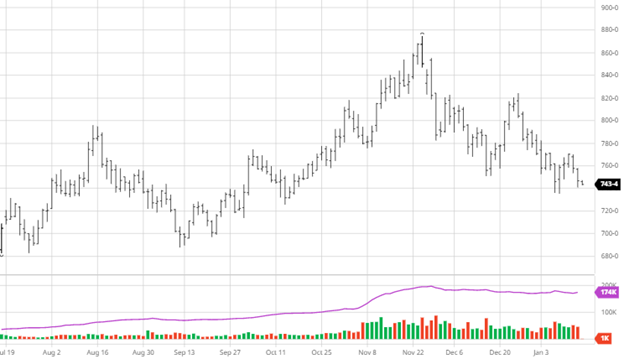

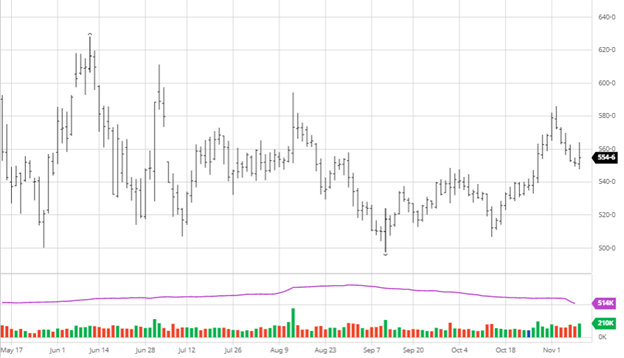

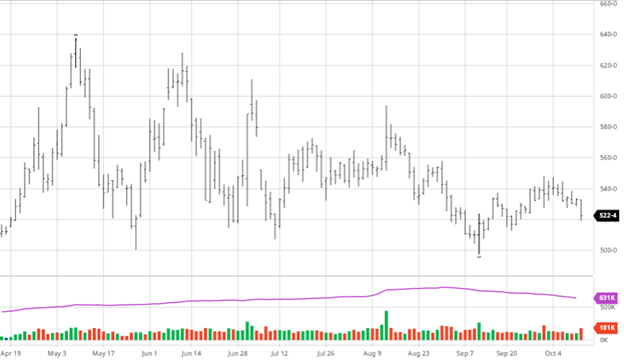

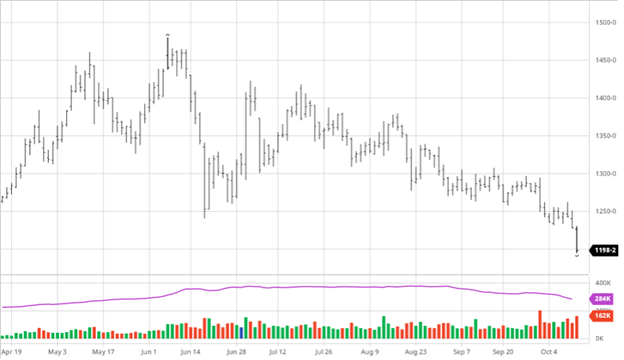

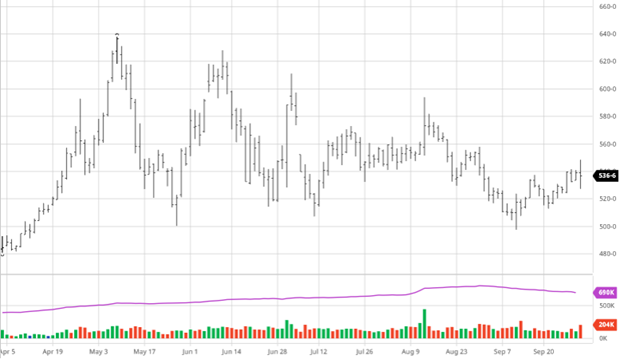

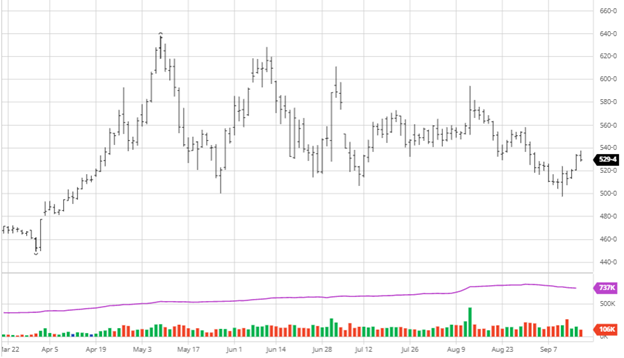

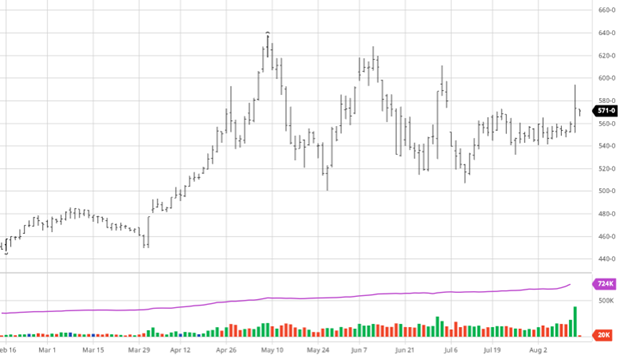

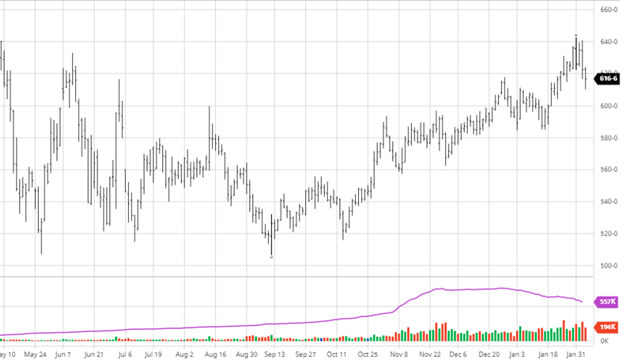

Corn suffered small losses this week, going a different direction than beans. Private estimates of the South American crop are consistently lower than the USDA’s last estimate, and we should see an adjustment on next week’s USDA report. The Chinese’s cancelation of 380,000 tonnes of corn was a drag on the market on Thursday. One cancelation is not the end of the world; it happens, but should we see a trend develop that could damper the bull sentiment right now. The driest areas of South America will continue to dry over the next couple of weeks, hurting their crop in those regions. Private estimates think that Argentina’s corn yield could be 43.5 million metric tons, while Brazil’s could be 112 MMT. These are well below the last USDA report’s numbers, so next week will be interesting to see how much the USDA adjusts their estimates.

