Lumber Weekly

Last Week:

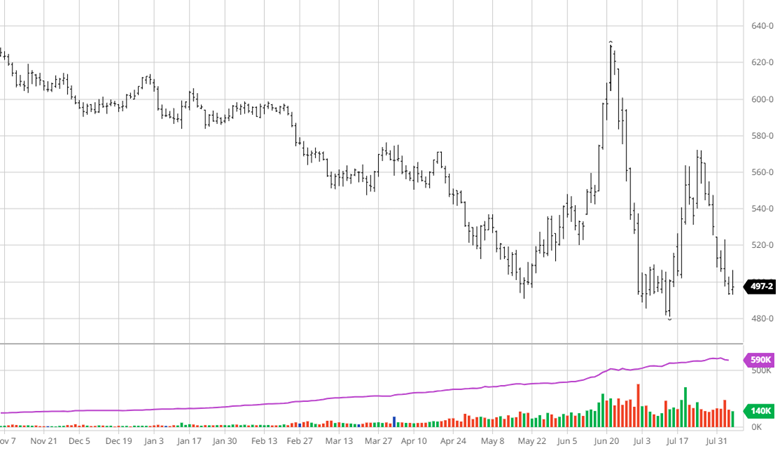

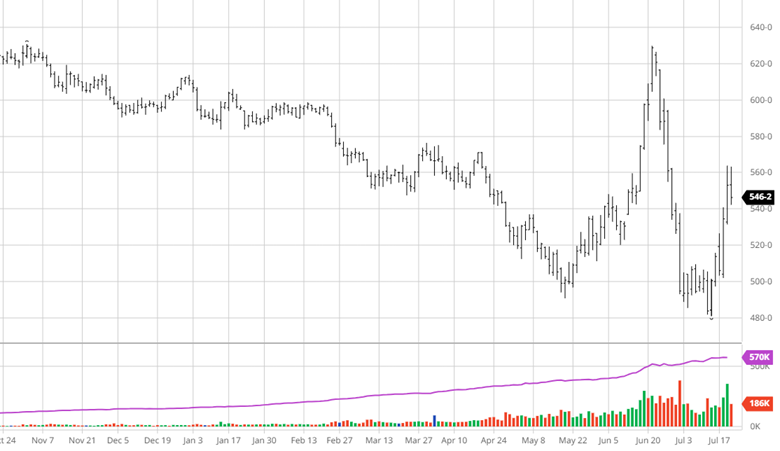

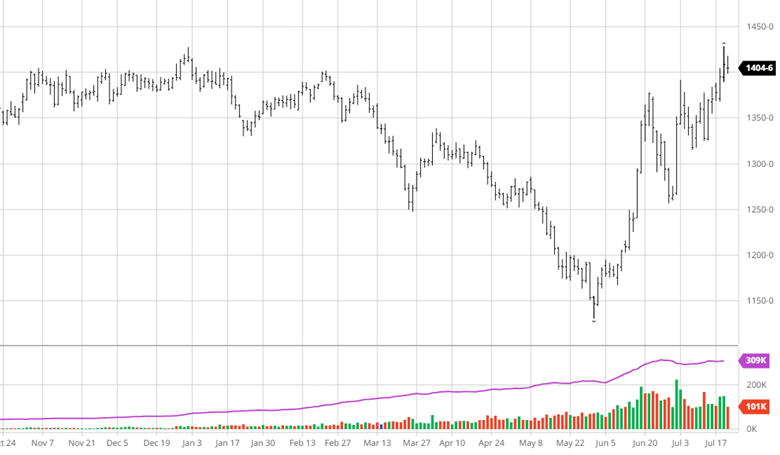

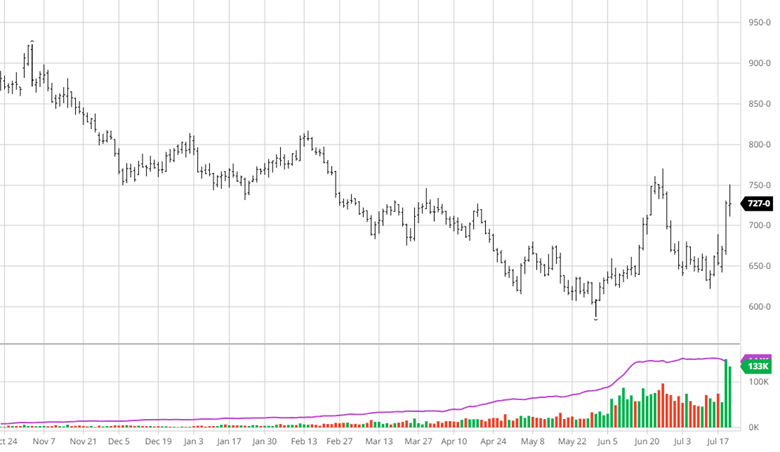

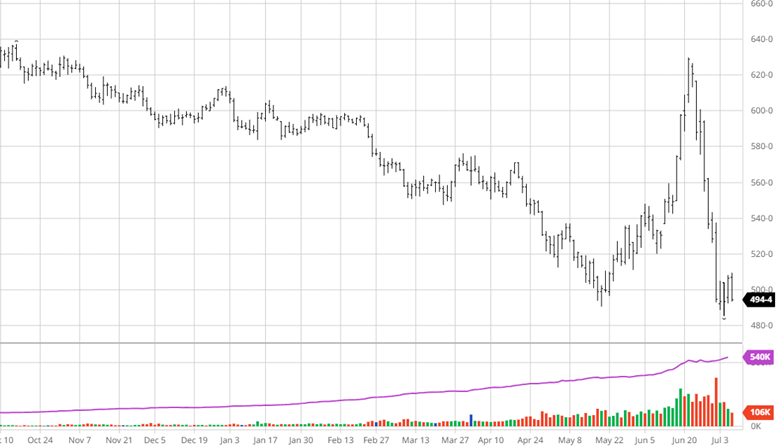

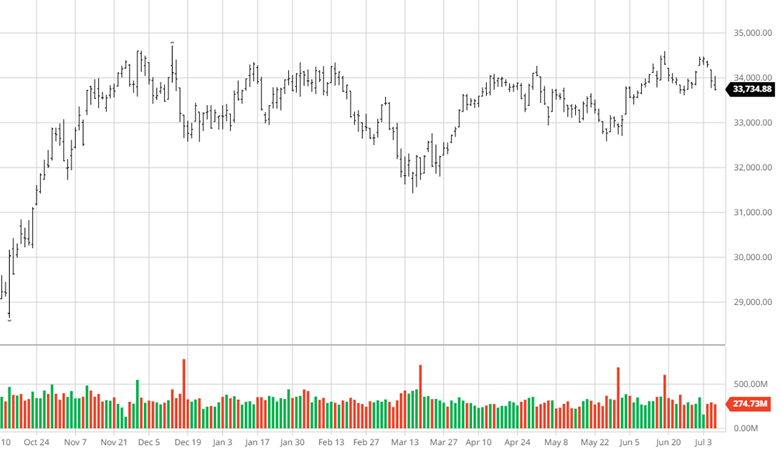

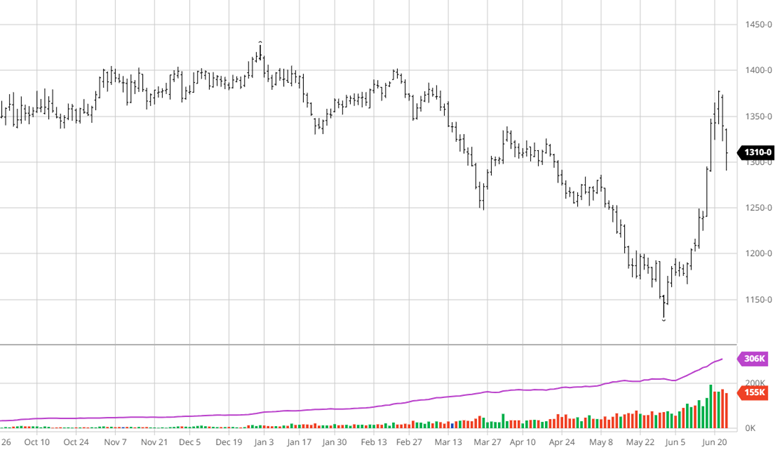

The market had a $29 range but only closed 50 cents lower for the week. What is incredible is the lack of movement in this market. I keep searching for the correct equation to find value and have missed that a flat market has no value. Deals aren’t deals in a slow trading market. The conversations today are either about the massive underbuilt conditions out there or the numerous economic headwinds the industry could be facing. Let’s take a look at a few issues.

