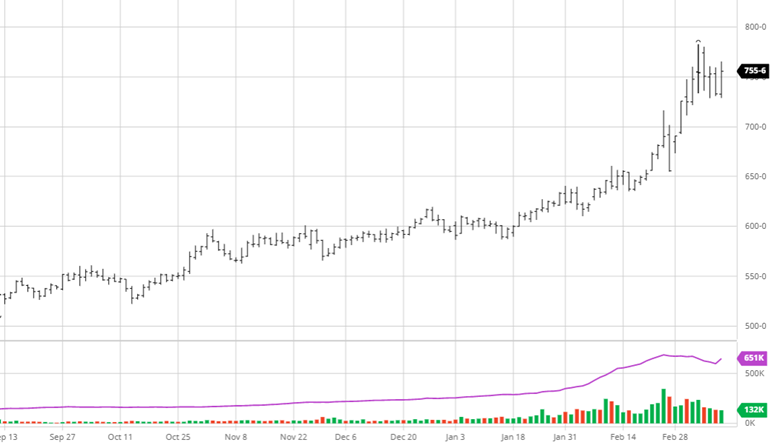

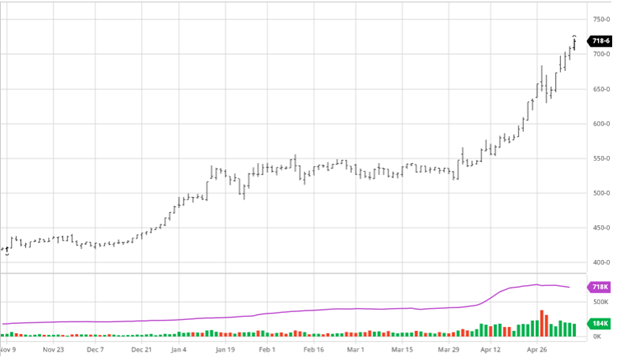

Corn made slight gains on the week with very volatile intraday markets. The Ukraine and Russian news continue to stay in the market and will likely dominate headlines until it ends. Other news worldwide is that South America got rains in southern Brazil and Argentina, with dry central and northern Brazil. Russian officials announced that they would suspend fertilizer exports through the end of the year, presenting a supply crunch across the world. This week’s USDA report was nonexistent in the markets as there were no surprises. As mentioned last week, Ukraine’s corn crop may not get in the ground as only 60% of seed is on farm; this will be important moving forward as world balance sheets get tighter.

Corn made slight gains on the week with very volatile intraday markets. The Ukraine and Russian news continue to stay in the market and will likely dominate headlines until it ends. Other news worldwide is that South America got rains in southern Brazil and Argentina, with dry central and northern Brazil. Russian officials announced that they would suspend fertilizer exports through the end of the year, presenting a supply crunch across the world. This week’s USDA report was nonexistent in the markets as there were no surprises. As mentioned last week, Ukraine’s corn crop may not get in the ground as only 60% of seed is on farm; this will be important moving forward as world balance sheets get tighter.

