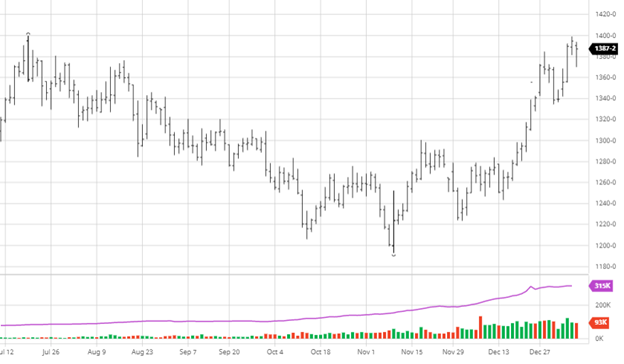

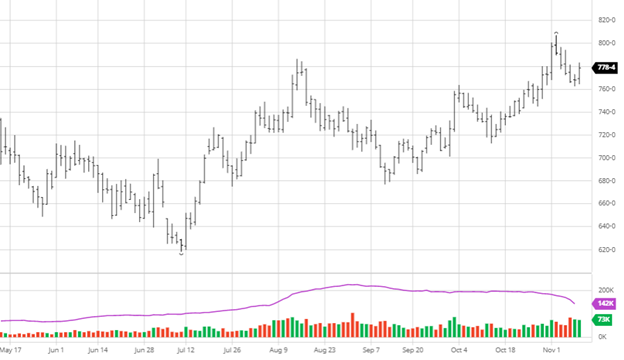

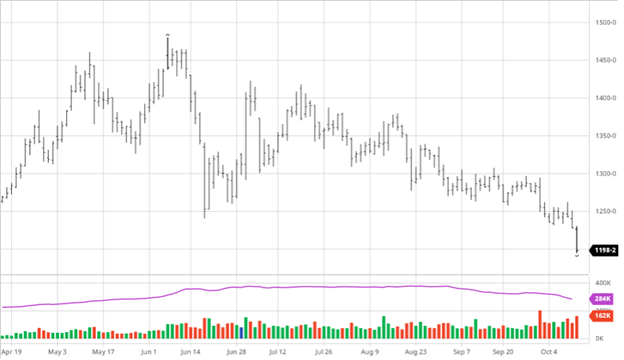

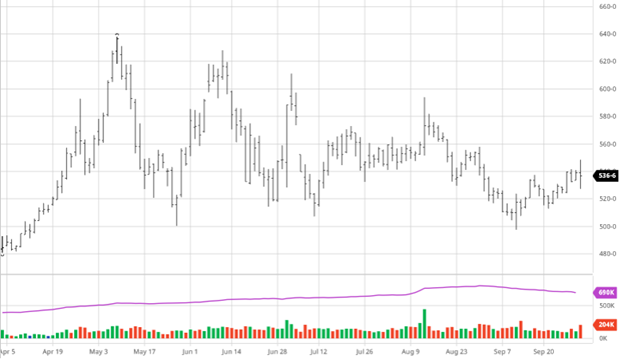

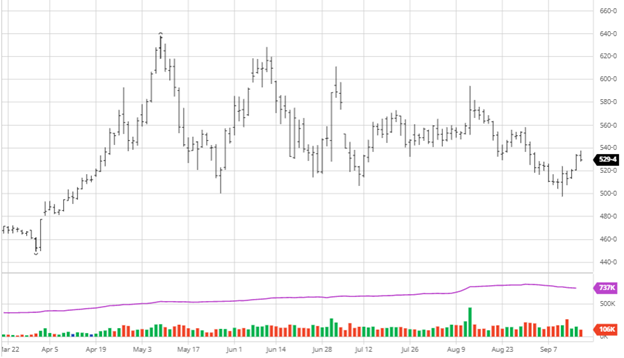

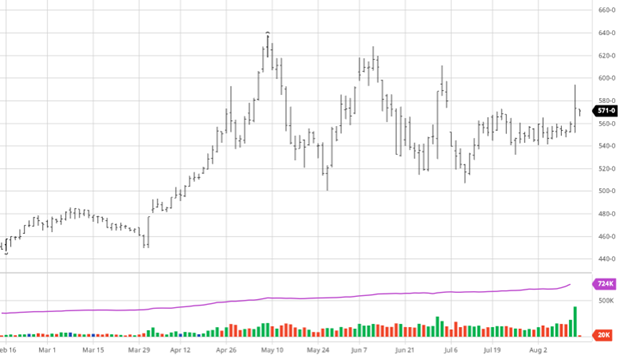

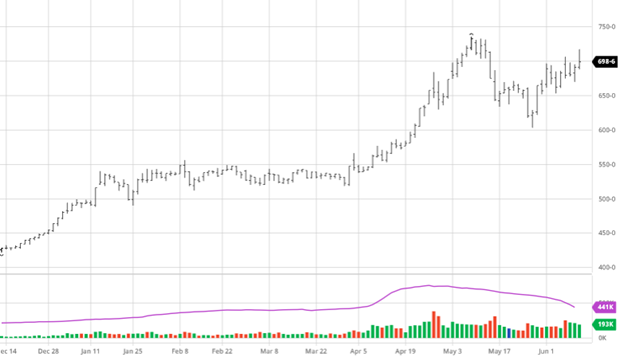

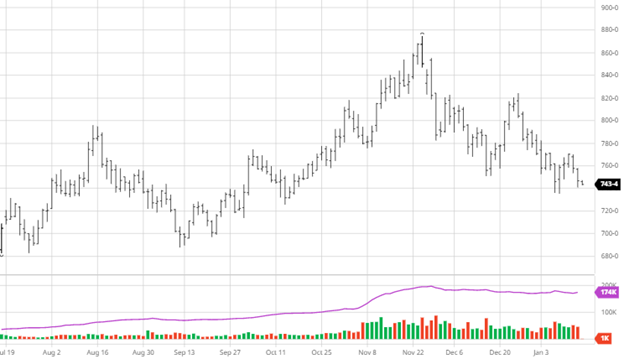

The USDA report was met with a mixed reaction on Wednesday as markets traded both higher and lower immediately following the report. Thursday brought on large selling though, as rain in the dryer parts of South America took the headlines after the USDA Report ultimately did not provide any major changes. The USDA did not change the U.S. yield for corn as it stayed at 177 BPA while raising total crop size to 15.115 billion bushels and 1.540 billion bushels for ending stocks. World stocks were lowered along with smaller yield numbers expected in South America. The rain will do little to alleviate the stress on the crop as more will be needed before we feel better about less yield loss. Several private estimates believe the Brazil and Argentinian losses are larger than the USDA updated. However, there is still plenty of time before the crop comes out of the ground to rebound.