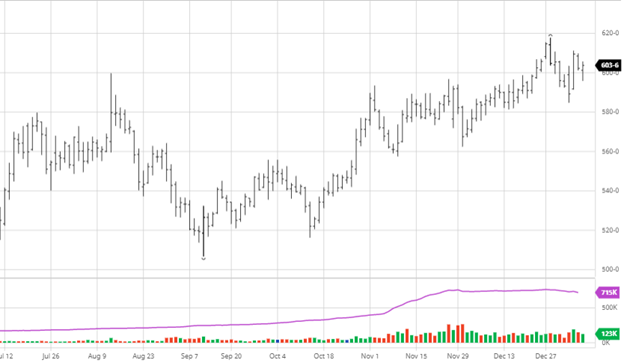

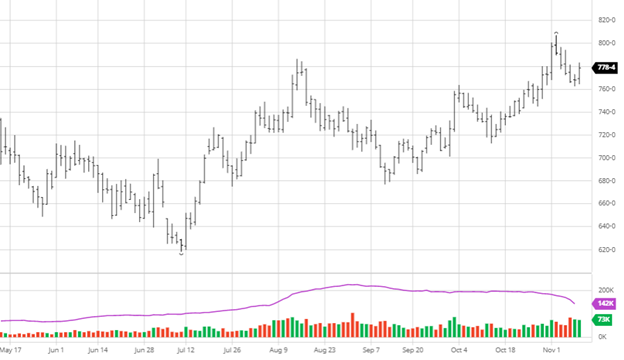

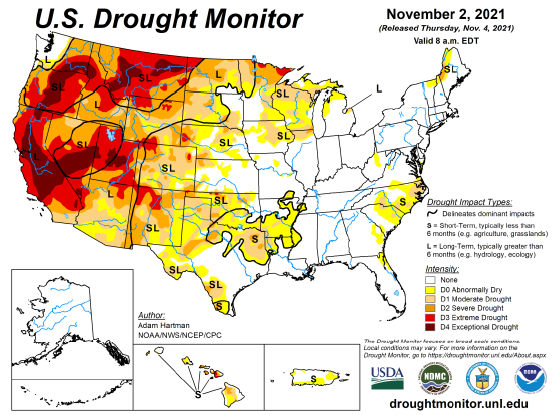

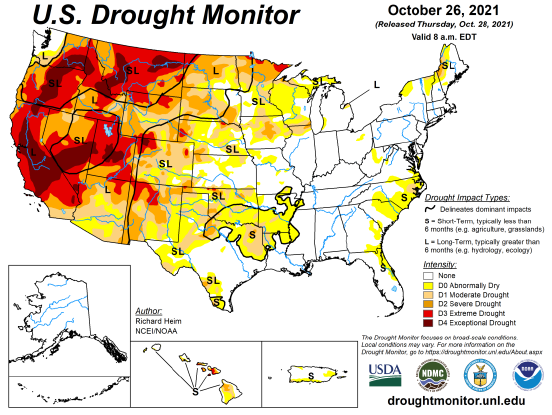

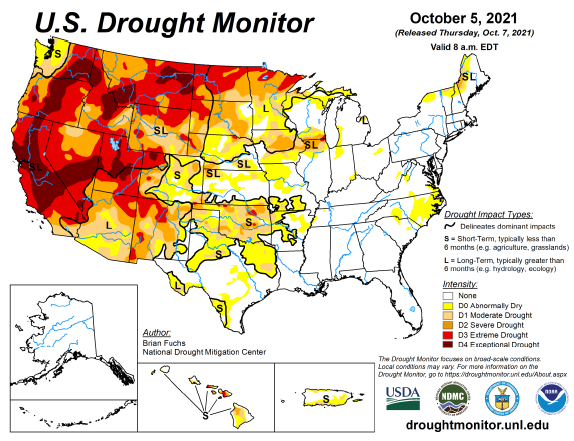

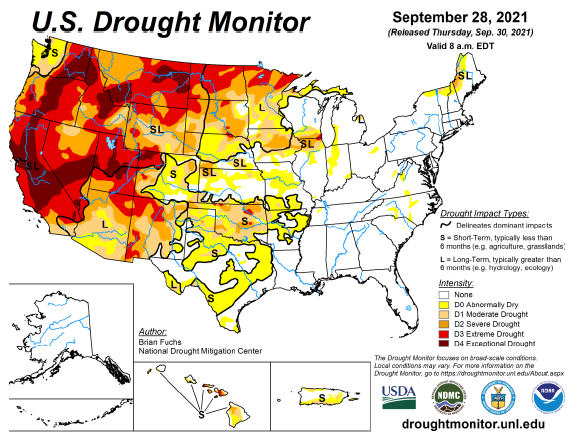

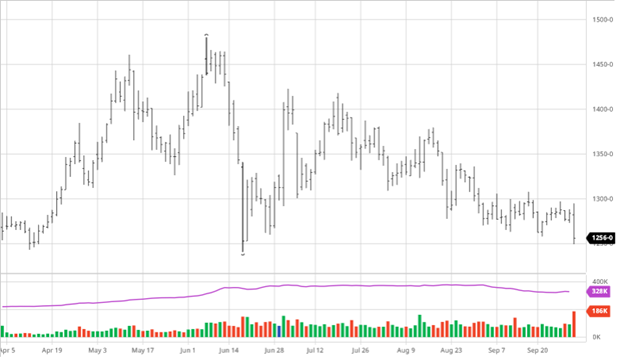

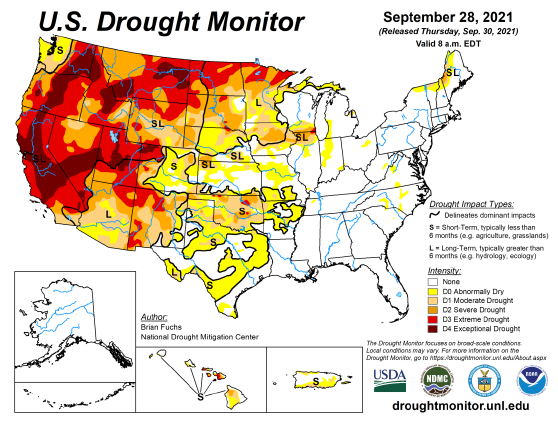

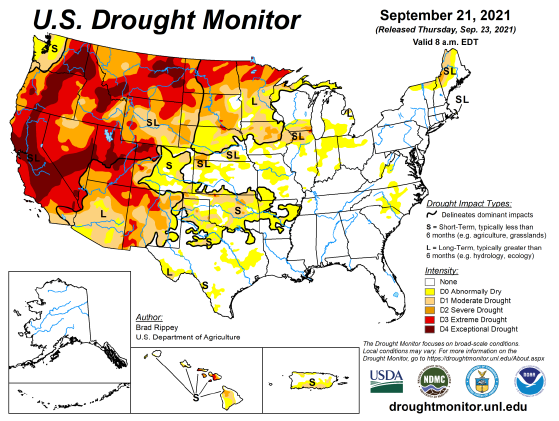

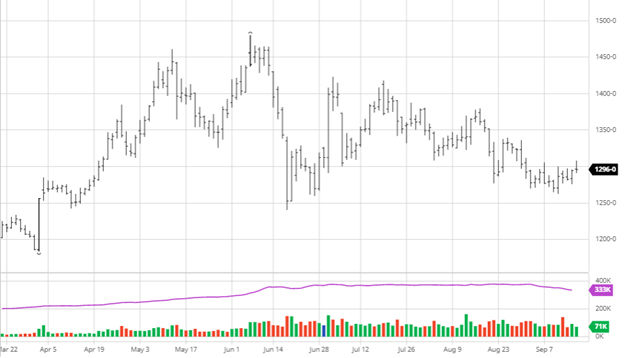

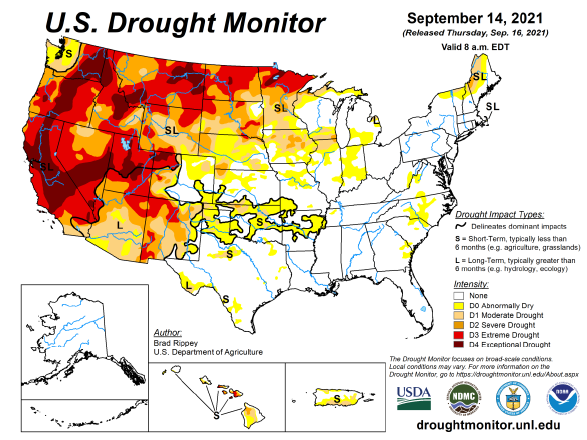

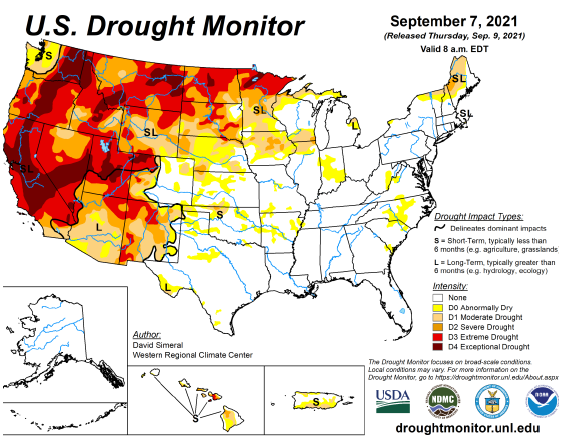