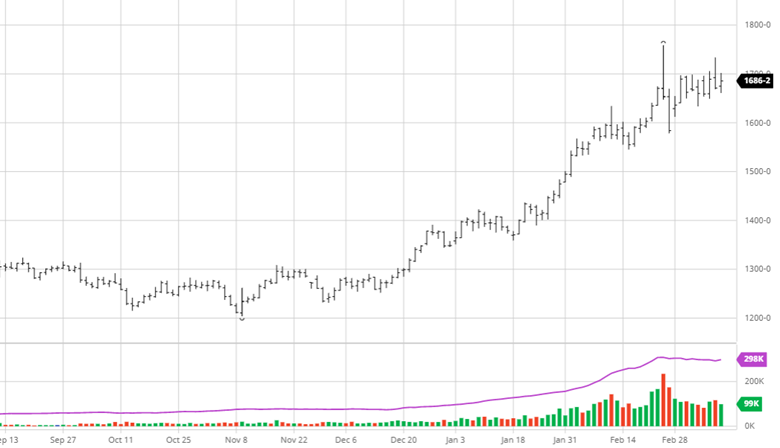

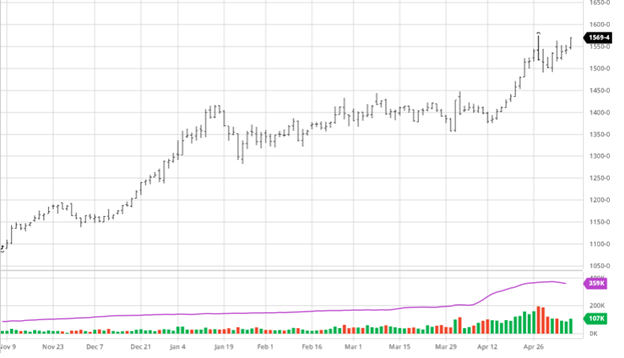

Soybeans made small gains this week despite the wild intraday volatility. The USDA trimmed South American production again in this week’s report as they continue to baby step lower to what will be a smaller crop. World edible oil prices were up on the week pulling bean oil and soybeans higher. The Black Sea area’s worry and trade have affected the oils market, not just wheat.

Soybeans made small gains this week despite the wild intraday volatility. The USDA trimmed South American production again in this week’s report as they continue to baby step lower to what will be a smaller crop. World edible oil prices were up on the week pulling bean oil and soybeans higher. The Black Sea area’s worry and trade have affected the oils market, not just wheat.

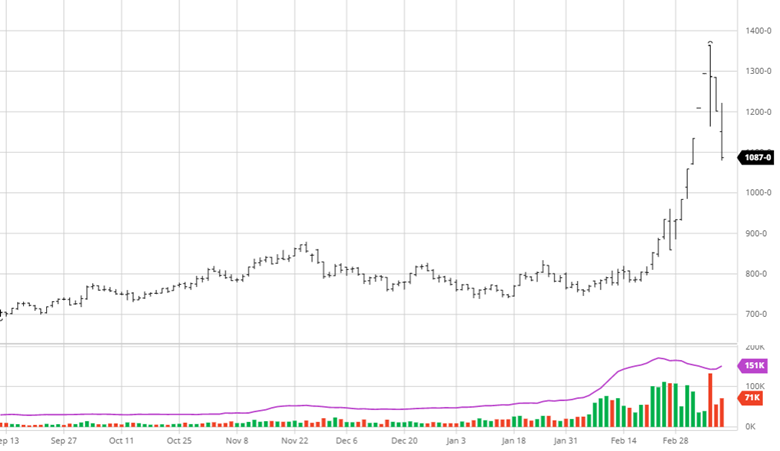

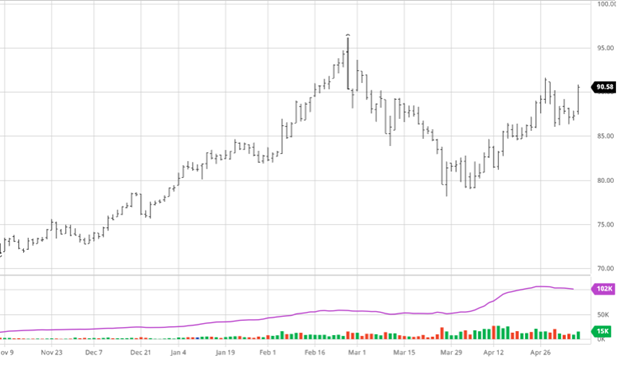

Wheat fell hard this week with an expanded limit down the day with a small bounce on Friday heading into the weekend. All the short wheat positions that were getting run over had the opportunity to get out this week with the move down. However, the unknown in eastern Europe and China having its worst winter wheat crop on record means there is still upside with volatility. Friday’s gains were welcome to see after three days of large losses. The cash market will be essential to follow as it will help determine the fair market value.

