to grow as margins remain above $1 per bushel, pushing plants to produce at top capacity. This week’s output was the 3rd largest ever and will be an important supporting factor for corn going forward.

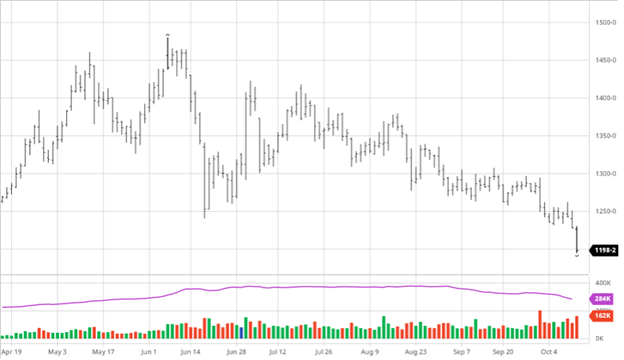

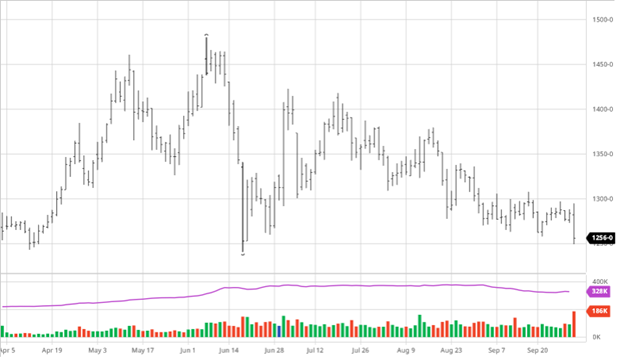

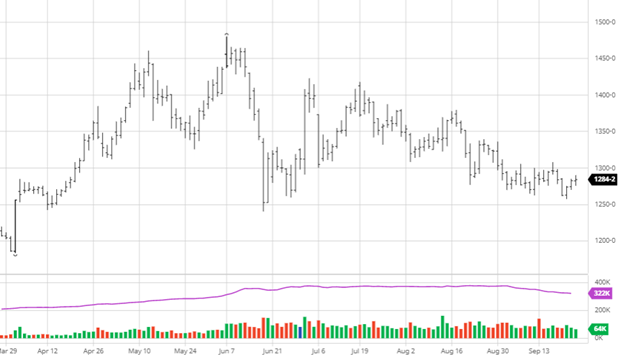

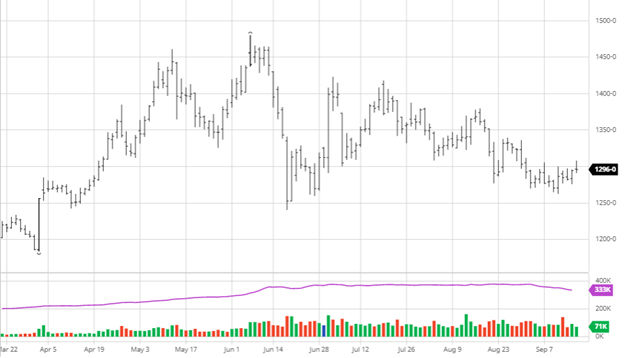

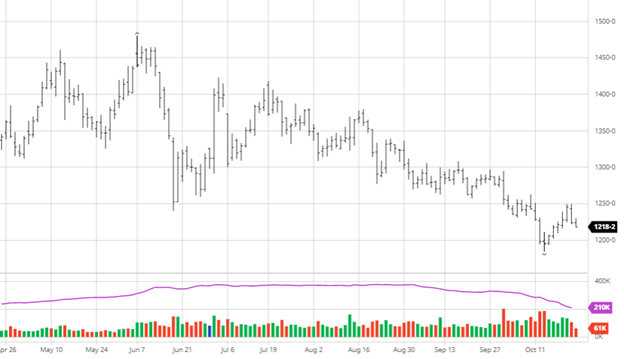

Soybeans have had a good rally since the report, like corn even with the pullback at the end of this week. World bean oil and veg oil markets saw a rally this week that helped pull soybeans up along with many of the same factors as corn. Weekly exports this week were 2x that of last week and the highest in 13 months, with China being the main buyer. According to the most recent USDA report, if we can get consistent demand from China moving forward, that should help soybeans despite the crop being bigger than initially thought. The chart is tough to look at, but the market did close above the 20 day moving average at one point this week. It will not get back to that level to end the week, but the double high of $12.49 ½ this week makes it look like that $12.50 range may be hard to break through unless we get more bullish news. All eyes will move to the 2022 contracts next week as we begin to look at options for stored beans.

