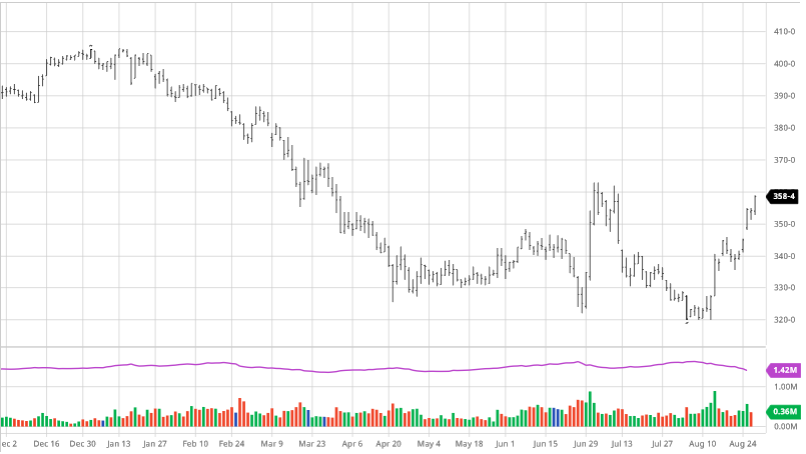

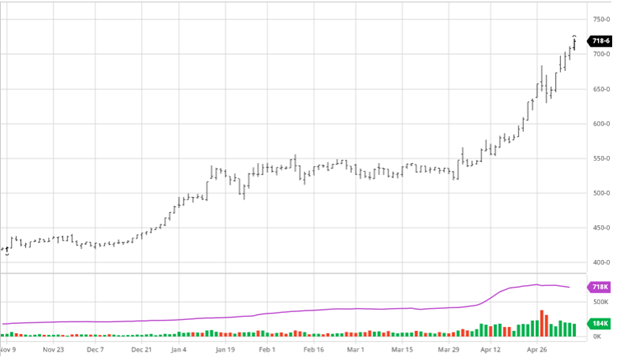

The May USDA report was mixed but the most bullish news out of it was lowering expected yield to 177 bu/acre from 181. This adjustment trumped the other numbers as US and world stocks were higher than expected. The USDA appears to think demand rationing is in the future but is also aware the late panted US crop will not achieve record yield. The USDA did not change their estimates for Brazil’s safrinha crop, their estimates remain a few hundred million bushels over private estimates. Corn planting was seen as being 22% complete to start the week with more progress being made. The US is well behind its normal pace and there are still places that have yet to start, the longer planting drags out the lower that yield is expected to go.