Wheat fell hard this week with an expanded limit down the day with a small bounce on Friday heading into the weekend. All the short wheat positions that were getting run over had the opportunity to get out this week with the move down. However, the unknown in eastern Europe and China having its worst winter wheat crop on record means there is still upside with volatility. Friday’s gains were welcome to see after three days of large losses. The cash market will be essential to follow as it will help determine the fair market value.

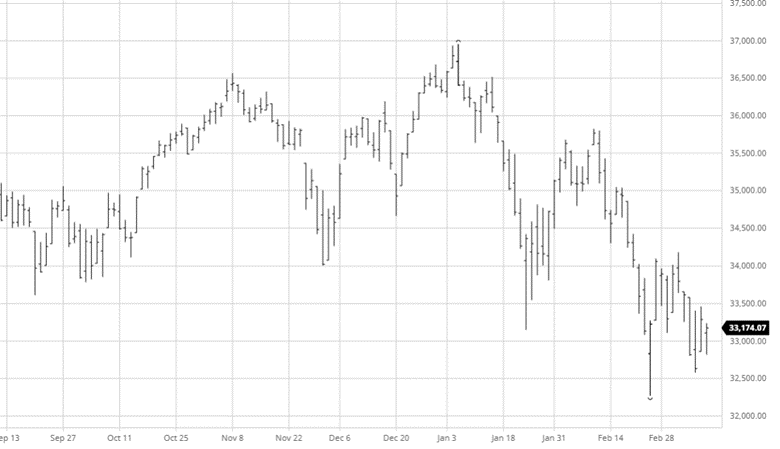

Dow Jones

The equity market fell again this week as continuing war, and another record inflation number was challenging for the market to figure out. While the market seems like it is struggling to make up its mind, there are pockets that are performing alright. The world economic outlook appears to be teetering, and trying to digest what to do with Russia will be a major decider.

Podcast

Tune in as biotech guru Dr. Channa S. Prakash discusses everything from Alabama football, genetics as one of the most extensive agricultural advancements, the most significant risk factors to feeding the world over the next 30-50 years, plus everything in between.

Why producing crop plants with a much gentler footprint on the natural resources will help feed the growing population. How 75% of the world’s patents in agriculture gene editing are coming from China. Understanding that trying to impose restrictions on our ability to grow food can be a considerable risk to agriculture. Listen to hear about these topics and more!

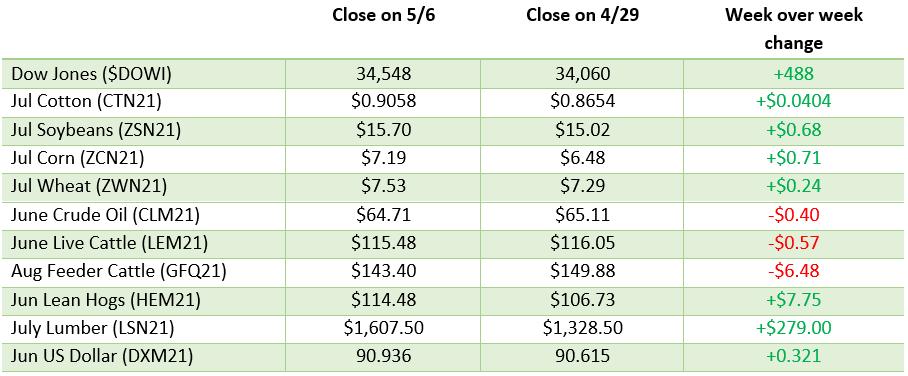

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].

For the past year, commodity prices have perpetually soared and continue to trend higher. We’re diving into the fertilizer forecast with a unique guest, Billy Dale Strader, a branch manager for Helena Agri-Enterprises in Russellville, KY., who is truly at the epicenter of the rising fertilizer prices.

