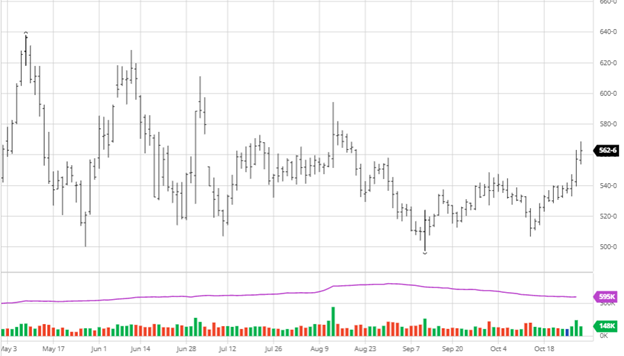

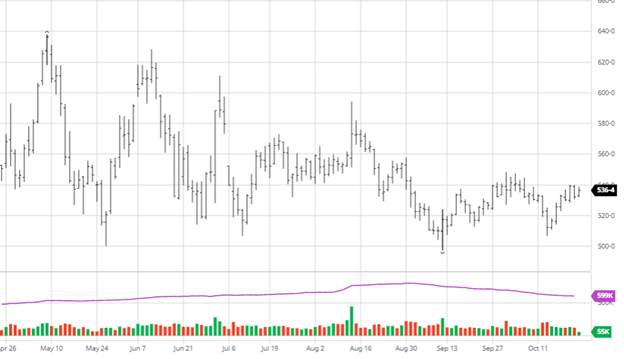

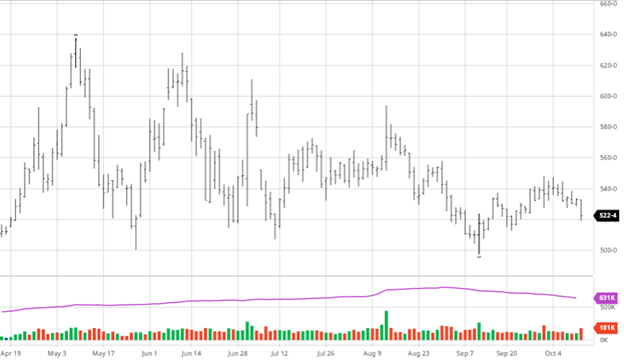

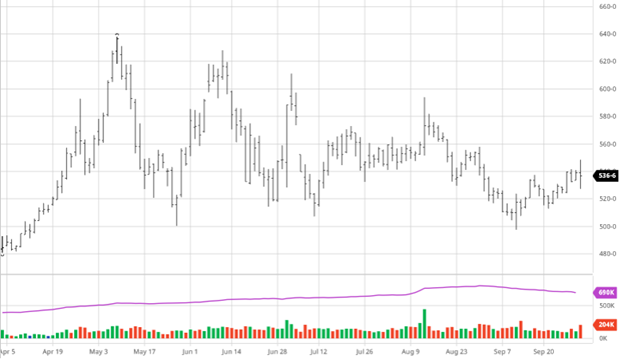

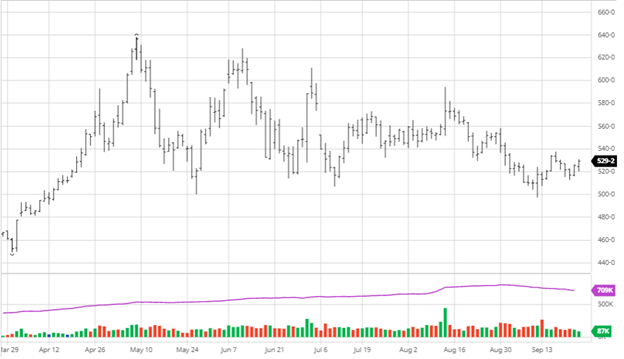

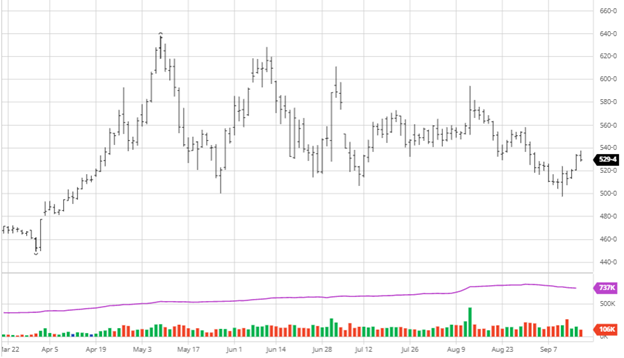

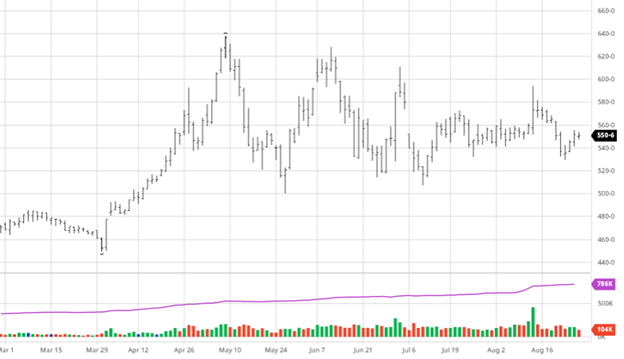

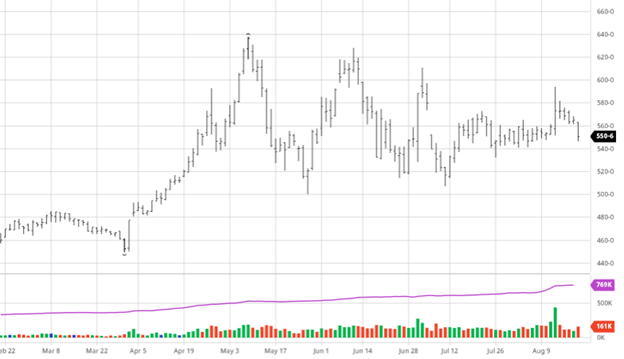

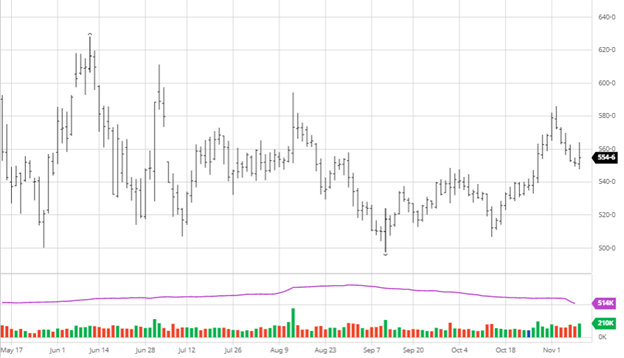

Corn was struggling this week heading into the Nov 9th USDA report, where it saw a good bounce after its release before falling back to only finish up slightly higher on the day. The corn numbers that came out of the report were fairly neutral, with a 177 bu/acre yield and 15.062-billion-bushel U.S. production. The yield was slightly raised from 176.5 the month before but was right in line with estimates, so there was no significant reaction on that number. Overall, there were not many surprises for corn as most bullish reactions came from soybeans pulling them higher with them. With ethanol margins very profitable and crude oil staying higher, the demand side will continue to keep basis levels high. As harvest was 84% complete at the start of the week, there is still time for any weather issues to create issues to finish up harvest, but this is always expected, so being this far along is helpful.

