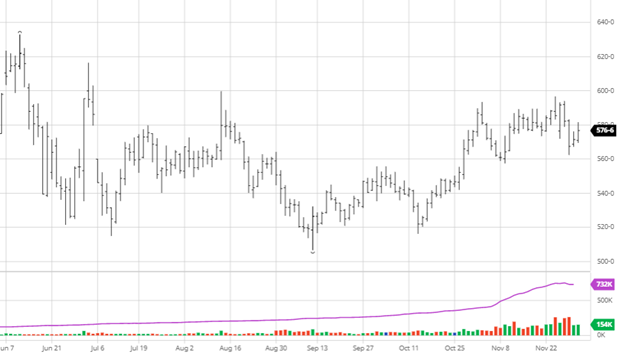

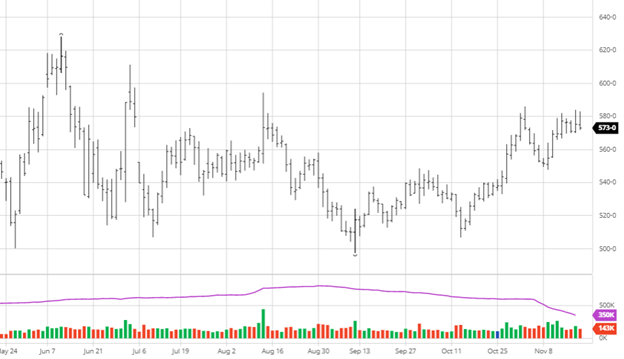

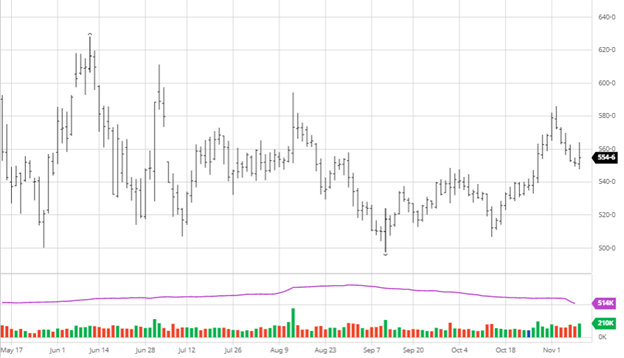

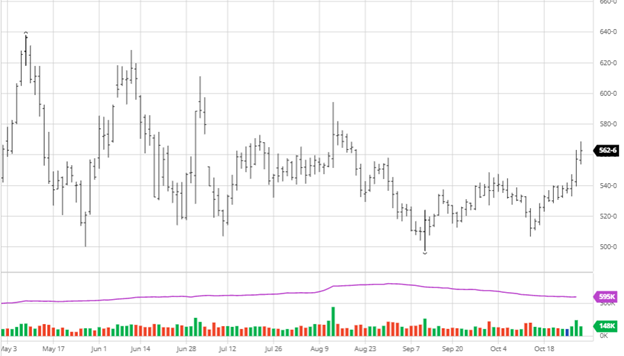

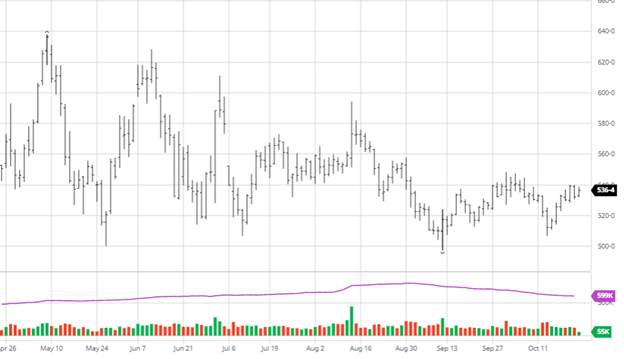

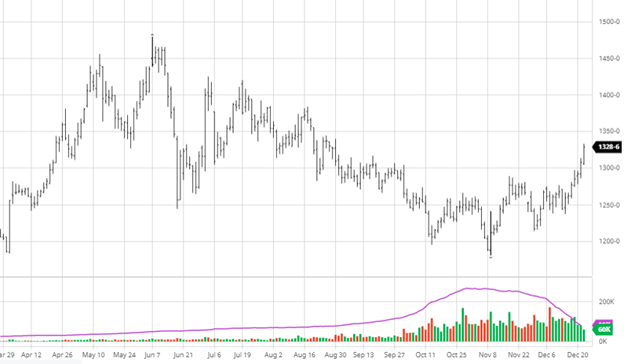

Since early December, corn has had a great run as South America’s dryness continues and delays planting in some areas. The corn crop is only about 60% planted in Argentina, which is the slowest pace on record for late December. Anything planted after January 10th will probably experience some yield drag. Their planting rate is on par with last year, but the weather has been far dryer and looks to continue going forward. As you can see in the chart below, March corn has rallied 90+ cents since early September. With continued strong basis and raises at prices, farmers have been given a gift but when the farmers choose to claim the gift and how long the gift stays available is another question. If Argentina and Brazil stay dry, this rally could continue, and we could retest the summer’s highs. Ethanol margins shrunk, and crude fell but remain at much higher than average levels, which will also support corn.

