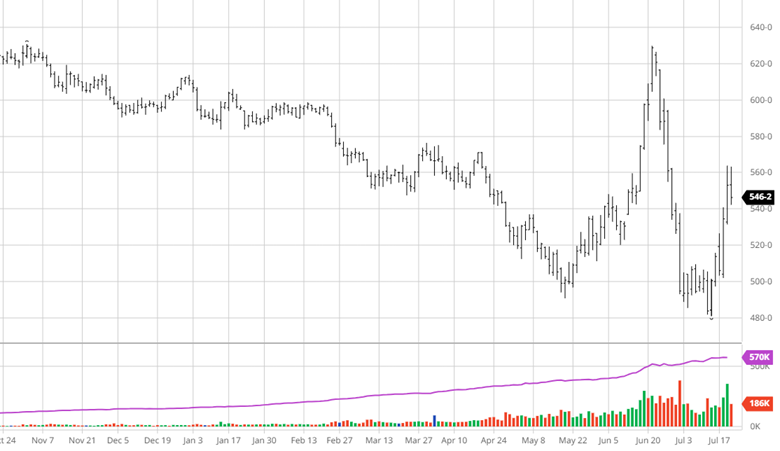

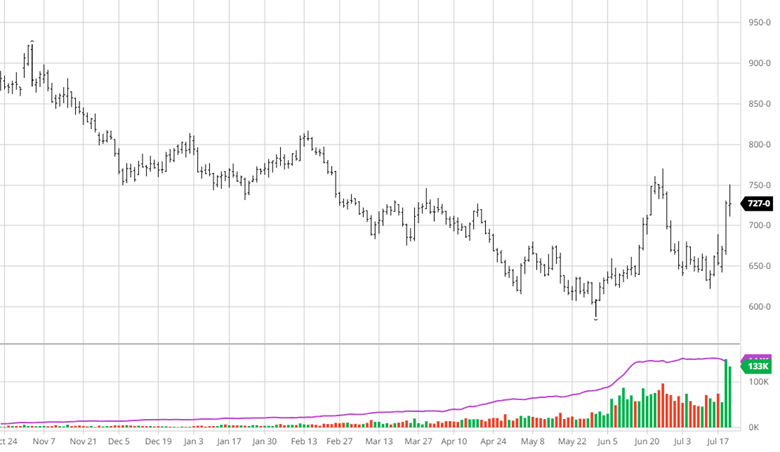

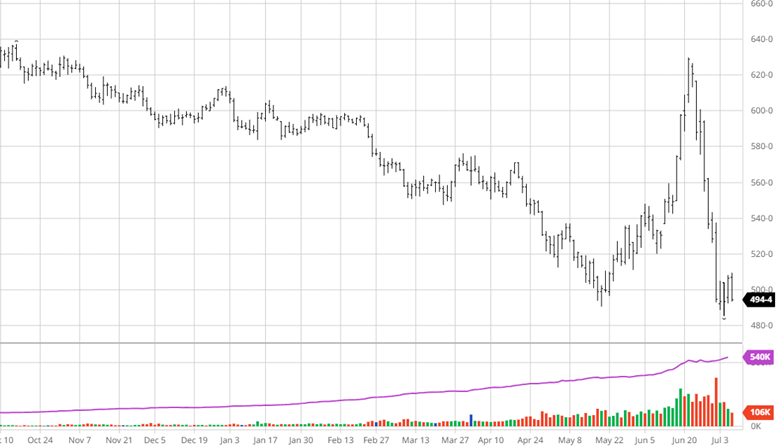

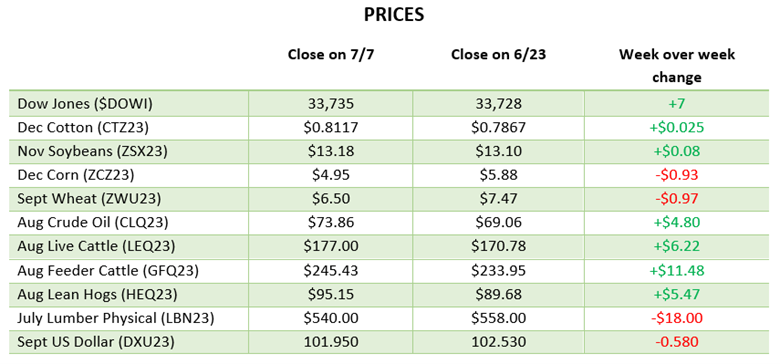

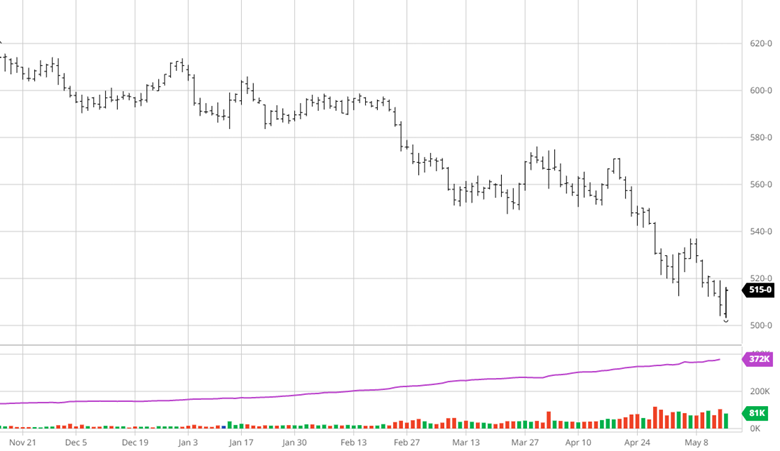

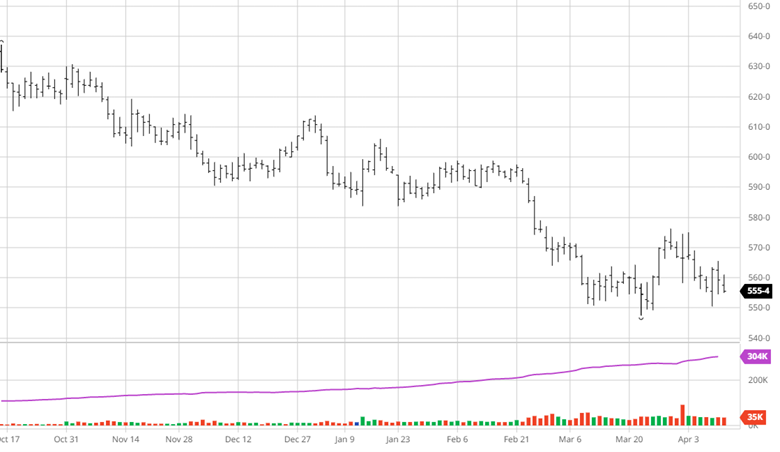

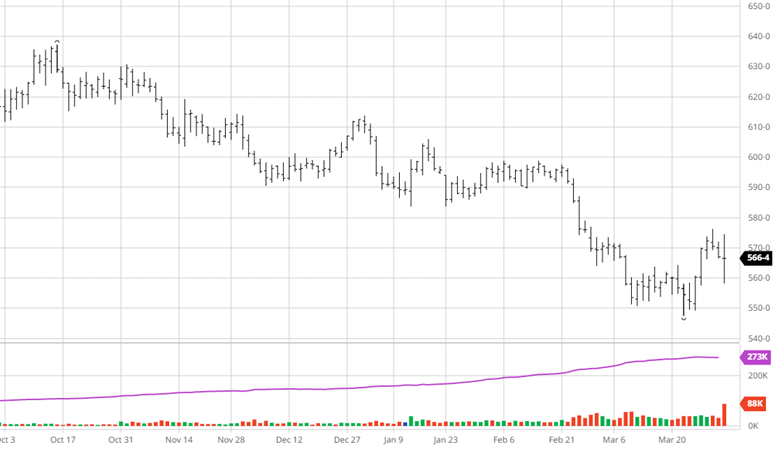

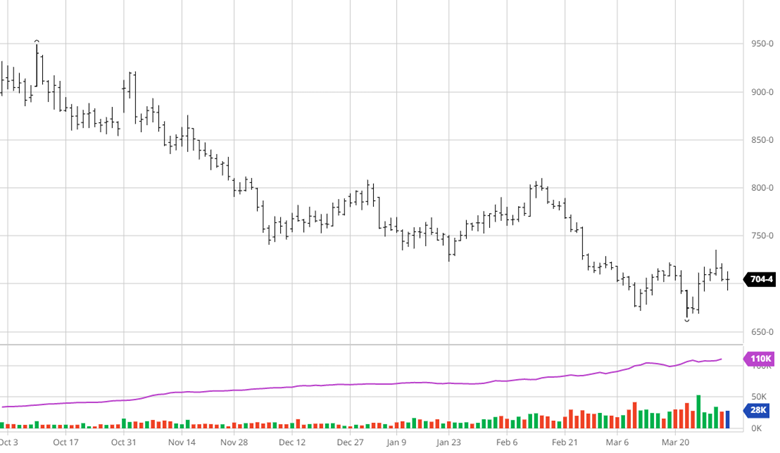

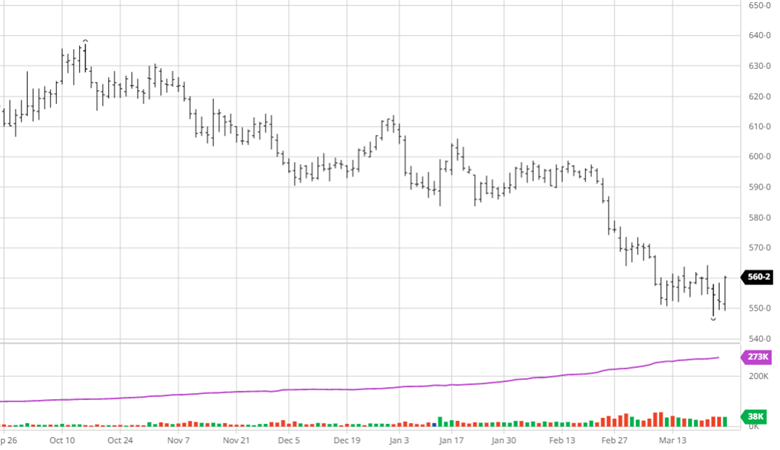

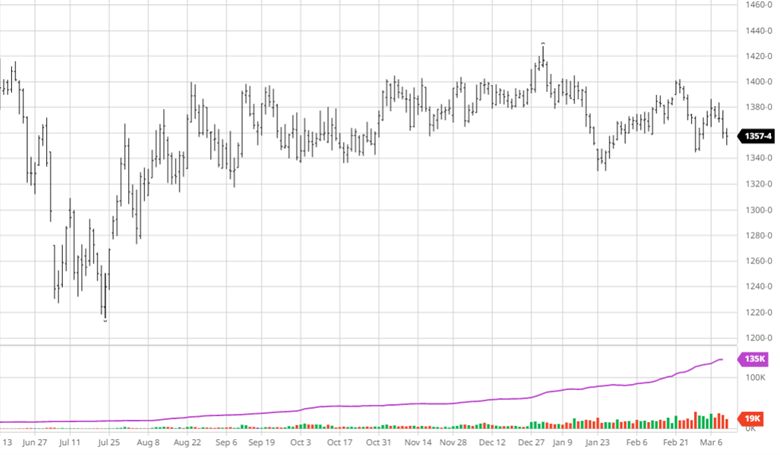

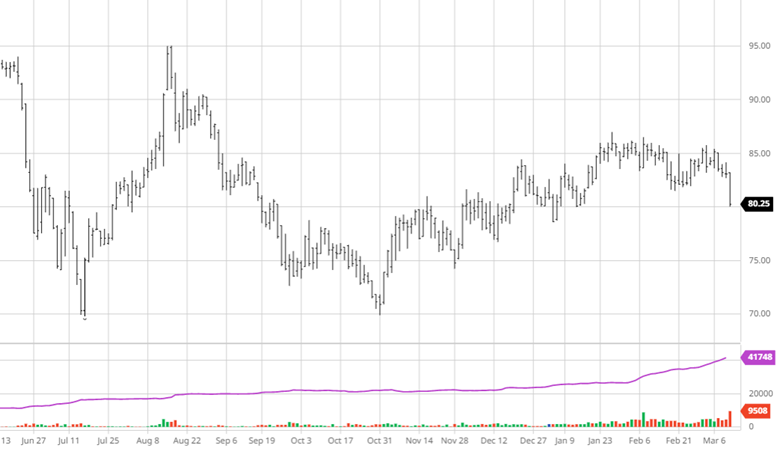

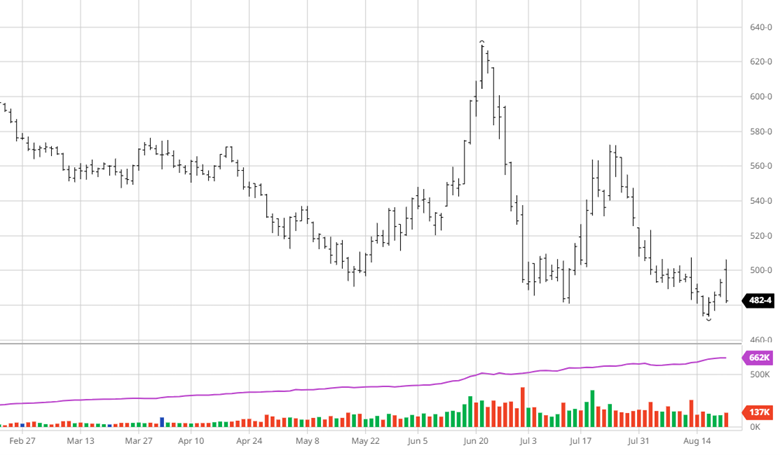

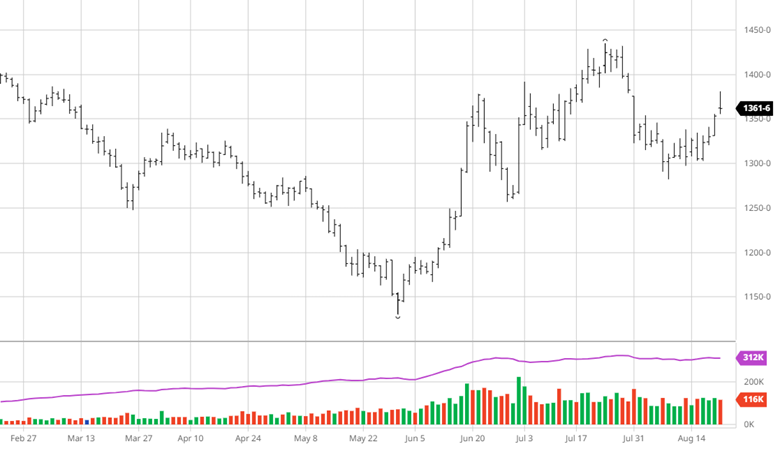

Corn had a rough two weeks with the cool and wet weather that covered large areas of the US coming just in time on a stressed crop. The August 11 USDA Report came in with a 175.1 bu/acre US yield, slightly below trade estimates. This yield seems very reasonable with the early drought stress and the recent rains to help stabilize the crop. The scorching heat and dry weather coming to most of the US the next week+ will stress the crop but the areas that are no longer experiencing drought conditions (see drought charts below) are positioned to handle it. The ProFarmer crop tour is this week and will give insights into what to expect from this crop and give insights we do not get from the USDA. If the USDA updates the planted acres lower from 94 million in September that will be news the market has eyes on.

