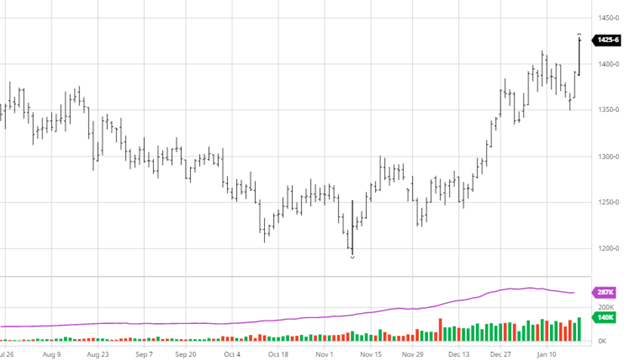

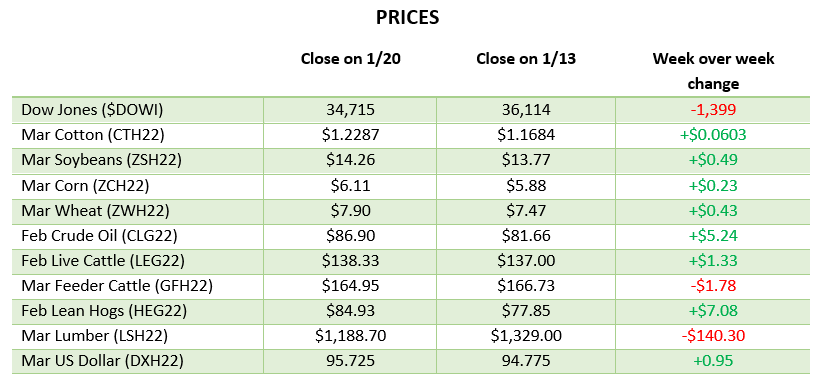

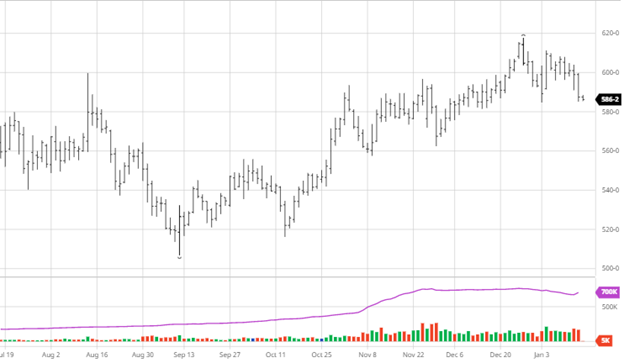

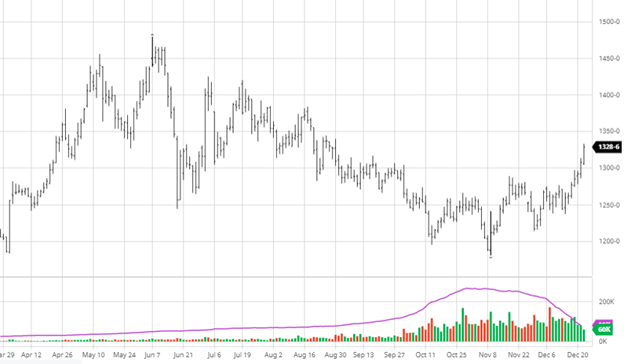

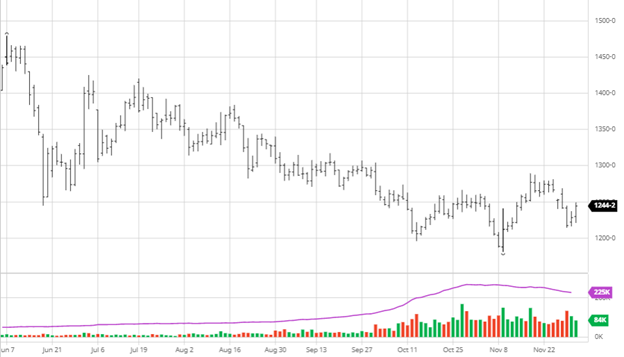

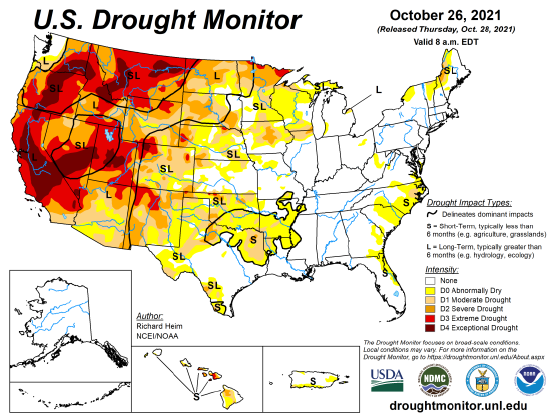

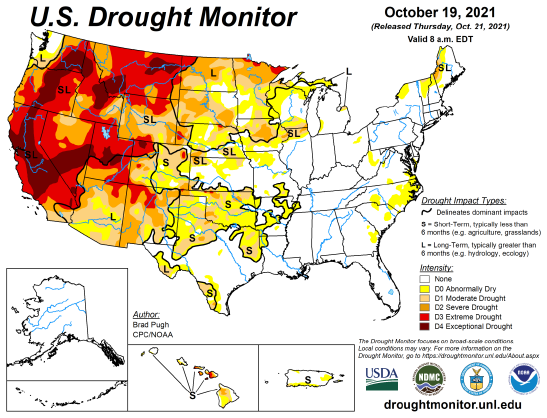

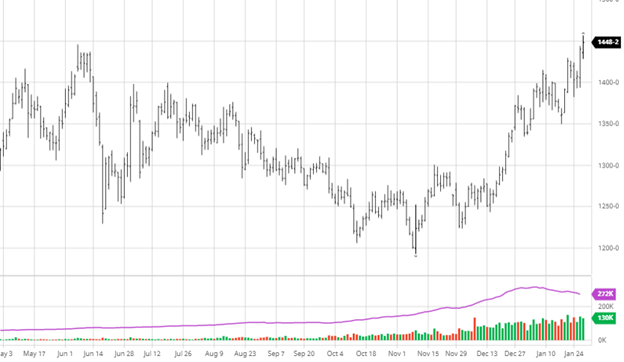

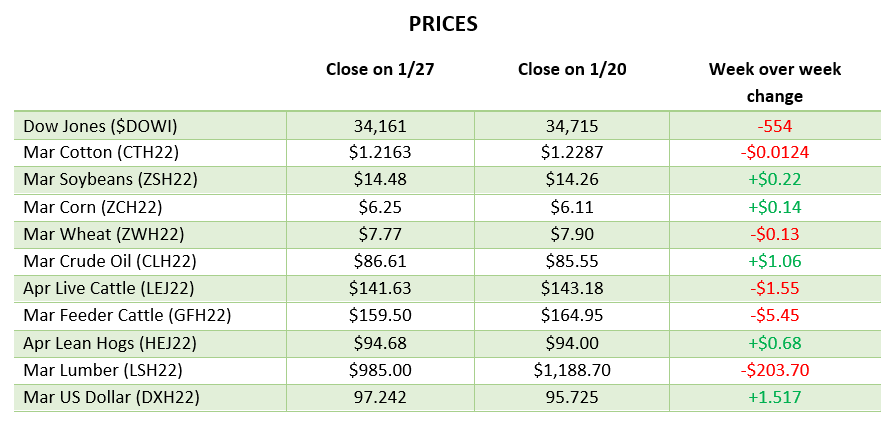

Corn continued its rally this week as grain bulls and inflation continue to drive it higher. The yield losses in South America continue to have news around it as the reality of significant losses begins to set in. Too much rain and heat or not enough rain and heat have been driving the issues, with very few areas having excellent growing conditions. With the Chinese New Year coming up, China will disappear from the export reports for a little bit, but once they come back, the market will have a better idea of where Brazil and Argentina sit. If the rumored losses come to fruition, we could see China increase its purchases. Corn has continued its rise while wheat struggles to make up its mind with confusion around the Russia and Ukraine situation. Any escalation there will result in more bullish factors in the market. Despite some volatility, energy prices continued their rise, with crude oil hitting a new high this week. Ethanol plants will continue to produce even with higher corn prices as long as their margins remain strong despite resulting in less fuel consumption. Many energy companies think we could see $100+ Crude in the next few months.