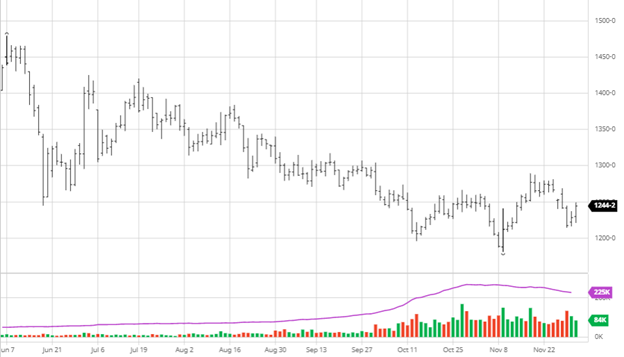

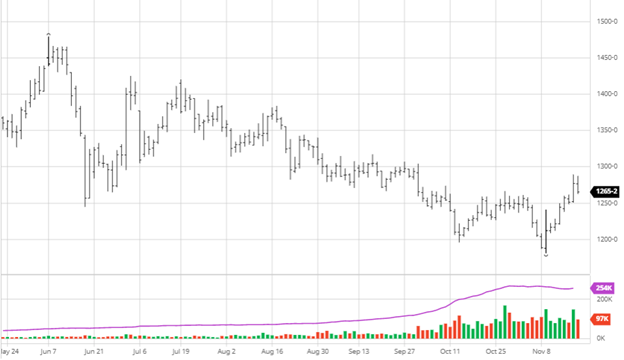

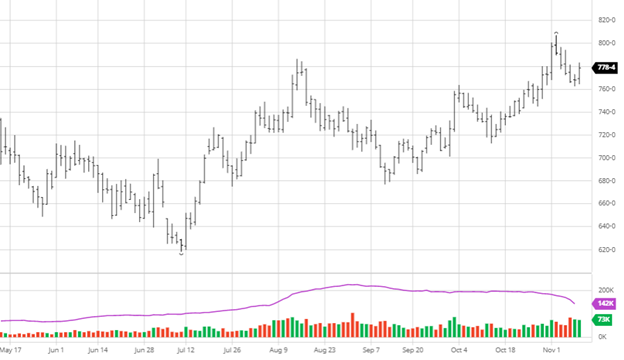

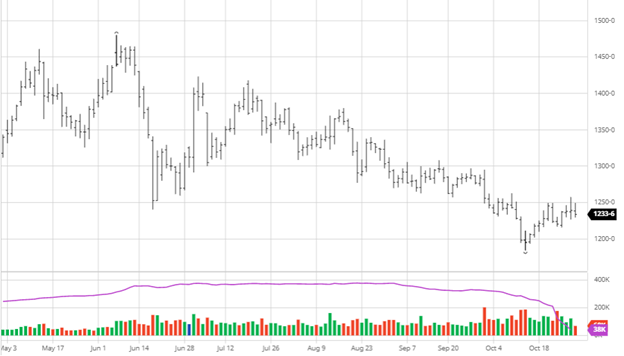

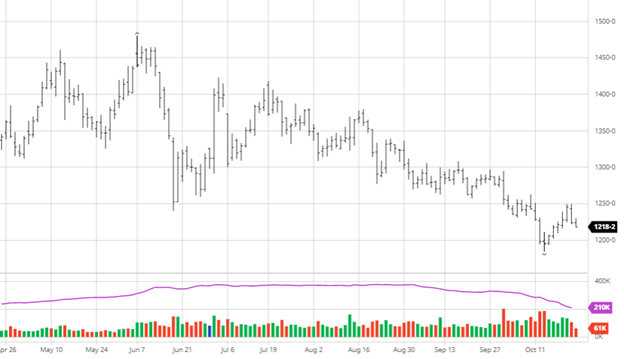

Soybeans, like corn, have enjoyed a nice rally as South American weather issues cause some worry. This week, Brazil’s bean crop had its production estimate lowered by 3 million metric tons by Parana’s crop analysis firm, Deral. While Brazil is still on pace to produce a record crop, it is not expected to be as large. They increased planting this year, so a larger crop is expected in Brazil, even with some headwinds. The basis is holding steady around the country for beans as we head into the new year. Beans and corn are likely to move together leading up to the January USDA report.

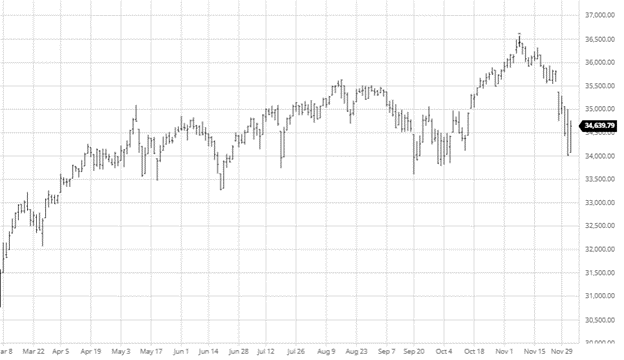

Dow Jones

The Dow had a flat week and a half with volatility due to the Omicron variant having it all over the place with several large down days followed by a good bounce. The Omicron variant’s spread has been