AG MARKET UPDATE: MARCH 31 – APRIL 14

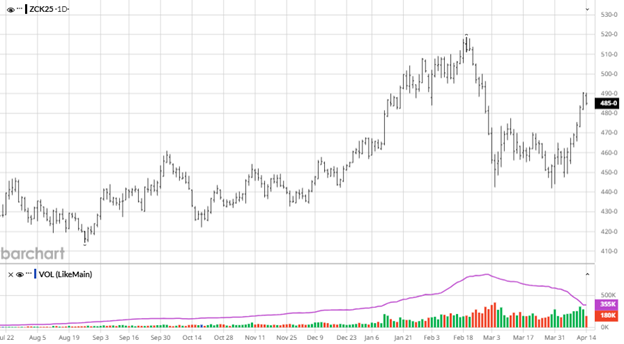

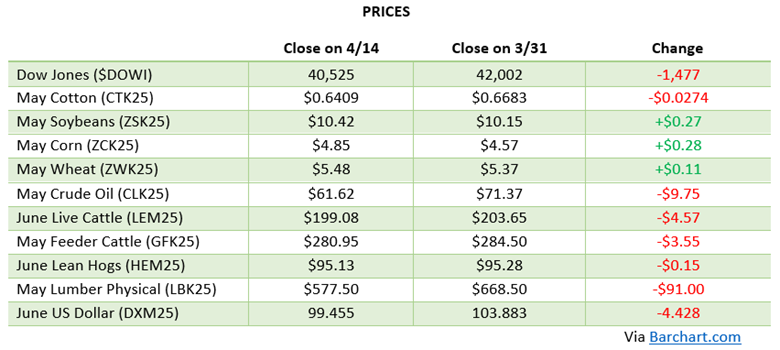

Old crop corn has had a strong rally over the last 2 weeks, having a 40 cent rally after trading relatively flat since its 80 cent pullback in February. While markets were rallying before President Trump’s announcement of a 90 day pause on tariffs, they liked that news to push higher. Any positive news about negotiations with Mexico would be great for corn. The April 10th crop report cut old crop stocks more than expected on increased exports by 100 million bushels, but a modest 25-million-bushel demand cut to US feed demand. US planting should accelerate this week as weather is favorable and where planting hasn’t started allow for field work to get done. Weather during planting will be the main factor if we end up having 95-96 million acres of corn planted.

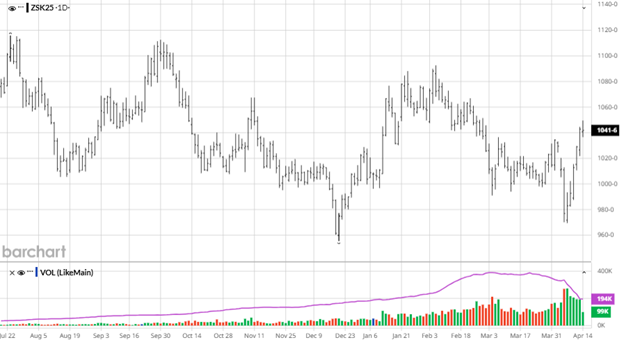

Soybeans have also benefited from the recent rally corn has. While the rally may be losing steam until we have a better idea on how many acres will actually be planted in the US, new crop’s rally above the 20, 50 and 100 day moving averages provides some support under a volatile market. China continuing buying beans will be important as any mass cancelations will signal trade issues in Washington. As trade negotiations continue it will be important for small wins for the ag sector in all of them who are currently buyers.

Equity Markets

“Liberation Day” created sharp market selloff with the White House announcing a delay to the tariffs a week later as countries came forward wanting to negotiate. The markets are well off their highs from February as well off their lows from the post tariff announcement. As the market is in flux as they try to get a feel for what could come next for the economy (recession?) or what comes with these negotiations and China, volatility will likely remain on any headline news.

Other News

- Any progress in trade agreements with Mexico could be good for corn prices as they are our largest buyer. China needs to continue buying beans and any trade progress with them would help beans.

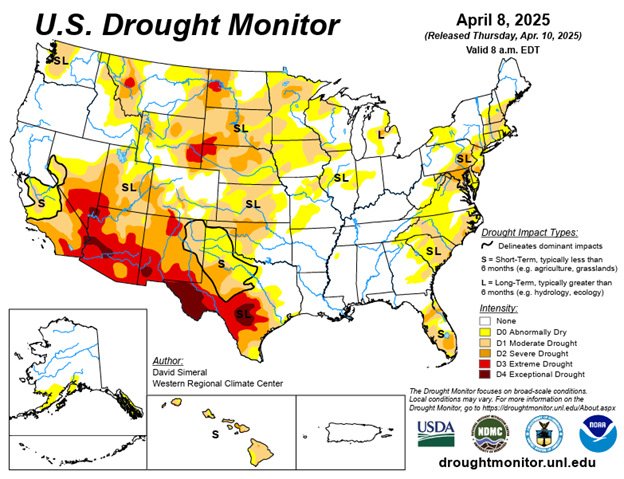

Drought Monitor

As planting approaches here is the most recent drought monitor.

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.