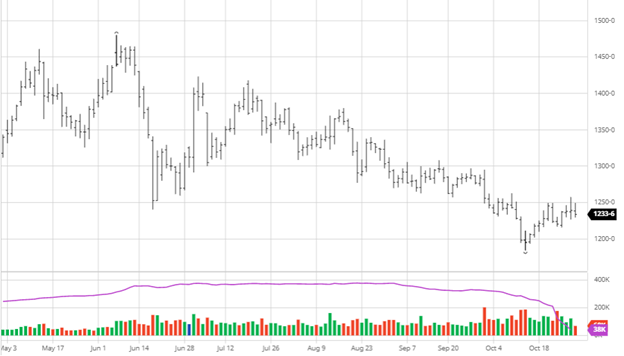

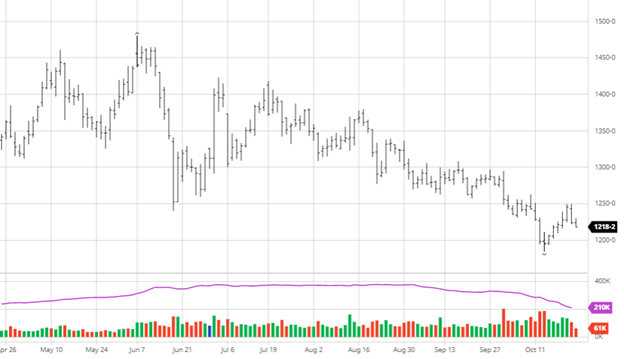

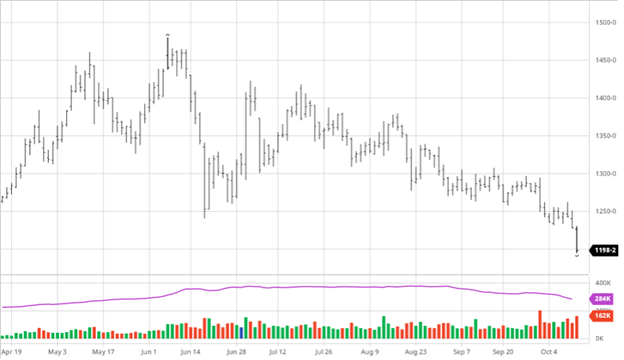

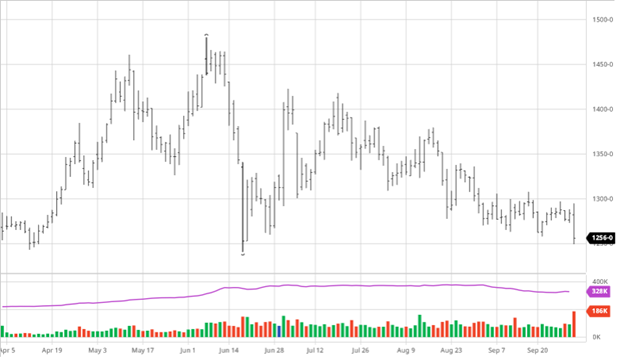

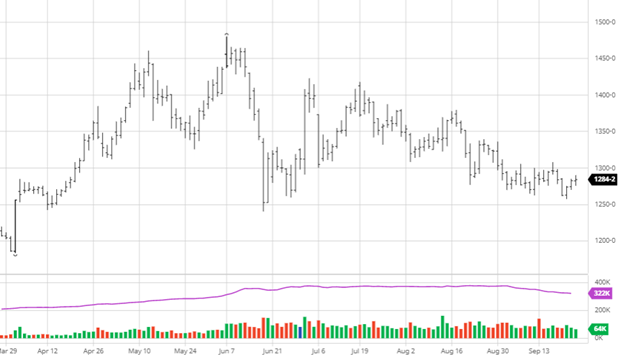

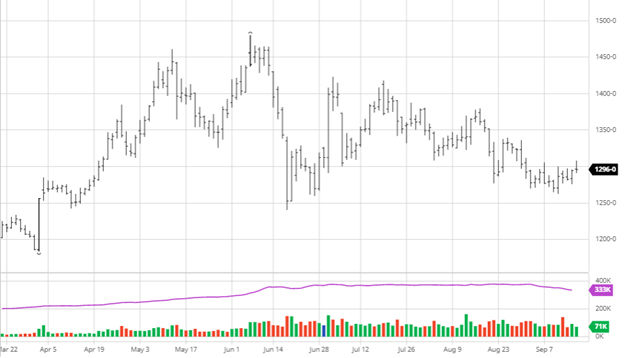

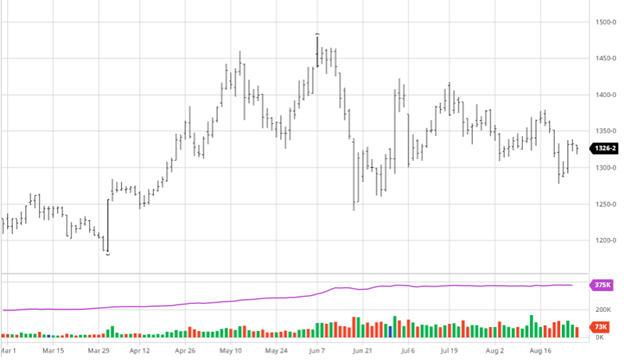

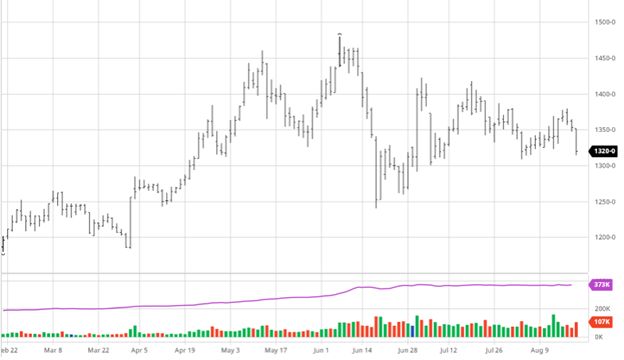

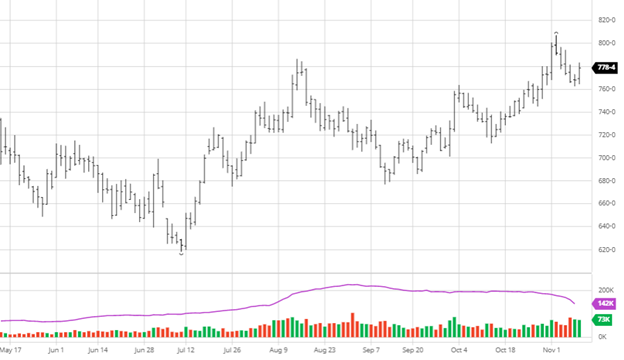

Soybeans had an excellent bounce post USDA report but finished well off the highs of the day. The yield came in at 51.2 bu/acre, down 0.3 from last month, along with lower world-ending stocks. As far as U.S. ending stocks. the USDA pegged it at a manageable 340 million bushels, slightly up from last month —these numbers are not outright bullish. South America’s weather is non-threatening right now; however, with solid world crush margins, there is not much reason for a bearish outlook heading into the winter. With funds currently flat, we may hang around this area trading until new news enters the market.

There were no surprises in the wheat report,, but it did follow beans higher after a down week leading into the report. US wheat stocks came in at 583 million bushels (pre-report estimates were 581 million) and world-ending stocks of 275.80 million metric tons (pre-report estimates 276.5 MMT). Despite the recent pullback, there is still a bullish sentiment in the market moving forward for the time being.

