AG MARKET UPDATE: AUGUST 21 – SEPTEMBER 1

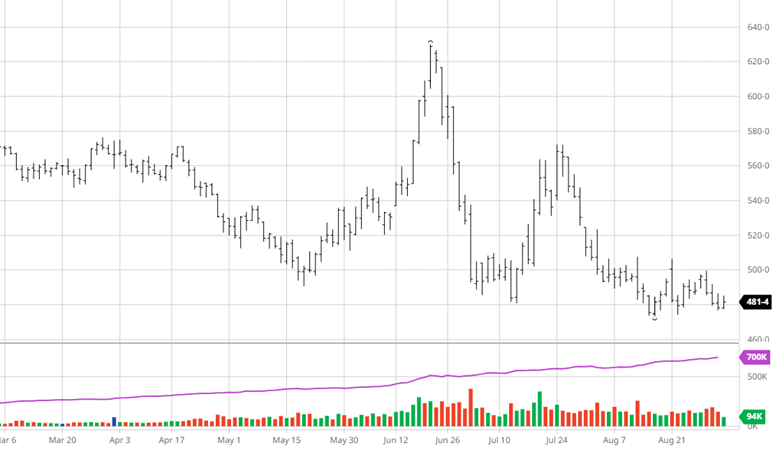

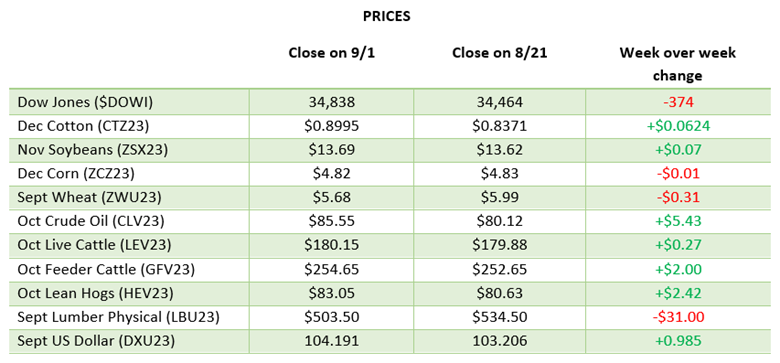

Corn has been range bound lately looking for anything to give it direction. The heat and dryness currently happening across most of the US is bullish, but the rains and cool weather before may have given this crop enough to weather the heat. There has been some rain added to the forecast but far enough out to not get too excited about yet. Exports remain steady and within expectations with no major changes expected. Corn has been held down with wheat while Russia sells their wheat for cheap on the world market to pay for the war in Ukraine. Last week’s Pro Farmer tour came back with a 172 bu/ac yield for the US, below the latest USDA report by over 3 bu/ac. While many estimates think the latest USDA is still probably too high, a 172 yield is closer to other estimates even with the current heat. The long weekend always allows for news to change and create a volatile trade to start next week.

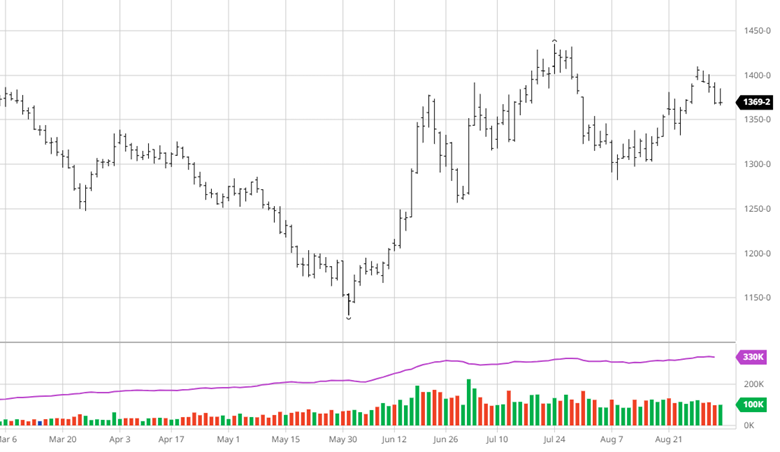

Soybeans fell this week following helpful rains before the heat. The Pro Farmer tour estimated the US crop to be 49.7 bu/ac, below the USDA projection of 50.9 bu/ac. The soybean balance sheets are tighter than corn and will only get worse the more this crop shrinks down the stretch. New crop sales are well behind USDA projections of an 8% decrease for the 23/24 marketing year, currently running 37% behind last year’s pace. With a shrinking crop it is hard to expect export sales to significantly ramp up but if drought conditions continue with heat and river levels stay low we could see logistic problems again this year. The next few weeks will be important to finish this crop but with harvest approaching most of the damage has likely been done.