Factors:

Euro wood:

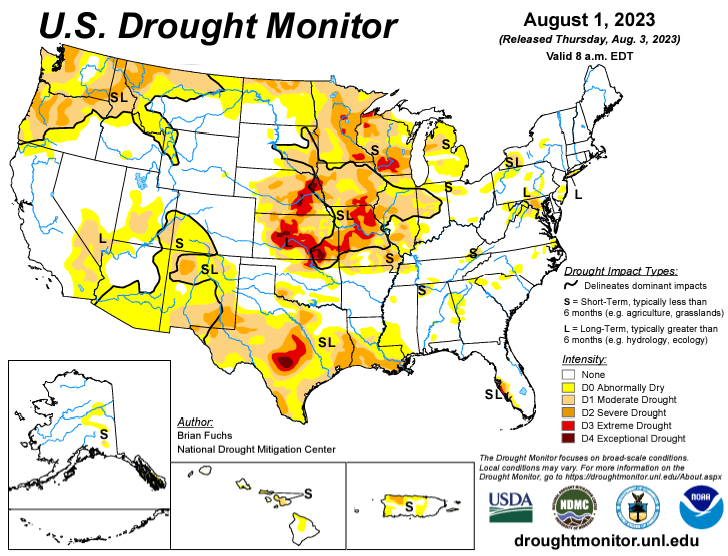

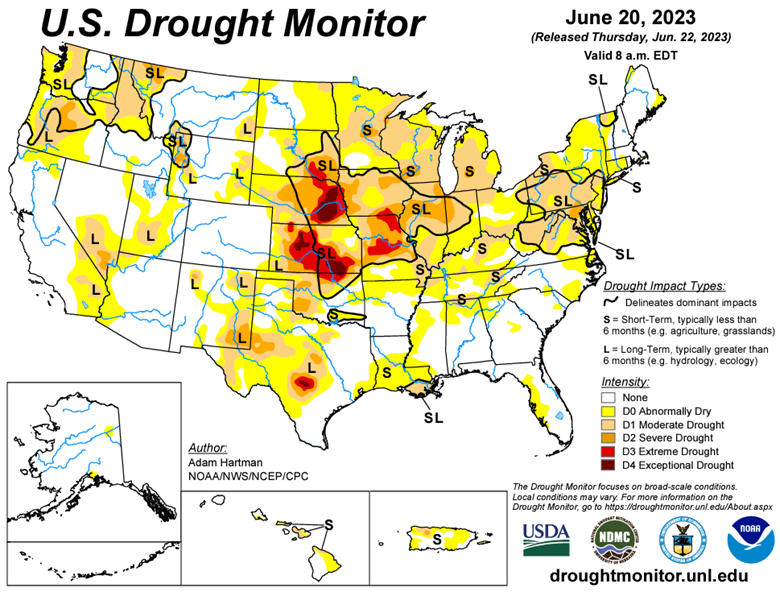

What once was considered a transitory issue is now becoming much stickier than expected. It almost has a bug-kill timber feel to it. That shit would never go away. That seems to be Euro today. While they have been able to reduce the amount at the ports, it won’t be enough when the next ships arrive. Will the euro mills keep shipping at a loss? The answer is yes. The slow European and Asian markets are forcing the cash flow issue into the equation.

*The supply of euro does not dictate prices in our industry, but it adds pressure to the buyer.

