AG MARKET UPDATE: NOVEMBER 4 – 18

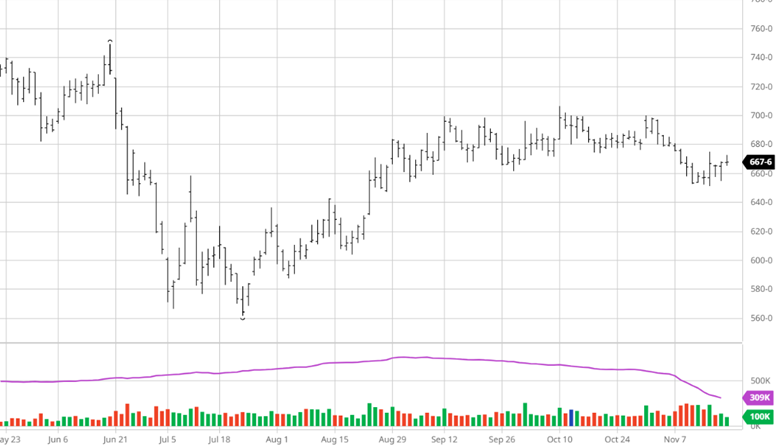

Corn strung together several days lower in a row last week with a neutral USDA report in the middle of it. The USDA raised the US yield to 172.3, which was within the range of estimates. While corn had been trading sideways for some time, the move lower remained in its trading range, followed by a bounce back higher this week. The black sea export corridor deal being renewed is welcome news for the world supply chain. Brazil and Argentina got some needed rain while some dry areas missed out. They are still suffering drought conditions, but it is also still early in the year. Exports improved this week from last, as the current price levels attract buyers.

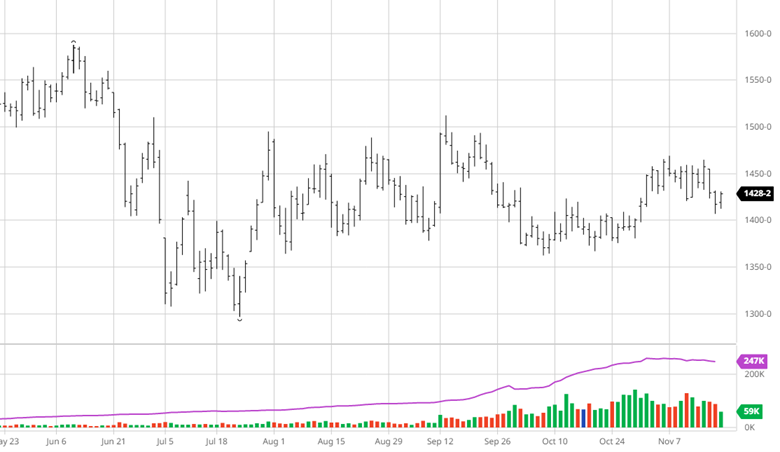

Soybeans fell over the last two weeks, due to two days of large losses this week. Soybean Oil got hit as world veg oil prices fell, pulling beans down with it. The rain in Argentina helped speed up soybean planting but rain will still be needed moving forward as still about 25% of the country experiences drought. Bean exports, like corn, improved and better than expected this week. The lack of news makes this a difficult market to trade in as there are no overwhelming bullish or bearish factors dictating direction.

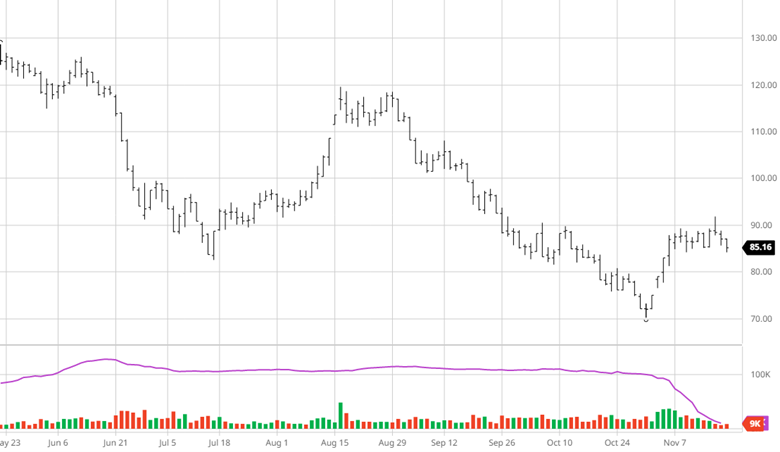

The US cotton supply was raised in last week’s USDA report with better yields and lower demand. The problem in the cotton market right now is demand. While more money is being spent , fewer units are being bought which translates to less consumption. With the continued high energy prices and inflation issues across the world people are prioritizing eating and heating their homes and fueling their cars (good call) over buying new clothes. The potential for a looming world recession in 2023 does not ease demand concerns as we would not see demand for cotton pick up as producers would sit on inventory they currently have. Until we get more clarity on the world outlook and 2023 it is a time to be cautious. The weakening USD will be worth keeping an eye on.

