With the world population just crossing 8 Billion in November 2022, the details of what it takes to feed the world today and the question of what it will take to feed the world 30 years from now when the population is expected to approach 10 Billion is mind-blowing to many. Today’s guest, Russel Taylor, is an expert on the science behind bringing additional agriculture yield to life through soil health.

Russell Taylor is President of Live Earth Products, Inc., a premium producer of humic shale-derived products. He has spent 20 years mining, extracting, and marketing of humic acid-based products. Areas of experience include; agriculture, turf management, organic fertilizers, animal feed, and soil reclamation. His knowledge has put his company at the forefront of the soil health revolution.

Check out the complete Transcript from this week’s podcast below:

Populations are rising and so are food costs – can improved soil conditions save the day? With Russell Taylor

Jeff Eizenberg 00:14

Welcome to the hedge edge by RCM Ag Services where we’re getting out of the field and onto the mic to bring you weekly market updates, commentary from commodity experts in monthly interviews with the biggest names in agribusiness. Welcome to the next episode of The Hedged Edge. As always, I’m your host, Jeff Eizenberg. With the world population just crossing 8 billion in November 2022. The details of what it takes to feed the world today, and question of what it will take to feed the world 30 years from now, when the population is expected to reach 10 billion is absolutely mind blowing. Today’s guest is an expert on the science behind bringing additional agricultural yield to life through soil health. Russell Taylor is President of Live Earth Products Inc, which is a premium producer of humic shale derived products. He spent 20 years in mining, extraction and marketing of humic acid based products. Areas of expertise for Russell include agriculture, turf management, organic fertilizers, animal feed and soil reclamation. His knowledge has put his company on the forefront of the soil health revolution. Russell, welcome to show.

Russell Taylor 01:42

Thanks for having me.

Jeff Eizenberg 01:44

All right, good deal. Well, again, we’re jumping right in here. And before we get started, everyone wants to know what’s in the background there. Why is there a pile of dirt over your left and right shoulder, what’s going on back there?

Russell Taylor 01:59

That’s a virtual background. It’s a picture of the mine, which I’ll cover a bit more on today’s call. It’s actually from the ancient tropical forests where we mine and it’s a picture of the deposit.

Jeff Eizenberg 02:10

As I believe and you’re in Utah, I looked up where you are Emery, Utah, it’s basically not too far from Moab. So if we kind of put that in perspective, you know, we all know the arches and everything out there. That’s the type of soil and ground that you’re dealing with out there. Yeah.

Russell Taylor 02:26

Yeah, yeah. So we’re underneath the sandstone cap. The sandstone has basically kept this ancient forest trapped for millions of years. But we’re in the middle of the Utah desert of all places.

Jeff Eizenberg 02:38

Yeah. And so getting into your background, you would say you grew up in the dirt. Sounds like you got involved with mining and some of this opportunity here, you know, from a young age. Is that true?

Russell Taylor 02:53

Yes. So my father opened the mine in the early 80s. At the time, I was nine years old. And he would be out there drilling the holes, and I’d be getting the dynamite ready.

Jeff Eizenberg 03:03

it’s with them, I played with them at ease and throw them in the pond and try to kill frogs. So does that count?

Russell Taylor 03:09

Yeah, close. But my experience felt like work. I grew up around it, you know, to be in the industry for that long. It’s hard not to learn a lot of things. After college, I’ve been working here exclusively. I’ve been with Live Earth as Vice President since 95. I’ve also been the President of the Humic Product Trade Association for 10 years. I was involved with humic long before it was cool, but that’s implying that the humic industry is gaining traction now.

