USDA OCTOBER CROP REPORT UPDATE

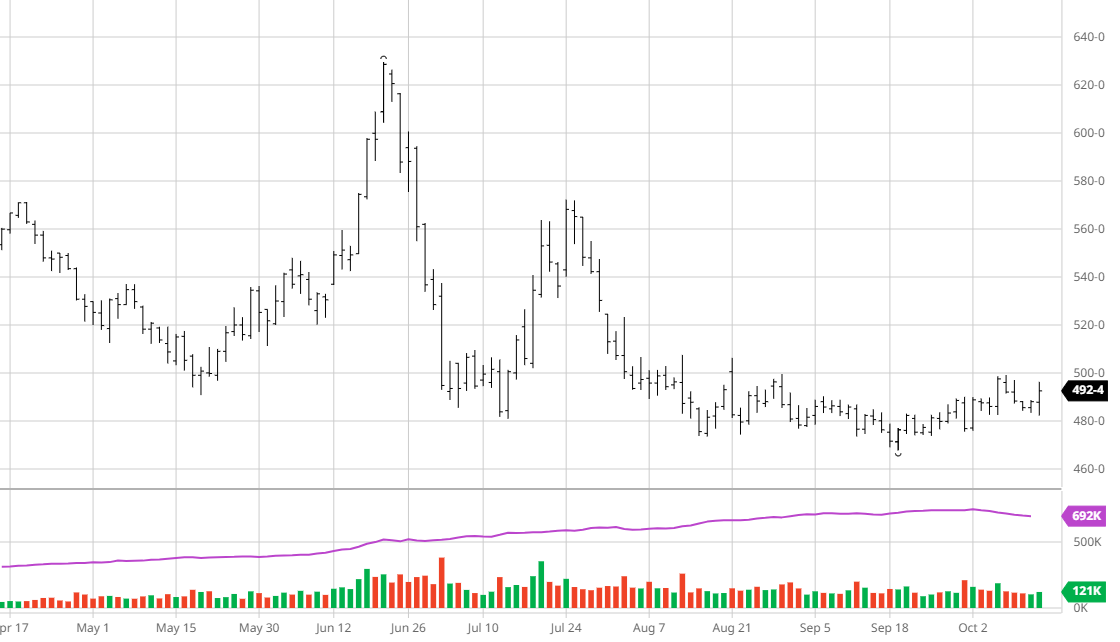

2023 Yield Estimate: 173.0 BPA (173.5 BPA Estimate)

23/24 US Corn Stocks: 2.111 BBU (2.138 BBU Estimate)

23/24 World Corn Stocks: 312.4 MMT (313.05 MMT Estimate)

- The USDA lowered US corn yield 0.5 bu/ac which is in line with what we have been hearing from farmers in the field with many areas having great yields but the July heat and dryness did too much damage in other areas. The USDA lowered exports by 25 million bushels while also revising beginning stocks down 91 million bushels.

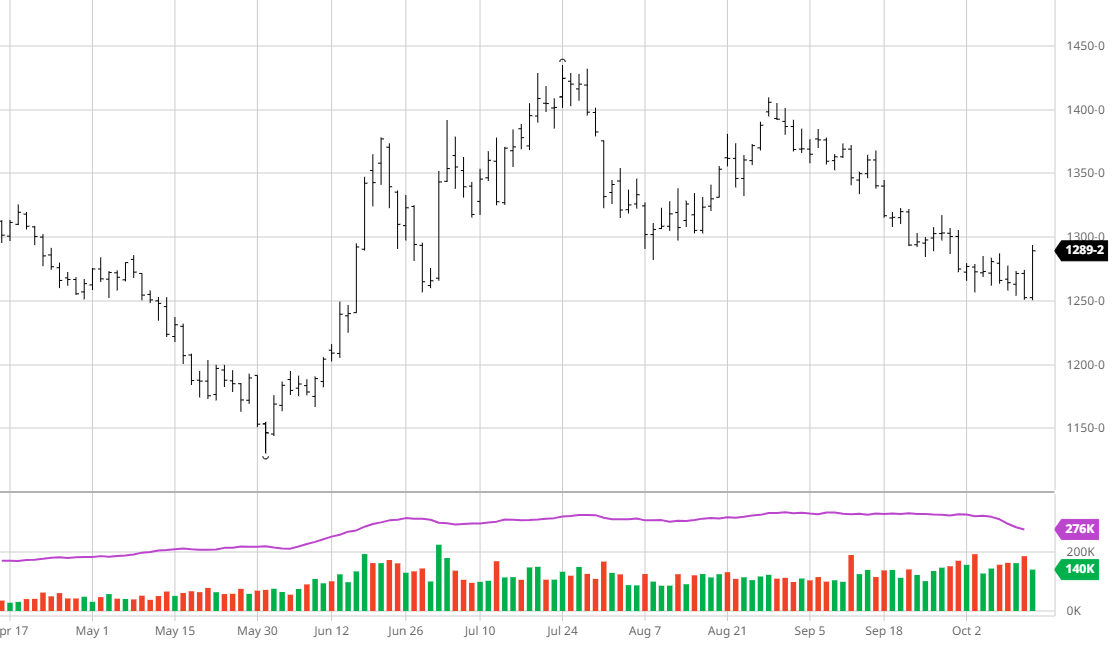

2023 Yield Estimate: 49.6 BPA (49.9 BPA Estimate)

23/24 US Bean Stocks: 220 MBU (233 MBU Estimate)