Billy Dale planted his agriculture roots on his family-owned farm and has managed regional seed and chemical sales at Helena for the past decade. In this week’s pod, we tackle the big question for farmers and ultimately end-users — is the impact of higher-priced inputs, like seeds, chemicals, and fertilizer, on the supply and demand for the major U.S. crops? Listen or watch to find out!

Find the full episode links for The Hedged Edge below:

Jody Lawrence, RCM Ag Services’ head of research, joined Shay Foulk on his podcast “The Ag View Pitch” for this week’s market outlook. Jody hits on some major points, including harvest, basis, the upcoming USDA stocks report, and storage decisions that need to be made.

Jody makes the point of discussing what the cash market has been telling us vs. what the futures market and USDA are. Basis has been historically strong while the USDA has not had drastically tight balance sheets showing us some disconnect. Should we expect this week’s report to lower ending stocks as the cash market would hint at?

A harvest update from what Jody and Shay are hearing from their people, both agree that there were many unknown/under-reported issues early in the year that we may be seeing played out combined with the dry and hot finish.

The basis discussion starts with ethanol and how the plants are affecting many different commodities. Currently, margins for ethanol allow them to have a better basis, which forces elevators to do the same to remain competitive.

Should you store soybeans or corn this year? Jody and Shay dive into the margins and spread in the futures markets and basic considerations. No matter what you decide, allowing yourself the opportunity to still participate in the market via futures and options will allow you to not miss out on upside possibilities.

Jody has some final thoughts on the oats market that he leaves us with and what it could mean for the corn and grain markets in countries with major oats markets.

It is no secret that commodity markets have been on fire over the past 12 months. On today’s podcast we’ve brought on one of our real-life firefighters from RCM Ag – Jody Lawrence along with Tim Andriesen from the CME Group to provide us with some inside baseball knowledge of the current state of the agriculture markets and to discuss the real world application of the use of short dated options to potentially fight the current blaze of volatility surrounding agriculture markets.

As the director of Research for RCM Jody is no stranger to the podcast. Tim, is the Managing Director of Agriculture products for the CME Group and is responsible for management of the company’s global agriculture commodities business – including grain, oilseed, livestock and dairy risk management products.

Find the full episode links for The Hedged Edge below:

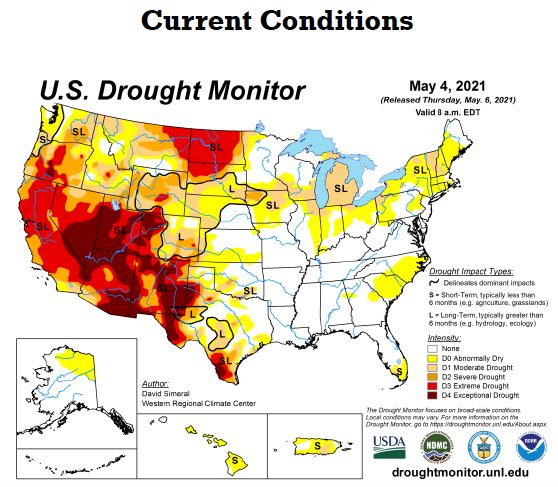

Corn continued it’s hot run this month with a great week in both old crop and new crop prices. As Brazil’s safrinha crop keeps facing a dry outlook, pressure is mounting on the US to produce a great crop to fulfill world demand. The US forecast is turning wetter for many major growing areas but remains cool for this time of year. The cool weather is not ideal for early growth, but the rain will be welcome in areas facing drought conditions (see map at bottom). There is a rumor of more Chinese interest in new crop which helped propel old crop to end the week. Despite poor exports this week, this news, along with South America’s troubles, have been the market moving news this week. The US corn crop is seen at 44% planted at the start of the week beginning May 3.

Soybeans followed Corn this week as they also saw strong gains. China’s ASF news has slowed as of late which is good for export expectations to China. The world demand has continued to be strong and helpful to prices in both South America and the US, while US beans remain competitive in the world market even at these levels. The recent wet and colder weather across much of the US is not expected to cause any issues for the soybean crop except maybe pushing planting back in some areas where farmers also must wait to plant corn. 25% of the US soybean crop is seen as being planted for the week beginning May 3.

