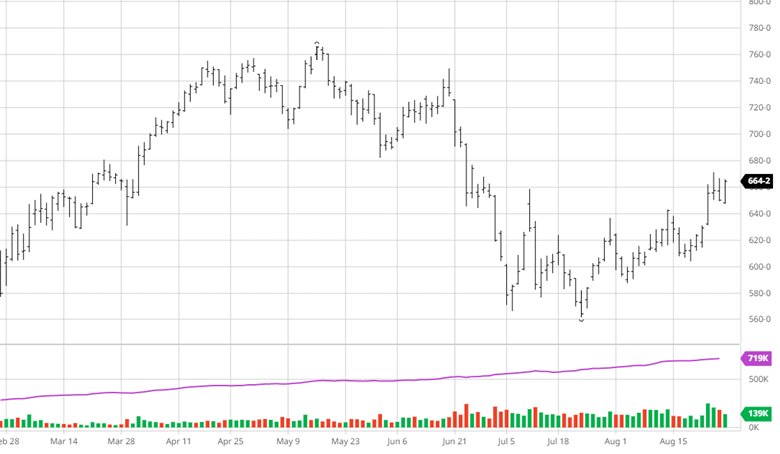

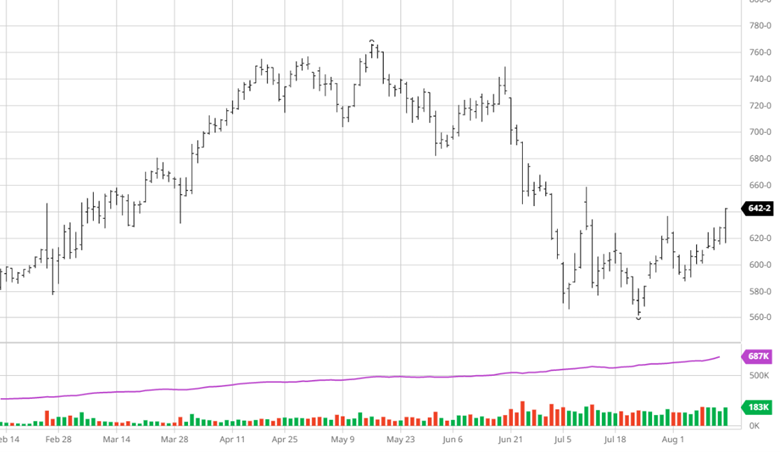

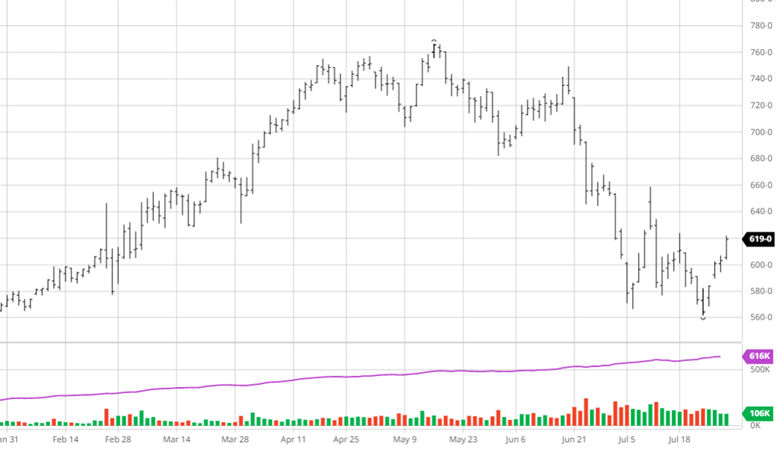

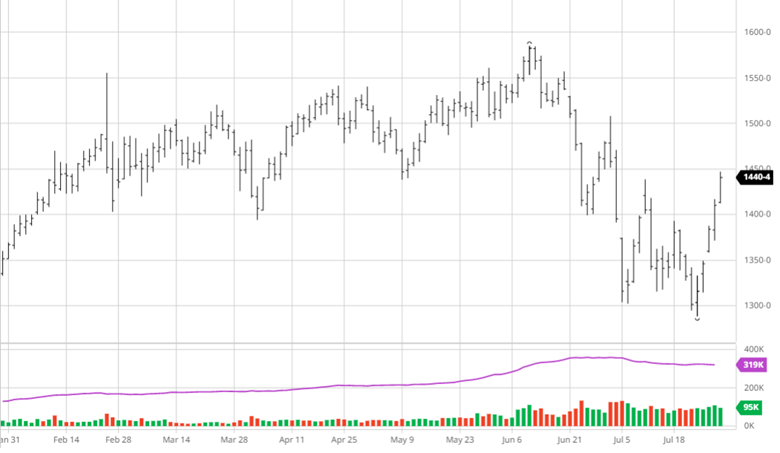

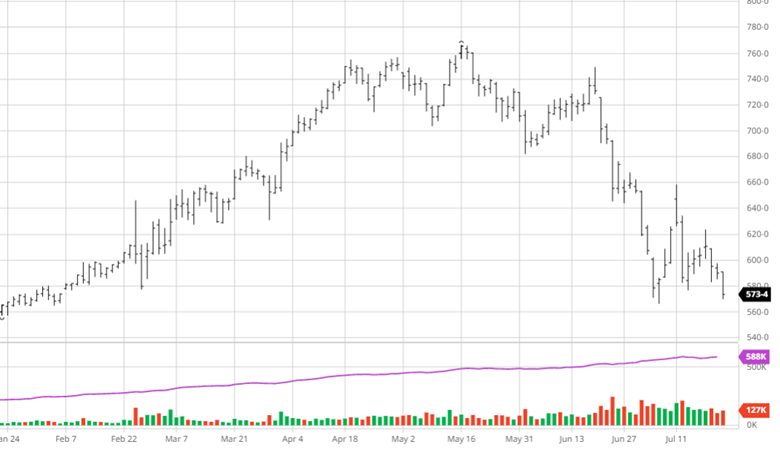

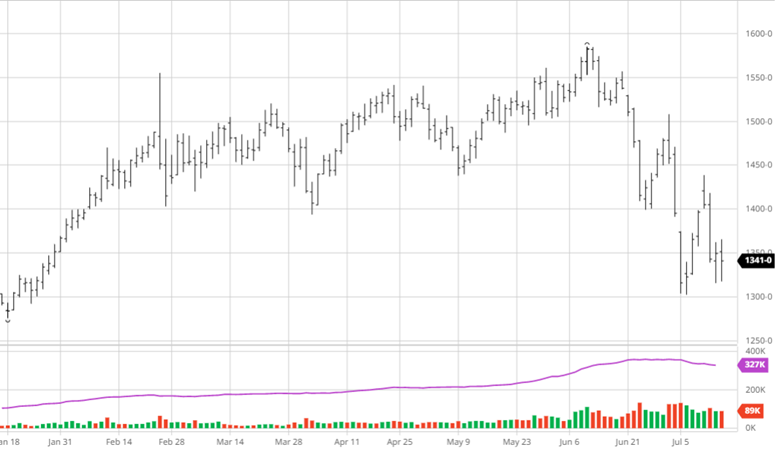

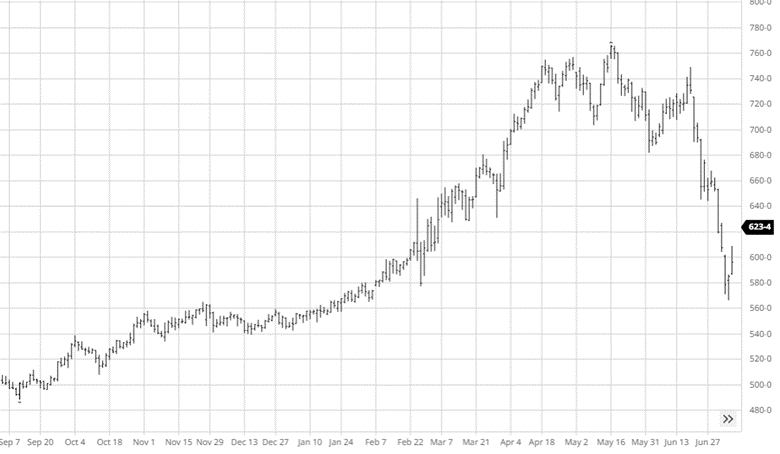

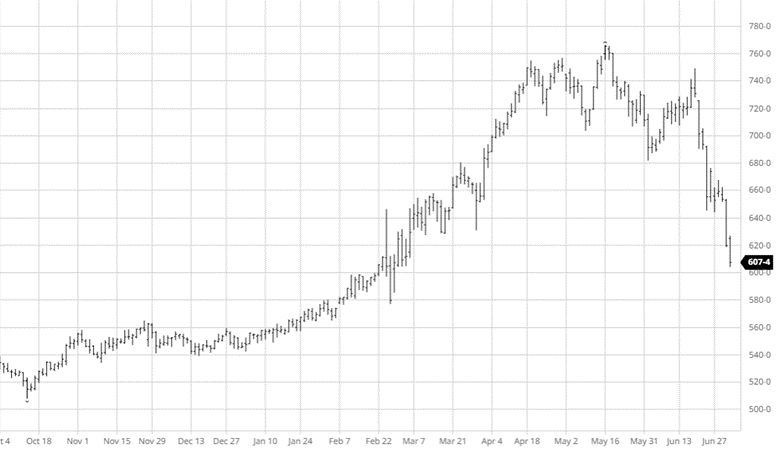

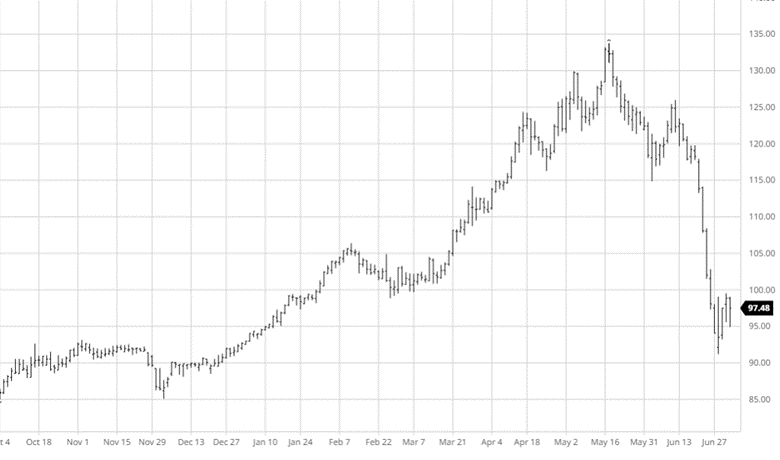

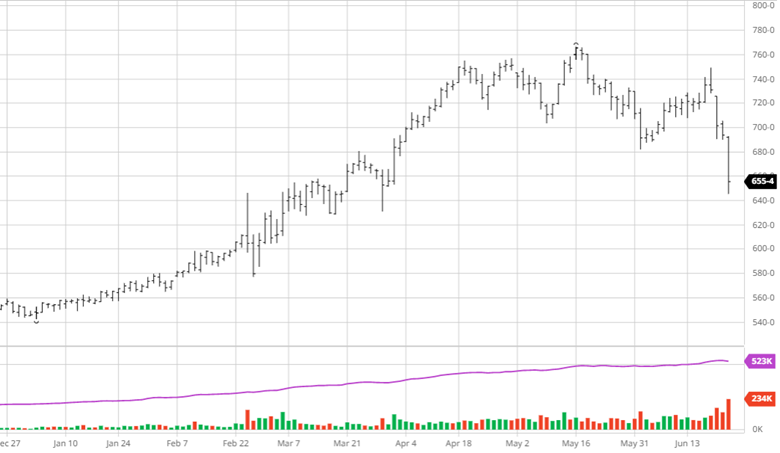

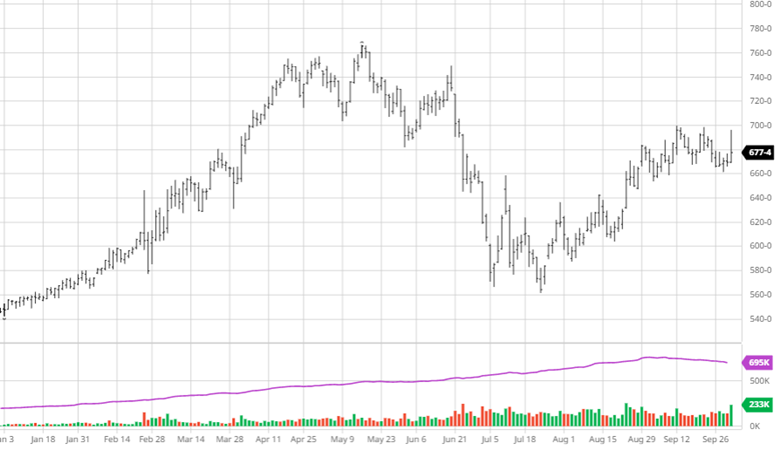

What a day…what a week for grain market volatility! With the anticipated shrinking US Corn crop, Corn has been moving higher over the last few weeks and today did not disappoint. The Sept 30 USDA report was bullish for corn coming in with quarterly stocks of 1.377 billion bushels. This was below the trade estimate (by roughly 1.6 bu/ac), giving corn prices a boost. The charts remain range bound but are starting to look more bullish. The October USDA report is in 2 weeks and is sure to have some surprises, be prepared for the volatility ahead and take advantage of rallies to catch up on sales.