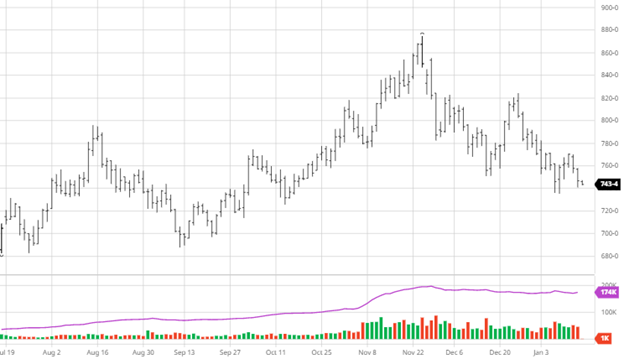

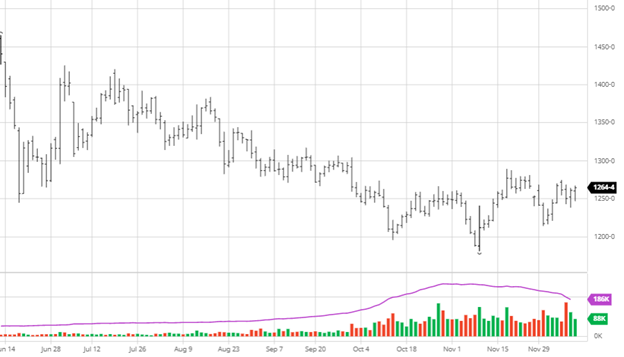

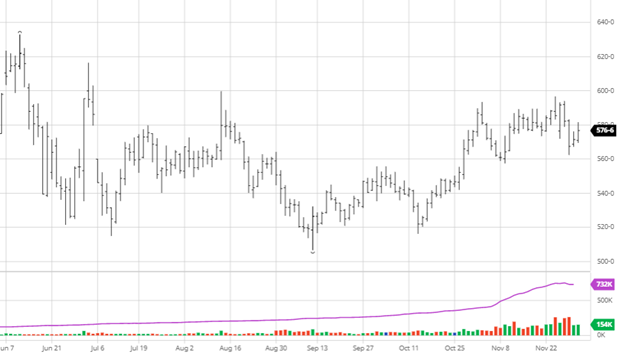

Soybeans continued to move this week on similar news as corn with South America’s issues and continued world veg oil strength. With strong veg oil prices pulling beans along with it as long as that lasts, we can expect some support under beans with any lower moves. Like corn, if private estimates of losses to the South American crop become a reality, we should continue this run higher. If China comes back from Chinese New Year and starts picking up bean purchases, mixed with world veg oil prices could see this rally continue. Acreage estimates for 2022 have been coming out, with Informa pegging the US bean crop at 87.8 million acres. This is slightly higher than the 87.2 million acres from 2021, but we have a long way to go before we get to that point.