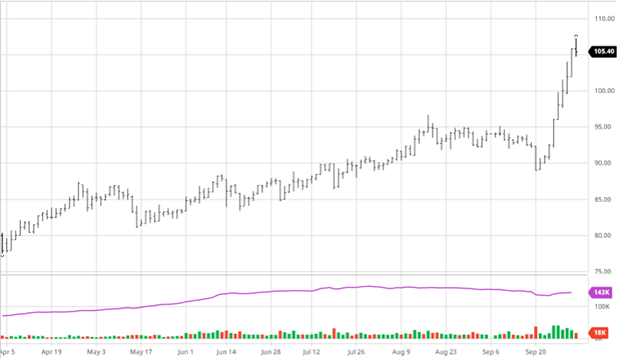

Dow Jones

The Dow had another good week as we have seen a good October for the equities market. After a tough September, this is good to see money back in the markets as questions around tapering, inflation and other Fed issues remain. Supply chain woes continue to plague many industries and will probably only worsen with the coming holiday season.

Podcast

In this week’s podcast Simon Quilty, from Melbourne, Australia, and Jeff Malec join Jeff Eizenberg to discuss global meat markets. We get an overview of the global meat market: beef, poultry, and pork, the main players and their main concerns, including labor and shipping shortages being a critical problem. Simon talks about how he goes about hedging the various contracts providing risk management for the current disruption for in-demand meat products.

For additional information, read our blog “Weigh More Than You Wanted To Know About Meat” here: https://www.rcmalternatives.com/2021/10/weigh-more-than-you-wanted-to-know-about-meat-with-agritrends-simon-quilty/