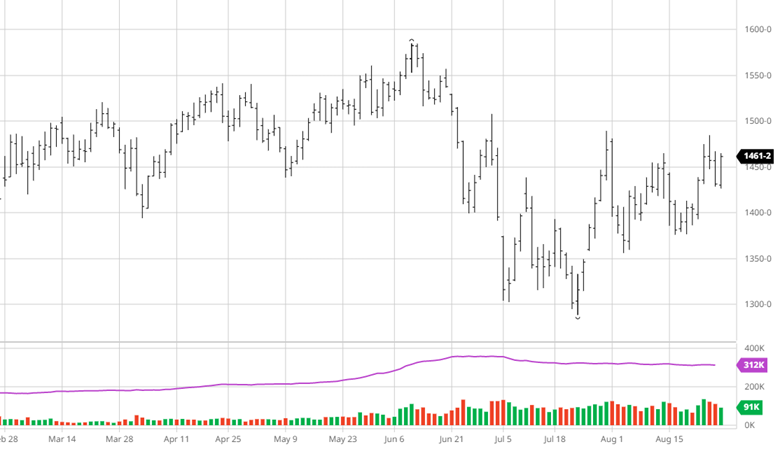

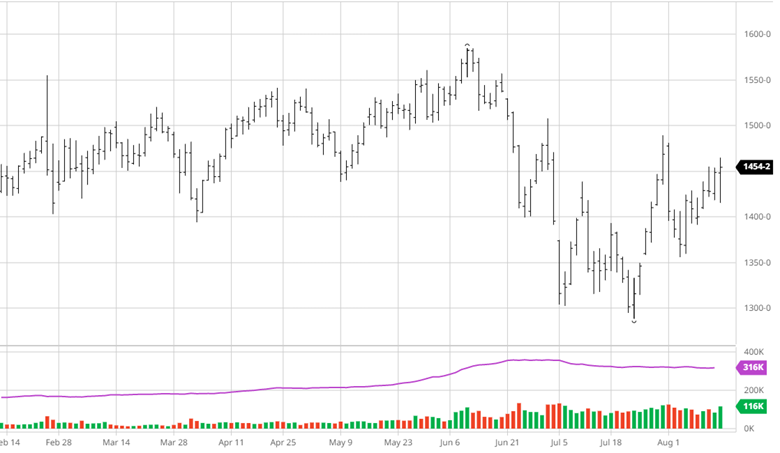

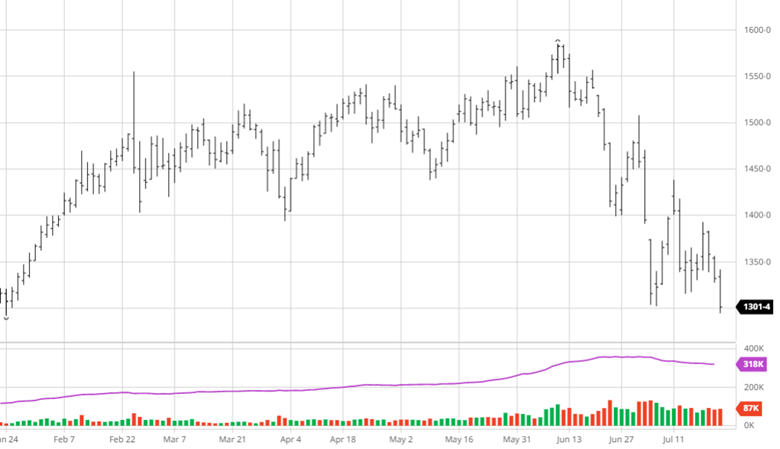

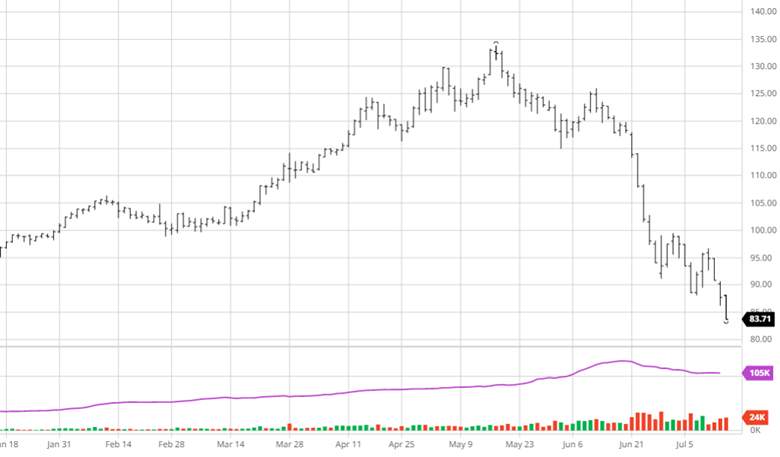

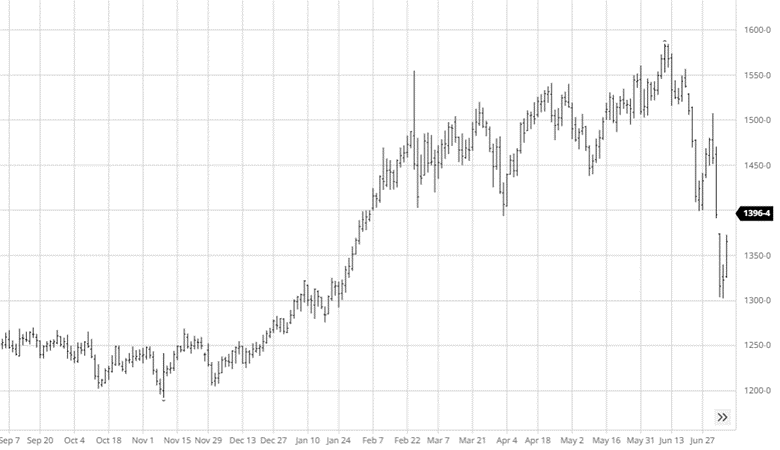

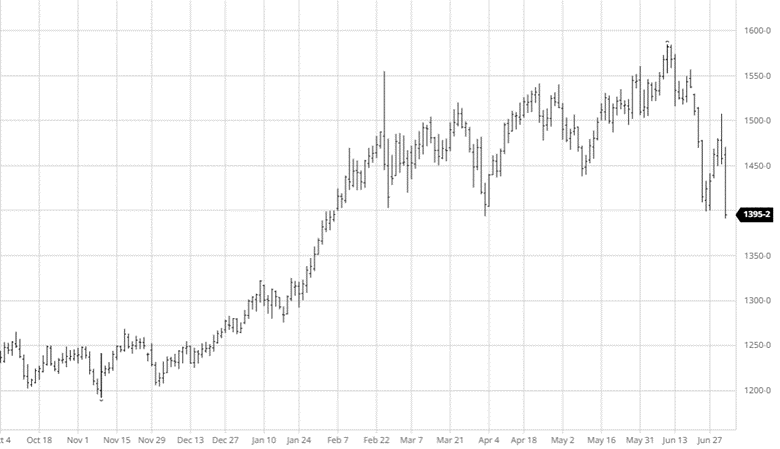

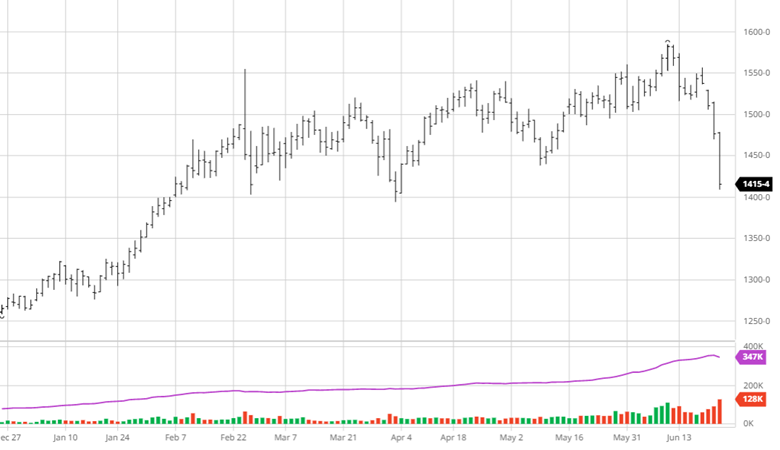

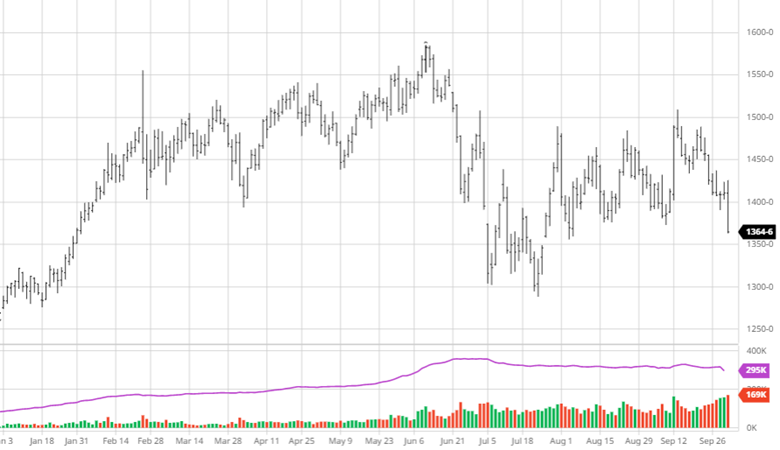

Beans have not had any good news over the last 2 weeks as they continue lower into harvest. Friday’s report did nothing to help this, having 274 million bushels in quarterly stocks where the average trade estimate was 242 M/bu. While exports for beans have been slow, this number was much higher than expected and beans had an appropriate reaction lower. With a stronger USD vs international currency, there is limited expectation of any major export news in the near future. While beans are still about $1 higher than the July lows, there is little hope that additional supportive news around beans is coming to bail out the bulls…higher stocks reported today, Brazil off to a great start to their planting, and limited exports…Bears win (not talking about the @Chicagobears).