The big question right now: What is going on with cotton? Cotton has not enjoyed in the rally in 2021 that other commodities have. The demand has been there, but there are already worries about the 2021 cotton crop. Normally these are a recipe for higher prices, right? The fundamentals would agree as higher comparative prices for other commodities may take away some cotton acres by the end of planting season. The technical side has been cotton’s enemy as of late as they have not been able to make new contract highs, unlike the grains. The world shipping bottleneck does not appear to be getting any better and as the US continues to come out of lockdowns along with other countries demand will only make it worse. This problem needs to be solved sooner rather than later.

Dow Jones

The Dow was up this week while other indexes were mixed with the Nasdaq and Russel falling. As earnings continue to be reported many of the winners of the last year have posted strong quarters but it appears the momentum behind them have slowed as good earnings have sometimes been followed by selling.

Lumber

Check out our recent post about the lumber market and what all has been going on.

Podcast

Check out or recent podcasts with guests Elaine Kub and Kyle Little. Elaine and Jeff discuss grain markets and trading grains while Kyle helps give insight into the Lumber markets and what has been going on.

Listen with Kyle:

Listen now with Elaine

CME

CME Group announced this week that it will not re-open its trading pits that were closed last March at the start of the pandemic. The Eurodollar Options pit will remain open. See the full press release here.

US Drought Monitor

The map below shows the current drought conditions throughout the US as planting continues across the country.

Weekly Prices

Via Barchart.com

In this monthly segment on The Hedged Edge, RCM Ag Services pros Jody Lawrence, Ron Lawson, Kevin Bost, and host Jeff Eizenberg come together to provide expert knowledge on important markets including cotton, meat, and grains following the USDA Report. Watch the whole episode below!

If you’d rather listen – click on the links below to find your preferred platform:

For the commodity world, 2020 has been particularly interesting. Between stimulus packages and China buying pullback, to ramping up production and setting up for a potential big comeback in 2021 it feels like we’ve been living through a game of ping pong. So to review it all – plus give some insight into 2021 – we’ve brought Dr. Scott Irwin on to go through it all. Dr. Scott Irwin is chair of the Agricultural Marketing in the Department of Agriculture and Consumer Economics at University of Illinois Champaign-Urbana. Scott is a national and international leader in the field of agricultural economics. His research on agricultural markets is widely-cited by other academic researchers and is in high demand among market participants, policymakers, and the media. In today’s episode, we’re talking about 2021 and beyond, game changers in the ag market, Chinese demand, the USDA report, University of Illinois program, and FarmDoc.

Follow along with Scott on Twitter and LinkedIn and check out FarmDoc.

And last but not least, don’t forget to subscribe to The Hedged Edge on your preferred platform, and follow us on Twitter, LinkedIn, and Facebook.

Disclaimer: This podcast is provided for informational purposes only and should not be relied upon as legal, business, or tax advice. All opinions expressed by podcast participants are solely their own opinions and do not necessarily reflect the opinions of RCM Alternatives, their affiliates, or companies featured. Due to industry regulations, participants on this podcast are instructed not to make specific trade recommendations, nor reference past or potential profits. And listeners are reminded that managed futures, commodity trading, and other alternative investments are complex and carry a risk of substantial losses. As such, they are not suitable for all investors. For more information, visit www.rcmalternatives.com/disclaimer

In this monthly segment on The Hedged Edge, RCM Ag Services pros Jody Lawrence, Ron Lawson, Kevin Bost, and host Jeff Eizenberg come together to provide expert knowledge on important markets including cotton, meat, and grains following the USDA Report.

During today’s episode we’re talking about reporting back from farmers on the recent USDA report, labor shortfalls, taxes and tariffs, commodity price inflation, adjusting planting intentions, feed prices affecting hog/cattle prices, calorie reports, corn vs beans, and more from the report and looking towards the end of 2020.

Find the full episode links below: