AG MARKET UPDATE: JANUARY 13 – 26

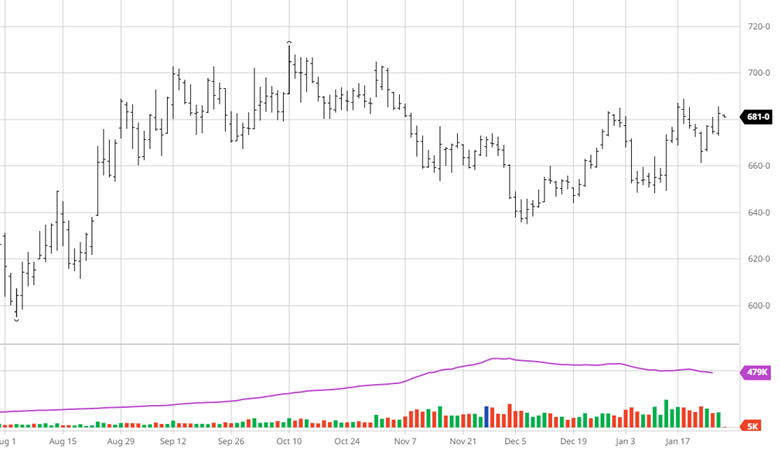

Corn made small gains over the last 2 weeks as news was quiet outside of South American weather with China being on holiday for Chinese New Year. Exports were better than expected this week, but Mexico continues to look at increasing their corn imports from Brazil. The forecast for rain in Argentina over the weekend will direct the trade to start the week. The news to look for in the coming weeks will be purchases from China and any changes in South American weather. Any developments in Ukraine will have ripple effects across the commodity space, but trying to predict what will happen there is almost impossible.

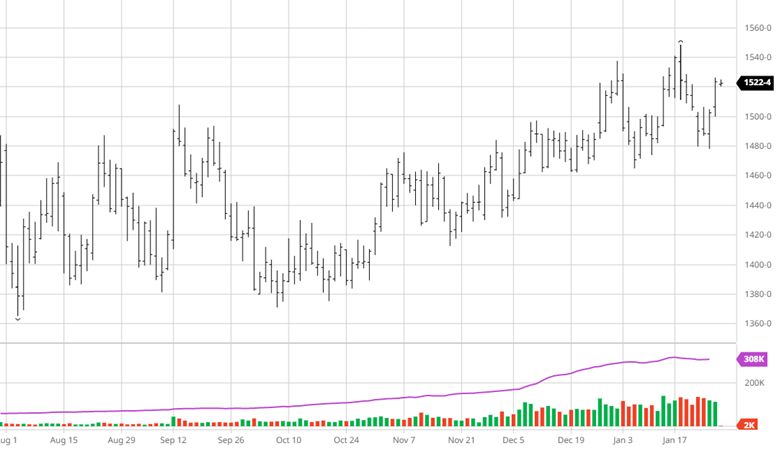

Soybeans, like corn, had an up and down 2 week span but ended with modest losses. The uptrend beans have seen since October has been promising but eventually it will run out of steam with Brazil in a good position. If Brazil’s harvest gets off to a fast start we could see a weakening in old crop quickly with new crop following slower. Like corn, bean exports to China as they come out of covid lockdowns and Chinese new year would help provide some support until Brazil starts sending them beans. Keep an eye on any positive trade news from China, don’t expect news out of Brazil to be bullish.