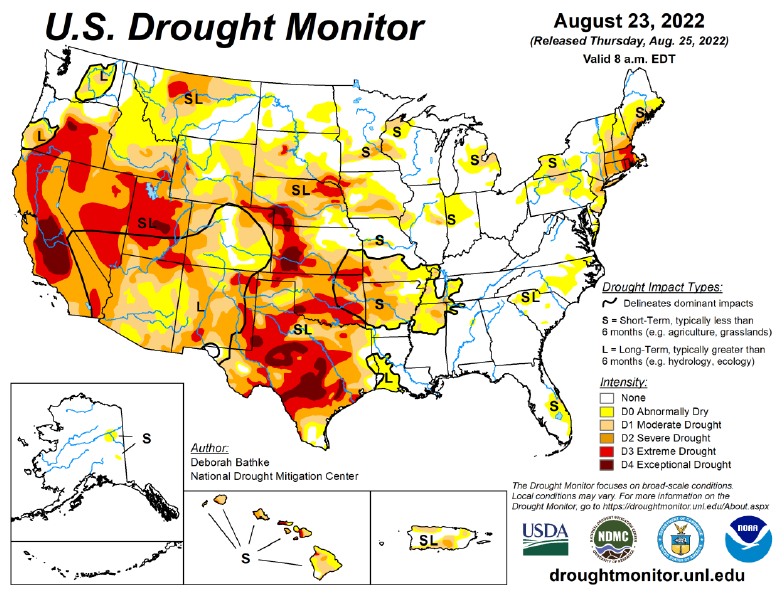

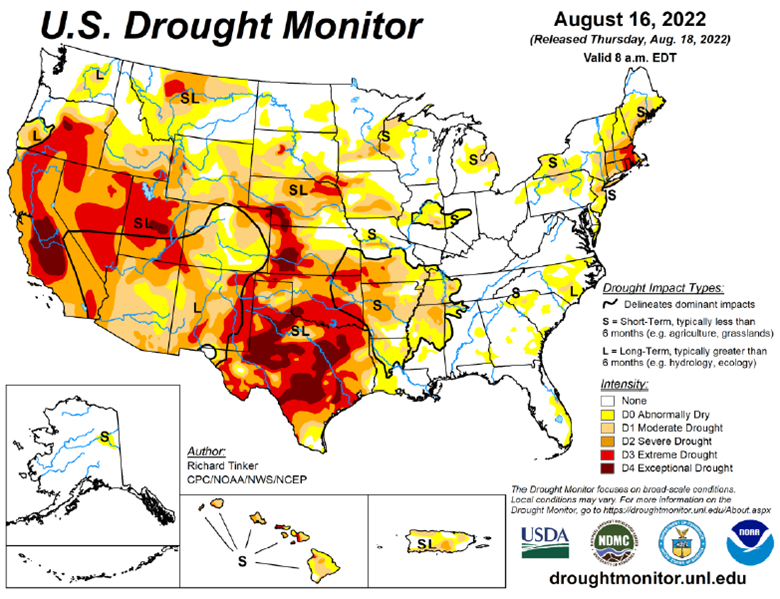

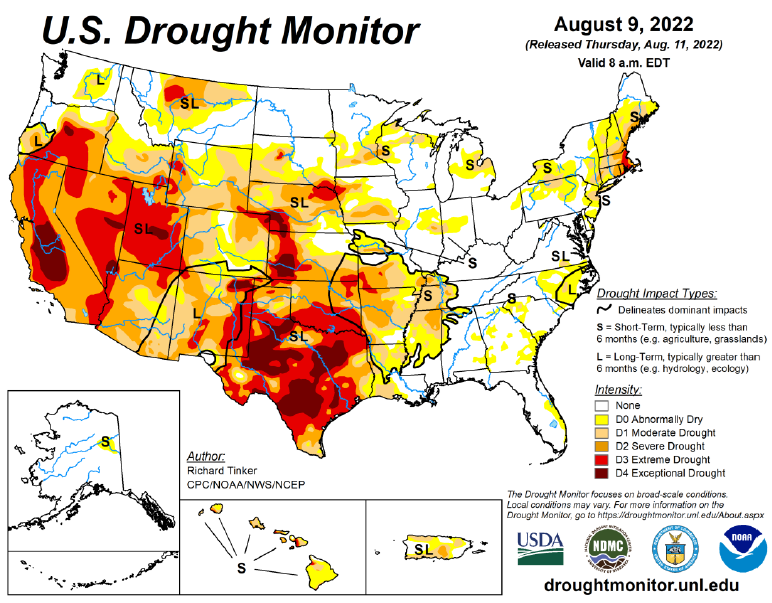

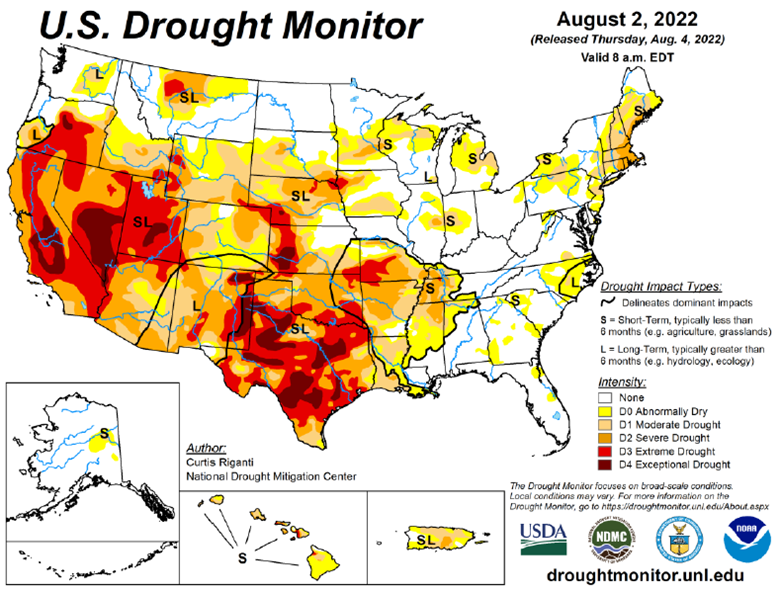

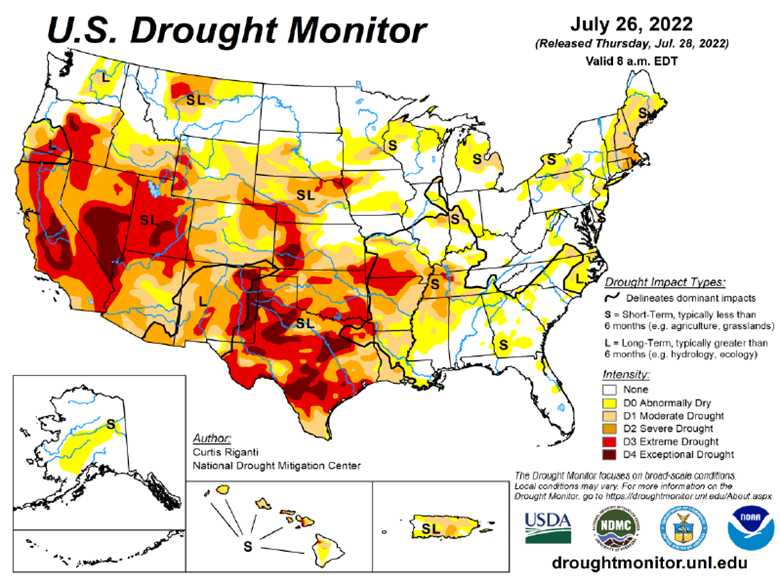

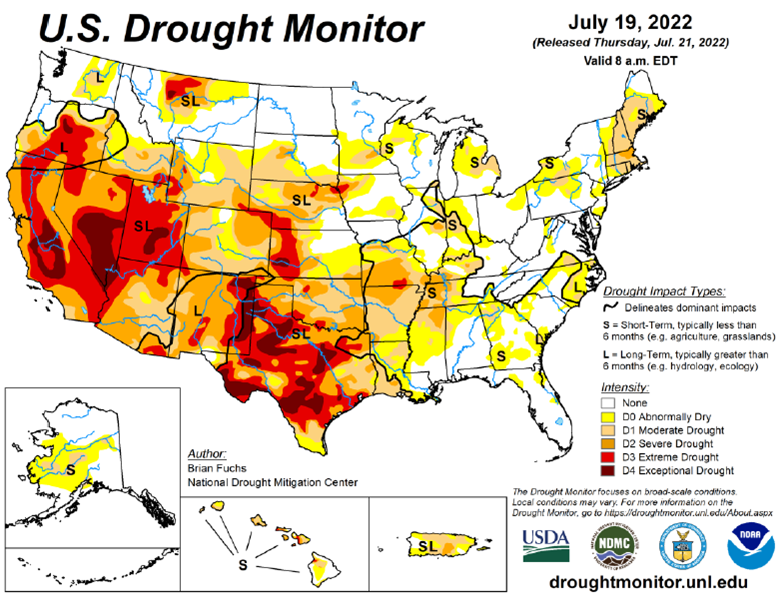

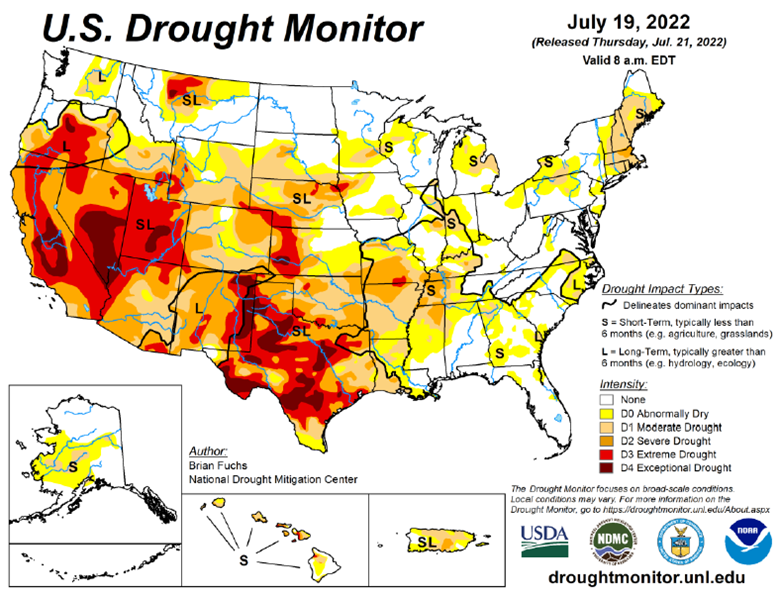

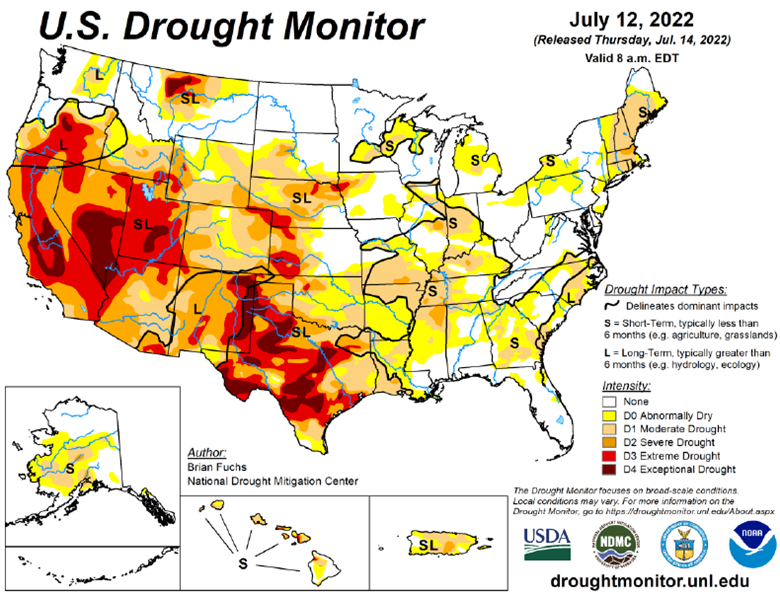

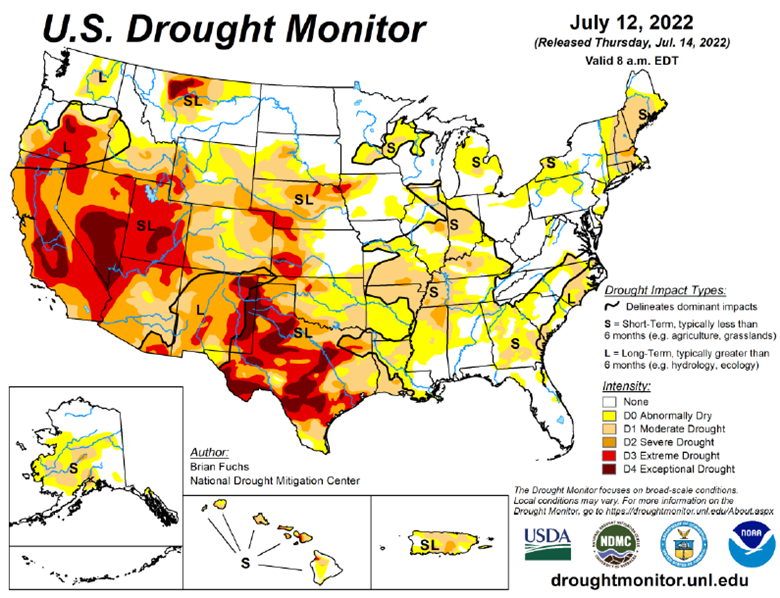

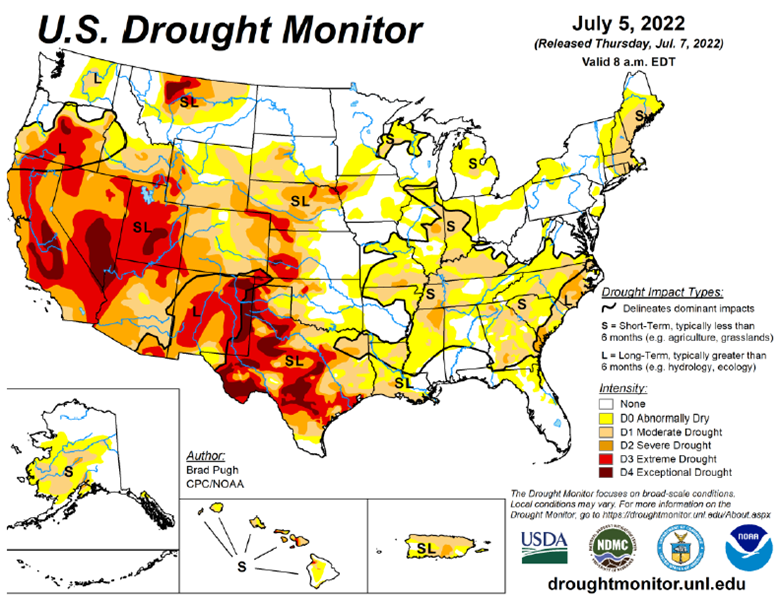

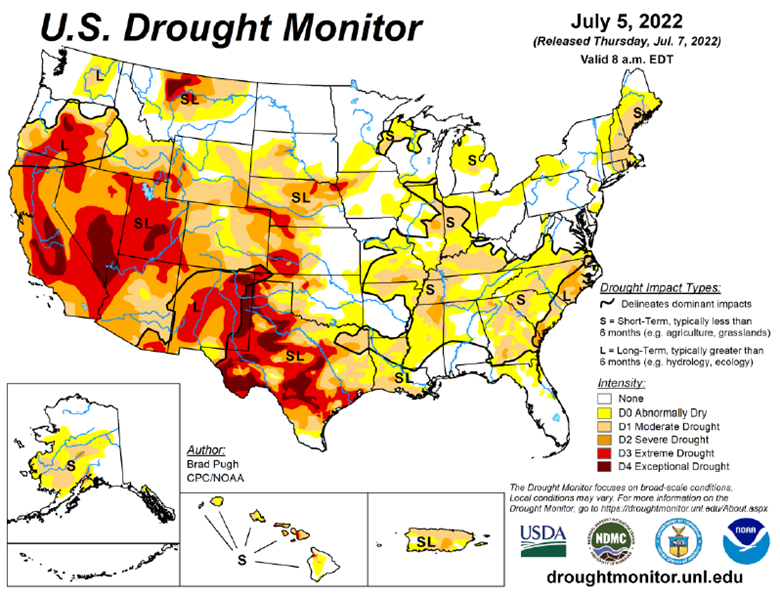

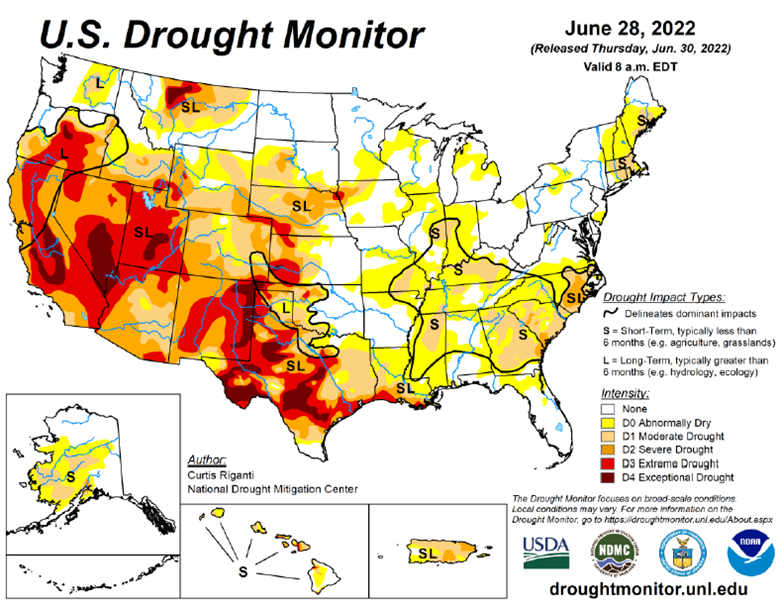