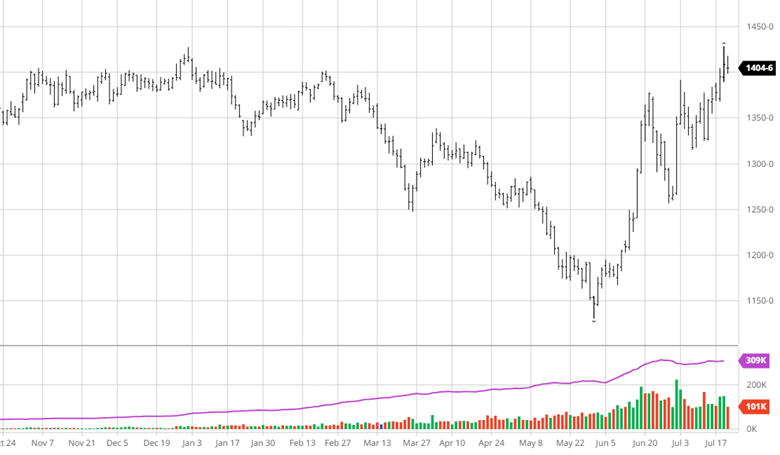

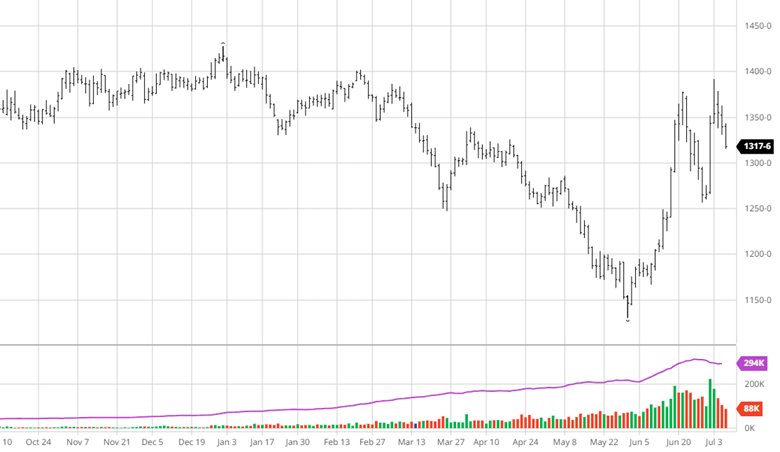

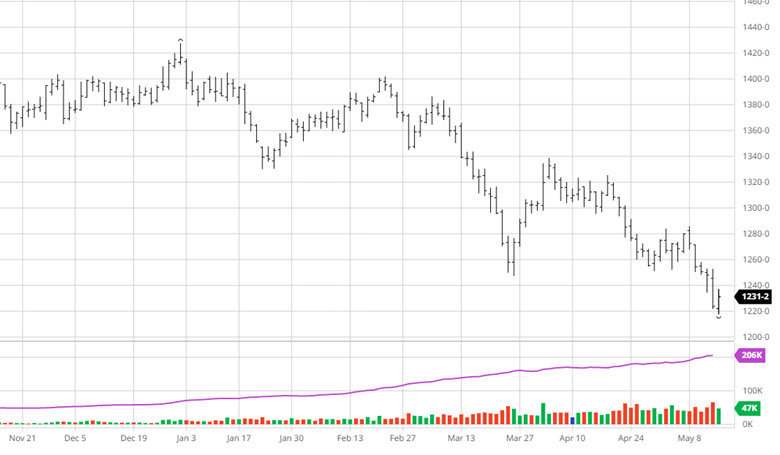

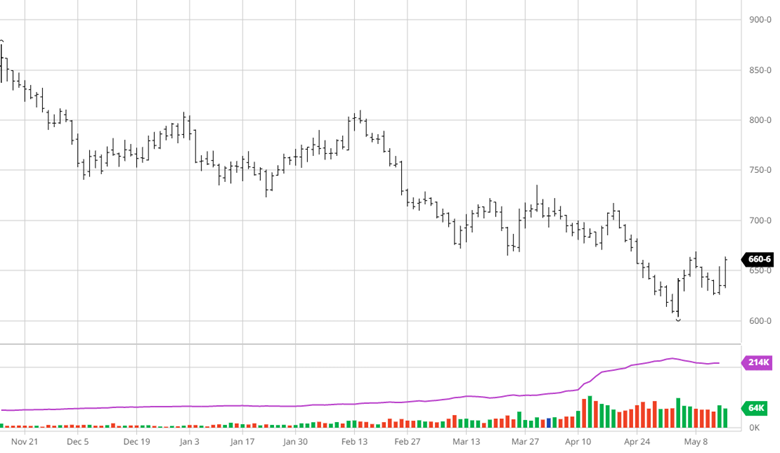

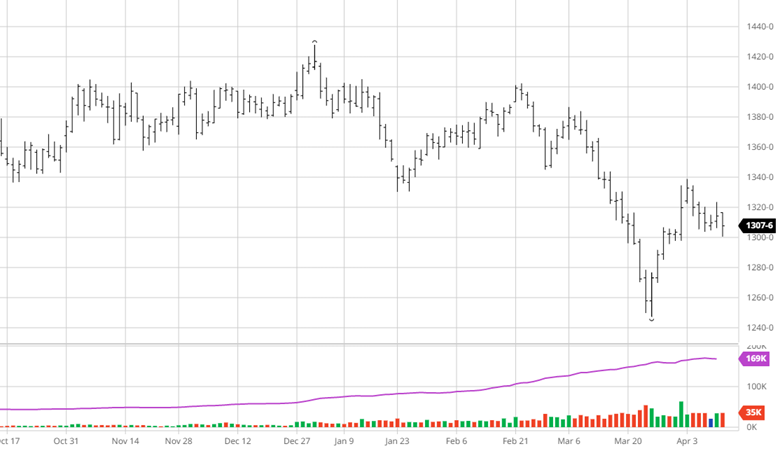

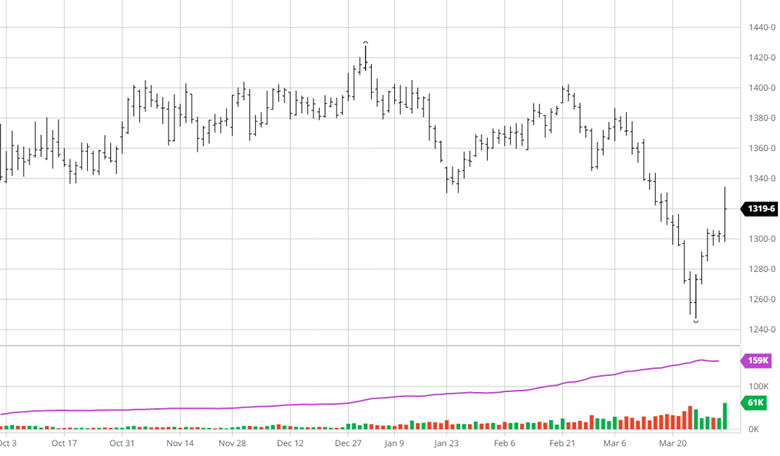

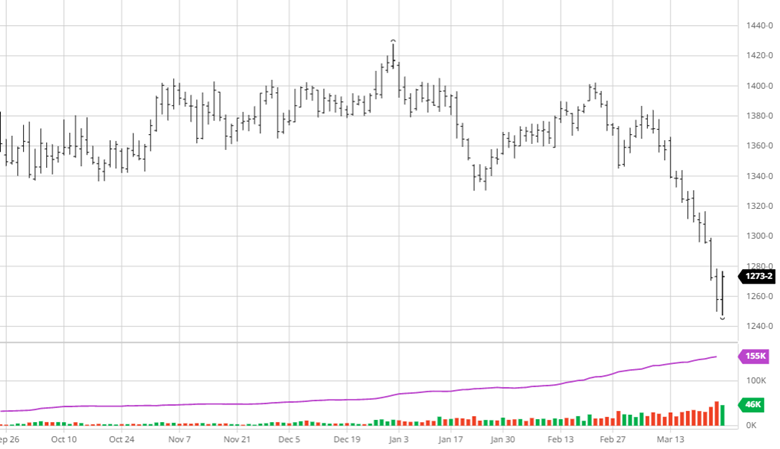

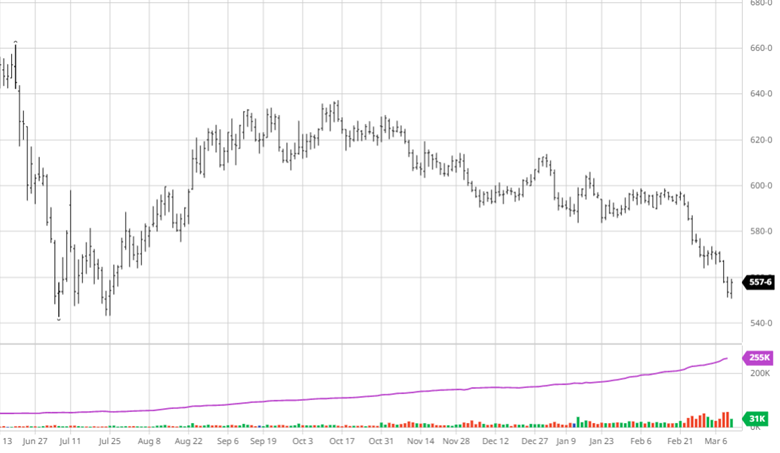

Soybeans have held together well over the last couple of months with the low acreage number supporting it. The weather was not great for beans early on, but like corn, the last couple of weeks have been very beneficial and the heat over the next 10 days can cause some issues. The USDA updated their yield estimates to 50.9 bu/acre, below the trade estimates and previous report but also a reasonable number with how the growing season has gone so far. Bean demand appears to be increasing and if this continues into harvest, momentum behind beans could give it another push that corn seems to be missing. The ProFarmer crop tour will be the news this week along with the hot dry weather, an adjustment to acres down the road is a variable that can change the look of this crop.

Soybeans have held together well over the last couple of months with the low acreage number supporting it. The weather was not great for beans early on, but like corn, the last couple of weeks have been very beneficial and the heat over the next 10 days can cause some issues. The USDA updated their yield estimates to 50.9 bu/acre, below the trade estimates and previous report but also a reasonable number with how the growing season has gone so far. Bean demand appears to be increasing and if this continues into harvest, momentum behind beans could give it another push that corn seems to be missing. The ProFarmer crop tour will be the news this week along with the hot dry weather, an adjustment to acres down the road is a variable that can change the look of this crop.

