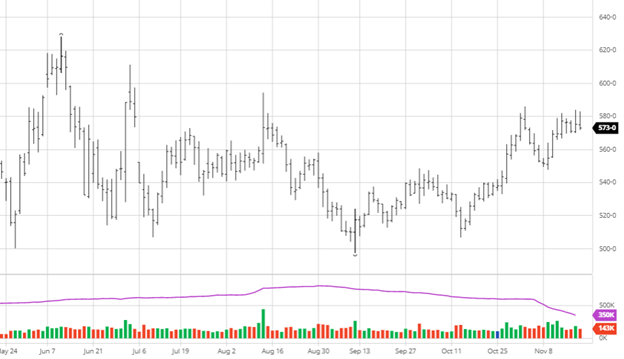

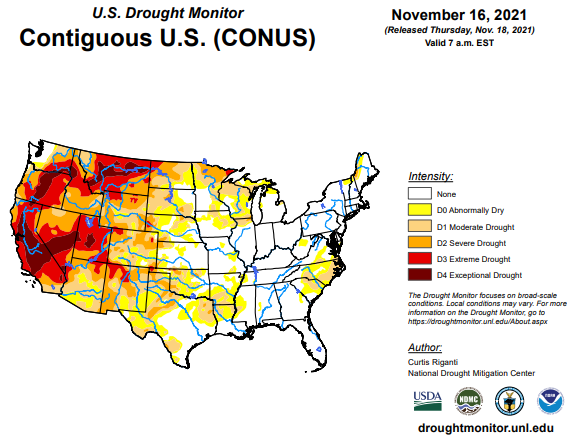

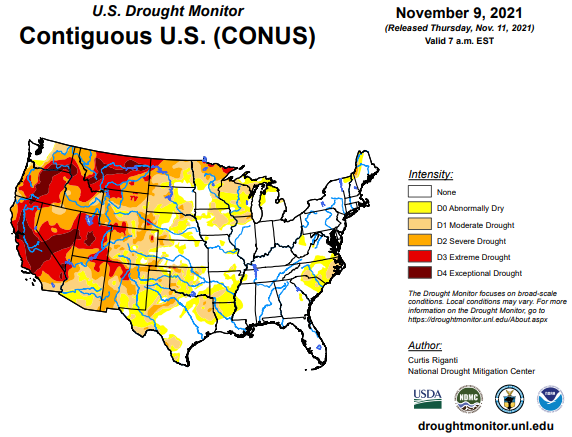

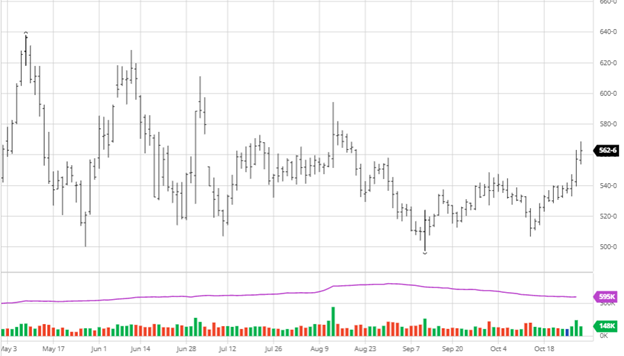

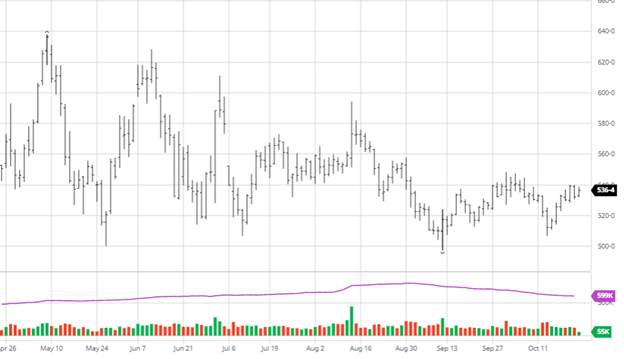

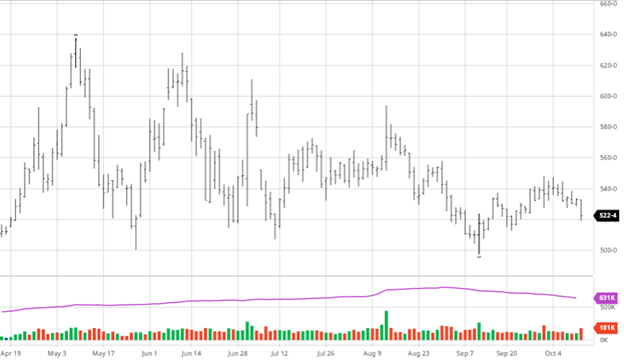

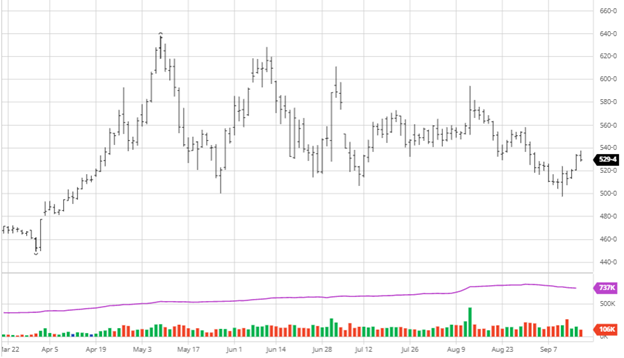

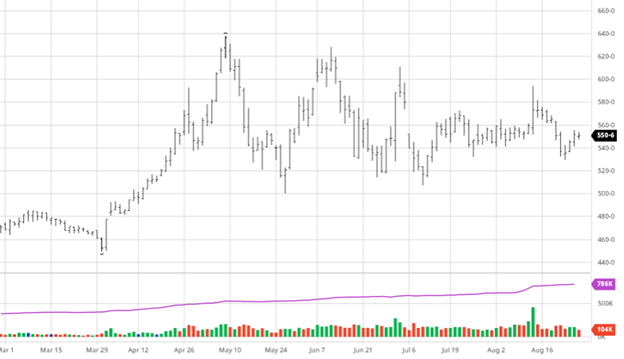

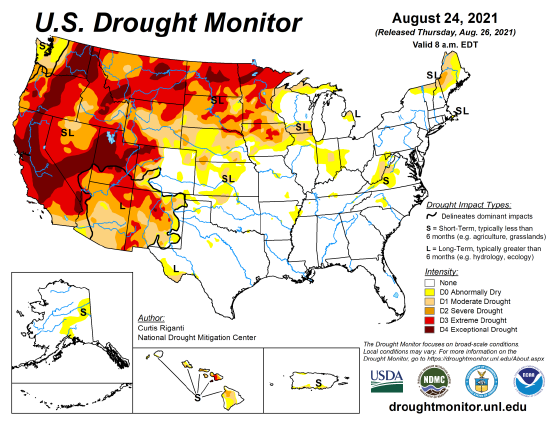

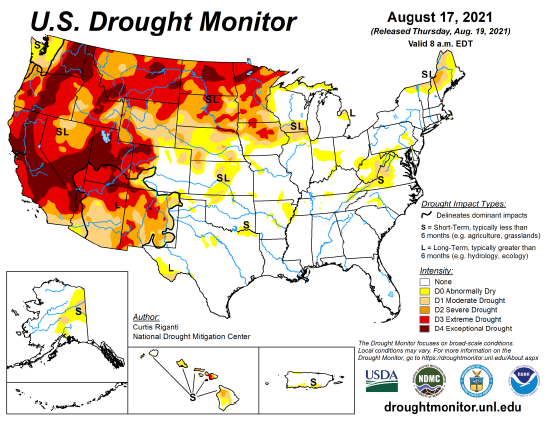

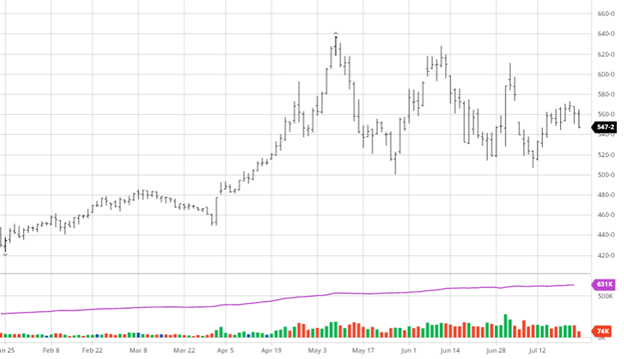

