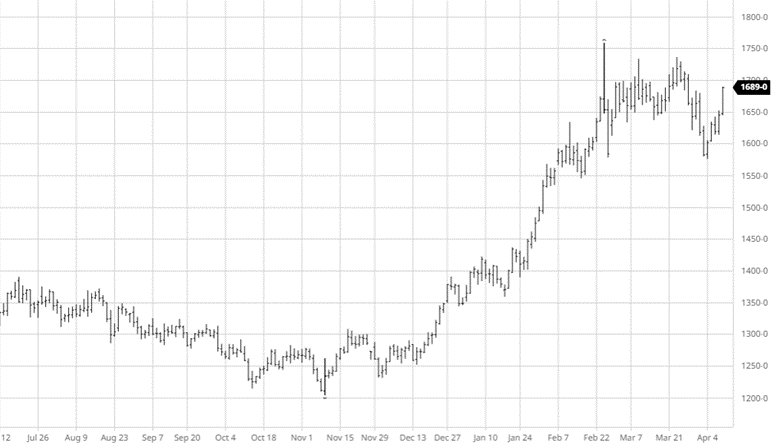

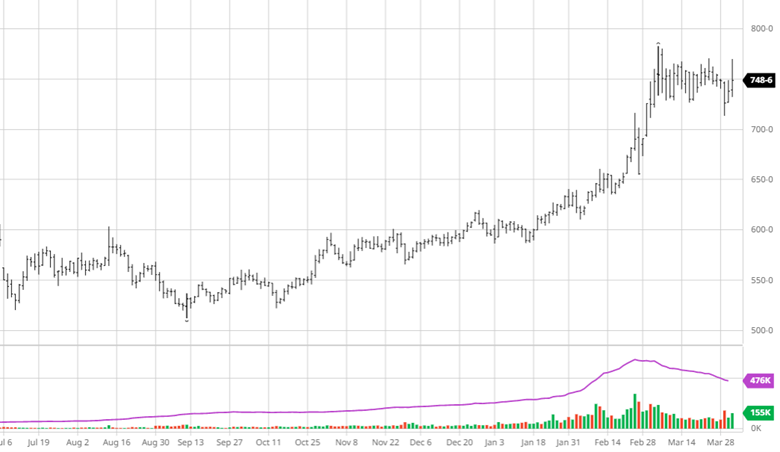

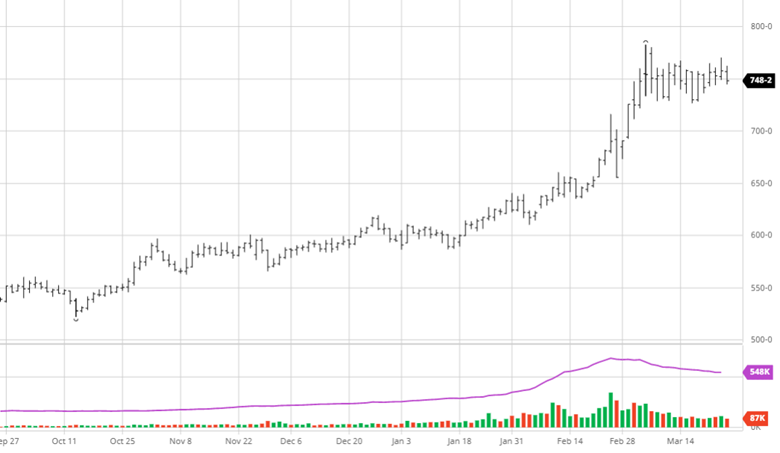

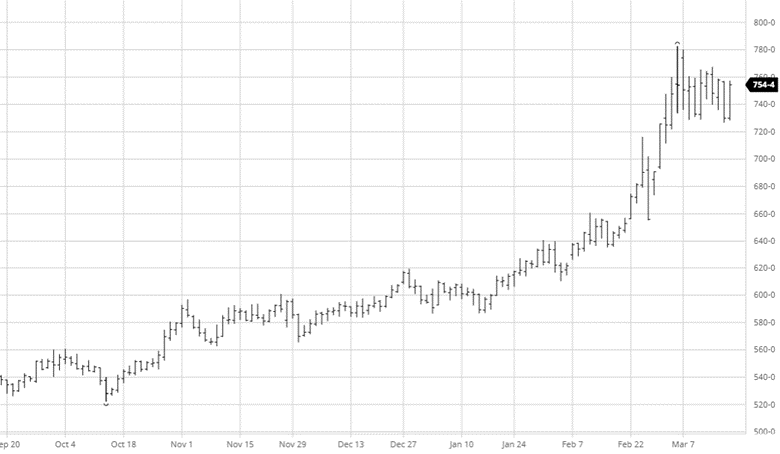

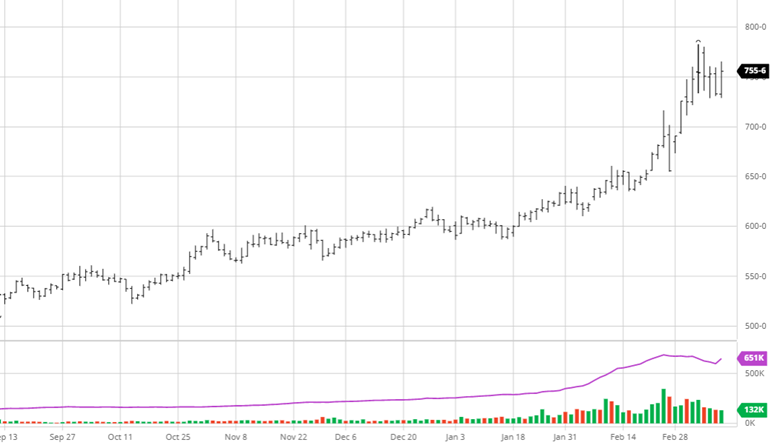

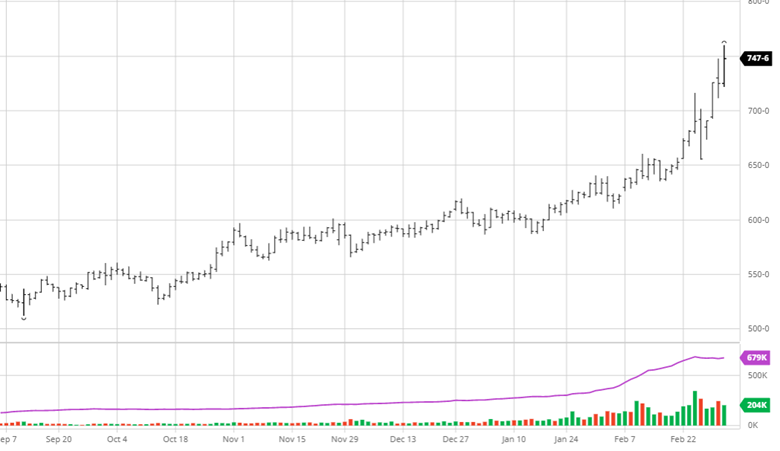

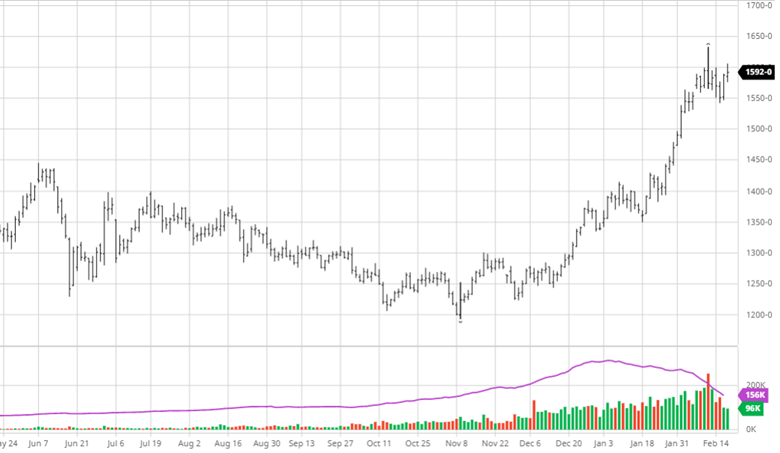

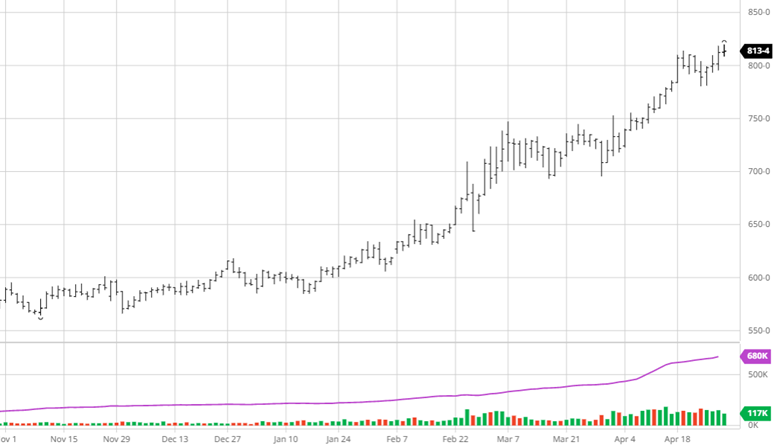

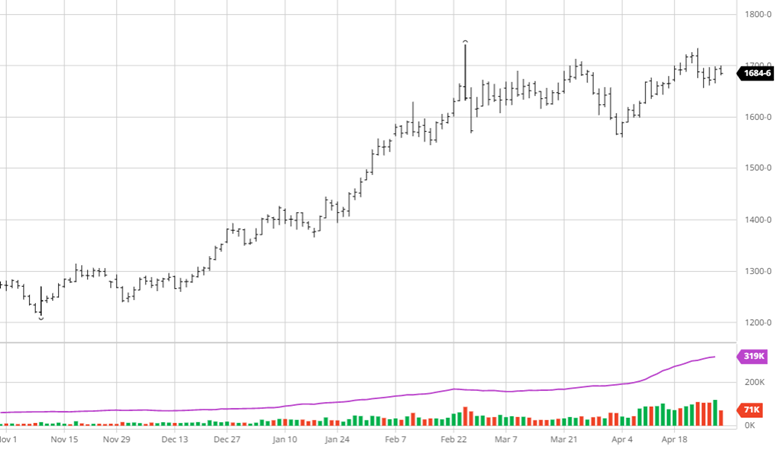

Corn continues to move higher as planting has gotten off to a slow start in the US and Brazil’s safrinha crop is facing drought conditions, shrinking their crop. The wet and cool forecasts remain into May for the north and eastern corn belt which will make it unlikely to see much planting progress in those areas. The rain will be welcome in the western corn belt that has been dry and making slow progress in planting, but the rain will be welcome for the soil even if it slows planting for a day or two. The ongoing conflict in Ukraine continues to decimate their infrastructure as Russia destroys ports and has seized stored corn to sell as their own. China was a buyer of corn this week and will hopefully continue to show up on exports as demand from other buyers has slowed. Limits have been increased at the CBOT for some commodities and corn will now have a 50 cent limit starting May 1 from the current 35 cent limit.

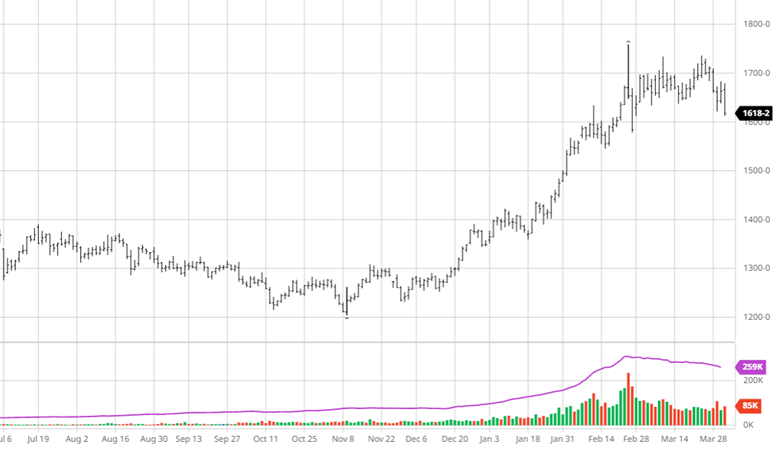

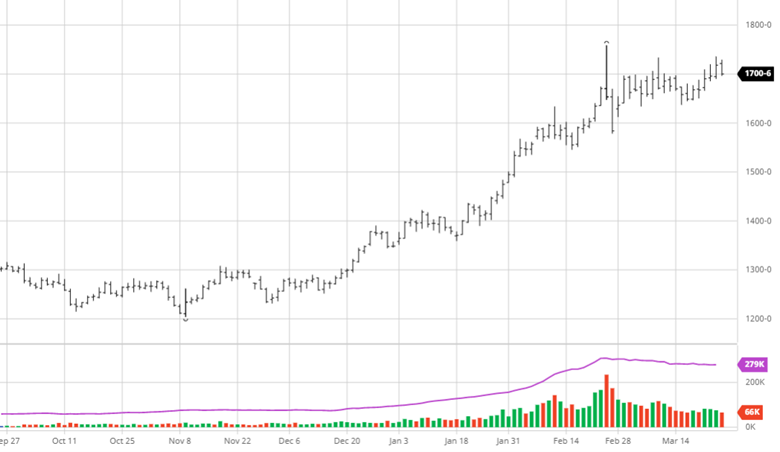

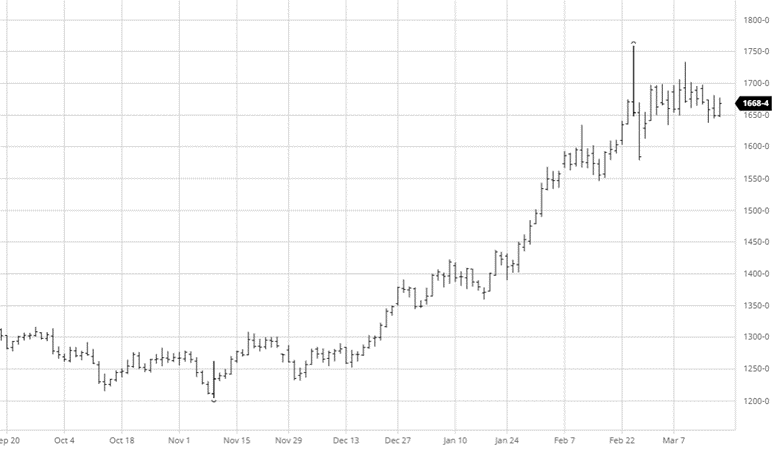

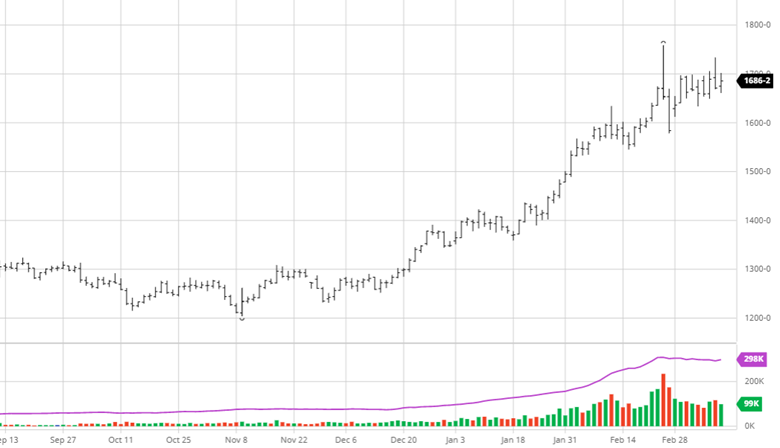

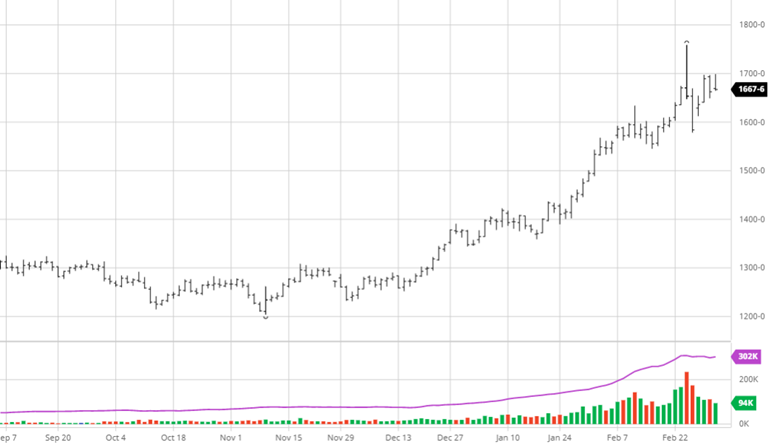

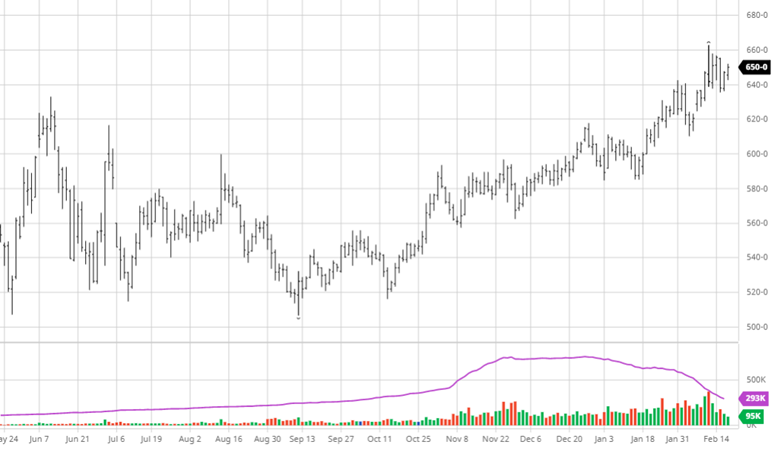

Soybeans had a small dip this week after its nice run higher from the previous dip at the end of March. Soyoil prices continue their move higher pulling beans with it while meal struggles. Indonesia placed a palm oil ban on both refined and unrefined product. The slow start to planting will ultimately roll into affecting soybeans like corn but we aren’t at panic mode yet. The start to the year has been less than ideal when the world stocks need a great year. Beans daily trading limit will move up to $1.15 effective May 1st.

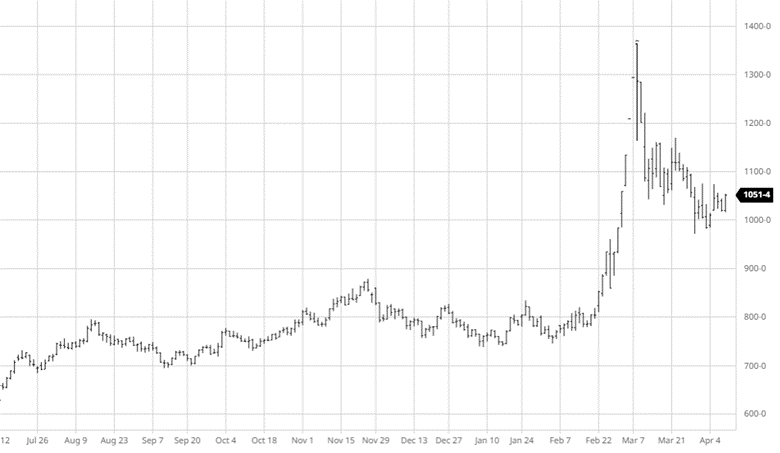

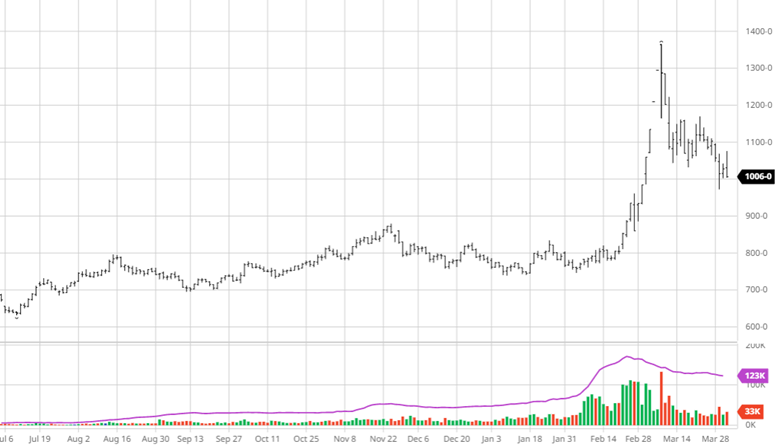

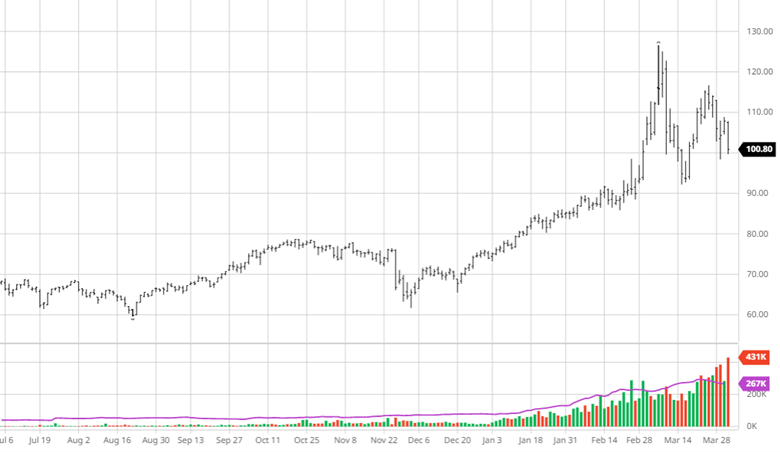

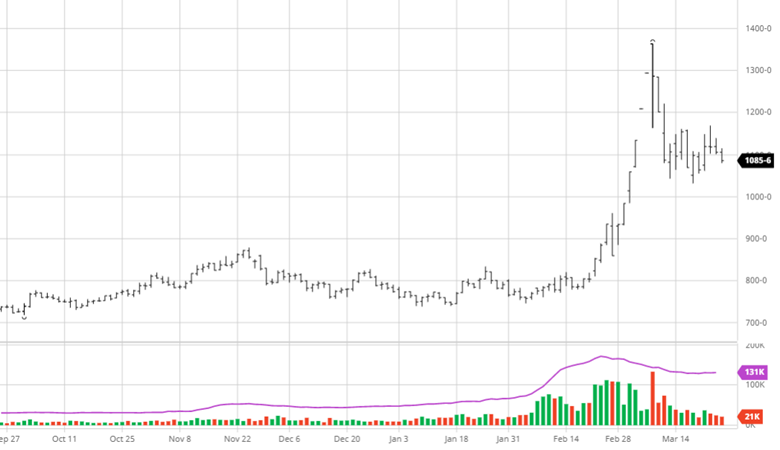

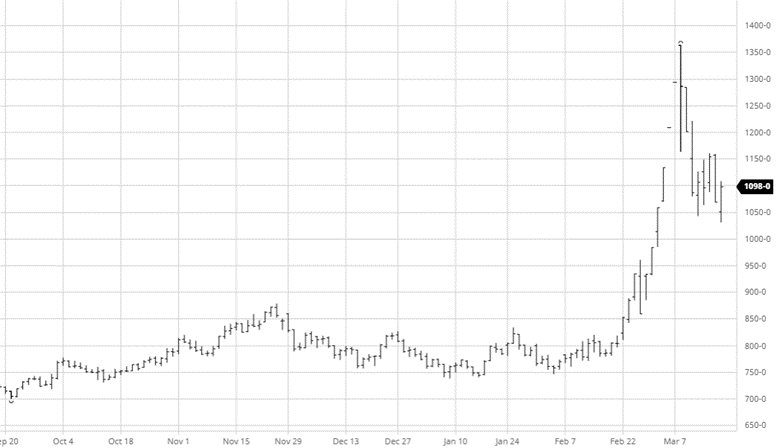

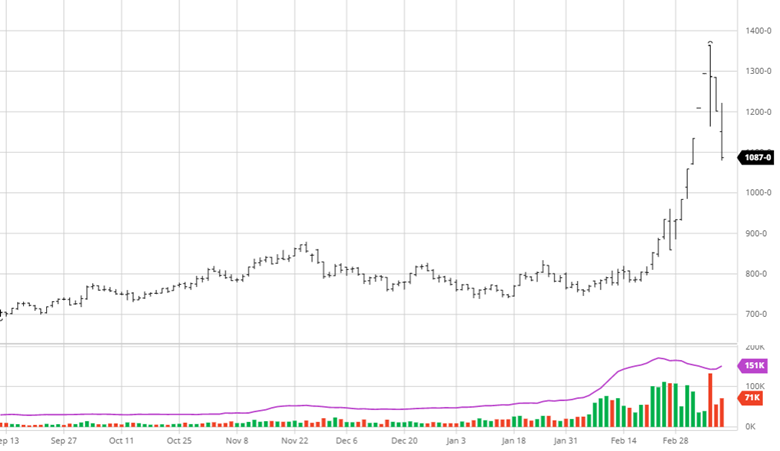

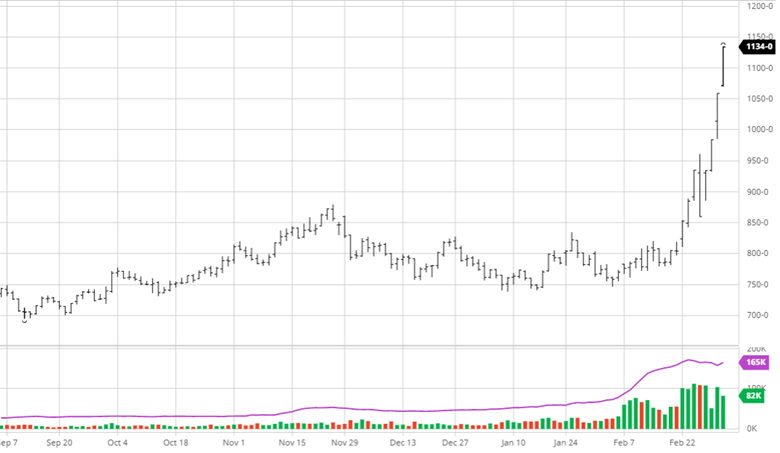

