AG MARKET UPDATE: OCTOBER 4 – 29

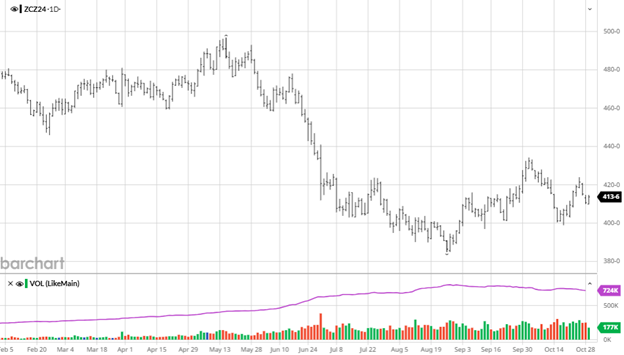

Corn has been range-bound the last 2 months between $4 and $4.40. With no weather issues during harvest following a very dry end of the growing season, the market did not get any unexpected help to push it higher. Mexico continues to buy US corn at a fast pace, appearing again in the export reports. With no major problems starting the year in South America and smooth sailing to the finish of US harvest there does not appear to be anything to give this market a boost. Expect technicals to play a major role in the direction of the trade for the near term as the fundamental trade will be reliant on harvest news.

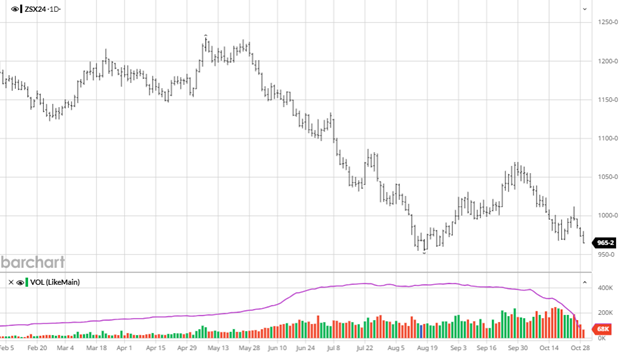

Soybeans weakness over the month has lowered it with corn. Beans do not have any bullish news on the horizon as they failed to rally through technical resistance. With the election next week, a tariff war with China would hurt beans in an already depressed market as we have seen in the past. Funds are very short and will need a catalyst to get them to change course, which currently is lacking. Bean harvest is 89% complete which means there won’t be much opportunity for unexpected bullish news moving forward.

Soybeans weakness over the month has lowered it with corn. Beans do not have any bullish news on the horizon as they failed to rally through technical resistance. With the election next week, a tariff war with China would hurt beans in an already depressed market as we have seen in the past. Funds are very short and will need a catalyst to get them to change course, which currently is lacking. Bean harvest is 89% complete which means there won’t be much opportunity for unexpected bullish news moving forward.

Equity Markets

The equity markets continue higher as the biggest week of earnings kicks off. The Fed is expected to cut rates again by the end of the year, but inflation and jobs data are sending a mixed picture. The 10-year US treasuries have moved higher since the rate cut as the market is questioning whether or not the Fed will get it right.

Other News

- China announced that total grain production this year would be a record 700 million metric tons. As China continues to increase domestic production of edible commodities while continuing to invest in South America the US needs to find a new partner to replace their demand as they continue to try and be less reliant on American agriculture.

- Crude Oil has been volatile but has moved lower this week as possible easing tensions in the Middle East as cease fire negotiations restart.

- With the election results potentially being unknown for a few days following November 5 there could be some volatility in all markets.

- The October insurance averages are $4.16 1/2 for corn and $10.06 for beans as of 10/29. The February insurance averages were $4.67 for corn and $11.60 for beans.

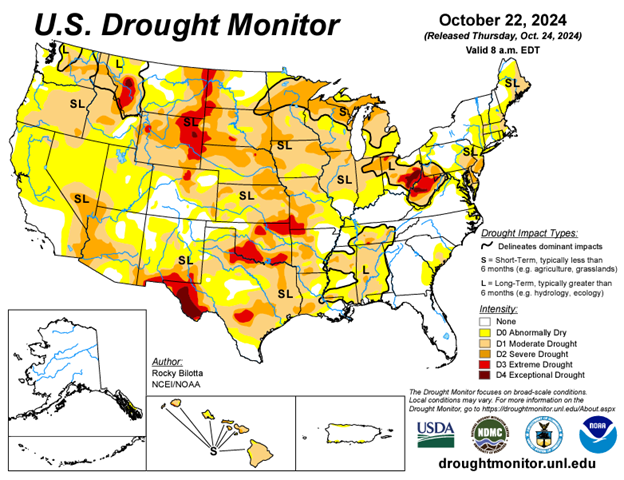

Drought Monitor

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.