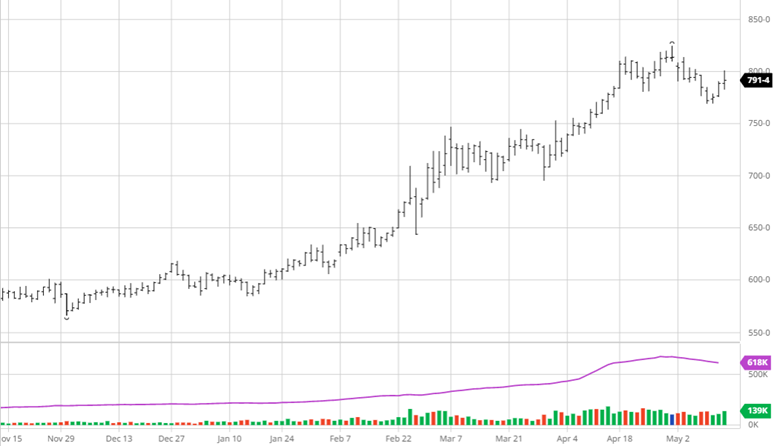

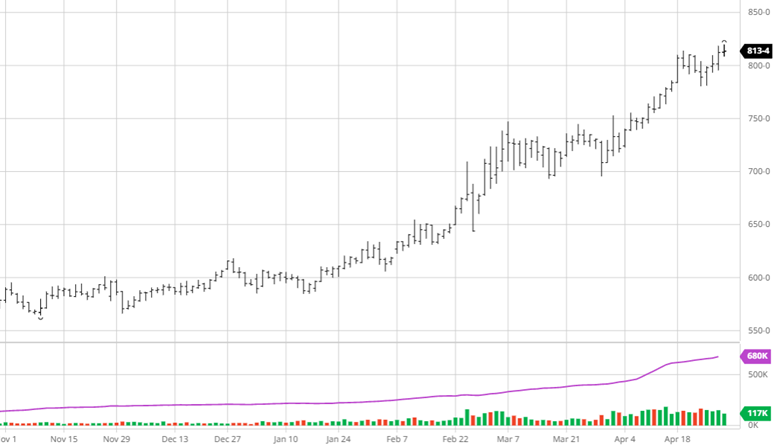

Soybeans have struggled the last few weeks as it has fallen to the low $16s. The USDA report was relatively neutral with a mixed bag of numbers that offset each other. They kept the US yield estimates at 51.5 bu/acre as the slow planting pace has not gotten to the end of the soybean window yet. One important thing to note is the USDA’s acreage already had a large shift to beans from corn. If the wet areas do not dry in time for corn to get in so beans get planted instead, we could see an even larger bean vs corn gap in acreage. The slower corn gets planted the more eyes will turn to soybeans and could make for an interesting year.