Jeff Eizenberg 03:43

No, and I think that that’s really what we’re dealing with here today. And part of the reason why I wanted to get in touch with you is that, you know, here we are, we’re in an environment where we have rising input costs to farmers, we’ve got growing world populations, and it’s just a very timely discussion, to figure out how it is that other people or companies like yours are helping the world get ready for the next phase of real agricultural growth. And, you know, we have a lot of farmers that we work with, we work with a lot of elevators and you know, and consumers of commodities. And for them, they need to buy the products, right, or they’re producing them. And, you know, the question starts to come to mind are, what is it that can be done outside of just, you know, the traditional, you know, soil kind of background with the with the soil and then plant the seeds fertilized and go, you know, are there more things that can be done and so, bringing you on here, it sounds like you’ve been doing this since the 80s. Clearly, you have a good idea of some alternative solutions and seeing an alternative As in our background, love to kind of dive in. So yeah, share with us a little bit.

Russell Taylor 05:05

Right. So we’ll start from the beginning and work backwards a little bit. The deposit we mined is an ancient plant deposit. So imagine a rich tropical forest, where all that material is stacked up underneath that forest. That’s what we have. Now, why is that necessary? And the reason is, you know, you’ve usually got a soil that doesn’t have sufficient organic matter, or you’ve damaged your organic matter through cultural practices, and telogen, and a lot of other things. And so farmers are finding benefit by adding these products back. There’s been a big disconnect between fertility and soil health. And those are completely separate topics where you can add something that adds fertility to the soil, which will yield crops that can be detrimental to soil health. And soil health includes variables like structure, water conservation, and nutrient retention. And so as your soil health decreases, a lot of those other problems come to the forefront. And so, as an industry, we’re looking forward and saying, okay, what can we do? What is going to be needed in the near future, and with limited resources? As far as fertilizer, and nutrients, limited water, and also reduction in land, all these 1000s of pristine acres are to be converted into roads and houses and other things. So it’s kind of a triple witching effects, where you see a lot of things competing for the same resources. And we’re ignoring soil health. So it’s extremely problematic.

Jeff Eizenberg 06:44

Now, you’re, you’re talking about mining and ancient forest, I think he told me on the phone, or beforehand, here 70 million year old forest, that is essentially it was a tropical, you know, equivalent of the rain forest today. You know, mining and organic matter, don’t usually go hand in hand, right. But everything that I’ve read, and you’re telling me is that there is a large deposit of organic matter in your area, that you’re able to mine extract. And then I assume further process for delivery out to farms, other agricultural systems, whether it’s, you know, I saw you’re involved with the Rose Bowl, and some other things like that. So maybe just walk us through, I mean, how much how much matters there? And is it unlimited or what’s what’s going on? Well,

Russell Taylor 07:46

We’ve received 1000s of acres of mineral leases over the years. We’ve been mining for the past 30 years. So, in the grand scheme of things, we’ll be here for a while. When you talk about organic matter, you need to break it into two categories, active organic matter, which is being broken down by your microbes, and then the leftovers passive organic matter, which the microbes aren’t breaking down any further. As a farmer, you know, when you’re trying to contribute organic matter back, it’s usually in stover and corn stocks. So, you know, in a normal system in nature, those things are being returned to the soil and building up your soil organic matter. So you see the cultivation over time that farmers are slowly decreasing the organic matter. And your organic matter is your storehouse, your pantry, where you store nutrients, store water, and create room for microbes and oxygen and all those things that plant X and used to live. So by adding the product that we’re selling, which is humate, you’re kind of backstopping that process. You might not be returning those organic compounds back to the soil through the crops, but you’re actually able to add this to help build the soil organic matter through other means.