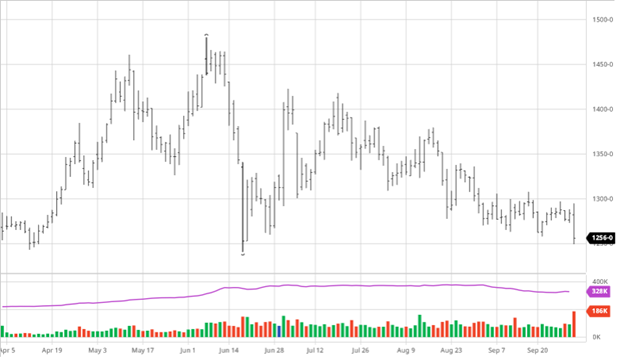

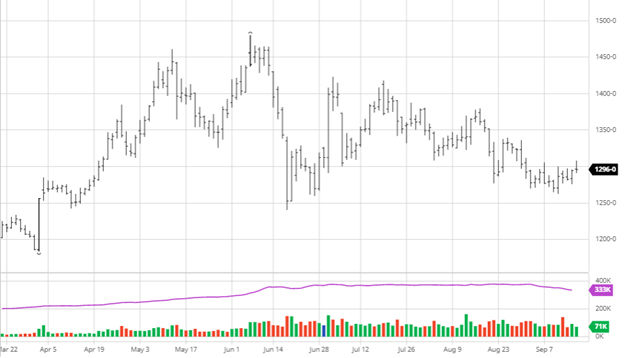

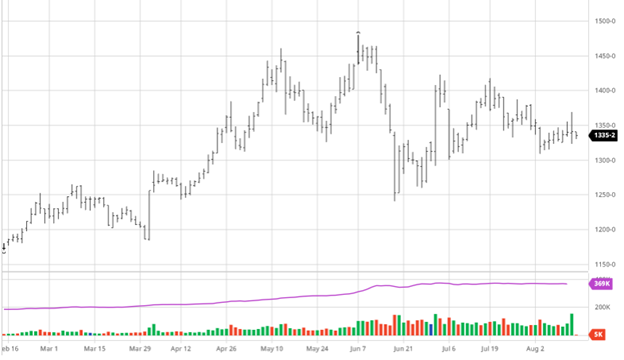

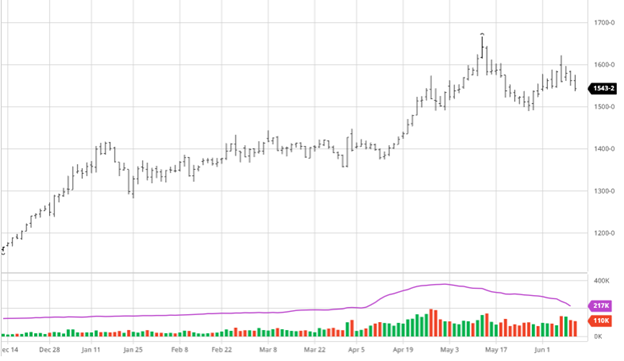

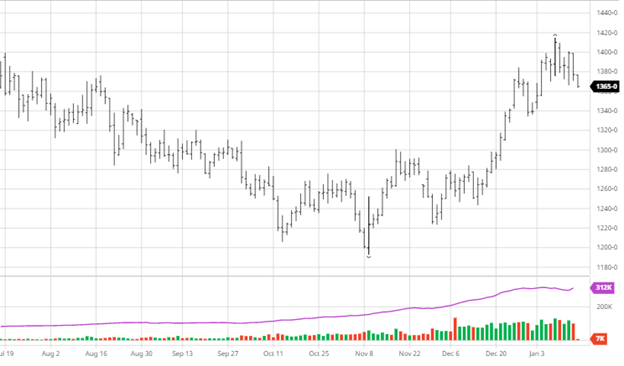

Soybeans fell on the week for the same reasons as corn. The USDA Report was slightly more bearish for beans as they raised the U.S. yield 0.2 BPA to 51.4. They slightly increased total production and raised U.S. ending stocks by 10 million bushels to 350 million. A good amount was cut from World-ending stocks due to the issues in South America, but the market had already priced that in, if not more so than was reported. Exports were within expectations, so no surprises there. One wild card still out there is that China is $16 billion behind their Phase 1 trade agreement commitments. Obviously, not all of this is soybeans, but they are far off their soybean numbers. It is unlikely the Biden administration will press them to get to their commitments, but if South America’s troubles are worse than expected, they have to go buy them from somewhere.