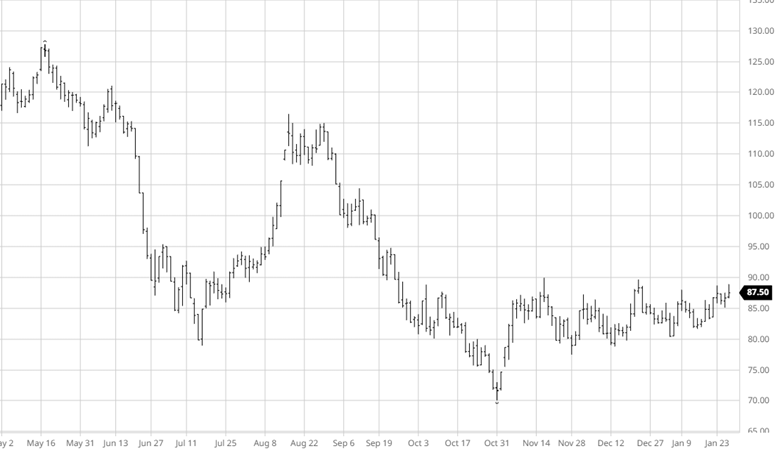

The cotton chart below shows the trade has stayed between 80 and 90 cents for the last couple of months. Cotton is caught in the middle of the markets thinking there will be a recession, and China coming out of Covid lockdowns with capital to spend on consumable goods. Cotton will need some news to get it out of this range, until then expect this trade to continue. While exports increased last week from the previous it is still half of this time last year, showing the demand situation is very different.

Equity Markets

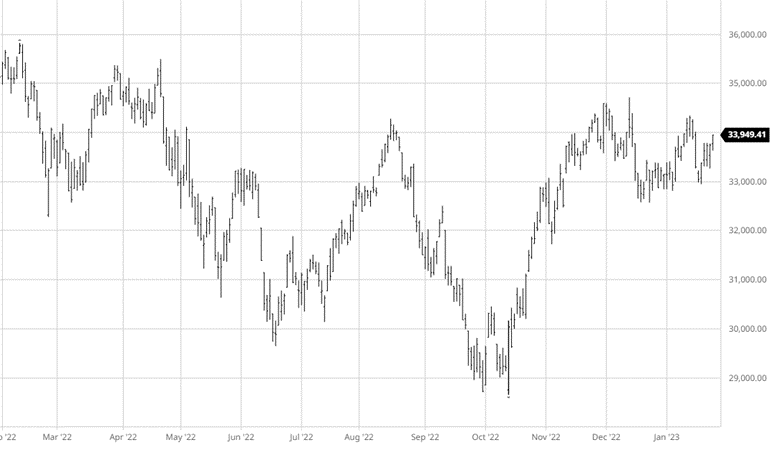

The Dow fell over the last 2 weeks as everyone is playing a guessing game with 1. What the Fed will do and 2. Will there be a recession? The economy is still doing well as jobless claims have not begun to go up and inflation is cooling but still has a way to go. With earnings underway guidance will be important to understand how companies are expecting 2023 to go with jobs and what they think the Fed will do.

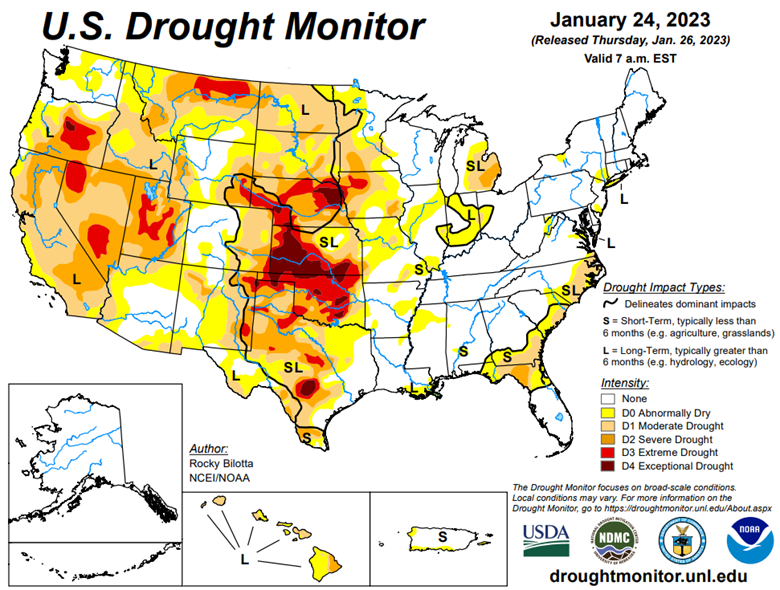

Drought Monitor

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.