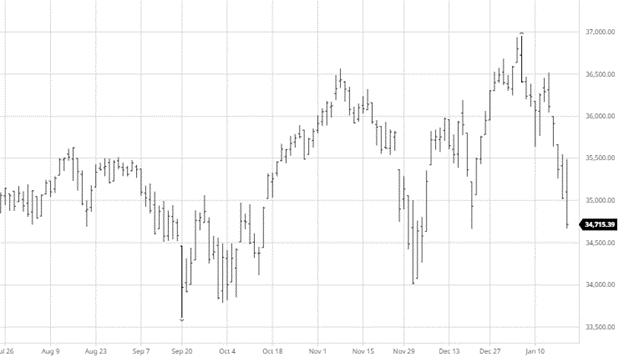

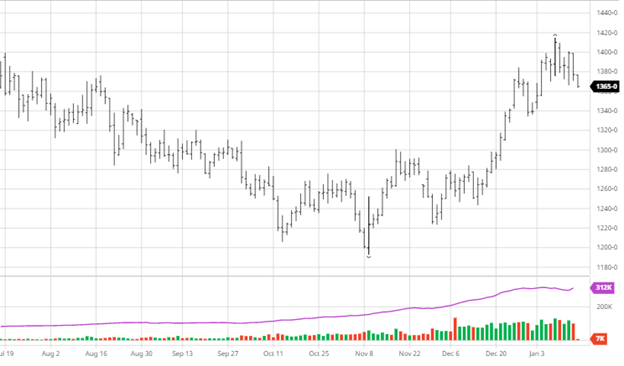

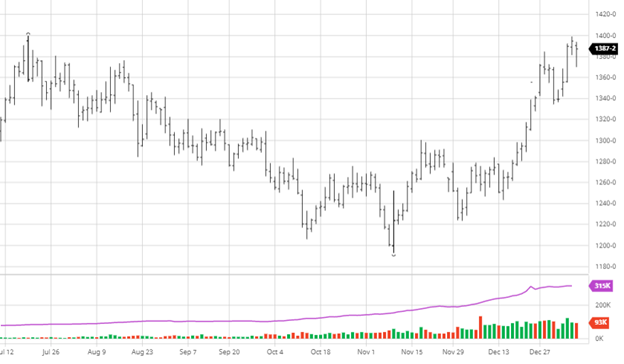

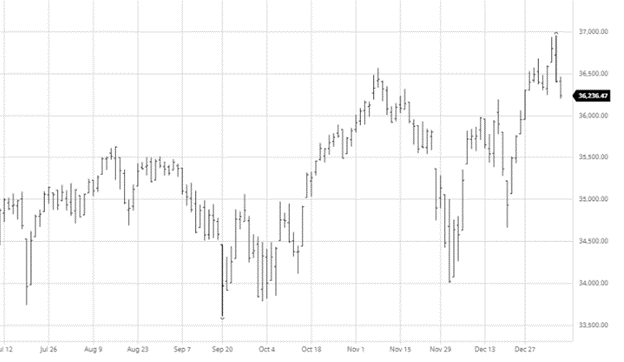

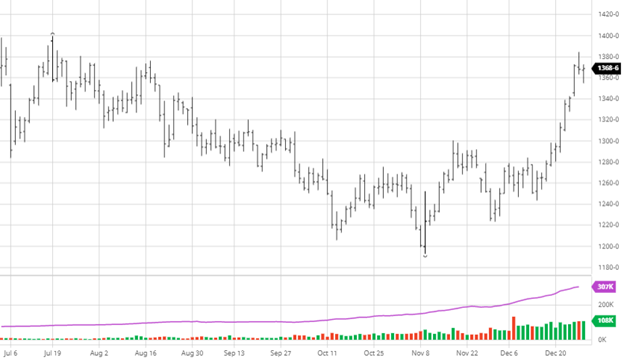

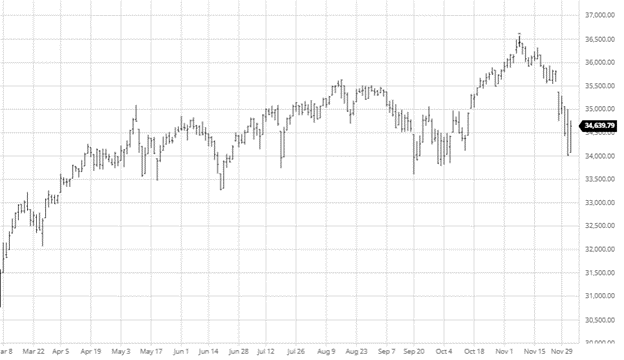

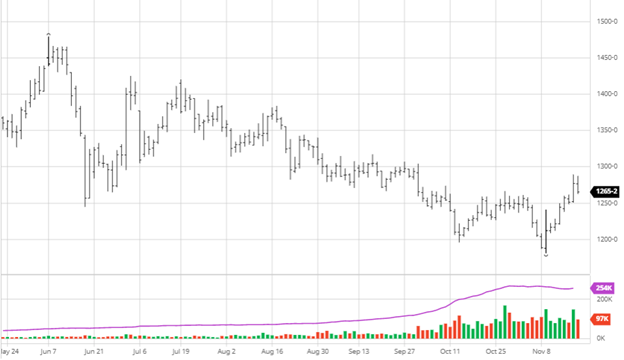

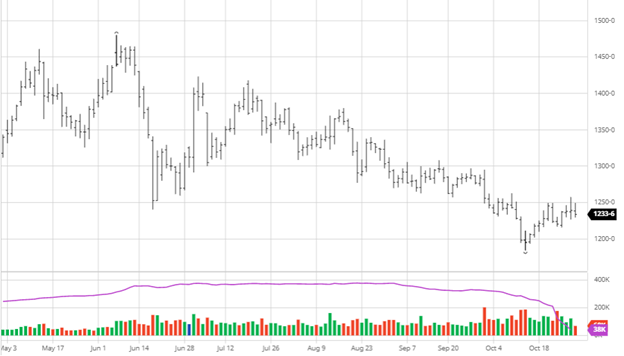

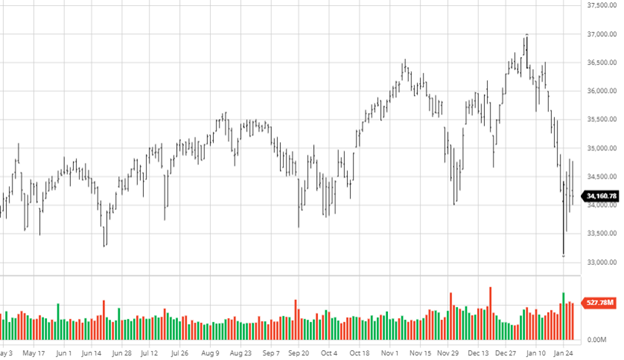

Dow Jones

Equities had quite the week with large intraday trading ranges as the market does not seem to make up its mind. This week, the Fed’s decision to leave interest rates as-is means we should expect a raise from the March meeting. The Fed also said they would adjust asset purchases moving forward. The tensions between Ukraine, Russia, and NATO remain a large question mark, but it appears Putin may not do anything until after the Olympics. This will be important to keep an eye on for equities and commodity prices.