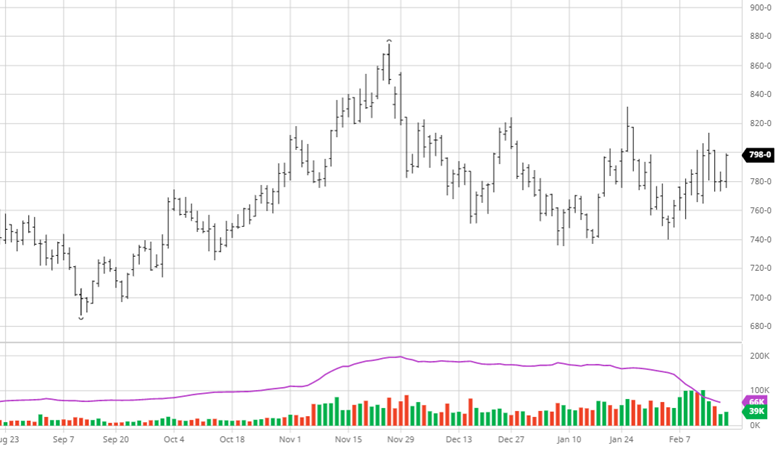

Cotton

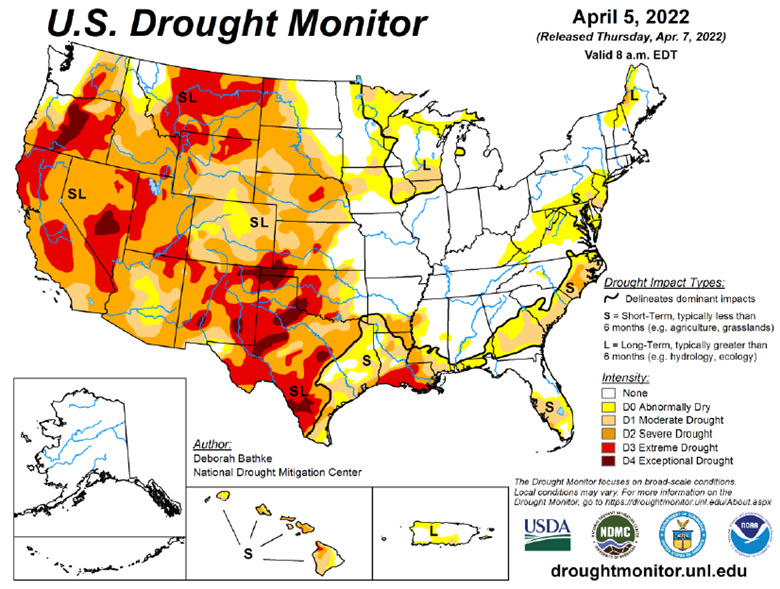

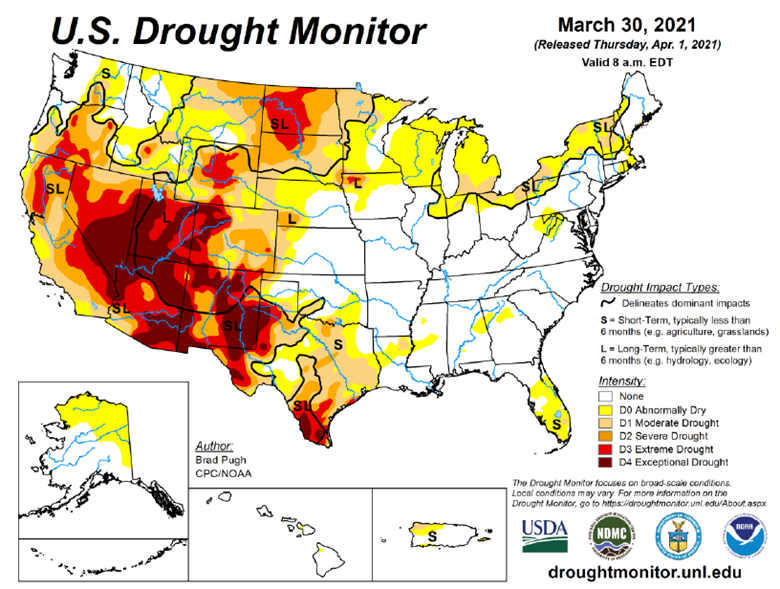

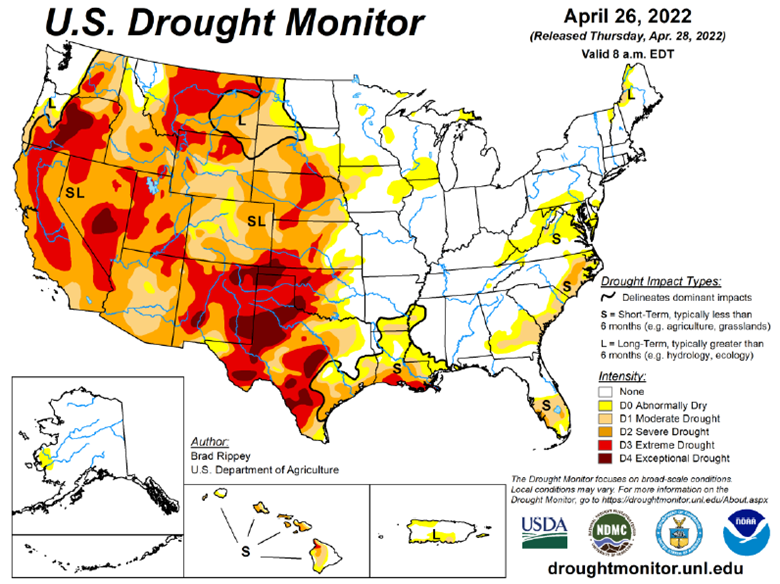

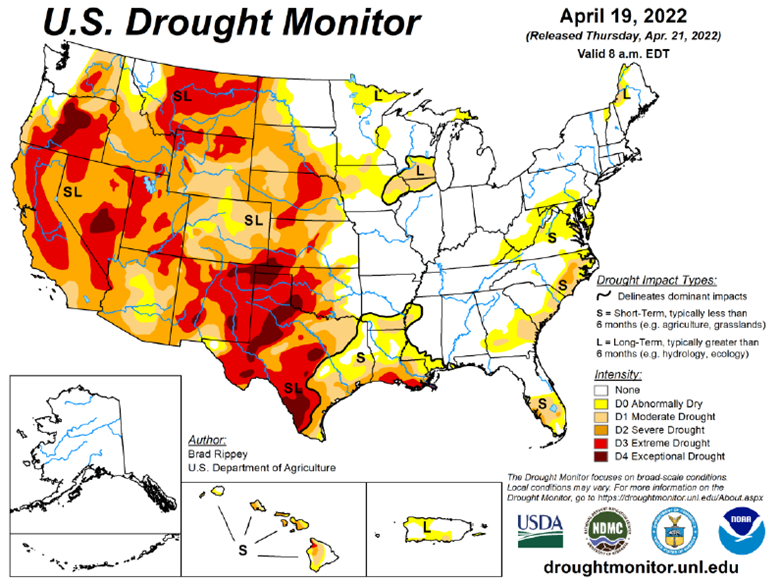

July cotton traded limit up (7 cents) on Thursday to set a new contract high at $1.4768. Export data from last week was better than the last few weeks. Cotton’s problem appears to be a lack of world supply mixed with (so far) not ideal growing conditions in Texas. Forecasts for rain in Texas are very welcome but will need to be widespread and a large amount to help the drought. (See drought map below)