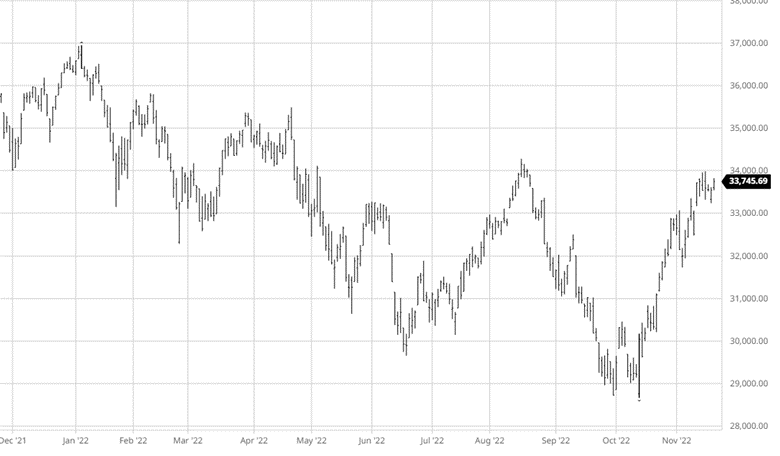

Equity Markets

The equity markets started off November with gains after a cooler than expected October CPI of 7.7%. While a drop is nice to see it is important to remember the target is 2-3% so we are still much closer to the top than the bottom with a Fed rate rise coming in early December. The markets seem to expect a 50-point hike, but there is still plenty of time for that to change and get priced in before. One big question that remains for the markets looking ahead is “what will December bring?”. Will there be a Santa Clause rally? Will markets fall as investors do some tax loss harvesting? Many investors still think a recession is coming in 2023 and the next month and half could give us a better idea what to expect.

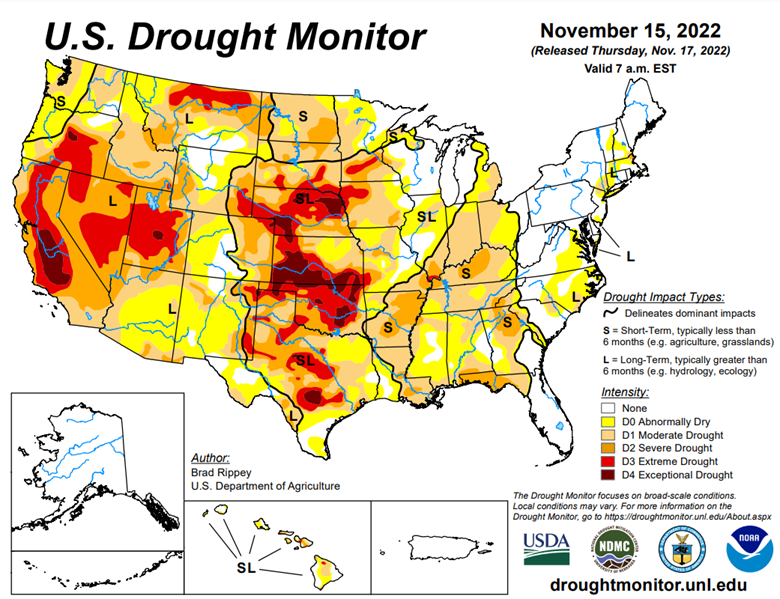

Drought Monitor

Podcast

The Hedged Edge is back online with a guest who could be this podcast’s most important guest of all time. At a time when inflation is running rampant through the world economy, drought conditions are drying up our rivers, and the global supply of grain is scarce. We are tasked with the question, “what the hell is going on in logistics, and is there any relief in sight?”

To help address these questions and more, I am joined today by a man that needs no introduction to most in the physical commodity sector – Woodson Dunavant with the Dunavant Logistics company based in Memphis, TN.

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.