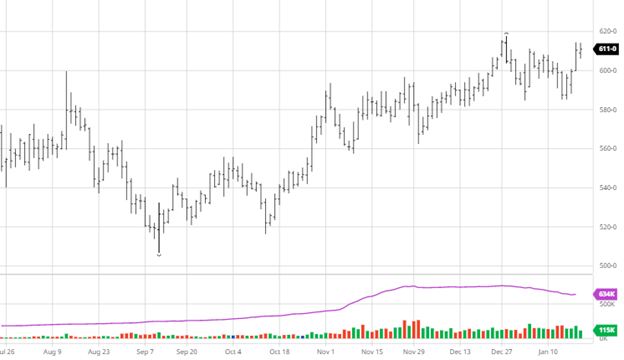

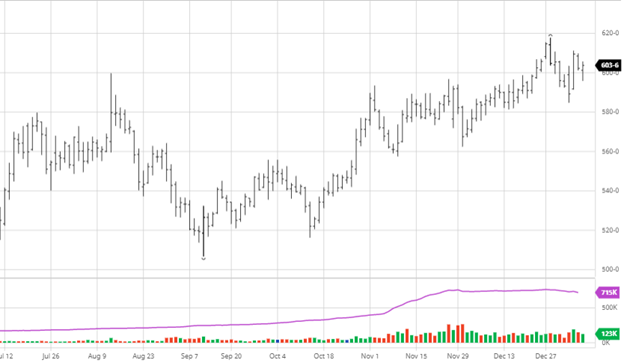

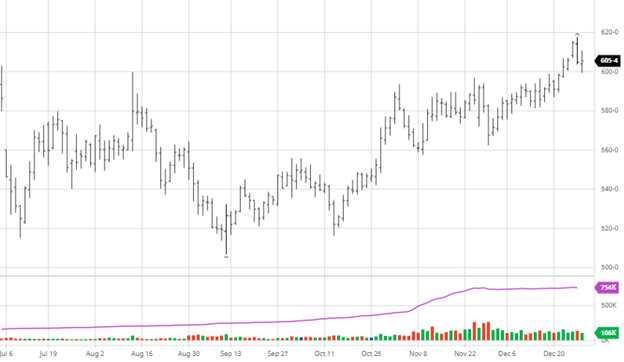

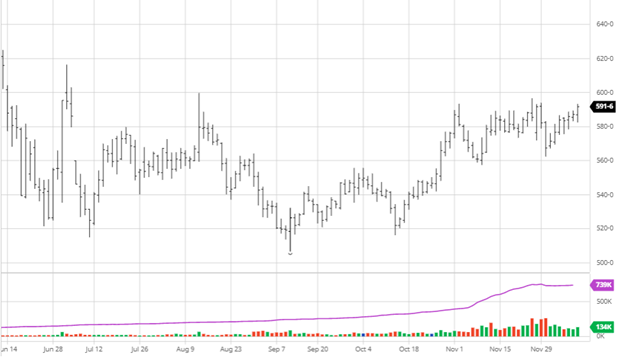

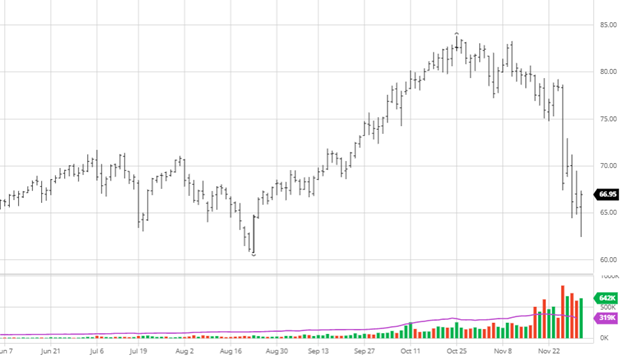

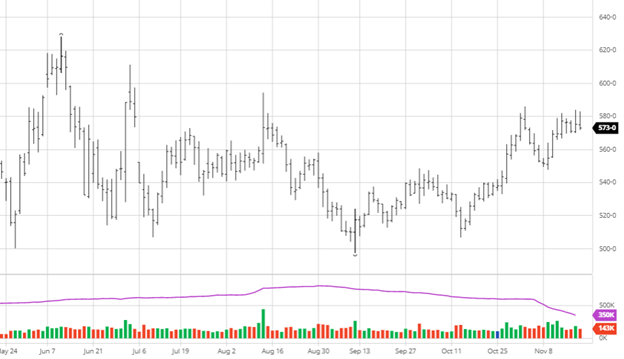

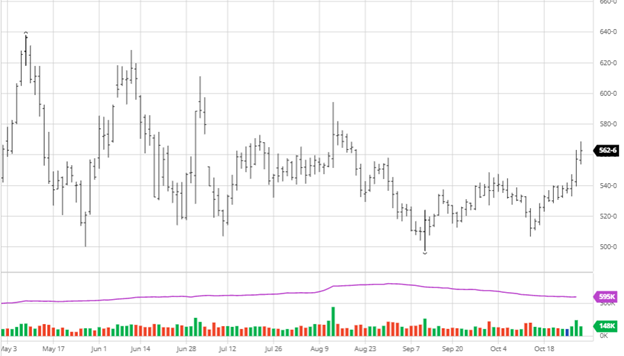

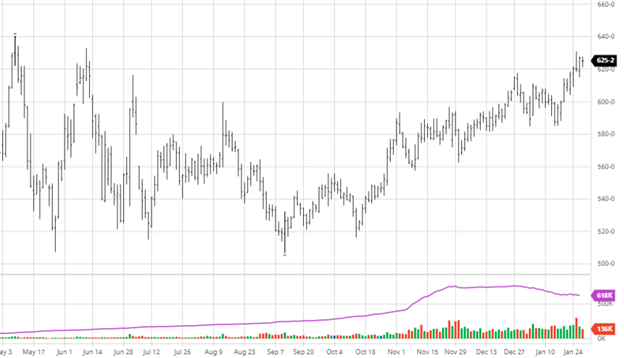

Cotton

The cotton market has held in this $1.20 range for the last ten trading days. World demand is there, and this bull market could have room to run if inflation sticks around with other supply chain bottlenecks. We could continue to see this strength last into the spring when planting starts until we get a better idea of what the U.S. cotton crop will look like this year. With rising consumer demand, the cost of production and transportation in the next few months could see volatility.