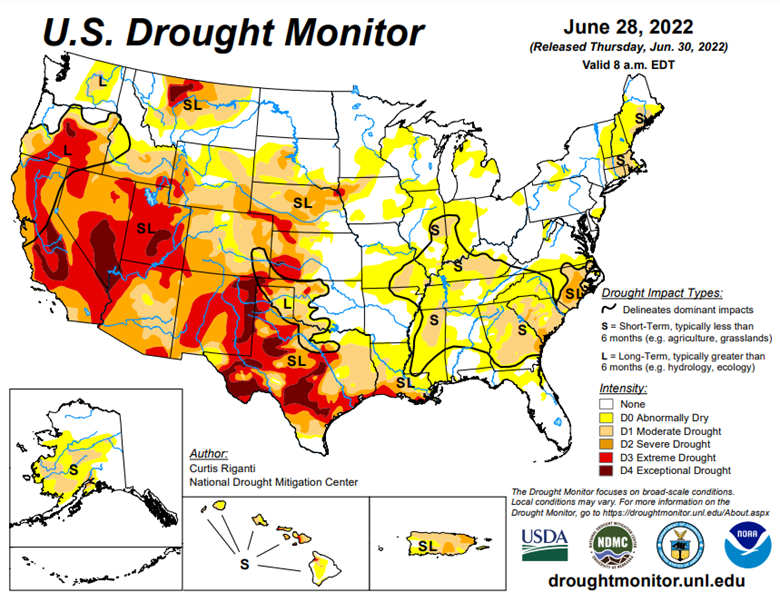

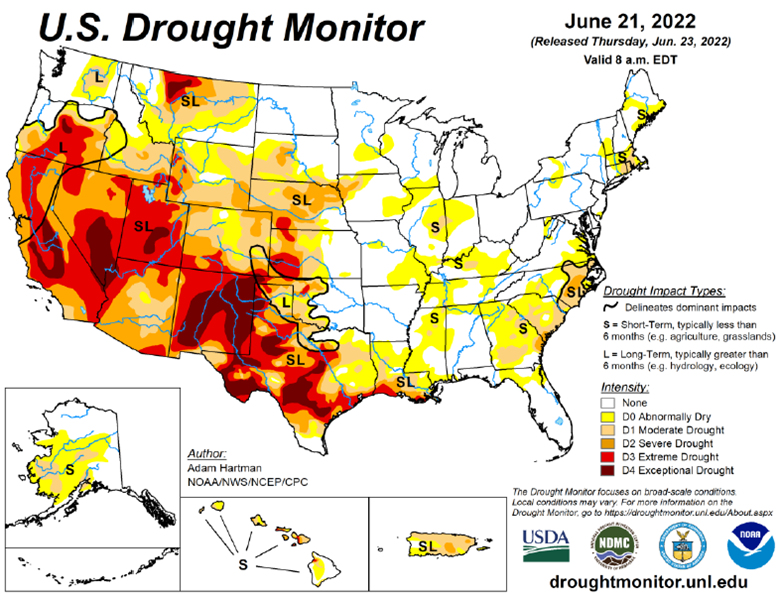

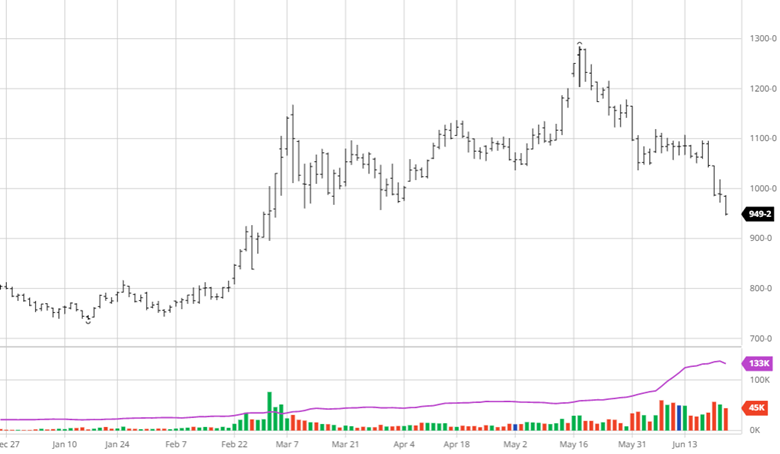

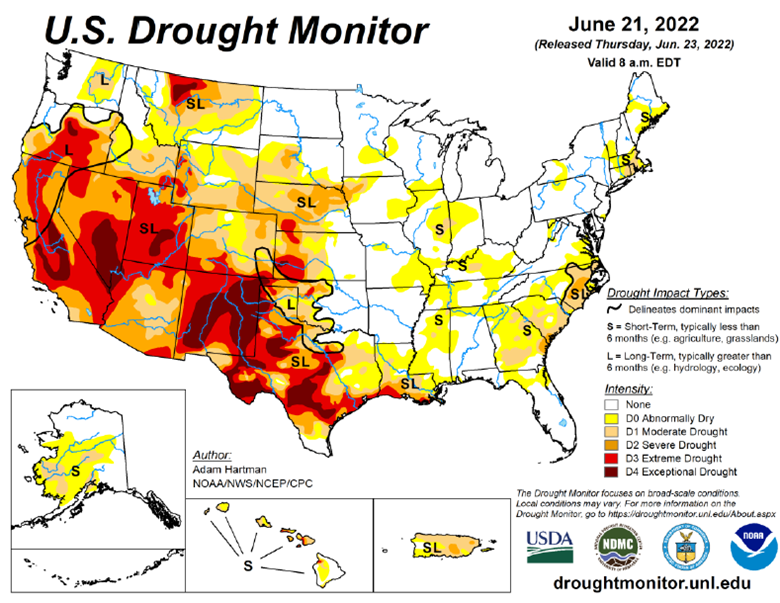

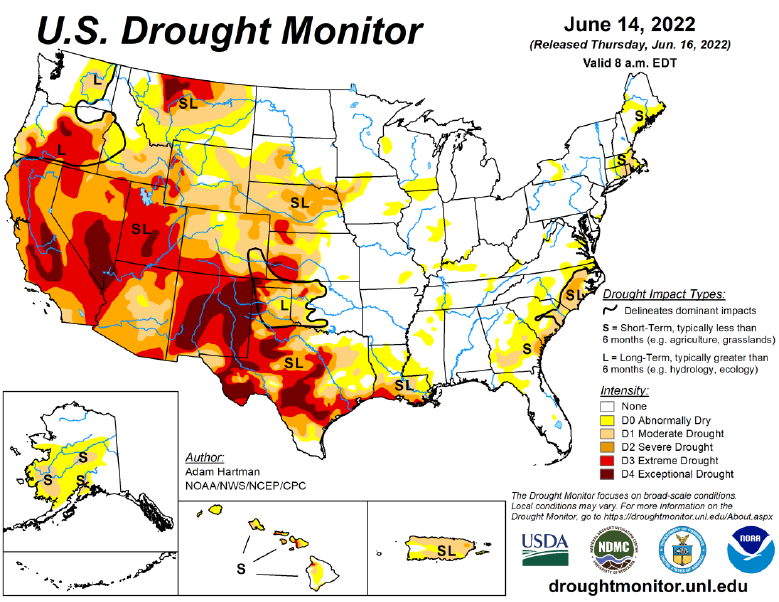

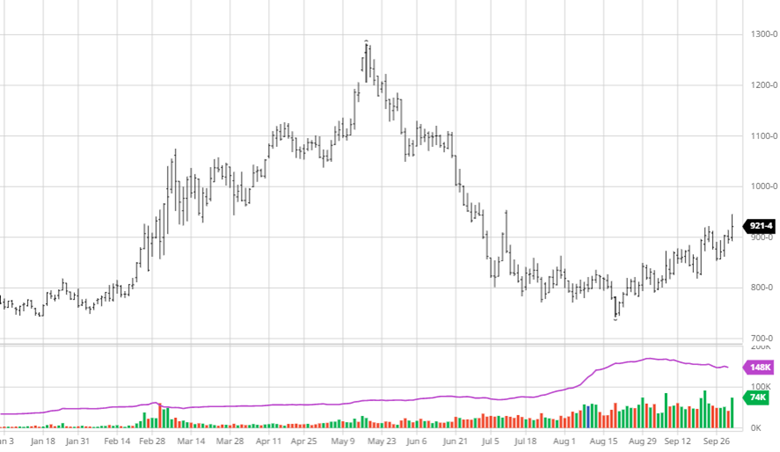

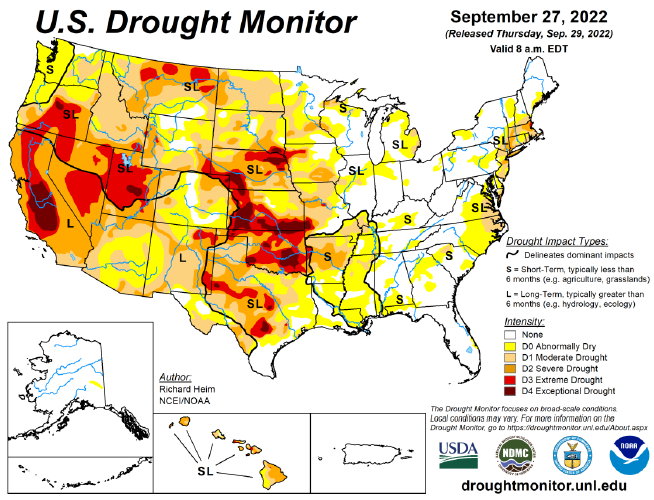

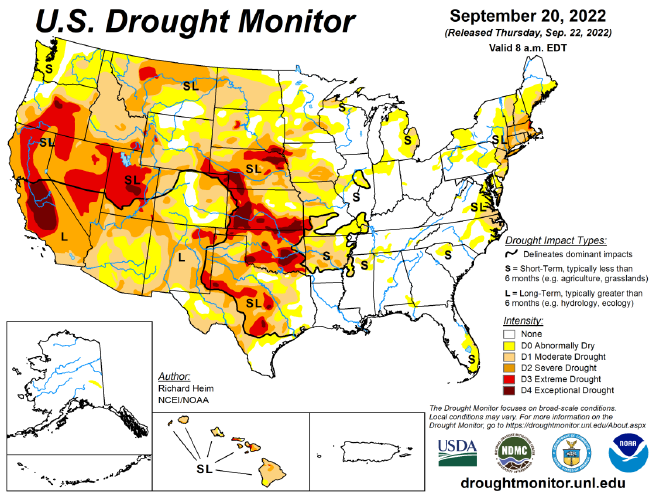

Wheat has had a good run since the August lows and received more bullish news in today’s USDA report. Wheat stocks came in below estimates at 1.650 billion bushels (1.778 billion estimate). The tight world wheat stocks are supportive for prices, along with the continued war in Ukraine. Any developments in the Black Sea trade corridor would add volatility to the grain markets, specifically wheat. Beyond the unknown factors of war sixty four percent of US winter wheat production is in areas that are currently experiencing moderate to exceptional drought. In this case the Bulls are the clear winners (not the @Chicagobulls).