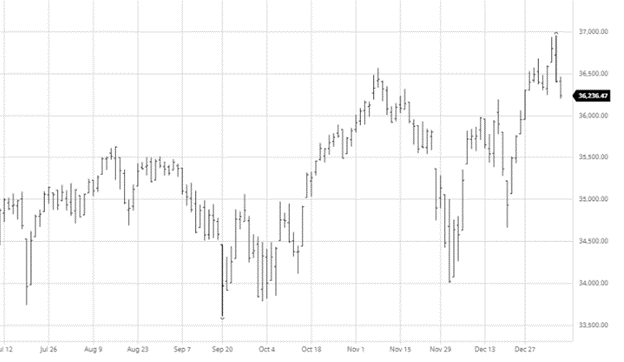

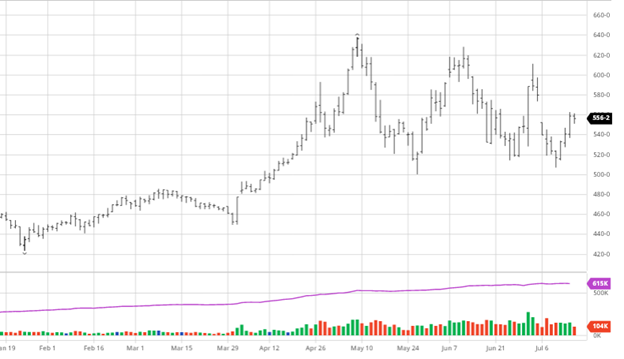

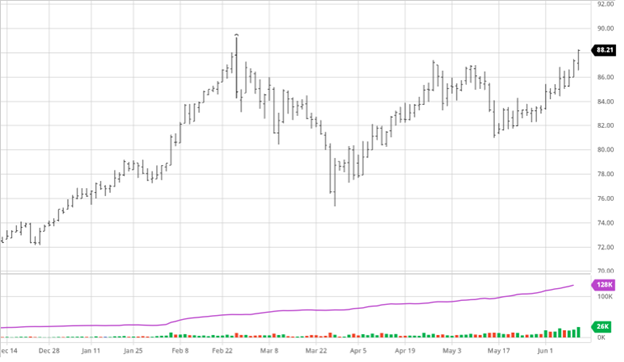

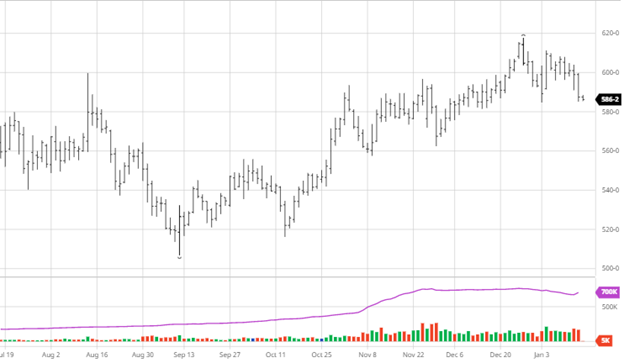

Dow Jones

The Dow fell slightly on the week but bounced back off its lows from Monday. The markets are looking for direction following 4 days of loses straight. With repositioning for the year ahead and profit taking after a historic year the volatility could be around for a while.