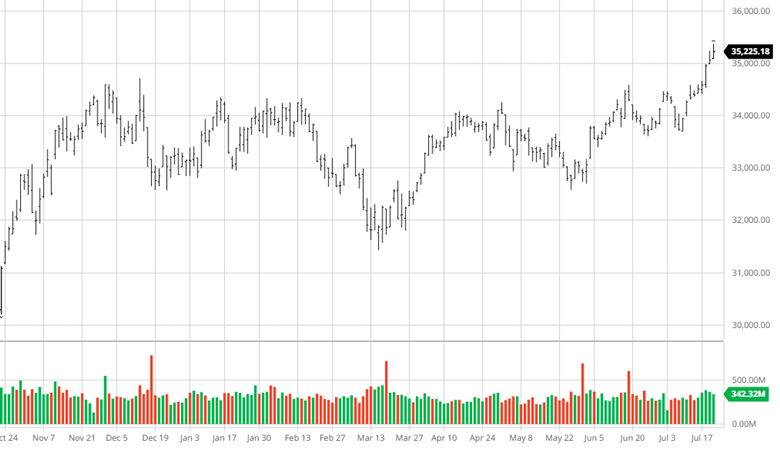

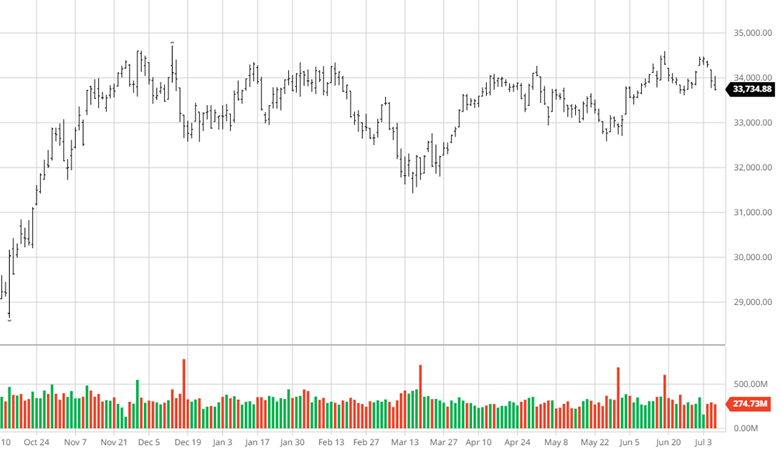

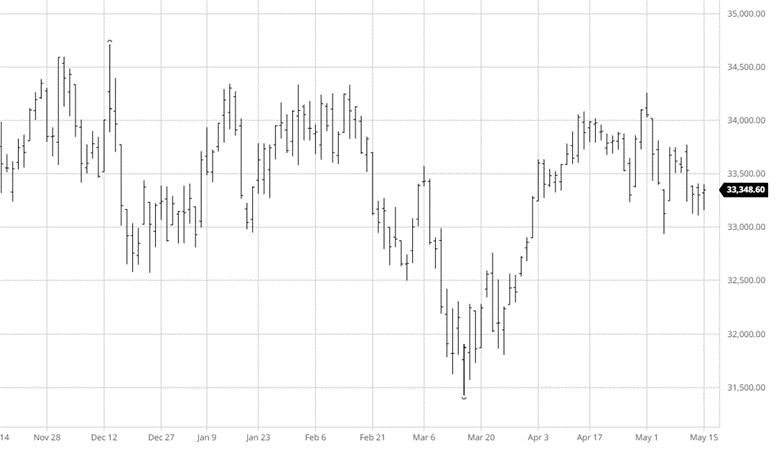

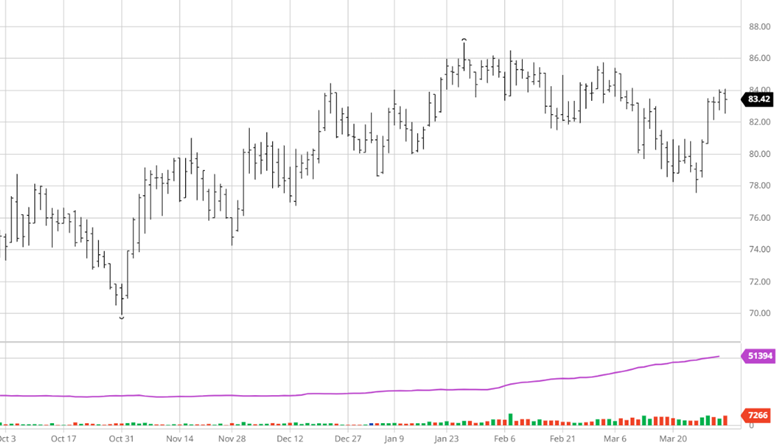

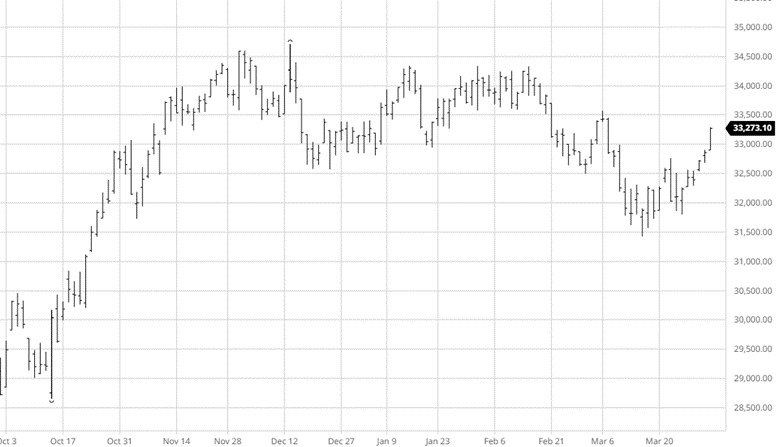

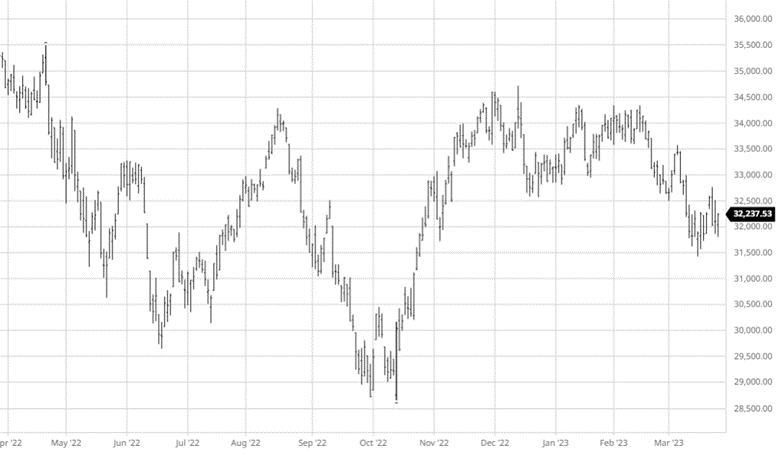

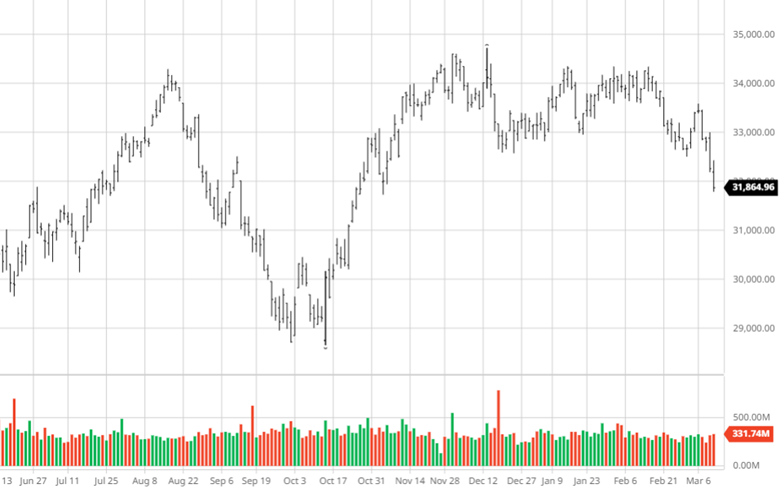

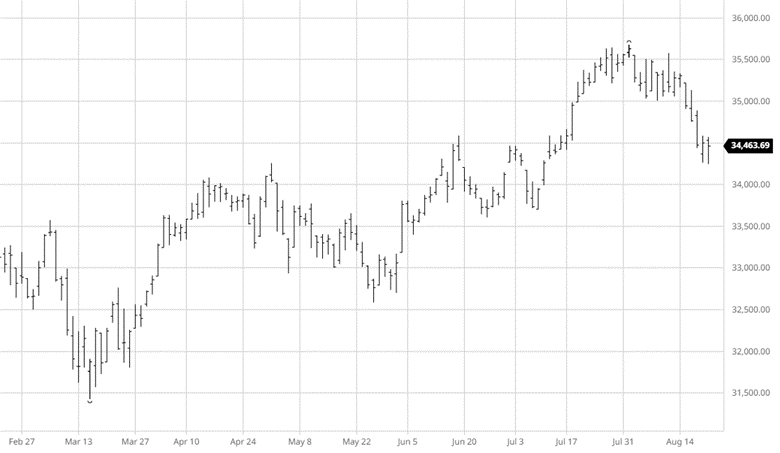

Equity Markets

The equity markets have struggled the last few weeks as tech stocks stopped pulling the markets higher and seasonal trends took over. Earnings season is almost over with only a few big names left to report. Inflation and the Fed will be the news moving forward as markets are still unsure what their next move is.