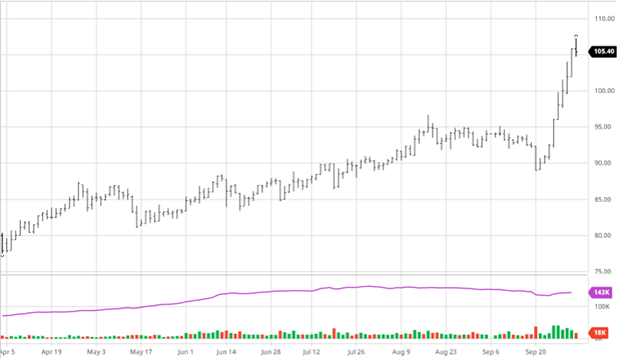

Dow Jones

The Dow has continued to trend higher this week as it has put together an impressive month despite Tuesday’s pullback. Many markets have led it higher from tech to industrials, with the new infrastructure bill playing a role.

Side note: The crypto markets have also been on a tear the past couple of weeks. It will be interesting to watch heading into the end of the year after an impressive last year and a half.

Podcast

For the past year, commodity prices have perpetually soared and continue to trend higher. We’re diving into the fertilizer forecast with a unique guest, Billy Dale Strader, a branch manager for Helena Agri-Enterprises in Russellville, KY., who is truly at the epicenter of the rising fertilizer prices.

Billy Dale planted his agriculture roots on his family-owned farm and has managed regional seed and chemical sales at Helena for the past decade. In this week’s pod, we tackle the big question for farmers and ultimately end-users — is the impact of higher-priced inputs, like seeds, chemicals, and fertilizer, on the supply and demand for the major U.S. crops? Listen or watch to find out!