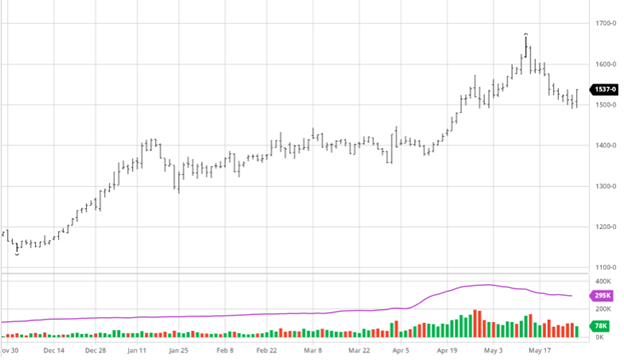

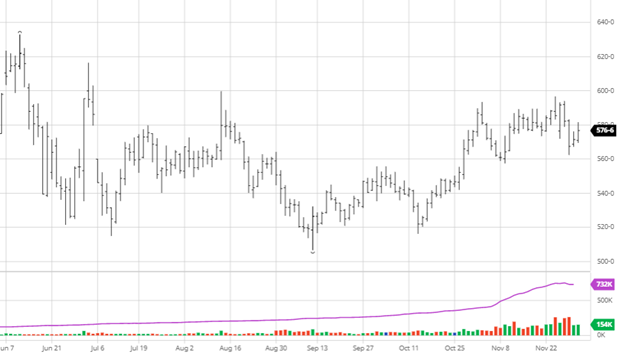

Volatility was the name of the game this week as every market experienced it from, grains to equities. Corn partook in the excitement, as you can see from the chart below. Important to note is following the small rally in the past couple of days to get back to the levels we saw before Thanksgiving. Wheat was a big winner Thursday and pulled corn with it on the intensifying issues with Russia and Ukraine. If wheat rallies, expect it to pull corn with it even on limited corn news. The La Nina pattern continues to form in South America as southern Brazil remains dry, and forecasts have that continuing. Another non-corn-specific factor to keep an eye on will be energy prices, as ethanol production will depend on how the omicron variant will/could affect US travel into the winter and holiday season.

