AG MARKET UPDATE: JUNE 14 – JULY 8

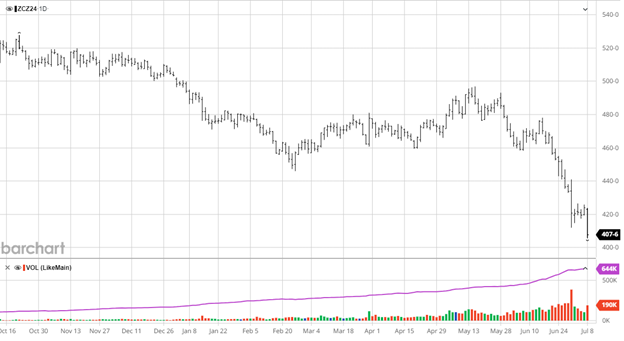

Corn had the bottom fall out of it after trading between $4.60 and $5 from March to June. The USDA last week pegged the US corn crop at 91.475 million acres, over 1 million acres higher than the trade estimate. The USDA did make a note that those were the reported acres at the time of the survey so there is a good chance not all those acres end up getting planted. The crop ratings are currently better than last year’s at this time that led to a record crop and with no major weather concerns on the horizon and rains from Beryl expected to help some areas in the ECB later this week. With no major weather concern in the US or abroad right now, corn will need to find help in demand or fund buying as ending stocks remain high.

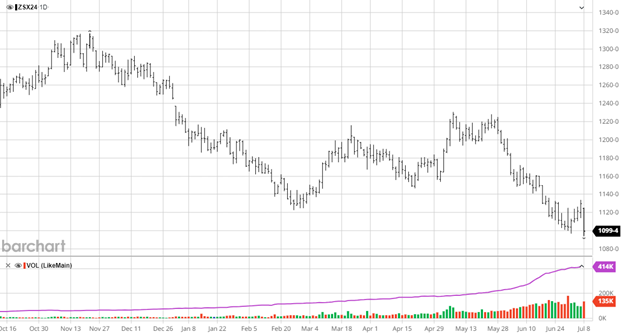

Beans seemed to find a slight rally heading into the 4th of July before having a sharply lower start to the week, falling below $12 in the November futures contract. While the corn acreage number was bearish the soybean acres came in at 86.1 million acres (below the trade estimate of 86.783). The June 1st stocks number was slightly higher, but the markets could not find a catalyst higher. With no major weather issues on the horizon beans will need the funds to get out of their short positions while the charts still look bearish.

Beans seemed to find a slight rally heading into the 4th of July before having a sharply lower start to the week, falling below $12 in the November futures contract. While the corn acreage number was bearish the soybean acres came in at 86.1 million acres (below the trade estimate of 86.783). The June 1st stocks number was slightly higher, but the markets could not find a catalyst higher. With no major weather issues on the horizon beans will need the funds to get out of their short positions while the charts still look bearish.

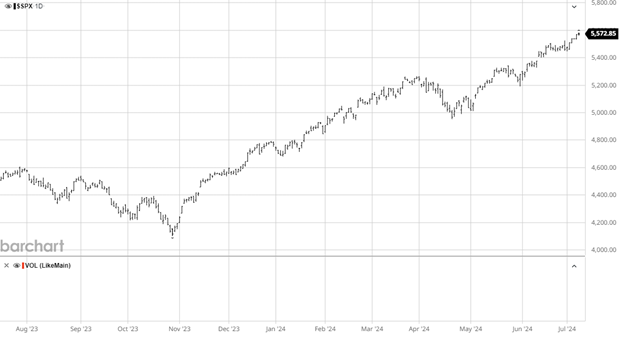

Equity Markets

The equity markets have remained strong as they continue to set new highs. The market is looking to broaden after being very top heavy the first half of the year. With an election and possible rate cuts in the second half of this year, the market will have plenty of information outside of earnings to watch for.

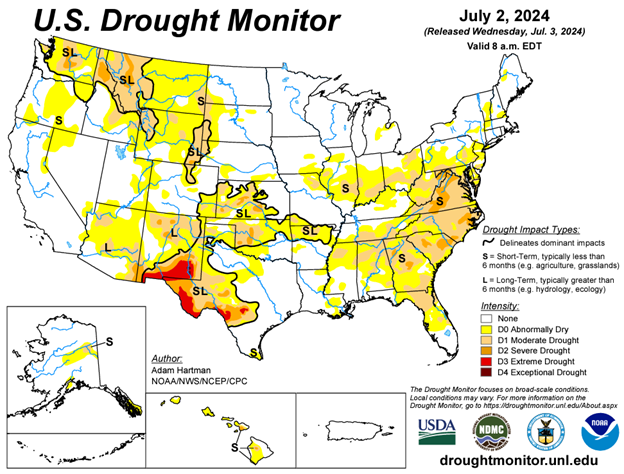

Drought Monitor

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.