Jeff Eizenberg 09:07

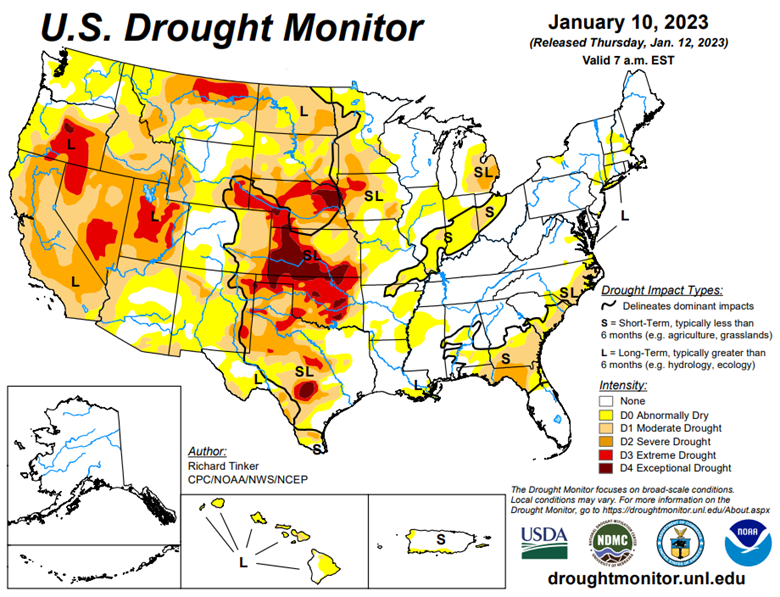

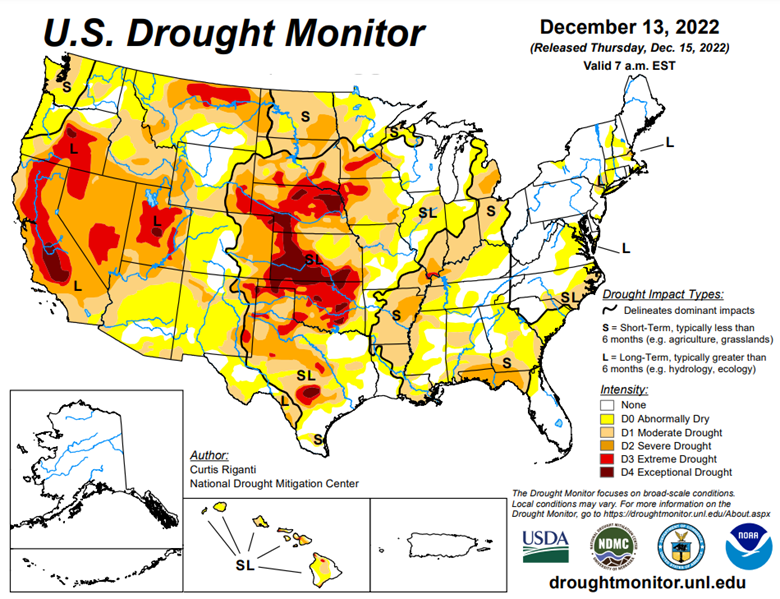

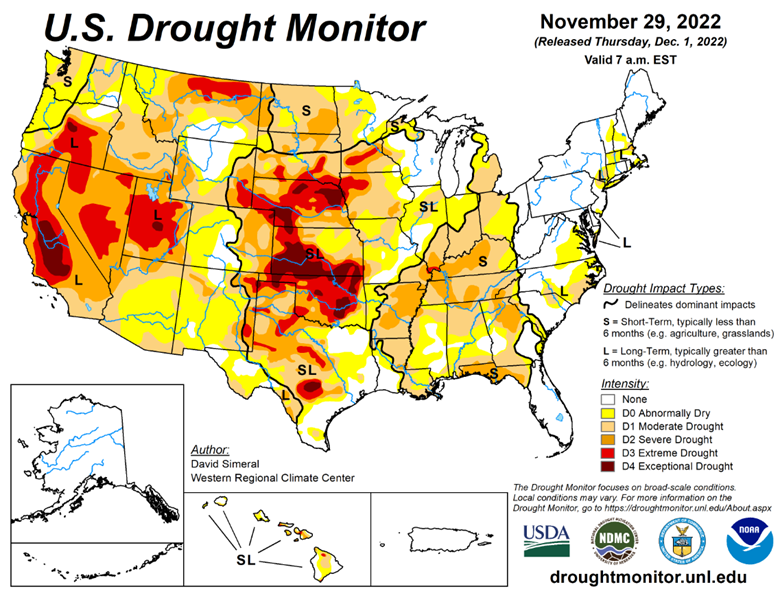

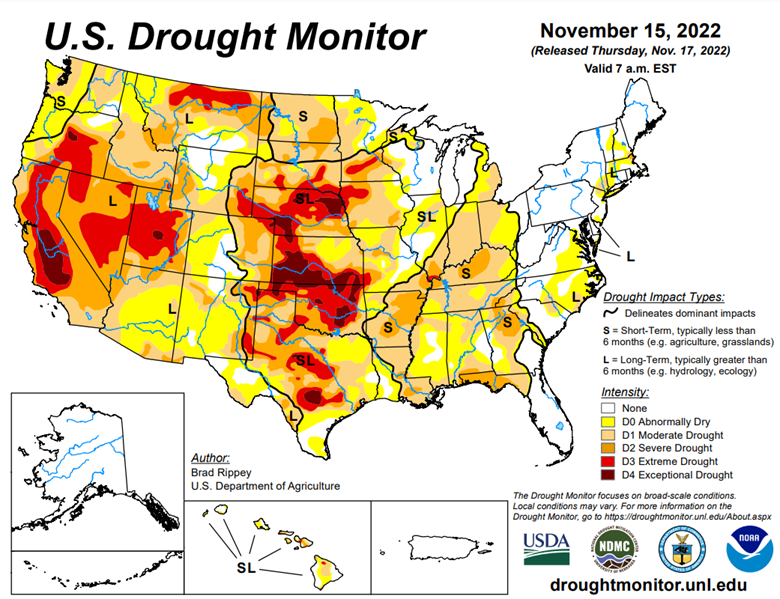

And that’s a big deal right now with areas especially there in the West. I mean, it’s so dry, you’ve got drought conditions, you know, if you could hold on to more water, then that’s a bonus. Right?

Russell Taylor 09:18

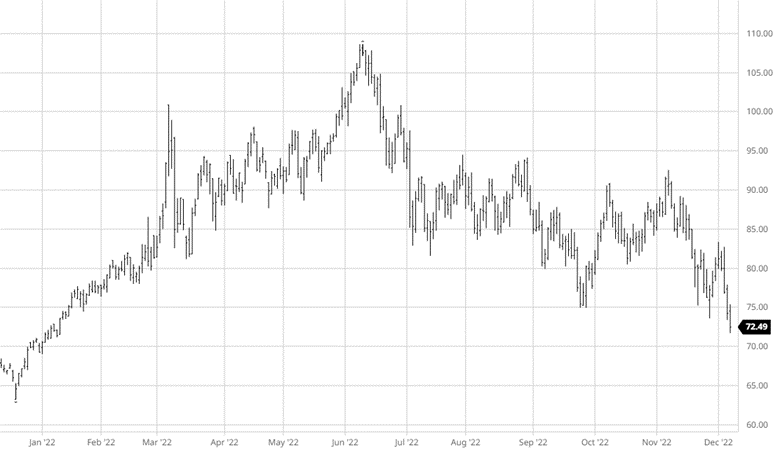

Right, right. And it’s kind of a catchy thing, right? You use less because you lose less. But it’s true. You know, a lot of times, we’re seeing water loss and nutrient loss just simply happen, because there’s not enough organic matter to hold those nutrients and water into the soil profile longer. And the hard part is, we’re breeding our plants to be these racehorses, for lack of a better word. We’re building these really high power hybrid plants that have to have extreme amounts of energy to perform properly. Suddenly, soils just can’t sustain those nutrient loads and have a lot of waste. It was really easy for us to be wasteful when things were inexpensive? You know, a year and a half ago, two years ago, urea was $250 a tonne, right? Last May I think it hit $1,200 a tonne. So, I mean, look at the cost difference to the farmer and say, Wow, this is a big difference, how do we get more efficient? Because those conversations were, they weren’t being held as much because it was so cheap. So now is the time where people are looking at companies like us and saying, oh, okay, let’s talk about conserving nutrients, making those things last longer, because all of a sudden, they got expensive, and that’s hitting my bottom line in a big way.