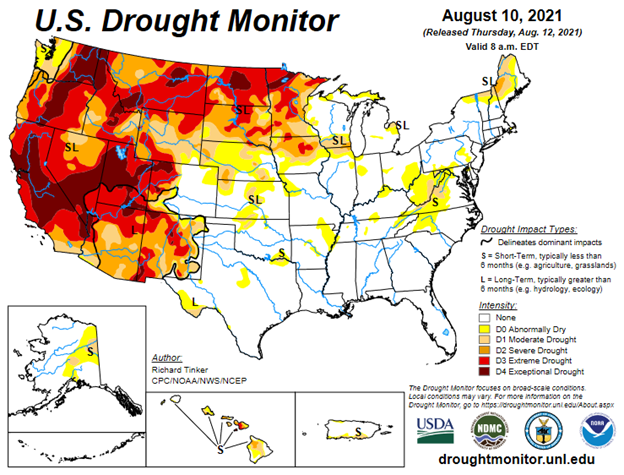

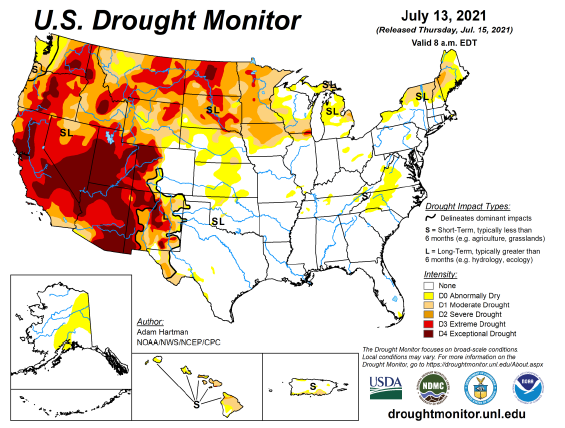

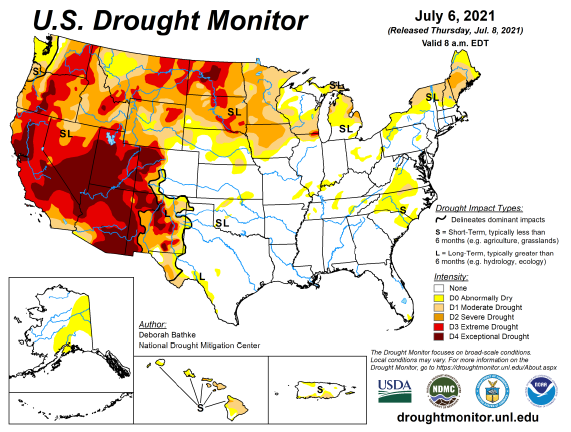

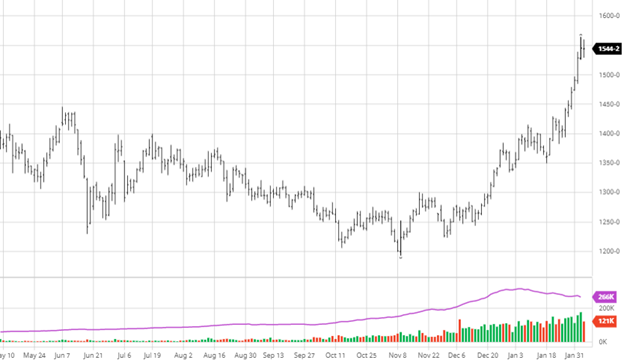

Soybeans continued to move higher this week as the South American weather issues will probably significantly impact the soybean crop. The continued heat and dry weather will continue to stress the crop like corn. The market can’t go up every day, no matter what it seems like; the closing off the highs the last two trading days suggests the market may want to take a break until there is more news. Brazilian producers are still not selling, which has interior cash bids competitive with exporter bids. With this playing out in Brazil, the U.S. could see some more business as a result. Especially if China steps in and makes purchases out of the Pacific Northwest, keep an eye on drought conditions around the U.S. even though we are well out from planting as we have seen drier than normal weather in some growing areas to this point of the year.