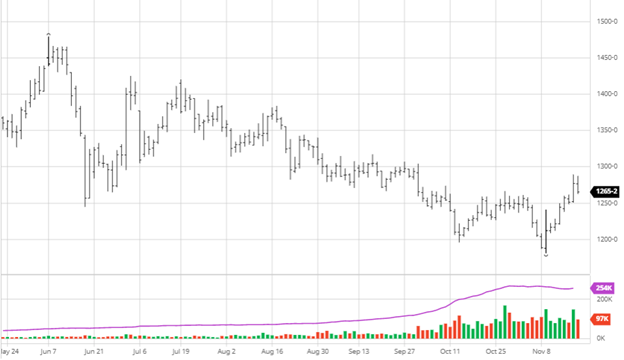

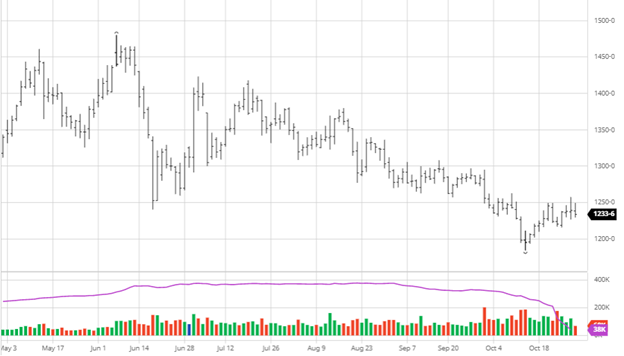

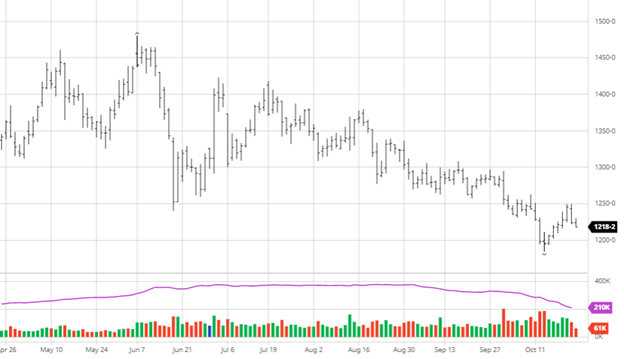

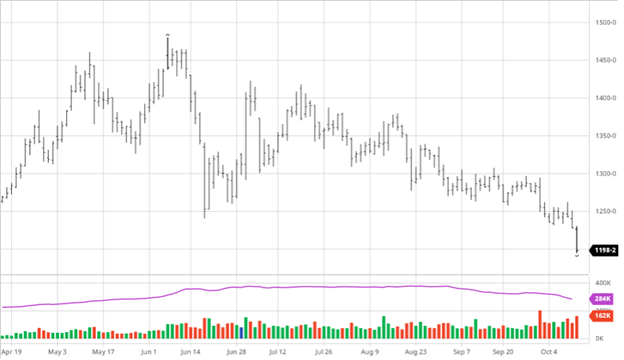

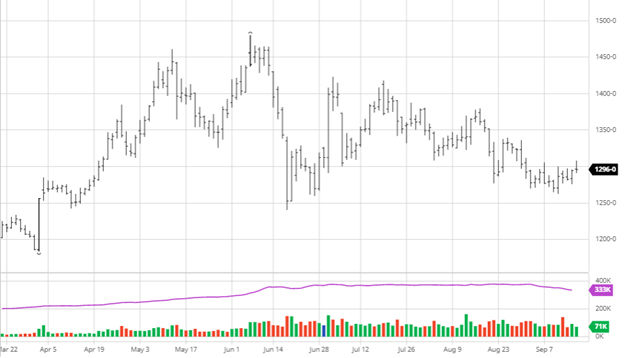

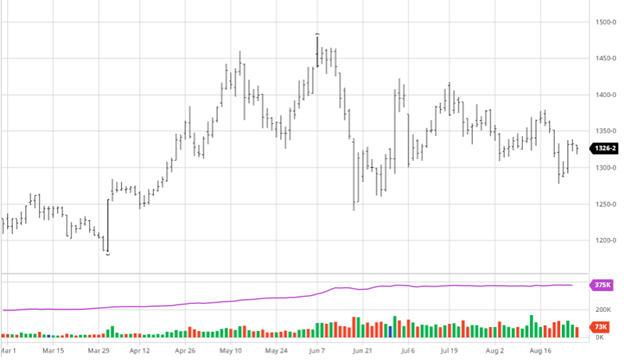

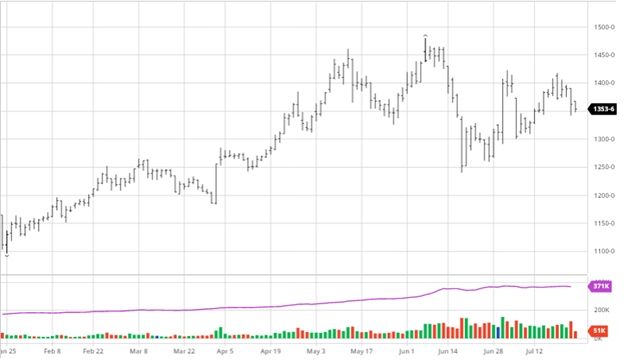

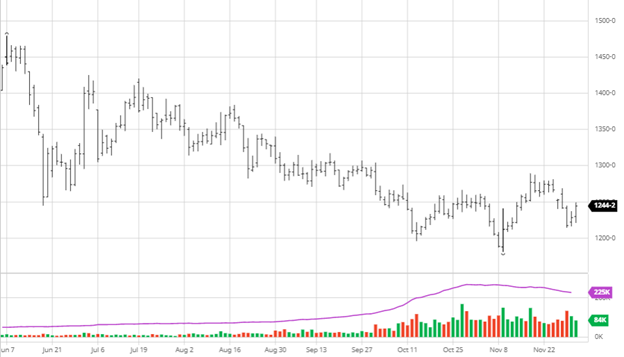

Soybeans, like corn, saw a bounce the last couple of days to get back to close to the range we were in pre-Thanksgiving. The bounce has brought us back in the range we were trading for most of October, which seems like a good place for the market to hang around when there is a lack of news. Exports continued but were on the lower end of expectations this week, while soybean meal and oil were as expected. If beans could close this week over the 20-day moving average, that would be supportive for bulls who are looking for good news. As harvest is wrapped up, all eyes turn to South American weather and their crops this year.

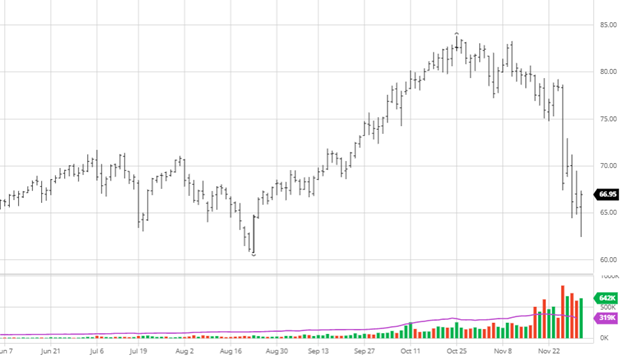

Crude oil has sank following the Thanksgiving holiday as concern over the new Omicron variant, and its impact on demand hit the market. While these concerns are valid as much is still unknown, the largest problem that seems immediate to demand will be air travel and international travel causing, less jet fuel demand. As of right now, it does not appear to be worrying many Americans, but as more cases are found, we will see how it will affect demand. OPEC+ countries also announced they might cut output if demand falls due to the virus, leading prices back higher.

Natural Gas prices have also faltered this week as a warmer U.S. winter is expected to occur, requiring less NG for heating. Diesel prices have also fallen a lot this week following the Omicron variant news and presents farmers with an opportunity to hedge their fuel needs for next year.

