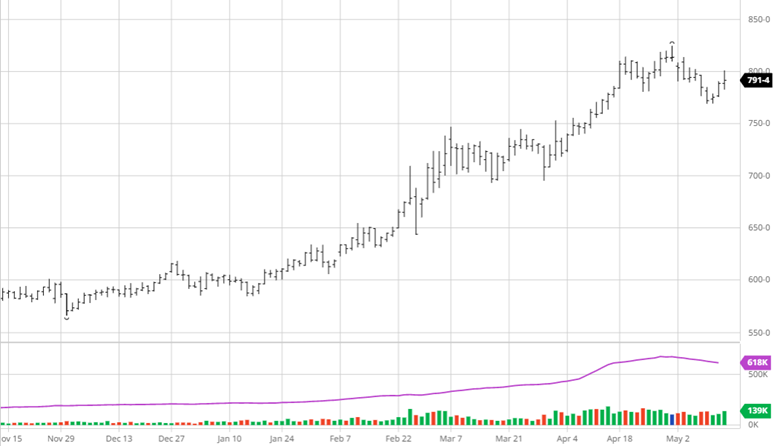

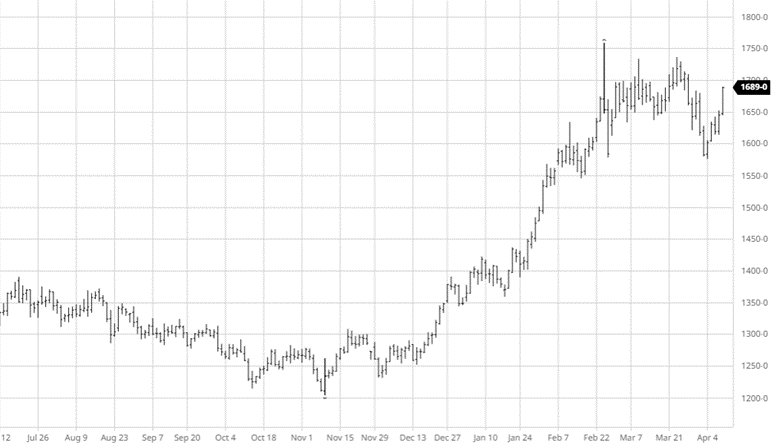

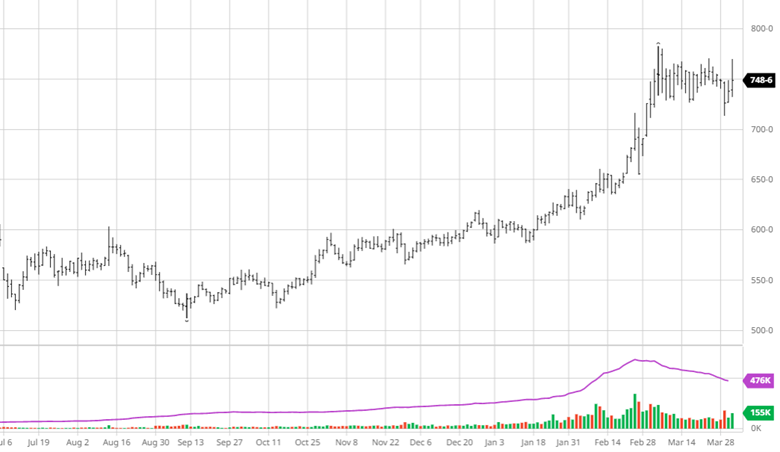

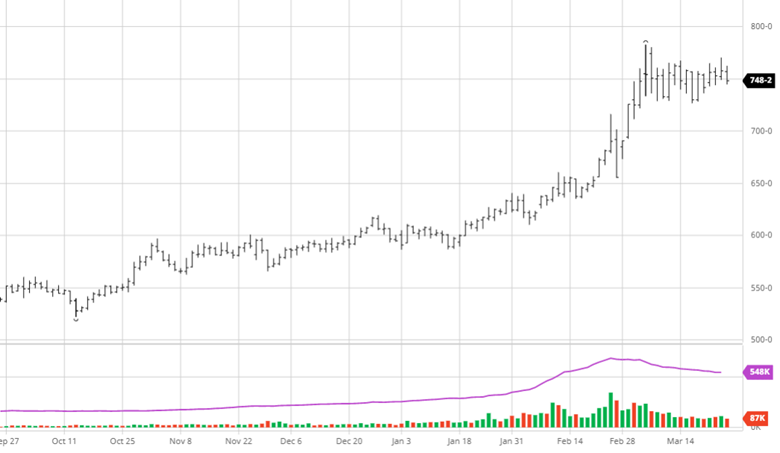

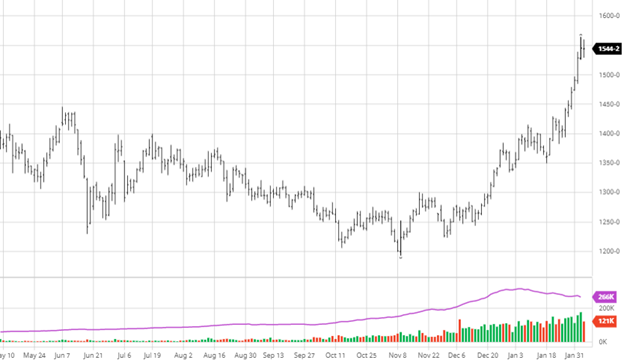

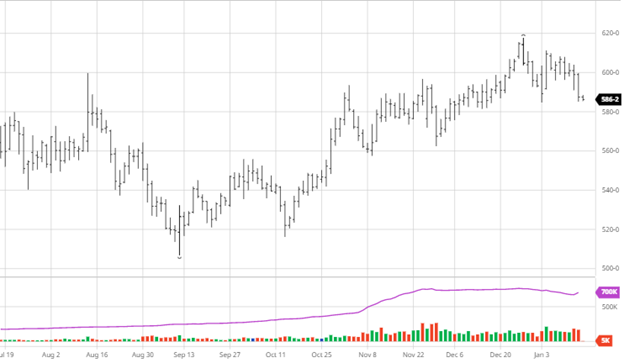

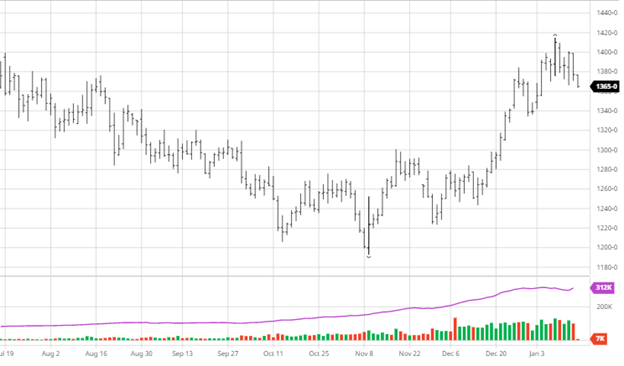

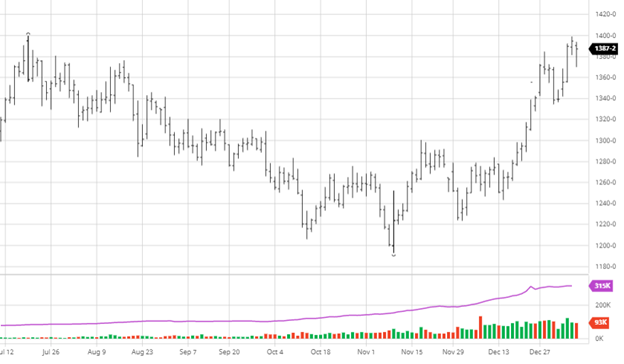

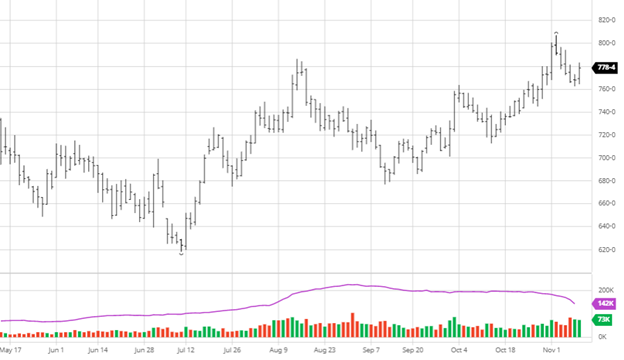

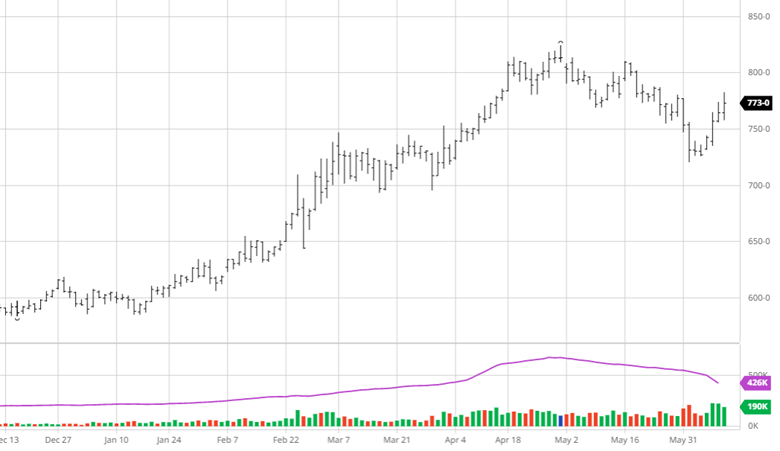

Corn had a good week with solid gains as there has still been no conclusive progress on an open trade corridor for Ukraine to export grain. The US weather outlook for late June remains hot and dry for many areas. While this is not too worrisome yet, if that pattern continues for the summer it could lead to the long-term weather problems the world supply does not need. The cash market remains hot with positive basis for corn pushing corn up over $8 in many areas in the corn belt. The USDA Report Friday did not include many surprises but had a reduction in old crop corn exports. This led to a rise in expected ending stocks for 22/23 to 1.400 billion bushels for the US. World supplies were risen as well on a bigger Ukraine crop expected (up 5.5 mmt from the May estimate).