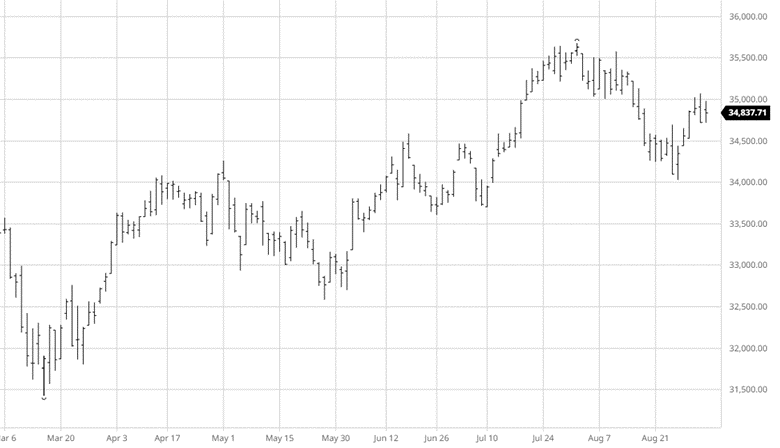

Equity Markets

The equity markets rallied over the last two weeks with some important stocks posting strong quarters such as Nvidia. After a tough August the markets will look to bounce back in September with economic data and Fed decisions in the coming weeks.

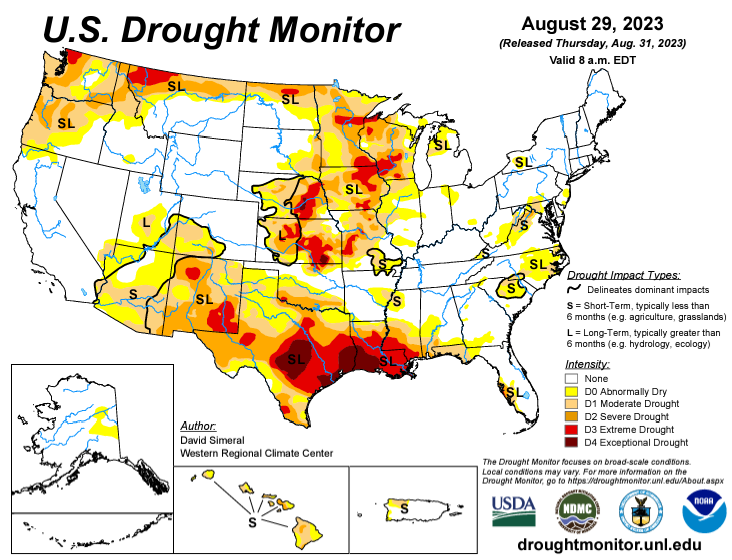

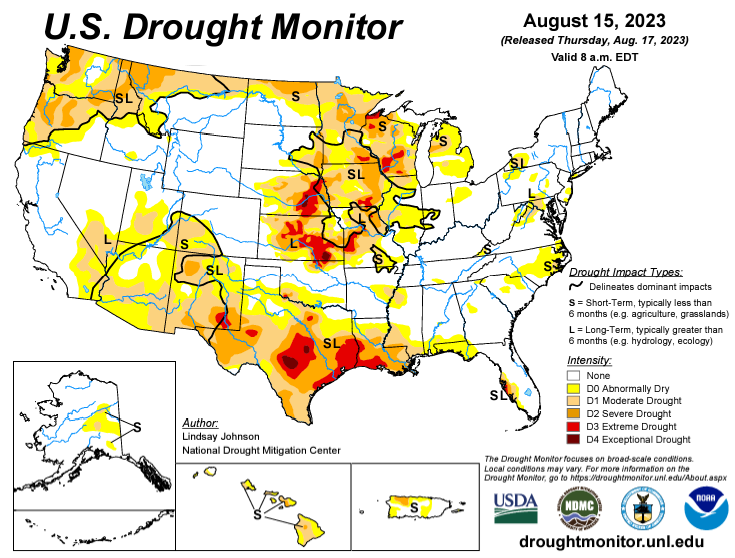

Drought Monitor

The drought monitors below show the change in drought conditions over the last 2 weeks.

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.