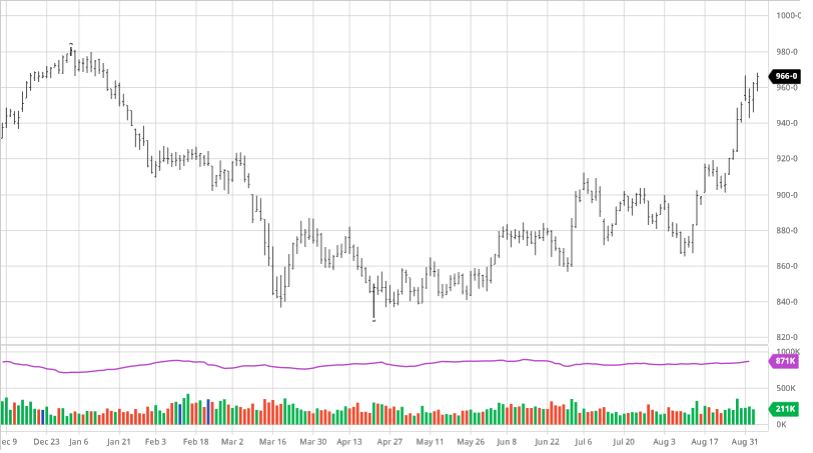

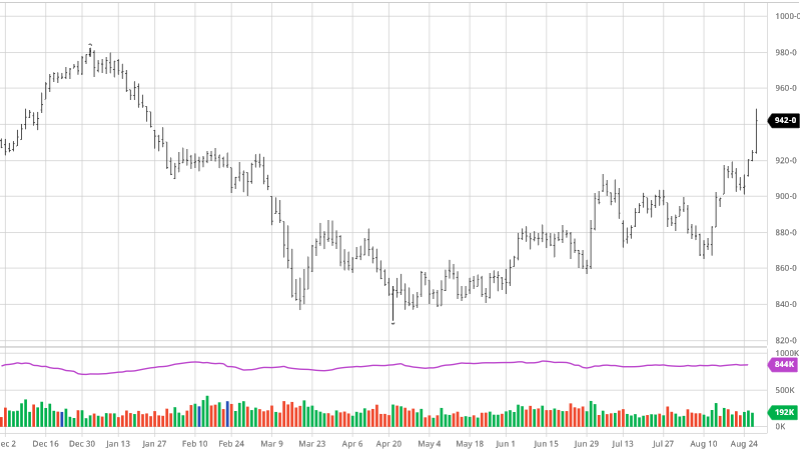

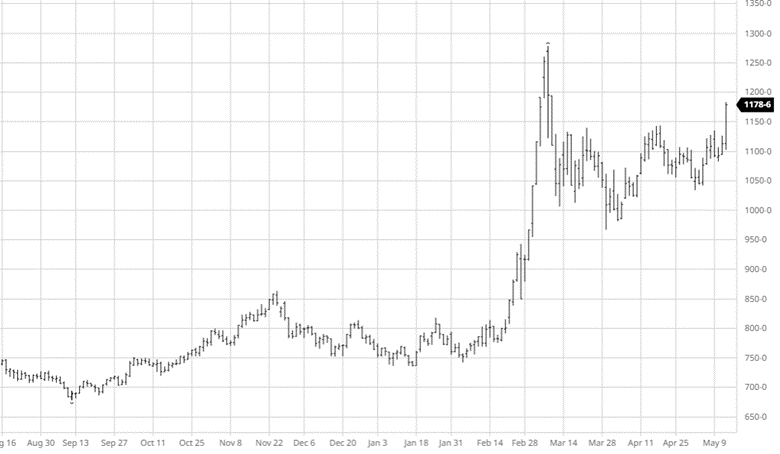

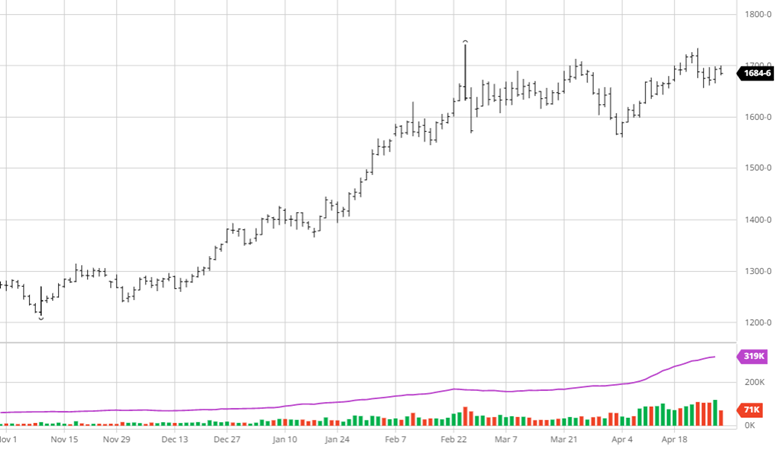

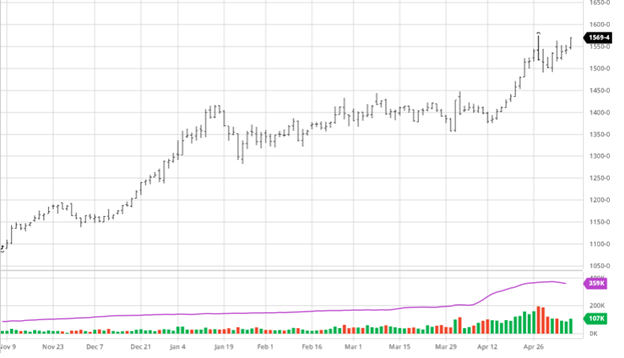

Wheat has seen a good rally over the past 2 weeks, lead by a big day after the USDA report. World wheat supplies are at record low stocks to use ratios and moving deeper into 2022. Replacing lost Ukrainian and Russian bushels is a challenge for the USDA balance sheets. World wheat stocks are at 991 million bushels below expectations from the May report in 2021. With the continued war in Ukraine and troubles with wheat crops all over the world, including here in the US, wheat has several bullish factors behind it heading into the summer.