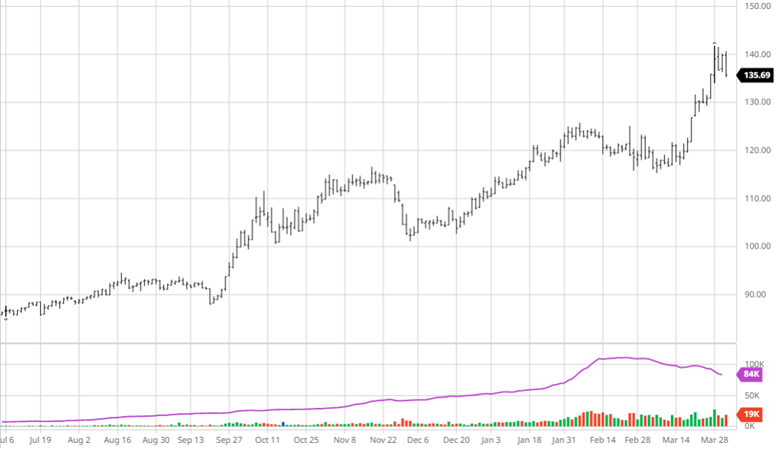

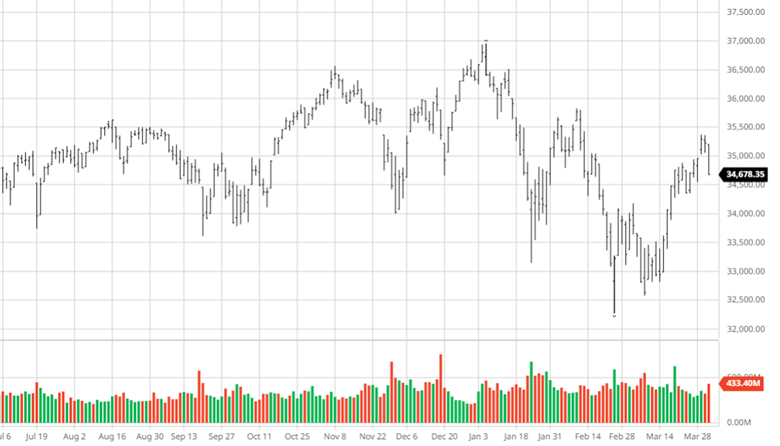

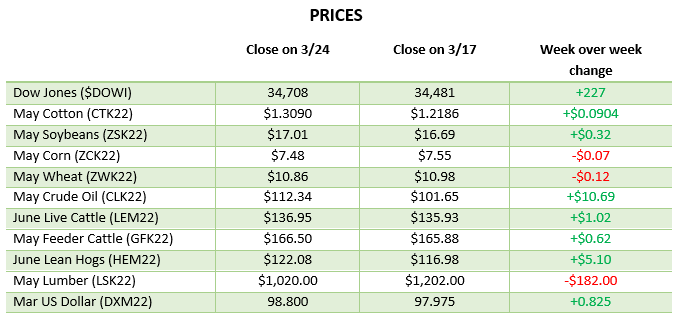

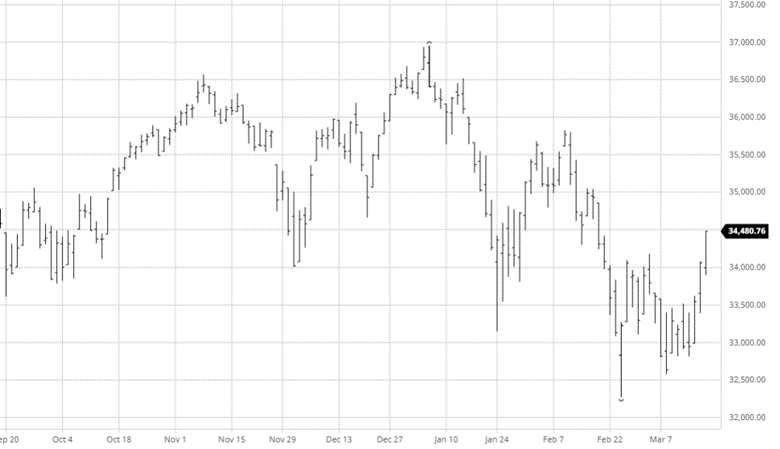

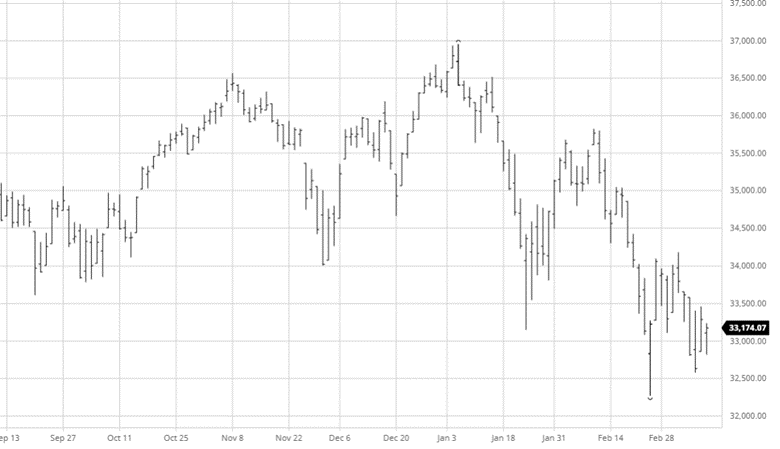

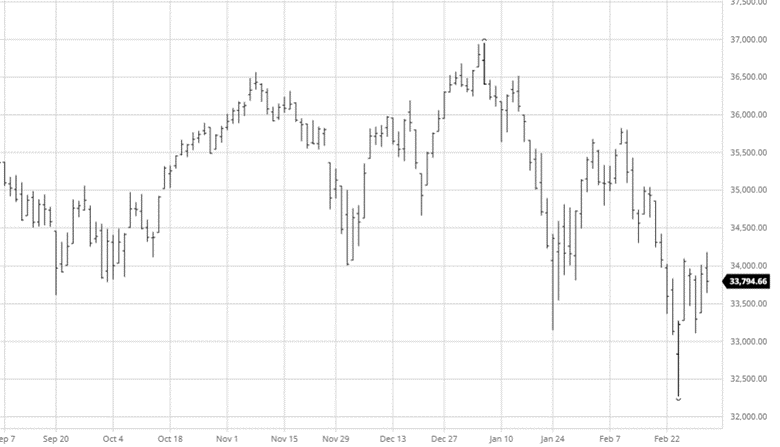

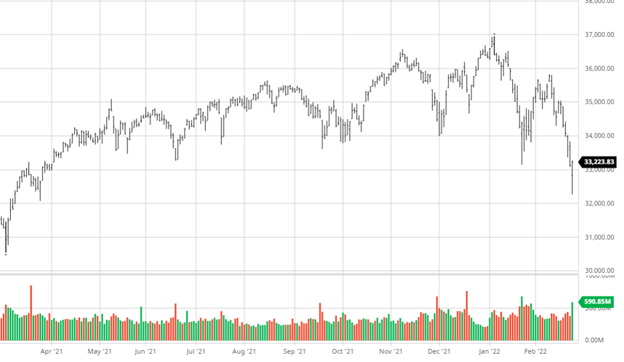

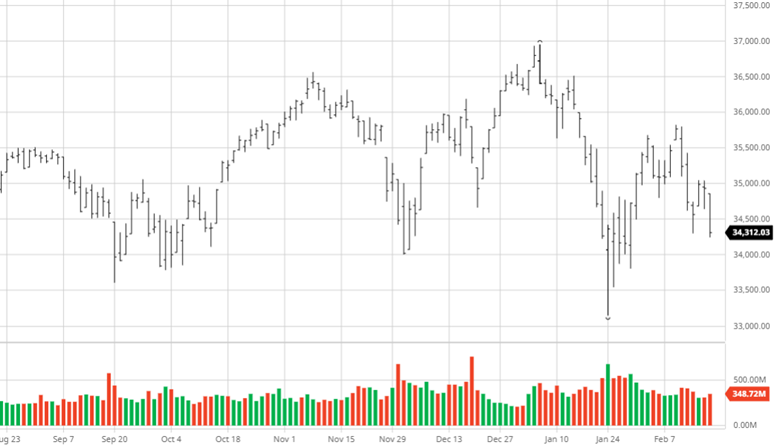

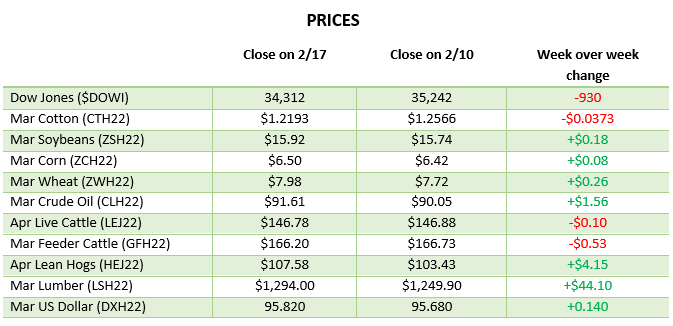

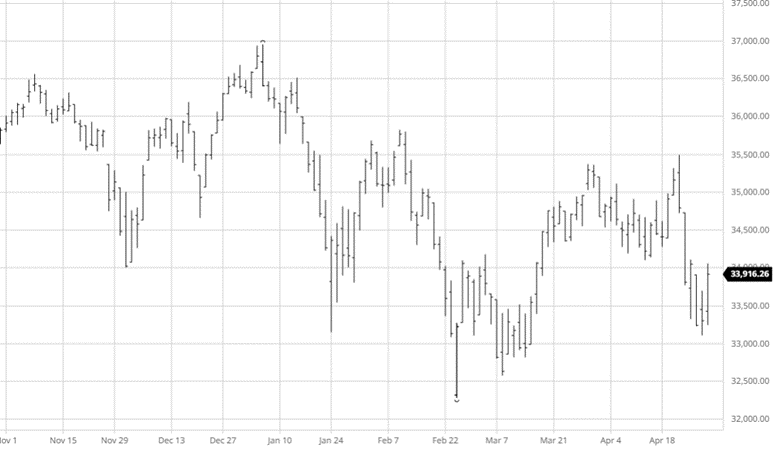

Dow Jones

The Dow was down this week as volatility continues to be in the markets as earnings continue to come across with some large companies getting crushed and others posting solid numbers. Tech companies have had a good week after getting run over the past couple months. This may not be the bottom for tech but it is nice to see some good numbers and some support.

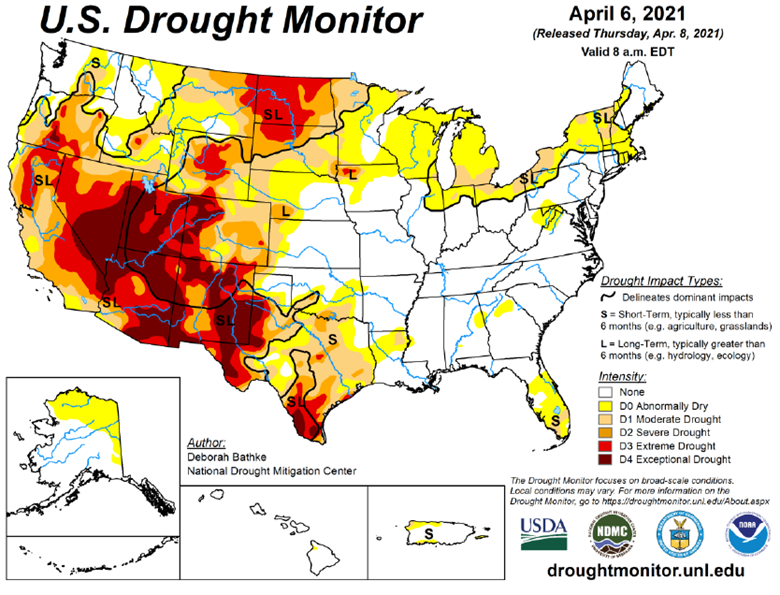

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