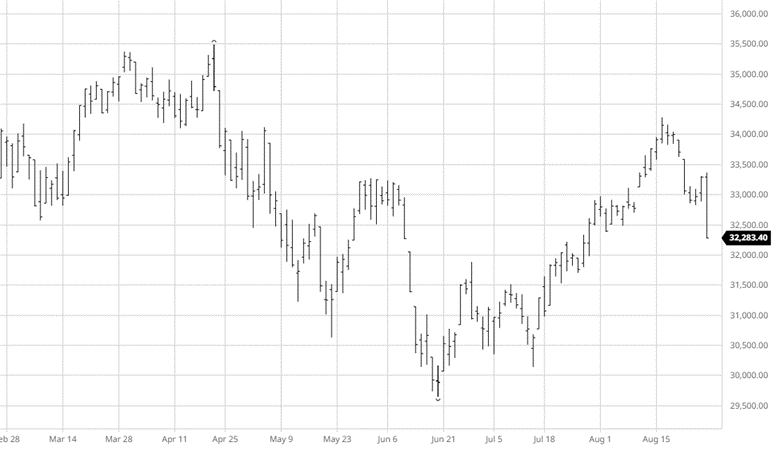

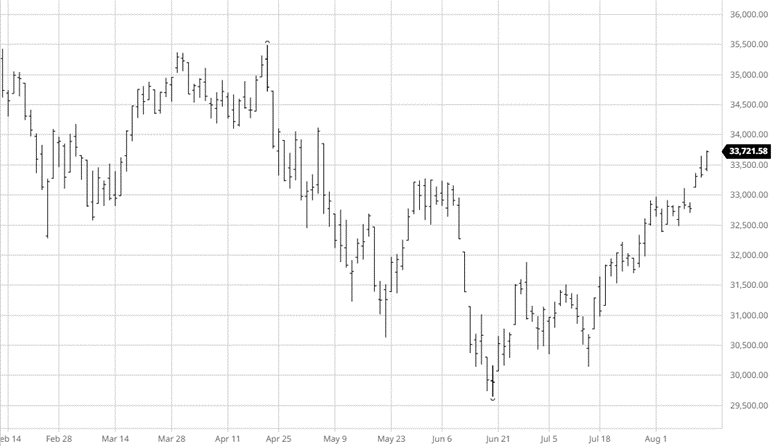

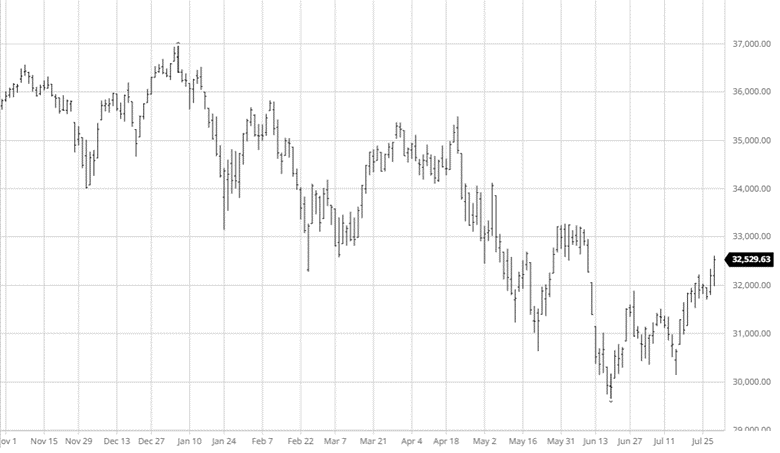

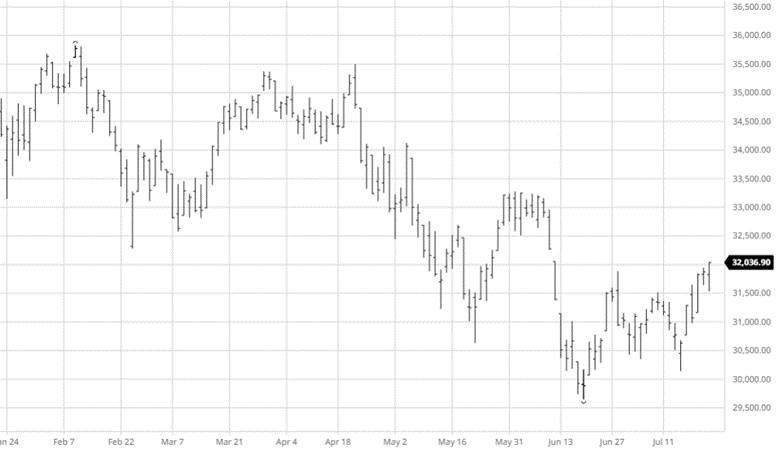

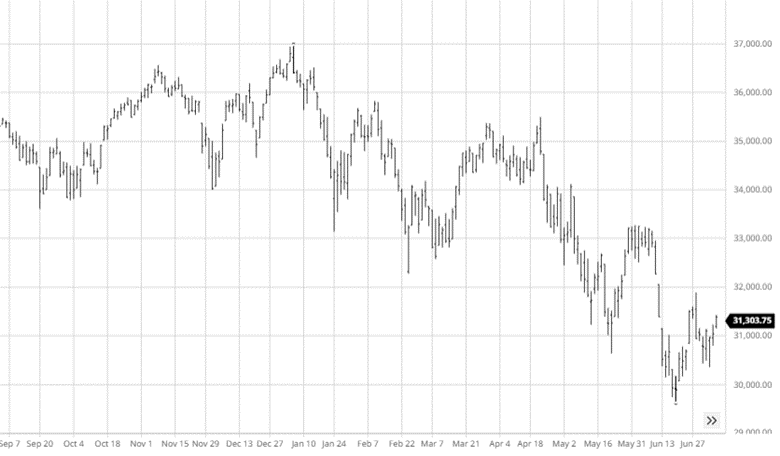

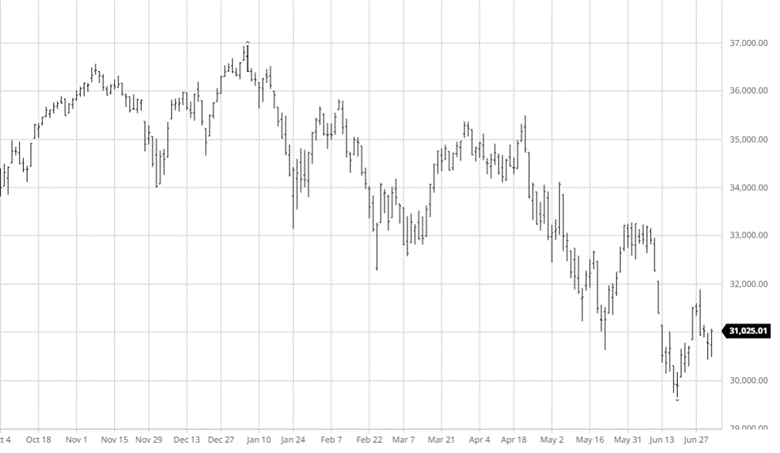

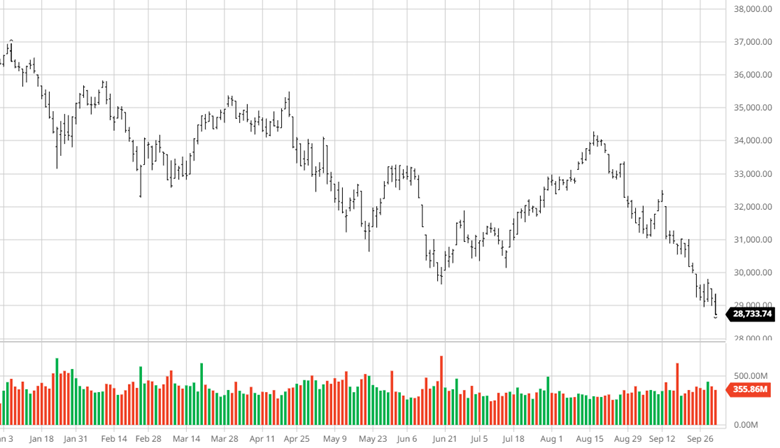

Equity Markets

The markets were decimated in September with inflation not cooling off, increasing US & global recession fears and continued Fed rate hikes. There is no way around it, the news for the markets has been horrendous, with unemployment numbers remaining the limited good news. The S&P blew through the June lows today and is set to finish the quarter down -4.7% and the YTD down approximately – 24.8%. It’s anyone’s guess from there where the FED will go next; but as of now, they are set to continue to raise rates adding additional pressure to capital markets.

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

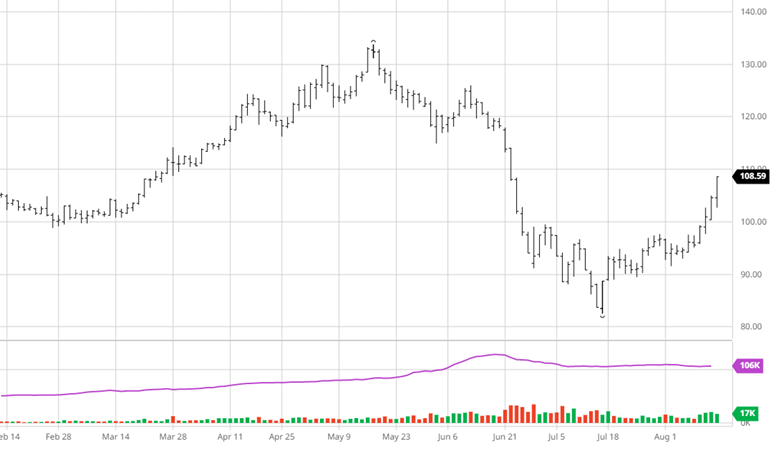

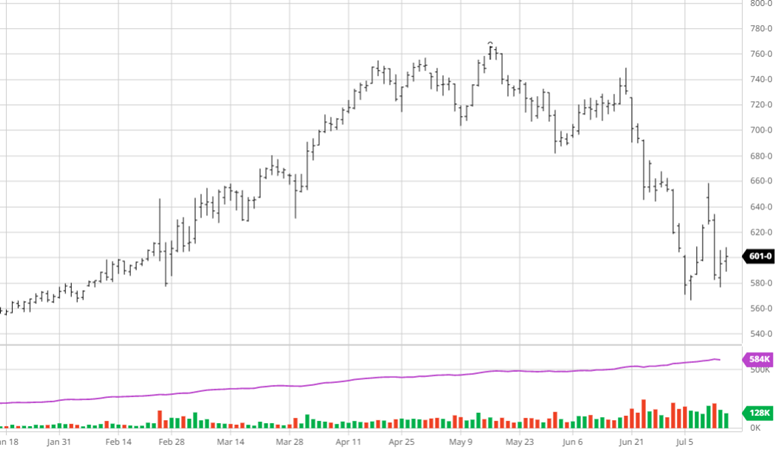

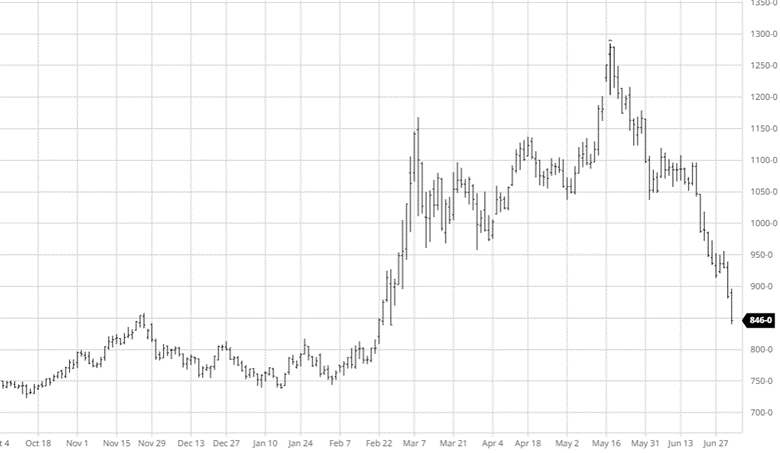