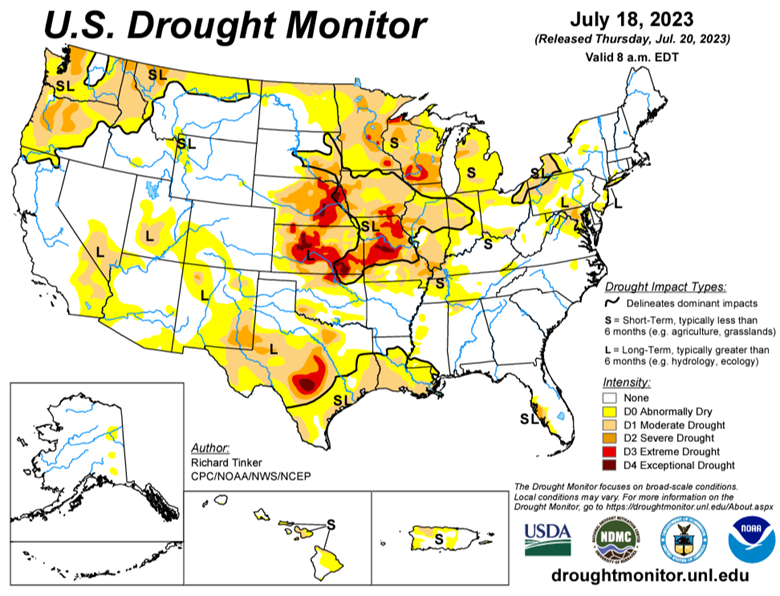

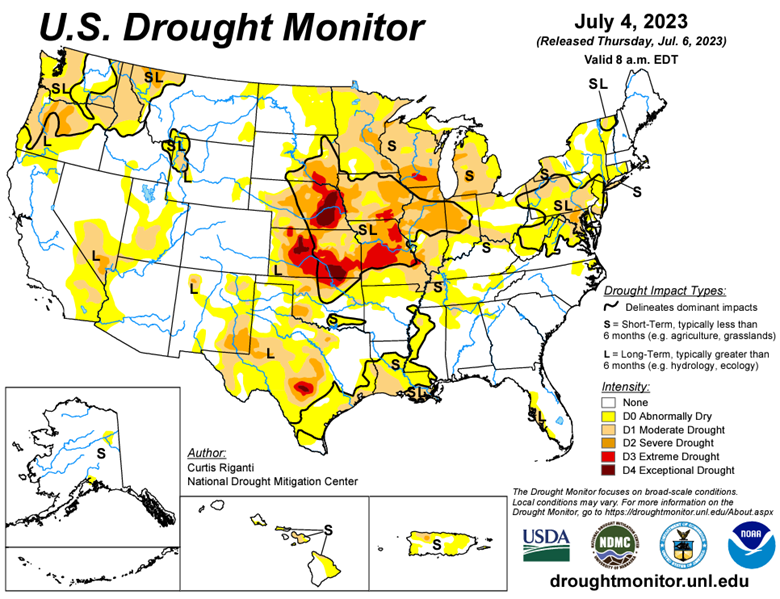

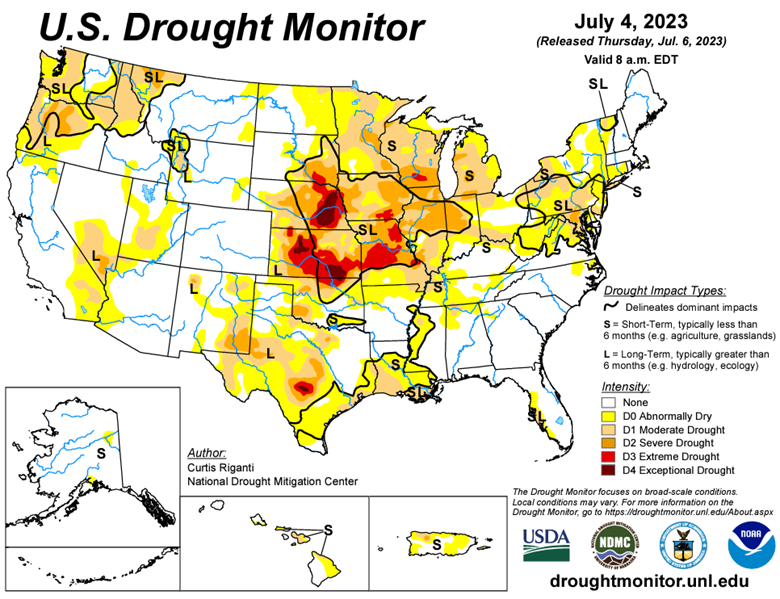

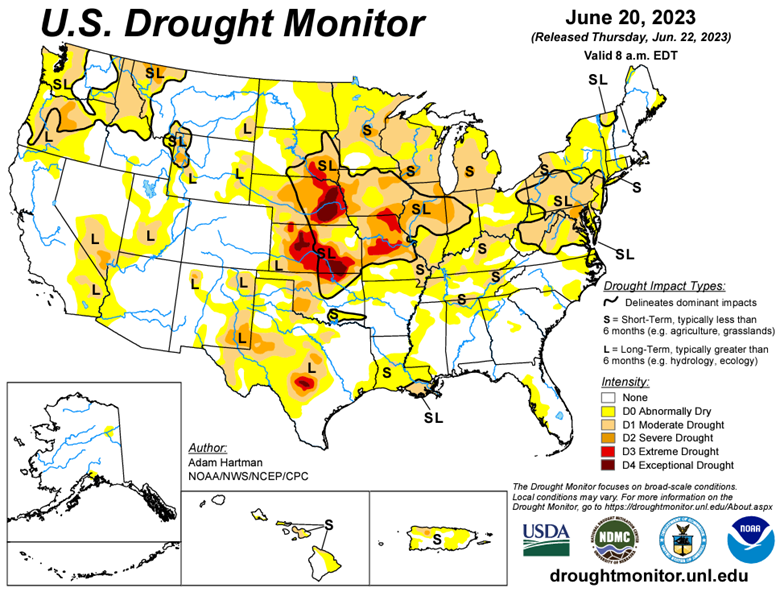

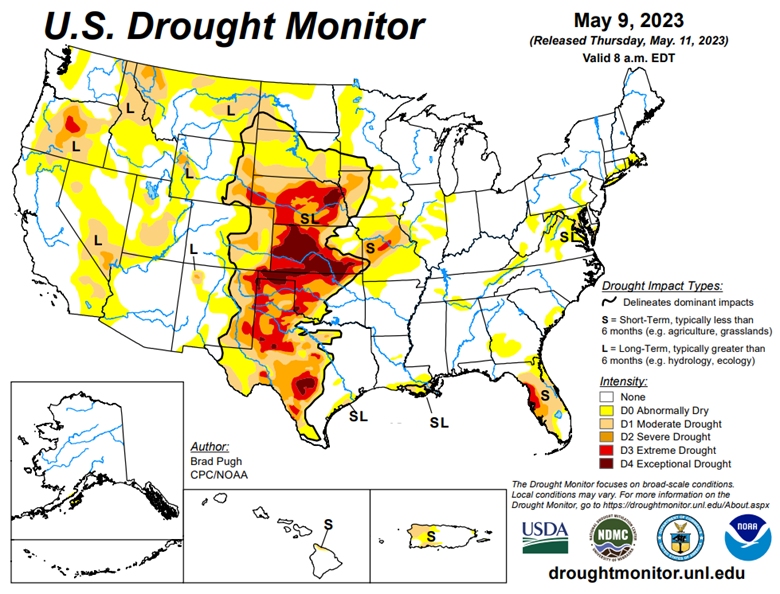