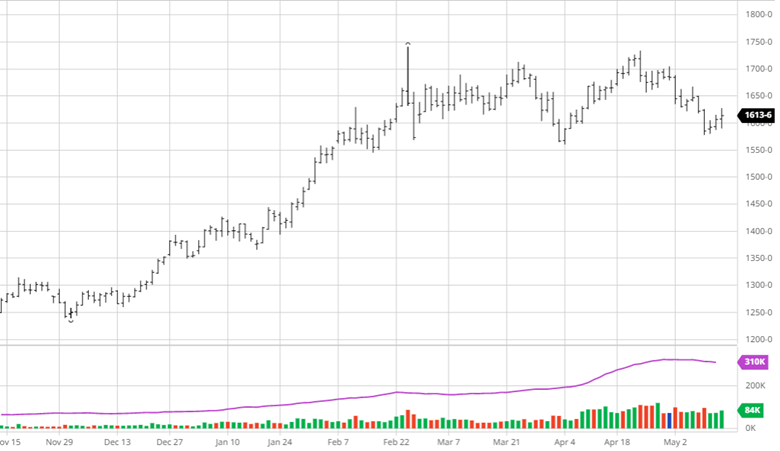

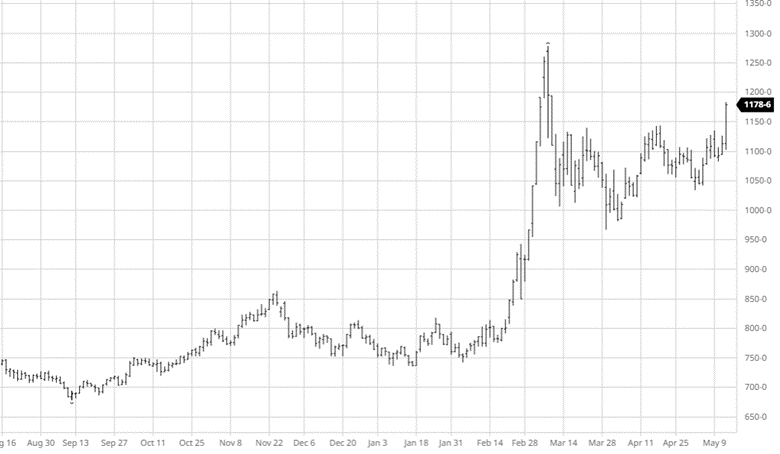

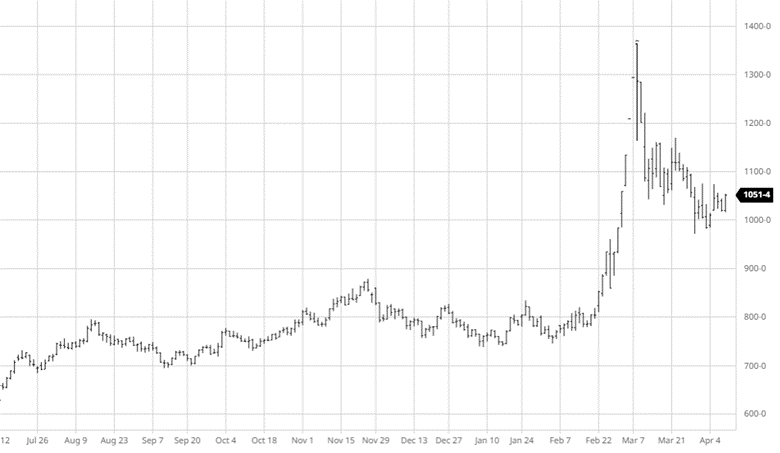

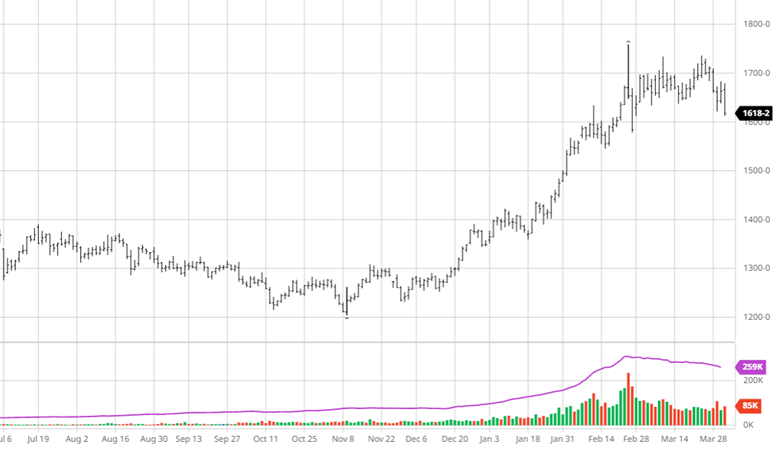

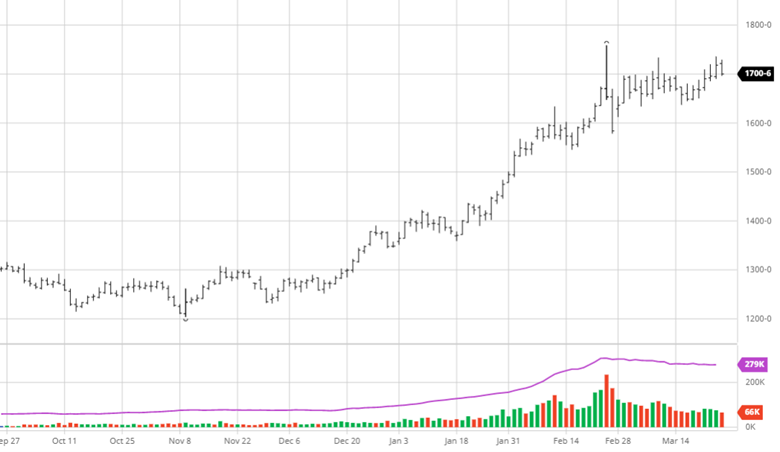

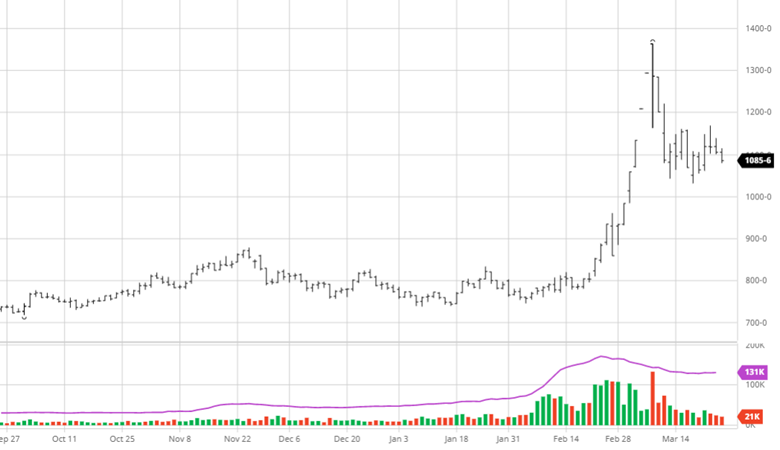

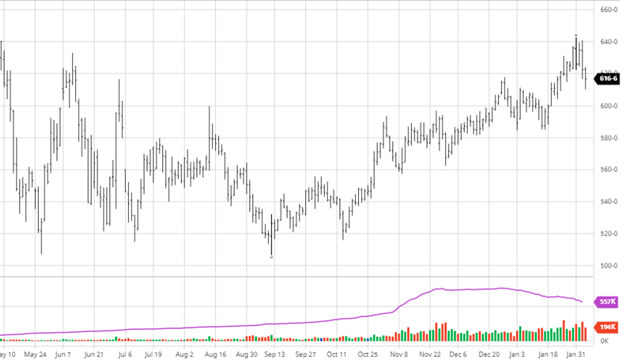

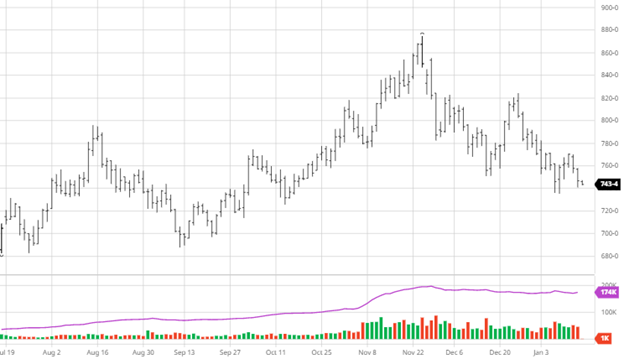

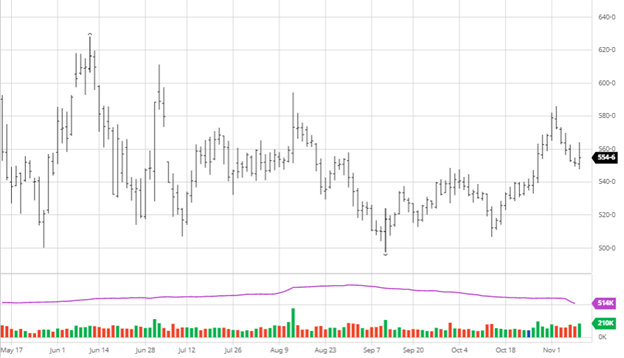

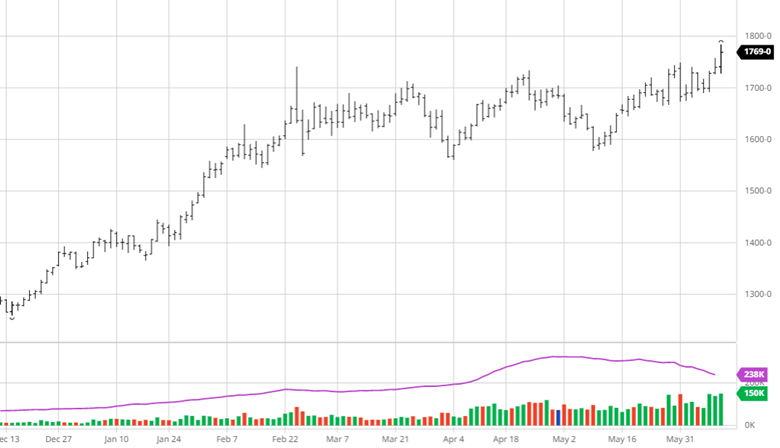

Soybeans had a good week with strong exports and higher bean oil prices. While there has not been much soybean specific news, the same supportive factors of the last few weeks remain. The high-pressure ridge that may move into the Midwest is providing support, like for corn, but whether that ends up happening will be a wait and see. The high crude prices will continue to help, and they may stick around for the summer as demand picks up. In Friday’s USDA report, Soybeans ending stocks were lowered to 280 million bushels for 22/23 for the US. World ending stocks were raised to 100.46 million tonnes, slightly higher than May.