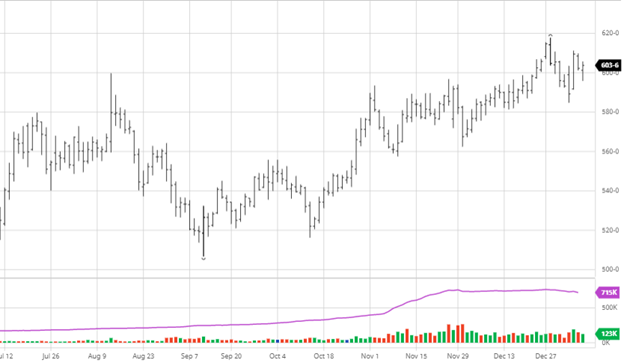

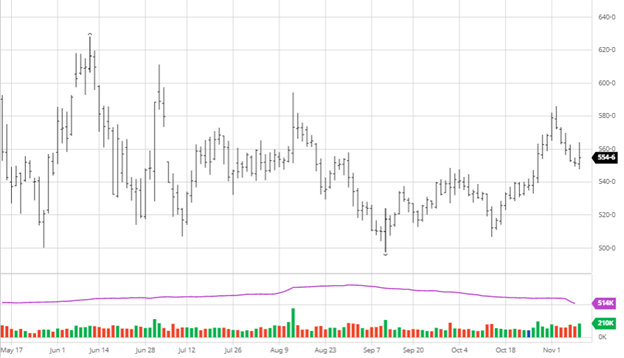

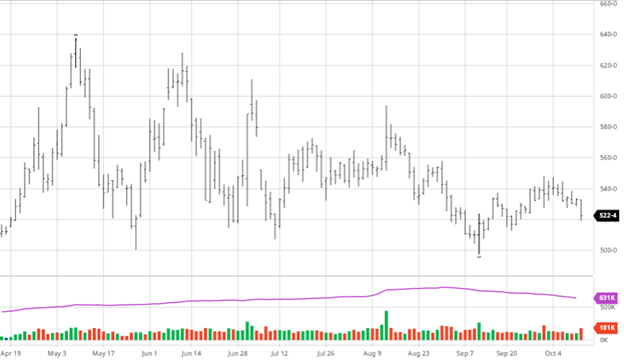

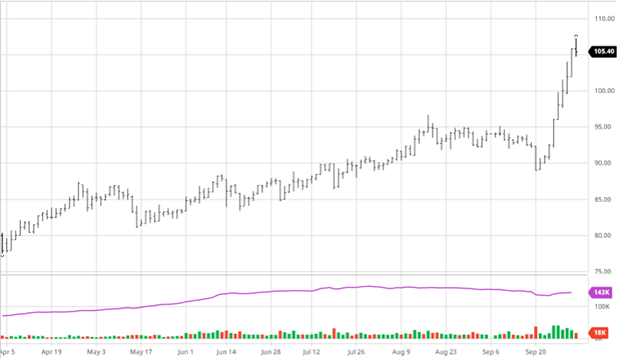

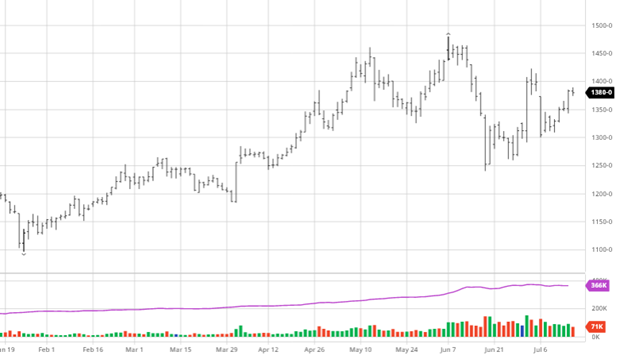

Wheat

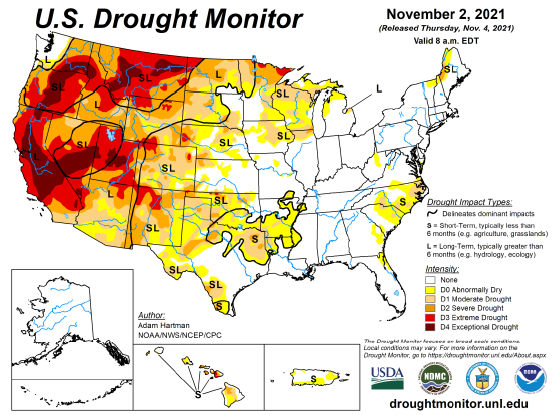

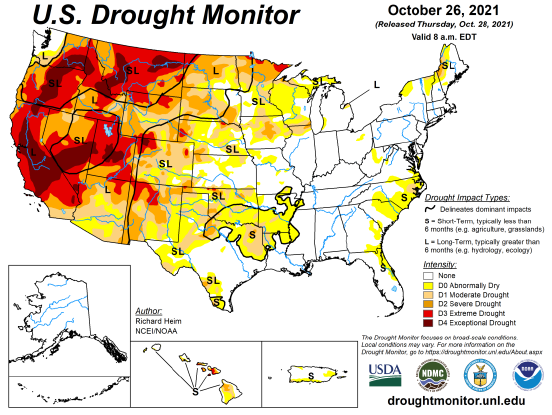

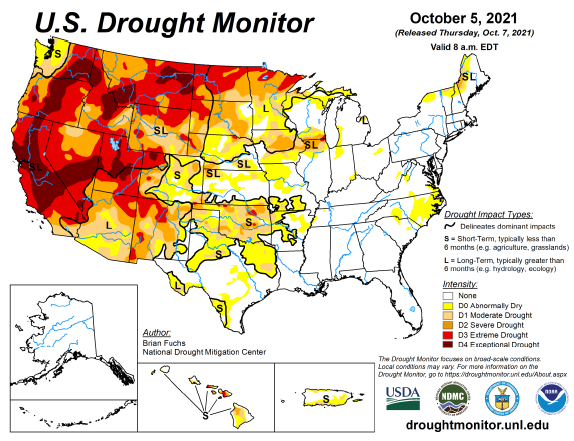

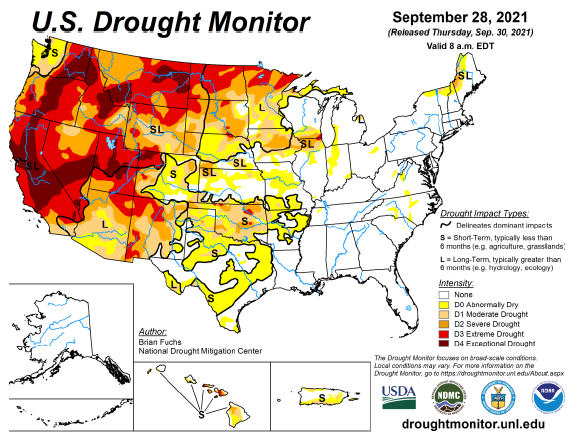

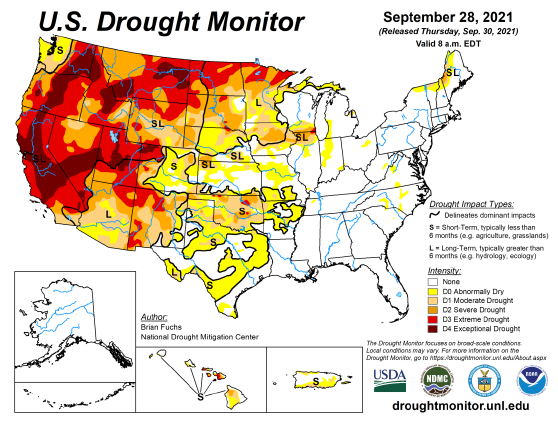