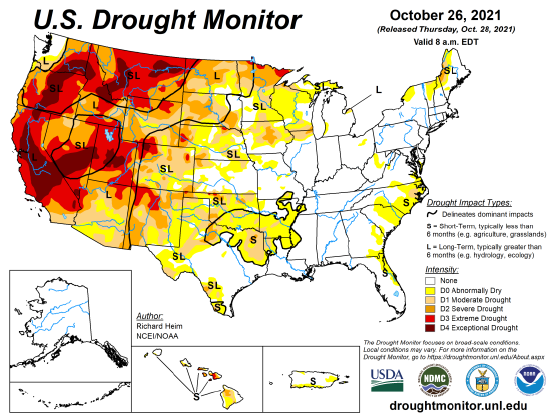

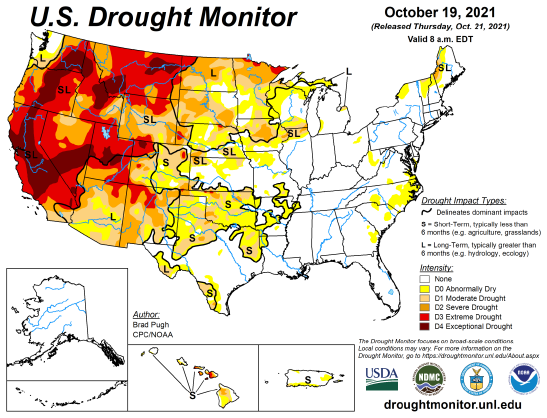

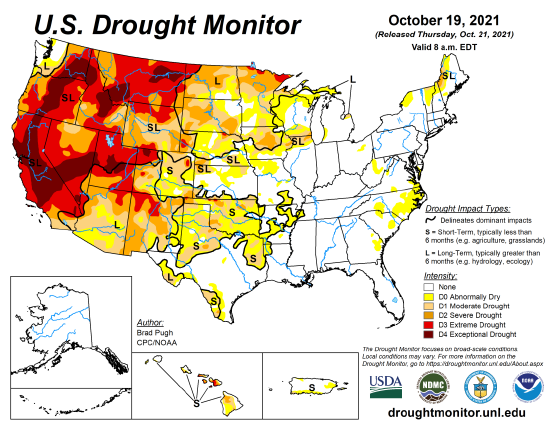

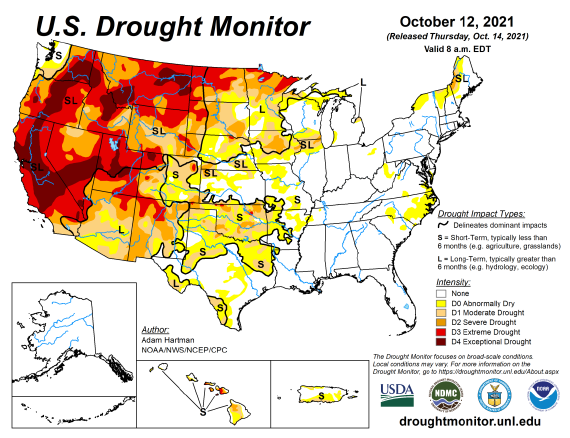

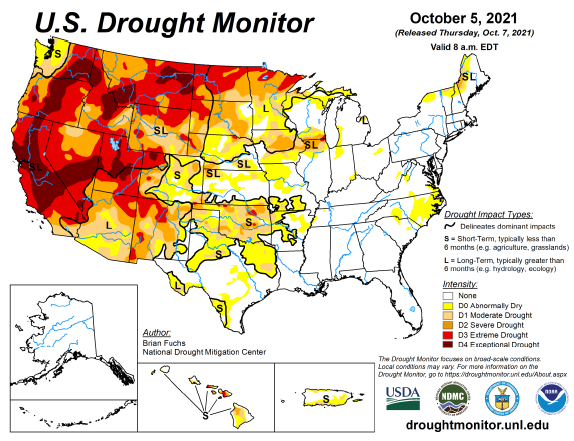

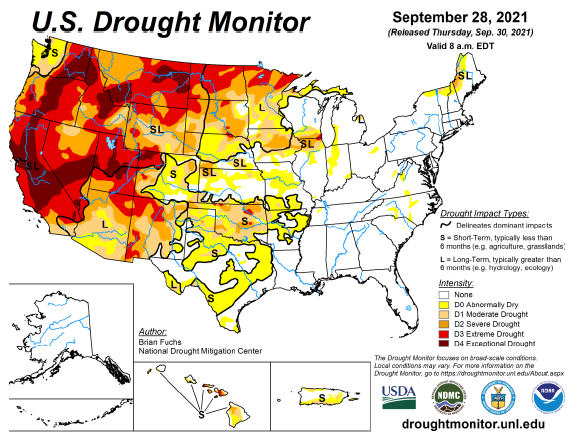