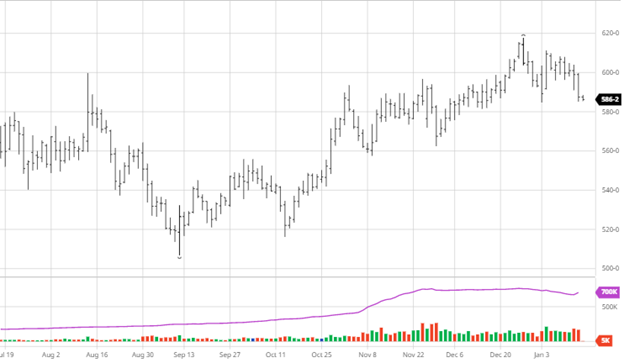

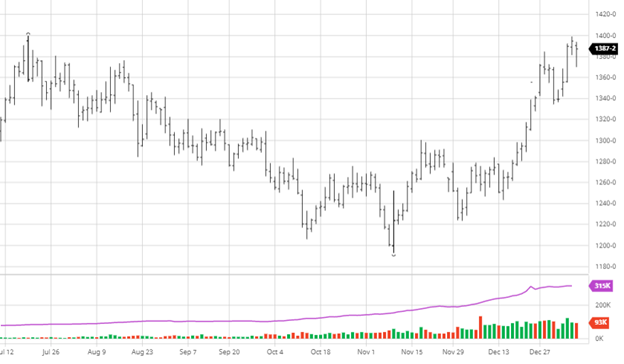

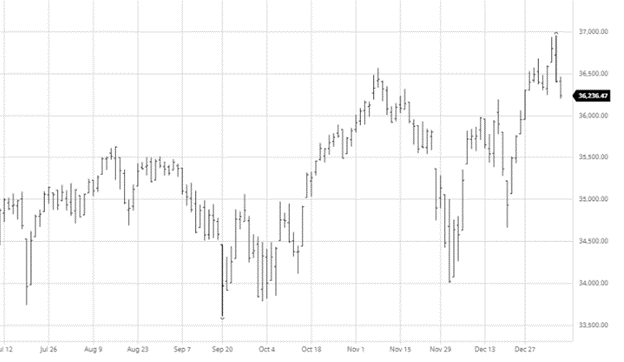

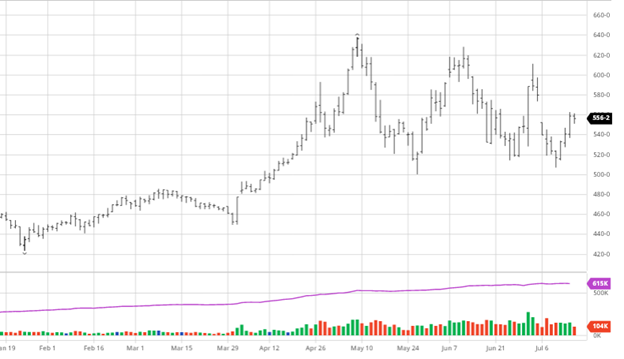

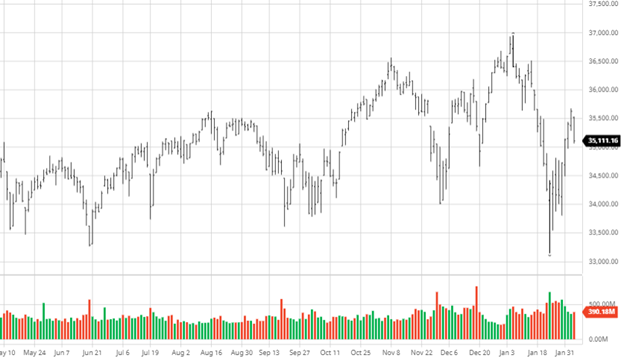

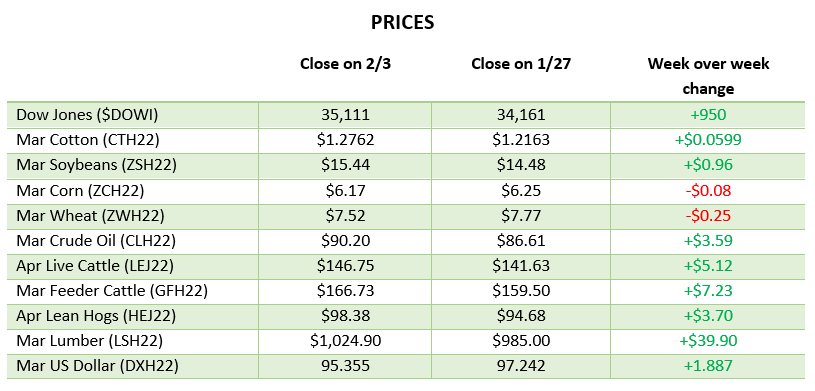

Dow Jones

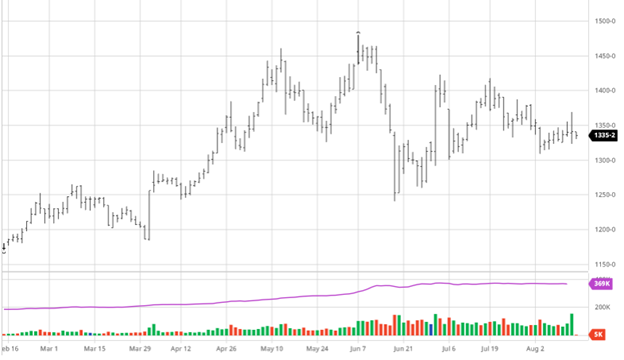

Equities have made a strong rebound off the lows until Thursday’s struggles following some bad earnings report lead by Facebook’s (now Meta) major fall. Amazon posted a good quarter which may give investors some relief that Facebook’s problems were their own and not market wide. The bounce was nice to see from an investors point of view as a correction seemed to be done, but guidance from many companies has not been as growth friendly looking forward as the last year. Volatility may stick around for a while so do not expect the markets to recover as quickly as they fell.