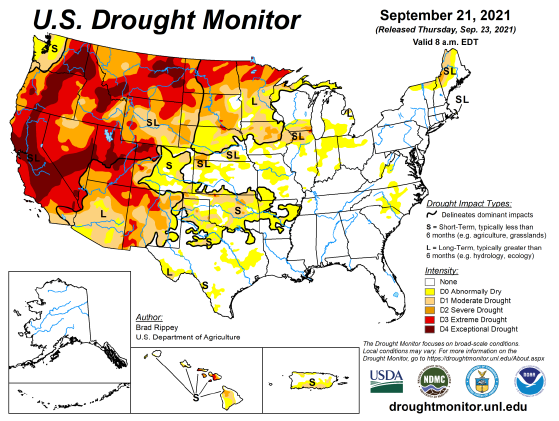

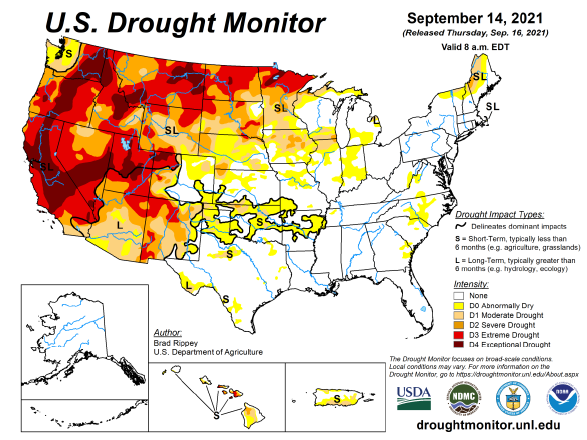

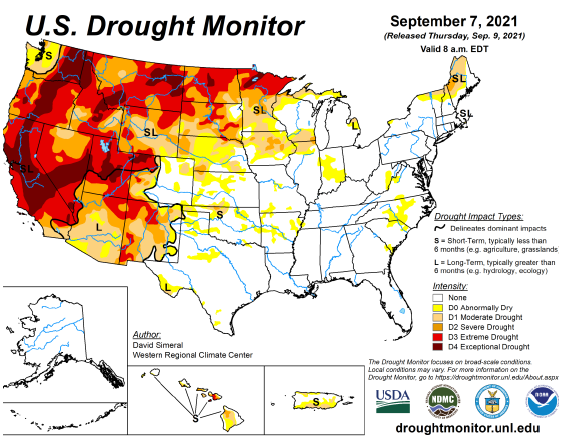

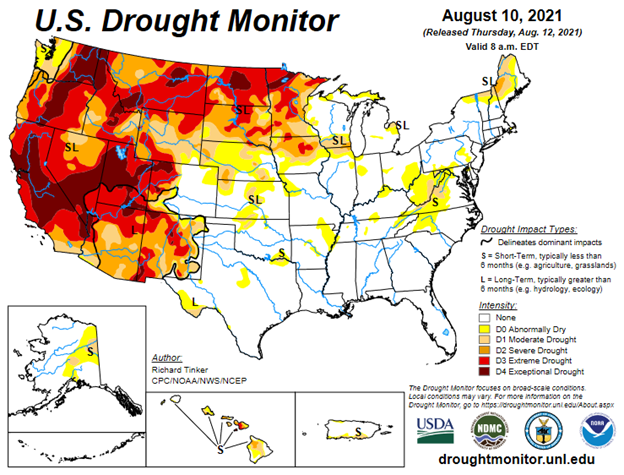

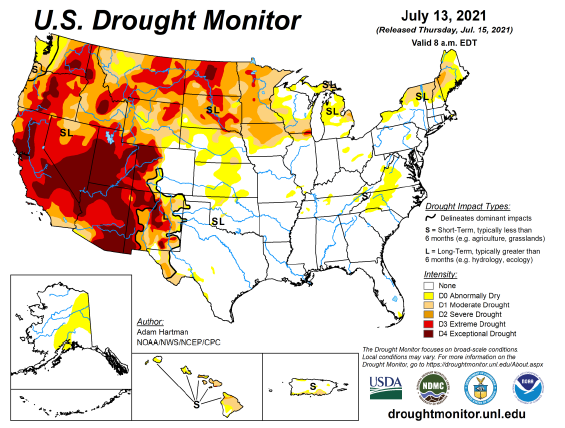

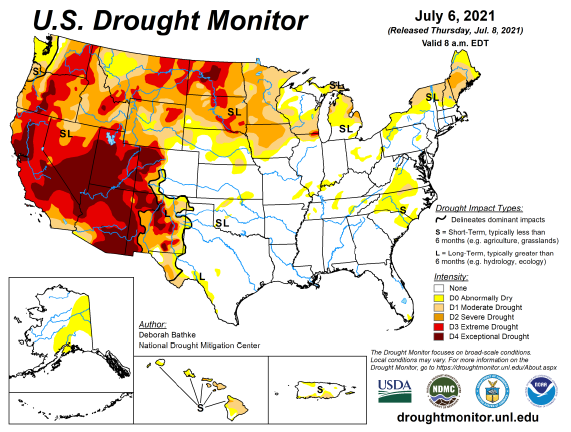

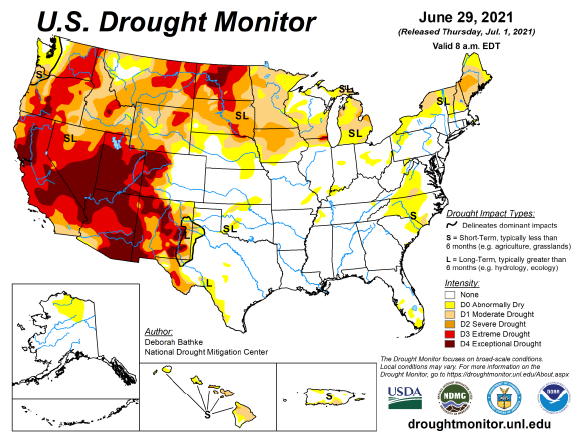

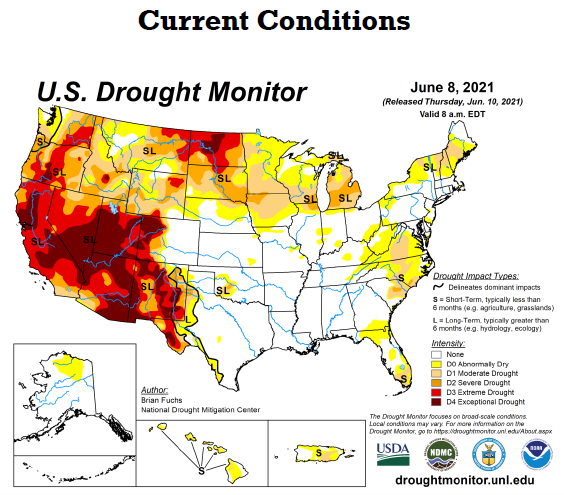

Wheat has taken it on the chin the last couple of weeks as you can see in the chart below. Wheat sold off following the other