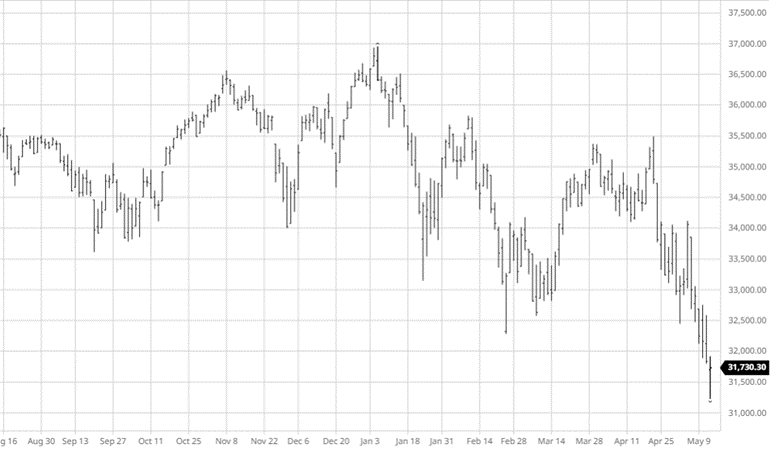

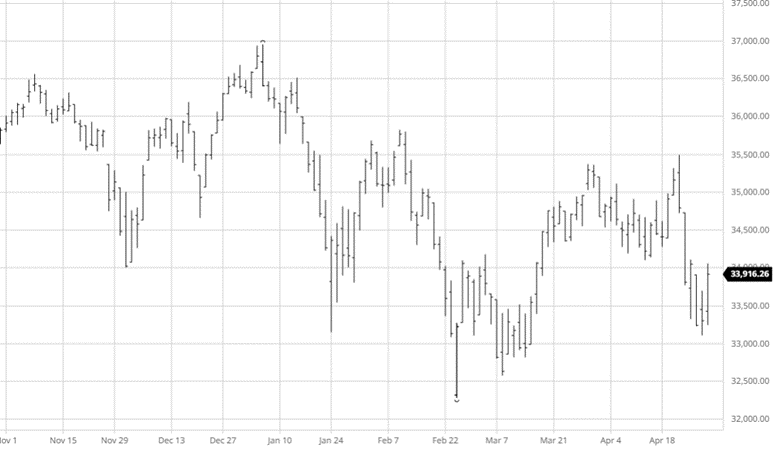

Equity Markets

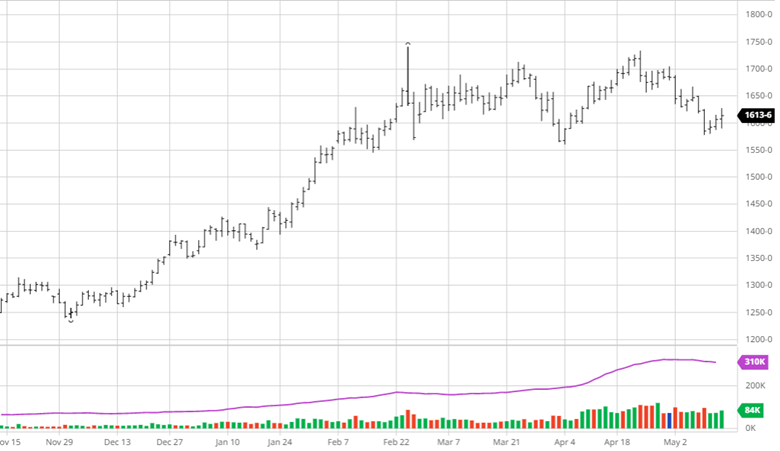

There really is not much to say as the markets continue lower with inflation posting 8.3% this week. The Fed raised rates last week another 50 points, this was expected, and the markets actually immediately responded favorably before continuing the loses of the last few months. Several rounds of earnings happened this week with few winners and Apple continues its fall as it falls below $150. Apple is always one to keep an eye on as it is no longer the most valuable company in the world. The S&P and NASDAQ are getting hit just as hard (NASDAQ the worst down over 30% from its record highs in November).

