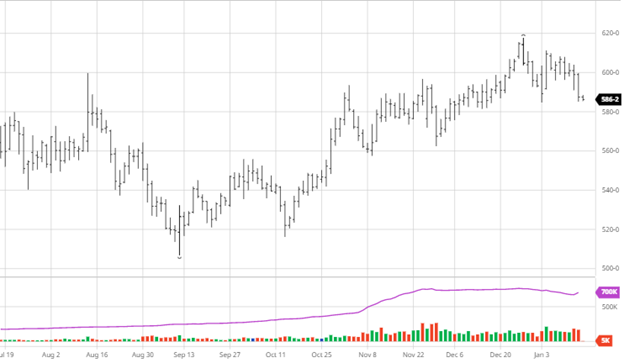

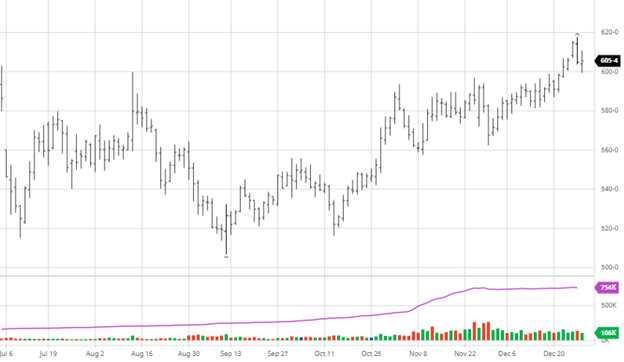

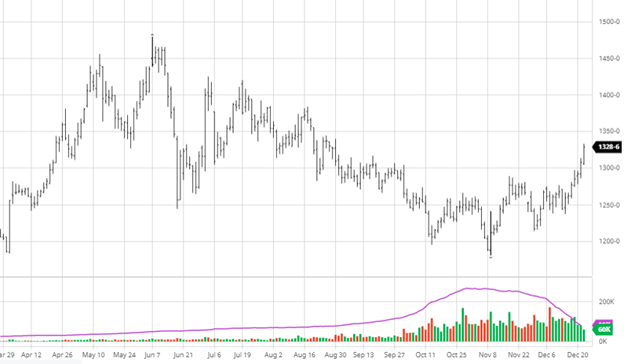

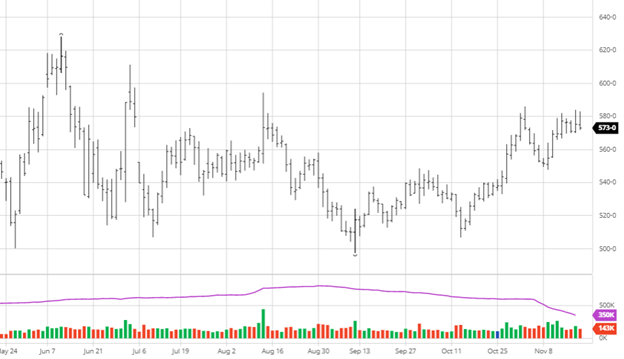

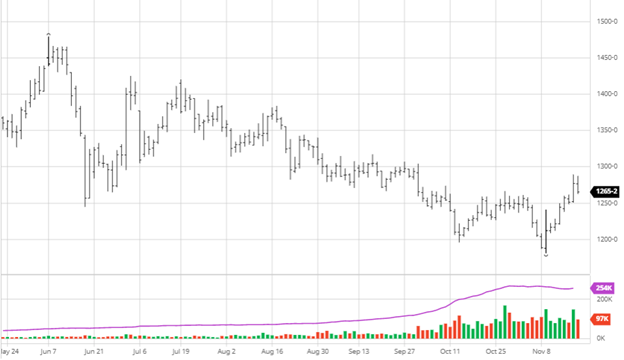

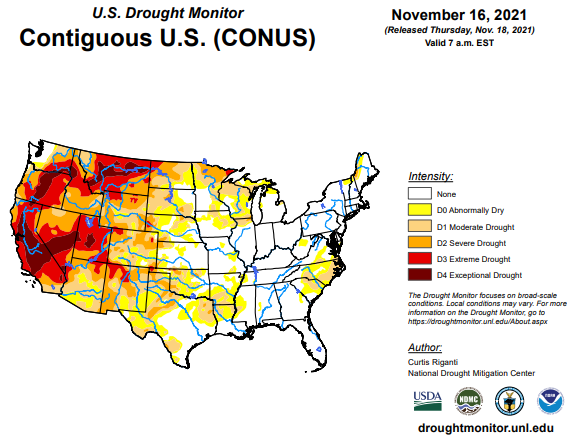

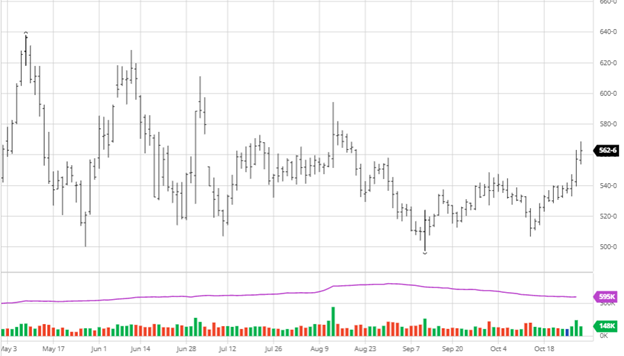

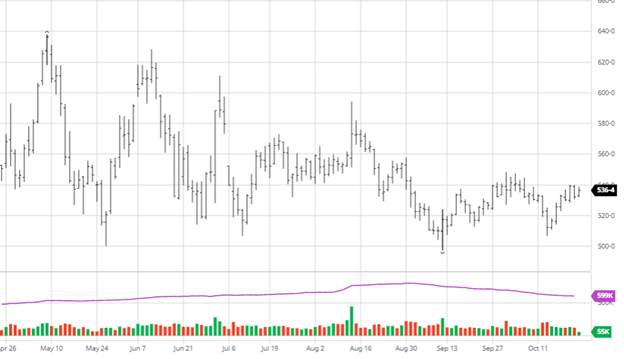

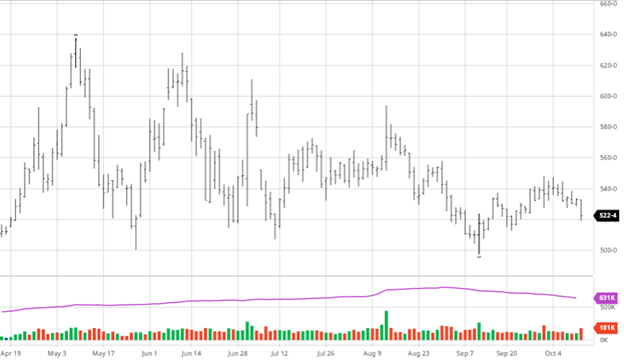

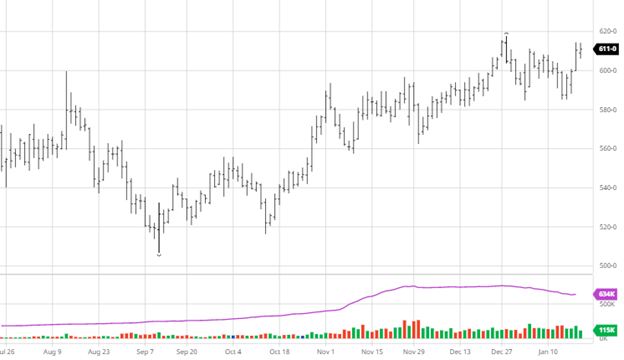

Corn rallied this week with beans with news of trouble in South America continuing and rumors of purchases from China. As we have mentioned before, China buying all ag products is welcome news as they are well behind the Phase 1 targets. The Russia and Ukraine tension, should it boil over, will have major implications for the commodities market as Ukraine’s exports will all but cease. The news of Brazil stopping bean sales is worrisome as there could be more bean and corn yield lost than thought. Energy prices continue their run higher as ethanol demand does not seem to be slowing down. With corn still below recent highs, unlike soybeans, it would appear there is still room for upward movement, but the trade into the weekend, where anything can happen as we know, will be important.