worrisome as restrictions start to come back into play in major cities. It will be important to keep an eye on this around the holidays as we also hope to see the “Santa Clause rally.” Senator Manchin also stopped President Biden’s BBB plan as he will not vote to approve it in its current form.

Podcast

Commodity prices have perpetually soared for the past year and continue to trend higher. We’re diving into the fertilizer forecast with a unique guest, Billy Dale Strader, a branch manager for Helena Agri-Enterprises in Russellville, KY., who is truly at the epicenter of the rising fertilizer prices.

Billy Dale planted his agriculture roots on his family-owned farm and has managed regional seed and chemical sales at Helena for the past decade. In this week’s pod, we tackle the big question for farmers and ultimately end-users — is the impact of higher-priced inputs, like seeds, chemicals, and fertilizer, on the supply and demand for the major U.S. crops? Listen or watch to find out!

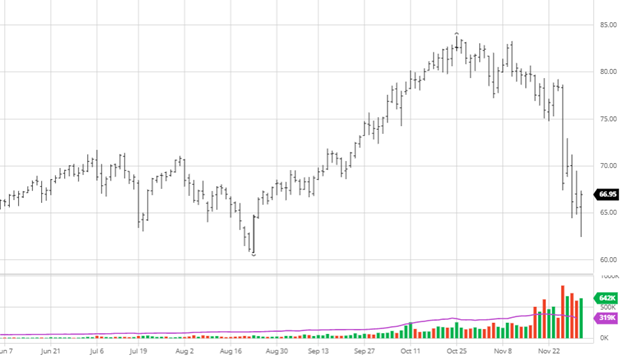

Via Barchart.com