Are the Fed’s hikes starting to dampen inflation? Oil, grains, and metals have all fallen from their highs. But the rarely spoken of Cotton market was one of the first to crack…falling from 1.58/lb to 0.95/lb in just a few short days. We’re digging into this sharp drop and just why and how Cotton is involved in seemingly everything with RCM’s very own cotton king, LOGIC advisors Ron Lawson.

In this episode, Ron is giving us the low down on how and why he believes it’s not Dr. Copper which acts as the global economic barometer, but how Cotton is the real Canary and leading indicator on global demand. In between those talks, we’re covering all things Cotton including crop insurance, irrigated vs dry land, the scam that was Pima and Egyptian Cotton, the process of cotton – which countries have it, which want it, ginning it, spinning it, dyeing it, global commodity merchant co’s pushing it around, and even micro-plastics, climate change, and how Cotton always flows to the cheapest labor source. Finally, we’re walking in some high Cotton putting Ron in the hot seat. Will we ever get the growth back? Tune in to get these critical hot takes — SEND IT!

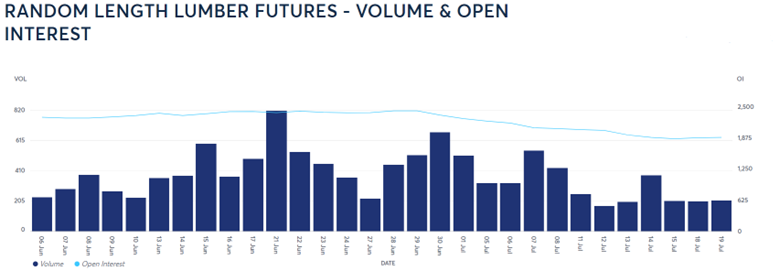

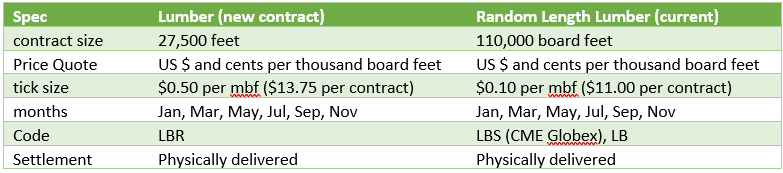

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].