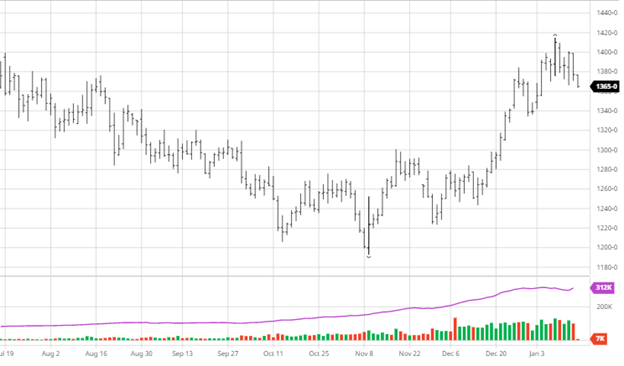

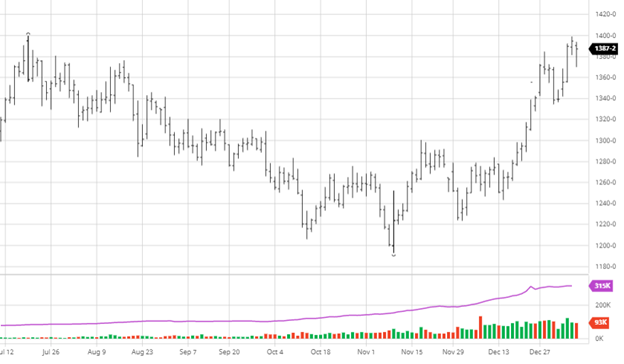

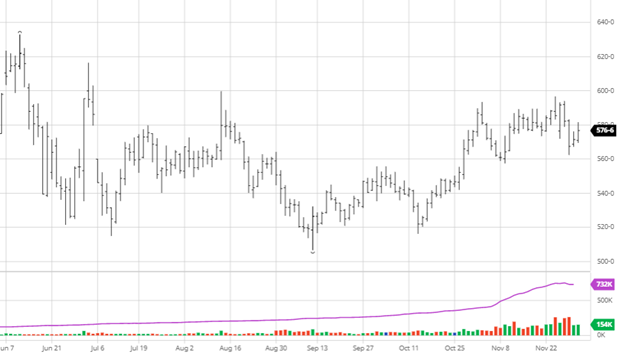

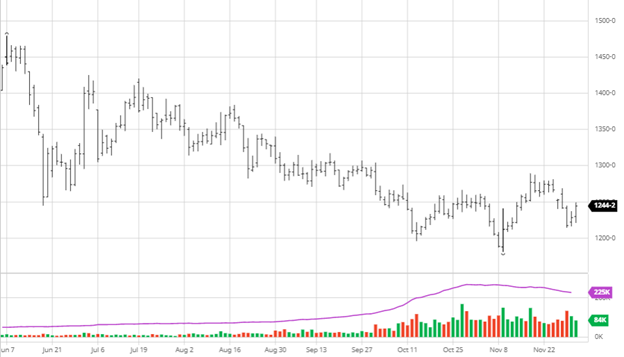

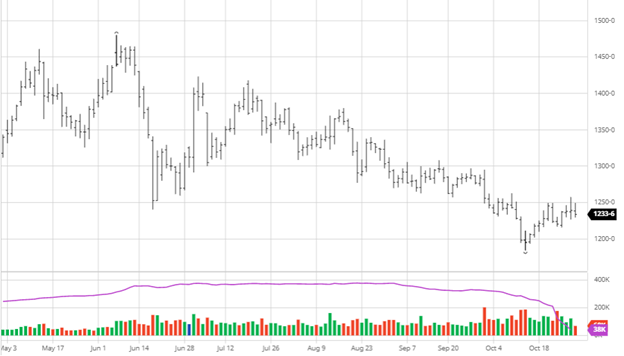

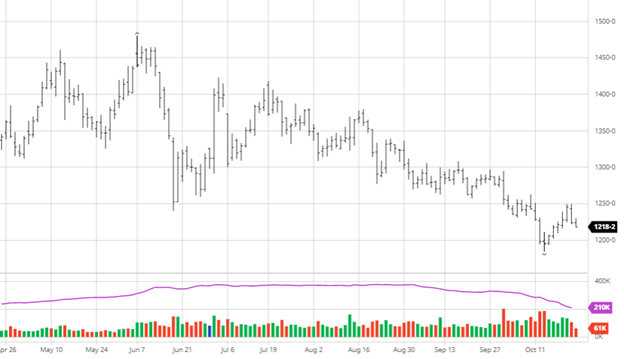

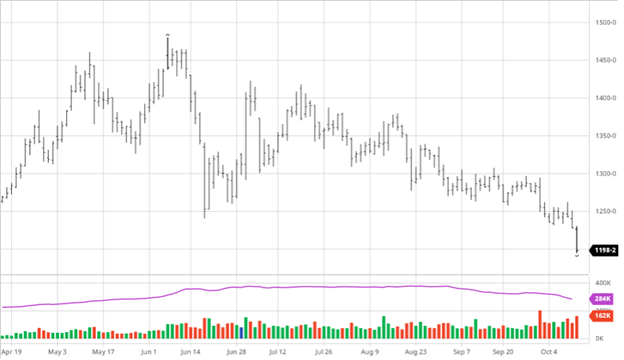

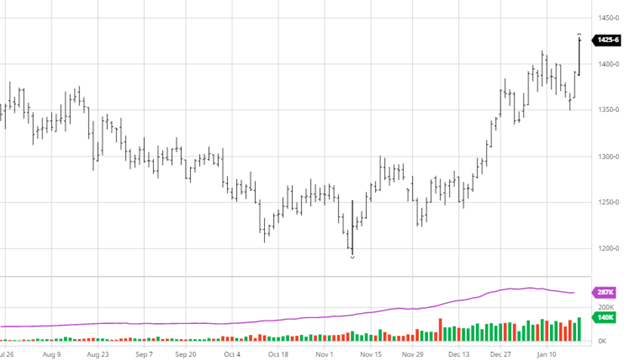

Via Barchart  Soybeans rallied this week as soy oil and meal also rallied. The noise around the problems with South America’s crop got a little louder this week with StoneX reporting that Brazil soybeans have gone to “no offer” due to farmers refusing to sell new-crop supplies in the current environment, with drought losses in the south worse than first believed. South American weather remains mixed as southern Brazil and northern Argentina remain hot and dry while southern Argentina received rain over the last couple of weeks. In early February, all areas are expected to revert back to hot and dry in the forecast. These troubles make it sound like the USDA was off on their South America estimates in last week’s report. This is a situation to monitor as any stoppage of sales from Brazil and Argentina would mean purchases from the U.S.

Soybeans rallied this week as soy oil and meal also rallied. The noise around the problems with South America’s crop got a little louder this week with StoneX reporting that Brazil soybeans have gone to “no offer” due to farmers refusing to sell new-crop supplies in the current environment, with drought losses in the south worse than first believed. South American weather remains mixed as southern Brazil and northern Argentina remain hot and dry while southern Argentina received rain over the last couple of weeks. In early February, all areas are expected to revert back to hot and dry in the forecast. These troubles make it sound like the USDA was off on their South America estimates in last week’s report. This is a situation to monitor as any stoppage of sales from Brazil and Argentina would mean purchases from the U.S.