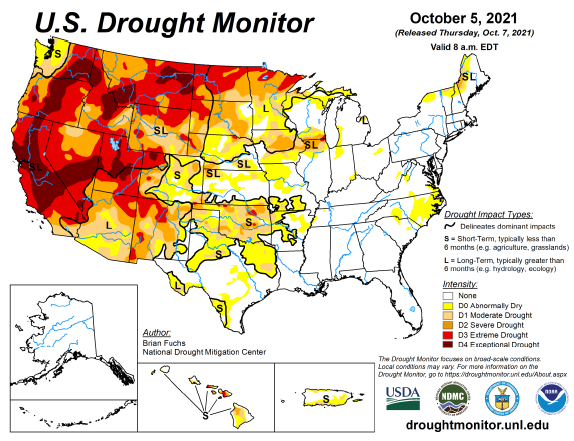

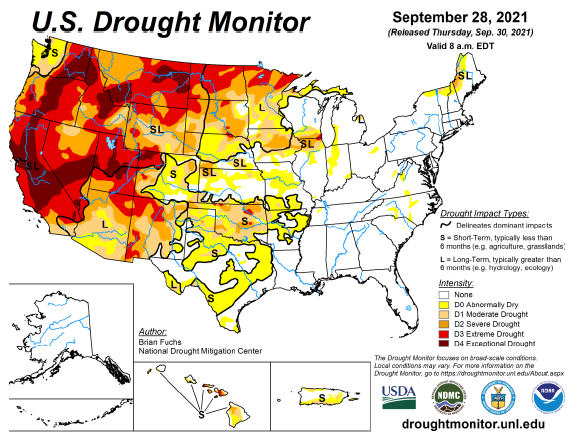

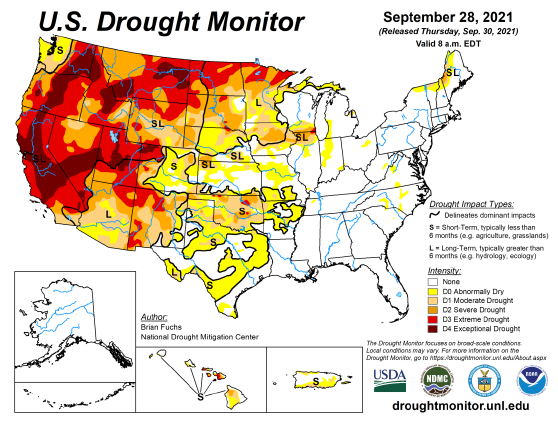

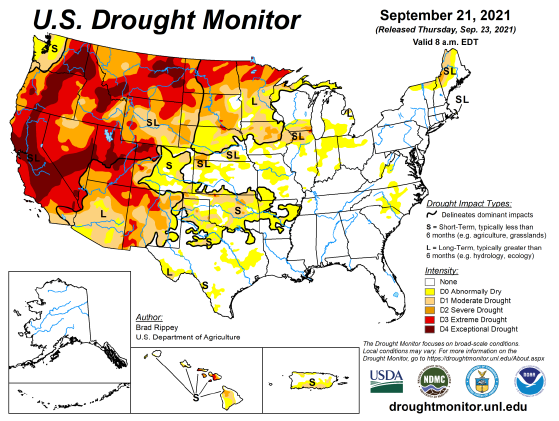

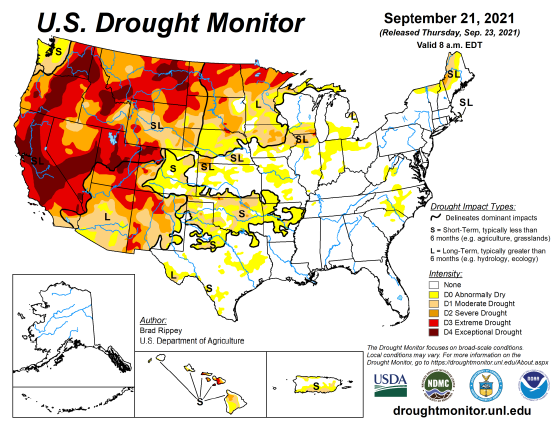

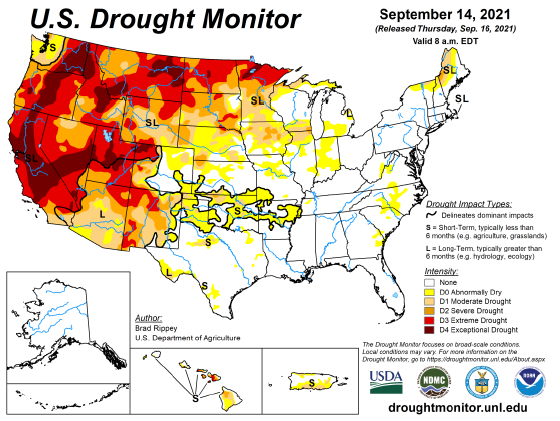

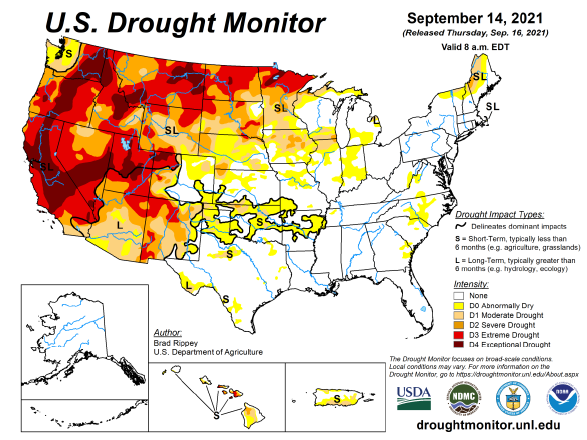

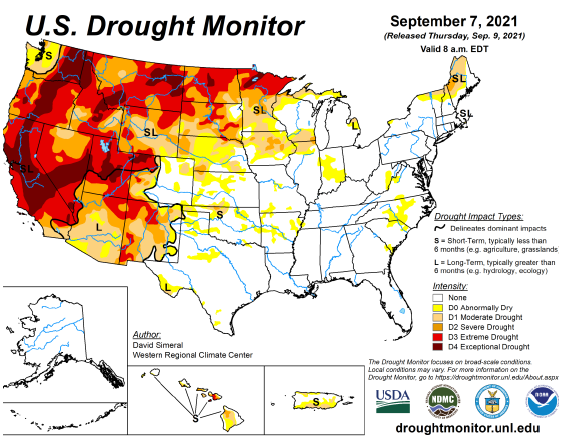

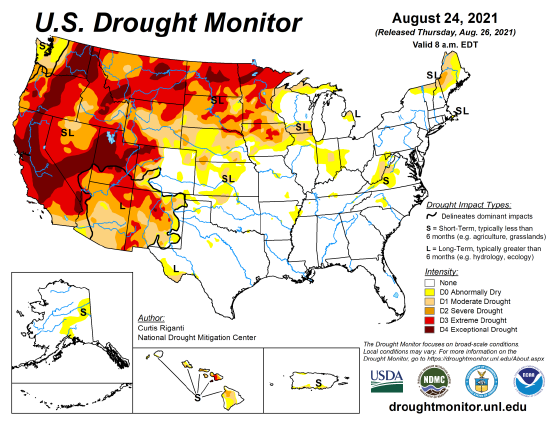