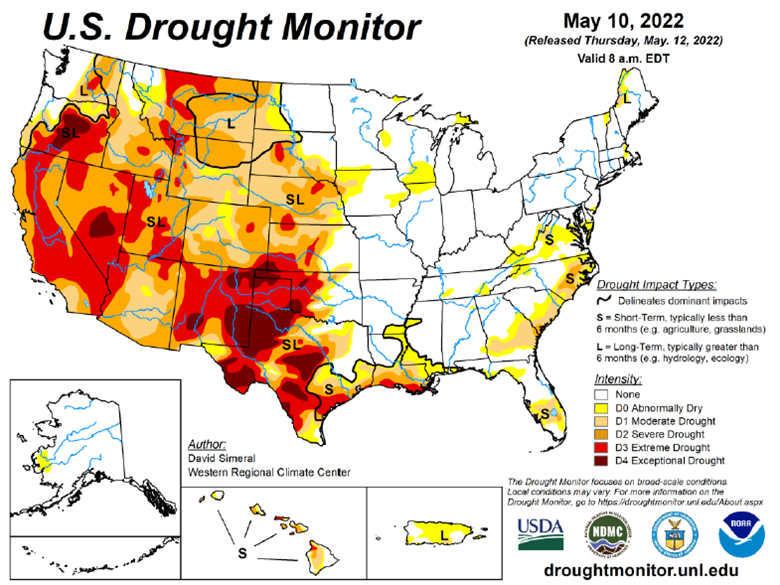

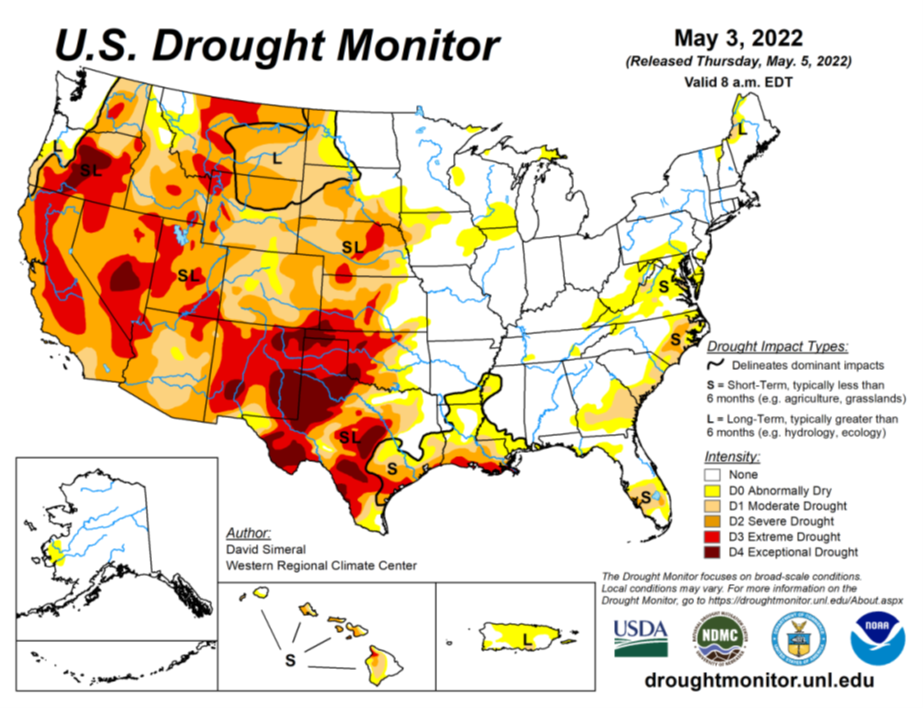

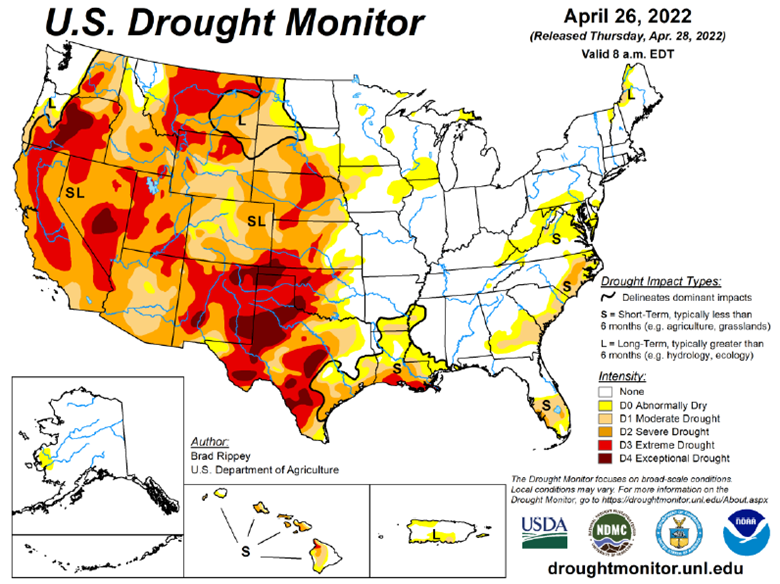

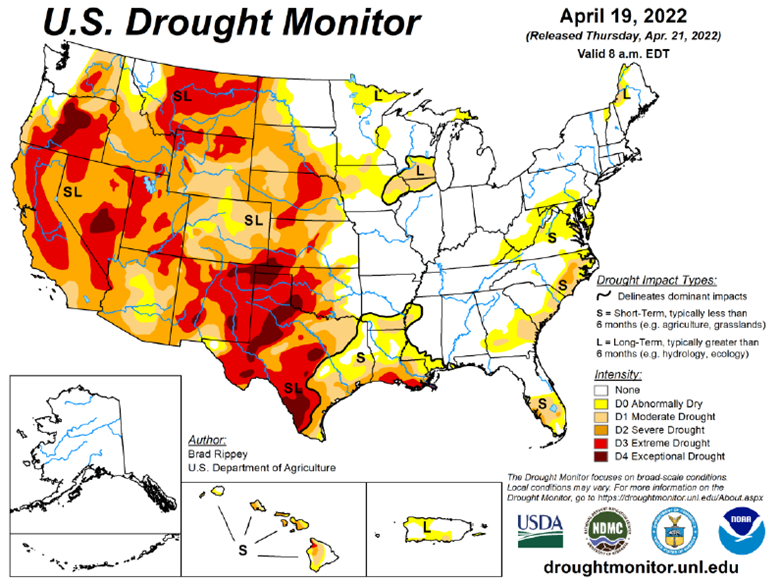

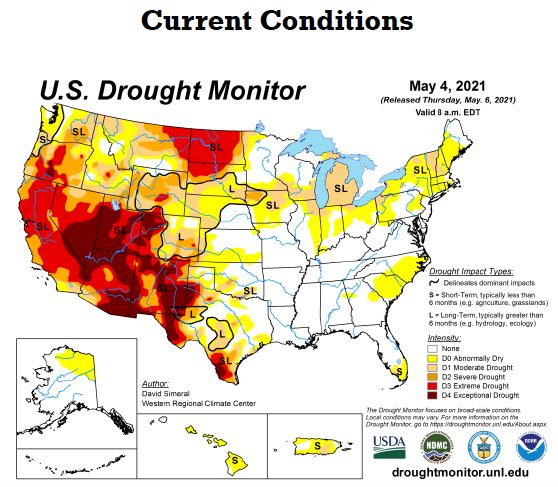

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

There is an agriculture tug of war happening across the nation, impacting America’s farmland. Fertilizer prices are continuously fluctuating, and it has us taking a page the “The Clash” should we stay or should we go?! And we aren’t the only ones. Many farmers are asking their agronomist and chemical salespeople, “what will fertilizer cost me the rest of the season, and what are my options if I don’t want to go all-in on my typical fertilizer treatment plan?”