Jeff Eizenberg 10:35

So okay, you know, that’s, that’s right. And we’ve got input costs have gone through the roof that Russia Ukraine, raw war has caused for increased pricing on the urea, it seems like fertilizer prices are coming back down, which is a good thing for the farm and for the inputs. But you know, supplementing it with what you’re doing now, you said you using 20 to 30 acres of the 1000s, you have access to what does it look like for you to actually harvest or extract a lot of this, this this matter? And then sell it large scale? I mean, are you are you targeting, selling the product to large seed and chemical companies as a mix in with some of their current fertilizers? Are you trying to go direct to farmers? What is the kind of the business model here to you know, help direct people down your path?

Russell Taylor 11:29

Sure. So we are a family business. Owned by my father, operated by myself, my brother, and we are small, right? So we work through dealers, there’s no sense for us to, as a small company we try to recreate the wheel, you know, find a local agronomist and get them hired on. So we sail through distribution through a local farmer, co-op. So in Utah, for example, if you went to Intermountain Farmers Association, you would find our products readily available through their cooperative. We sell through random cooperatives within the United States, and also through some ag dealers. So that’s where you get our product, you know, make sure you’re talking to AG dealer and getting in the process.

Jeff Eizenberg 12:05

If this was Shark Tank, I’d be asking you, you know, who do you have your large distribution with? And, you know, try to get you in with bear or somebody like that, right. So let’s see what we can do.

Russell Taylor 12:20

Yeah, we have some of the largest distributors in California, for example. Penny Newman, great company distributes our products and Penny Newman’s huge and we’re happy to be a partner with that company. Some of the areas where we have less distribution, the further you get to the east, obviously, you know, freight becomes an issue. And prices get a little more sensitive to the farmers. But we distribute nationally, internationally, we sell these products as raw materials and extracts. So what you see there behind me, that’s just a picture of the raw deposit. And we’ll just take that the Sansa layer on top glass and remove it. And just take an excavator and share it. It’s soft, brown dark material, and screen it granulate it and sell it as a raw material. We also do some extracted ingredients; we sell liquid humic acid and liquid fulvic acid. What’s interesting about this deposit, you’d mentioned, you know where we’re selling it, is it going to just ag? The answer’s no. We sell into ingredients and dietary supplements, cosmetics, animal feeds, and fertilizers. And you’re thinking, well, that’s kind of an odd thing. But this is an old plant deposit. And it’s clear full of minerals. So sometimes on the label, it says “minerals”, that’s us, because they’re using it as a background, trace mineral, got it?

Jeff Eizenberg 13:31

And now it’s started, I started to think about okay, you know, we’re talking to the beginning, that, you know, we really need to focus on soil health, for around the globe to grow and increase the amount of yield of food that we can actually make available to the world population. Are there other types of deposits like this, or areas that you and your company could target around the globe to really just replicate your business and say, you know, sub Sahara Africa or, you know, China or something along those lines.

Russell Taylor 14:01

You know, for a company, we’re not wanting to take over the world, only all these deposits, we actually have some friends and peers in our industry through the humic product trade association that are doing similar things. So if you’re looking for a deposit in the United States where you know, we’re not reaching, go to humictrade.org and look at the member section, you’ll see a list of members that are also our peers in the industry selling and manufacturing humic acids. Now you make deposits vary in their parent material. So, you know, 75 million years ago, we were set by tropical forest, some places had grasslands or swamps, and so or peat bogs and so what made their humic deposit was a different pair of material. So they’re all a little bit different. Some might have higher humic values or lower fulvic values. And so they will vary in what they describe as age range and decomposition. So you know, some are very immature like in Canada you got those peat bogs that are fully kind of no longer peat, but slowly transitioning into these deposits. And in the listeners minds imagine, you know, when there’s an apple turned into compost, it’s a process right you know decomposition, the same thing is occurs with this old plant material, you got an ancient forest that fell down, and then it got deposited in overtime with heat and pressure. It hasn’t turned into coal yet, but it sure broken down from what it was. So that’s kind of where it’s at is somewhere between peat moss, and cool.