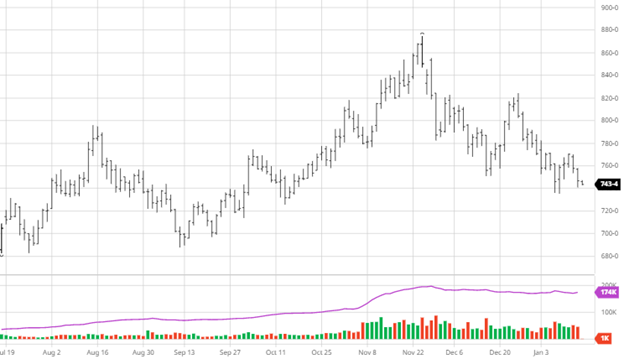

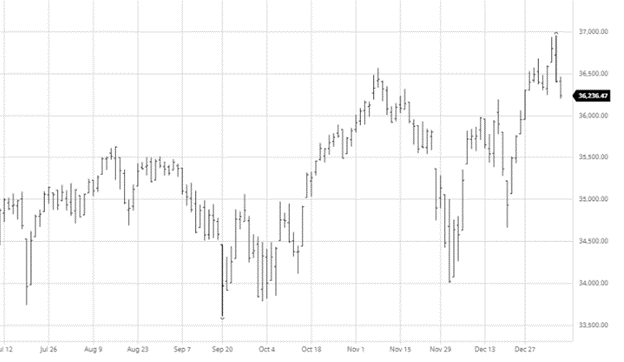

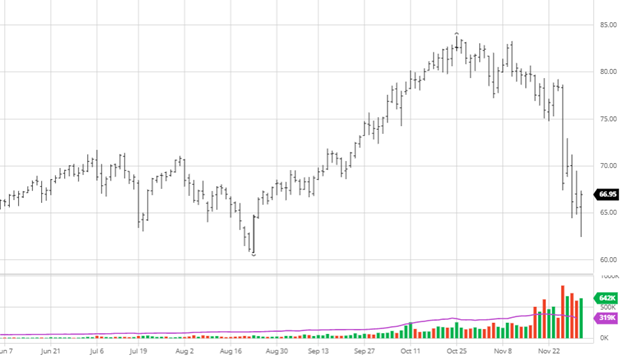

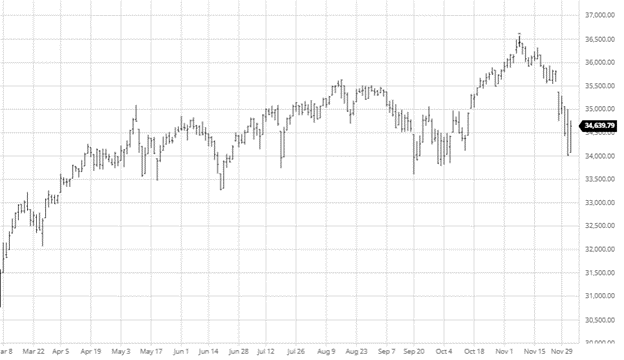

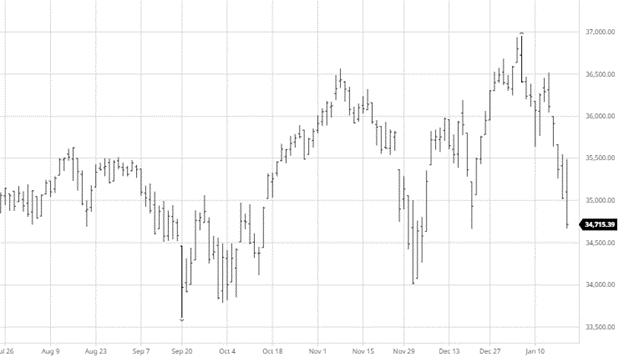

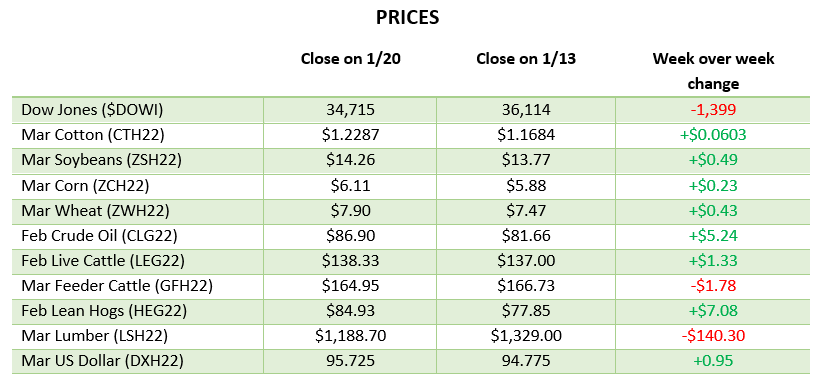

Dow Jones

Equities have had a bad week as tech has led the way lower. These rounds of selloffs will offer opportunities to buy back in at some point but as always, timing the market is not an easy job. The market was so hot last year pullbacks are expected, but it is hard to stomach when it falls this much this fast. We are still above the levels we were right after Thanksgiving, but the volatility of the last couple of months looks to still be hanging around.