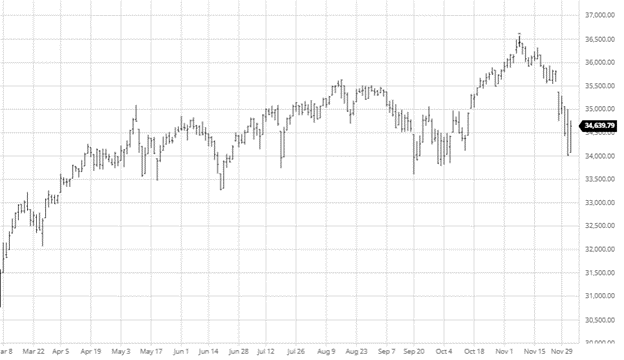

Dow Jones

The Dow experienced a lot of volatility this week as news of the Omicron variant in the U.S. and more places worldwide spooked some investors. The reports are that it only has caused mild symptoms, which is good, but the reaction was not of fear of the virus itself but how the governments will respond with potential lockdowns and travel bans soon. On Thursday, the strong bounce-back shows that investors are still eager to get in the market, so any large pullbacks will be met with buying if it is seen as a jerk reaction, but any longer lasting weakness could be seen as a correction. The down-trend of the last week has made some investors worried and moved some to the sidelines while we see what happens. Powell will stay as head of the Fed and said they might start tapering and raising interest rates sooner rather than later as inflation does not appear to be transitory.

Podcast

For the past year, commodity prices have perpetually soared and continue to trend higher. We’re diving into the fertilizer forecast with a unique guest, Billy Dale Strader, a branch manager for Helena Agri-Enterprises in Russellville, KY., who is truly at the epicenter of the rising fertilizer prices.

Billy Dale planted his agriculture roots on his family-owned farm and has managed regional seed and chemical sales at Helena for the past decade. In this week’s pod, we tackle the big question for farmers and ultimately end-users — is the impact of higher-priced inputs, like seeds, chemicals, and fertilizer, on the supply and demand for the major U.S. crops? Listen or watch to find out!

Via Barchart.com