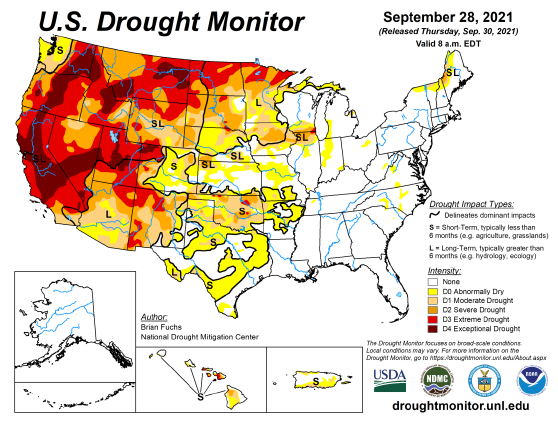

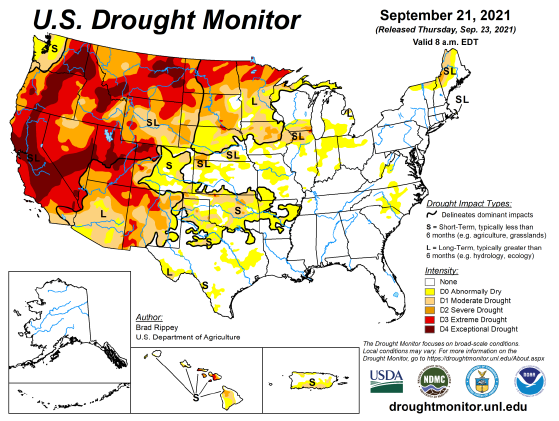

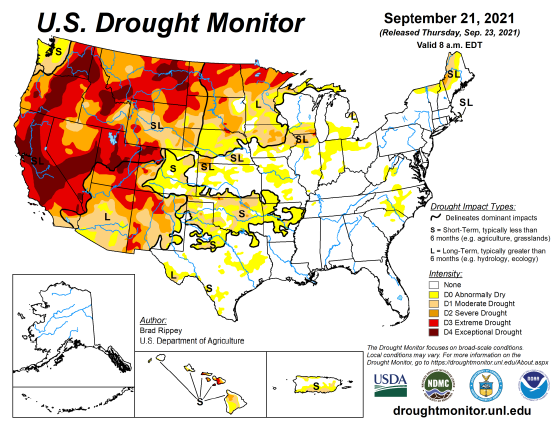

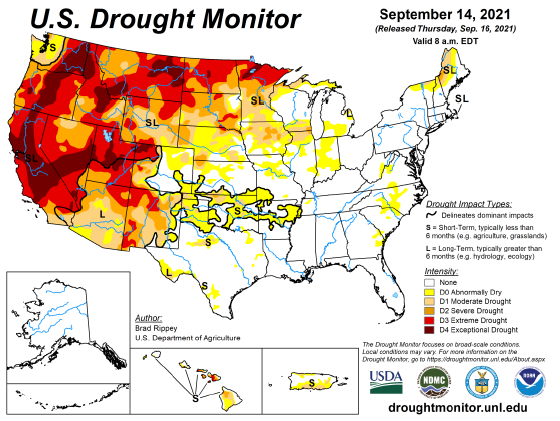

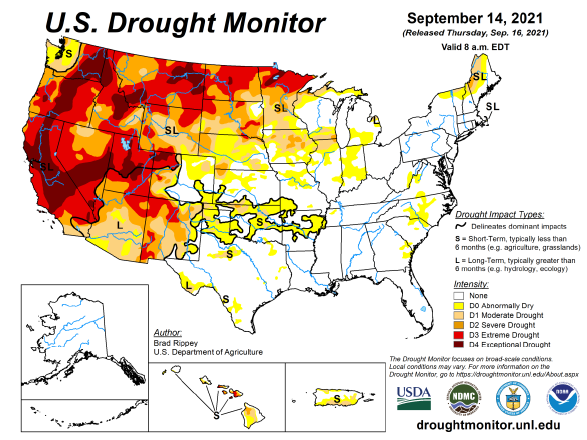

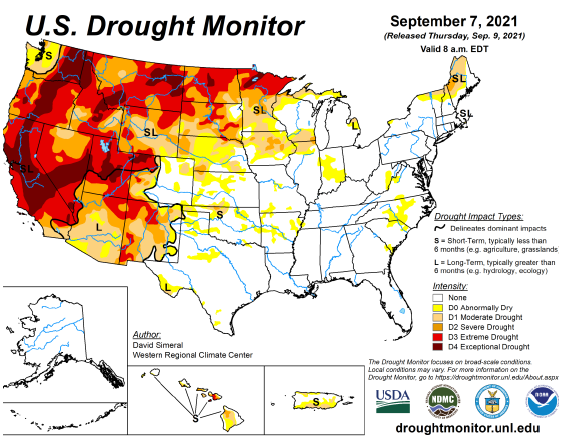

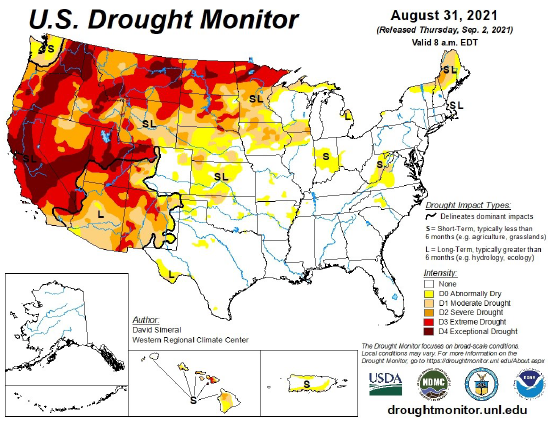