RCM Ag Services put a unique spin on National Agriculture Day by going international. That’s right, we jumped right into international waters with Maria Dorsett from USDA’s Foreign Agriculture Services for an interesting discussion about linking U.S. agriculture to the rest of the world.

Each year, March 22 represents a special day to increase public awareness of the U.S.’s agricultural role in society, so why not take it one step further by bringing in a global component? As the world population soars, there’s an even greater demand for producing food, fiber, and renewable resources. That’s why we’re taking a deeper dive into the USDA’s trade finance programs, like the GSM-102, which supports sales of U.S. agricultural products in overseas markets and supports export growth in areas of the world that are seeing some of the fastest population growth.

So, jump aboard (no passport needed), as Maria discusses how U.S. companies use GSM-102, what the program features, and the benefits that it offers!

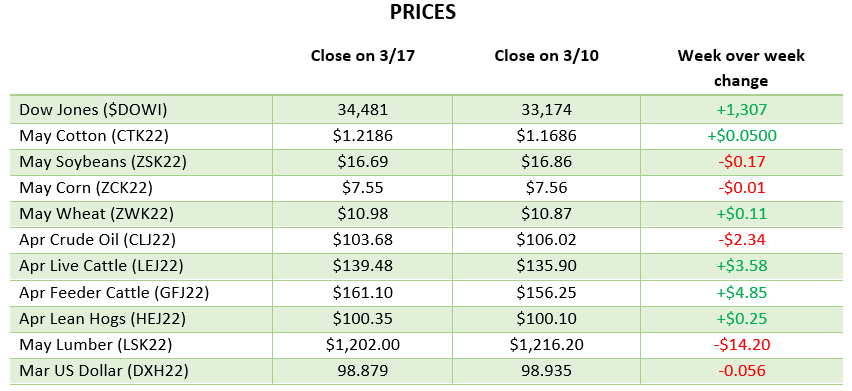

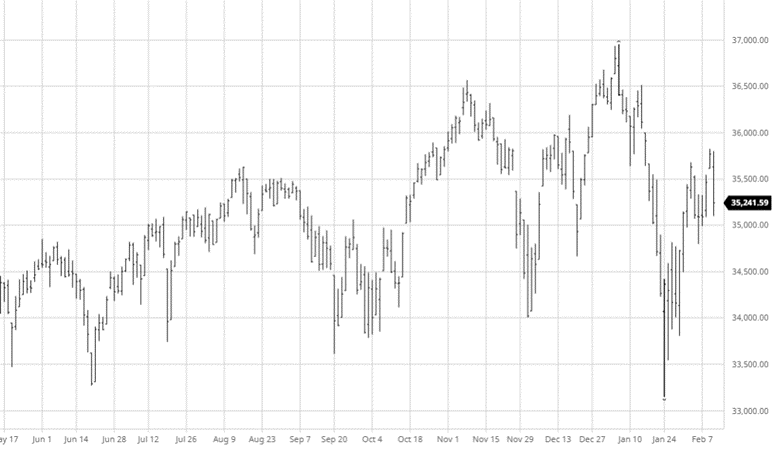

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].