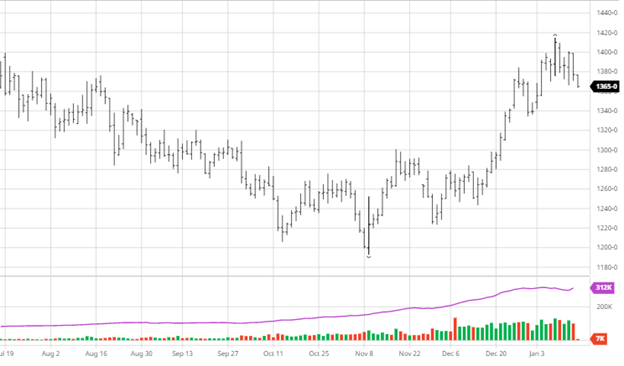

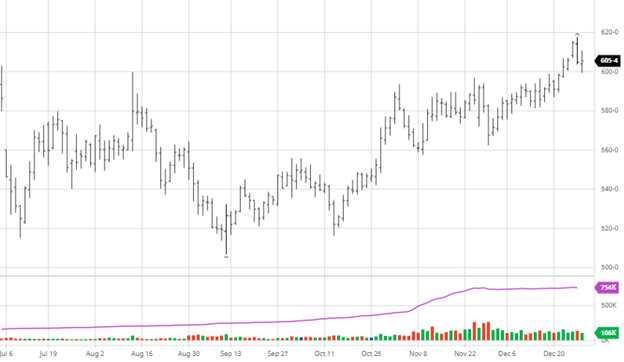

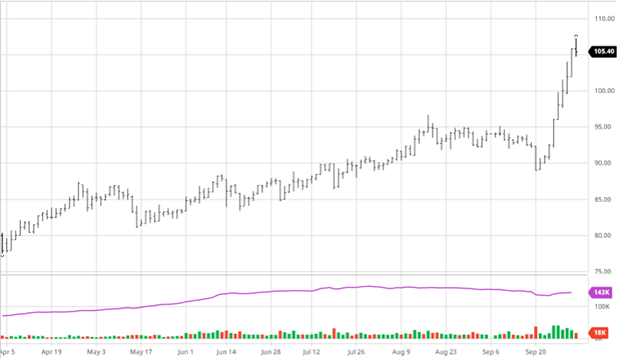

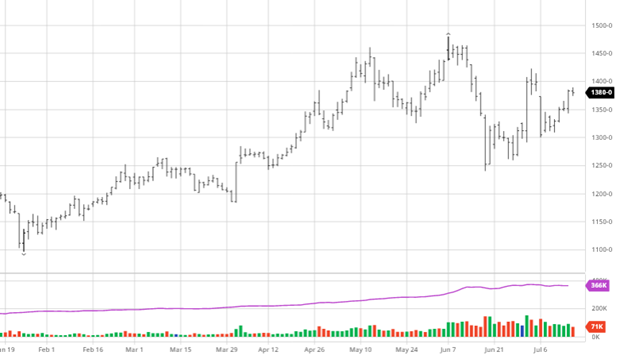

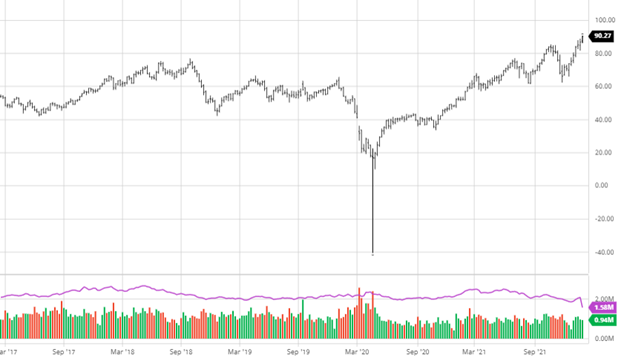

Crude Oil

Crude hit $90 this week for the first time since 2014, while Natural Gas also rose to over $5.500 before dipping back below $5 this week. Crude continues its move higher as OPEC+ does not plan to expand production while consumption remains strong. This is a classic higher demand without more supply price raise over the last two months, and many analysts see $100+/barrel as a possibility this spring. Higher fuel prices will affect farmers’ bottom lines as fuel expenses and shipping for other chemicals and fertilizers will be much higher this year on top of higher input costs. (5-year chart below for reference)

Feb USDA Report

The February WASDE report will be released next Wednesday, February 9. This will be the primary driver of the week after weekend weather has its say in the market on Monday. This is not usually a major market mover, but it never hurts to be well-positioned and ready before a report.

Podcast

Tune in as biotech guru Dr. Channa S. Prakash discusses everything from Alabama football, genetics as one of the most extensive agricultural advancements, the most significant risk factors to feeding the world over the next 30-50 years, plus everything in between.

Why producing crop plants with a much gentler footprint on the natural resources will help feed the growing population. How 75% of the world’s patents in agriculture gene editing are coming from China. Understanding that trying to impose restrictions on our ability to grow food can be a considerable risk to agriculture. Listen to hear about these topics and more!

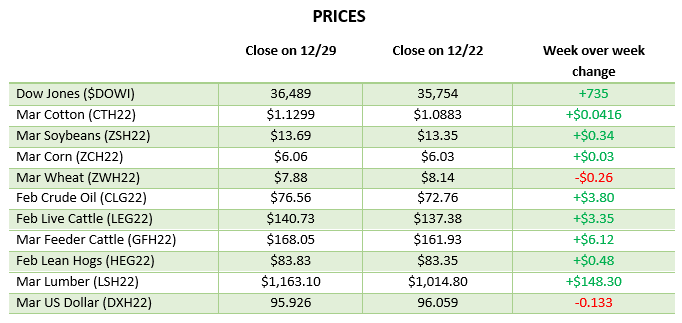

Via Barchart.com