Jeff Eizenberg 15:30

Well, I’m definitely buying a bag this year from my, from my garden here in Ohio, I’m going to need it let’s let’s, let’s move on a bit here, this, this is a super interesting step, you know, the way that, you know you guys have even started this business and grown it over the years. And the fact that you’re also involved with, you know, others that really kind of as an association and attempt to, you know, kind of share the wealth. What do you think of so so you’re kind of sitting in a unique spot that you’re talking with people all over the country, and presumably the globe? I guess what do you think agriculture success looks like if we start looking out 510 2030 years from now, thanks to soil health and opportunity.

Russell Taylor 16:21

There’s a lot of hope on the horizon. When I say that is, you know, conservation has become a big issue, particularly because inputs got expensive. When it got expensive, all of a sudden, people started talking about conversation, until our agricultural practices decouple from petroleum based inputs will always be beholden to the industry. And the problem is us the nitrogen industry, for example, nitrogen is made through what they call the haber bosch process, they use some type of either natural gas or in Europe, or maybe some dirty coal in China to capture nitrogen out of the air and make that nitrogen. So that’s when you see a war on these fossil fuels. And you start looking at some of the dirty players where we can impact it, and nitrogen is one of them there, we’ve got to decouple our nitrogen from these processes. So in the future, you know, some businesses will succeed significantly by either figuring out a way to produce that nitrogen without fossil fuels, or conserving the nitrogen we make, maybe that’s the only way we could make this type of nitrogen. But using technology like ours, actually taking that nitrogen and making better utilization of it. So going forward, I think we’re going to focus in on not just precision ag, because Precision Ag you know, in the past, people thought, no machines and computers and strategically plants, placing fertilizer on the soil. The problem is, if that soil health is degraded, it’s not going to hold those nutrients. You know, in some ways, fertilizers are extremely soluble. So one example is – imagine, somebody told you and me that we’re going to have to drink all of our water for the month, in one sitting from a firehose, right now, both painful and inefficient, right? There’s going to be waste and water everywhere, and you and I are going to be unhappy. That’s what we’re doing with some of these crops, we’re given them a big dose of fertilizer at the beginning of the season. And at the end of the season, they’re saying what you ran out. So when we’re mimicking nature, when we’re taking that nitrogen and attaching it to a carbon, like a humic acid, that plant gets a longer look at it. So I can give you a couple examples. We recently did some work in 2018 through 2021, with the University of Tennessee, okay. We do granular fertilizers and then liquid fertilizers. We took a side dress application, that’s where you go on corn later on the season, and you give it another dose of nitrogen in that sideways application we went with and without humic acid. Now the corn that had received extra humic acid produced almost 20 more bushels of corn than the corn that did not. Now this is a lower getting better soil. And that’s the response you would want to see. Okay, how was that corn plant able to produce more corn? And the simple answer is that plant was able to get a longer look at that nutrient for it was last volatilized or converted. That’s how nitrogen is lost it is either it goes in the air as the gas gets rinsed away in your aquifers are it’s mineralized in a way that the plant can get it. So by adding these organic acids back to current fertility programs, we’re able to assist the farmer into making a better use of some of those expensive inputs like nitrogen. And I think looking forward in the future, like you said, where do we see this? This has to occur? Because I can’t see inputs going down. Right? I can’t see the war on fossil fuels and fossil fuel use decreasing. So I think that’s the first step, I think the NRCS and some of those other agencies as far as cultural practices, no till and some of those things, they’re trying to encourage farmers to do it that’s going to continue to occur. But I think getting smart with our nutrients is going to be, particularly nitrogen is going to be some of the pivotal things we’ll see in the next 2030 years.

Jeff Eizenberg 20:21

I think, you know, farming has evolved, and it will continue to, especially in other areas of the world, where, you know, the people, sometimes they’re just stuck with the soil that they have. The question becomes is, is there a economies of scale for you, your business and the farmers in far out regions away from where these deposits are, for them to be able to, again, economically, bring in the right amount of additional soil or nutrients that you’re talking about, to that region? And I guess that’s, that’s a question for you. I don’t know.