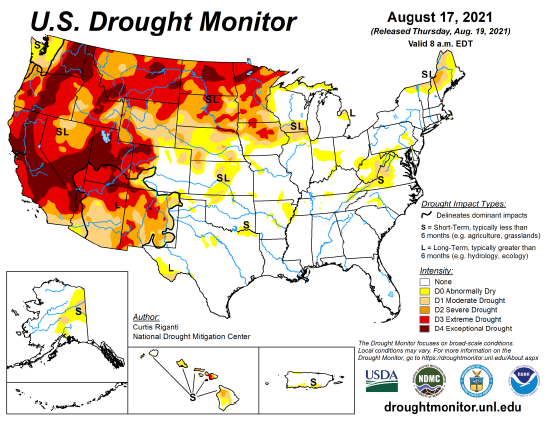

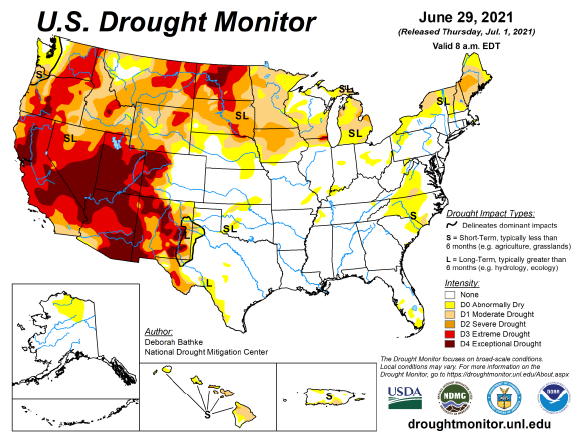

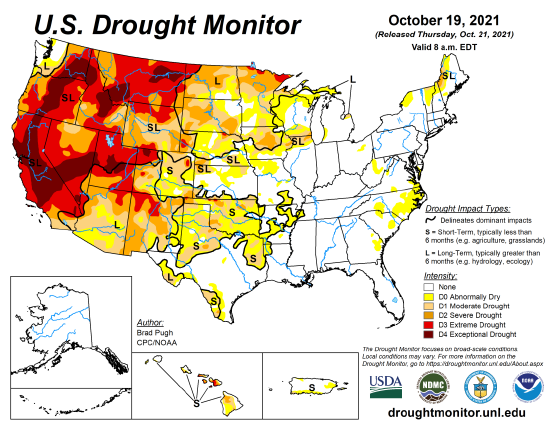

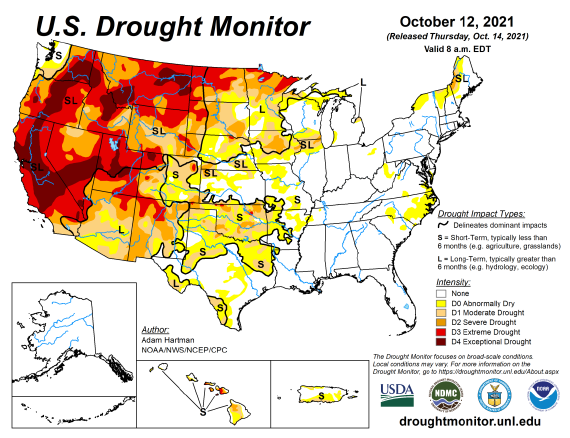

U.S. Drought Monitor

The maps below show the U.S. drought monitor and the comparison to it from a week ago. The outlined areas in black are areas that the drought will have a dominant impact.

Via Barchart.com