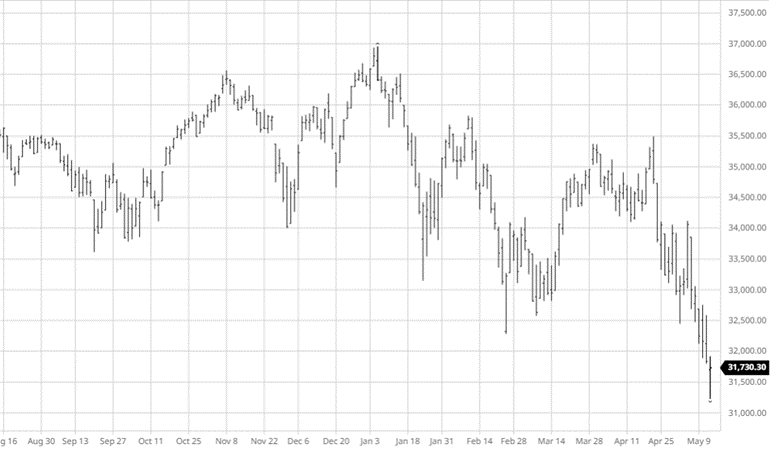

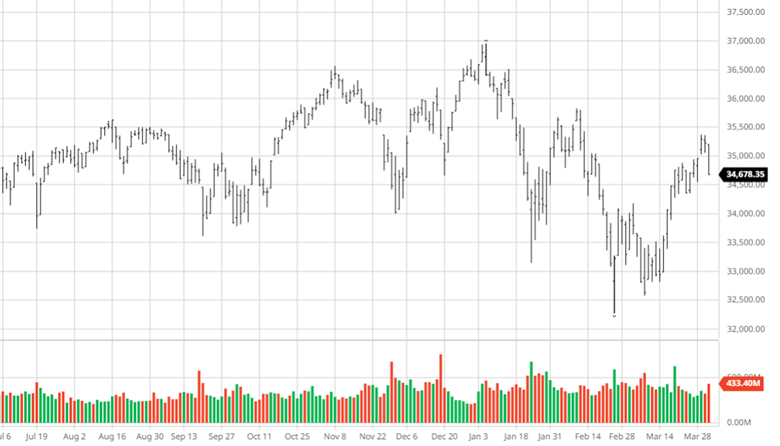

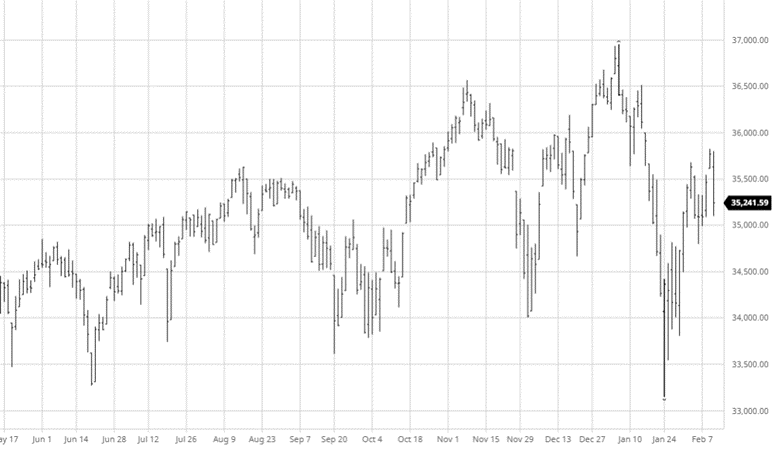

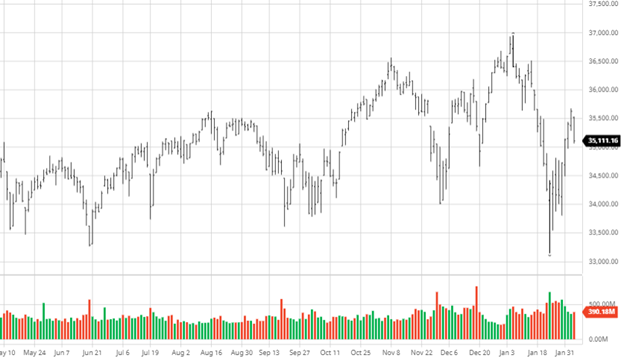

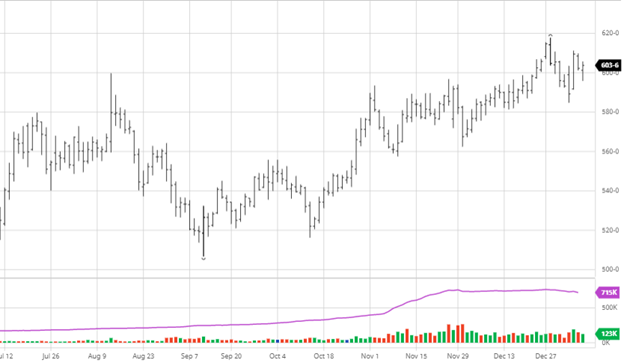

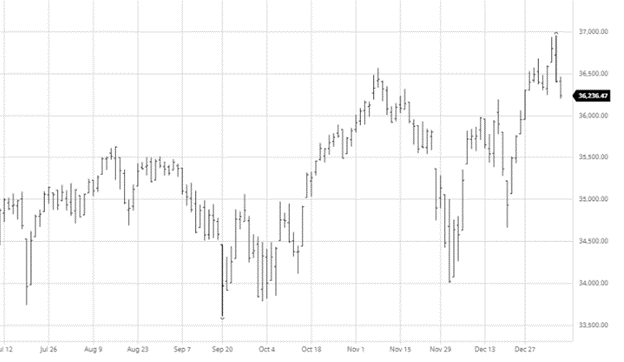

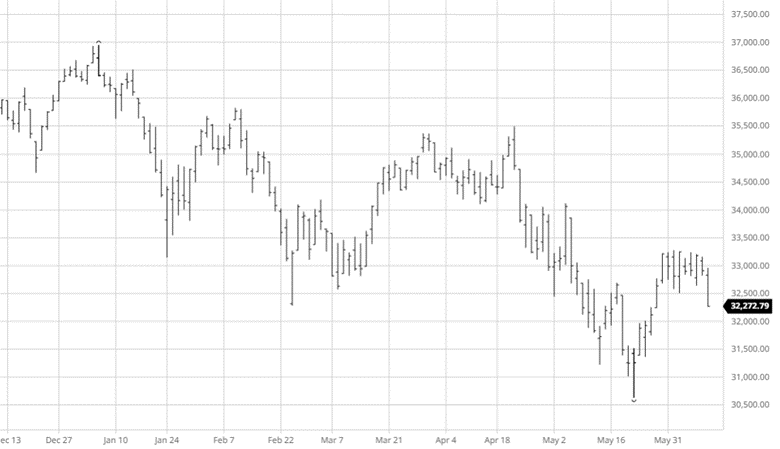

Equity Markets

The equity markets had been trading sideways for the last couple weeks but took it on the chin Thursday and Friday. While the market tries to pick a direction to go, the inflation number on Friday did not help as it rose to 8.6%. Markets tumbled on Thursday as the ECB said it would end asset purchases and begin to raise interest rates, pushing global bond yields higher. Hopes were that inflation had peaked, that was not the case, and the market reacted as expected to a 8.6% inflation number and record low consumer sentiment.