Russell Taylor 20:58

So there is a document out there by the NRCS, that talks about soil health, and how to build soil health and how to build soil organic matter.

Jeff Eizenberg 21:06

Yeah, we’ll make that one available in the notes in the show notes here.

Russell Taylor 21:10

Sure, sure. So I’ll just summarize, you know, a couple points out that real quickly. It talks about how to change soil organic matter over time. And the ones that you’ve got to remember is, it’s like eating an elephant, you know, you’ve got to do this one bite at a time and slowly, slowly commit to doing it. Because if you start backing up the numbers, let’s say for example, you took an acre of soil, six to eight inches deep, and that’s where most of your corn would root right, and you took that acre soil six, eight inches deep, and you made a big pile, that’s going to make 2 million pounds of soil in that pile. So if we said, let’s change our soil organic matter, 1%, 1% of 2 million is 20,000 pounds of pure organic matter. So you’re going to tell a farmer look, you need to put up 20,000 pounds of stable organic matter. Now stables got the big Asterix next to it because corn stover and manure and all those things have a 10 to one conversion, when it when the soil microbes breaking down takes 10 pounds of active organic matter to make one pound of passive. So that means to get your 20,000 pounds of stable organic matter, you have to put 200,000 pounds of active organic matter. Okay, no farmers putting down 100 tonnes of anything. Exactly. That’s that when we’re talking about taking bites us at a time, you’ve got to commit to it now, what’s the upside and the benefits and if you read that document, we’ll see you know what percent change organic matter will conserve 27 to 30,000 more gallons of water per acre. All of a sudden, that makes a difference, you could fill a few swimming pools with that amount of water. If let’s say you’re dryland wheat, or dryland corn, you’re conserving 30,000 more gallons of water per acre, that’s a big deal. You know, it’s not acres and acres feet of water, but it’s enough water to maybe make a difference on a yield. So that over time plus the nutrient retention is real big reasons why you should increase soil organic matter. And that down the road is going to turn into profits. If you’re retaining nitrogen, it’s because you’re retaining the water, it’s got that water there nitrogen in it and keep preventing it from leaching away.

Jeff Eizenberg 23:12

So you’re you’re really if I had to put an analogy around it, you’re saying that your efforts and these efforts in general, whether it’s through you, your company, or your association, it’s more of a dial than a switch, you really have to commit to this over time, and see is to see the results.

Russell Taylor 23:32

Right now there is one little nuance in there and it these raw materials, like I’ve talked about behind me in bulk, or use the soil amendments. In some of the extracts, we make these products act like a biostimulant, where we see some accelerated plant growth with these solubilized some of the components, so people will actually add those extracts to the fertilizer, I call it a dealer cocktail, but they’re adding them and what we see is kind of a one plus one equals three, where the added benefit of the humic acid caused that plant to take those nutrients in quicker and allow that plant to achieve a higher genetic potential or better yield.

Jeff Eizenberg 24:15

Well, this has been super interesting Russell, I, you know, don’t spend much of my days thinking too much about the organic matter and soil. But today’s has been one of those days and I actually really enjoyed this opportunity to speak with you. Are there anything else that you know, that we’ve missed here that you want to make make the audience aware of before we kind of wrap up?