Podcast

Tune in as biotech guru Dr. Channa S. Prakash discusses everything from Alabama football, genetics as one of the most extensive agricultural advancements, the most significant risk factors to feeding the world over the next 30-50 years, plus everything in between.

Why producing crop plants with a much gentler footprint on the natural resources will help feed the growing population. How 75% of the world’s patents in agriculture gene editing are coming from China. Understanding that trying to impose restrictions on our ability to grow food can be a considerable risk to agriculture. Listen to hear about these topics and more!

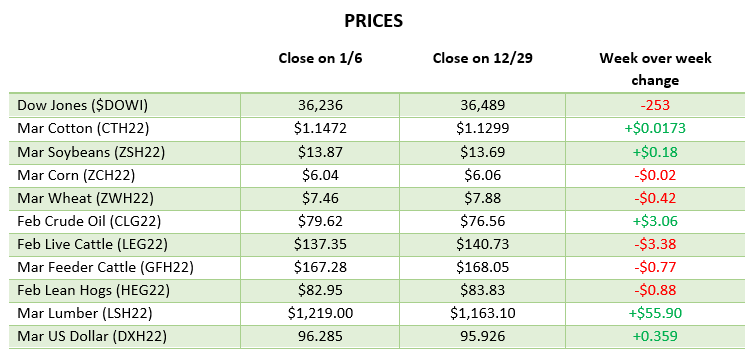

Via Barchart.com