Lumber buyer patterns:

The “great run-up” in 2021 and then again in 2022 change the amount of risk the buyers would take. It went from the industry standard of 3 months to 30 days. In a bull cycle, the shorter term keeps upward pressure on the cash market. They are forced to be in all the time buying. In a down cycle, it adds to the weakness because while they are in to buy more often, the quantity isn’t significant enough to tighten up the entire market.

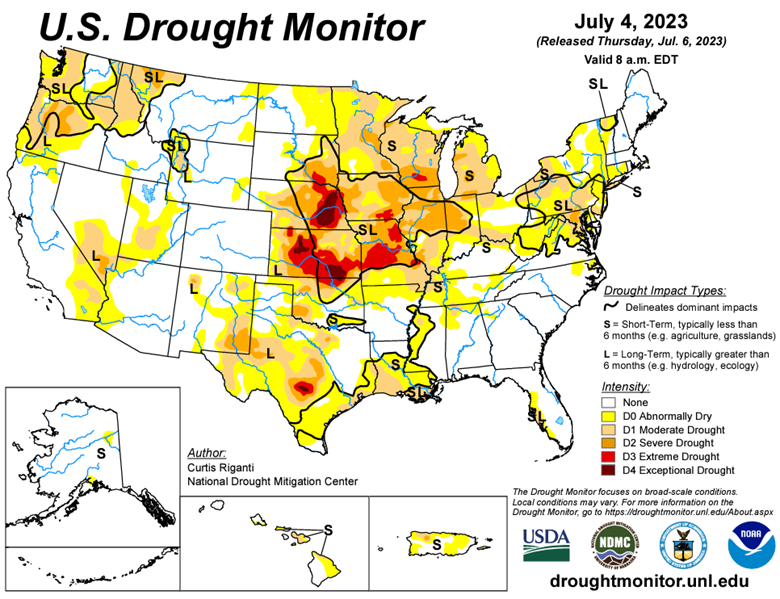

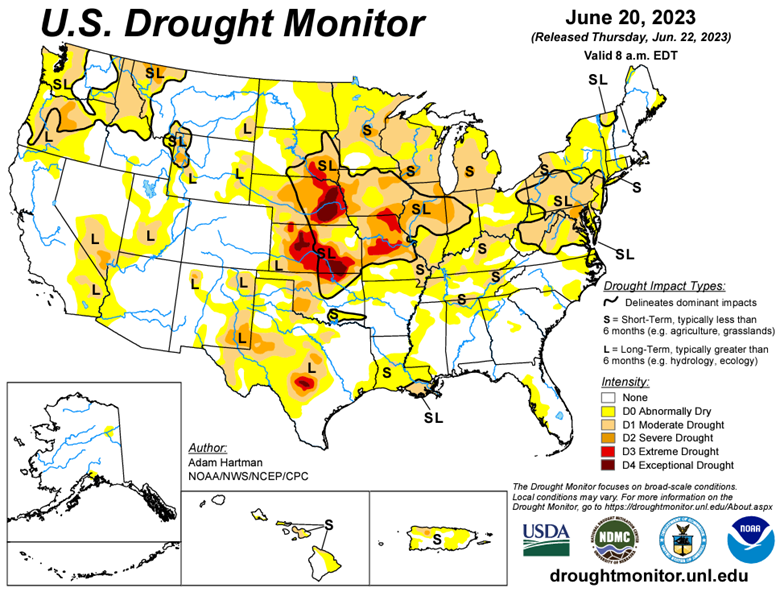

Demand:

Demand is good out there, no doubt. The problem is between VMI programs, contracts, and the wacky and wild euro wholesaler; the lumber buyers can only get in trouble if they become aggressive. Without building momentum, the market is range bound. Don’t expect that to change anytime soon.