Podcast

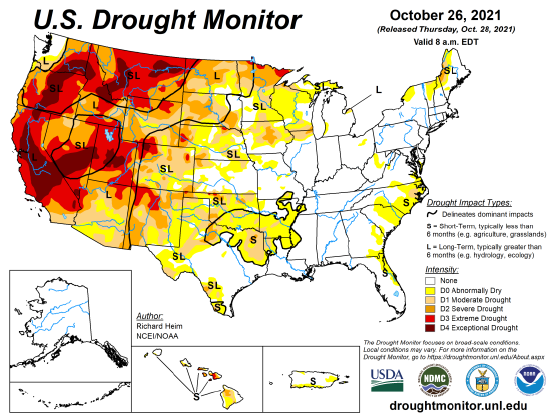

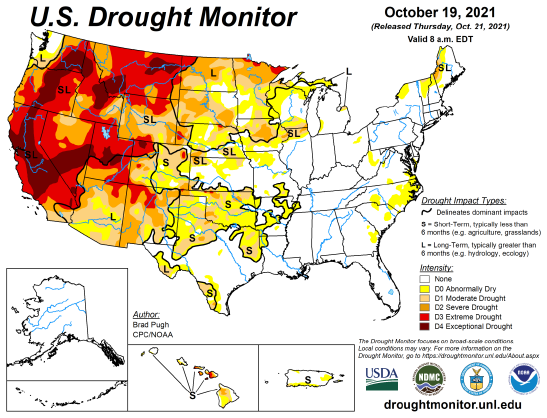

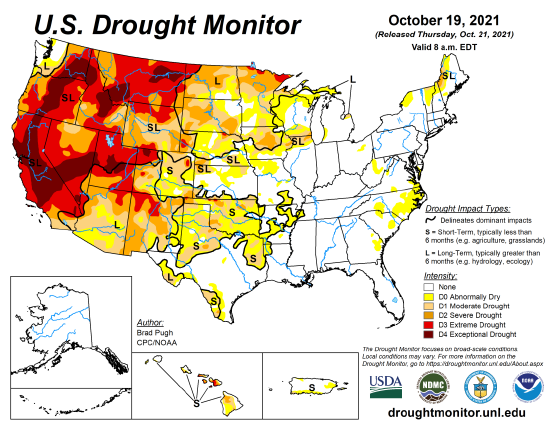

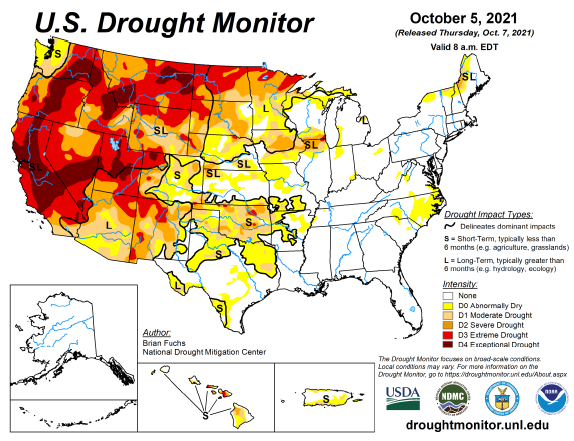

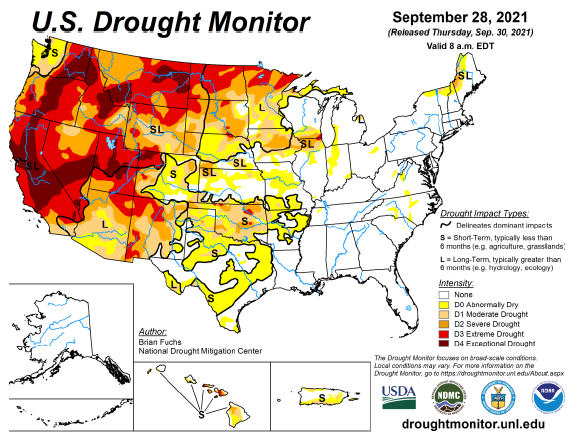

The 2021 U.S. grain crop has the potential to be one of the largest on record. Where did all the yield come from, what areas were the hardest hit, and why on God’s green earth are grain prices still so high?

Today, we are joined by several RCM Ag Services grain markets experts from around the country to catch up on a post-harvest update and share an outlook for production and marketing in each of their respective regions for the remainder of the 2021 marketing season and the upcoming 22 crops.

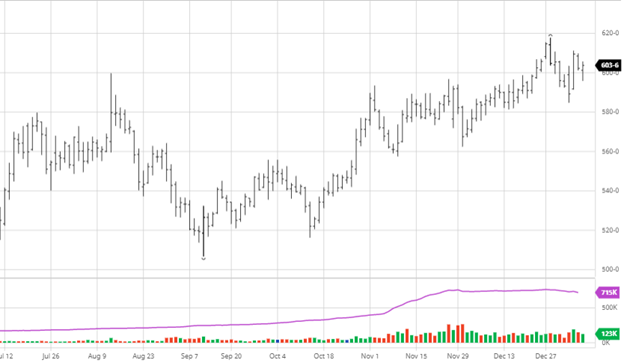

Via Barchart.com