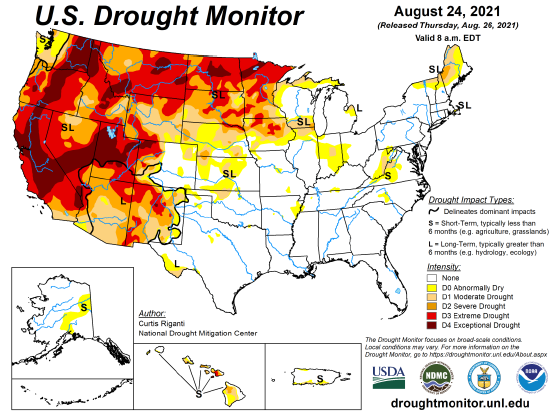

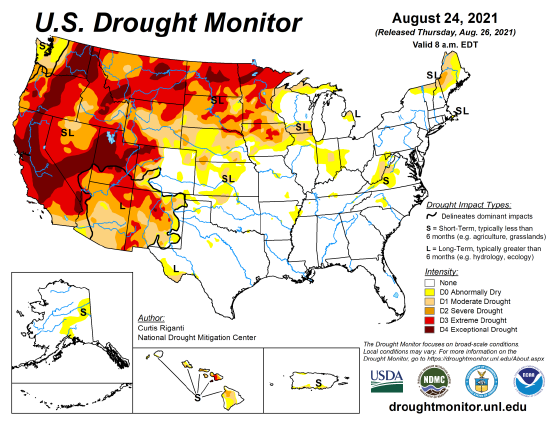

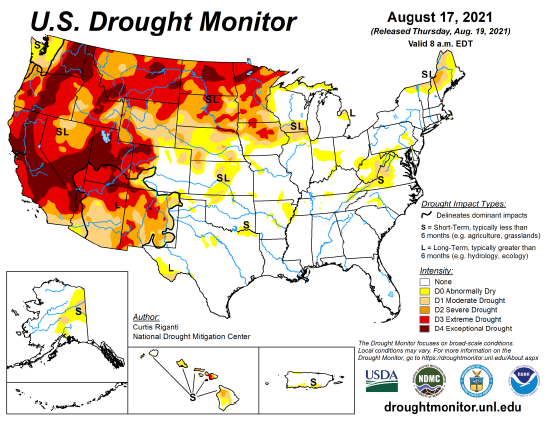

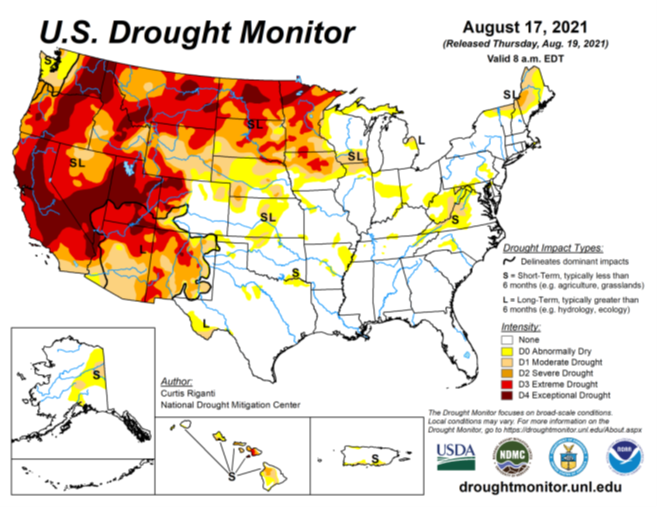

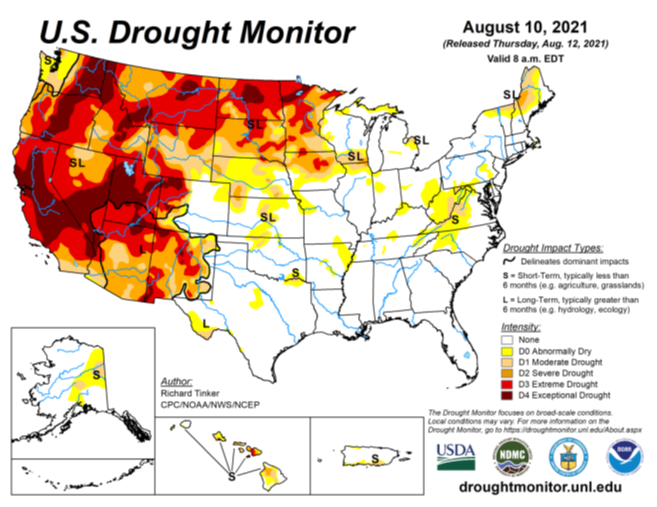

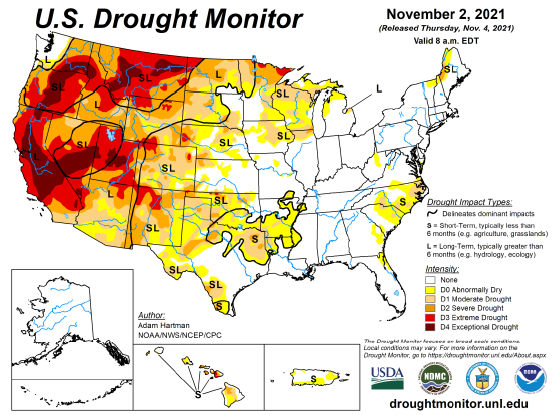