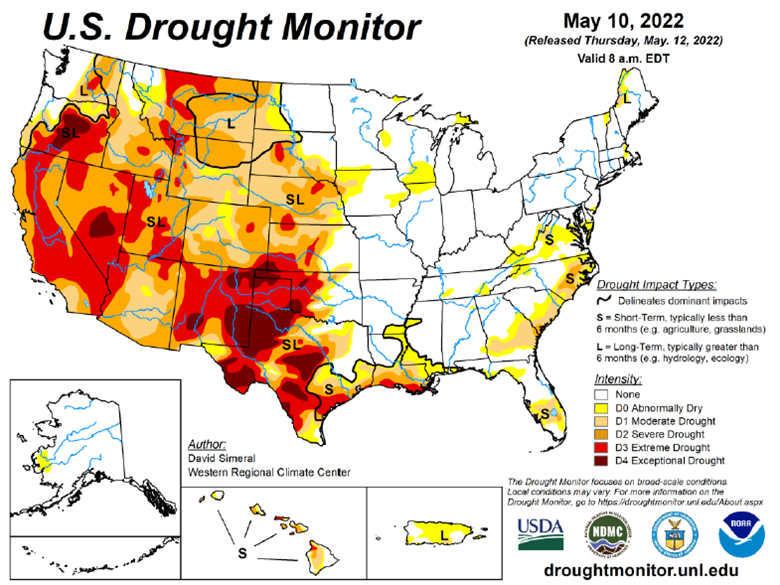

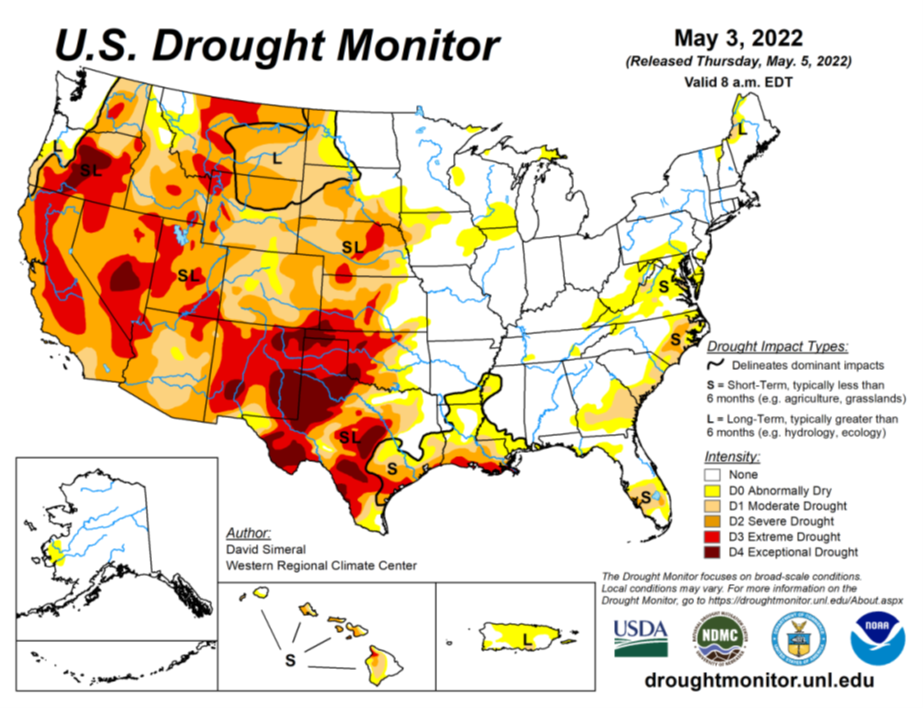

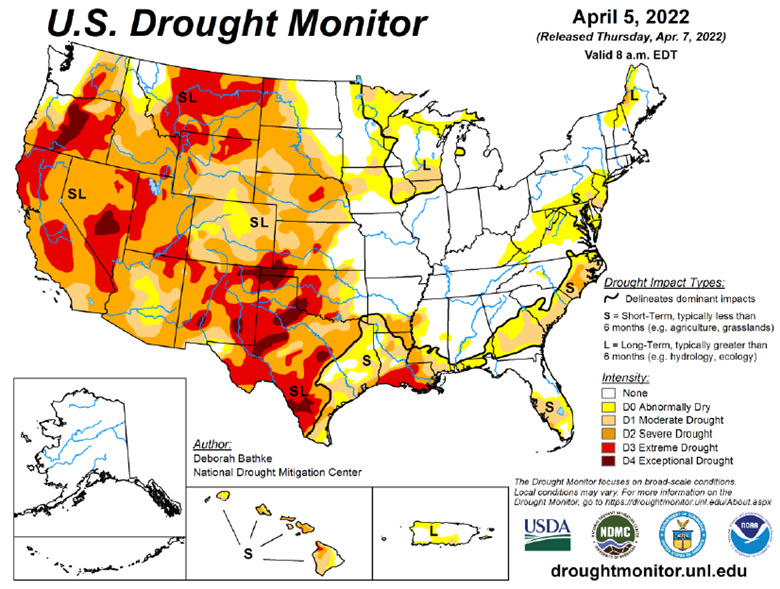

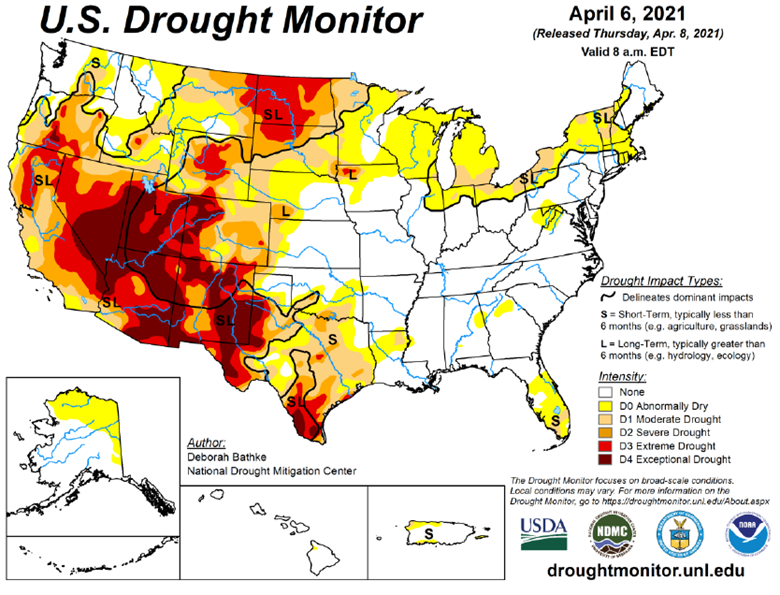

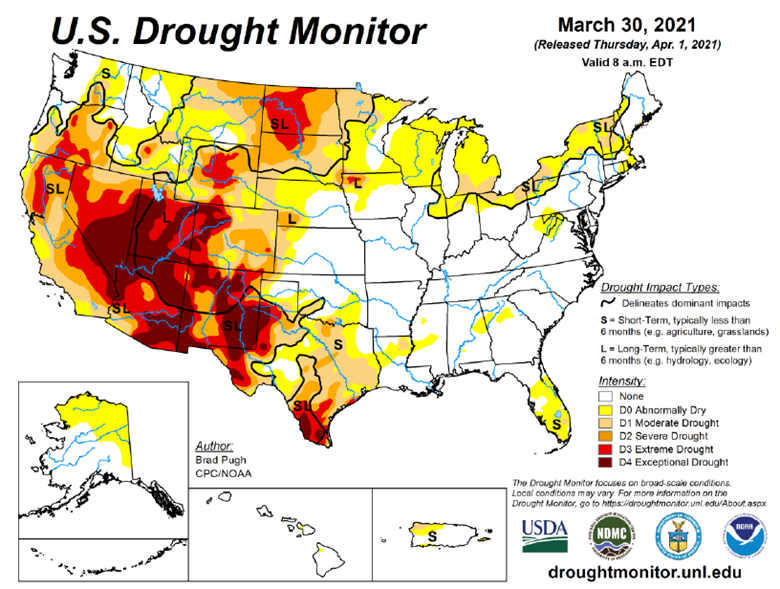

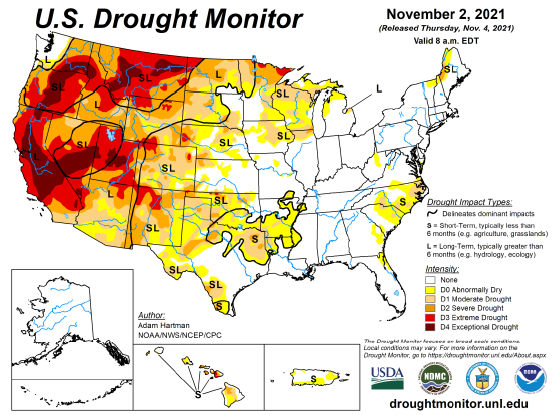

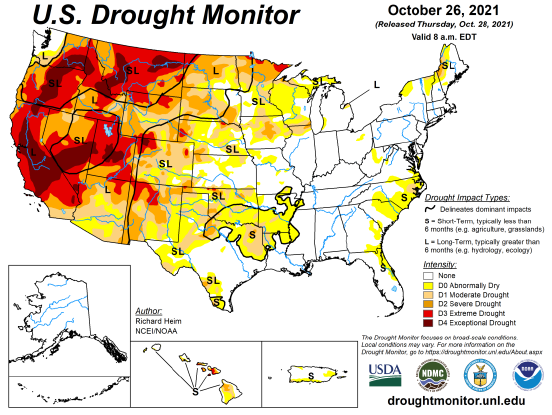

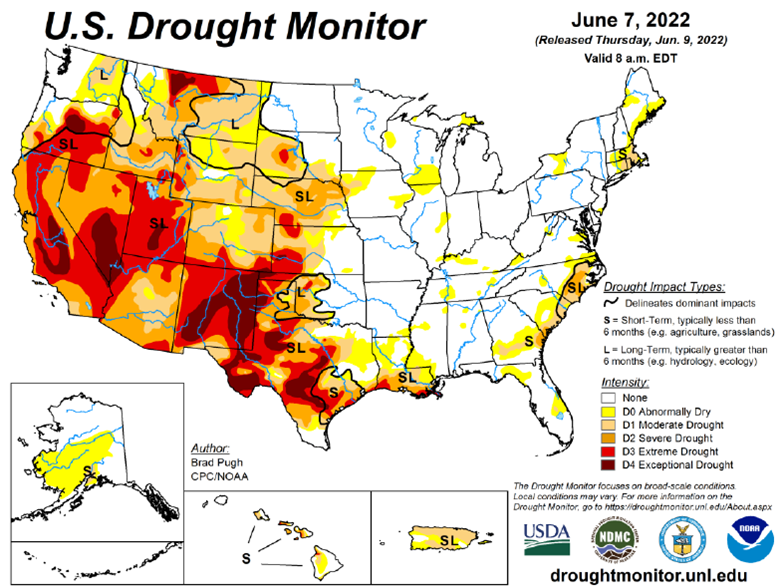

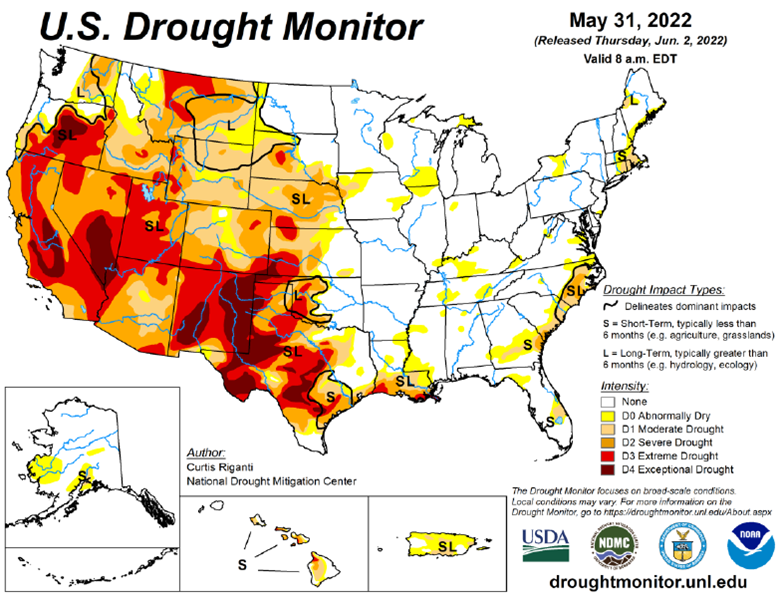

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

There is an agriculture tug of war happening across the nation, impacting America’s farmland. Fertilizer prices are continuously fluctuating, and it has us taking a page the “The Clash” should we stay, or should we go?! And we aren’t the only ones. Many farmers are asking their agronomist and chemical salespeople, “what will fertilizer cost me the rest of the season, and what are my options if I don’t want to go all-in on my typical fertilizer treatment plan?”