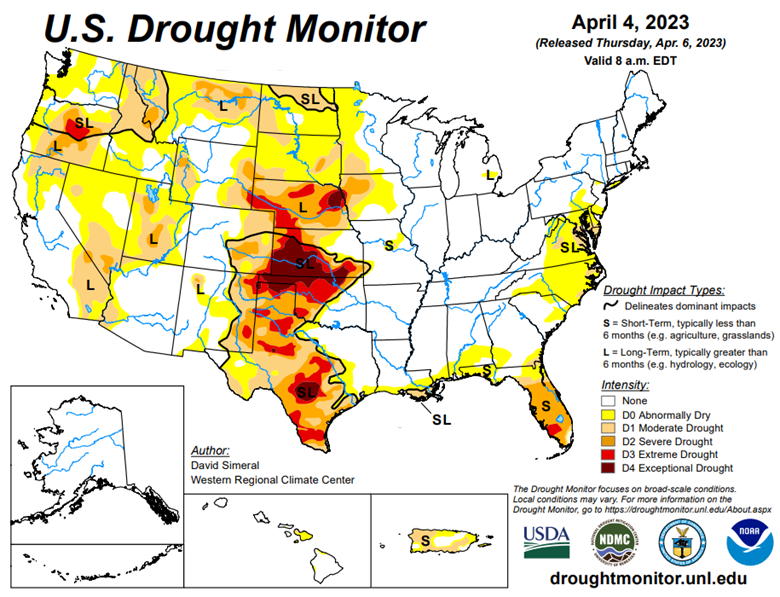

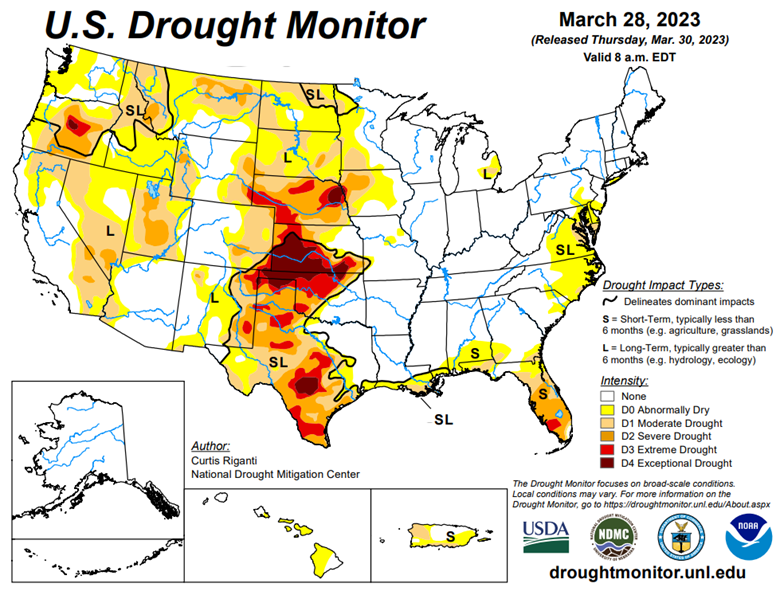

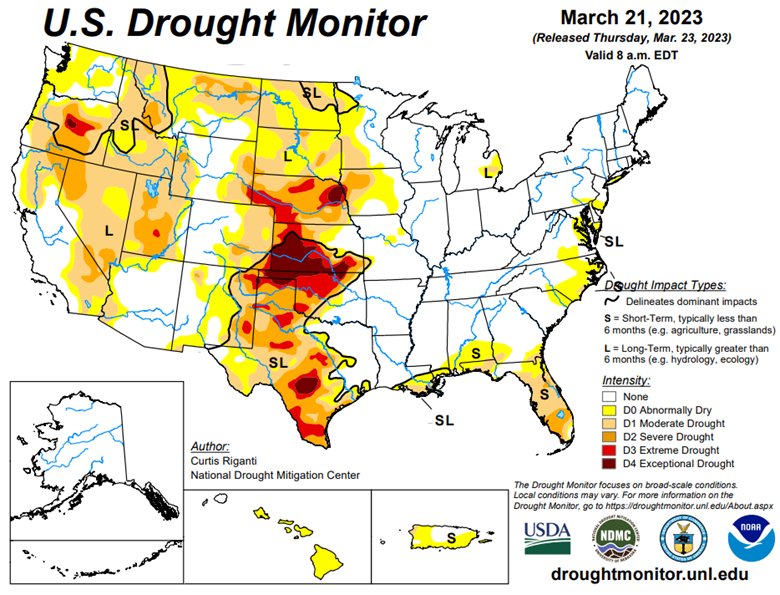

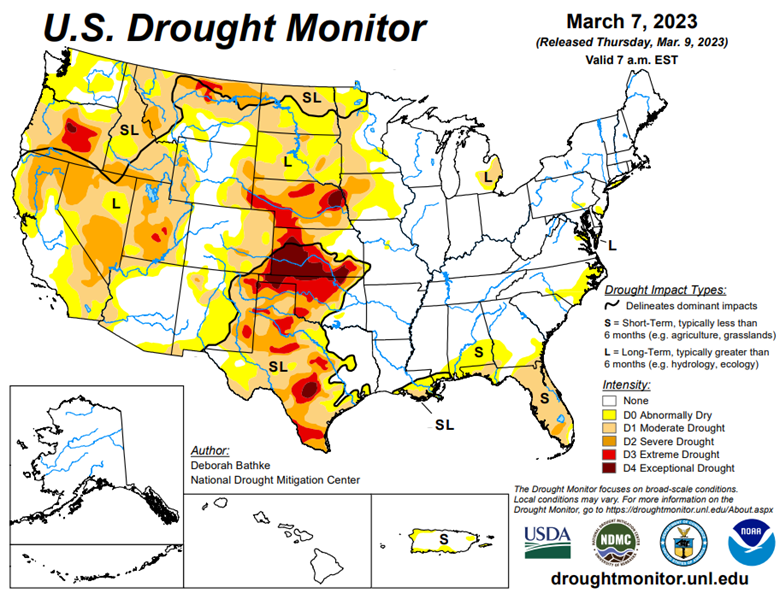

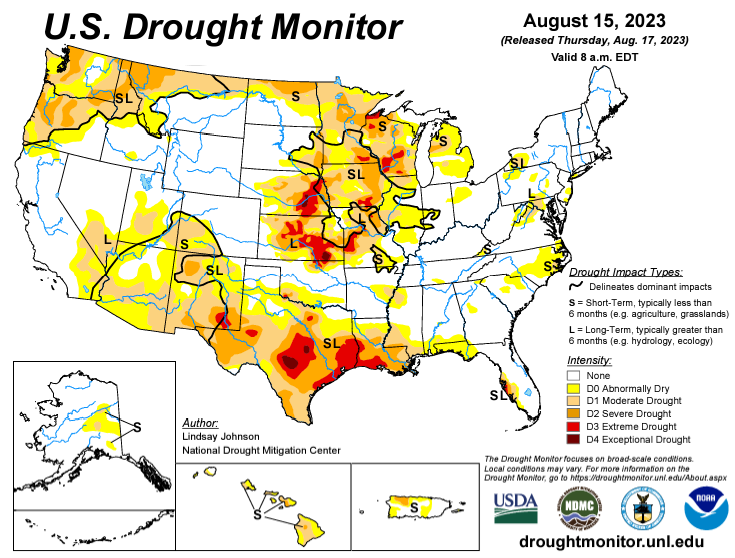