Russell Taylor 24:40

Well, you know, I try to fly the banner for the industry as much as I can about promoting as the president of the trade association. I tried to be selfless and say hey, you know that I’m trying to help everybody out. But you know, we’re a small family business. We’d like to make sure we’re promoting our name out there. And it’s small companies like myself that are there selling these products. You’re not seeing large agricultural conglomerates really getting behind this yet. And that’s primarily through what’s going on with some changes in laws, how they treat these products. And it’s a long topic, but I’ll just cover it real briefly is the way our government acts, they have got a law for pesticides. And then then the states are in charge of regulating the fertilizers. So there’s this gap in the middle where soil amendments like ours, they’re not a pesticide, they’re not a fertilizer. And so there’s just a gray area. And so there’s not been a lot of laws, rules and testing methods that have been real favorable for our industry. And that’s all in the process of changing now. So you’re going to see updated seals of approval through trade association that show, you know, this, this testing method is approved for products like ours. And consumers should just ask more about how these products are tested and get informed. And the other thing is, there’s a lot of confusion between black products. And I’ll give you one quick example from our chart. Now, biochar, it has an application. And it is nowhere near humic substances. Biochar, somebody’s burnt trash that they didn’t they want to hold in a landfill, it’s a burden on the farm. They’re trying to sell to the soil and it’s beneficial in soils that have low pH, and they’re well drained. Okay, that’s the only the only place where biochar has been shown to be beneficial in soils that have higher pH and because biochar has the lambing potential, and it also has its germinated germination inhibition. Now, those two things, you know, might be too technical agronomy, but basically, you’re putting a product down, that keeps the seed from germinating. So if you just put a crop in the ground, he put something down, it inhibits germination, that’s going to be bad. So you look at it a little bit deeper, I would encourage anybody listening to this, you know, look at the industry, look at what they’re trying to do, and learn a little bit more the difference in these products because humic substances definitely differ between biochar just because it has carbon. They’re not all the same. So let’s talk about the how this carbon is bonded and how it’s useful.

Jeff Eizenberg 27:26

Well, we’ve got your video on video now. So you know, when we see you on the steps of the USDA, with with a with a picketing sign telling them to pay more attention to your products, we’ll, we’ll be sure to, you know, tie that back to you.

Russell Taylor 27:39

Thank you. Yeah. You may see us on the Rose Bowl, we been on the Rose Bowl Stadium since 2006.

Jeff Eizenberg 27:46

okay, well, now that we’re talking, I’d like to go to the next game. The one that coming up here that would if you got extra tickets, I’ll be there.

Russell Taylor 27:52

Yeah, we’ll talk offline. I’ll hook you up.

Jeff Eizenberg 27:53

All right, I like that. Last question for you ask all my guests. It’s kind of a fun thing. Off topic. Since we’re talking football and sports, in your background, or in your I guess your in your favorable, previous 21 year old body? What extreme sport would you be most inclined to do try or be involved in

Russell Taylor 28:18

Extreme sport that I would want to be involved in? Rock climbing, you know, in my area people do a lot of bouldering. And I see the kids out there like lizards on a rock. And I think, you know, if I was younger and didn’t feel like falling off a giant rock that might be interesting to me.

Jeff Eizenberg 28:37

Well, seems like you’ve probably got a lot of them there around you so that maybe maybe this will inspire you to get back out there. All right, Russell, this has been great. What is the best way to get in touch with you if people have questions or want to reach out,

Russell Taylor 28:50

You’re always welcome to reach out through the website, livearth.com.You can also call us, we’re a small family business. I’m a certified crop advisor. I like picking up the phone talking to people. And we’re always available by phone. And that’s 800-846-2817.

Jeff Eizenberg 29:10

Excellent. Well, this has been a real pleasure to appreciate your time and interest here. And, you know, I was kind of risk management approach. You know, we obviously try to help as many people just stay informed with, you know, all that’s happening in agriculture. And this is obviously not anything brand new, but it is on the forefront. So appreciate the time, and maybe we’ll get a chance to hook back up again. And, you know, maybe you’re you tell us you found, you know, the Tyrannosaurus Rex skeleton in that mine or something like that.

Russell Taylor 29:43

Yeah, we won’t tell anybody about that. We don’t want to turn that mine into an archeological dig.

Jeff Eizenberg 29:48

Yeah, right. Yeah. Good idea. All right, Russell. Well, thanks for your time. I really appreciate it and we’ll be talking to you soon. Have a great holiday.

Russell Taylor 29:56

Thank you for the interview.

This transcript was compiled automatically via Otter.AI and as such may include typos and errors the artificial intelligence did not pick up correctly.