markets after the report. The drought in the winter wheat belt is concerning and if it does not improve, we should see prices move higher in the next month or two. The drought is not a big problem right now, but if it continues into February, it would be concerning. This week saw the lowest close in KC Wheat since October.

Podcast

The 2021 U.S. grain crop has the potential to be one of the largest on record. Where did all the yield come from, what areas were the hardest hit, and why on God’s green earth are grain prices still so high?

Today, we are joined by several RCM Ag Services grain markets experts from around the country to catch up on a post-harvest update and share an outlook for production and marketing in each of their respective regions for the remainder of the 2021 marketing season and the upcoming 22 crops.

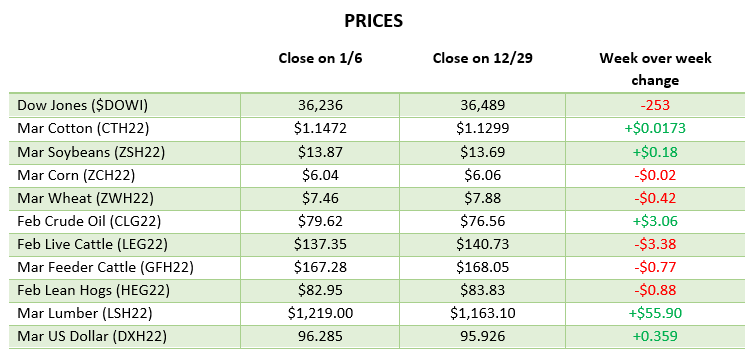

Via Barchart.com