In this episode of the Hedged Edge, we are joined by a special guest who needs no introduction in his local circle, Dick Stiltz. Dick is a 50-year veteran of the fertilizer and chemical industry and is the current Agronomy Marketing Manager of Procurement fertilizer and crop protection at Prairieland FS, Inc in Jacksonville, IL. He is at the pulse of the current struggle and here to discuss the topic at hand.

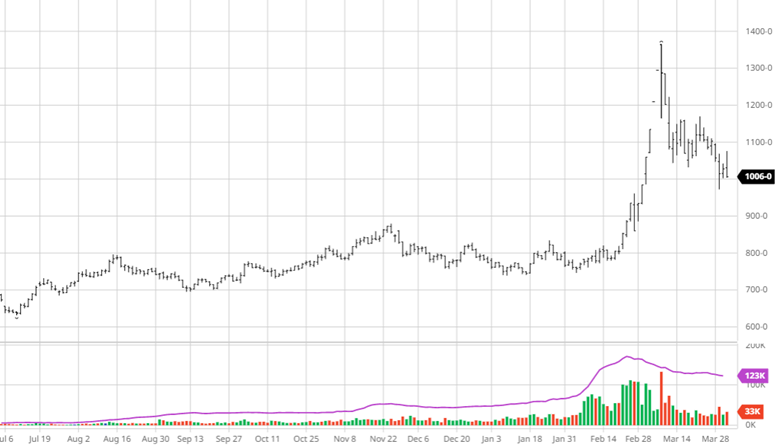

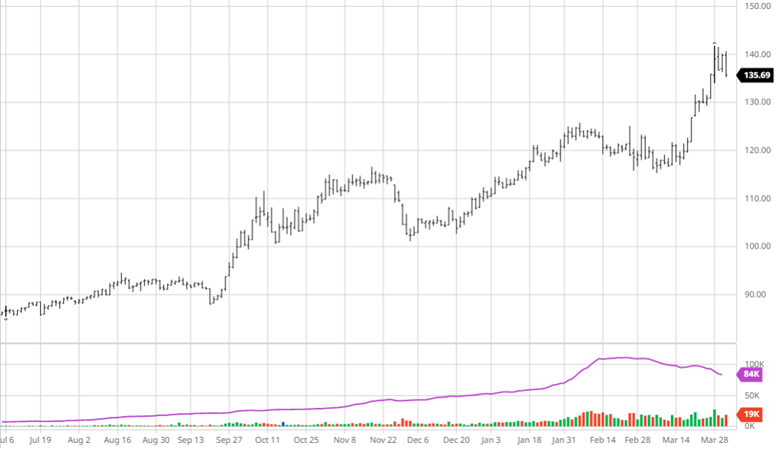

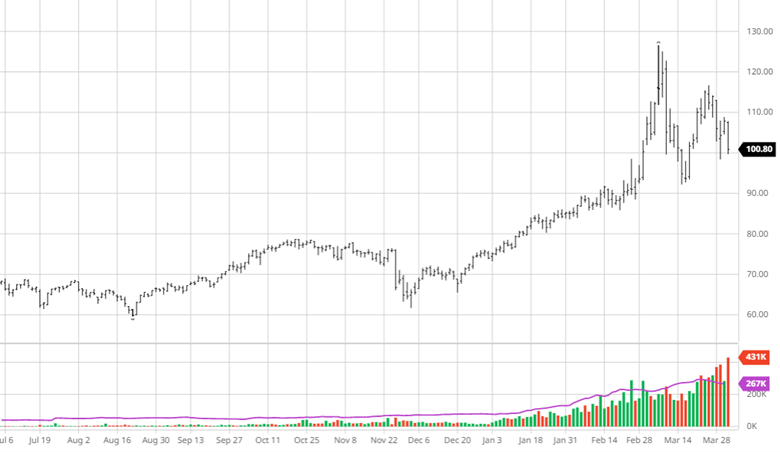

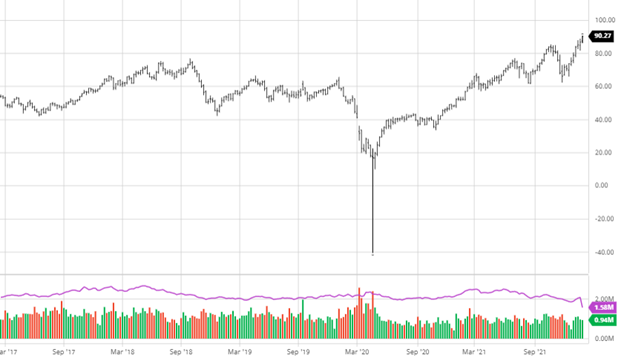

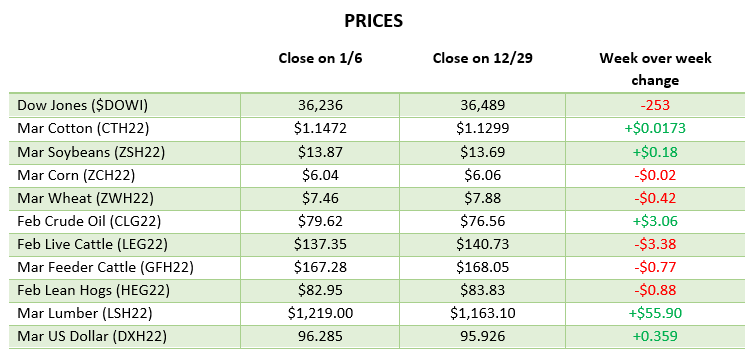

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].