23/24 World Bean Stocks: 115.62 MMT (119.71 MMT Estimate)

- The bean numbers were lowered as well with the USDA bringing yield down 0.5 bu/acre. The markets responded favorably to this while the USDA raised beginning stocks, lowered exports, and kept ending stocks the same at 220 million bushels. The drop in bean production was slightly offset by the lowered exports and higher crush.

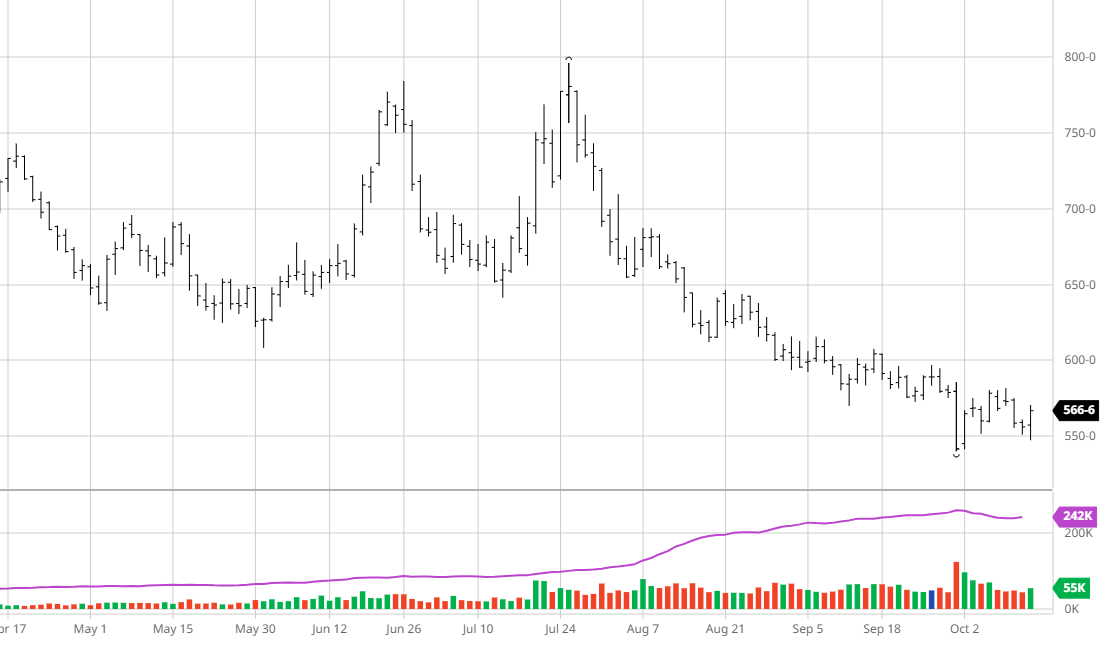

23/24 US Wheat Stocks: 670 MBU (647 MBU Estimate)

23/24 World Wheat Stocks: 258.13 MMT (258.38 MMT Estimate)

- The world wheat picture is still clouded by conflict between Russia and Ukraine but the USDA lowered world ending stocks while raising US ending stocks. The Australian wheat crop was lowered 1.5 mmt.

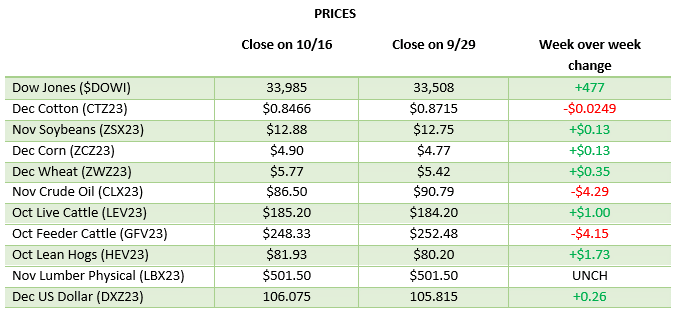

Overview:

The USDA gave bulls some life after a sideways trade in corn and lower bean trade the last 2 months. As harvest continues to roll the picture will become clearer but the record low levels on the Mississippi River are being monitored and could lead to the same problems last time this happened with bottlenecks in the export space. As the war in Ukraine continues, war in Israel (a US ally) and the continued tensions between China and Taiwan, the world geopolitical climate is tense and could have ripple effects in world trade.

December 2023 Corn

November 2023 Beans

December 2023 Wheat

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.