AG MARKET UPDATE: NOVEMBER 18 – DECEMBER 10

Corn has had a good month but needs some more help to get over the $4.50 hump that it bumped against after Tuesday’s Dec USDA report. The bullish trade leading into the report was hoping the USDA would find better numbers for ethanol and US exports, but they underestimated the demand numbers with the US ending stocks coming in 168 million bushels below estimates for US stocks. World stocks were also lower by 268 million bushels. While these stocks numbers are still very strong, they have tightened enough to raise the floor for the meantime while corn could trade between $4.30-$4.55 heading into the new year.

Soybeans’ last few weeks of trade between $9.80 and $10 has not provided much bullish optimism. There were no surprises in the Dec USDA report as large South American crop expectations and the US bean carryout doubling from 2023 are still bearish influences. Soybeans have a tough road ahead as South America is on pace to produce another record crop, and the incoming administration will likely not be biofuel friendly in the US. With all the recent investments in biodiesel and sustainable aviation fuel, there is a cloud that hangs over those areas that we are not sure if it is nothing and will blow over or a storm that may linger.

Equity Markets

The equity markets have continued higher with some recent weaknesses in the largest stocks while strength in the market has broadened. Analysts are beginning to release their outlooks for 2025, while plenty still feel good about the market do not expect another year of 20+% returns like we saw in ’23 and ’24 (so far) after the down year in ’22.

Other News

- The Assad regime in Syria is over. Israel and Hamas appear close to reaching a temporary ceasefire. The fallout of both will be watched by energy markets as many questions will emerge in the region.

- There was a slight cut to US wheat stocks, but world stocks are as expected, and comfortable as low Russian cash prices continue to reflect their ample supplies.

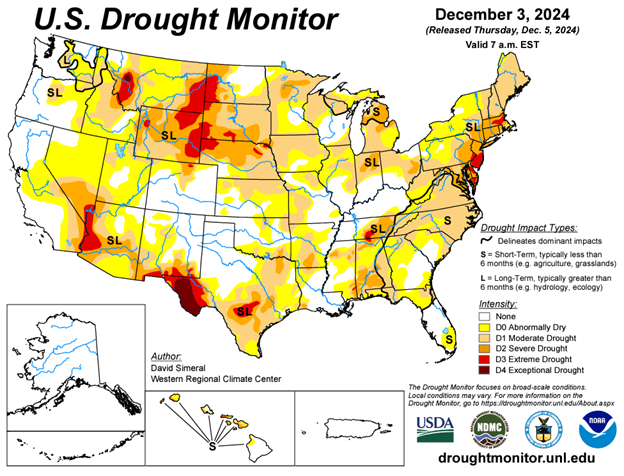

Drought Monitor

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.