Housing Dynamics:

Points:

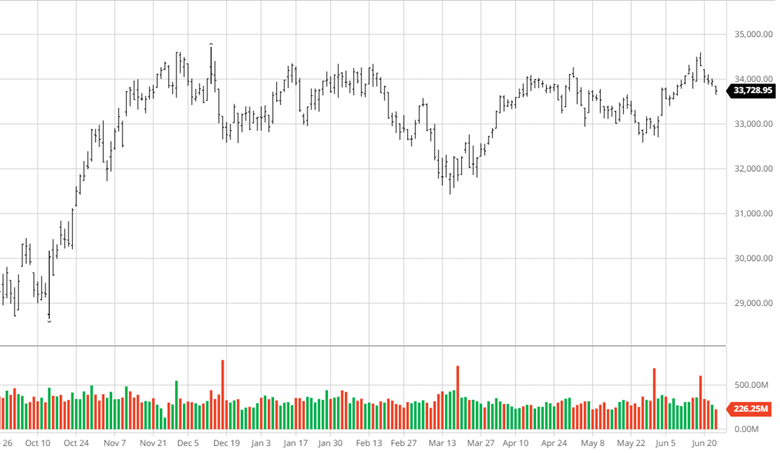

- 2008 to 2012 was a housing depression. Equity in homes hit a 30-year low.

- From 2012 to 2022 the industry saw record-low mortgage rates.

- 2020 saw covid and a major shift in the homeownership trend.

- 2016 to present the industry suffered from a labor shortage and logistic issues. That kept the pace of construction well below the growing demand. It also could not keep pace with the growing number of household formations.

- Today there is a record amount of $$ in the system and now we see most of it headed toward wage increases.

The key takeaway is that this is a great industry to be in today. It should stay statistically underbuilt and underbought for years. That doesn’t mean prices will go up. It just means that there will be trading.

Market Make Up:

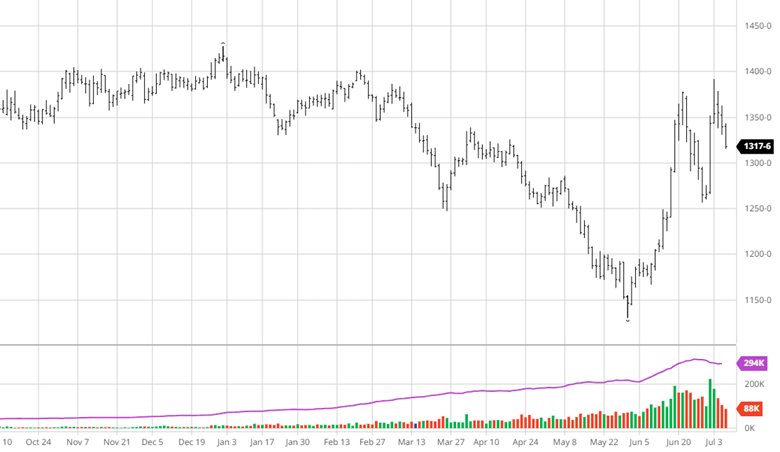

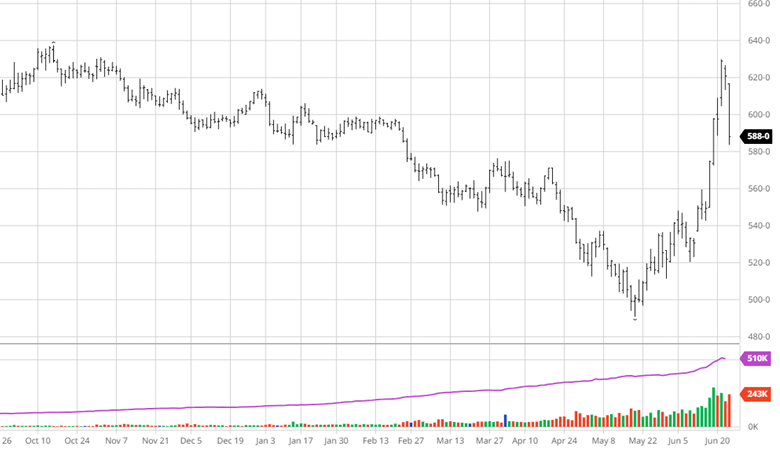

The futures open interest is closing in on 8000 as the funds are up to 2600. That is the highest number of shorts they have held in the new contract. The other side was picked up by the industry and the spec buying. Even the swap dealers got involved. They added most of the shorts in the hole. One would think there could be a bounce once they begin to roll.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636