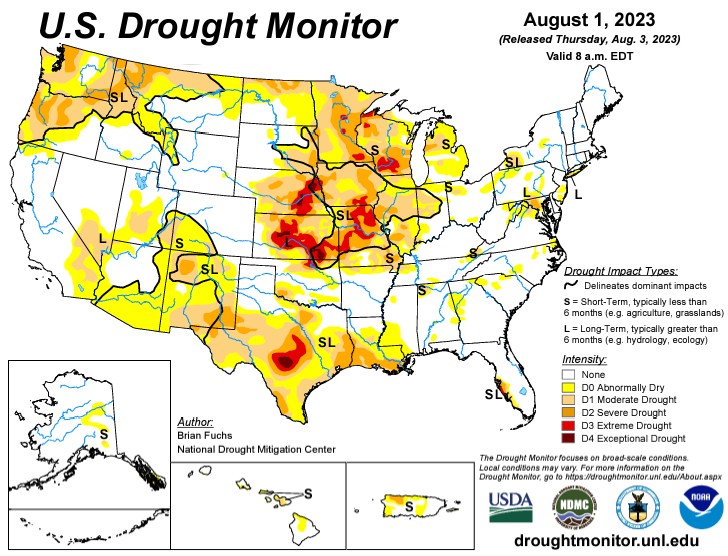

Drought Monitor

The drought monitors below show the change in drought conditions over the last 2 weeks.

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.