In this episode of the Hedged Edge we are joined by a special guest who needs no introduction in his local circle, Dick Stiltz. Dick is a 50 year veteran of the fertilizer and chemical industry and is the current Agronomy Marketing Manager of Procurement fertilizer and crop protection at Prairieland FS, Inc in Jacksonville, IL. He is at the pulse of the current struggle and here to discuss the topic at hand.

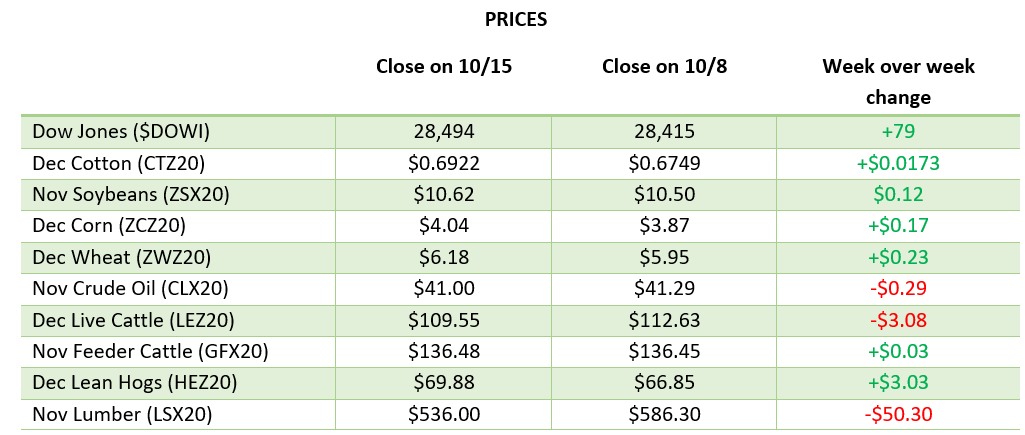

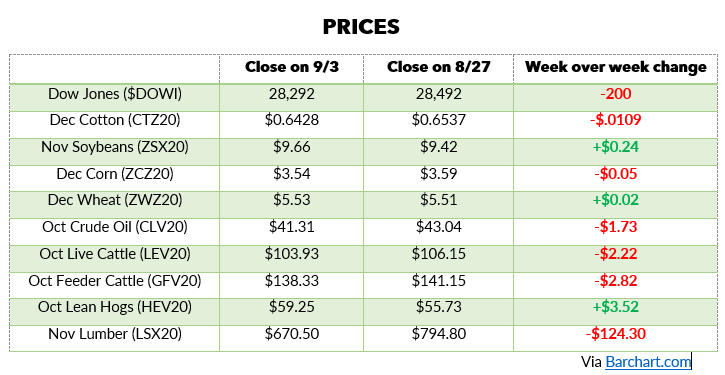

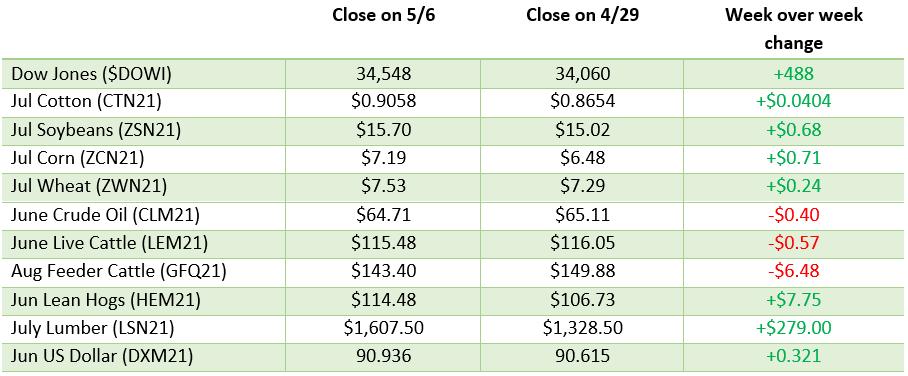

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].

Via

Via