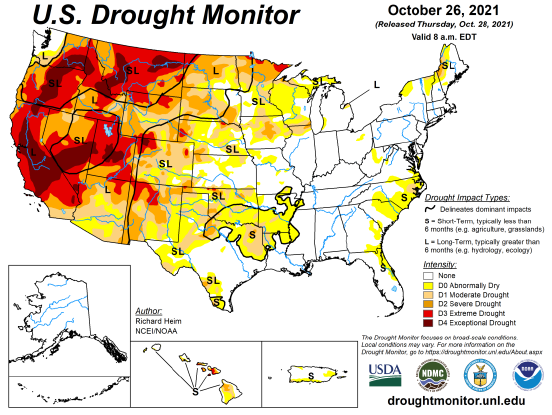

U.S. Drought Monitor

The maps below show the U.S. drought monitor and the comparison to it from a week ago. The outlined areas in black are areas that the drought will have a dominant impact.

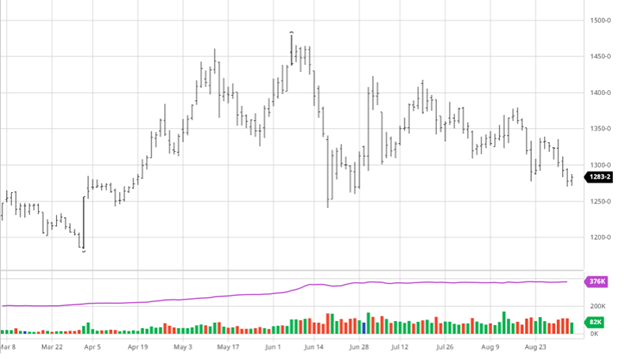

Via Barchart.com